Construction Job Openings – Behind the Headlines

Recent data indicates ~ 300k job openings. Let’s look at support. To support those openings, there must be an equivalent added volume of work.

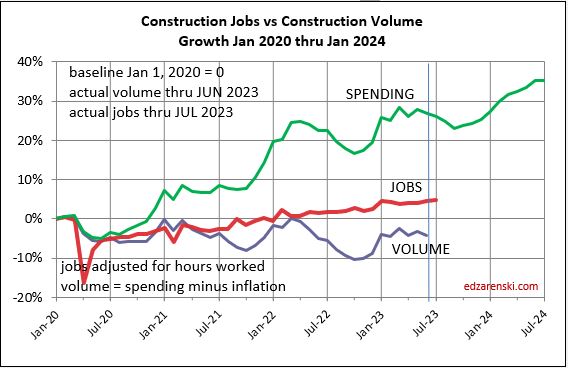

As we entered 2020, construction spending (in current $) was at a (then) all-time high of $1.530 trillion(t). Let’s set that point in time as the base and track growth since. Construction spending peaked in March 2023 at $1.970t and is currently at about $1.950t.

Volume growth in constant $ (constant $ = spending minus inflation) fell from $1.530t to $1.350t in Oct’22, has since returned to $1.450t as of June. So real volume growth is up off the bottom, but is still $80t or 5% below 2020. It is forecast to fall $50t over the next 6 months and return to current level in mid-2024.

Jobs, as we entered 2020, stood at 7.600 million(m). Jobs rapidly fell to 6.500m but recovered most of that by Dec 2020. Jobs now stand at 7.970m, up 5% since Jan 2020.

So, let’s summarize the facts: Since Jan 2020, spending is now nearly equal, volume of work is down 5%, but jobs are up 5%. So, since Jan 2020, jobs have increased 10% in excess of volume of work to support those jobs.

By my calc, if we were to add 300k jobs, either today or over the next year, we would see jobs increase by another 4%. Jobs growth since Jan’20 would exceed volume growth by nearly 14%. You might argue that 300k openings are there to fill the void of jobs supporting the current workload, but jobs growth already exceeds volume growth by 10% in the last 3 years.

Anyone want to try to explain how job openings of 300k is supported by the data?

Note 1: Job openings as of July are closer to 400,000

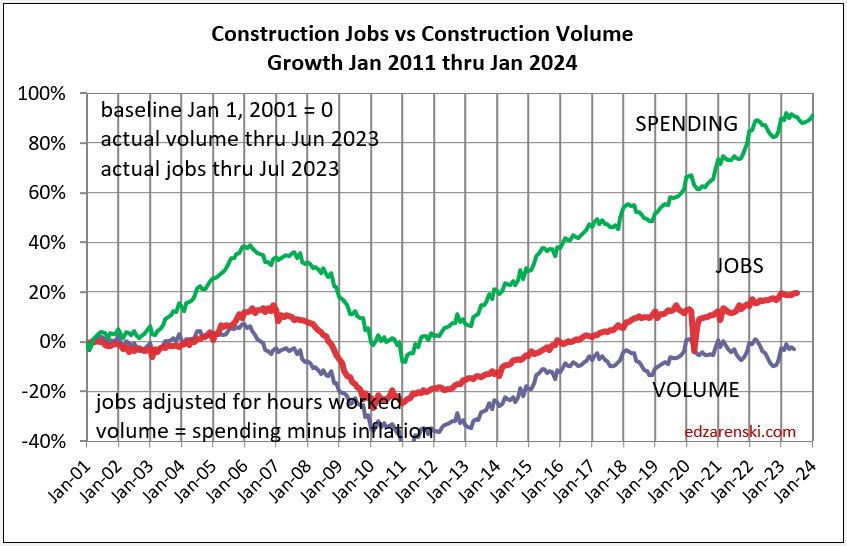

Note 2: plots shows baseline back to 2020 and 2001. Baseline 2001 situation becomes worse. See prior post https://edzarenski.com/2023/08/05/midyear-23-jobs-outlook/ for plots to baeline 2011 and 2020.

Am no economist but perhaps those excess jobs are funded by the inflation, i.e., they partially account for the inflation

LikeLike

Yes, excess jobs account for a part of inflation. Excess jobs show up as a loss of productivity, less volume put-in-place per job.

LikeLike

Love your work, Ed! My less-than-fully reconciled contribution to how we square this data: 1. Since there is no perfect or universal way to adjust spending for inflation (that I am aware of), what is the variance in the deltas if inflation adjustment methodologies are changed? Is it appreciable or just marginal? I would guess the latter. 2. Given your reply above to Robert and your previous posts re: labor productivity, can we explain this delta primarily by continued downward trends in per-job productivity (as a ratio of output and compensation)? You note that pushing the baseline further back in time shows a direct relationship with the delta magnitude; this would seem to align with the trend in productivity decline.

LikeLike

I’m at a loss to know of any other way of inflation adjustment methodologies.

It seems the largest divergence in jobs vs volume occur in periods of highest inflation. As I’ve commented before, it’s pretty hard for the decision makers in a company to NOT add jobs when they see revenues increase by 10-12% in a year, even though inflation was 15% during that period and real volume declined.

LikeLike

is it possible that you need to look further back than 2020 for an appropriate baseline of # of jobs to support the respective volume or $? That is to say, was the situation in 2020 unsustainable in terms of the number of jobs that existed for the amount of work going on? Anecdotally, (I know you like data) ever since the recession of 2008-2009 my field of architecture pushed more work onto less people. Admittedly there was likely more capacity in those number of workers. But if you look at 2012-2016 does the picture look much different than 2020? Just a thought.

LikeLike

I’ve looked at several baselines. The numbers change some but the result is the same. At baseline 2011 the delta is 9%. If we look at a baseline of 2007, the numbers get much worse. If we take baseline back to 2001, the difference in volume growth vs jobs growth is 20%.

Added baseline 2001 plot to the post. See https://edzarenski.com/2023/08/05/midyear-23-jobs-outlook/ for baseline 2011 and 2020 plots.

LikeLike