Home » Spending

Category Archives: Spending

Construction Briefs NOV 2025

After some delayed data released recently, we now have August Construction Spending and Sept Jobs.

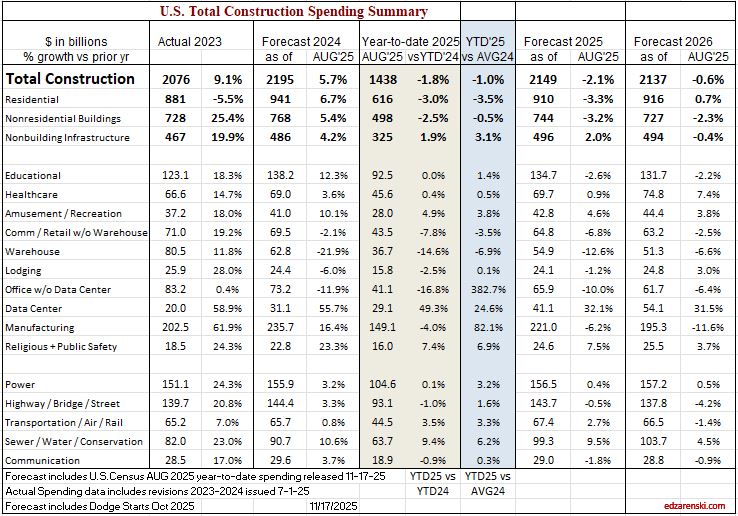

In the past 12mo, Rsdn construction jobs fell 46k (-1.4%). Nonres Bldgs jobs increased 59k (+1.6%) and Nonbldg jobs increased 24k (+2.1%). Rsdn spending is down 5% (-$39bil) Nonres Bldgs is down 3.4% (-$25bil) Nonbldg is up 3.1% (+$15bil) Expect total spending in 2025 down 2.1%, jobs UP 1%

Construction Spending Forecast Total spending varies less than 1% from current through 2026 Jobs YTD up 16k. Only times job growth that slow was 2020 or recessions. 2011 through 2024, even with losses in 2020, avg jobs growth was 200k/yr. Don’t expect job openings (see JOLTS) in near future.

Environment for construction jobs looking difficult. Constant $ spending in 2026 is down just less than 1%. But Volume of work (spending minus inflation) available is down just over 4% and is declining all through 2026. Biggest declines by far, Manufacturing and SF Rsdn.

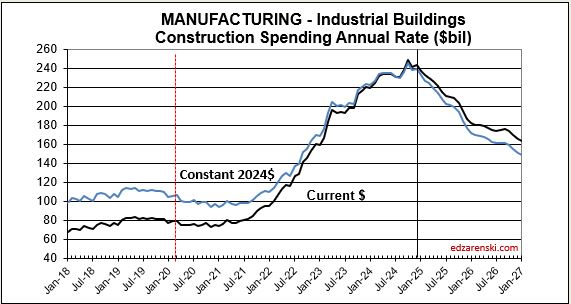

The decline in Manufacturing construction spending is due to having passed the peak in the scheduled project timelines for the large volume of mega-projects that started in 2021-22-23-24. (I wrote about it in more detail in Nov’24 in the article linked.) Peak spending is typically just past the midpoint of project construction. From Apr 2024 to Nov 2024, Mnfg spending averaged $240bil., the highest rate of spending on record. In 2025 it started the year at a rate of $$230bil but will end the year at $210bil. By the end of 2026 the rate of spending drops to $190bil.

The Manufacturing Spending Taper

My forecast has not changed much overall in the last few months. Residential has gained in revisions added to June and July and Aug posted a very strong 1.3% gain.

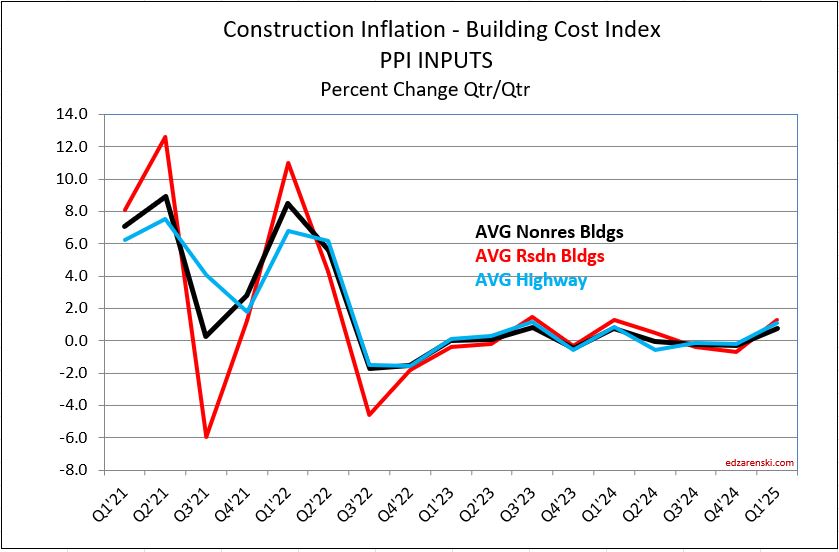

We will wait a little longer before we see any meaningful changes in construction materials input costs. September data (released 11-26-25) reported here. Also remember, PPI does not track imports, only domestic producers. Therefore, any implied increase in PPI being related to tariffs would be a domestic reaction to an import tariff. We can expect that.

INPUTS thru Sept up ~2% from avg2024. Final Demand for Nonres Bldgs is up 1.2% ytd vs avg 2024. However, Oct is the revision month for Q3 Final Demand data, so Final Demand data not finalized for Q3.

Forecasting in a Shutdown

10-7-25 It sure doesn’t help forecasters when we can’t get fresh data. So how can we forecast when there is no current data forthcoming?

One of the data sets that my forecasting models are set to calculate is annual forecast on smaller sets of data within the year. For example: The Total Spending SAAR average for the months of AMJJAS (Apr thru Sept) when extended for a full 12 months, predicts the annual spending within +/- 1%. This calculation has been within this 1% limit 22 times in 24 years (think Drake Maye accuracy here). The other 2 years were off by 1.1% and 2.2% (in 2020). And unfortunately, we don’t have August or September data.

The last actual data we have is July. For Nonresidential Bldgs, the average predicted from AMJJ (Apr thru July) predicted the annual total Nonres Bldgs spending within 1.8% 13 out of the last 14 years (2011 to 2024), with one year being 2.6%. The average of those 14 years is less than 1% off from the actual.

This is not a simple average. Each month produces a different share of annual spending. For ex: Based on 20-year averages, January and February each produce only about 7% of annual Nonres Bldgs spending while June and July produce each about 9% of annual spending. When a small set of data is used, the spending in each of those months is compared to the 20-yr average for those months and projected out to get 100% or a full 12 months of spending.

The small data set of AMJJ, when used to predict 2025 Nonres Bldgs spending, forecasts +/- 0.9% or $730bil to $756bil. The average predicts spending on Nonres Bldgs will hit $743bil. My current forecast, which includes actual data thru July and forecast to year end, predicts spending will hit $749bil.

Residential spending, based on small data set is between $882bil and $920bil., with the average predicting $901bil. My current forecast with all actual data from Jan thru July and forecast thru year end is $892bil.

The best small data set predictor is having data for AMJJAS. This predicts total spending will come in between $2109bil and $2149bil, with the average for the year at $2133bil. My current forecast predicts spending for 2025 will total $2140bil.

Generally, I look at these small data set calculations to insure I haven’t made some kind of blunder in my forecast. In this case, the small data set gives some comfort level that the annual forecast, although based on only 7 months of actual data, may not be very far off from what to expect at year end.

Construction Briefs Sept 2025

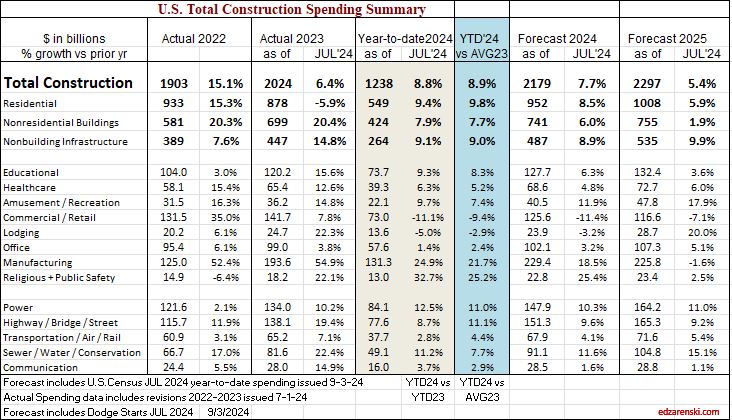

The headline construction data is the year-to-date (ytd) comparison. Through July data, ytd2025 is -2.2% compared to ytd2024. But where is it headed. Watch for this. Last year spending was increasing until it peaked in October. This year spending is falling and will continue to fall into Q3. Every month now the ytd spread gets worse, because 2025 is decreasing and 2024 was increasing. It’s significant in residential which is currently thru July down YTD 4.0% and is forecast to finish 2025 down 5.2%.

Construction Spending is down 7 out of the last 9mo, now down -3.5% or an inflation adjusted total -6.5% since October. Over that period spending is down most significantly in Residential. Residential spending peaked in October 2024. Since then it’s down 10% ($90bil). Warehouse is down -12% ($8bil). Manufacturing is down only 6% but that is $15bil. Manufacturing is experiencing the tail end of a huge volume of work that peaked also in Oct., 2024. It is expected to continue on a slowly declining spending slope for at least the next year. Spending is up the most now in Data Centers, on track to gain 32% (+$10bil) in 2025 and 31% ($13bil) in 2026.

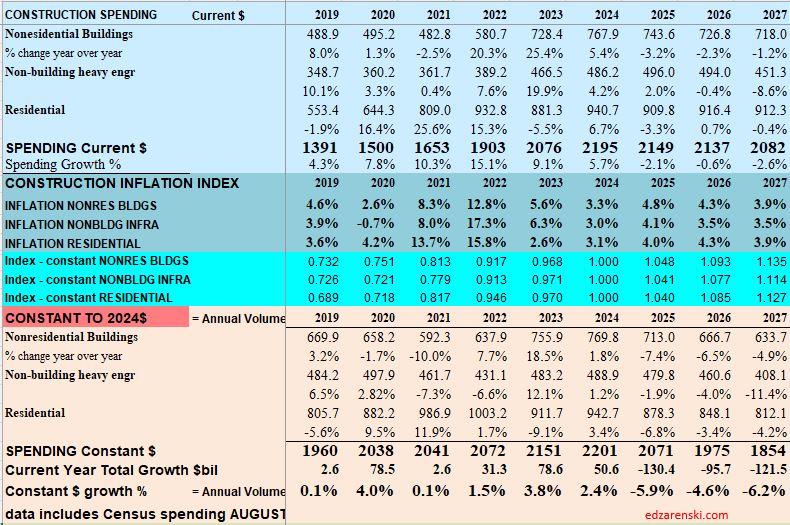

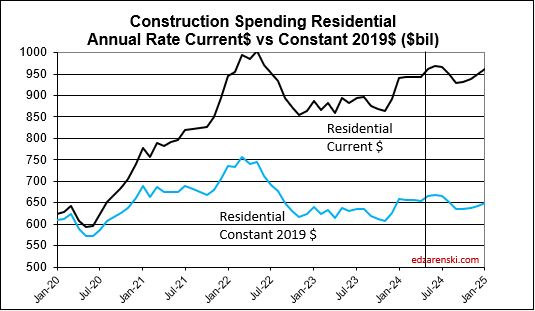

When spending is up by just a little it looks like we are making progress. But we are always fighting inflation. If spending is up by 3% but inflation is 4%, then real business volume declined by 1%. If spending is down 5%, with 3% to 4% inflation, business volume is down 8% to 9%.

Overall, business is declining. The current data in the table below indicates constant$ spending, or business volume, drops for the next three years.

Do not overlook the impact of inflation. Residential spending for 2025 may end down only 5.2% but spending includes inflation of 4.7%. When real residential volume is compared to real volume in 2024 we find that residential volume of business declined 9.1% in 2025. This happened also in 2023, then not since 2009, when it fell 24%. Let that sink in! Residential business volume in 2025 is forecast down almost 10% ($85bil). Since the most recent peak spending in 2022, residential volume is down almost 15%, (~$150bil).

Since 2011, (excluding recession yrs) construction jobs thru Aug increased on average by 150,000 over the 8mo. For 2025, jobs thru Jul increased only 6,000, the slowest jobs growth (ex recessions) in 50 years. Residential construction jobs peaked in Sep’24. Spending was near the May peak from August to December. Since then, spending has been falling and will continue to fall. Rsdn jobs have fallen 7 out of the last 10 months. Rsdn jobs are down 1% ytd. Nonresidential and Nonbuilding jobs are both increasing slightly. The outlook for 2025 has construction jobs falling by 40,000. Jobs are expected to fall even more in 2026.

While many of the construction cost items in the PPI are tame so far, there are a few that have outsized gains. PPI YTD thru Aug vs the 2024 avg Conc Pipe +6.2%, Lumber/Plywd +4.4%, Fab Str Steel +3.5%, Nonferrous wire +7.2%, Alum Shapes +12%, Diesel -10.3%.

Final Demand pricing for Nonres Bldgs holding down at 2% or lower. Construction Analytics inflation rate for 2025, which includes inputs from eight sources, is 4.4%.

Remember, the PPI does not track imports or tariffs.

Construction Briefs July 2025

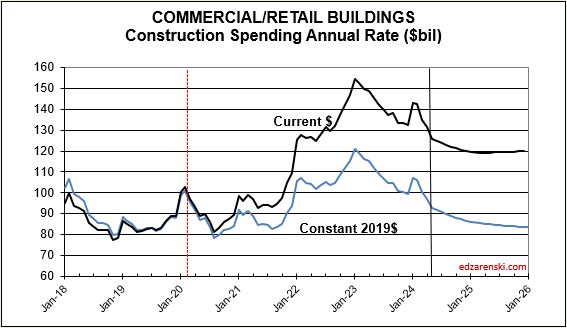

Construction Spending is down in each of last 5mo, now down a total -2.4% from Dec. Biggest declines are Warehouse -7.7%, Commercial w/o Wrhse -4.6%, Office w/o Data Centers -4.3%, Residential -4.2%, Transportation -3.7% and Manufacturing -3.5%.

Residential posted the biggest $ rate drop, -$40bil SAAR since Dec.

Data Centers are up 9% in 5mo, but last year DC were up 56%, increasing 15% in the 4th qtr alone. The rate of growth has slowed from near 4%/mo in the 2nd half 2024 to less than 2%/mo in the 1st 5mo 2025.

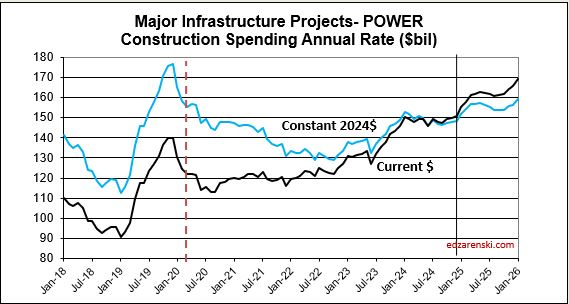

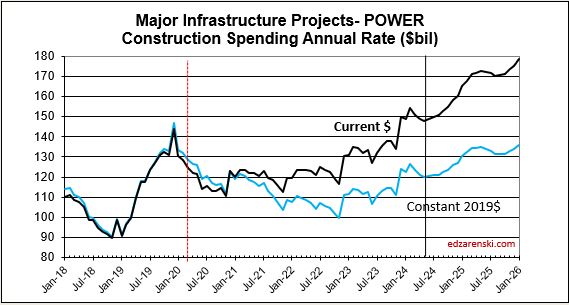

With this issue of May Construction Spending, Census revised all data back through 2023. Total spending was revised UP $52bil in 2023 and $39bil in 2024. Due to the increase in 2024, all percent growth in 2025 is slightly lower. The largest revisions up in 2024 were Residential +$11bil, Educational +$8bil and Power +$8bil. Also, in 2023, Power was revised up +$17bil and Manufacturing +$9bil.

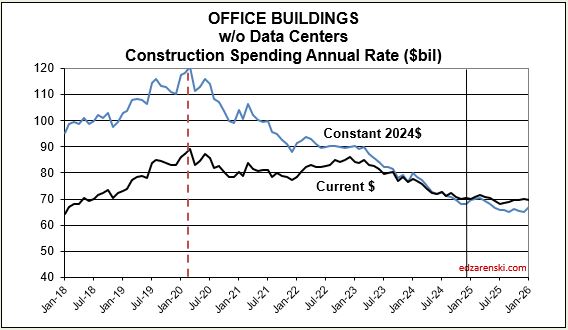

Office vacancy rates are very high, near 20%, and in some places, like San Francisco, about double that. It’s hard to see that office construction will increase anytime soon. Office construction spending has declined every month for the last 10 months and is down 10% compared to the same 5mo 2024.

Construction Forecast Update May 2025

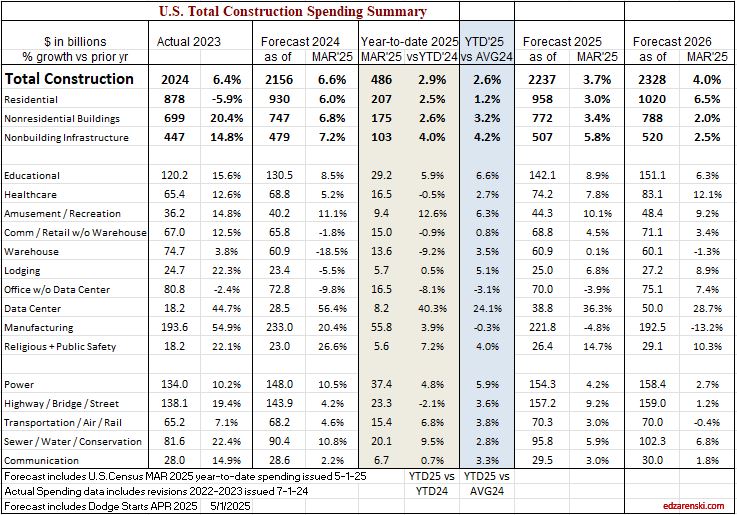

The total construction spending forecast, now at $2,237bil, +3.7% vs. 2024, has been lowered a bit since the Outlook in Feb. ($2,272bil, +5.5%). Most of the reduction is in Residential, from $997bil, +7.2% down to $958bil, +3.0%. Nonres Bldgs was reduced by $11bil and Nonbldg increased by $7bil. Compared to the average for the year 2024, current total spending YTD is up 2.6%, but is expected to pick a little up throughout the year across all sectors.

Constant $ growth is forecast down 0.7% in 2025 and down more after that. Inflation Index shows annual percent and index to base 2024 = 100. All years, current spending / index = reported as constant 2024$, as if all constant years are the same 2024$.

Residential Single Family spending has been in a range +/- 2.5% for the last 7 months. With only a few months lower than that, this range extends back 18 months. Take out 3%/yr inflation and you can see that SF volume has been flat to down. Multi-family spending, for the last 12 months, is down 15% off recent highs in Q1’24. Reno/repair spending extended recent highs across 5 months in mid 2024, before falling off 10% in Q4, and now, in Q1’25 it has gained back most of that drop. Any spending gains in the near future would be driven by multi-family.

Manufacturing is still the largest $ contributor ($222bil/yr) to nonresidential bldgs total spending ($772bil/yr), but has fallen 6% in the last 5 months. The trend is down in most months for 2025 and down in 2026. This decline is entirely expected and you can read about it in my article, The Manufacturing Taper.

Data Centers shows the largest % spending growth for 2025, forecast +39%, continuing on a phenomenal streak of +45% in 2023 and +56% in 2024. Data Center starts increased 300% over the previous 3 yrs. and still increase in 2025 and 2026, but at a slower rate of growth. Manufacturing spending peaked in Oct’24. Data Center spending continues to increase for the next few years. Both of these forecasts take into account some cancelations or delays announced recently (see May Briefs), however do not account for any major stoppages due to recent trade impacts.

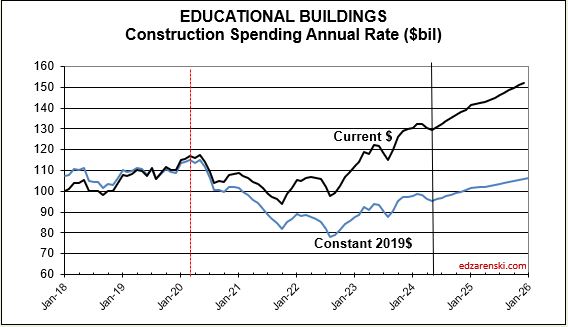

The largest $ increases in spending are Power, forecast to increase +$16bil, and Highway +$13bil. Educational spending is forecast to post the largest nonres bldgs $ growth in 2025 (+$12bil, +9%). Data Centers increase $10bil.

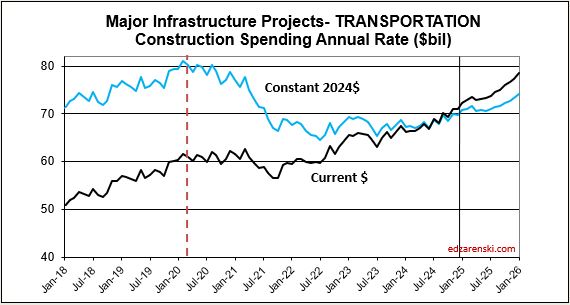

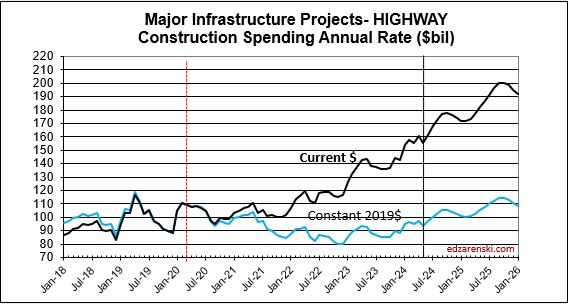

This same scenario that looks to occur in Manufacturing will occur also in Highway/Bridge. Normal starts were about $100bil/yr, with slow growth. But for the last 3 years, actual starts totaled closer to $500bil for the 3 years or $167bil/yr. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for 4 years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. But once the taper begins it will have the same effect on Nonbldg Infrastructure spending that we will see from Mnfg in Nonres Bldgs.

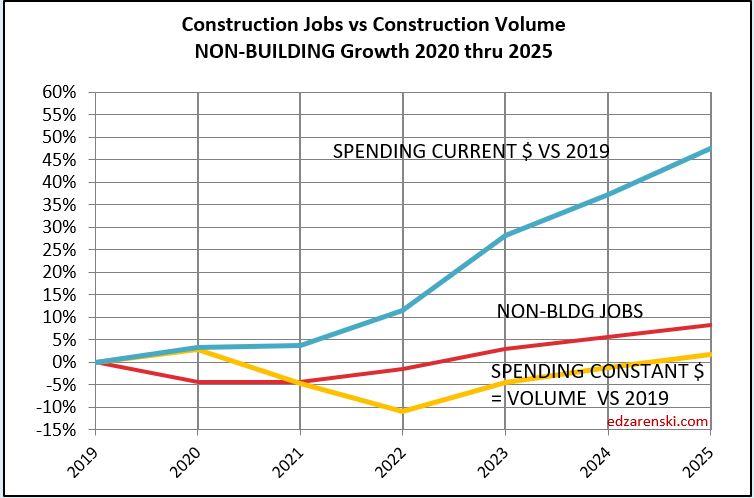

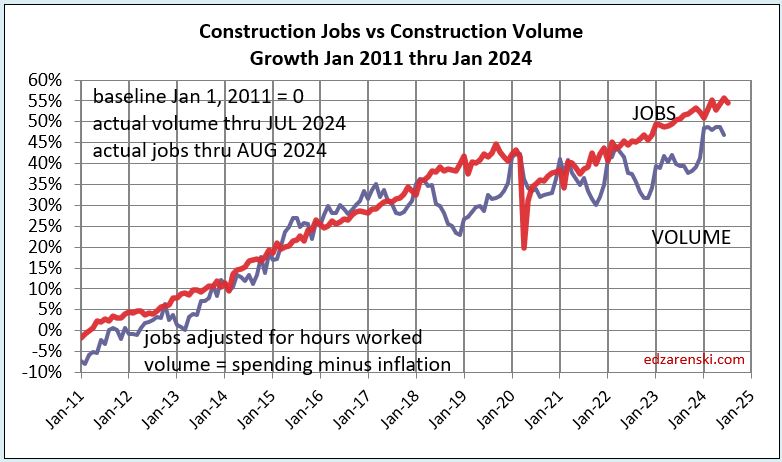

Typical jobs growth is 2.5% to 3.5% per year, even though spending can sometimes far outpace that. But jobs growth doesn’t track spending, it tracks volume growth. Volume is spending minus inflation. For example, for the 4 years 2021 thru 2024, spending increased 44%. But inflation increased 33%. Volume growth was only 11%. Jobs increased 12.5%. For 2025, Inflation will outpace spending growth by 1%, but jobs are still expected to increase by 1.5%. Rarely do jobs decrease. That could change.

There are 870K construction jobs in TX. 500K are immigrants and 300K are undocumented.

New starts are forecast up in 2025, but I would caution there are a lot of headwinds that could slow new starts growth. Many economists predict the current trade impacts will slow overall economic growth. That in turn could slow capital expenditures, which, in this case, is new construction starts. So far year-to-date, spending is outpacing new starts growth. That means backlog is decreasing, mostly in nonresidential buildings. We haven’t seen a decrease in Nonres Bldgs backlog since pre-2011. Residential backlog is down slightly. Nonbuilding is increasing.

See Also Construction Briefs May 2025

and Construction Briefs Apr 2025

5-15-25 all ppi DATA UPDATED TO APR See Construction Inflation 2025

I’ve increased the inflation outlook since Feb to a range of 4.5% to 5%. Inflation may be the most uncertain of all factors affecting construction this year. We have yet to see any significant impact from tariffs, and there is sure to be impacts to many construction inputs. We may not know the total impact for several more months. But I would expect, if anything, inflation will go up from here, not down.

The bees are swarming the flowers outside. At least some lifeform is content and at peace with this world.

Construction Briefs May 2025

For the 9th consecutive year, I will be speaking at Advancing Preconstruction. I will be opening the program May 22 to the plenary session with a summary of the current and expected economic conditions affecting everyone involved in construction, all geared towards one word, RISK.

Construction Spending Q1’25 vs Q4’24 notable Q/Q increases: Education, Healthcare, Amusement/Recreation and Communication are all up 2% to 3%. Highway is up+4.9%, Data Centers +5.4%, Warehouse +7.5% and Lodging +8.3%.

Construction Spending for March is down 0.5% from Feb, but that’s because Feb was revised UP by 0.5%. Jan also revised up 0.66%. YTD Total vs Jan-Mar 2024 is up 2.8% YTD. Data Centers vs Jan-Mar 2024 is up 40%.

Construction Spending Q1’25 vs Q4’24 is UP in every category except Residential, Commercial/Retail w/o Warehouse and Manufacturing (Mnfg was expected). Residential and Comm/Rtl are down only a slight 0.2% and 0.4%. Manufacturing is down 4.7% Q1vQ4. This is the beginning of the Manufacturing spending taper as early projects come to an end. I described that taper here. The Manufacturing Spending Taper

Not seeing any major indications in spending due to tariffs yet. Still early in the data (thru Mar) for that.

Construction Jobs increased 11,000 in April. However, hours worked dropped by 0.6%. Total workforce hours worked declined by an equivalent of 50,000 jobs. Jobs are now at 8,316,000, an all-time high. Jobs are up 27k year-to-date, the slowest growth for the 1st 4 months since 2012 (excld 2020). Although hours worked fell in April, total workforce hours worked increased 2.1% over same 4mo 2024. Average yr/yr growth for Jan-Apr hours worked is 3.7% for the last 10 yrs (ex 2020).

J P Morgan expects imports from China to fall 75%-80% in the 2nd half of the year. Total all imports from all sources are expected down 20%. Some products are going to become unavailable.

The U.S. imports about 30 million metric tons, about 30% of total steel used, of all types of steel annually. The U.S. imports about 6 million metric tons of steel pipe annually. Approx 2/3rds of steel pipe used annually in the U.S. is imported. If the U.S. loses its imports of steel pipe, we can’t support as many building projects. Pipe here refers to pipe and tube. That includes things like gas and oil pipelines, water pipe, steel conduit and structural square/rectangular tube sections (Trump’s Wall).

What’s frustrating this week is all the latest construction spending and jobs data just came out, and everyone wants to know, What’s the impact on the forecast?, and none of the data reflects tariff impacts or potential slowdowns. Spending is thru Mar31 and jobs are thru Apr12. Some of the inflation data is 1 to 2 quarters behind.

I am expecting, when I prepare the Midyear Forecast, that spending projections will go down, perhaps 1% to 3%, and inflation projections will go up. Currently, I’m carrying inflation between 4%-5%. Owner’s may slow or even cancel capital expenditures and material prices are broadly expected to increase.

When PPI data is released May12, that will be thru April. But remember, PPI data is domestic products only. So any inflation in the PPI data is domestic suppliers adjusting pricing to reflect pricing similar to expected increases to match imports. We might begin to see our first clues of tariff impacts/demand when the next construction starts data gets released around the end of May. How much in previous starts have been canceled/delayed? We already know of some chip plants and data centers canceled/delayed.

Construction – What to Watch: Cost to build going up; Cost to finance is up; Product availability in question; Product delivery schedule delays; Margins pressured; Small/Midsize firms squeezed; Labor let go/disappearing; Projects in planning, delayed; Project ROI not met; Projects planned, canceled.

I recommended (going back 6 yrs ago, but still relevant today) that every construction cost estimator is going to need to identify in every estimate/budget presented to an owner for every upcoming project, all items subject to price revision due to tariff. If you don’t you stand to lose your already meager profits.

I can’t even begin to know what to tell construction cost estimators to carry in budgets for increased cost due to tariffs and supply issues. Best I could suggest at this time is to carry an agreed allowance (IMO, better than contingencies), which can be visited at a later date and adjusted to actual cost. Contingencies are for unknown, unexpected, unidentified issues. Allowances are described in the basis of estimate for identified cost issues, but at unknown cost amounts. All allowances in any estimate/budget should be identified at conception with intent to revisit at later date to adjust to actual cost. (The most common allowance you may be familiar with is a rock allowance). Identify allowances up front and reach agreement on budgeted cost with all parties. This will make your contract administration go a lot smoother than trying to negotiate how much of the contingency you can use for a cost increase that was foreseen. The only unforeseen here is actual cost.

ABI – DMI – CBI Leading Construction Indicators

With exception of residential, which has short durations and for which backlog is always only about 30%-35% of previous yr revenues, for all other work, never (since 2010) was backlog shown to be less than the previous yr spending. https://edzarenski.com/2021/05/01/abi-dmi-cbi-leading-indicators/

Construction Backlog, all work under contract yet to be put-in-place, usually extends out 2 to 3 years. Backlog changes only IF new starts are greater than spending in the month, backlog goes UP. If new starts are less than spending, backlog goes DOWN. Subtract canceled projects from starts causes backlog to go down, but delays are are just moved out in time, so are still in backlog.

PPI INPUTS Q1 vs avg 2024: to Nonres Bldgs +0.9%, to Residential +1.15%, to Highway +1.0%. All these being near 1% for Q1, if growth is constant, would be near 4% for the year. Big IF! Paving mixtures +11% in Q1, Lumber Plywood +4.5%, Fab Str Steel +0.03%, Fab Str Stl Bridges -1.1%, #2 Diesel Fuel -9.6%, Steel Pipe and Tube -3.85%, Nonferrous Wire and Cable +1.8%, Copper and Brass Mill Shapes +4.7%, Aluminum Mill Shapes +7.5%.

PPI Final Demand 1st 3mo vs avg 2024: Avg Nonres Bldgs +1.3%, Educational +1.6%, Healthcare +2.7%, Roofing Contractor + 2.8%, Avg 4 trades +1.7%. Your monthly reminder, although this index is posted monthly, it is corrected quarterly. April data is the correction month for Q1.

New home construction costs have risen about 3% in the last year, from lumber down 4% to concrete up 6%, per JBREC. The US Census Constant Value Rsdn Index is up 3.5% for the 1st 3 months 2025.

The Biden admin supported the construction $200 billion in new manufacturing facilities that began in 2022 and is now tapering down. It will take a lot of jobs to fill those facilities. But will jobs grow in the current economic environment?

Just about anything that can be considered a leading indicator is pointing down. Layoffs, container ship projected offloads are down and falling, China cut shipping to US, supply chains disrupted, immigrant fears affecting labor. Expect costs up, workload down, labor tight.

I’ve been asked, Why don’t you use AI to develop economic analysis? Artificial Intelligence sometimes gets analysis really wrong. There is some percentage (40%?, 60%?) of end results that AI creates that is literally just made up. If you were to use AI to develop forecasts and analysis of construction data, without having a thorough knowledge of the data and an ability to recognize when it’s meaningful, or garbage, then how would you know when AI is right or wrong. Understand your data well enough to know when your analysis makes sense. For my part, I’d rather spend my time understanding the data and the analysis then to spend it verifying if AI is producing realistic and meaningful output.

Summer is just around the corner. The Hummingbirds returned last week.

Construction Briefs Apr 2025

Tariff actions are not yet reflected in Feb PPI Inputs or PPI Final Demand index. Still early. Also remember, PPI does not include imports or tariffs on imports. When we do see movement in the PPI, it reflects domestic pricing decisions following on tariffs.

Lutnick: “Foreign goods may become a little more expensive, but domestic goods do not.” FALSE see next par.

PPI Excludes Imports/Tariffs. The 2018 steel tariffs of +25% applied on imported steel. However the 2018 PPI data shows that the cost of ALL DOMESTIC steel mill products (of all types) produced in the US increased 18% in 2018, after the steel tariffs were imposed.

If tariffs, for example, affect only 10% or 20% of products used in the industry, then the PPI shows us the domestic producers reaction to tariffs, which gets applied to the other 80% to 90% of product. For instance all steel is not imported, so not all steel will experience a tariff. The point here is that tariffs impact pricing decisions on all domestically produced products, not just the imported products. Consumers pay the price.

Impacts on Construction Inflation and Spending (guesstimates).

2021 inflation was 8%-14%. 2022 it was 12%-17%. Could 2025 repeat 2022? Yes. Will it? ??? I guess it hits 6%-10%.

I’m guessing some projects contributing to 2025 spending will be canceled/postponed. So maybe spending drops 5% from here, to zero growth. Construction spending annual growth is normally in the range 4% to 10%. 2025 and 2026 were both forecast at 5% to 7%. No doubt some projects will be canceled or mothballed. So the next 3 yrs spending gets reduced, and cost gets increased.

I’m beginning to think one of the first issues we have to deal with is supply shortages. All types of imported products are not going to be available, and there aren’t enough domestic products to replace them. This will add delays and cost to building projects.

Yeears ago, when I was a construction cost estimator, a major client would run numbers on a proposed new building project. If it couldn’t balance a ROI in 7 yrs, project would not move forward. As cost to build increases, it becomes harder to hit ROI. This supports that some projects may be canceled or postponed.

- Construction – What to Watch

- Cost to build going up

- Cost to finance is up

- Product availability in question

- Product delivery schedule delays

- Margins pressured

- Small/Midsize firms squeezed

- Labor let go/disappearing

- Projects in planning, delayed

- Project ROI not met

- Projects planned, canceled

Virginia has the largest concentration of Data Centers in the U.S. Virginia is projecting energy shortages due to the extreme demand DCs put on power grids. If you don’t build out the energy grid, the data centers put too great a demand on the current grid. “There are six states in the United States where data centres already consume over 10% of the electricity supply, with Virginia leading at 25%.” https://www.iea.org/reports/energy-and-ai/understanding-the-energy-ai-nexus

In the Q1 pre-tariff outlook, Data Center spending (SAAR), began the year 16% above the avg of 2024, is steadily climbing at 1.5% to 2%/mo., and sometimes more, is now up 22% vs avg 2024. By midyear the rate of spending will be up 28%. Data Center spending increased 45% in 2023 and 56% in 2024. Forecast for 2025 +37%. Obviously, this could get reduced if/when some projects get canceled.

The New Albany (Ohio) project, projected worth $1bil, is one of the two announced DC projects that have been halted https://www.nbc4i.com/news/local-news/licking-county/microsoft-pulls-out-of-licking-county-projects/

What if: A 10%/yr reduction in forecast new Data Center starts in 2025 and 2026 would result in reduced Data Center construction spending by -3% in 2025, -7% in 2026, -7% in 2027 and -3% in 2028.

What if: A 10%/yr reduction in forecast new Data Center starts in 2025 and 2026, combined with a 10% cancelation of 2024 starts, would result in reduced Data Center construction spending by -8% in 2025, -10% in 2026, -8% in 2027 and -3% in 2028. A 10% drop in Data Center spending is $4bil/yr.

It is not clear if the two halted projects mentioned in the article above were already committed construction starts or future proposed starts.

The Fed Chair just said what every credible economist, every economics textbook, and every empirical study shows: Tariffs reduce output and raise prices. – Justin Wolfers, Econ professor at Michigan, Senior fellow, Brookings and PIIE.

Let’s not forget what initiated growth in new manufacturing facilities. New manufacturing building contract starts over the last 3yrs is just over $600bil. Normal starts without government investment would be about $300bil over 3yrs. About $100bil of spending growth over the 3 years is inflation, leaving the remainder of about $200bil in spending growth attributed to government investment. All that began, and most of it got spent, under the previous administration. https://www.forbes.com/sites/courtneyfingar/2024/12/12/manufacturing-jobs-boom-arrives-too-late-for-biden-to-benefit/

Whenever we get an unusually large increase in new construction starts and spending, the tapering off of those projects leads to a decline on the tail end. Mnfg new starts peaked in 2022-2023. We are entering the period of the manufacturing construction spending taper. Mnfg spending has fallen slightly in 4 of the last 5 months. The forecast for 2025 is down -10%.

Microsoft has announced a pullback in spending on new Data Centers. Reduced demand negates need for new facilities, kills expansion plans, lowers new construction forecast, decreases jobs growth in construction. Mothball if partially built factory, not only expensive for owner, but also negative impact to contractor’s forecast revenues.

Whenever there’s a devastating natural disaster, causing destruction to homes, property and infrastructure, the supply of contractors, laborers and materials stays the same while demand skyrockets from victims trying to rebuild. Contractors generally pick more profitable projects over less lucrative ones.

In the Construction Analytics Outlook Feb 2025 report I said, “Don’t be surprised if 2025 construction jobs growth slows a bit. Jobs are slightly ahead of volume growth, particularly in the Non-building Infrastructure sector.”

Construction gained 19k (+0.2%) jobs in Feb, BUT total hours worked declined 0.3%. Total jobs have increased but Hrs worked has gone down the last 5 months. We’ve posted minor jobs gains in both Jan and Feb, and yet unemployment has gone up from 5.2% in Dec to 7.2% in Feb.

The March jobs report shows only minor gains in the # of jobs. We’ve added only 24,000 new jobs in the 1st quarter, the slowest 1st qtr jobs growth in 13 years (except for 2020, Covid). But hours worked in March increased by 1.5%. That acts on the entire 8.3 million workforce and is equivalent to adding 128,000 more jobs.

The jobs numbers reported April 4th cover the period from Feb15-Mar15. There are not yet any impacts from tariffs reflected in the jobs numbers.

We may see the term “force majeure” come up a lot in the near future. And if construction contracts don’t have a force majeure clause, there may be a lot of contractors in trouble.

My guess is if the people of Greenland take a vote to Join the United States, it would be 99-1 No. Of course, they would say “No, thank you.” As they so eloquently put it, “We’re not assholes.”

Construction Analytics Outlook Feb 2025

2-22-25 — A PDF of this entire Outlook article has been attached at the bottom of this post. 32pages, watchout. The Outlook has quite a bit more than in the post here.

Construction Spending

for 2024 vs 2023, as of Dec 2024 data, is up 6.5%. All sectors gained between 6% and 7% over 2023. Growth is forecast at 5.5% in 2025. While Residential and Non-building Infrastructure will both gain 7%, Nonresidential Buildings will only see growth of 2% in 2025.

In February of 2025, with the Dec 2024 data in hand, my forecast for 2025 spending is $2,272 billion, 5.5% higher than my current 2024 forecast of $2,154 billion. There is strength in most markets, but Manufacturing is starting a downward slope in spending after three years of blockbuster performance.

This is the first report of a full 12 months of data from 2024. This number gets revised in Mar and Apr and again in July, when any/all months for the last two years get revised.

Last year at this time, leading into 2024, many of the Nonres Bldgs and Non-bldg line items showed Nov-Dec spending was already several points higher than the 2023 average. This year, many markets show very small gains or a decline in the rate of spending from the 1st half of the 2024 into the 2nd half. Some notable declines are Warehouse (-2.7%), Office w/o Data Centers (-3.6%) and Highway/Bridge (-2.9%). All begin 2025 down from the average in 2024.

However, Data Center spending is already up 16% in Oct-Nov-Dec vs the average of 2024, so begins 2025 on a high note, up 16% from 2024. Data Center spending increased 45% in 2023 and 56% in 2024. With spending increasing at an average 3%+ per month in 2024, and starting out at that pace in 2025, it’s easy to predict Data Center spending may reach 40% growth for 2025.

As we begin 2025, the current rate of spending (SAAR) for Nonresidential Buildings in Q4’24 is $761bil, only 2% higher than the average for 2024 ($746bil). If spending stays at the current level and no additional growth occurs, Nonresidential Bldgs spending will finish 2024 up 2%. Spending would need to have more monthly declines than increases to finish the year up less than 2%. The current forecast shows the monthly SAAR rates for Manufacturing, Warehouse and Office w/o DC are driving the downward pressure on overall spending.

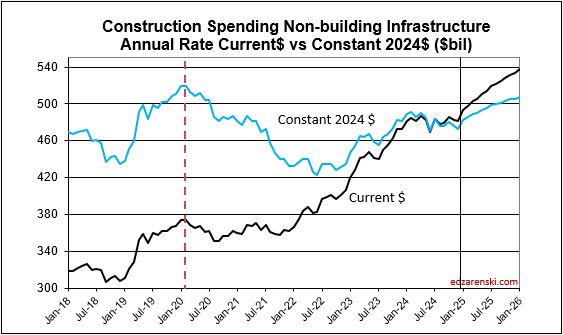

Non-building Infrastructure current rate of spending is only 1% higher than the average for 2024, however the forecast is indicating steady growth of 1.5%/mo for all of 2025. Highway, Transportation and Public Utilities are all contributing to that growth in the spending rate.

Residential current rate of spending is a bit less than 2% above the 2024 average. Growth of 1%/mo will occur in the 1st half 2025, then reverse to a slight decline in the 2nd half.

My construction spending forecast for 2025 Nonres Bldgs is only an annual gain of 2%. Low growth is driven by projects ending in Manufacturing and Warehouse. In the last 3 yrs, there were $230bil Mnfg starts, most in 2022, $130bil above normal, now some are ending. Without Manufacturing, Nonres Bldgs 2025 spending would be up 6%. So while outward appearance may be that Nonres spending is declining, in large part it is due to mega spending on Manufacturing buildings (and Warehouse) tapering down upon completion, creating very large annual declines, but normal. See The Manufacturing Spending Taper

Whenever we get an unusually large increase in new construction starts and spending, the tapering off of those projects leads to a decline in spending in the 2nd half of the scheduled construction. Mnfg new starts peaked in late 2022 – early 2023, so some of these projects would now be in construction for anywhere from 24 to 30 months, well past the midpoint or peak spending. Here’s what the manufacturing spending taper may look like.

In three years, 2020-2022 Manufacturing new starts increased by over 200%. Now, even projects that started in late 2022 are more than 24 months into construction. Peak spending occurs at the midpoint of a project, so peak spending may already be behind us. The current rate of spending in constant$, with exception of Oct. which jumped 2%, remained near flat for the last 8 months. Mnfg new starts peaked in late 2022 – early 2023, so some of these projects would now be in construction for anywhere from 24 to 30 months, well past the midpoint or peak spending. It appears the slowdown in the 2nd half 2024 may be an indication that spending peaked. Although 2025 spending begins 4% higher than 2024 average, my model indicates the rate of spending drops 10% by midyear and by year-end is down 25% from current spending. I’m forecasting 2025 spending average falls 8.5% below 2024.

See The Manufacturing Spending Taper

This same scenario will occur in Highway/Bridge. Normal Highway starts have consistently been about $100bil/yr, with slow growth. But actual starts were closer to $500bil total for the last three years. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for four years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. Once the taper begins it will have the same effect on Non-bldg Infrastructure spending that we will see from Manufacturing in Nonres Bldgs.

Residential spending is 45% SF, 15% MF and 40% Reno. So, only 60% of the total is spending on new housing units. The other 40% is Renovations. Single family construction spending reached a post-2006 high in Q4’21 thru Apr’22. From Apr’22 to the low-point in May ’23 spending dropped 25%. By year-end 2023 it had recovered most of that drop. It fell again in mid-2024, but has since recovered again to the year-end’23 level. Single Family spending is up 7% in 2024 over 2023. Multi-family in Q4’24 is down 10% from Q4’23. Renovations is up 15% from Q4’23 to Q4’24.

The Non-Building Infrastructure spending forecast for 2025 will be most affected by the fact that Power starts for the last 3 years range from 9% to 11%, Highway new starts range from 8% to 11% and Public Works new starts range from 13% to 17%. Starts have been greater than spending each of the last three years. Backlog increased 10% each in 2023 and 2024 and 9% in 2025. Power spending will increase $13bil (8.5%) in 2025, supported by 22% growth in starts the last 2 years. Public Utilities (Sewage and Waste, Water Supply and Conservation-Rivers-Dams) will increase $12bil (13%), with 30% growth in starts the last 2 years.

The Nonresidential Buildings spending forecast for 2025 is most affected by declines in Manufacturing and Warehouse, and increases in Educational and Data Centers. Starts in 2021 and 2022 increased at an average 14%/yr. But new starts in 2023 were only 5.5%, and in 2024 were only 2.6%. Starts in 2023, and especially 2024, have the most impact on 2025 spending. Backlog is increasing, but the rate of backlog growth has slowed from 15% in 2022 to 5% in 2024 and 2% in 2025. Although Data Center spending is expected to increase 42%, that is $12bil. Educational spending will also increase $12bil, even though that is only 9%.

Educational SAAR rate of spending begins 2025 4.5% higher than the average for 2024. Starts are up 18% over the last 2 years. Spending finished 2024 3% higher than it started. The rate of spending is increasing at 0.50% to 0.75%/month for 2025. My forecast is for 9% spending growth in 2025.

Healthcare SAAR rate of spending begins 2025 0.5% lower than the average for 2024. Starts are up 22% over the last 2 years. The rate of spending, increasing since June, is flat in Q1’25, then increases at an average of 1.5%/month for Q2 and Q3 before slowing. My forecast is for 6% spending growth in 2025.

Amusement /Recreation SAAR rate of spending begins 2025 3.0% higher than the average for 2024. Starts are up 18% over the last 2 years. The rate of spending, up 9% from Q1’24 to Q4’24, increases at an average 1.25%/month for 2025. My forecast is for 13% spending growth in 2025.

Lodging SAAR rate of spending begins 2025 3% lower than the average for 2024. Starts are up 14% in 2024 and 20% over the last 2 years. The rate of spending, lower in the 2nd half 2024, increases at an average of 1.25%/month for 2025. My forecast is for 9.5% spending growth in 2025.

Office Bldgs w/o Data Centers SAAR rate of spending begins 2025 3.6% lower than the average for 2024. Starts are down 15% over the last 2 years. Spending in the 2nd half of 2024 is down 5% from the 1st half, in fact from Q1’24 to Q4’24, the rate of spending fell 10%. The rate of spending increases 0.5%/mo in Q1’25, but then falls at 0.50% to 0.75%/month for Q2 thru Q4. My forecast is for a 4% spending decline in 2025.

Data Centers SAAR rate of spending begins 2025 16% higher than the average for 2024. Starts are up 120% over the last 2 years. From beginning to end of 2024 spending increased 20%. The rate of spending increases at near 2%/month for 2025. My forecast is for 42% spending growth in 2025.

Commercial / Retail Bldgs w/o Warehouse SAAR rate of spending begins 2025 only 1.5% higher than the average for 2024. Starts are down 0.5% over the last 2 years. In 2024, the rate of spending fell 3% over the year. The rate of spending begins 2025 with a slight drop then is flat for the rest of the year. My forecast is for 1% drop in spending in 2025.

Warehouse Bldgs SAAR rate of spending begins 2025 2.7% lower than the average for 2024. Starts are down 17% over the last 2 years. Spending in the 2nd half of 2024 is already down 13% from the 1st half 2024. The rate of spending in 2025 drops at 0.25%/month. My forecast is for 4% spending decline in 2025.

Highway SAAR rate of spending begins 2025 2.9% lower than the average for 2024. Spending fell 7% over the course of 2024, but still finished the year up 4%. Starts are up 18% over the last 2 years. Monthly spending is up and down, but averages 0.8%/mo for the year. My forecast is for 3% spending growth in 2025.

Power SAAR rate of spending begins 2025 2.0% higher than the average for 2024. Starts are up 22% over the last 2 years. 2024 spending finished level with where it started and begins 2025 up 2% over avg. 2024. The rate of spending starts strong at 2%/mo in Q1, then falls back to 0.3%/mo for the remainder of 2025. My forecast is for 8.5% spending growth in 2025.

Public Utilities SAAR rate of spending begins 2025 1.7% higher than the average for 2024. Starts are up 29% over the last 2 years. From Q1’24 to Q4’24, spending increased 9%. The rate of spending slows from 1.5%/mo at the beginning of 2025 to 1%/mo by year-end. Sewage/Waste and Water Supply provide the greatest $ growth. My forecast is for 13% spending growth in 2025.

Transportation SAAR rate of spending begins 2025 4.0% higher than the average for 2024. Starts are up 9% over the last 2 years. Spending finished 2024 6% higher than it started. The 2025 rate of spending starts strong just above 1%/mo, but averages only 0.75%/mo for the whole year. My forecast is for 8.7% spending growth in 2025.

STARTING BACKLOG

Starting backlog is the estimate to complete (in this analysis taken at Jan 1) for all projects currently under contract. The last time starting backlog decreased was 2011. If new construction starts in the year are greater than construction spending in the year, then for the following year starting backlog increases. It’s when new starts don’t replenish the amount of spending in the year that backlog declines.

80% of all nonresidential spending in any given year is from backlog and could be supported by projects that started last year or 3 to 4 years ago. Residential spending is far more dependent on new starts than backlog. Only about 30% of residential spending every year comes from backlog and 70% from new starts.

The table below, Forecast Starting Backlog, is model generated by Construction Analytics. Adjusted starts are spread over time to generate cash flow. Spending each year is subtracted from starting backlog and new starts are added to get starting backlog in the following year.

Construction Backlog leading into 2025 in total is up 53% from Jan 2020. Even though several markets are down for the year, every sector (Res, Nonres, Nonbldg) is at all-time high. Since 2020, construction starts have been greater than construction spending, therefore backlog is increasing, but the spread is decreasing. From 2015 through 2019, new construction starts were steady at 4% greater than spending. In 2020, 2021 and 2022, starts exceeded spending by 8%. In 2023 it fell to 6% and in 2024 it was 5%. For 2025, starts are expected to exceed spending by only 3%, indicating the rate of backlog growth is slowing.

Reaching new highs in Backlog could mean not enough labor to support advancing growth so quickly. Future workload from new starts is piling up faster than the current workforce can complete. And the labor force has limitations to how fast it can grow. Nonresidential Bldgs and Non-building posted higher than average starts growth vs spending.

Residential new starts average only 2% greater than spending. Residential new starts in 2023 were lower than spending, so, in 2024, for the first time in 10 years, residential backlog decreased. Even then, residential backlog beginning 2025 is up 61% since 2020. However, these backlog numbers are not inflation adjusted. 45%, or about ¾’s of the 61% residential backlog growth over 5 years is inflation. Real residential backlog growth since 2020 is 16%.

Nonresidential Bldgs starting backlog for 2025 received a boost from all the starts in 2021, 2022 and 2023. Backlog is up 55% from 2020. After 36% inflation, real backlog growth over 5 years is 19%.

Non-building Infrastructure starting backlog was also boosted by strong starts in 2021- 2024. For 2025, backlog is up 49% from Jan 2020. After 38% inflation, real backlog growth over 5 years is 11%.

Manufacturing backlog increased 130% from 2020-2025, from $117bil going into 2020 to $270bil beginning 2025. Prior to tracking Data Centers separately, no other market has ever been close to that growth. But, Manufacturing is 6 times the dollar value of Data Centers. Manufacturing was responsible for 60% of all the Nonres Bldgs spending $ growth in 2023 and 85% in 2024. It was also responsible for 33% of the Nonres Bldgs Backlog growth from 2020 to 2025.

Nonres Bldgs has a total 3.7 million jobs and has never increased by more than 150,000 jobs in one year. Manufacturing is 30% of all Nonres Bldgs spending, so we can assume 30% of Nonres Bldgs jobs. That’s 1.1 million jobs supporting just Manufacturing projects. So Backlog of $270bil, at 5000 jobs per billion per year, would need 1,350,000 jobs for a year. With a 1,100,000 jobs share of the workforce, $270billion in backlog would provide support for 15 months. Of course, new starts add to support throughout the year, but the calculation of how long backlog would support that market segment is valuable.

Likewise, Highway/Bridge has 2025 starting backlog of $240billion and represents 30% of Non-bldg Infrastructure spending, so may occupy 30% of Non-bldg jobs, or 345,000 jobs. But Non-bldg work requires fewer jobs, more like 3,000 jobs/bil/yr, so $240 billion at 3000 jobs/billion/year would need 720,000 jobs for 1 year to complete. Therefore, with a pool of only 345,000 jobs supporting highway work, the backlog of $240billion would provide support for 25 months.

Backlog at the beginning of the year or new starts within the year does not give an indication of what direction spending will take within the year. Backlog is increasing if new starts during the year is greater than spending during the year. An increase in backlog could immediately increase the level of monthly spending activity, or it could maintain a level rate of market activity, but extended over a longer duration. In this case, there is some of both in the forecast. It takes several years for all the starts in a year to be completed. Cash flow shows the spending over time.

NEW CONSTRUCTION STARTS

Total construction starts for 2024 are up 5.3%. Residential starts increased 5.7%.Nonresidential Buildings starts gained 2.6% and Non-building Infrastructure starts are up 8.3%.

Total construction starts for 2025 are forecast to increase 3.8%. Residential starts are forecast to increase 6.1%. Nonresidential Buildings starts are expected to gain 2.5% and Non-building Infrastructure starts will be up only 1.6%.

Residential starts increased 5.7% in 2024. Only about 30% of the spending in 2025 comes from 2024 starts. Most of the spending (70%) in 2025 comes from projects that starts in 2025. This is a result of short duration single-family and renovations projects. Residential starts are expected to increase 6.1% in 2025.

Nonresidential Buildings, starts fell 20% in the 1st half 2023 but still posted the 2nd highest 6-mo average ever. Some of these starts will still be adding to spending into 2025. Nonres Bldgs starts for 2024 gained only 2.6%, due to large declines of 7% to 8% in Manufacturing, Office w/o Data Center and Warehouse, and a moderate 1.2% decline in Commercial / Retail w/o Warehouse. Office w/o Data Center has fallen each of the last 5 years and is down 15% in the last 2 years. Manufacturing starts in 2025 are expected to drop -13%, Office w/o Data Center -4%. Strong growth in new starts in 2025 is expected from Data Centers, Lodging, Healthcare and Public Bldgs (80% of Other Nonres Bldgs). The forecast for Nonres Bldgs new starts in 2025 is +2.5%.

Non-building starts for the 6-mo period Mar-Aug 2023 posted the best 6 months on record, up 30% from the average of 2022. For 2024, Power, Highway/Bridge and Public Works have the strongest gains. These same three markets had the strongest gains in 2023. Power starts are up 22% the last two years. Highway starts are up 19% the last two years. Environmental Public Works are up 29% the last two years and up 50% the last three years. Total Non-building Starts for 2024 are up 8.3%. Non-building starts for 2025 are forecast up only 1.6%.

Data Center starts are up 300% since 2020, up 53% in 2023 and up 44% in 2024, and are expected to increase 27% in 2025. In 2014-2015, Data Centers was less than 5% of total Office+DC construction spending. Today it is approaching 30%. Next year it will approach 40%.

Warehouse starts have dropped 17% in the last two years. Warehouse spending will now slow after climbing 100%+ since 2019. In 2015, Warehouse was 25% of total Commercial spending. By 2022 it had climbed to 54%. In 2025, it will fall back to 45%. But spending will remain near the current level at least for the next three years. Warehouse starts will remain flat in 2025.

Manufacturing starts, the market with the largest $ movement, fell 8.7% in 2024, but still gained 115% from 2019 to 2024. Manufacturing projects can have a moderately long average duration because some of these are multi-billion $ projects and can have schedules that are 4 to 5 years, so some of these projects are still contributing a large volume of spending in 2025. However, as earlier projects begin to taper off, spending will begin to decline.

Manufacturing starts hovered near $80bil/yr from 2014 through 2019. By 2023 new starts had increased to $206bil/yr. Starts fell 9% in 2024 and are predicted to fall by $20bil/yr to $30bil/yr (10% to 15%) over the next three years. Spending is predicted to decline by approx. 10%/yr for the next three years.

Public Works project starts have increased on average 15%/yr for the last four years. Project starts are up 75% in the last four years. Spending is predicted to climb for the next three years.

CURRENT $ SPENDING / INFLATION / CONSTANT $ VOLUME

Volume = spending minus inflation. Spending includes inflation. Inflation adds nothing to volume.

Many construction firms judge their backlog growth by the remaining estimate to complete of all jobs under contract. The problem with that, for example, is that Nonresidential Buildings spending (revenues) increased 14% in 2022, but after adjusting for 12% inflation the actual volume of work was up only 2%. By this method, firms are including in their accounting an increase in inflation dollars passing through their hands. Spending includes inflation, which does not add to the volume of work.

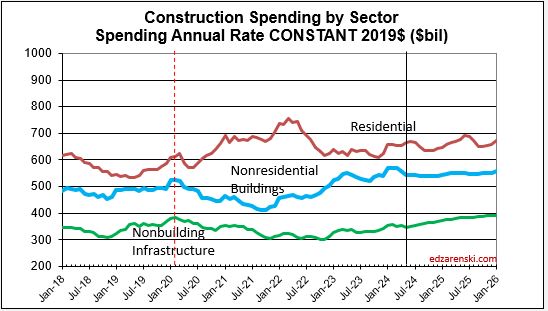

Total volume for 2024 is up 3.1%. Residential +2.7%, Nonres Bldgs +3.3%, Non-bldg +3.5%.

Total volume forecast for 2025 is +1.3%. Residential +2.9%, Nonres Bldgs -1.9%, Non-bldg +3.0%.

Since 2019, spending has increased 55%. Volume has increased only 10%. The difference is inflation.

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. Spending is current to the year stated. The values in the constant table are indexed to a constant value year, now using 2024. This shows business volume year to year, can be a lot different than spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Caution: the following table, showing Constant$ analysis, now shows Constant$ with base year at 2024. Since Q1-2020 I have used the base year at 2019. This update changes the Constant$ amount, but not the Constant$ percent growth. Slight changes in prior years inflation resulted in some minor changes in Constant$ growth.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. Therefore, Revenue does not measure volume growth. In 2022, Nonresidential buildings inflation was 12%, so business volume was 12% less than spending, or 12% less than revenue. Residential volume was 15% less than spending.

Construction spending includes inflation, which adds nothing to the volume of work put-in-place. Construction Volume is a measure of business activity. It eliminates inflation as a variable and shows Constant$ growth. As an example, 2021-22 posted some of the biggest spending increases we’ve seen in 20 years, up over 25% in two years. But, if you look at the bottom row in the table above, we see constant$ growth, or volume, increased only 1.6% in those two years. The inflation rates for those years confirms that almost all of the spending increases were inflation, not added business volume. Construction volume, (spending minus inflation) will finish 2025 up 1.3%, but up only 12% since 2019.

Compare this following Spending by Sector Constant$ plot to the Sector Current$ plot at the beginning of this article.

CONSTRUCTION JOBS

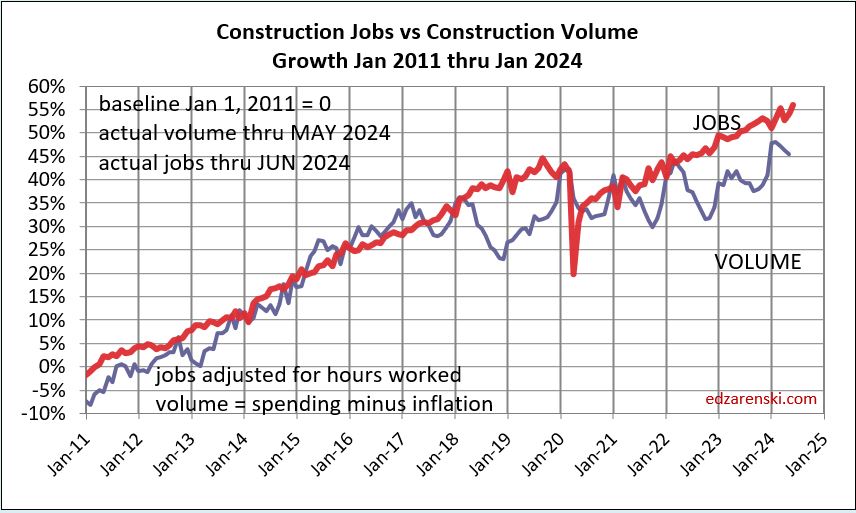

Construction Jobs should not get compared to construction spending. Spending includes inflation, which adds nothing to business volume. Compare Jobs growth to Volume growth. If volume is declining, there is little to no support to increase jobs. And yet, we’ve seen historically that jobs increase at an approximately 3.5%/yr, even when volume does not increase.

Construction Jobs increased 204,000 jobs or 2.5% in 2024. There are currently 8,291,000 construction jobs reported by BLS. The largest annual increase post 2010 is 321,000 jobs (+4.6%) in 2018. The average jobs growth post 2010 is 200,000 jobs per year.

From 2012-2019, we added an annual average 245,000 jobs/yr (+3.9%). From 2021-2024, we added 240,000 jobs/yr (3.1%). In 2024 we added only 204,000 jobs (2.5%). Since 2011, there have been only 3 years in which we added fewer than 200,000 jobs, 2012, 2020, 2021. Also, since 2011, there have been only 3 years in which we added more than 300,000 jobs, 2015, 2018, 2022. Seldom do jobs increase by 400,000 or by 5%/yr. Excluding down years, since 2012, average annual growth is 3.6%/yr.

Here’s an enlarged view of just Jobs/Volume. Removing Spending enhances the vertical scale.

From 2012-2019, we added an annual average 245,000 jobs/yr (+3.9%). From 2021-2024, we added an average of 240,000 jobs/yr (3.1%). In 2024 we added only 204,000 jobs (2.5%). Since 2011, there have been only 3 years in which we added fewer than 200,000 jobs, 2012, 2020, 2021. Also, since 2011, there have been only 3 years in which we added more than 300,000 jobs, 2015, 2018, 2022. Seldom do jobs increase by 400,000 or by 5%/yr. Excluding down years, since 2012, average annual growth is 3.6%/yr.

January jobs report shows we added 4k jobs in Jan, but the unemployment rate went up from an average 4.7% in Q4 2024 (5.2% in Dec), to 6.5% in Jan.

3-7-25 Construction gained 19k (+0.2% mo/mo) jobs in Feb, BUT total hrs worked fell -0.3%. Total jobs have increased but hrs worked has gone down in each of the last 5 months. We’ve posted minor jobs gains in both Jan and Feb, and yet unemployment has gone up from 5.2% in Dec to 7.2% in Feb.

The unemployment rate in construction goes UP in the 1st qtr every year, by at least 2% to 3% (data since 2011). Now, your 1st thought may be, if unemployment is increasing, that is probably because jobs are falling. Well, construction has ADDED jobs in the 1st qtr. every year since 2011 (excluding 2020), by an avg of nearly 30% of all jobs added annually. Construction unemployment is not going up in winter months because we lose jobs in winter. So how can the unemployment rate still go up? The numerator (jobs) is increasing. There’s only one number left in the equation, the denominator (workforce). The result goes up because the entire workforce increases. In this case, the workforce is increasing by greater than the number of jobs added. So, when the unemployment rate increases in Q12025, don’t assume it is because we are losing jobs.

The plot below shows how consistent jobs growth has been over the last 14 years. After the 2020 dip, the slope (annual rate of growth) of jobs growth is about the same as Jan2011-Jan2020. Jobs increase at about 3.5%/yr to 4%/yr., regardless of what volume is doing. In fact, since 2016, the last time volume increased by more than 4%, jobs are up 22%. Volume is up only 11%.

Since Jan 2011, average jobs growth is 3%/yr. Average volume of work growth since 2010 is 2.3%/yr. This plot above shows Jobs and Volume growth closely match from 2011 to 2018. With few exceptions for recession periods, this pattern can be seen throughout the historical data.

What’s remarkable about the growth is this; since 2016, spending has increased 77%, volume after inflation increased only 11% and jobs increased 22%. Volume and jobs should be moving together.

It takes about 5000 (Nonres) jobs to put-in-place $1 billion of volume in one year. It could easily vary from 3000 to 5000, depending on the type of work. So, on average, an add of $100 billion+ of Nonres Bldgs in one year would need 500,000 new jobs. Jobs should track volume, not spending growth. Volume = spending minus inflation. Normal construction jobs growth is about 250,000 jobs per year and maximum prior annual growth is about 400,000.

Non-building, over the next two years, could experience the same kind of growth spurt as Nonres Bldgs., a forecast increase in volume the next two years without an equal increase in jobs. Volume which was lower than jobs since 2021, is now increasing faster than jobs. Non-bldg volume is forecast up 6% to 8%/year the next 3 years. Jobs increase at an avg. 3.5%/year.

Residential volume has exceeded residential jobs all the way back to 2011. The recent decline in volume brings the two even, if the jobs hold the pace.

For as long as I can remember, the construction industry has been complaining of jobs shortages. And yet, as shown in the data mentioned above, jobs have increased greater than volume of work. With an exception for recession years, (2007-2010 and 2020), jobs increase at a rate of 2.5% to 3% per year. The greatest disparity between jobs and volume occurred in late 2022, when jobs growth had already resumed normal pace, but volume of work was still reeling from the effects of new construction starts that were canceled dating back to late 2020 and early 2021. Recent volume growth at a much faster rate than jobs growth is now closing the gap.

For the 4yr period 2021 thru 2024, jobs are up 13%, but volume of work put-in-place is up only 6%.

Don’t be surprised if 2025 construction jobs growth slows a bit. Jobs are slightly ahead of volume growth, particularly in the Non-building Infrastructure sector. Since 2019, both Jobs and Volume increased 10%. But that includes 2020, when volume increased 4% but jobs fell by 250k, or 3%.

When jobs increase without an equal increase in the volume of work, productivity declines. This recent increase in volume and the projected increase in volume in 2024, several points stronger than jobs, will offset some of the disparity which has been negative for a long time.

The Harvard Joint Center for Housing Studies recently posted that In Texas, California, New Jersey, and the District of Columbia, immigrants make up more than half of construction trade workers. This analysis will make no effort to discuss the potential impact of immigrants in the workforce, but we must recognize the makeup of who is filling these jobs. Keep in mind after this analysis reaches some conclusions that this aspect may weigh heavily on the outcome.

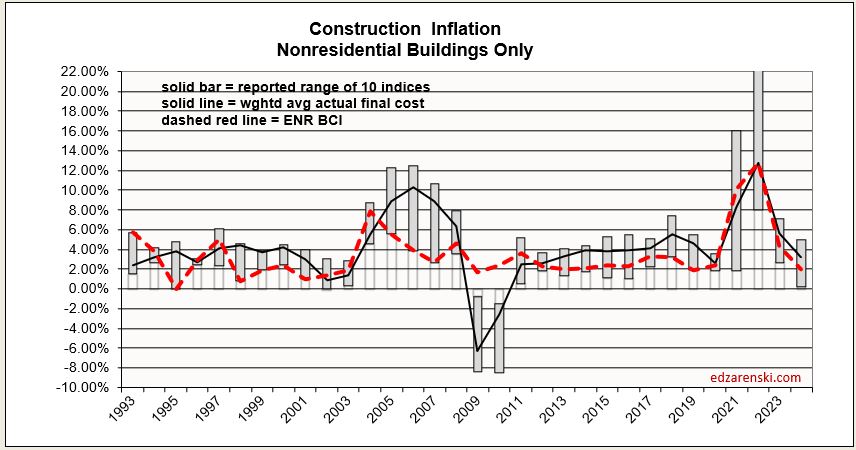

INFLATION

To properly inflation adjust the cost of construction, use a Final Cost Inflation Index.

General construction cost indices, that do not address labor, productivity or margins and Input price indices, don’t reflect whole bldg final cost and therefore do not capture the full cost of escalation in construction.

Final cost indices represent total actual cost to the owner and are usually higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, may not represent final cost of materials to the jobsite and do not include labor, productivity or margins. That’s why a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost.

Construction Analytics Building Cost Index is a weighted average of eight final cost indices.

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

This short table shows the inflation rate for each year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years. The plot below shows the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

30-year average inflation rate for residential and nonresidential buildings is 4.1%. But when excluding deflation in recession years 2008-2010, for nonresidential buildings the long-term average is 4.7% and for residential is 4.9%. For Non-bldg Infrastructure the 30-year average is 3.6%. When excluding deflation in recession years 2008-2010, Non-bldg long-term average inflation is 3.9%.

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

Reference Inflation Data Construction Inflation 2024

Construction Analytics Nonres Building Cost Index is a weighted average of eight final cost indices. It is compared below to the PPI Inputs (not final cost) and PPI Final Demand (yes final cost).

Final cost indices represent total actual cost to the owner and are usually higher than general indices.

Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost.

We can’t always tell what affect changes in the cost of construction materials will have on the final outcome of total construction inflation. PPI materials index does not account for productivity or margins and varies on stage of input.

Jan’25 Inputs are up, +0.8% to Nonres, +1.2% to Residential and 1.2% to Highway, the largest increases since Jan’24. The largest Input item increases in January are Paving Mixtures (up 14.6%), Diesel Fuel (up 3.6%), Concrete Brick, Block & Pipe (up 2.2%), Copper & Brass Shapes (up 1.9%) and Flat Glass (up 1%). Steel Pipe & Tube is down 1.3%. Both Lumber/Plywood and Fabricated Structural Steel are down 0.5% or less.

The PPI Final Demand index (for Nonresidential Bldgs only) is one of several that does account for labor and margins, hence it is defined as a final cost index. In this plot, Jan’25 closes out Q4’24. Total growth in 2024 was only 0.4%.

A Check on Measuring Methodology

And finally, here’s one of the markers I use to check my forecast modeling, my forecasting performance tracking index. The light plot line is forecast predicted from my modeling. The dark plot line is actual construction spending. Even after any separation in the indices, the plots should move at the same slope. Almost without fail, the forecast model, estimated spending from cashflow, predicts the changes in direction of actual spending. The nonresidential buildings plots (and the residential plot prior to 2020) are remarkably close, providing an indication the method of analysis employed, cash flow of all construction starts to get spending forecast, is reasonably accurate.

Note the divergence of residential in Jul-Dec 2020. Actual residential spending finished much higher than predicted. Even the cash flow from an all-time high in new residential starts does not predict spending to increase so rapidly. But residential project spending was fully back to prior levels by August 2020, within 3 months from the May 2020 bottom. In 3 months, the actual spending pushed 15% higher than starts predicted. A part of the spending was the resumption of delayed projects, but another big part was renovations, which surged, and reno is 40% of all residential spending.

Construction Inflation 2025 – 2-21-25 PPI data, INDEX TABLES, Inflation History

Construction Briefs – As We Begin 2025 jobs and unemployment, PPI and tracking edz

Construction – Brief Thoughts Dec’24 thoughts on jobs and when spending mega ends

Compare 10 Construction Forecasts Jan 2025 Jan and Midyr Forecasts compared to actual at end of yr

The Next Forecast Challenge written Apr 2023. Nonres volume did climb much faster than Jobs.

This analysis does not take into consideration the inflation impact of a recession or significant new tariffs. Nor does it assume losing any portion of the workforce to deportation. These are all possible. Construction starts may be negatively affected, and if so, then construction spending will also be affected. Some business will be negatively affected. All will lead to higher inflation.

You can print the Summary report by selecting/printing just the first 5 pages.

Construction Data JULY Briefs 9-5-24

Construction spending 2024 through July is still on track to finish the year up 7.7%. Residential is forecast up 8.5%, Nonresidential Buildings up 6.0% and Non-building up 8.9%.

We still have 3 or 4 more months of slightly declining construction spending, driven mostly by residential, but also by Manufacturing. This is not a long term trend. Sit tight. Oct or Nov, trend tuns back up. You can see the dip in this Current $ spending plot.

Construction spending total for 2024 expected up 7.7%. With inflation at a 4yr low (3%-4%), the amount of spending that is real volume growth is up this year, highest since 2016. It just edge out 2020.

I’m forecasting residential construction spending total for 2024 at $952b ,+8.5%. But three other indicators I calculate to compare to my forecast are telling me it could come in between $960b and $970b. I’m leaning towards higher, but I’d like to see Aug data, and Sept data.

And then there’s this. Census SAAR avg YTD (the average of the reported rsdn monthly SAAR for the 1st 7 months) is $939b. My YTD SAAR avg is $964b. Some down months will lower that slightly by year-end. .

Statistically, YTD spending through July for Rsdn and Nonres Bldgs is 57% of the total annual $ spent. This is indicating year-end total $ for residential will be $963b and $744b for Nonres Bldgs.

JOBS REPORT

Jobs are up by 34,000, 0.4%, in August, up by 80,000 in the last 4 mo., for a total up 1%/4mo. Year-to-date construction jobs are up 160,000 or 2%. Of those, 100,000 were for Nonresidential Buildings. Typical growth is 3.5%/year or about 250,000 to 300,000 jobs/year.

In this last month volume fell 1%. In the last 3 months, business volume fell 2.5%. Volume is falling and jobs are still increasing. There will be a slow patch for the next few months where volume will still fall another 1% to 2%. But jobs did not fall recently, and I don’t expect jobs to fall in the next few months.

The plot above from Jan2020 to Jan2026 is just enlarged view from this plot below, which shows how consistent jobs growth has been over the last 14 years. After the 2020 dip, the slope of jobs growth is about the same as Jan2011-Jan2020.

These next three plots break out the major sectors.

Construction Data MAY Briefs 7-1-24

With the July 1 release every year, Census issues spending revisions to prior years, in this case to 2022 and 2023.

For 2022, Census added +$54bil (3%), mostly to Nonres Bldgs. The largest revisions in 2022 are Comm/Rtl +$10bil (+8%), Mnfg +$10bil (+8%), Power +$12bil (+11%).

For 2023, Census added +$44bil (+2%). The largest revisions are Comm/Rtl +$10bil (+7%), Amuse/Rec +$4bil (+11%) and Power +$12bil (+9%).

Along with 2022 and 2023, Census also revised Jan-Apr 2024. For the first four months of 2024, Census added +$14bil (2.2%), mostly to Residential +$7bil (+2.6%) and Power +$4bil (+8.4%).

Overall, total construction spending, including the May data for 2024, is now forecast +8.5% over 2023. With the upward revisions to Jan-Apr, Rsdn spending forecast is now +7.7% for 2024. Nonres Bldgs (+6.9%) and Nonbldg (12.7%) growth over 2023 is down from prior forecasts not because 2024 spending went down, but because 2023 revisions were higher.

Compare this forecast to the forecasts issued in July in the AIA Consensus Construction Forecast.

From 2012 to 2024, construction spending has been up every year, averaging +8.2%/year. It’s been as low as +4% and as high as +15% in that time. Well, after taking out inflation, construction volume of business really increased only on average +3.2%/year. The low years were +0.2% to -0.2%. The highs were 2014 and 2015 when volume increased +7% and +9%. All other years were +5% or lower. The table below shows the percent volume growth for recent history and forecast.

So far, through May, the inflation rate for all building types is much lower than most of the recent years. All inflation at this point is projected to finish 2024 between 3.5% and 5%. 2024 spending in constant$ will be the highest rate of volume growth since 2020. Keep in mind, the Constant$ in the table above (and in all the plots below) represents 2019$. If reported in 2024$, then 2024 would be constant and all total annual dollars would be higher. The percent Constant$ change from year to year would not change.

While the first 5 months of 2024 show no new highs for residential starts, the average of the first five months is higher than the average for 2023. Starts in 2022 still hold the highest monthly and highest annual average for residential starts.

The jobs plots below show a steady rate of growth in jobs before the spike down, as well as after. It’s just that the pattern was delayed for two years until jobs caught back up to where they were. Jobs move somewhat independent of the volume of work being put-in-place, at a very steady long term growth rate.

Since 2011, jobs have increased at an average of 3.3%/yr., several times reaching 4%/yr., seldom hitting 5%/yr. In the last 12 months jobs are up 3.6%. Year-to-date jobs are up 1.5% for the 1st six months.

This enlarges the 2020-2025 portion of the plot above. Volume growth has spent much of the last three years still lower than needed to balance with jobs growth, but has made rapid recent gains. But look at the Volume plot, down midyear in 21, 22 and 23. My data file shows the next 4-5 month, a stall in spending, but we are at all-time highs, (so, it doesn’t hurt much) then followed by 15 months of growth.

JOBS Year-to-date:

- Residential jobs are up 1.0%. Volume is up 6.4%

- Nonres Bldgs jobs are up 2.0%. Volume is up 1%.

- Non-Bldg jobs are up 1.4%. Volume is up 1.3%

- Total all construction jobs is up YTD 1.5%. Volume is up 3.3%

JOBS In the last 12 months and last 24 months:

- Residential jobs are up 2.6%. Volume is up 4.1%. Over two years, jobs are up 4.4% while volume is up 6.9%.

- Nonres Bldgs jobs are up 4.8%. Volume is up only 0.4%. But look back over two years and jobs are up 8% while volume is up 18%.

- Non-Building jobs are up 3.1%. Volume is up 2.9%. Over two years, jobs are up 6.9% while volume is up 12%.

JOBS Since the onset of the Pandemic (May 2024 compared to Dec 2019):

- Residential jobs are up 15.0%. Volume is up 13.4%

- Nonres Bldgs jobs are up 5.4%. Volume is up 10.6%.

- Non-Bldg jobs are up 6.0%. Volume is down 5.8%

- Total Construction Jobs are up 9.2%. Total Volume is up 7.6%.

Non-Bldg Infrastructure volume is forecast to increase 10% in the next 12 months. Nonresidential Bldgs volume expected to increase 1.7%. Residential expected to increase 1.0%. I expect total volume to increase by 4% to 4.5% in 2024, I expect total construction jobs to increase about 3.5% to 4% in 2024. Total jobs through June are up 1.5%.