Construction Analytics Outlook 2026

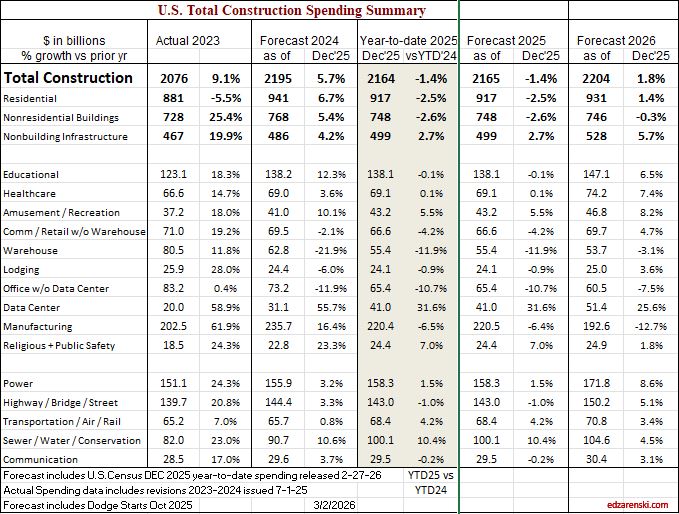

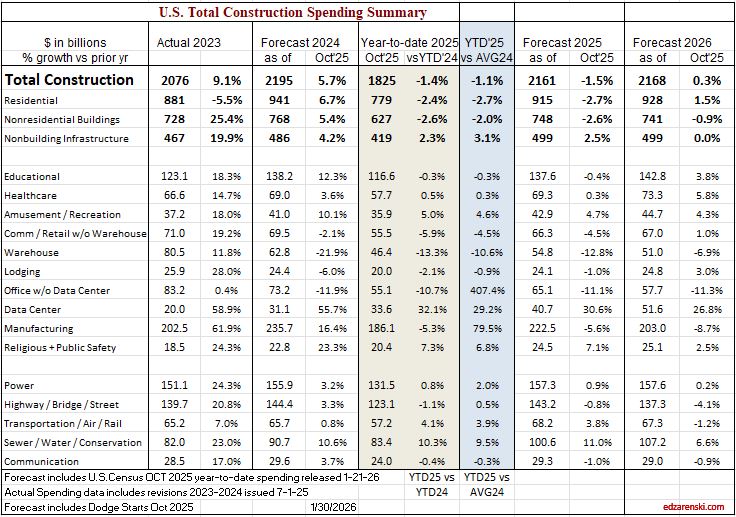

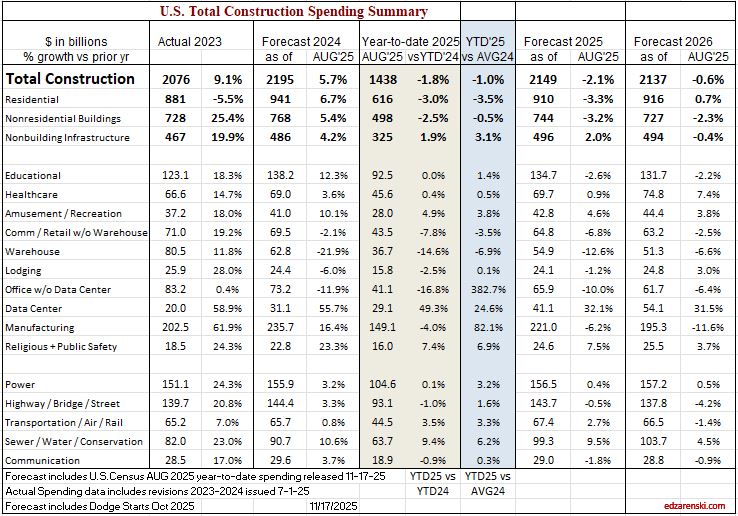

First pass at forecast 2026, includes first Census report of final 2025 spending. 2025 will be revised several times in the coming months, Dec and Nov are still subject to revision. All of this is behind what would be normal schedule due to shutdowns. Then all of 2025 will be revised, often a more significant revision, with the release of May data on July 1. However, this represents my initial Outlook for 2026 spending. More to soon follow on jobs and inflation.

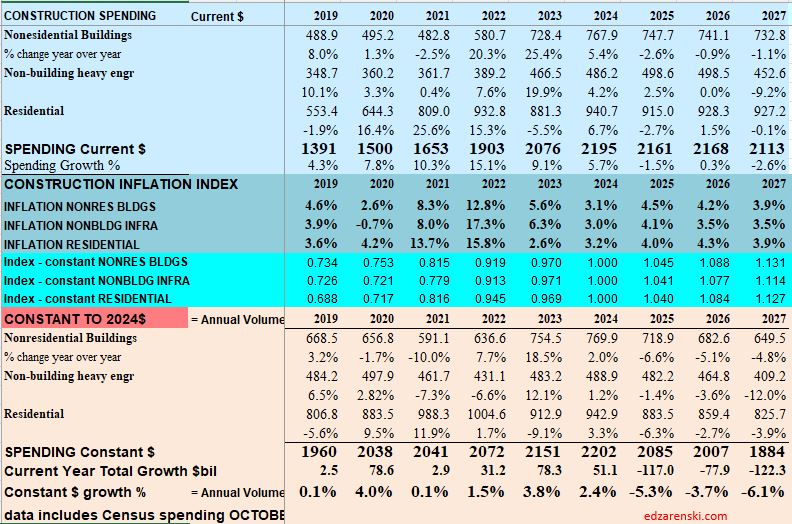

SPENDING

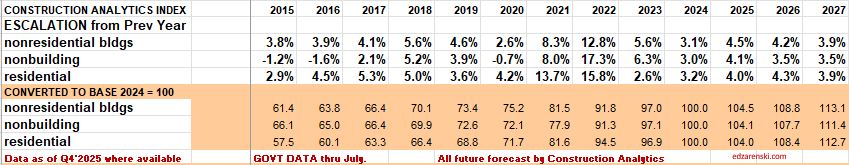

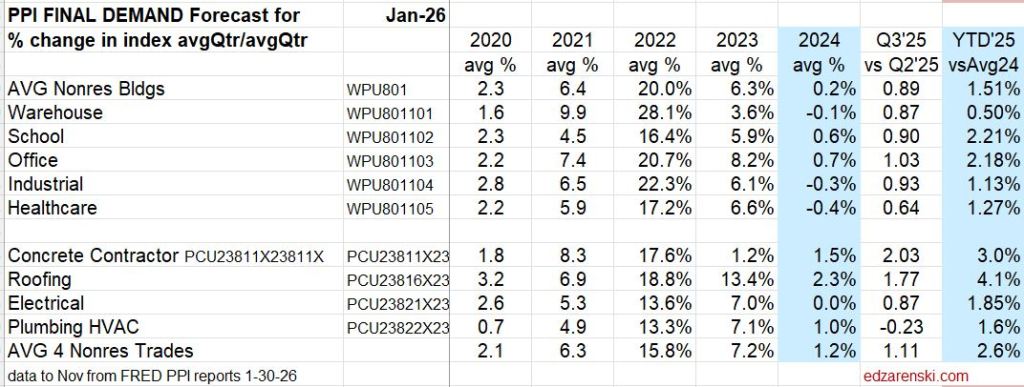

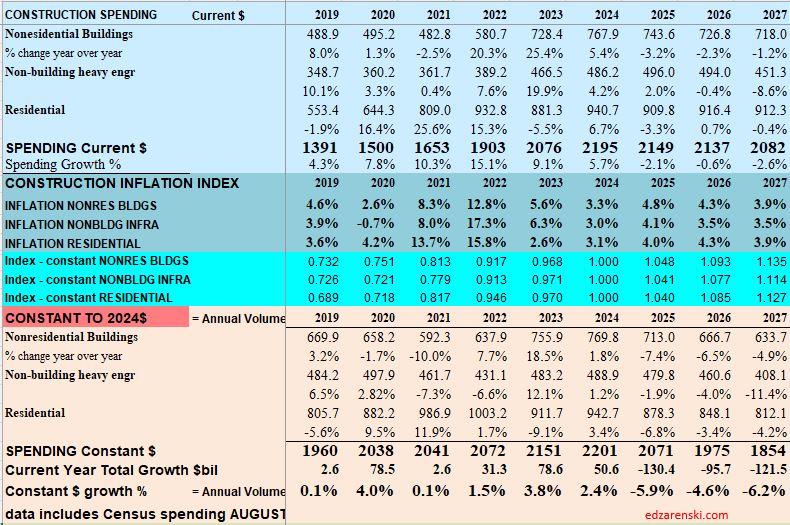

INFLATION

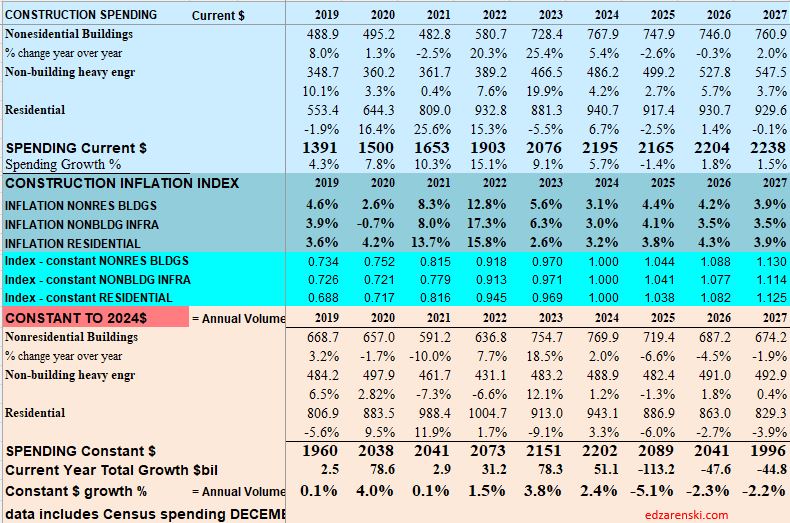

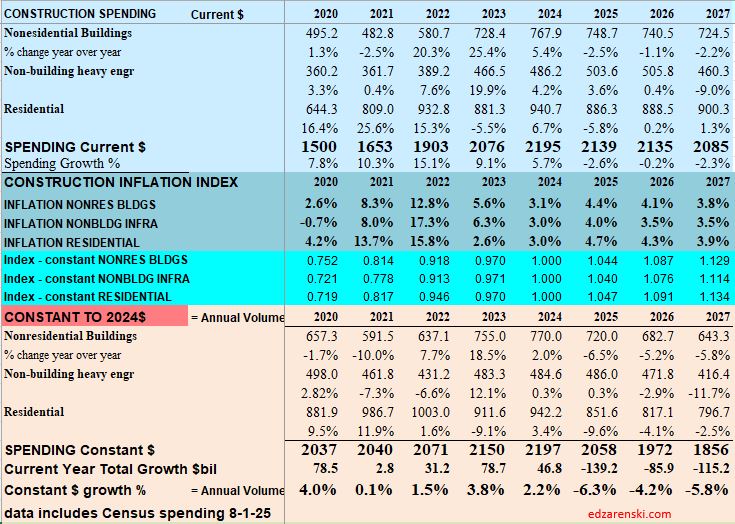

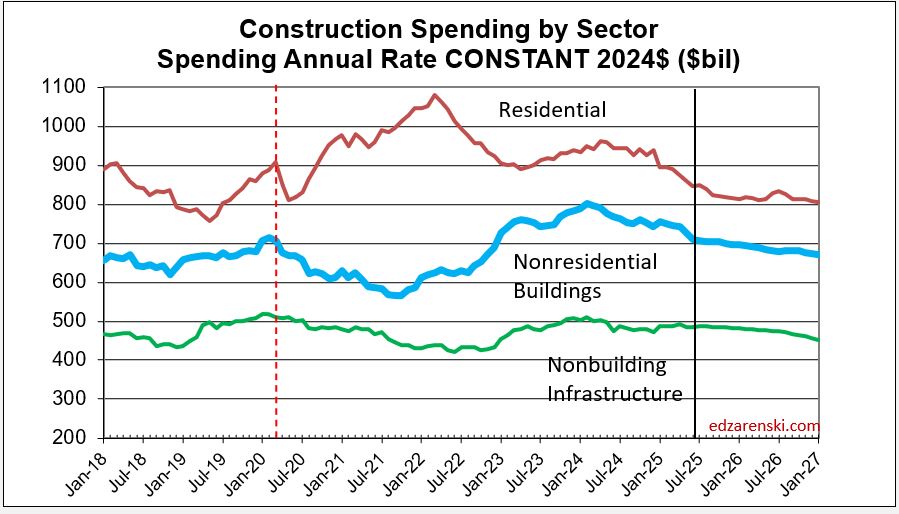

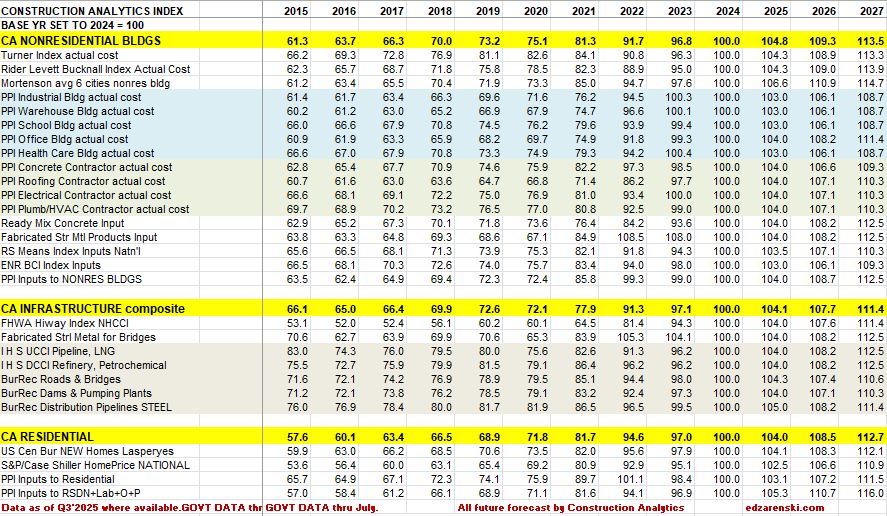

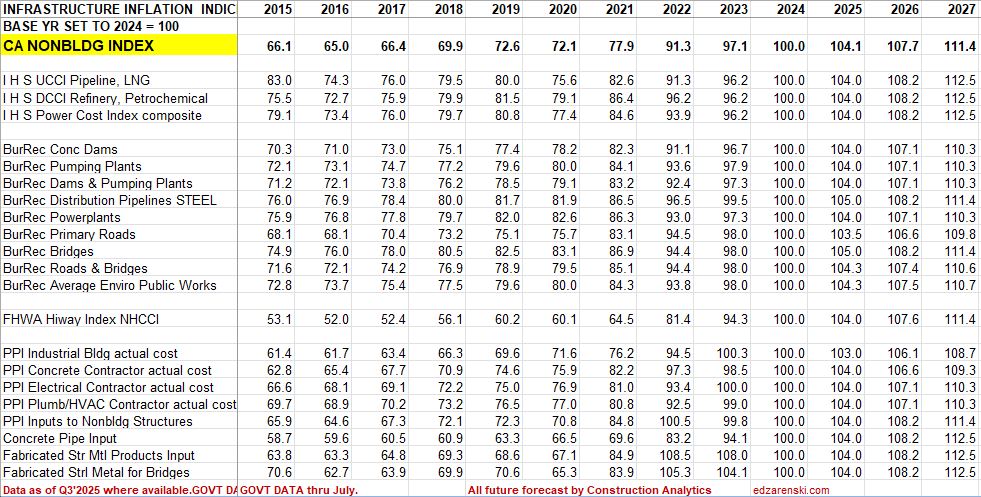

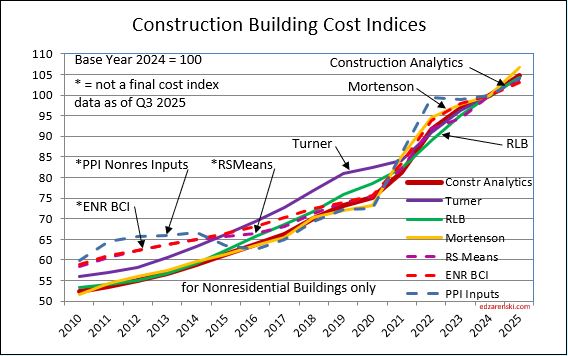

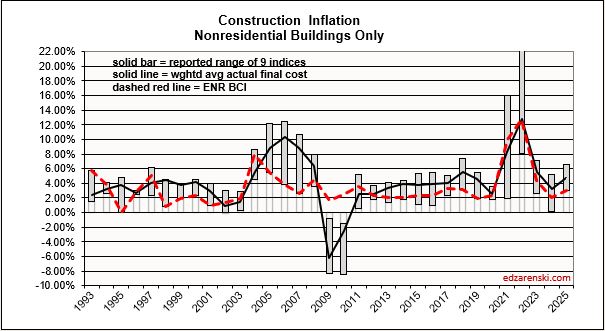

Notice in the table below, I carry inflation at about 4% in 2025 and similar in 2026. Actual inflation values are a composite of eight different sources, so the inflation carried in these reports will never be the highest or lowest. Predicted inflation reverts to historical averages with some influence of current conditions. Taking 4% out of all the spending numbers above gives the Constant$ results or actual volume of business conducted. For 2025 business volume declined 5.1%. For 2026 it’s expected to decline about 2.3%.

An increase in gasoline/diesel prices results in an increase on every single material item used in construction. If it’s not delivery charges, it’s heavy onsite machinery operation to install. Fuel surcharges are not uncommon in construction contracts. It could also be in fuel needed to manufacture products. The current world situation may/will have adverse effects on future construction inflation.

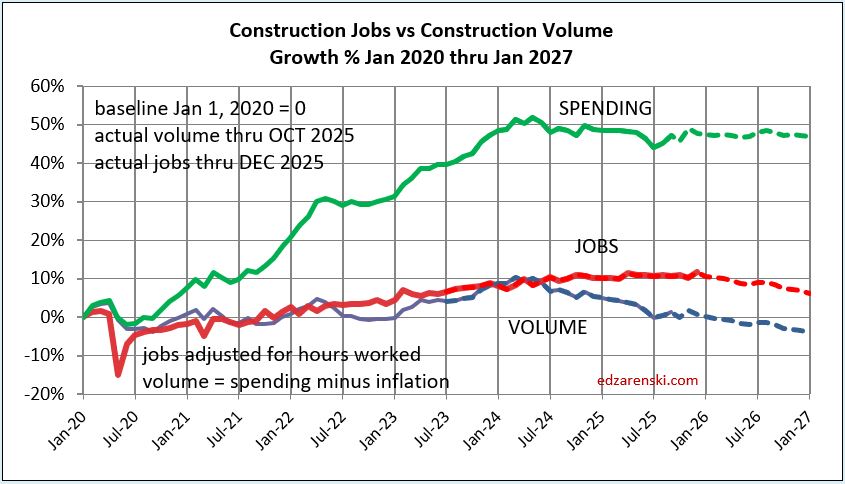

JOBS

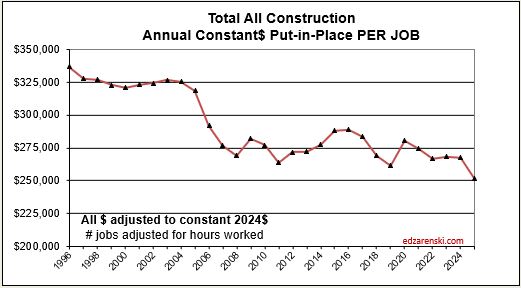

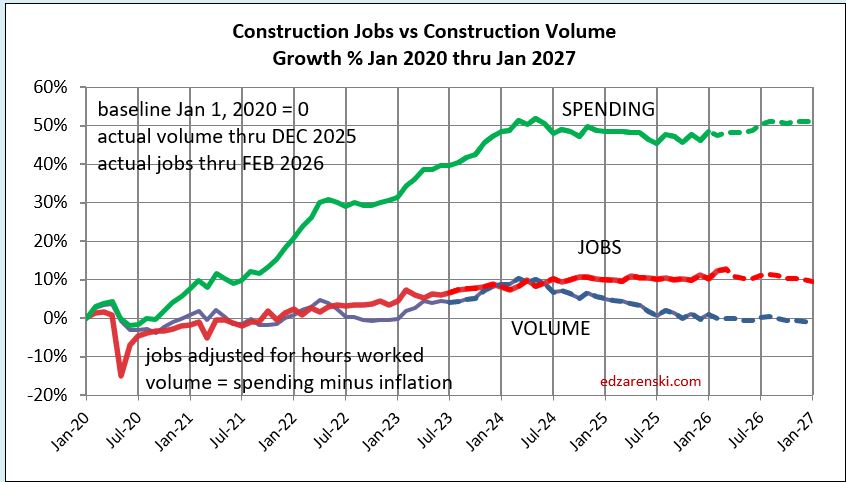

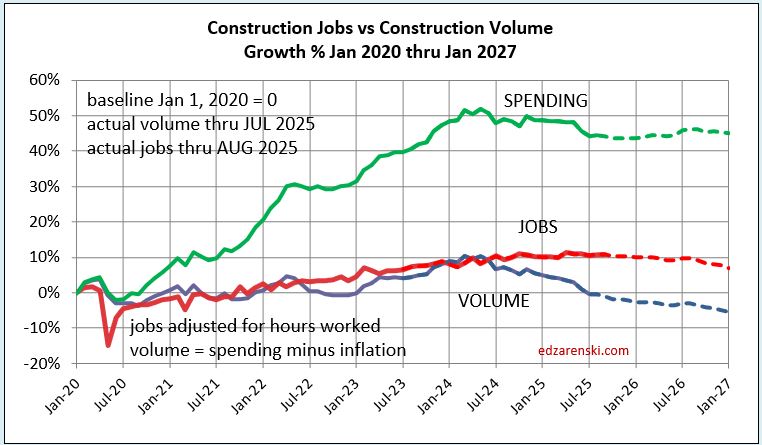

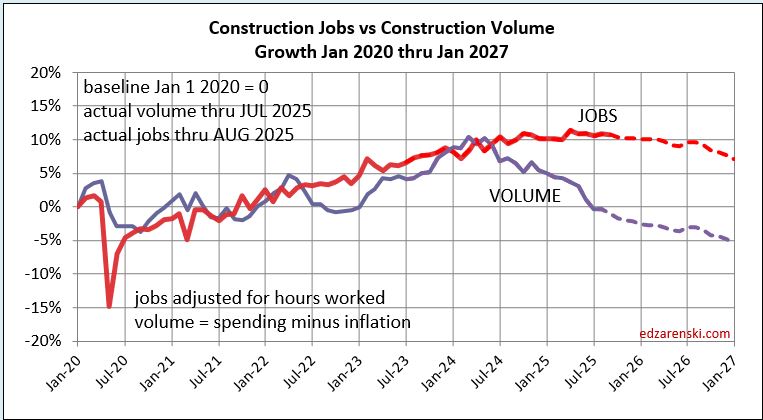

Construction jobs from Dec24 to Dec25 fell by 4,000. But the better comparison, Avg’25 vs the Avg’24, increased by 58,000. Spending was indicating a decline in jobs. Current $ spending in 2025 declined -1.4% or $30bil. After inflation, or Constant$ spending, declined 5.2%. That would indicate a decline of 400,000 jobs, but jobs seldom fall at the same rate as spending.

When constant$ spending declines more than jobs, that indicates a decline in productivity. It’s safe to say that construction productivity is at its lowest point in over 30 years, and by the looks of the following plot, probably the lowest ever.

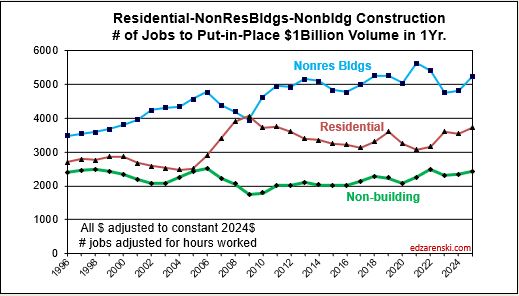

The inverse of $ put-in-place per job (the plot above) is # of jobs to put-in-place a given amount. The plot below does that for $1 billion worth of construction volume. For every billion$ of volume Nonres Bldgs, it takes about 5,000 jobs one year to put-in-place. For residential it’s only about 3,700 jobs. Both vary from year to year. For Nonbldg infrastructure jobs it takes only about 2,500 jobs to put-in-place $1billion in one year.

Although Current$ spending in 2026 is expected to increase slightly, Constant$ spending after inflation is projected to fall about 2.5%, indicating a drop of 200,000 jobs. Once again, don’t expect jobs to fall at the same rate as spending, so don’t expect a decline of 200,000 jobs, but I don’t expect even slow jobs growth like we see in 2025.

YTD through Feb. 2026, construction jobs are up 50,000 over Jan-Feb 2025. That’s kind of a hard to believe number, since construction Constant$ spending, or real construction volume, is forecast down 1.5% or $2.5bil (NSA not seasonally adjusted) over the same two month period. That would have us suspect a loss of 10,000 jobs. Even more astonishing is that workforce hours worked over the same 2 month period ’26 vs ’25 increased 2.5% or the equivalent of +200,000 jobs.

In 2022, 2023 and 2024, jobs increased in 35 out of 36 months. Construction volume fell in 14 out of those 36 months, but average volume increased all three years. We added 680,000. Total 3yr annual average volume increased 8%.

In 2025 plus Jan-Feb 2026, construction jobs declined in 9 out of 14 months. Volume has fallen in 10 out those 14 months. Jobs are down only 0.6% since Dec 2024. Volume fell 5.1% in 2025 and is forecast to fall 2.3% in 2026. Currently there is no growth in volume to support jobs growth.

January 2026 posted the largest construction jobs increase (+48,000) in 4 years. There has been no consistent increase in volume to support jobs growth since the 1st half of 2024.

Unemployment and productivity includes only jobs counted in the official U.S. Census Bureau of Labor Statistics (BLS) jobs report. There is a large, unaccounted for shadow workforce in construction. By some accounts, 40% or more of the construction workforce in California and Texas are immigrant workers. Immigrants may comprise between 14% and 22% of the total construction workforce. It is not clear how many within that total may or may not be included in the U.S. Census BLS jobs report. However, the totals are significant enough that they would alter some of the results commonly reported.

MARKETS

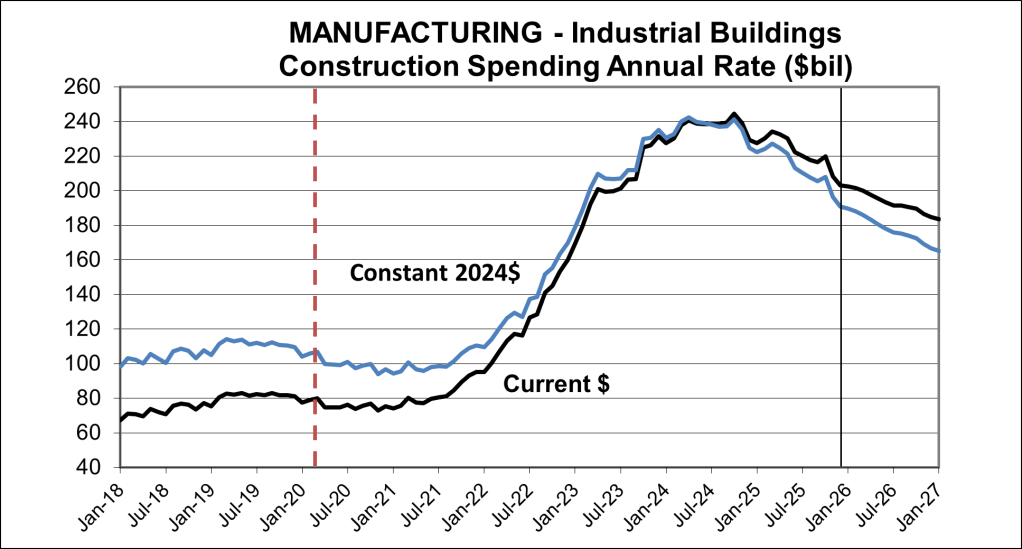

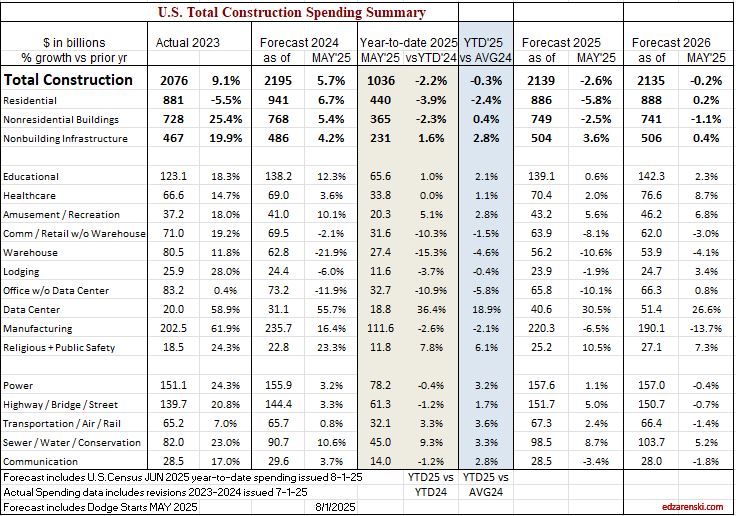

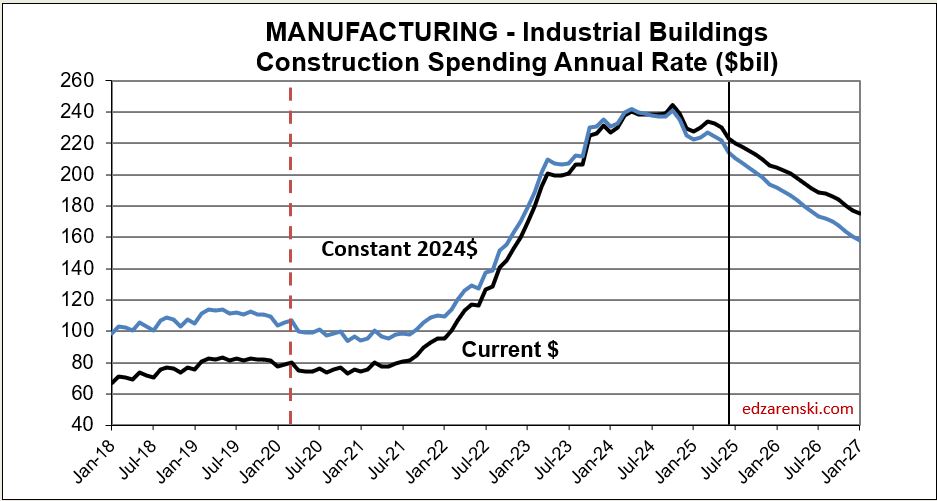

Manufacturing starts peaked in early 2023, now down 25%. Will fall another 10% in 2026. Spending continues decline into 2027.

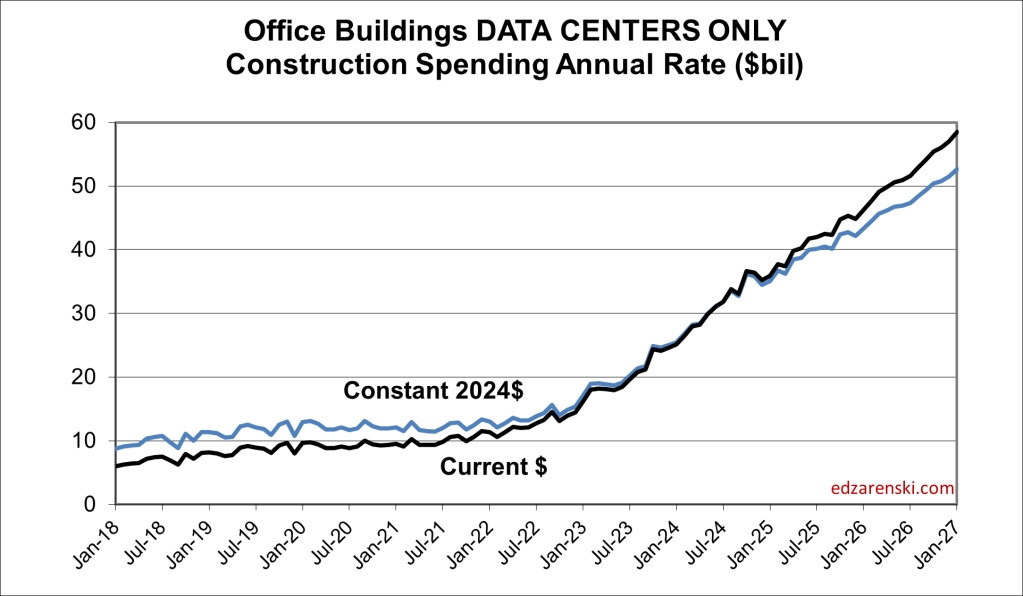

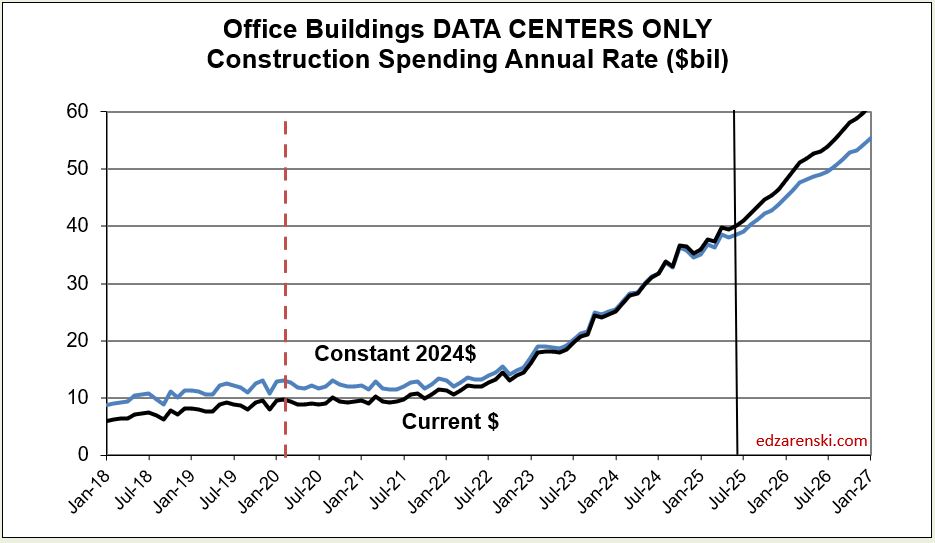

Data Center new starts have been increasing $10bil/year for the last three years contributing to rapid spending growth.

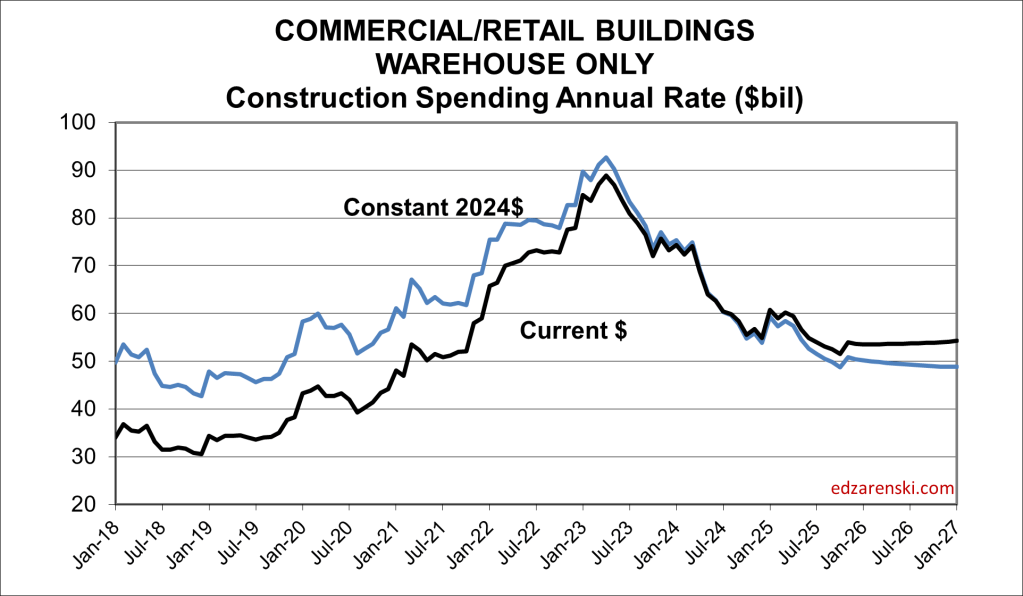

Warehouse starts peaked in 2022 and since have fallen 25%. Spending is down 35% from 2023 peak and may remain at this level through 2027.

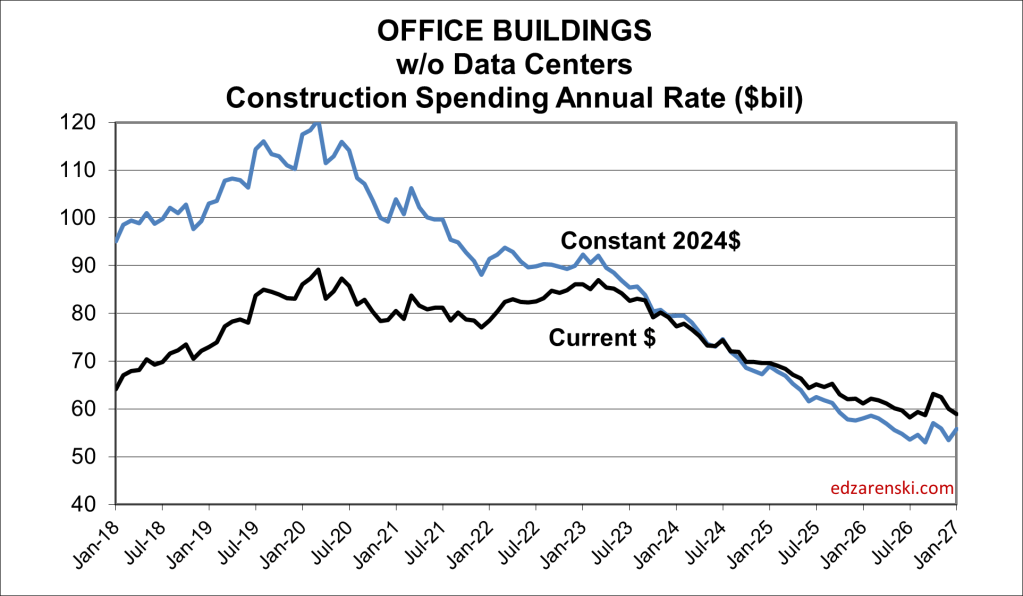

Without Data Centers, Office spending is doing poorly. Spending in Current$ peaked in early 2020 then again in early 2023. Spending is now down 30% from the 2023 peak and is predicted to remain flat for the next few years.

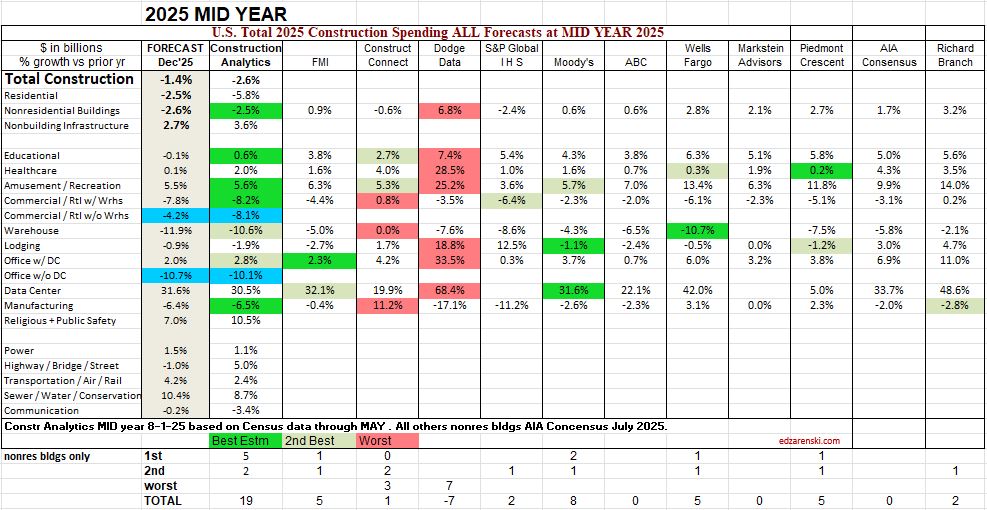

My Midyear’25 Forecast Compared to AIA Consensus

This is a simple list compiled of the percent growth forecast by each firm at Mid year 2025, then compared to the final outcome at year end. It’s a “How’d we do? comparison. The column titled Forecast’25 is the year-to-date spending through Dec. reported by Census 2-28-26, or in essence, the 1st look at final spending for 2025, the number all forecasters are trying to predict. There will still be minor revisions to this number.

To get an idea of how each firm’s forecast compares, I scored 3 points for closest forecast to actual, 2 points for 2nd closest and minus 1 point for worst forecast. Only Nonresidential Bldgs is counted here. We always see the forecasts published. We seldom, if ever, see the final outcome published.

You can search this website (search for the word Compared) for the outcome results for the last 6 years. Construction Analytics, by far, has proven to post the best forecasts. Not always, but more often than any others, particularly in the Midyear forecast where Construction Analytics, out of six years, has three of the best and two of the 2nd best forecasts.

AIA Consensus did not report Commercial/Retail w/o Warehouse, nor Office w/o Data Center. Construction Analytics did not report Comm/Rtl w/Warehouse nor Office w/Data Center, but those values were available in the file data and are shown here for comparison. The two items highlighted in blue are not used in the score.

Construction Briefs Jan 2026 Data Update 2-2-26

We are still not where we should be with actual data due to government data delays caused by the shutdown. Recent releases bring BLS jobs data up to Dec, PPI data through Nov and Construction Spending data through October. Here’s a collection of tables and plots reflecting some of that data through the end of January.

Construction Spending Value Put in Place

The November 2025 release, originally scheduled for January 2, 2026, and the December 2025 release, originally scheduled for February 2, 2026, for the Monthly Construction Spending report have been rescheduled for release on February 27, 2026.

There’s is an unusually large decline in residential construction spending in Sept data, almost entirely attributed to renovation work. A closer look at the data shows it may be that Aug and Oct reno data seem out-of-sync and those may be overstated. All 2025 data still open to Jul 1 revision.

25 data center projects were canceled in 2025 amidst surging local opposition — 4X as many as in 2024.

( Personal opinion – Data Center growth will be restricted by difficulty to ramp up power generation and transmission. This in turn will slow construction spending growth in this market).

Construction Jobs increased 1.1% in 2025. Spending (actual thru Oct) fell 1.5% in 2025. But inflation ate up 4% of spending. So real volume of construction activity fell 5.3%. Therefore, productivity fell 6.4%.

Also, if your construction business revenue increased less than 5.3% in 2025, your real business growth fell in 2025.

Jobs 2025 Nonres Bldgs +1.6%, Nonbldg +2.4%, Residential -0.6%

Construction Spending – Volume – Jobs

Construction Jobs avg 2025 increased only 88k from avg 2024. Slowest jobs growth since 2011 (ex 2020). Jobs 2025 up 1.1% over 2024. Jobs have been flat (or +/- slight) since Feb.

Residential jobs down 0.6%, but rsdn spending ytd thru Aug down 3.7% from Q4’24. After adjusting for inflation rsdn volume ytd is down 6%. Nonres Bldgs jobs up 1.6%. Nonres Bldgs volume down 3%. Nonbldg jobs up 2.4%. Nonbldg volume up 1.5%.

Environment for construction jobs looking difficult. Volume of work (spending minus inflation) available is declining all through 2026. Biggest declines by far, Manufacturing and SF Rsdn.

In the 10 months period Jan-Oct’25, construction volume declined by 4%. In the same period, construction jobs increased by 0.5%. And yet some economists are saying that job openings and hires indicate a labor shortage. Jobs should follow the amount of business volume.

Don’t expect construction to add jobs in 2026. While spending may be near flat, inflation data for 2026 has volume projected to fall 3.7%.

Construction Productivity

Construction spending constant $$ (volume) for 2025 is down 5.3% compared to start 2025 or same month 2024. I’m forecasting a decline of 3.7% in 2026. A 3.7% drop in volume could be a loss of 300,000 Jobs. Companies usually don’t cut # of jobs indicated by falling business volume. More jobs remain than volume. Productivity ($ pip per job) declines.

In 2026 real construction volume after inflation is expected down -3.7%. If we keep all current jobs, then volume put-in-place per job is lower, a decline in productivity of 3.7%. If we want to maintain the current level of productivity, we would need to lose 3.7% (300k) jobs. Unless the volume of work increases, I’d expect productivity to fall in 2026.

Volume of work is spending minus inflation. When jobs growth exceeds volume growth, productivity is declining. Volume has been declining for last 2 years and is expected to continue declining in 2026.

Inflation Index and Producer Price Index

If you track company revenues as business growth, without adjusting your business plan for inflation, you’re tracking register receipts, not business volume. Here’s a simple example to understand the difference in revenues (spending) vs volume. If a basket of apples 2yrs ago cost $25, but today the same basket cost $35, receipts increased 40%, but business volume has not changed.

Construction Briefs NOV 2025

After some delayed data released recently, we now have August Construction Spending and Sept Jobs.

In the past 12mo, Rsdn construction jobs fell 46k (-1.4%). Nonres Bldgs jobs increased 59k (+1.6%) and Nonbldg jobs increased 24k (+2.1%). Rsdn spending is down 5% (-$39bil) Nonres Bldgs is down 3.4% (-$25bil) Nonbldg is up 3.1% (+$15bil) Expect total spending in 2025 down 2.1%, jobs UP 1%

Construction Spending Forecast Total spending varies less than 1% from current through 2026 Jobs YTD up 16k. Only times job growth that slow was 2020 or recessions. 2011 through 2024, even with losses in 2020, avg jobs growth was 200k/yr. Don’t expect job openings (see JOLTS) in near future.

Environment for construction jobs looking difficult. Constant $ spending in 2026 is down just less than 1%. But Volume of work (spending minus inflation) available is down just over 4% and is declining all through 2026. Biggest declines by far, Manufacturing and SF Rsdn.

The decline in Manufacturing construction spending is due to having passed the peak in the scheduled project timelines for the large volume of mega-projects that started in 2021-22-23-24. (I wrote about it in more detail in Nov’24 in the article linked.) Peak spending is typically just past the midpoint of project construction. From Apr 2024 to Nov 2024, Mnfg spending averaged $240bil., the highest rate of spending on record. In 2025 it started the year at a rate of $$230bil but will end the year at $210bil. By the end of 2026 the rate of spending drops to $190bil.

The Manufacturing Spending Taper

My forecast has not changed much overall in the last few months. Residential has gained in revisions added to June and July and Aug posted a very strong 1.3% gain.

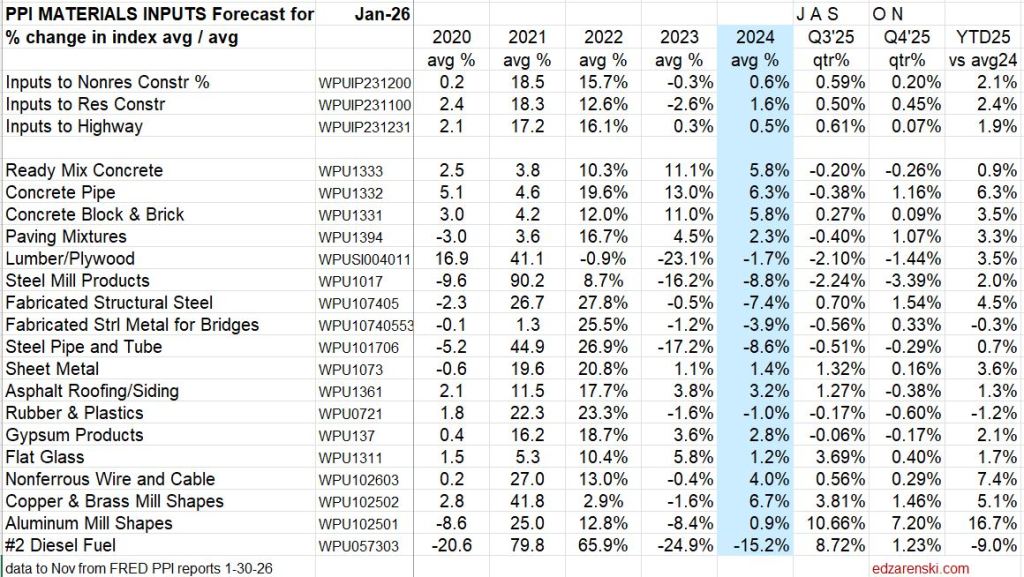

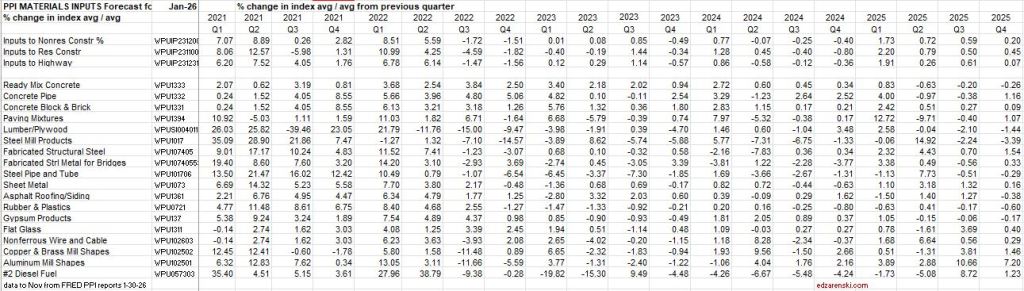

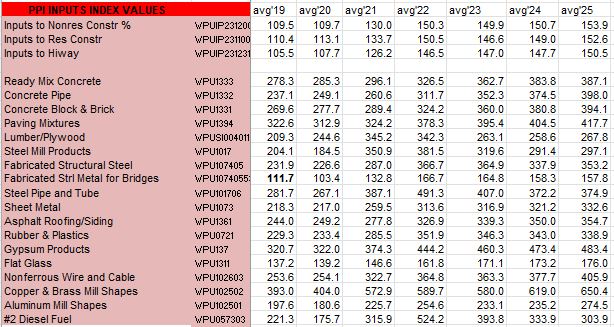

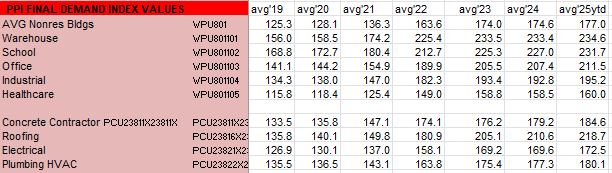

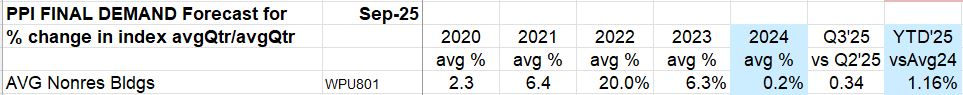

We will wait a little longer before we see any meaningful changes in construction materials input costs. September data (released 11-26-25) reported here. Also remember, PPI does not track imports, only domestic producers. Therefore, any implied increase in PPI being related to tariffs would be a domestic reaction to an import tariff. We can expect that.

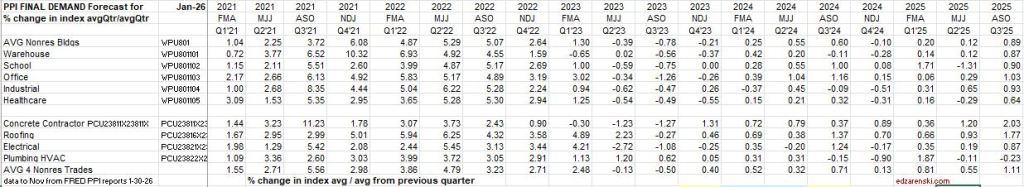

INPUTS thru Sept up ~2% from avg2024. Final Demand for Nonres Bldgs is up 1.2% ytd vs avg 2024. However, Oct is the revision month for Q3 Final Demand data, so Final Demand data not finalized for Q3.

Construction Inflation 2025 Update Nov

Please refer to Construction Inflation & PPI 2025 updated 10-17-25 for extended discussion of inflation, how and when to apply, historical indices, PPI Data and Tables. Also see Construction Briefs Sept 2025 for August PPI data. No PPI data has been updated since Aug data issued in Sept.

We are still missing a lot of information. It was expected that much of the tariff costs would show up in Q3, or even Q4, so these costs are more likely to go up than down. But we can’t see those changes in cost. However, there are no shortage of reports of cost pressures. It’s much more than just tariffs.

Turner Nonres Bldgs Index is up 3.5% ytd for Q3, up 1.1%-1.2% each quarter.

Rider Levitt Bucknall Nonres Bldg Index for Q3 is up 3.3%, up 1.0%-1.1% each quarter.

Mortenson Nonres Bldgs Index is up 6.3% for 9 months.

Census New Single Family Home Index is up 3.9% YTD for 8 months thru Aug.

RS Means Nonres Bldgs Index is up 3.4% for 9 months, w/o margins.

The Producer Price Index for construction materials shows these items up greater than 4% ytd as of Aug: Concrete pipe, Paving Mixtures, Lumber/Plywood, all copper and aluminum wire and shapes.

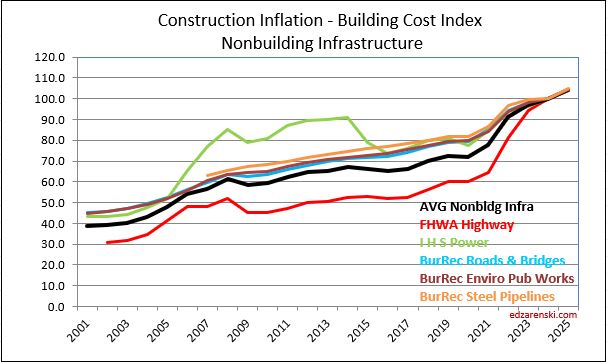

30-year average inflation rate for residential and nonresidential buildings is 4.1%. But when excluding deflation in recession years 2008-2010, for nonresidential buildings the long-term average is 4.7% and for residential it’s 4.9%.

For Non-bldg Infrastructure the 30-year average is 3.6%. When excluding deflation in the recession years 2008-2010, Non-bldg long-term average inflation is 3.9%.

All of these long term averages went up in recent years because, instead of including 1991-1994 at 2%/yr, we are now including 2021-2024 at 7%-8%/yr. All long term and short term inflation rates went up.

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

The forecast values carried in the following tables reflect trades and firms currently posted Q3 inflation trackers, using an assumption that rates tend to follow the current pattern and with no reasoning to assume a Q3/Q4 price decline.

Forecasting in a Shutdown

10-7-25 It sure doesn’t help forecasters when we can’t get fresh data. So how can we forecast when there is no current data forthcoming?

One of the data sets that my forecasting models are set to calculate is annual forecast on smaller sets of data within the year. For example: The Total Spending SAAR average for the months of AMJJAS (Apr thru Sept) when extended for a full 12 months, predicts the annual spending within +/- 1%. This calculation has been within this 1% limit 22 times in 24 years (think Drake Maye accuracy here). The other 2 years were off by 1.1% and 2.2% (in 2020). And unfortunately, we don’t have August or September data.

The last actual data we have is July. For Nonresidential Bldgs, the average predicted from AMJJ (Apr thru July) predicted the annual total Nonres Bldgs spending within 1.8% 13 out of the last 14 years (2011 to 2024), with one year being 2.6%. The average of those 14 years is less than 1% off from the actual.

This is not a simple average. Each month produces a different share of annual spending. For ex: Based on 20-year averages, January and February each produce only about 7% of annual Nonres Bldgs spending while June and July produce each about 9% of annual spending. When a small set of data is used, the spending in each of those months is compared to the 20-yr average for those months and projected out to get 100% or a full 12 months of spending.

The small data set of AMJJ, when used to predict 2025 Nonres Bldgs spending, forecasts +/- 0.9% or $730bil to $756bil. The average predicts spending on Nonres Bldgs will hit $743bil. My current forecast, which includes actual data thru July and forecast to year end, predicts spending will hit $749bil.

Residential spending, based on small data set is between $882bil and $920bil., with the average predicting $901bil. My current forecast with all actual data from Jan thru July and forecast thru year end is $892bil.

The best small data set predictor is having data for AMJJAS. This predicts total spending will come in between $2109bil and $2149bil, with the average for the year at $2133bil. My current forecast predicts spending for 2025 will total $2140bil.

Generally, I look at these small data set calculations to insure I haven’t made some kind of blunder in my forecast. In this case, the small data set gives some comfort level that the annual forecast, although based on only 7 months of actual data, may not be very far off from what to expect at year end.

Construction Briefs Sept 2025

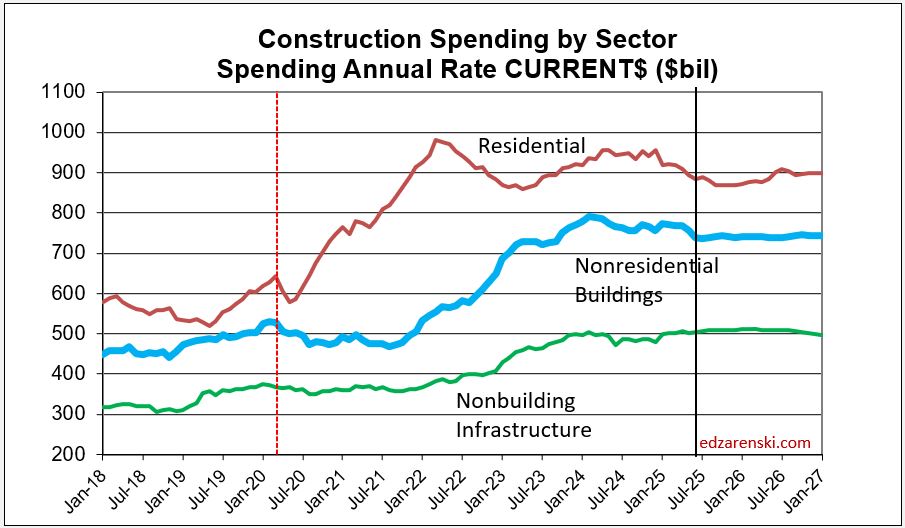

The headline construction data is the year-to-date (ytd) comparison. Through July data, ytd2025 is -2.2% compared to ytd2024. But where is it headed. Watch for this. Last year spending was increasing until it peaked in October. This year spending is falling and will continue to fall into Q3. Every month now the ytd spread gets worse, because 2025 is decreasing and 2024 was increasing. It’s significant in residential which is currently thru July down YTD 4.0% and is forecast to finish 2025 down 5.2%.

Construction Spending is down 7 out of the last 9mo, now down -3.5% or an inflation adjusted total -6.5% since October. Over that period spending is down most significantly in Residential. Residential spending peaked in October 2024. Since then it’s down 10% ($90bil). Warehouse is down -12% ($8bil). Manufacturing is down only 6% but that is $15bil. Manufacturing is experiencing the tail end of a huge volume of work that peaked also in Oct., 2024. It is expected to continue on a slowly declining spending slope for at least the next year. Spending is up the most now in Data Centers, on track to gain 32% (+$10bil) in 2025 and 31% ($13bil) in 2026.

When spending is up by just a little it looks like we are making progress. But we are always fighting inflation. If spending is up by 3% but inflation is 4%, then real business volume declined by 1%. If spending is down 5%, with 3% to 4% inflation, business volume is down 8% to 9%.

Overall, business is declining. The current data in the table below indicates constant$ spending, or business volume, drops for the next three years.

Do not overlook the impact of inflation. Residential spending for 2025 may end down only 5.2% but spending includes inflation of 4.7%. When real residential volume is compared to real volume in 2024 we find that residential volume of business declined 9.1% in 2025. This happened also in 2023, then not since 2009, when it fell 24%. Let that sink in! Residential business volume in 2025 is forecast down almost 10% ($85bil). Since the most recent peak spending in 2022, residential volume is down almost 15%, (~$150bil).

Since 2011, (excluding recession yrs) construction jobs thru Aug increased on average by 150,000 over the 8mo. For 2025, jobs thru Jul increased only 6,000, the slowest jobs growth (ex recessions) in 50 years. Residential construction jobs peaked in Sep’24. Spending was near the May peak from August to December. Since then, spending has been falling and will continue to fall. Rsdn jobs have fallen 7 out of the last 10 months. Rsdn jobs are down 1% ytd. Nonresidential and Nonbuilding jobs are both increasing slightly. The outlook for 2025 has construction jobs falling by 40,000. Jobs are expected to fall even more in 2026.

While many of the construction cost items in the PPI are tame so far, there are a few that have outsized gains. PPI YTD thru Aug vs the 2024 avg Conc Pipe +6.2%, Lumber/Plywd +4.4%, Fab Str Steel +3.5%, Nonferrous wire +7.2%, Alum Shapes +12%, Diesel -10.3%.

Final Demand pricing for Nonres Bldgs holding down at 2% or lower. Construction Analytics inflation rate for 2025, which includes inputs from eight sources, is 4.4%.

Remember, the PPI does not track imports or tariffs.

Construction Briefs Aug 2025

The biggest story in construction data right now is jobs.

Average construction jobs growth through July, last 25 years, excluding recessions, +130,000.

Average construction jobs growth through July, last 10 years, excluding recessions, +140,000.

2025 Construction Jobs growth through July, +21,000.

Not so surprising, as the Constant $ construction spending through July is down -5.7%, (compared to same months previous year), steepest decline since 2011, which was the end of the great recession. Constant $ (inflation adjusted) construction spending is now back to early 2022 level.

Construction Spending is down 5 of the last 6mo, now down a total -3.0% from Dec. Over that period spending is down most significantly in Residential, Manufacturing and Commercial w/o Warehouse. It’s up the most in Data Centers, Highway and Public Utilities. Overall, business is declining.

Construction Spending inflation adjusted is forecast to drop slightly every month for the rest of the year. Expect constant $ spending at year end down -6.3% from 2024. Uncertainty over tariffs and funding subsidies has slowed decision making on planning and moving new projects forward to construction. This is not an environment to expect jobs growth.

If jobs were to move at the same rate as business volume, with 2025 construction spending in constant$ expected to fall -6.3%, then jobs would be expected to fall -6.3%. That’s 500,000 jobs. The only times we’ve ever lost 500,000 jobs in a year was in both 2009 and 2010. In those years, after falling 17% in the previous 3 years, business volume dropped another 12% and 10% respectively.

Residential construction jobs peaked last September and are now down 1% or 35,000 jobs since then. In Constant $, residential spending is down 10% since last September. Jobs never move at the same rate as spending. This has a significant impact on productivity.

Data Centers are the bright spot in construction spending, up 17% since December and forecast to finish the year up 30%, an increase of +$10bil.

Biggest forecast declines in Current$ construction spending: Residential -5.8% (by far largest $ decline, -$55bil); Manufacturing – 6.5%, -$15bil; Warehouse -10%, -$7bil; Office (ex Data Centers) -10%, -$7bil; Comm Retail (ex Warehouse) -8%, -$6bil.

Manufacturing spending is now receding from an astronomical high. From 2019 through 2021 spending was averaging $80bil/yr. In 2024 it reached an average of $235bil, and peaked in Oct at $244bil. In June it was only $223bil and it’s expected forecast for 2025 is down -6.5% from 2024, but that is still a very high $220bil.

Presentation Recorded 5-25 Advancing Precon (inflation data only)

Even though this file is shortened from the full presentation it is still over 800MB. It’s too large to transfer by email and the full presentation is too large to upload here. May take 20 minutes to download.

Comprehensive Construction Inflation 2025 text and graphics post on this blog Construction Inflation 2025 PPI updated 5-15

Construction Briefs July 2025

Construction Spending is down in each of last 5mo, now down a total -2.4% from Dec. Biggest declines are Warehouse -7.7%, Commercial w/o Wrhse -4.6%, Office w/o Data Centers -4.3%, Residential -4.2%, Transportation -3.7% and Manufacturing -3.5%.

Residential posted the biggest $ rate drop, -$40bil SAAR since Dec.

Data Centers are up 9% in 5mo, but last year DC were up 56%, increasing 15% in the 4th qtr alone. The rate of growth has slowed from near 4%/mo in the 2nd half 2024 to less than 2%/mo in the 1st 5mo 2025.

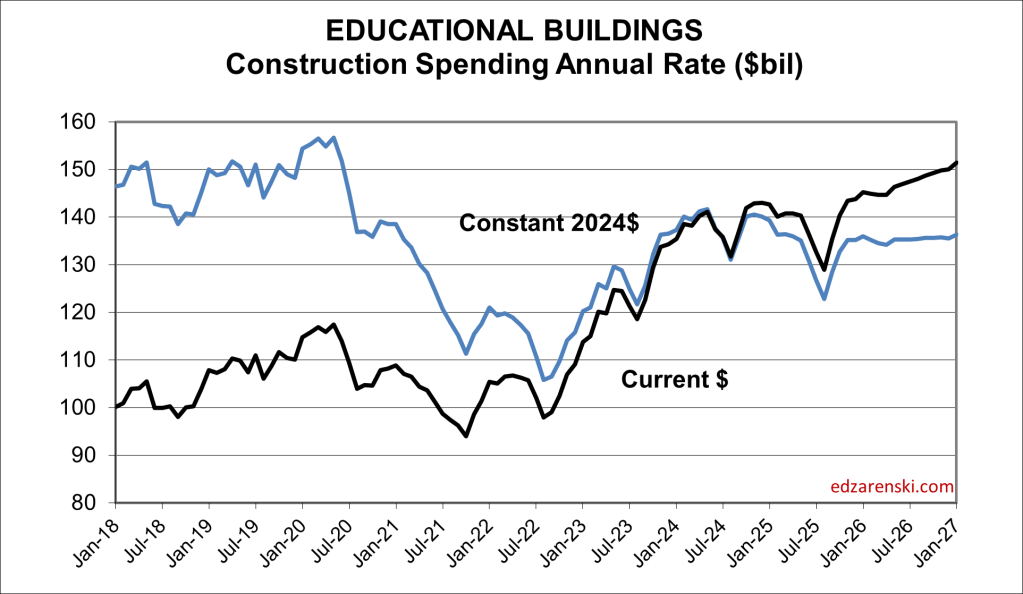

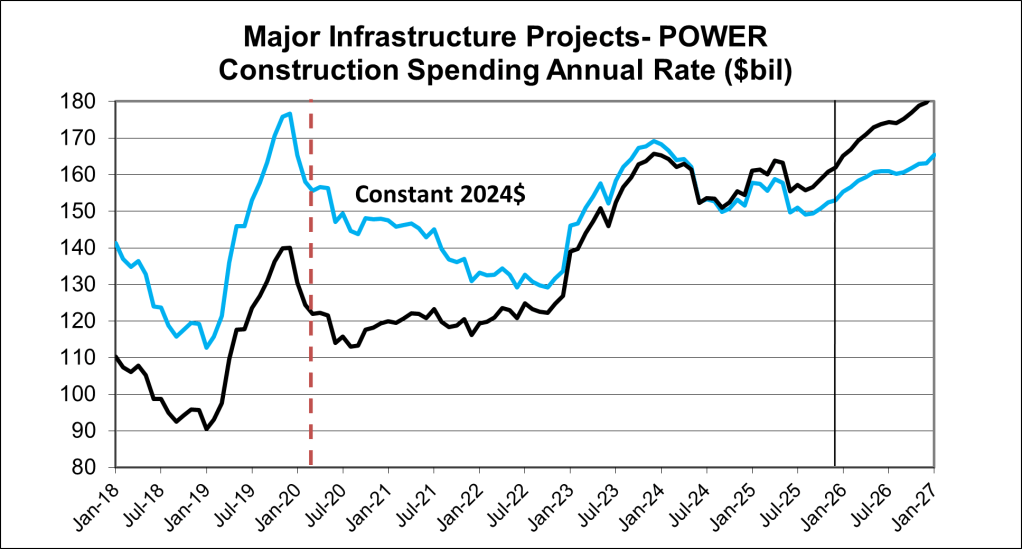

With this issue of May Construction Spending, Census revised all data back through 2023. Total spending was revised UP $52bil in 2023 and $39bil in 2024. Due to the increase in 2024, all percent growth in 2025 is slightly lower. The largest revisions up in 2024 were Residential +$11bil, Educational +$8bil and Power +$8bil. Also, in 2023, Power was revised up +$17bil and Manufacturing +$9bil.

Office vacancy rates are very high, near 20%, and in some places, like San Francisco, about double that. It’s hard to see that office construction will increase anytime soon. Office construction spending has declined every month for the last 10 months and is down 10% compared to the same 5mo 2024.