Home » Inflation Indexing

Category Archives: Inflation Indexing

Construction Inflation 2024

To properly adjust the cost of construction over time you must use an Actual Final Cost Inflation Index, otherwise called a selling price index. General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of escalation in construction projects.

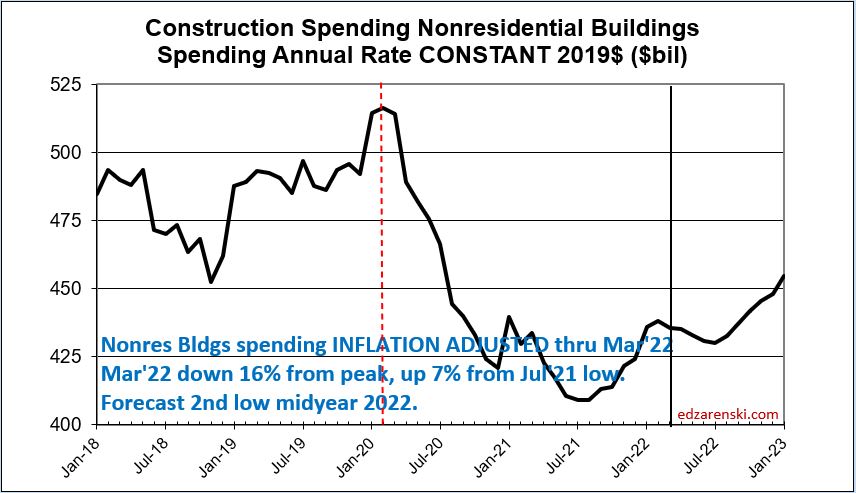

Spending Must Be Adjusted by Inflation

Usually, construction budgets are prepared from known “current” costs. If a budget is being developed for a project whose midpoint of construction costs is two years in the future, you must carry in your budget an appropriate inflation factor to represent the expected cost of the building at that time. Why the midpoint? Because half the project cost occurs prior to that point and half occurs later than that. Actually, the midpoint of spending is 50-60% into the schedule, but the calculation to the midpoint of schedule is close. So, the average inflation for the project includes early contracts that have less inflation than average and also later contracts that would have more than the average inflation. Construction inflation should always be calculated from current cost to midpoint of construction, or in the case of using historical data and converting an older actual cost to a future budget, from midpoint to midpoint.

Any time a construction project is delayed or put on hold to start at some future date, construction cost inflation must be calculated and added to the previous budget to account for the unanticipated cost increase due to the delay. Of utmost importance is using appropriate cost indices and forecasting future cost growth to account for the difference in original budget and revised budget.

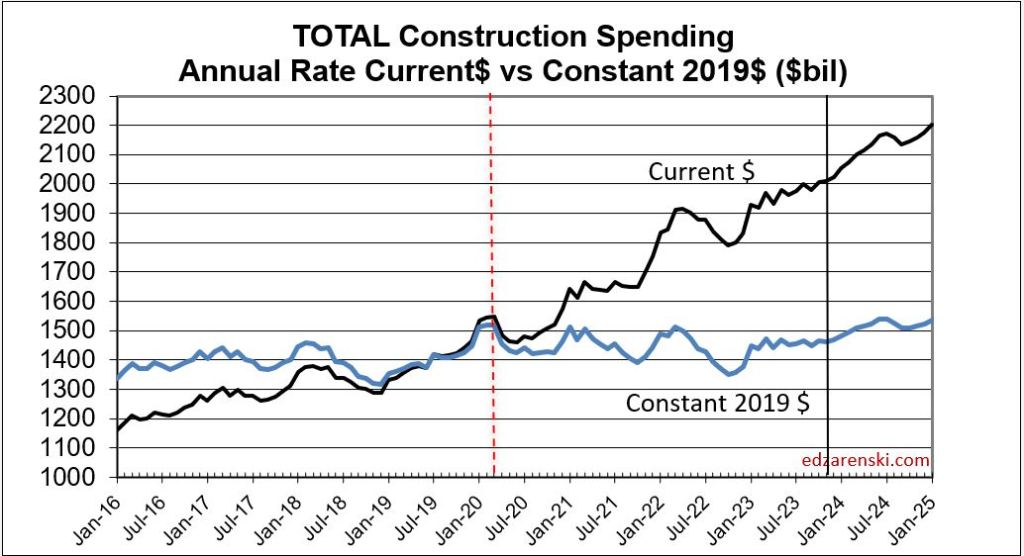

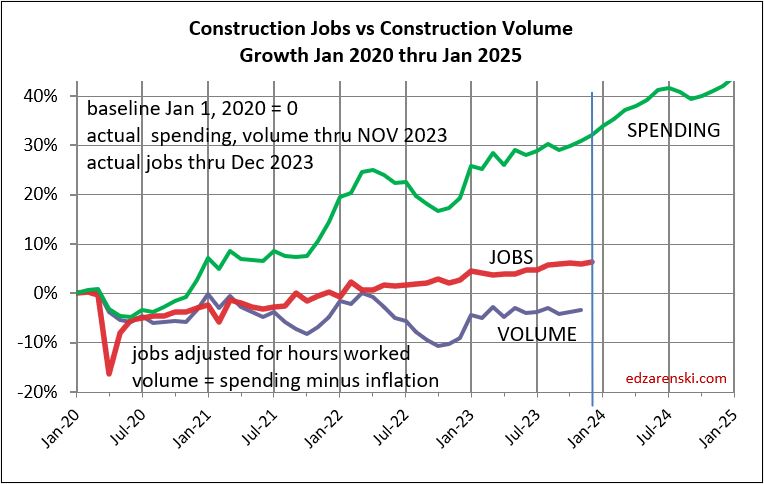

Besides the estimator’s need to accurately reflect future expected cost, inflation is an important aspect of the company business plan. Typically discussed in tandem with spending, inflation has an impact on tracking and forecasting company growth. All spending includes inflation, but inflation adds nothing except $ signs to the overall growth. For example, in a year when company revenues (spending) increase by 10%, if inflation is 6%, then total growth is only 4%. To accurately calculate growth, and the need for labor to support that growth, spending must be adjusted by the amount of inflation.

Types of Construction Inflation Indices

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of inflation on construction projects.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. The CPI index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI tracks material cost inputs at the producer level, not prices or bids at the as-built level.

Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are examples of commonly used indices that DO NOT represent whole building costs yet are widely referenced by construction firms and estimators everywhere to adjust project costs. Neither includes contractor margins.

It should be noted, there are far fewer available resources for residential inflation than for nonresidential inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce bids. When activity is high, there is a greater opportunity to bid on more work and bids can be higher. The level of activity has a direct impact on inflation.

To properly adjust the total cost of construction over time you must use actual final cost indices, otherwise known as selling price indices.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

Construction Analytics Building Cost Index, Turner Building Cost Index, Rider Levett Bucknall Cost Index and Mortenson Cost Index are all examples of whole building cost indices that measure final selling price (for nonresidential buildings only).

Residential inflation indices are primarily single-family homes but would also be relevant for low-rise two to three story building types. Hi-rise residential work is more closely related to nonresidential building cost indices.

Producer Price Index (PPI) Final Demand Indices are an example of construction cost indices that represent whole building costs. Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, material, equipment, overhead and profit. Labor includes change in wages and productivity.

Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices. For the past six quarterly updates, about 80% to 90% of the change in the index was posted in the update month. Therefore, PPI Final Demand Indices should not be referenced monthly. These are quarterly indices. January is an update month. PPI Final Demand for Jan index is basically the correction for Nov and Dec. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Jan +Dec+Nov)/(Oct+Sep+Aug).

Refer to National Inflation Indices for comparison to several national selling price indices or various Input indices. National reference indices are useful for comparison. Few firms project index values out past the current year, therefore all future projections in these tables are by Construction Analytics.

Construction Inflation History

Post Great Recession, 2011-2020, average inflation rates:

Nonresidential buildings inflation 10-year average (2011-2020) is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. In 2021 it jumped to 8%, the highest since 2006-2007. In 2022 it hit 12%, the highest since 1980-81.

Residential 8-year average inflation for 2013-2020 is 5.0%. In 2020 it was 4.5%. In 2021 it jumped to 14% and then in 2022 reached 15.7%. the highest on record.

30-year average inflation rate (excluding 2021 and 2022) for residential and nonresidential buildings is 3.7%. Excluding deflation in recession years 2008-2010, then for nonresidential buildings it is 4.2% and for residential it’s 4.6%.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- In times of rapid construction spending growth, nonresidential construction annual inflation averages about 8%. Residential has gone as high as 10%.

- Nonresidential buildings inflation (prior to 2021-2022) averaged 3.7% since the recession bottom in 2011. Six-year 2014-2019 average is 4.4%.

- Residential buildings inflation (prior to 2021-2022) reached a post-recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It has averaged 5.3% for 8 years 2013-2020.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors’ and suppliers’ margins.

- When construction volume increases rapidly, margins increase rapidly.

- Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume went down 33% and jobs were down 30%.

Historically, when spending decreases or remains level for the year, inflation rarely (only 10% of the time) climbs above 3%. Avg inflation for all down/flat years is less than 1%. That did hold true in 2020 for both Nonres Bldgs and Non-bldg Infra. It also held true in 2023 for Residential. It did not hold true in 2021 or 2022. In 2021, spending was down for nonresidential buildings and flat for non-building. Inflation for both was over 8%.

Differences in Tracking Period

Be careful when referencing YTD growth. YTD can be the growth so far this year, that is, growth compared to December of the prior year, or it can be YTDcurrentyr/YTDlastyr. Neither represents the growth from the avg of the previous year, which becomes the historical value. Both are useful during the year to judge trends. The average growth for the year accounts for all the peaks and valleys within each year and and is the value carried forward into the index tables and charts.

Also, use caution when referencing Dec/Dec growth. An example of the difference between Dec/Dec tracking or year over year, and annual average tracking, is Steel Mill Products which was down 28.7% Dec22/Dec21, but the annual average for 2022 is still up 9.0% from the average 2021. In fact, the three years 20-21-22 show Dec/Dec combined inflation is +71%, but the annual averages for those same three years shows total inflation growth of 87%. Annual averages should be used to report inflation.

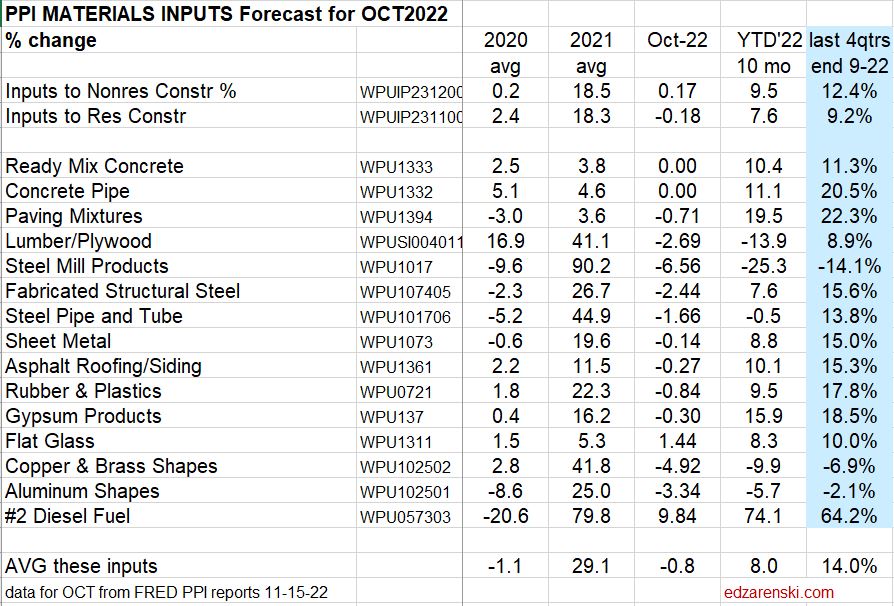

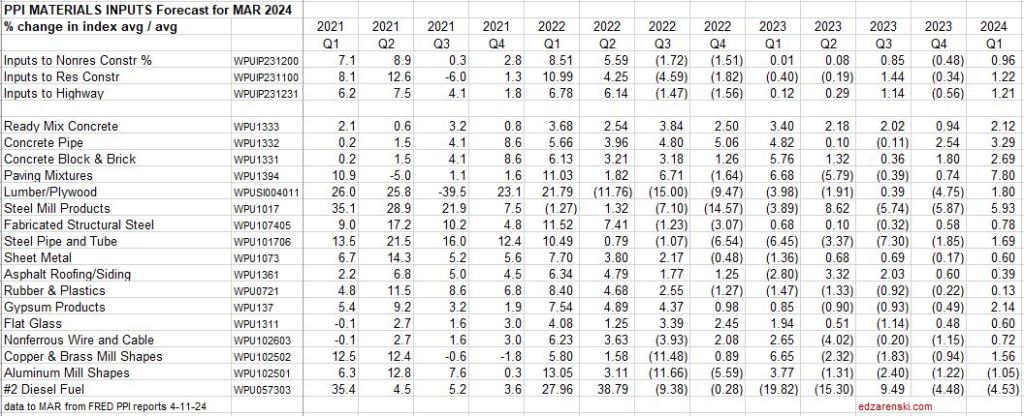

PPI Construction Materials Inputs Indices

Inputs Table updated 4-11-24 Total index for 2023 was flat to down slightly. Currently, Concrete products and Paving 4% to 6% above the average index for 2023, lumber down 2%.

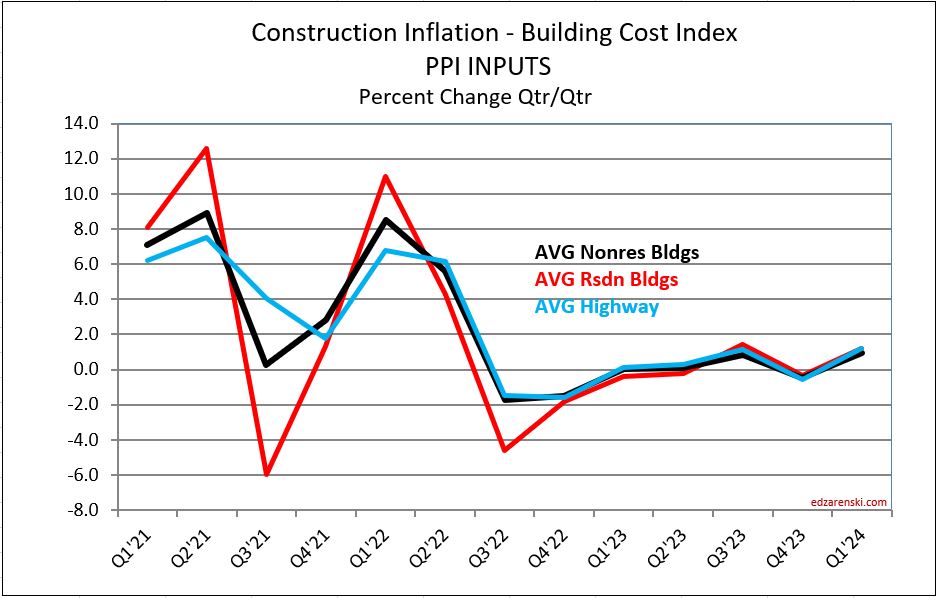

In the quarterly percent change table you can see the drop in Q3’22 and more in Q4’22, a sharp change in the rate of inflation. This shows up as expected in lower average of Inputs to Res and NonRes for 2023.

4-11-24 PPI Materials Inputs to both Residential and Nonres Bldgs UP slightly (1.0% to 1.2%) in Q1 (after both were up most of 2023 but down every month in Q4’23. PPI Final Demand shows several qtrs down. So, recent relief could be decrease in margins.

A General construction cost index or Input price index doesn’t track whole building final cost and does not capture the full cost of inflation in construction. Final cost indices represent total actual cost to the owner and are often higher than General indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. PPI Final Demand indices include all costs and do represent actual final cost to the Owner.

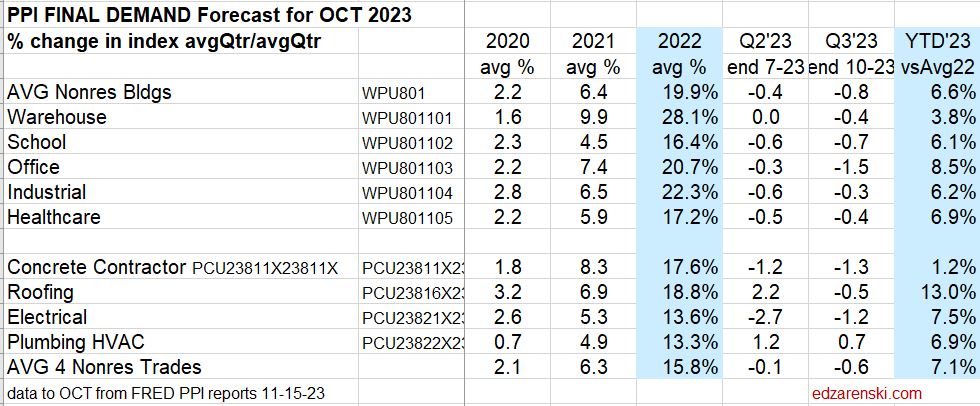

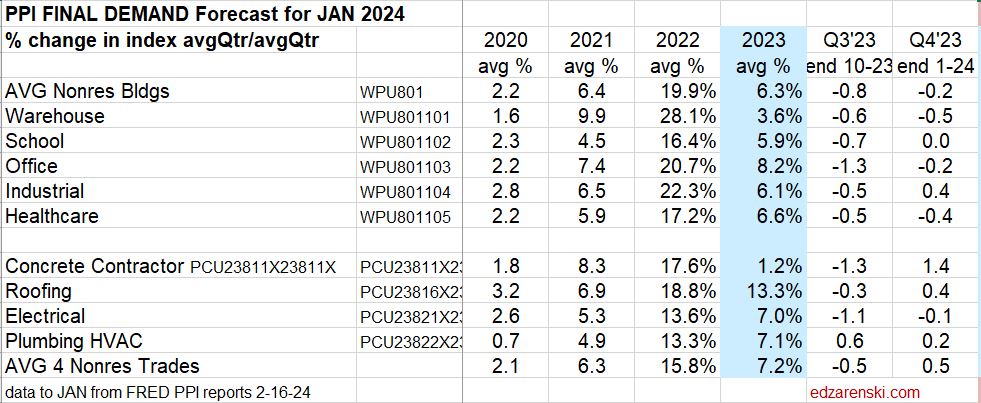

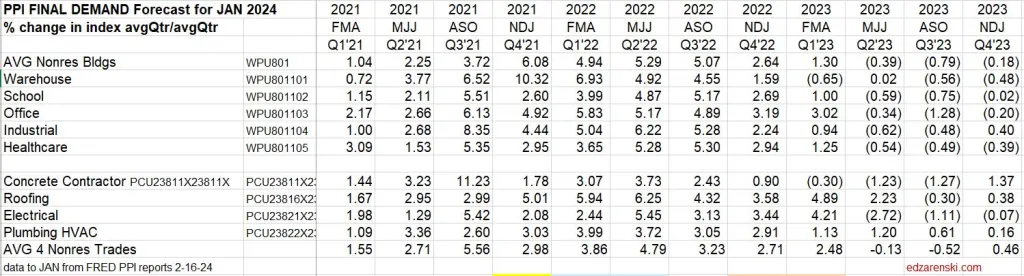

PPI Construction Final Demand Indices

PPI Final Demand indices should not be referenced monthly. These are quarterly indices. PPI Final Demand Indices are for Nonresidential Bldgs only. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices for the current month and the previous two months. For the past six quarterly updates, about 80% to 90% of the change in the index was posted in the update month. January data (released in Feb) is an update month. The PPI Final Demand for Jan. is basically the correction for Nov.+Dec.+Jan. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Nov+Dec+Jan)/(Aug+Sep+Oct).

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), the correction month for the last 3 full periods flipped the sign of the 6 modeled months and turned every month for the last 9 months negative.

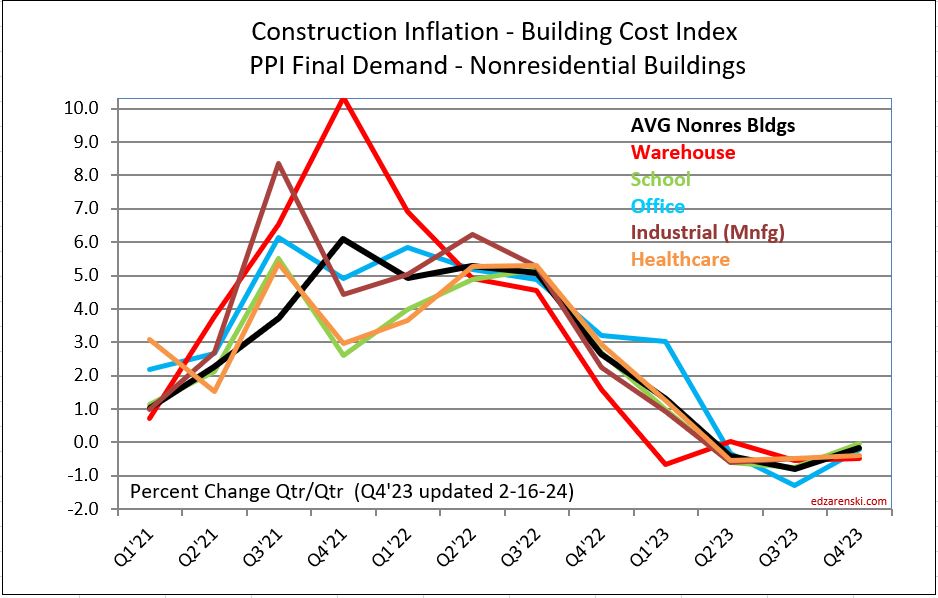

2-16-24 The PPI Final Demand table below is updated to Jan, 2024 data, which closes out Q4’23. Most bldg types are down from Nov-Dec-Jan’23 to Nov-Dec-Jan’24, so, if extended, the trend leading into 2024 is for slightly lower inflation. However Roofing and Plumbing trades are increasing.

The Construction PPI Final Demand for Nonres Bldgs posted declines for the last three, and in some cases four, quarters, Q1 thru Q4 2023. When the adjustment is distributed back into the months being corrected, Apr into Feb and Mar, Jul into May and Jun, and Oct into Aug and Sep, it shows all bldgs, except Offc, have at least nine months of a declining rate of inflation cost, and actually for the last 6 months negative inflation or deflation. Office has been negative for 2 quarters, warehouse has been declining for 12 months and negative for 9 months.

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), the correction month for the last 3 periods has flipped the sign of the 6 modeled months and turned every month for the last 9 months negative.

In 2023, for each quarter, we see two months posted positive, then a large negative value for the correction month. The negative correction is large enough in all cases to turn the entire quarter negative. Here’s an example: for the period May-Jun-Jul, Jul is the correction month. PPI values were +0.09%, +0.02%, -1.23%. The average for each of the 3mo is -0.37%, (the sum of the 3 months divided equally. The May and Jun values that were originally posted based on modeling flipped from + to – after the contractor survey value is applied to the QTR. That highlights why PPI Final Demand indices should not be referenced monthly.

However, these declines are from such a high mark at the end of 2022 (we began 2023 up 11%), that the current rate as we begin 2024 is still up 6% to 7% from the average in 2022.

2-16-24 The PPI Final Demand table of qtr/qtr is updated to Jan, 2024 data

2-16-24 The PPI Final Demand plot is updated to Jan, 2024 data

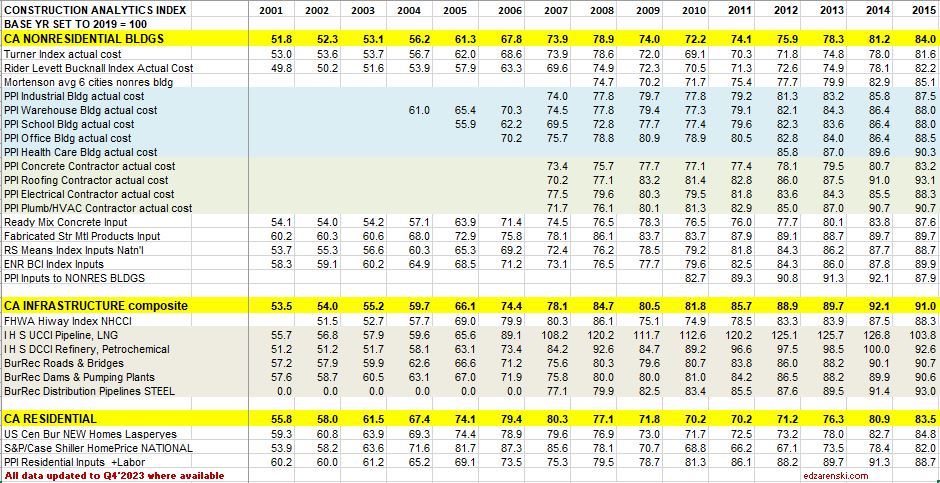

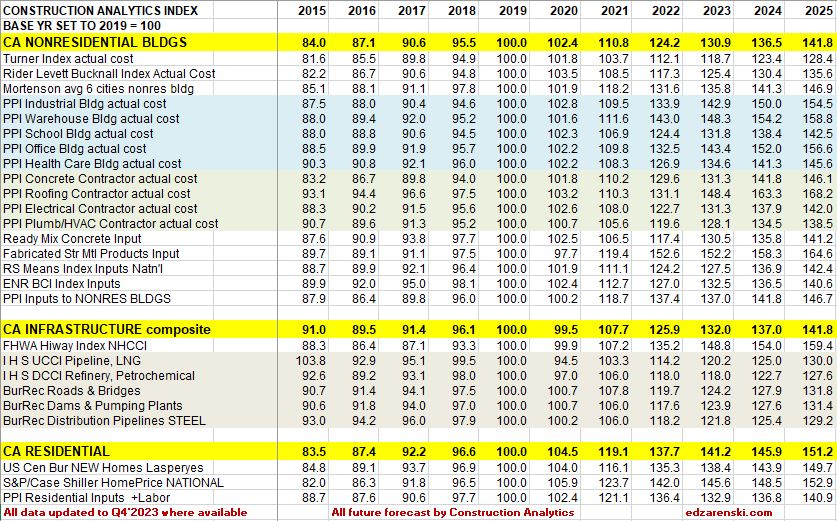

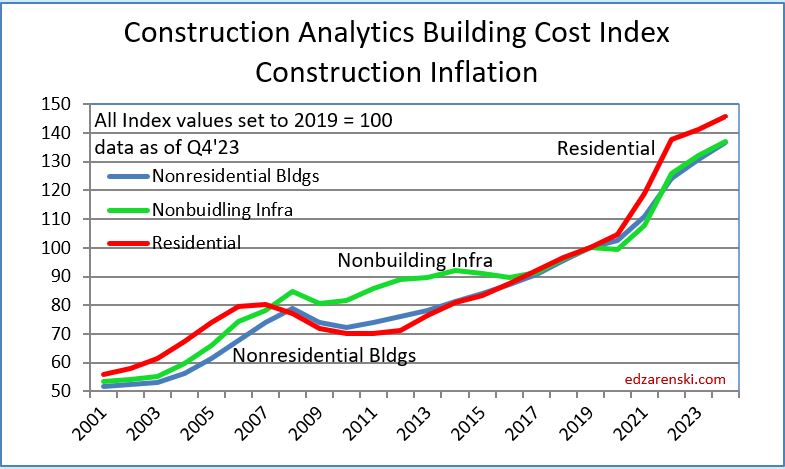

Construction Analytics Building Cost Indices and Reference Indices

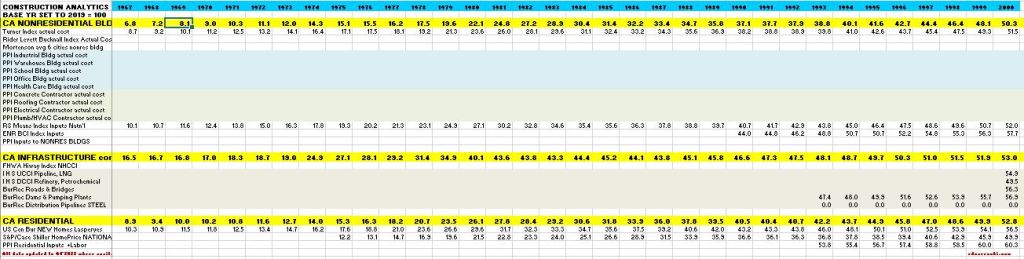

Current and predicted Inflation updated to Q4’23 1-13-24

- 2022 Rsdn Inflation 15.7%, Nonres Bldgs 12.1%, Nonbldg Infra 17.0%

- 2023 Rsdn Inflation 2.5%, Nonres Bldgs 5.4%, Nonbldg Infra 4.9%

- 2024 Rsdn Inflation 3.4%, Nonres Bldgs 4.5%, Nonbldg Infra 3.8%

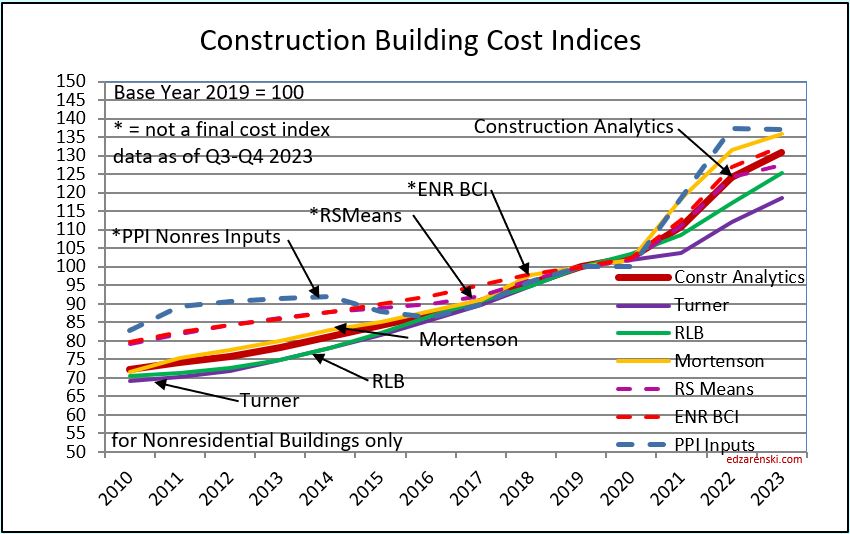

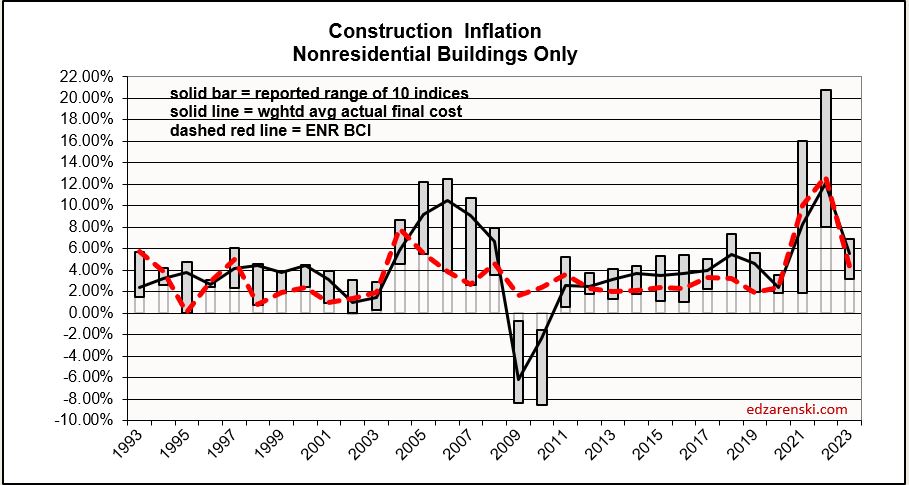

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

Most of the tables and plots here are cumulative indexes. Construction Inflation annual percents for the three major sectors, Residential, Nonresidential Bldgs and Non-building Infrastructure, are recorded in this short table, Escalation form Prev Year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years.

Final cost indices represent total actual cost to the owner and are generally higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost. The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

All of the Index Tables and the plot below, Construction Analytics Building Cost Index, show the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. An index already compounds annual percent to prevent the error of adding annual percents. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from, TO/FROM. Costs should be moved from/to midpoint of construction, the centroid of project cost. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

The three yellow highlighted lines in the index tables are plotted here. The three major sectors, Residential, Nonresidential Buildings and Non-building Infrastructure,

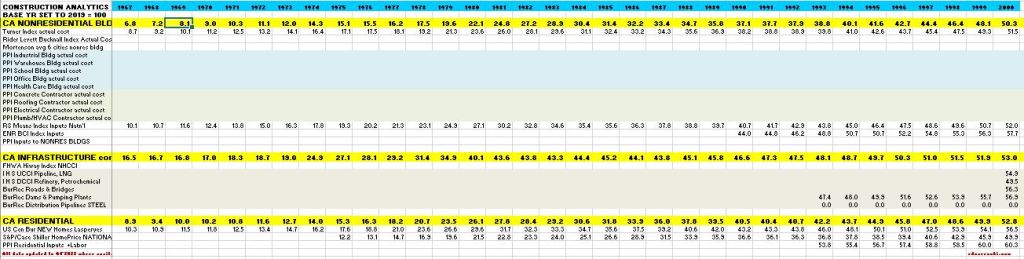

This table and plot is an extension of the tables and plots above. Data is as of Q4 2023, but the table covers from 1967 to 2000. Data is pretty sparse.

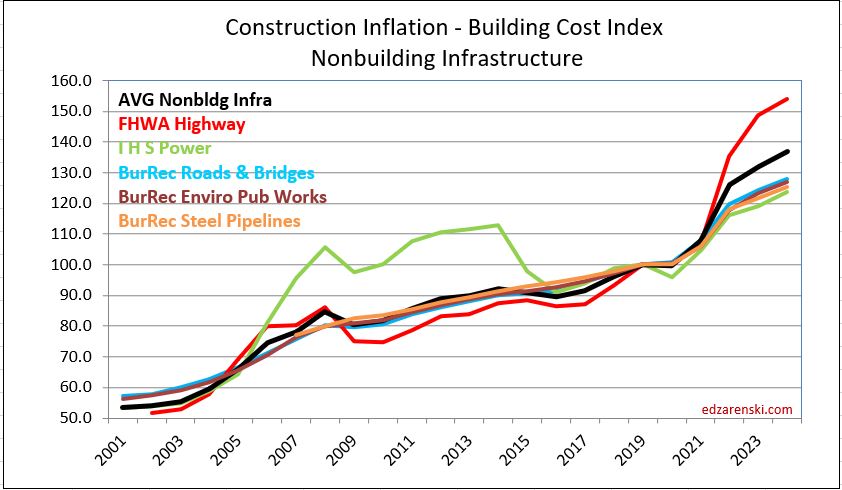

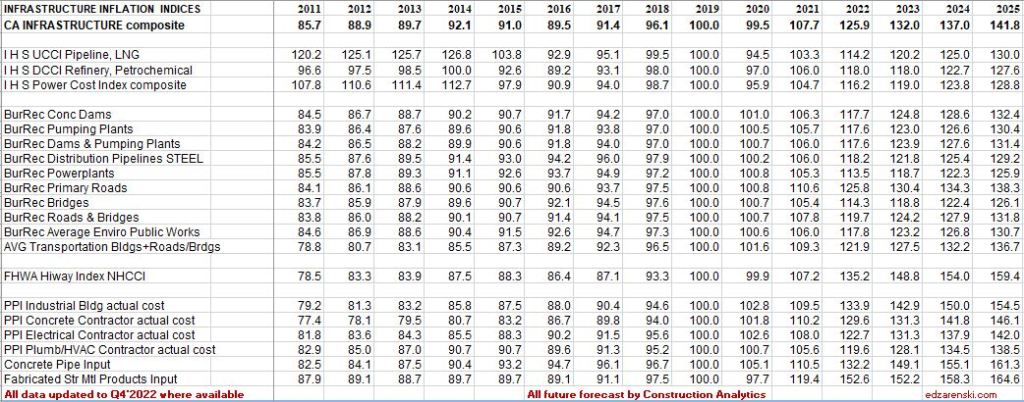

Non-building Infrastructure Indices

In the Index tables above, dividing the current year by the previous year will give the current year’s inflation rate. All indices are the average rate for the year.

Also, in the tables above, all reference indices data is gathered from the original source, then all are normalized to a common base, 2019 = 100. This allows us to see how different indices compare.

Comparison of Indices

This plot compares four final cost indices and three inputs cost indices. Prior to 2020 there is a lot of symmetry in the final cost group. Everything changed after that.

Previous year Construction Inflation 2023 – last updated 12-15-23

Links to Data Sources Construction Inflation >>> Links

Links to Explanations of PPI Index PPI Explanation provided by AGC

Construction Data Briefs – Nov Data 1-3-24

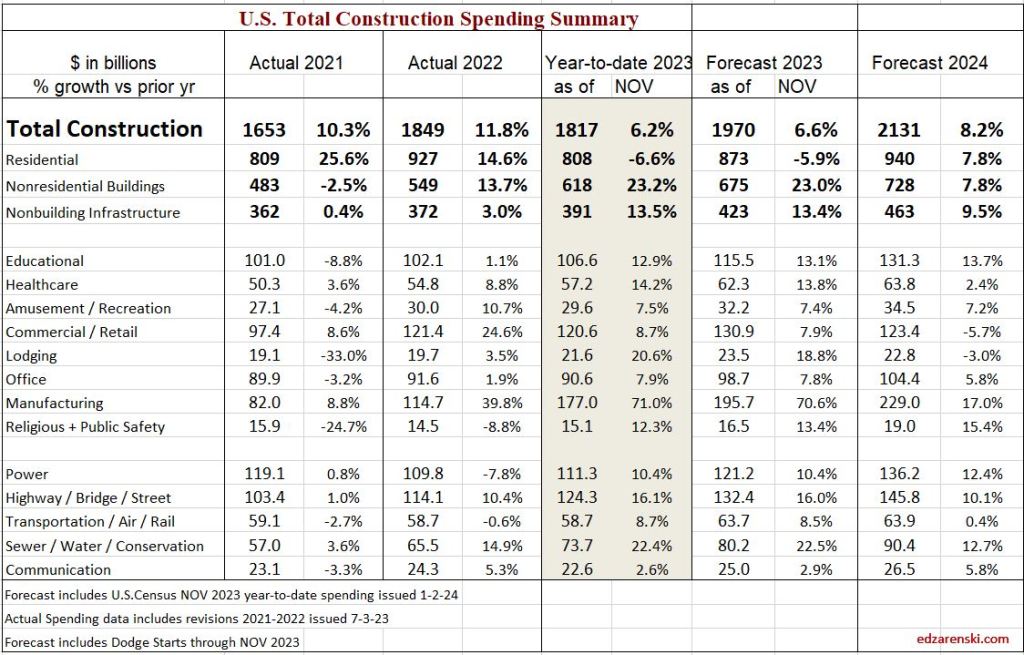

Overall forecast has not changed a lot from the last two months. I’ll add much more to this post in the coming days, but for now here is a summary of construction spending through November, Inflation through 3rd qtr or Nov where available, and resulting constant dollar volume.

This forecast is preliminary to the 2024 Outlook, which will be published in February after Census releases the initial Dec. 2023 spending (on Feb. 2nd) to begin closing out the year 2023, although 2023 spending will be revised three times after the February release. In addition construction starts, jobs data and inflation will be updated, all leading to a more accurate forecast for 2024 spending and inflation adjusted volume.

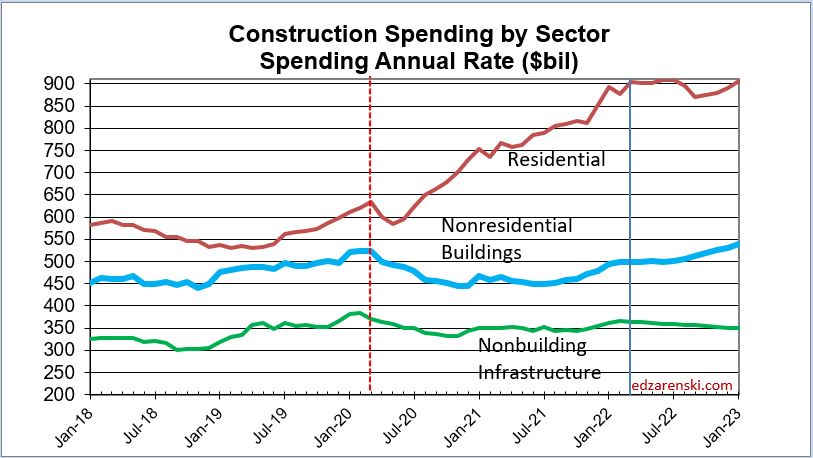

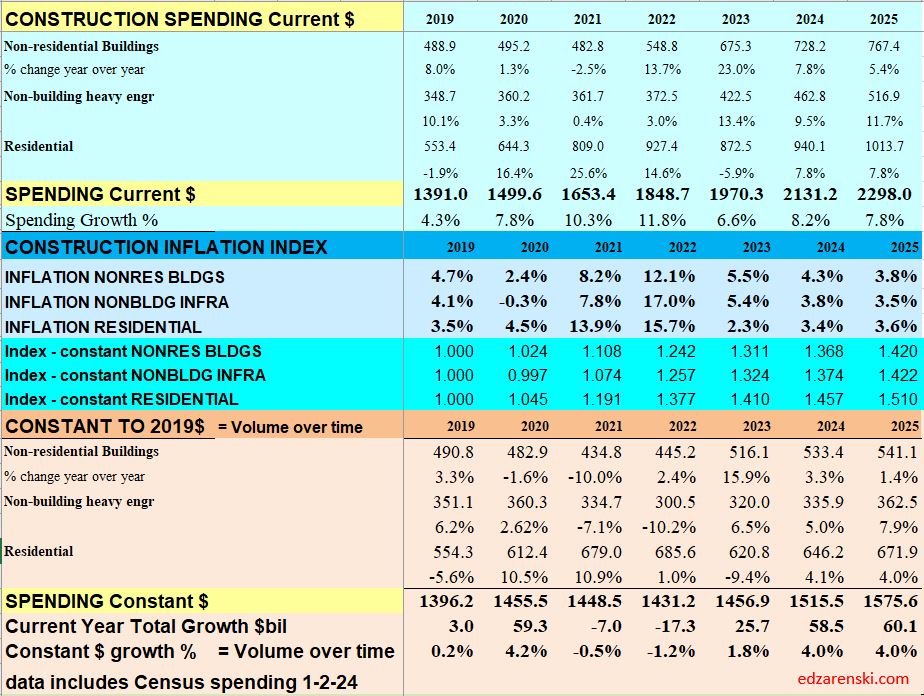

Total construction spending forecast is up 6.6% in 2023. Spending was up 12% in 2022 and 10% in 2021. Almost all of that is inflation. You can see the Constant$ line, with one lower dip in 2022, has ranged between $1400bil. to $1500bil. since mid-2019.

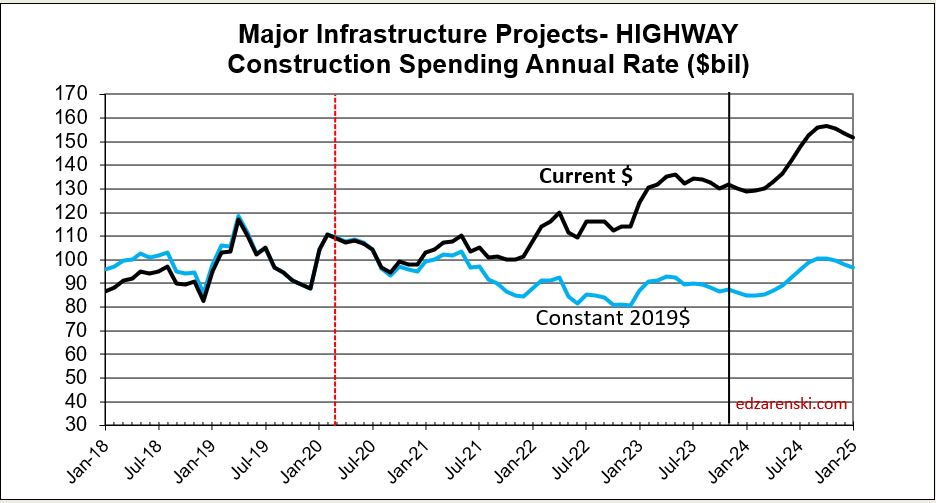

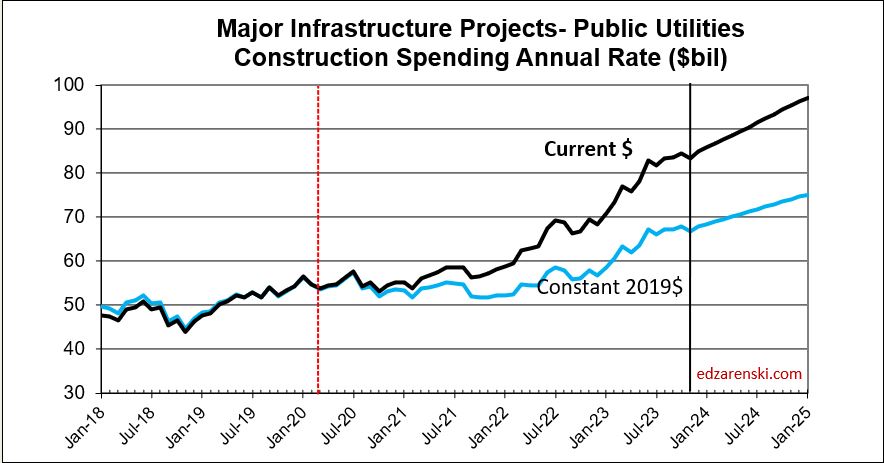

As we begin 2024, the current rate of spending for Nonresidential Buildings is already 3.5% higher than the average for 2023, so if spending stays at the current level and no additional growth occurs, 2024 Nonres Bldgs spending will finish the year up 3.5%. The current forecast shows a monthly rate of growth slowing to less than 0.5%/mo in 2024. Non-building Infrastructure is currently only 1% higher than the average for 2023, however the forecast is indicating steady grown of 1%/mo for all of 2024.

Residential current rate of spending is 1.5% above the 2023 average and is forecast to average an increase of 0.5%/mo for 2024.

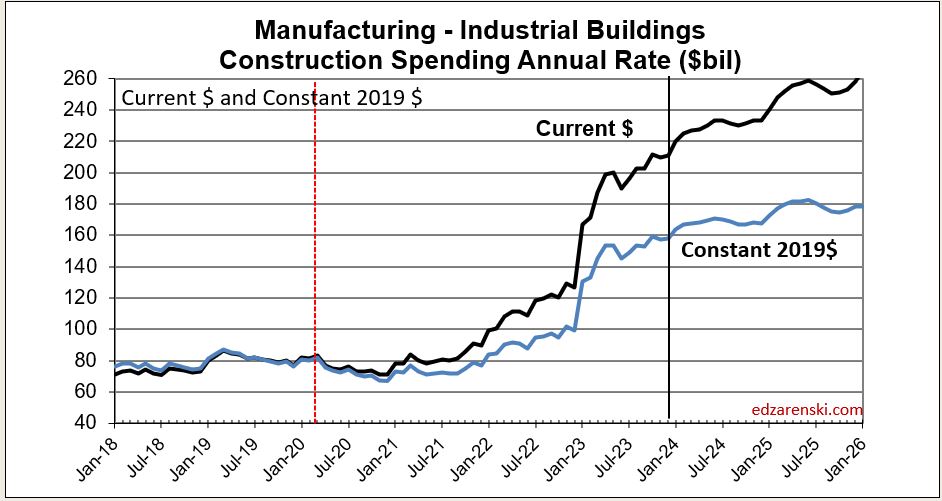

One big question is how did the forecast for Manufacturing increase so much since the beginning of 2023. The starts forecast for 2023 increased by 35% since January. Starts for future years increased by 50%. Starts (contract awards) drives up the spending forecast since spending is a function of the future monthly cash flow (spending) of starts.

The largest increases to construction spending in 2023 are Manufacturing +$80bil, Highway +$18bil and Public Utilities (Sewage and Waste, Water Supply and Conservation-Rivers-Dams) +$15bil.

Residential regains the top spot in 2024 with a forecast spending increase of $68bil. Manufacturing is forecast to add +$33bil. Educational gains +$16bil and Power +$15bil.

Remember when referencing the Constant $ growth that the dollars for all years are reported here in 2019$. In this table, the nominal spending is divided by the inflation INDEX for the year. You can also deduct the percent inflation from any individual year of construction spending to find inflation adjusted $ for that year alone, however that method would not allow comparing the adjusted dollars to any other year. Setting a baseline year is necessary to compare dollars from any year to any other year.

Reference Inflation Data Construction Inflation 2023 updated 1-12-24

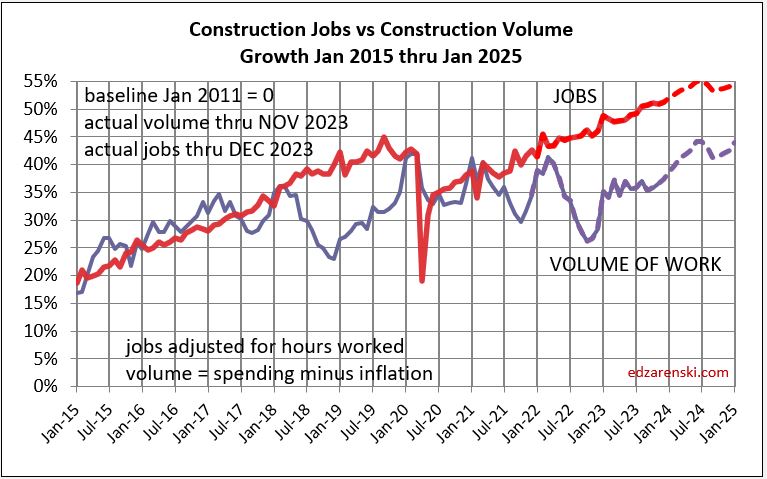

Construction JOBS increased 2.75% in 2023. We added 214,000 jobs (avg’23-avg’22). There are currently 8,056,000 construction jobs. The largest increase post 2010 is 321,000 jobs (+4.6%) in 2018. The average jobs growth post 2010 is 200,000 jobs per year.

Since 2010, average jobs growth is 3%/yr. Average volume of work growth since 2010 is 2.3%/yr.

In the last 7 years, 2017-2023, jobs increased 2.5%/yr. Volume of work increased only 0.8%/yr.

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

Final cost indices represent total actual cost to the owner and are generally much higher. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. PPI Final Demand indices include all costs and do represent actual final cost. The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

This short table shows the inflation rate for each year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years. The plot below shows the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

Construction Inflation 2023

Construction Inflation

1-16-24 SEE Construction Inflation 2024

1-12-24 PPI Inputs table updated to Dec data, updated quarterly inputs, updated 2023 Firms Inflation plot

12-13-23 PPI ( Inputs Only) updated to Nov data

11-15-23 PPI Inputs and Final Demand updated to OCT data

10-13-23 PPI Inputs updated to SEP data

10-4-23 PPI Inputs and Final Demand tables updated to AUG data

8-11-23 PPI Inputs and Final Demand tables updated to July data

8-19-23 Inflation Table 2015-2025 updated to Q2 2023

Usually construction budgets are prepared from known “current” costs. If a budget is being developed for a project whose midpoint of construction costs is two years in the future, you must carry in your budget an appropriate inflation factor to represent the expected cost of the building at that time. Why the midpoint? Because half the project cost occurs prior to that point and half occurs later than that. The balance point for spending is 50-60% into the schedule. Construction inflation should always be calculated from current cost to midpoint of construction, or in the case of converting an older actual cost to a future budget, from midpoint to midpoint.

Any time a construction project is delayed or put on hold to start at some future date, construction cost inflation must be calculated and added to the previous budget to account for the unanticipated cost increase due to the delay. Of utmost importance is using appropriate cost indices and forecasting future cost growth to account for the difference in original budget and revised budget.

The level of construction activity has a direct influence on labor and material demand and margins and therefore on construction inflation.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors/supplier margins.

- When construction volume increases or decreases rapidly, margins change rapidly.

When construction is very actively growing, total construction costs typically increase more rapidly than the net cost of labor and materials. In active markets, overhead and profit margins increase in response to increased demand. These costs are captured only in Selling Price, or final cost indices.

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of inflation on construction projects.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. This index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI tracks material cost inputs at the producer level, not prices or bids at the as-built level.

Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are examples of commonly used indices that DO NOT represent whole building costs yet are widely used to adjust project costs. Neither includes contractor margins.

It should be noted, there are far fewer available resources for residential inflation than for nonresidential inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce bids. When activity is high, there is a greater opportunity to bid on more work and bids can be higher. The level of activity has a direct impact on inflation.

To properly adjust the cost of construction over time you must use actual final cost indices, otherwise known as selling price indices.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

Refer to National Inflation Indices for comparison to several national selling price indices or various Input indices. National reference indices are useful for comparison. Few firms project index values out past the current year, therefore all future projections in these tables are by Construction Analytics.

1-18-23 Construction Analytics PPI Tables and Building Cost Index

Construction Inputs to Nonresidential Buildings dropped for five of of last six months, now down 5.2% since June, but still up 7.2% since last December. However, the average index for 2022, when compared to the average for 2021, is up 15.7%.

The average growth for the year accounts for all the peaks and valleys within each year and is the value carried forward into the index tables and charts. A glaring example of the difference between Dec/Dec tracking, or year over year, and annual average tracking, is Steel Mill Products which is down 28.7% Dec22/Dec21, but the annual average for 2022 is still up 9.0% from the average 2021. In fact, the last three years show Dec/Dec combined inflation is +71%, but the annual averages for the last three years show total inflation growth of 87%. Annual averages should be used to report inflation.

Residential inputs are down seven of the last eight months, down 7.1% since April, but still up 7.1% since last December. The average for 2022, when compared to the average for 2021, is up 12.7%.

Several major cost components have been on decline the last few months: Lumber/Plywood, Steel Mill Products, Fabricated Steel, Steel Pipe and Tube, Aluminum and Diesel Fuel. Of the 15 items tracked here, 10 declined in the last quarter. Concrete is the only product that has not posted any monthly decline in 2022. Costs are still high, but are moving in the right direction after 1st quarter 2022 costs that averaged +7% (28%annual) to +8%. Historically, most cost increases are posted in the 1st quarter and the least in the 4th quarter.

If inputs costs remain where they are right now as we start the year, input costs for 2023 will finish the year at -2% Nonres and -4% Residential. If we were to post small but steady cost increases of 0.25%/mo for the rest of the year, we would end with both Res and Nonres input costs up 4% for the year.

4-14-23 PPI Inputs slowed considerably since last year.

PPI Inputs to Construction March 2023—Nonres down 0.1% in Mar, down 6 of last 12mo, -1%over 12mo. Rsdn down 0.3% in Mar, down 9 of last 12mo, -7.5% over 12mo.

Qtrly change last 5 qtrs Nonres 9.7, 3.0, -3.2, -2.5, 1.6 Rsdn 15.2, -1.4, -5.0, -2.3, 1.0

Historically, the 1st or 2nd qtr would post the highest gains for the year. Here’s 1st and 2nd qtr for 2021, 2022, 2023

Nonres 7.1% & 8.9, 9.7 & 3.0, 1.6 & … Rsdn 8.1 & 12.6, 15.2 & -1.4, 1.0 & …

Last 12 months down -1.0% for Nonres and -7.5% for Rsdn. 1st qtr 2023 1.6 and 1.0, instead of (2022) 9.7 and 15.2% and (2021) 7.1 and 8.1%

Still early, but 12mo, 6mo and 3mo PPI signs are pointing down or at least low increases for construction inputs in 2023

Be careful when referencing the 2023YTD. YTD is the growth so far this year. That is growth AFTER December. That does not represent the growth from the avg 2022. As an example, using Inputs to Nonres, the average growth in 2022 was 15.7%. That could be expressed as a starting Jan index of 100, a Jul 1 index of 115.7 and an ending Dec index of 131.4. The average of all 12 months in 2022 = 115.7, the average being at midyear. Well by averages the midyear index would be 115.7. The 2023YTD index is 2.6% since December (131.4) not 2.6% added to 115.7. This really highlights why it is much better to track the index than to report the percentage.

The last column, YTD vs 2022avg, gives an indication of 2023 avg if current YTD costs remain constant for the remainder of the year.

PPI INPUT TABLES and Inputs plot UPDATED 1-12-24

Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, material, equipment, overhead and profit. Labor includes change in wages and productivity. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct these Final Demand indices. For the past six quarterly updates, about 80% to 90% of the change in the index was posted in the update month. Therefore, Final Demand indices should not be referenced monthly. These are quarterly indices. January is an update month. PPI Final Demand for Jan index is basically the correction for Nov and Dec. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Jan +Dec+Nov)/(Oct+Sep+Aug) The table shows the slowing progression from a 20% annual rate of gain for all of 2022 (avg nonres bldgs), to 2% the last two qtrs to only 0.1% the last qtr. Slowing is good. The last column, YTD vs 2022avg, gives an indication of 2023 avg if current YTD costs remain constant for the remainder of the year.

PPI FINAL DEMAND TABLE UPDATED 11-15-23

The Construction PPI Final Demand for Nonres Bldgs posted declines for the two most recent adjustment months, Apr and Jul. If distributed back to the months being corrected, Apr into Feb and Mar, Jul into May and Jun, it shows all bldgs, except Offc, have at least 6 months of declining cost. Office has been declining for only 3 months but Warehouse has been declining for 8 months.

The final demand PPI index for 2022 nonresidential buildings is substantially higher than Construction Analytics nonresidential buildings cost index reported in the index tables. These PPI values are but one of the references used to develop construction analytics building cost index.

Current and predicted Inflation rates 1-18-23:

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 7.4%, Non-bldg Infra Avg 7.9%

- 2022 Rsdn Inflation 16.1%,Nonres Bldgs 12.9%, Non-bldg Infra Avg 13.8%

- 2023 Rsdn Inflation 1.9%, Nonres Bldgs 4.0%, Non-bldg Infra Avg 4.3%

Current and predicted Inflation updated to Q4’22 3-3-23

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.4%, Nonbldg Infra -0.3%

- 2021 Rsdn Inflation 14.0%, Nonres Bldgs 8.0%, Nonbldg Infra 7.9%

- 2022 Rsdn Inflation 15.8%, Nonres Bldgs 12.2%, Nonbldg Infra 13.8%

- 2023 Rsdn Inflation 2.2%, Nonres Bldgs 4.8%, Nonbldg Infra 4.7%

Current and predicted Inflation updated to Q2’23 8-17-23

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 8.2%, Nonbldg Infra 7.8%

- 2022 Rsdn Inflation 15.7%, Nonres Bldgs 12.1%, Nonbldg Infra 16.9%

- 2023 Rsdn Inflation 1.2%, Nonres Bldgs 5.4%, Nonbldg Infra 3.9%

- 2024 Rsdn Inflation 4.0%, Nonres Bldgs 3.8%, Nonbldg Infra 3.5%

Current and predicted Inflation updated to Q3’23 10-2-23

- 2023 Rsdn Inflation 1.4%, Nonres Bldgs 6.0%, Nonbldg Infra 3.9%

- 2024 Rsdn Inflation 4.0%, Nonres Bldgs 3.8%, Nonbldg Infra 3.5%

Most of the tables and plots here are cumulative indexes. Construction Inflation annual percent for Nonres Bldgs is plotted on this bar chart. The gray bar represents range of predicted inflation from 8 to 10 sources. The dark line is Construction Analytics (final cost) BCI. The red dash is ENR BCI (input index). The range in 2021 and 2022 was widest ever. The range for 2023 is small.

Construction Analytics Building Cost Index and other industry references

Tables and Plots 2001-2015 updated to Q4’22 2-6-23:

the following table 2015-2024 was updated to Q2 2023 on 10-2-23

In the table above, dividing the current year by the previous year will give the current year inflation rate. All indices are the average rate for the year.

Also in the tables above, all reference indices data is gathered, then all are normalized to a common base, 2019 = 100. This allows to see how different indices compare.

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. An index already compounds annual percent to prevent the error of adding annual percents. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from, TO/FROM. Costs should be moved from/to midpoint of construction, the centroid of project cost. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

Tables and Plots updated to Q4’22 2-6-23:

This Plot updated to Q3’23 11-15-23:

Plots below updated to Q4’23 1-12-24:

4-21-23 This table and plot is an extension of the tables and plots above. Data is as of Q4 2022, but the table covers from 1967 to 2000. Data is pretty sparse.

Previous year Construction Inflation 2022 – updated 12-10-22

Previous year PPI Tables 2022 Producer Price Index to NOV’22

Links to Data Sources Construction Inflation >>> Links

Construction Spending – Volume – Jobs

12-3-22

This plot is not showing good performance. Volume and jobs should be moving directly in tandem. When inflation is very high, spending climbs rapidly. But most of the climb is just due to inflation. To find out what’s really going on we need to look at business volume. Take out the inflation $.

Business volume = Spending minus Inflation. Inflation adds nothing to business volume. Inflation adds only to the amount of revenue that changes hands.

In 2022, residential spending is up 16%. Sounds great, homebuilder’s revenues are up 16%. It’s great until you note that residential inflation for 2022 is 15%. Real residential business volume for 2022 increased only 1%.

Since Jan.2020 spending is up 20%. Revenues are up 20%. It’s pretty hard to not think you need additional staff to support 20% growth in revenues. But inflation is 30%. Take out the inflation dollars and we find that volume is DOWN 10%. Well, during that time, jobs increased 1 to 2%. And yet, business volume is down 10%. That’s a massive 11%-12% loss in productivity. With labor being about 35% of the total cost of a job, that’s added about 4% to total inflation.

I recently read an article that stated (attributed to Assoc. Bldrs. & Contractors) that the construction industry needs to add 1,000,000 jobs over the next two years. Here’s why that won’t happen:

1) The construction industry has never added more than 440,000 jobs in one year. It’s only gone over 400,000 four times in 50 years, the last time 2005, and never two years in a row. The most construction jobs added in a year since 2011 is 360,000 in 2014. The average growth rate from 2011 thru 2019, and now also in 2022, is 230,000 jobs per year. The most jobs added in any two consecutive years is just over 700,000 in 1998-99 and 2005-06. So, the construction industry may not have the capacity to grow 1,000,000 jobs even in two years.

2) Since the Pandemic, nonresidential construction volume is down 20%, but nonresidential jobs are down only 1.5%. Compared to 2019, nonresidential construction has an 18% business volume deficit. In other words, Nonres construction in 2022 now has 18% more jobs per volume of work put-in-place than it did in 2019. Total ALL construction business volume in that period is down 10% while jobs are up 1.5%.

3) Inflation is playing a key roll here. In 2022, construction spending is increasing $160 billion or 10%. But inflation is 13%. Real total construction business volume in 2022 is down 3%. Jobs are up. For 2023, spending is forecast to gain $80 billion, 4.6%, but after inflation volume will be down 1%. 2023 numbers are driven down by residential.

4) In 2023, nonresidential volume increases $35 to $40 billion. Residential volume drops $50 billion. It takes 4000 to 5000 jobs to put-in-place $1 billion of volume in one year. Nonbuilding and nonresidential buildings growth of $40 billion would need 160,000 to 200,000 new jobs. Some small amount of that will come from the drop in residential. But, go back and read #2 again.

Since Jan 2020, the construction industry as a whole has nearly +175,000 (+2%) more workers to put-in-place -$175 billion (-10%) LESS volume. That’s a huge loss to productivity that may take years to recover, if ever.

Construction Inflation 2022

The most watched indicators of the rate of inflation are the costs of various construction materials and the labor needed to install them. However, the level of construction activity has a direct influence on labor and material demand and margins and therefore on construction inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce margins in bids. When activity is high, there is a greater opportunity to submit bids on more work and bid margins may be higher. The level of activity has a direct impact on inflation.

This analysis is national level data.

this post last updated 12-10-22

SEE 2023 data here Construction Inflation 2023

2-10-22 See the bottom of this post to download a PDF of the complete article.

update 5-3-22 This article AND the attached PDF downloadable document have been updated to include 1st qtr 2022 inflation updates.

update 5-8-22 This article AND the attached PDF downloadable document have been updated to include changes in inflation in PPI factors.

update 8-12-22 See Summary. Revisions to 2022 inflation.

update 9-19-22 SEE INDEX TABLES AND PLOTS updated to Q2 2022. Note these tables and plots are updated here in the blog post only. Original article attached IS NOT updated.

update 11-16-22 PPI INPUTS table and FINAL DEMAD table for October updated 11-16-22.

update 12-1-22 PPI INPUTS table for November updated 12-10-22. Also INDEX TABLES AND PLOTS updated to Q3 or Q4 where available.

End of updates

The construction data leading into 2022 is unlike anything we have ever seen. Construction starts were up in 2021, but backlog leading into 2022 is down. That is not normal. Backlog is rarely down and then usually when starts have been down the previous year. In this case the starts declined in 2020, but that 2020 decline was so broad and so deep, even with an increase in starts in 2021, backlog to start 2022 has not yet recovered (to the start of 2020). Spending for 2021 was up 8%, but after adjusting for inflation, real volume after inflation was down. Last time that happened was 2006 and 2002, the only two other times that happened in the last 35 years.

Summary

A significant impact of the pandemic on construction is the loss of spending due to the massive reduction in nonresidential construction starts in 2020. Those lower starts reduced nonresidential construction spending in 2020, but more-so in 2021, and in some markets will extend lower spending into 2022 and 2023. The most unexpected change was that residential spending continues a strong increase.

- 2020 new starts declined -7%. Res +6%, Nonres Bldgs -18%, Nonbuilding -15%.

- 2021 new starts increased +18%. Res +22%, Nonres Bldgs +18%, Nonbuilding +8%.

- Forecast 2022 starts are up +11%. Res +10%, Nonres Bldgs +18%, Nonbuilding +2%.

Nonresidential construction volume appears now will experience only slight dip mid-2022, the maximum downward pressure from the pandemic is past. Total All Volume, spending minus inflation, is expected to again reach the same bottom in mid-2022 as in 2021. That should impact jobs, but we haven’t seen jobs react to volume losses as would be expected. Jobs growth without volume growth to support those jobs is a productivity decline, increasing inflation.

Spending for 2021 is up 8%, but nonresidential buildings spending is down 4%. Almost all gains in 2021 spending are due to the 23% gain in residential.

Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume dropped 33% and jobs fell 30%. During two years of the pandemic recession, volume reached a low down 8% and jobs dropped a total 14%. But we gained back far more jobs than volume. That means it now takes more jobs to put-in-pace volume of work. That increases inflation.

No one predicted 2021 construction inflation. In Jan 2021, I predicted Inflation for nonresidential buildings near 4% and Residential inflation at 5% to 6%. Looking back, we now see nonresidential buildings inflation is 7%, the highest since 2006-2007 and residential inflation is 13%, the highest since 1977-1979, in part driven by the highest rates of increase in materials on record.

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.2%, Nonres Bldgs 6.7%, Non-bldg Infra Avg 7.5%

- 2022 Rsdn Inflation 11.7%, Nonres Bldgs 6.3%, Non-bldg Infra Avg 5.5%

edit 8-12-22 Much more information from a number of reliable sources is now available regarding recent inflation. Among several inputs, there is a recent BLS update to the Final Demand indices. See latest PPI tables. 2022 Residential Inflation 12.8%, Nonres Bldgs 9.4%, Non-bldg Infra Avg 5.6%.

edit update 9-19-22 inputs revise 2022 construction inflation as shown here. See Tables below:

- 2020 Rsdn Inflation 4.6%, Nonres Bldgs 2.7%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.4%, Nonres Bldgs 6.8%, Non-bldg Infra Avg 7.8%

- 2022 Rsdn Inflation 14.6%, Nonres Bldgs 9.9%, Non-bldg Infra Avg 12.0%

Cost Indices

General construction cost indices and Input price indices that do not track whole building final cost do not capture the full cost of inflation on construction projects.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

When construction activity is increasing, total construction costs typically increase more rapidly than the net cost of labor and materials. In active markets overhead and profit margins increase in response to increased demand. These costs are captured only in Selling Price, or final cost indices.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. This index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI is a materials cost index. Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are other examples of commonly used indices that do not capture whole building cost.

Construction Analytics Building Cost Index, Turner Building Cost Index, Rider Levett Bucknall Cost Index and Mortenson Cost Index are all examples of whole building cost indices that measure final selling price (for nonresidential buildings only).

Residential inflation indices are primarily single-family homes but would also be relevant for low-rise two to three story building types. Hi-rise residential work is more closely related to nonresidential building cost indices.

A nonresidential buildings index would be representative of commercial construction or hi-rise residential construction, since hi-rise residential is quite similar too commercial construction and in fact substantial portions of the building are constructed by firms classified as commercial constructors.

The Construction Analytics Infrastructure composite index is useful only for adjusting the total cost of all non-building infrastructure. Individual types of non-building infrastructure require attention to specific indices related to that type of work.

History

Post Great Recession, 2011-2020, average inflation rates:

Nonresidential buildings inflation 10-year average (2011-2020) is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. In 2021 it jumped to 9%, the highest since 2006.

Residential 8-year average inflation for 2013-2020 is 5.0%. In 2020 it was 5.3%. In 2021 it jumped to 14%, the highest since 1978.

30-year average inflation rate for residential and nonresidential buildings is 3.7%. Excluding deflation in recession years 2008-2010, for nonresidential buildings is 4.2% and for residential is 4.6%.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- In times of rapid construction spending growth, nonresidential construction annual inflation averages about 8%. Residential has gone as high as 10%.

- Nonresidential buildings inflation has average 3.7% since the recession bottom in 2011. Six-year 2014-2019 average is 4.4%.

- Residential buildings inflation reached a post-recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It has averaged 5.3% for 8 years 2013-2020.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors/supplier margins.

- When construction volume increases rapidly, margins increase rapidly.

Historically, when spending decreases or remains level for the year, inflation rarely (only 10% of the time) climbs above 3%. Avg inflation for all down/flat years is less than 1%. In 2021, spending was down for nonresidential buildings and non-building. Inflation for both was over 8%.

Nonresidential buildings inflation, after hitting 5.3% in 2018 and 4.8% in 2019, fell to 2.5% in 2020, lower than the 4.5% average for the previous four years. In 2021 it was 9.0%. Nonresidential buildings spending has not kept up with inflation since 2016. Spending needs to grow at a minimum of inflation, otherwise volume is declining. Since 2016, inflation exceeded spending by almost 20%.

Nonbuilding Infrastructure inflation, from 2013 to 2017 averaged less than 1%, but then jumped to 5% in 2018 and 2019. Inflation fell to -0.2% in 2020, but jumped to 9.1% in 2021.

Residential construction inflation in 2019 was only 3.4%. However, the average inflation for six years from 2013 to 2018 was 5.2%. It peaked at 7% in 2013 but dropped to 3.2% in 2015 and 3.4% in 2019. Residential inflation is 2021 was 14.0%.

Producer Price Index (PPI) Material Inputs (which exclude labor) to new construction averaged less than 1%/yr. from 2012 to 2017. Cost decreased in 2015 and 2016, the only negative costs for inputs in the past 20 years. Input costs averaged over 5% for 2018-2020. Then in 2021 input costs soared to 22%, the highest ever recorded.

2020 Performance

Even though material input costs were up for 2020, nonresidential inflation in 2020 remained low, possibly influenced by a reduction in margins due to the decline in new nonresidential buildings construction starts (-18%), which is a decline in new work to bid on. An 18% drop in new nonresidential buildings starts within one year equals a loss of near $100 billion of spending that would occur over the next 2-4 years. Nonbuilding starts were down 15%, equivalent to a loss of $50 billion in new work that would likely have been spread over 2-5 years. Residential starts in 2020 increased 6%, adding about $35 billion in new spending spread over 2 years.

Nonresidential buildings inflation for 2020 dropped to 2.6%, the first time in 6 years below 4%. Spending fell only 1.8% but after accounting for 2.6% inflation, volume decreased 4.4%. Nonresidential volume dropped every month in 2020 after the February 2020 peak, down 19% by December, but that’s not the bottom. Declines continue into 2021.

Nonbuilding Infrastructure in 2020 posted mild deflation of -0.3% after +5% in 2019, but averaged only 2%/yr. since 2011. 2020 spending increased only 0.7%. After accounting for -0.3% deflation, volume increased 0.4%. Public infrastructure inflation, up only 1.2% in 2020 after reaching over 4% in 2018 and 2019, averaged 2.7%, since 2011.

Residential inflation averaged 4.5% for 2020. Remarkably, spending increased 15% and 2020 volume was up 10%. Residential business volume dropped 9% from the March 2020 peak to the May bottom, but then by December recovered 16% to hit a post Great Recession high, 11% above Dec 2019.

2021 Performance

Most nonresidential construction markets had a weaker spending performance in 2021 than in 2020. Approximately 40%-50% of spending in 2021 is generated from 2020 starts, and 2020 nonresidential starts ranged down 10% to 25%, several markets down 40%.

Nonresidential buildings starts fell 18% in 2020, but gained 18% in 2021. Nonbuilding starts were down 15% in 2020, then added 8% in 2021. Residential starts increased 6% in 2020 and 22% in 2021.

Nonresidential buildings spending fell 4.4% in 2021. Nonbuilding spending was down 1.1%. Residential spending was the star of the year, up 23%, the largest yearly % gain on record.Nonresidential buildings inflation in 2021 jumped to 6.7%, the highest since 2007. Non-building average inflation was 7.5%, the highest since 2008. Residential inflation in 2021 jumped to 13.2%, the highest on record back to 1967.

After adjusting for inflation, total all construction volume in 2021 was down -1.1%. Residential volume for 2021 was up +10% while Nonresidential Bldgs volume was down -10% and non-building volume was down -7%. Jobs average over the year 2021 increased +2.3%. Volume was down -1.1%.

Current Inputs

U.S. Census Single-Family house Construction Index gained only 4% in 2020. The index is up 11.7% for 2021. The index has posted steady growth throughout 2021. Thru February 2022, over the last 4-5 months, the year/year rate of increase in this index has jumped from 12% yoy to 17% yoy. https://www.census.gov/construction/nrs/pdf/price_uc.pdf

Turner Construction Cost Index average annual for 2021 is up only 1.9% from 2020. That is unusually low, well below the range of 5% to 16% and the average of 9% for other nonresidential buildings indices. http://turnerconstruction.com/cost-index

Rider Levitt Bucknall nonresidential buildings index average for 2021 is up 4.8% from 2020. https://www.rlb.com/americas/

Mortenson’s cost index of nonresidential buildings data is posted through Q4 2021. The annual average inflation for 2021 is up 16% over 2020. https://www.mortenson.com/cost-index

RSMeans Nonresidential buildings index for 2021 is up 9.11%.

Engineering News Record (ENR) BCI inputs index for 2021 is up 10.0%. The BCI is up 5.3% year-to-date for the first 4 months of 2022.

Producer Price Index tables published by AGC show input costs to nonresidential buildings up about 18% for 2021. Final costs of contractors and buildings is up 5.3%. PPI Inputs for March show residential inputs up 8.2% and nonresidential buildings inputs up 12.6% ytd for 3 months. Also the average final demand increase cost for residential is up 16% and final demand cost for nonresidential bldgs is up 4.8% in the 1st quarter. https://www.agc.org/learn/construction-data

A caution here. AGC reports inflation for the year as the value reported in December of the year. Many others report the average inflation for all 12 months. These two reporting methods cannot be mixed. Construction Analytics has recently revised PPI data to reflect annual average inflation.

AGC April Construction Inflation Alert “The construction industry is in the midst of a period of exceptionally steep and fast-rising costs for a variety of materials, compounded by major supply-chain disruptions and difficulty finding enough workers—a combination that threatens the financial health of many contractors. No single solution will resolve the situation.”

New construction starts reported by Dodge thru Feb are up 15% over the same period in 2021, with residential at a new high and nonresidential near the previous high. Feb 2022 total was the highest level of new starts on record. High levels of activity often lead to higher levels of inflation.

Wage offerings are increasing (up 6% in 2021), productivity is declining (down 7% in last 4 years) and there are many instances of material shortages or delays in delivery (lumber, windows, roofing, cabinets, mechanical equipment, appliances, etc.). These issues are all present now and all work to increase inflation.

PPI INPUTS table updated 11-16-22

Steel Mill Products prices are up over 100% in 2021, but steel mill products includes all kinds of steel for all uses including automobiles and appliances. Construction uses slightly less than 40% of all steel and that is predominantly fabricated structural steel.

Fabricated Structural Steel prices are up 25% in 2021.

Here’s an example of how a PPI cost change affects the total final cost of the product installed. The mill price of steel is about 25% of the final price of steel installed. The other 75% of the cost is detailing, fabrication, delivery, lifting, labor and equipment for installation and markup. What affect might a steel cost increase have on a building project? It will affect the cost of structural shapes, steel joists, reinforcing steel, metal deck, stairs and rails, metal panels, metal ceilings, wall studs, door frames, canopies, steel duct, steel pipe and conduit, pumps, electrical cabinets and furniture, and I’m sure more. Assuming a typical structural steel building with some metal panel exterior, steel pan stairs, metal deck floors, steel doors and frames and steel studs in walls, then all steel material installed represents about 14% to 16% of total nonresidential building cost. Structural Steel only, installed, is about 9% to 10% of total building cost. The other 6% of total steel cost applies to all buildings. If mill price is up 100%, then subcontractor final cost is up 25%. With all steel representing 16% of total building cost then final cost of building would be up 4%.

Steel Prices Reach Levels Not Seen Since 2008 by The Fabricator

2021 Input costs for Residential and Nonresidential Buildings is the highest on record. Materials prices support high inflation into 2022. But some sources expect gains to moderate from 2021.

PPI FINAL DEMAND updated 11-16-22

For up to data 2022 PPI see Producer Price Index PPI Tables 2022

Inflation

Could a recession bring on deflation?

Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume went down 33% and jobs were down 30%. In 2020, business volume dropped 7% from February to May. By October, volume reached a low for the year, down 8%. Volume of work seemed to be recovering in the first quarter of 2021, up 3% from the October low, but then struggled most of the year. As of December 2021, volume is still down 7% from the February 2020 peak and up only 2% from the 2020 low. Jobs dropped 14%, 1,100,000+ jobs, in two months! But jobs recovered all but 3% by December 2020. As of December 2021, jobs are down 2% from February 2020 peak. We have now gained back 1,000,000 jobs. But we gained back far more jobs than volume. That means it now takes more jobs to put-in-place volume of work. That increases inflation.

Here’s a list of some 2021 indices average annual change and date updated.

- +6.7% Construction Analytics Nonres Bldgs Mar

- +5.4% PPI Average Final Demand 5 Nonres Bldgs Dec

- +5.3% PPI average Final Demand 4 Nonres Trades Dec

- +1.9% Turner Index Nonres Bldgs annual avg 2021 Q4

- +4.8% Rider Levett Bucknall Nonres Bldgs annual avg 2021 Q4

- +16% Mortenson Nonres Bldgs annual avg 2021 Mar

- +11.7% U S Census New SF Home annual avg 2021 Dec

- +7.4% I H S Power Plants and Pipelines Index annual avg 2021 Dec

- +7.1% BurRec Roads and Bridges annual avg 2021 Q4

- +6.0% FHWA Fed Hiway annual avg 2021 Q4

- +9.11% R S Means Nonres Bldgs Inputs annual avg 2021 Q4

- +10.0% ENR Nonres Bldgs Inputs annual avg 2021 Dec

Take note of the top six indices reported here. They all represent nonresidential buildings final cost. The spread is from 2% to 16%, wider than ever seen in any other year. The average of these six is 6.7%.

Future Inflation Forecast

Typically, when work volume decreases, the bidding environment gets more competitive. We can always expect some margin decline when there are fewer nonresidential projects to bid on, which typically results in sharper pencils. However, when materials shortages develop or productivity declines, that causes inflation to increase. We can also expect cost increases due to material prices, labor cost, lost productivity, project time extensions or potential overtime to meet a fixed end-date.

After adjusting for inflation, total volume in 2021 is down 1.1%. Residential volume for 2021 is up +10% while Nonresidential Bldgs volume is down 10% and Non-bldg volume is down 7%.

Total volume for 2022 is forecast up only 1.7%. After adjusting for inflation, Residential volume for 2022 is forecast up only 2%. Nonresidential Bldgs volume is forecast up 4% and Non-bldg volume is forecast down 2%.

Volume declines should lead to lower inflation as firms compete for fewer new projects. However, aside from remarkable cost increases for materials, if jobs growth continues while volume declines, then productivity declines, and that will add to labor cost inflation. Since 2010, Construction Spending is up over 100%, but after adjusting for inflation, Volume is up only 31%. Jobs are up 41%.

Notice in this next plot how index growth for ENR BCI and RSMeans, both input indices, is much less than for all other selling price final cost indices. From 2010 to 2020, Construction Analytics total final cost inflation is 103/71 = 1.45 = +45%. Input cost indices total inflation over the same period is only 103/79 = 1.30 = +30%, missing a big portion of the cost growth over time.

Nonresidential Buildings Selling Price Indices vs Input Indices updated 9-19-22

Several Nonresidential Buildings Final Cost Indices averaged over 5%/yr. in 2018 and 2019 and over 4%/yr. from 2015 to 2019 averaging +25% inflation for 5 years. Input indices that do not track whole building cost averaged only 12% inflation for those five years, much less than final cost growth. As noted previously, most reliable nonresidential selling price indexes have been over 4% since 2014. All dropped to between 2% to 3.5% in 2020.

Current and predicted Inflation rates updated 12-10-22:

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 7.4%, Non-bldg Infra Avg 7.8%

- 2022 Rsdn Inflation 15.4%, Nonres Bldgs 12.2%, Non-bldg Infra Avg 13.6%

- 2023 Rsdn Inflation 6.0%, Nonres Bldgs 4.8%, Non-bldg Infra Avg 4.3%

Construction Analytics Building Cost Index updated 12-10-22

As of April 2022, not all nonresidential sources have updated their Q4 inflation index. A few are still reporting only 2% to 4% inflation for 2021, but several have moved up dramatically, now reflecting between +10% to +14%. One national resource is reporting only 1.9% inflation for 2021! The 2015-2023 table has been updated to include all Q1 2022 data where available. We can still expect some minor change to 2021 and future forecasts.

The tables below, from 2015 thru 2023, updates 2021 data and includes Q1’22 data when available and provide 2022-2023 forecast. The three major sector indices, highlighted, are plotted above. NOTE, in this table and these plots all indices are set to a base of 2019=100. All original data is gathered for all indices, but since all indices have different index dates (start in different years), all data is modified to a common base date, in this case 2019. That allows all indices to be easily compared. These indices are annual average index reported at midyear. All forward forecast values, whenever not available, are estimated by Construction Analytics using long-term avg.

Index Table updated 12-10-22 for older indices see Construction Inflation Index Tables + Links

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from. Example: What is cost inflation for a building with a midpoint in 2021, for a similar nonresidential building whose midpoint of construction was 2016? Divide Index for 2021 by index for 2016 = 111.7/87.0 = 1.284. Cost of building with midpoint in 2016 x 1.28 = cost of same building with midpoint in 2021. Costs should be moved from/to midpoint of construction. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

Non-building infrastructure indices are so unique to the type of work that individual specific infrastructure indices must be used to adjust cost of work. The FHWA highway index increased 17% from 2010 to 2014, stalled from 2015-2017, then increased 15% in 2018-2019. During that time, the average of non-building indices would have given +12% from 2010-2014, +13% for 2015-2017 and +10% for 2018-2019. The IHS Refinery, Petrochemical plants index fell 10% from 2014 to 2016. In that same two-year period the IHS Pipeline, LNG index fell 25%. The CA Infrastructure composite index is useful only for adjusting the grand total cost of all non-building infrastructure.

Infrastructure Table updated 12-10-22

Volume of Work – The Impact of Inflation on Jobs

Volume is spending minus inflation.

Construction Spending drives the headlines. Construction Volume drives jobs demand. Total Volume is forecast flat to down over the next 12 months. Residential dips 4% then recovers to current level, nonresidential buildings volume increases 6% and Non-building infrastructure volume will fall 7%.

To differentiate between Revenue and Volume you must use actual final cost indices, otherwise known as selling price indices, to properly adjust the cost of construction over time.

When spending increases less than the rate of inflation, the real work volume is declining. In 2020, Nonresidential buildings spending was down 2%, but with 2.5% inflation, so volume was down 4.5%. The extent of volume declines impacts the jobs situation. In 2021, Nonresidential Buildings jobs increased by slightly less than 1%, but construction volume was down 10%. Total all construction jobs increased by 2.3%, but construction volume was down 1.1%. Jobs are supported by growth in construction volume, spending minus inflation. If jobs increase faster than volume, that adds to productivity losses and adds to inflation.

Many construction firms judge their business growth by the revenues passing through from all jobs under contract. The problem with that, for example, is that Nonresidential Buildings spending (revenues) are expected to grow 10% in 2022, but after adjusting for inflation the actual volume of work will be up by only 4%. By this method, in part, these firms are including in their accounting an increase in inflation dollars passing through their hands. Spending includes inflation, which does not add to the volume of work and does not support jobs growth.

Total volume for 2022 is forecast up only 1.7%. Residential volume for 2022 is forecast up 2.3%. Nonresidential Bldgs volume is forecast up only 4% and Non-bldg volume is forecast down 2.4%.

Construction Spending Current Dollars

Spending includes inflation which does not add to the volume of work. Before we can look at the effect on jobs, we need to adjust spending for inflation. The plot above “Spending by Sector” is current dollars. The sector plot below is adjusted for inflation and is presented in constant $. Constant $ show volume. Notice future residential remains in a narrow range after adjusting for inflation.

Constant $ = Spending minus inflation = Volume

Residential business volume is no stranger to hefty increases in spending and volume. In three years 2013-2015, spending increased 57% and volume was up 35%. For 2020-2021, spending increased 42% and volume was up 20%. Although residential spending remains near this elevated level for the next year, volume growth slows down in the 2nd half of 2022. Residential spending is forecast up 13% for 2022, but a forecast for 11.7% residential inflation slows volume growth to 2.3% for the year.

In January 2021, I had forecast by 3rd quarter 2021, nonresidential buildings volume would be 25% below the Feb 2020 peak. By 3rd qtr 2021 volume was down 21%. This follows the 20% decline in new starts in 2020. Most of the spending from those lost starts would have taken place in 2021. For 2022, spending is forecast to increase 10%, but inflation is forecast at 6%, resulting in volume growth of 4%.

In 2021, nonresidential buildings volume dropped 10%. Non-building volume dropped 7%. In 2022, nonresidential buildings volume should climb 4% but non-building volume falls 2.4%. In fact, the forecast shows non-building volume still drops another 4% in 2023. Although Power plants posted a massive gain in starts in 2019, declines in pipeline starts offset some of that gain. Transportation, a source of long duration projects, is also contributing to that decline. Although transportation starts were up 16% in 2021, that follows a 33% decline in starts in 2020-2021.

Below is the non-building plot, inflation adjusted. Both the nonresidential buildings and the non-building plots show there has been no substantial increase since Feb 2020 in volume to support jobs growth, and there is little to no help in 2022.

Jobs are supported by growth in construction volume, spending minus inflation. If volume is declining, there is no support to increase jobs. Although total volume for 2022 is forecast up 1.7%, with Residential volume forecast up 2.3%, Nonresidential Bldgs volume up 4% and Non-building volume forecast down 2.4%, we will not see total construction volume return to Feb 2020 level at any time in the next three years. By the end of 2023 volume is still down 3% from Feb 2020.

Construction Jobs Growth

When we see spending increasing at less than the rate of inflation, the real work volume is declining. For example, with construction inflation increasing at 3% annually, a nonresidential building spending decline of -2% would reflect a work volume decline of 5%. The extent of volume declines would affect the jobs situation.

There is a difference comparing growth to same month last year versus comparing annual averages. For Dec’21 vs Dec’20, Residential jobs are up 75k, Nonresidential Bldgs up 61k and Nonbuilding up24k. But annual averages tell a much different story.

AVG 2021 vs AVG 2020, Rsdn+153k (+5.3%), Nonres Bldgs +28k (+0.8%), Non-bldg +9k (+0.9%).

Dec vs Dec simply compares jobs at 2 points in time, without the benefit of what occurred in the other 11 months of the year, so does not tell us what took place over the year. Total labor production for the year must take into account all months. The annual average gives a much clearer indication of jobs growth over the year because it accounts for the peaks and dips of all 12 months during the year.

Jobs average over the year 2021 increased +2.3%. After adjusting for inflation, total volume in 2021 is down -1.1%. Residential volume for 2021 is up 10% while Nonresidential Bldgs volume is down 10% and Non-building volume is down 7%. Those are remarkable nonresidential declines, not seen that deep since 2010.

If jobs are increasing faster than volume of work, productivity is declining. For example, nonresidential buildings volume declined 10%, but nonres bldgs jobs increase 0.8%. That’s a 11% swing in productivity. Since labor is about 30% to 35% of the cost of a project, if productivity declines by 11%, then inflation rises by 11% x 35%, or 3.8%. The most recent year drop in volume, while jobs increased, added 4+% to nonresidential buildings inflation for the year. But some jobs counted as Nonresidential actually work on residential construction, so the individual sector data is skewed and there is insufficient detail to count those jobs. Better to look at all volume vs all jobs.

Jobs and Volume of work growth should move in tandem, as seen in the above plot from 2011 to Jan 2018. With exception of 2006, when jobs increased by 10%, but volume dropped by 5%, a negative impact 15% spread, similar to 2018, these plot lines have been moving in tandem like this, with minor differences, back to 1992. If jobs grow faster than volume, productivity is declining (a negative impact). When these plot lines grow wider apart with jobs above volume, that is a sign of a productivity decline. That loss of productivity for the workforce is a hidden aspect of inflation, not shown in pricing or wages.

Jobs are supported by growth in construction volume, spending minus inflation. Unless volume of work increases or job growth slows, by the end of 2022, volume will be lower than today.

What does that hidden loss of productivity for the workforce look like? How can we tell the magnitude of this impact on inflation when it is hidden, not seen in wages? It shows up in this following plot, the volume of work Put-In-Place per job.

If jobs are increasing faster than volume of work, can we tell if it’s production employees or supervisory employees? BLS reports ALL construction jobs (~7.5million) and Production jobs (~5.5million). The difference between these two data sets is supervisory employees.

Looking at the average number of construction jobs in the last 4 years, the average of 2021 jobs vs the average of 2017 jobs, production jobs increased +5%, but supervisory jobs increased +12%.

In 2011, supervisory jobs was 24% of all construction jobs. Now it is 35%. Growth in supervisory jobs has had a greater negative impact than production jobs on the spread between jobs and volume.

In January 2021, I had forecast We will not see construction volume return to Feb 2020 level at any time in the next three years. Well, unprecedented residential growth outperformed with 10% volume growth in both 2020 and 2021. Nonresidential and non-building volume since Feb 2020 are down 15% to 16%. Total construction volume since Feb 2020 is still down 2.5%. It is expected to fall another 3% in 2022. And the forecast still shows total construction volume from Feb 2020 down 2% by the end of 2023. That is a difficult environment to see jobs growth.

A final word about terminology: Inflation vs Escalation. These two words, Inflation and Escalation, both refer to the change in cost over time. However, escalation is the term often used in a construction cost estimate to represent anticipated future change, while more often the record of past cost changes is referred to as inflation. This graphic might represent how most owners and estimators reference these two terms.

Links to Articles and Data

The U.S. Census Single-Family house Construction Index

NAHB – Prices of goods used in residential construction

The Producer Price Index tables published by AGC

Construction Analytics Construction Inflation Index Tables for indices related to Nonbuilding Infrastructure work and for many more links to sources.

See this post on my blog Construction Economic Outlook 2022

October Record Increase to Construction Inflation 11-10-21

What’s the Construction Inflation rate?

From Sept to Oct construction materials input price changes were normal, but Final Demand prices for October increased in one month by what could be considered an entire year’s increase. We’ve been watching the price pass thru catch up slowly, until now.

This is the single largest monthly increase in Final Demand pricing since final demand records began in 2006. Prior to this, based on changes in recent months, I expected future cost increases to add on slowly. So I wasn’t expecting the huge jump all at once. This may be some increases that were occurring over a few months that finally got captured in the index.

In October, the Final demand cost for Buildings and Trades averaged +12% year-to-date. In July, August and September it was between 5% and 6%. A change like this in one month has never occurred before. In fact, this one-month change is greater than any annual change on record. So, it resets the baseline for all forecasts.

For Oct, Nonresidential Buildings 2021 inflation is estimated at 6.8% and Residential at 15%. The forecast for 2022 is estimated at 4.5% for nonresidential buildings inflation and 7% for residential. See inflation and PPI data on my blog for more.

It must be noted that huge jump in nonresidential buildings inflation may not yet be picked up in many of the industry indices that we reference. Construction Analytics BCI is now updated to include the 11-10-21 PPI final demand inflation. Some sources update only quarterly, some semi-annually. After this event, I would expect to see a change in most other sources, which may update sometime over the next quarter.

One important thing, when inflation turns out to be higher than you thought, that means productivity is lower than you thought.

See Inflation – PPI data Jun to OCT Updated 11-10-21

Also see 2021 Construction Inflation – updated 11-10-21

Speaking Engagement – Advancing Preconstruction 2021

Join us August 30 – September 1 in Dallas TX

I will be presenting to the plenary session on Main Conference Day 1, Tuesday August 31 on the following:

The State of Construction Post-Pandemic: Revealing Trends in Demand, Supply & Cost Escalation

• Revealing the economic reality and outlook in terms of construction volume and its impact on jobs and prices

• Identifying key metrics and data sources that will give you a reliable indication of inflation for your market

• Determining the likely impact of an Infrastructure Bill and other major construction investments on market forces

The 6th annual Advancing Preconstruction 2021 conference is North America’s largest gathering of contractors, design firms and clients looking to improve coordination of the design phase. You’ll hear how to align cost, schedule and project specifications to set projects up for success.

From conceptual estimating and winning work to constructability reviews and model-based quantity take-off, you’ll discover the latest technologies and workflows across five educational tracks.

New additions for 2021 include:

- Post-pandemic outlooks with a focus on cost escalation for major markets and bidding strategies

- Deep dives into estimating for specific CSI divisions including earthwork, steel, mechanical and electrical

- Benchmarking ways to conduct design reviews and maintain quality of coordination, including with remote working

- How direct material procurement, prefabrication, IPD and other trends could radically alter preconstruction and reduce costs

- https://advancing-preconstruction.com/

Construction Inflation May 2021

SEE Construction Inflation 2021 – Q3 Updated 10-15-21

update 6-15-21 PPI for May

Post Great Recession, 2011-2020, average nonresidential buildings CONSTRUCTION INFLATION is 3.7%. Residential cost inflation averaged over 5% for the last 8 years.

The 30-year avg inflation rate (including recession) for Nonres Bldgs is 3.5% and for Residential it’s 3.4%.

The 30-year avg inflation rate (EXCLUDING recession years) for Nonres Bldgs is 4% and for Residential it’s 4.75%.

I expect non-residential buildings construction inflation in 2021 to range between 3.2% to 3.5%, with potential to be held lower. Expect residential inflation of 7% to 8% with potential to push slightly higher.

As of March 2021, PPI for materials inputs to construction is up 12% to 14% yoy, measured to last March before the bottom dropped out. The PPI Buildings Cost Index for final cost to owner is up only 2%.