2-24-16

The most talked about reason for slower jobs growth is the lack of experienced workers available to hire. In fact, recent surveys indicate about 80% of construction firms report difficulty finding experienced workers to fill vacant positions. That certainly cannot be overlooked as one reason for slower jobs growth, but is that the only reason?

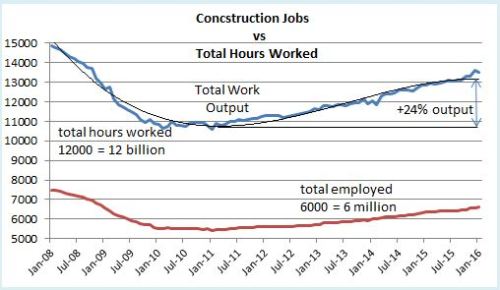

Even with all this talk of difficulty finding experienced construction workers, there is a lot of hiring going on. For the 5 year period 2011-2015 we added 1,100,000 construction jobs with the peak growth rate in 2014 at 6.1%. Jobs increased by 20% in 5 years.

For the two years 2014 + 2015 we added 650,000 jobs, the largest number of jobs in two years since 2004 + 2005. In that two years, jobs expanded by 11%, the fastest percent growth since 1998-1999, the fastest pace in 17 years. But peak growth was in 2014 with slower growth in 2015. I expect even slower growth in 2016.

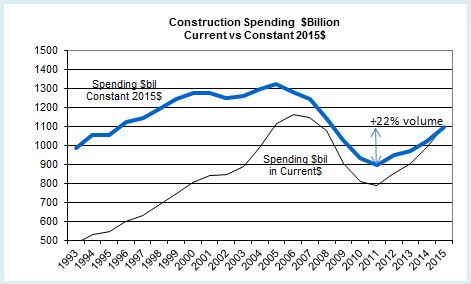

Construction spending hit bottom at the same time as jobs, the 1st quarter 2011. For the same 5 year period 2011-2015 construction spending increased far more than jobs growth. Why is it that jobs don’t increase at the same rate a construction spending? Because much of that spending growth is just inflation. When describing a shortfall of construction workers, jobs growth should not be compared to spending growth. After adjusting for inflation from Q1 2011 to Q4 2015, we find that construction volume increased by 22% in 5 years.

Now it looks like over 5 years jobs seem to be growing nearly the same as construction volume. It even looks like productivity increased, but that’s still not the whole picture.

Real work output growth is total jobs adjusted by the hours worked each year. From 2011 to 2015 construction hours worked increased by 3.6% from near the lowest on record to the highest ever recorded. The reason this has such a huge effect is hours worked gets applied on all 6.5 million jobs, not just the new jobs added. So, a workforce that grew by 20% worked 3.6% longer hours showing that net total work output actually increased 24.3%.

This data shows that over the last 5 years new volume increased by 22% while work output to produce that volume increased by 24%. Data clearly indicates we have added more work output than the volume of work we have produced. This indicates a drop in productivity over the last 5 years.

It is not uncommon at all that productivity declines during rapid growth. This pattern of growth appears prominently in the last two expansions between 1996 and 2006. Firms may be increasing staff based on revenue without strict attention to real volume growth, only to then slow jobs growth and allow volume production to catch up.

By measuring to previous productivity levels, we could say the construction workforce is currently overstaffed. Of course, spending (and net volume after inflation) is expanding rapidly and with it so must the workforce. But, if there is any hope that eventually productivity will return to previous levels, then we must hope for a minimum increase of 2%+ in volume with no matching additional increase in new jobs or hours worked.

Over the next two years I predict construction spending will increase close to 20%, BUT construction volume will increase only 10%, most of that in 2017. In a previous post, “How Many Construction Jobs Will Be Needed” I predicted jobs will grow by 500,000 to 600,000, only about 8%.

Filling positions with workers less qualified than those who were lost accounts for some of the decline in productivity. Working longer hours also leads to productivity loss. To regain lost productivity, new workers need to gain experience AND overall hours need to be reduced and that workload replaced with new jobs. That’s certainly not likely to happen all in one year, but it may account for some of the reason why volume is currently growing faster than jobs, and that’s a good thing. I expect that will continue at least for the next two years.

Ed, my point is that the magnitude of the seasonal rushes are driving the scarcity of work. Tradesman are leaving the profession because they are tired of fall layoffs. With fewer tradesman every summer, we’re forced to maximize our income on the revenue we can manage with fewer workers for those few months. Every year it gets worse.

I think the imbalance between volume and jobs that you’re pointing to is based on the assumption that the seasonal fluctuations are normal.

It’s been my experience that the post-recession “normal” seasonal fluctuation is more volatile than any other time.

So cumulatively, the impact of more growth without jobs means tradesman will be headed for unemployment at an exponential rate. What we desperately need are clients looking to build in 1st and 4th quarters like they used to.

LikeLike

Each year I see the summer rush driving prices up because tradesman are scarce. Many tradesman left construction because they couldn’t maintain steady employment all year. I see lots of summer projects stall out when the bids come in over-budget. Most of the summer rush work comes from government projects like schools, roads, and universities that are trying to do all their improvements before the end of summer. I think there’s a case to be made that the gap in new hires and spending is driven by seasonal rushes rather than productivity. Last fall every single 4th quarter project was canceled, or postponed. There were no 4th quarter start projects at all. Every colleague I spoke to indicated that spending was expected to resume some time in 1st quarter which has been largely true. It must be said that we have had almost 50% of our annual revenue in limbo for 90 days or more because clients haven’t given the go-ahead. Every year we have several contract awards delayed by 6 months or more because the clients financing fell through.

LikeLike

I wouldn’t disagree that seasonality may be a significant issue for a bidder. However, here I look at a 5 year and a 2 year view, so it doesn’t get to such a short period to look at seasonality. Any shift due to seasonal fluctuation to either side of a particular time period would be absorbed in this much longer term view. Thanks, edz.

LikeLike