Home » Posts tagged 'Forecast'

Tag Archives: Forecast

Construction Data MAR Briefs 5-5-24

Updates to Forecast, spending, starts, inflation, jobs

SEE ALSO Construction Analytics Outlook 2024

A side note, before I begin with the economic data, sometime within the next few weeks, I expect by May 31st, this blog will record the 1,000,000 view. Nearly 500,000 people read on average 2.1 articles every visit. Inflation articles draw the most attention, with a read rate of about 1000 times a week on a slow week and 2,000 on a busy week. Thank you to all my visitors. Keep reading!

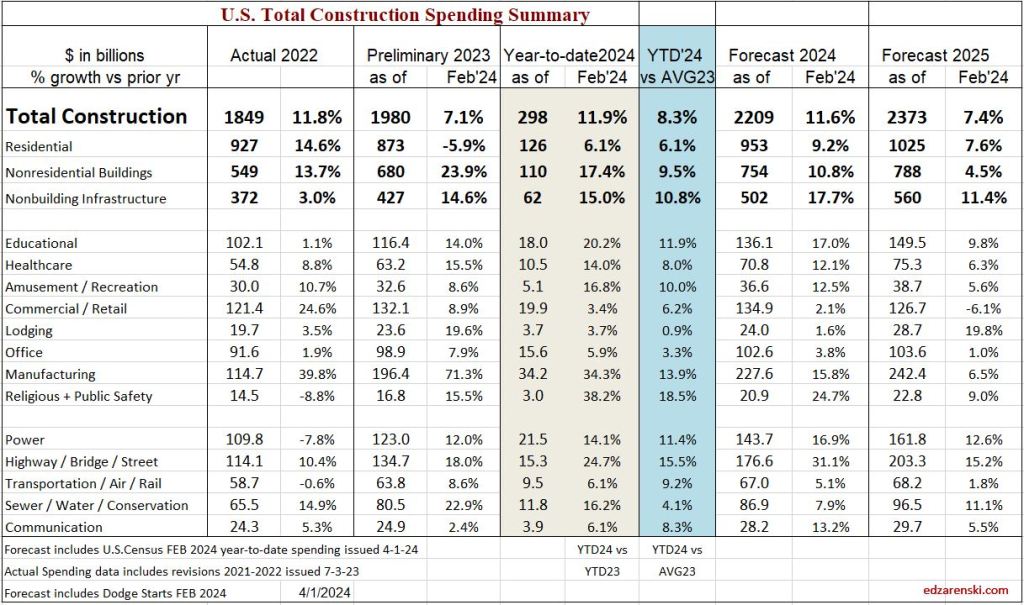

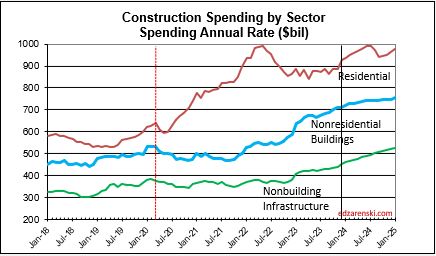

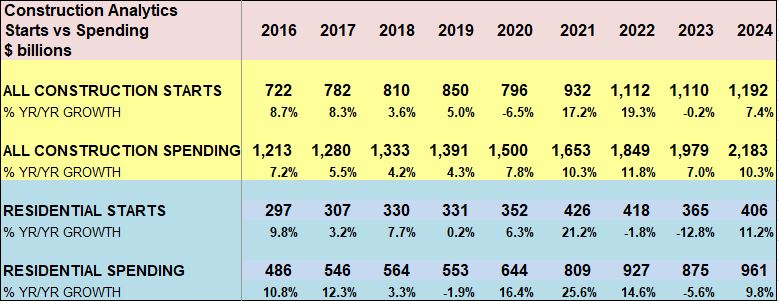

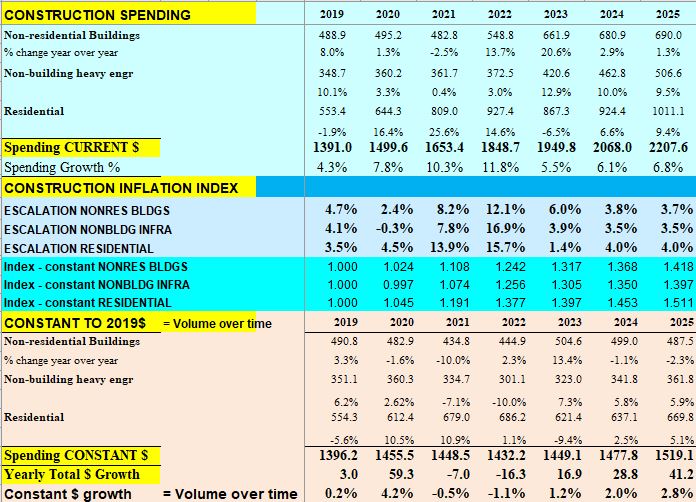

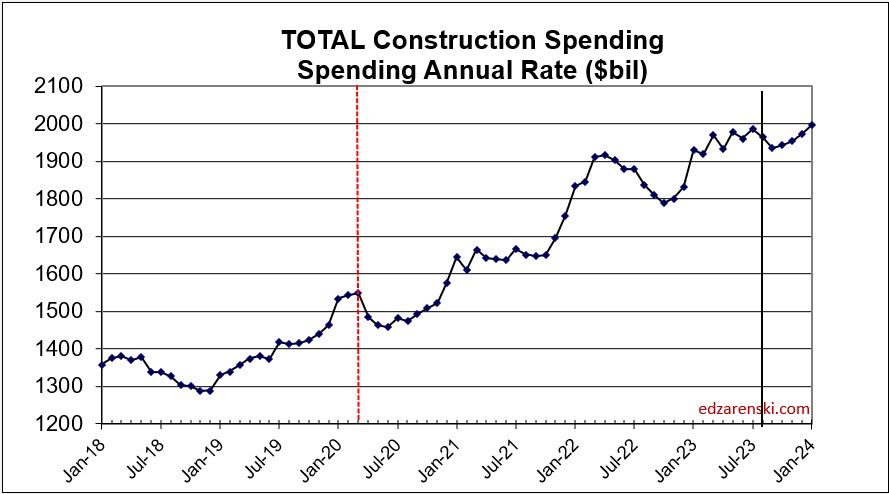

2024 construction spending will be measured to the avg of 2023, $1980 bil. The average Seasonally Adjusted Annual Rate (SAAR) for 2023 is the total spending for 2023, but is was lower in Jan and higher by Dec. By Dec the SAAR was already 6% higher than the average for 2023. So we began 2024 with Dec spending at a SAAR 6% above avg 2023.

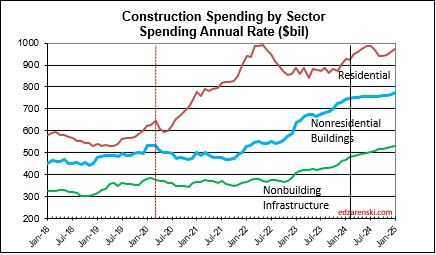

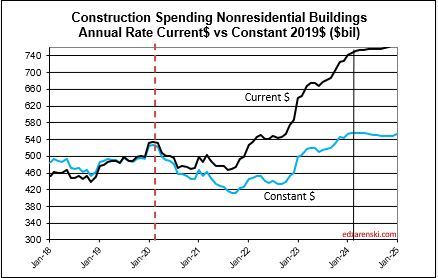

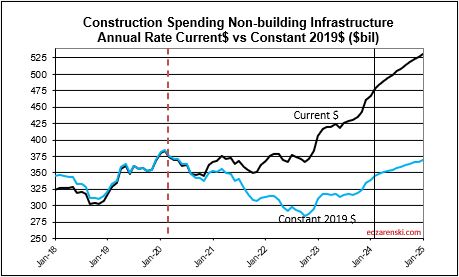

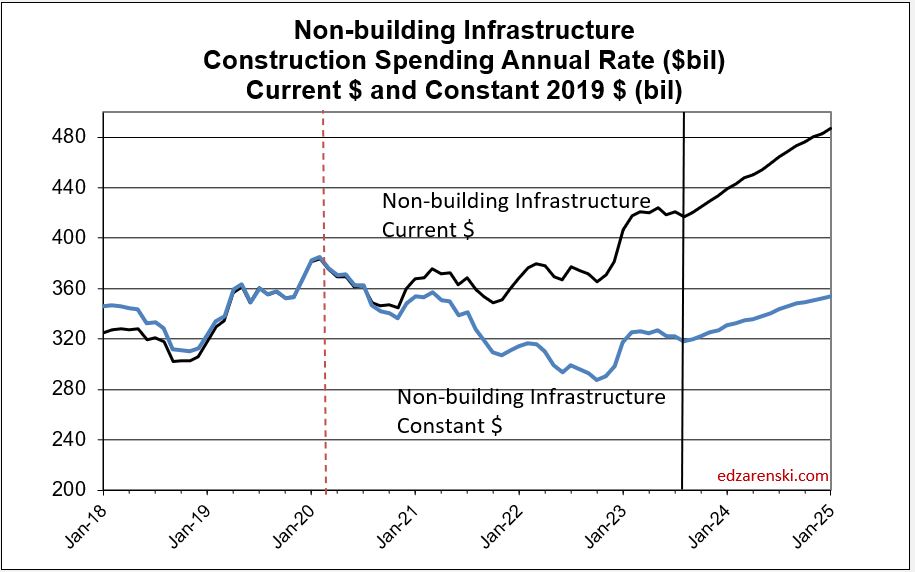

As of MAR, the total SAAR is 8.1% above 2023. Rsdn is +5.4%, Nonres Bldgs +10.0%, Nonbldg +10.8%. If growth stalls at the current level for the rest of the year, meaning, if we were to end the year with the SAAR unchanged from today, then we would finish with these gains for 2024. The trend in most cases is up, so I expect end of year we will be a little higher than today.

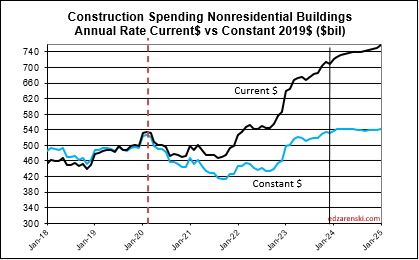

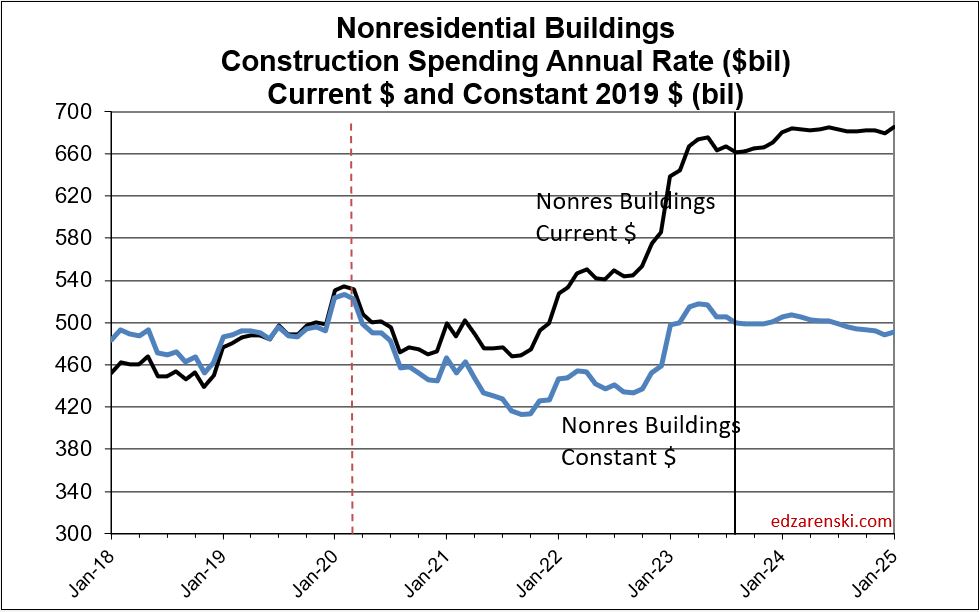

2024 construction spending for Nonres Bldgs, as of MAR, measured to the 2023 avg, is now +10.0% and trending up. We began 2024 with Nonres Bldgs Dec spending at a SAAR 6% above avg 2023. The American Institute of Architects (AIA) Consensus for Nonres Bldgs, published at the beginning of the year, averages +4% growth over 2023. Only one of the 10 forecasts for Nonres Bldgs spending in the AIA 2024 Consensus is still above the current reading. So, I think it’s safe to say, the AIA Consensus was low right from the very start.

The trend in Nonres Bldgs construction spending is up 18 of the last 19 months and continues up for the next 12 months. To fall to the AIA Consensus average of +4% for the year from the current SAAR, up +10.0%, the remaining 9 months of 2024 would need to fall from the current +10% to average only +2% higher than 2023. It may not be apparent, but that is a continuous decline of more than 1.5% every month for the next 9 months. That’s like falling off a cliff next month and not being able to get up. That’s unrealistic. Unless something sets off a deep recession similar to 2009, that will not happen.

At the beginning of 2007-2010, the first sign of recession for construction was a decline in 2007 of 25% in residential starts. Then in 2008 residential starts fell 40%. In 2009, both residential starts and nonresidential buildings starts fell 30%. Nonbuilding starts fell only 6%. By 2010 starts were increasing. But spending lags starts. Residential spending fell 60% from 2006 to 2009. Nonresidential buildings spending fell 33% from 2008 to 2010.

Although nonres bldgs starts fell 18% in 2020 and residential starts fell 11% in 2023, neither led to a devastating drop in spending as recovery occurred quickly. There is nothing in the current outlook to indicate recession, on any horizon. This forecast does not anticipate a recession.

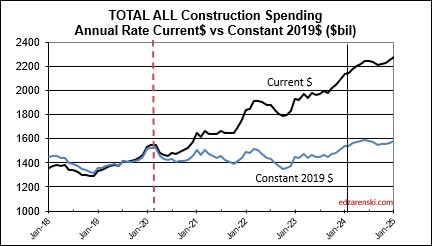

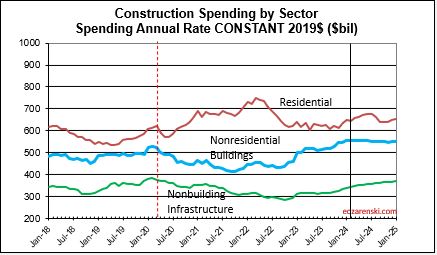

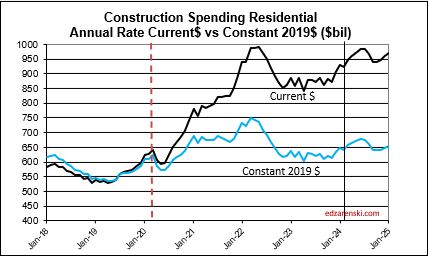

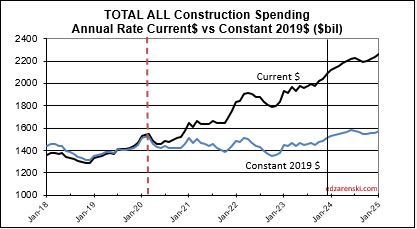

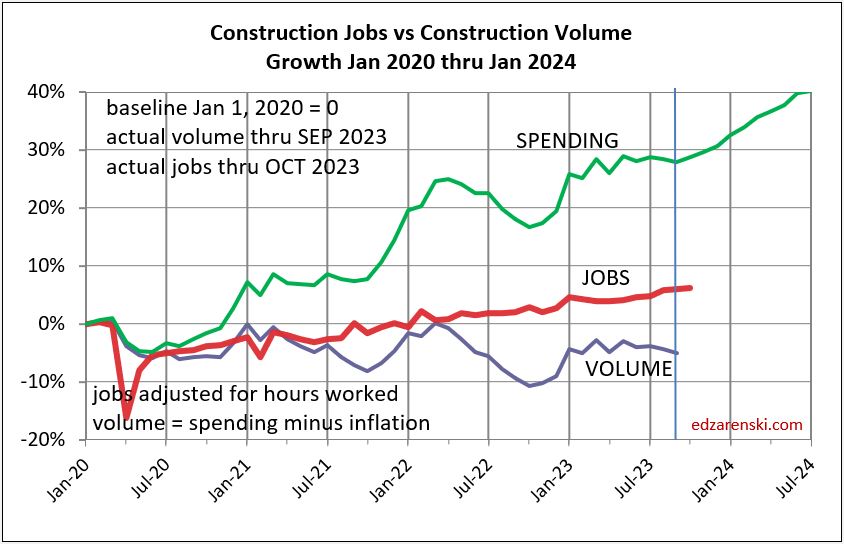

Since the end of 2019, (in Dec 2019 spending hit $1,464T) total construction spending as of MAR’24 is up 46%. After inflation, Volume is up only 6%. The real Volume of Business is spending minus inflation. More than 85% of the spending growth since Dec. 2019 is inflation. If current projections hold, the total business volume through year 2024 will have grown 10% since 2019. ALL business plan forecasts and labor demand should be based on this 10% growth. Inflation adds nothing to business volume.

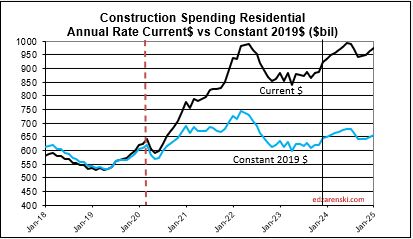

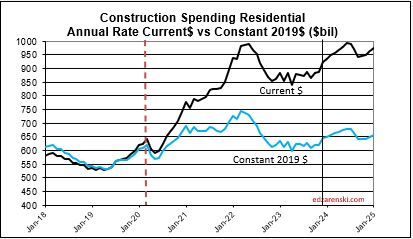

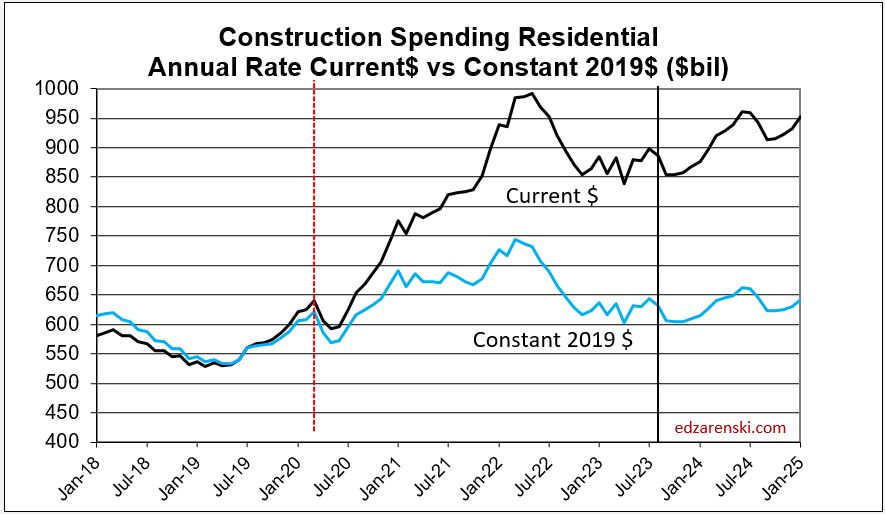

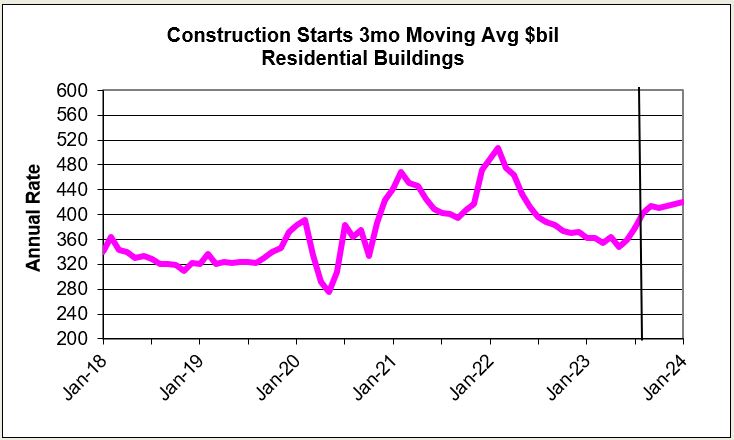

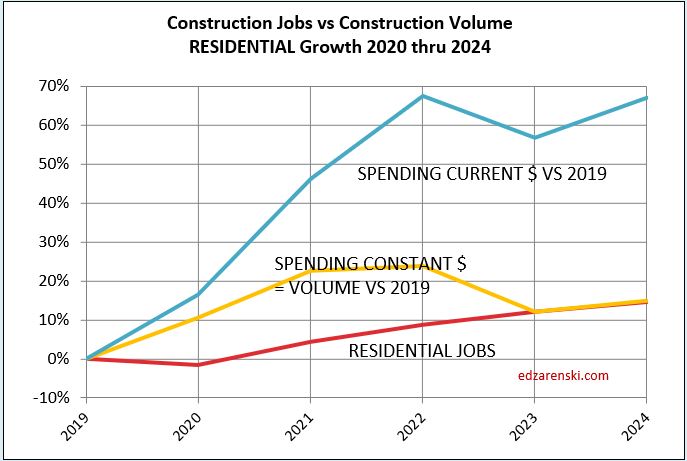

Over the last 9 months, residential new starts (as reported by Dodge) averaged the highest since the peak high in the 1st half of 2022. For Q1’2024, residential starts are 27% higher than Q1’2023. Currently, residential starts for 2024 are averaging 8% higher than the total in 2023. Residential spending peaked at an all-time high in Q2’22. Spending has been level or increasing the last few months at a rate 6.5% lower than the peak, but at a rate 55% higher than Dec 2019. Due to the short durations in residential building, fluctuations in starts are more quickly apparent in spending. Expect both nominal and real (inflation adjusted) spending to continue increasing thru the 1st half 2024, then drop back slightly in the 2nd half 2024. Spending is expected to increase 7% in 2024 over 2023. Volume after inflation should grow 3%.

Single Family spending YTD through Mar. is up 16% from Q1’2023. Single Family rate of spending through Mar. is up 11% over the average (total) spending in 2023. Multi-family spending for Q1’24 is up 6% from Q1’23 and is 2.5% lower than peak spending in Aug ’23, however it’s still up 1% over the avg spending in 2023. These are all nominal values, so real growth is lower. But residential inflation for 2023 was only 3%, so not much lower.

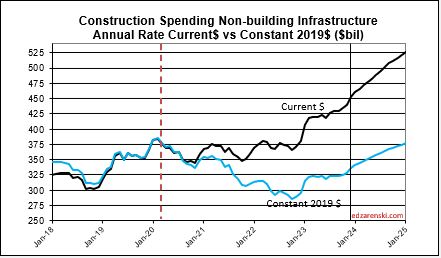

An avg spending curve for long-duration Non-bldg Infra is 15:30:30:20:5. The greatest spending impact does not show up until year two and three after the year in which the projects start. Example: If 2024 posts $100bil in new starts for Infrastructure, only $15bil of that gets put-in-place in 2024. $30bil would get put-in-place in 2025 and 2026.

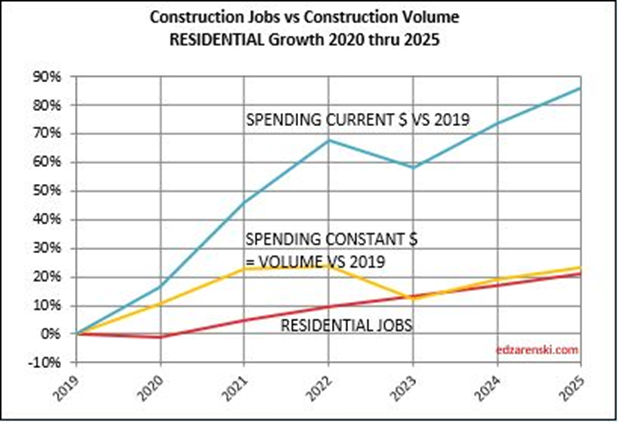

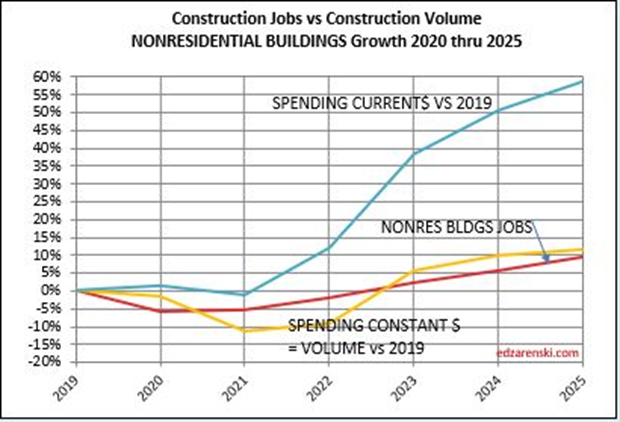

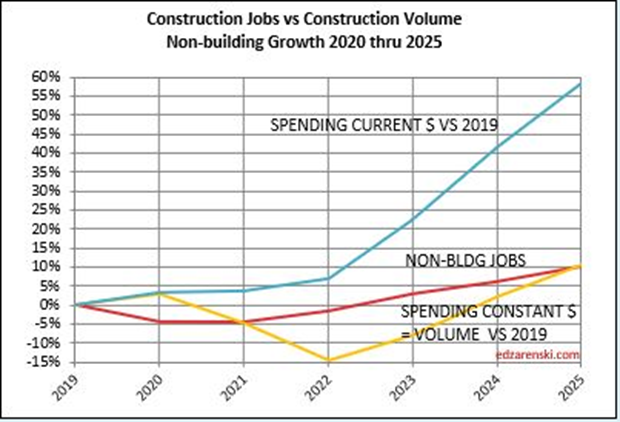

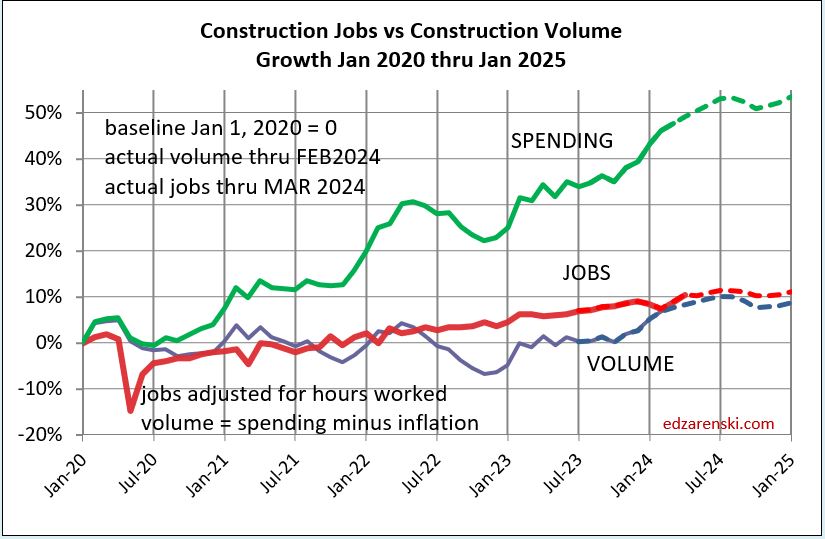

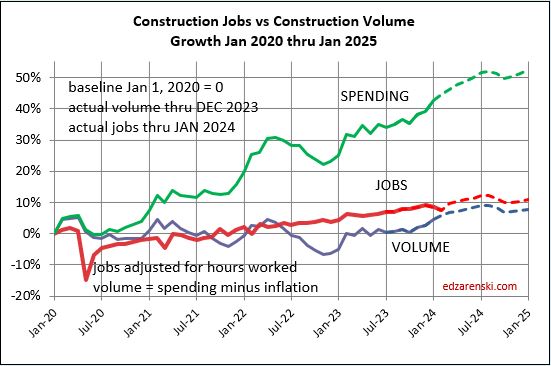

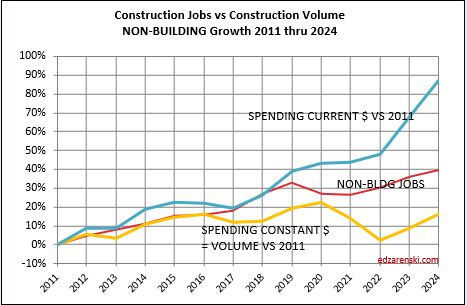

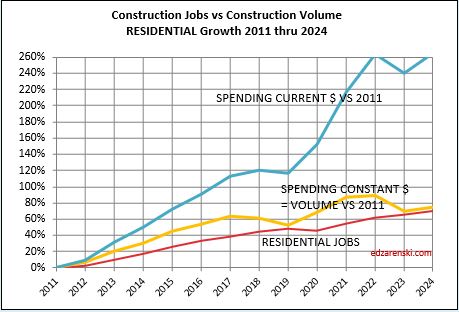

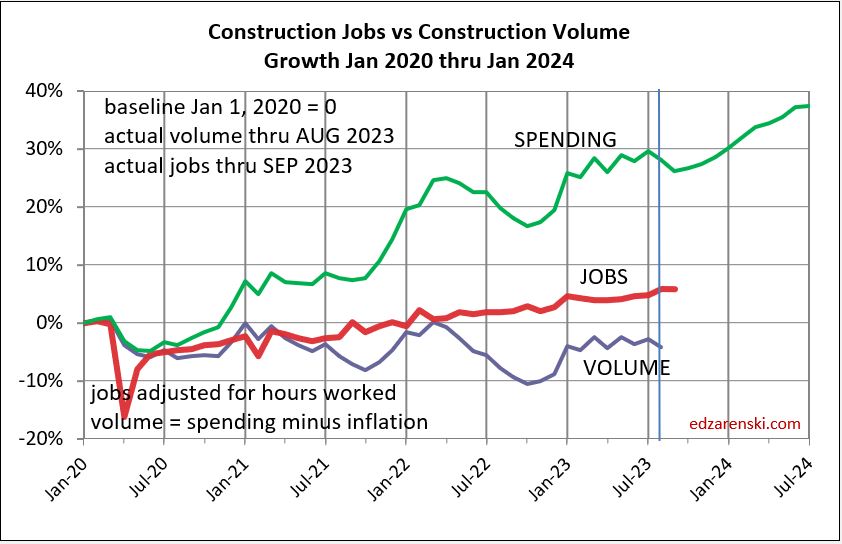

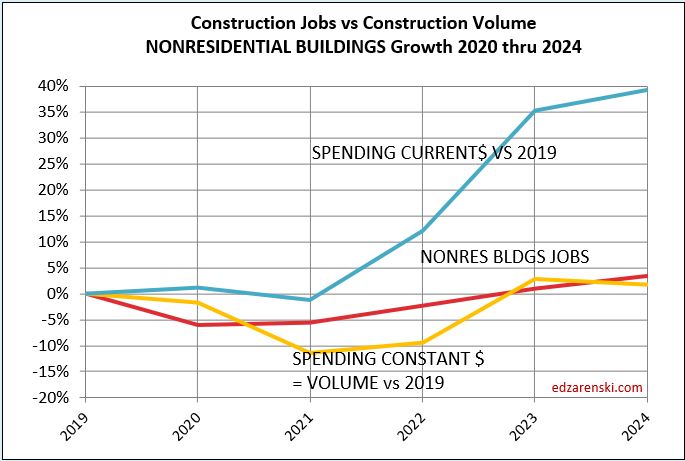

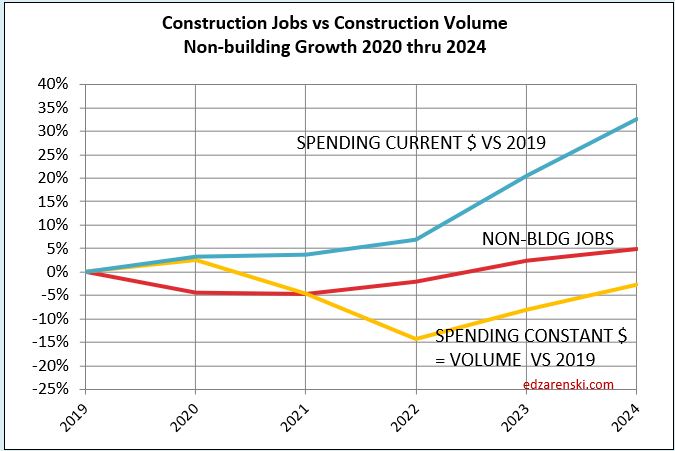

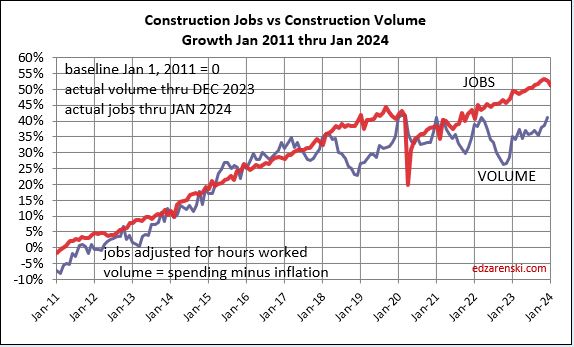

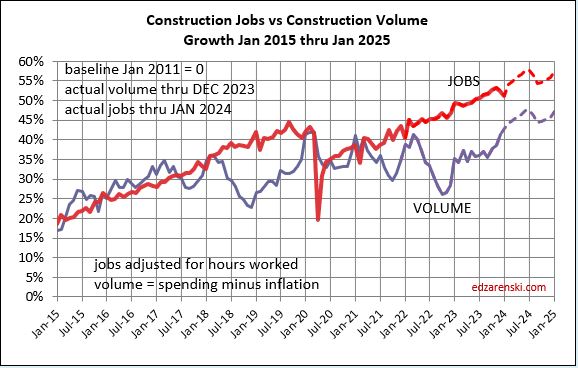

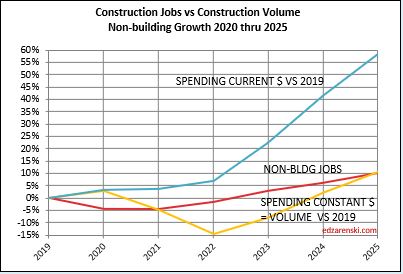

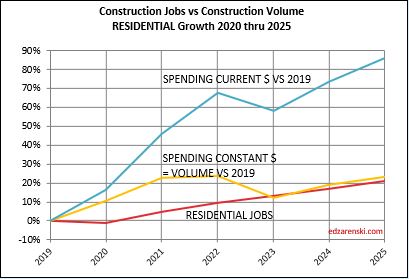

Plots below compare volume growth to jobs growth. Notice the slope of the increase in jobs is fairly constant, regardless of changes in volume growth.

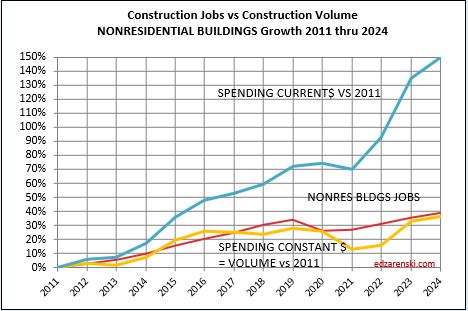

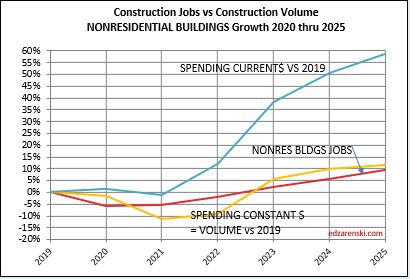

In the past 18 months, Nonresidential Buildings construction spending increased 37%. Nonres Bldgs JOBS increased only 7%. Normally, this would be explained by inflation, but in this case after adjusting for inflation volume still increased 28%. 18 months, +28% volume, +7% jobs.

Jobs and volume of work should be moving together, evenly. The construction industry has been saying jobs shortages, and yet over an 18mo period, the nonresidential bldgs sector added 20% more volume of work than added jobs. Seems to me that would indicate that volume was absorbed by existing jobs. If there were a significant jobs shortage, either the existing crew would need to work overtime, hours worked would have increased, or the work would not have been put-in-place and would potentially have been delayed or postponed. Neither happened. The fact that the work was put-in-place would indicate that the existing workforce readily absorbed the excess workload.

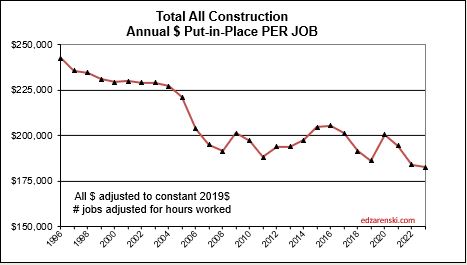

Since 2016, TOTAL construction spending has increased 63%, but after inflation, business volume increased only 6%, or 1%/yr. From 2016 to 2023, jobs increased 2.5%/yr. When jobs are increasing at a greater rate than the volume of work, productivity is declining. That is shown on these plots when the jobs line is above the volume of work line. Volume and jobs should be moving together.

In 2024, construction volume may increase 6%. Don’t expect jobs to increase 6%.

Since 1980, the fastest rates of growth in construction jobs were 1983-85 avg 6.0%/yr. and 1994-99 at 5.4%/yr. All other plus years averaged +3.2%, with only six years above 4%.

Since 2000, (excluding negative yrs, all associated with recessions) construction jobs growth is 3.3%/yr. and average real volume growth is 3.4%. I would expect future jobs growth to remain within the historical averages, somewhere in the 3%-5% range.

Construction Data FEB Briefs 4-3-24

Updates to Forecast, spending, starts, inflation, jobs

SEE ALSO Construction Analytics Outlook 2024

2024 construction spending will be measured to the avg of 2023, $1980 bil. The average Seasonally Adjusted Annual Rate (SAAR) for 2023 is the total spending for 2023. By Dec the SAAR was already 6% higher than the average for 2023. So we begin 2024 with Dec spending at a SAAR 6% above avg 2023.

As of Feb, the SAAR is 8.3% above 2023. Rsdn +6.1%, Nonres Bldgs +9.5%, Nonbldg +10.8%. If growth stalls here for the year, if we were to end the year with the SAAR unchanged from today, then we would finish with these gains for 2024. The trend in most cases is up, so I expect end of year we will be higher than today..

2024 construction spending, as of FEB, measured to the 2023 avg for Nonres Bldgs, is now +9.5% and trending up. The American Institute of Architects (AIA) Consensus for Nonres Bldgs averages +4%. Only one of the 10 forecasts for Nonres Bldgs spending in the AIA 2024 Consensus is still above the current reading.

The trend in Nonres Bldgs construction spending is up 17 of the last 18 months and continues up 9 of the 10 remaining months in 2024. To come close to most of the forecasts in the AIA, Nonres Bldgs spending for next 10 months of 2024 would need to decline drastically. To fall to the AIA Consensus average of +4% from the current SAAR, up +9.5%, all of the remaining 10 months of 2024 would need to fall from +9.5% to only +3% higher than 2023. Unless something sets off a recession, that will not happen.

Since 2019, spending is up 42%. But after inflation Volume is up only 5%. Almost 90% of the spending growth since 2019 is inflation.

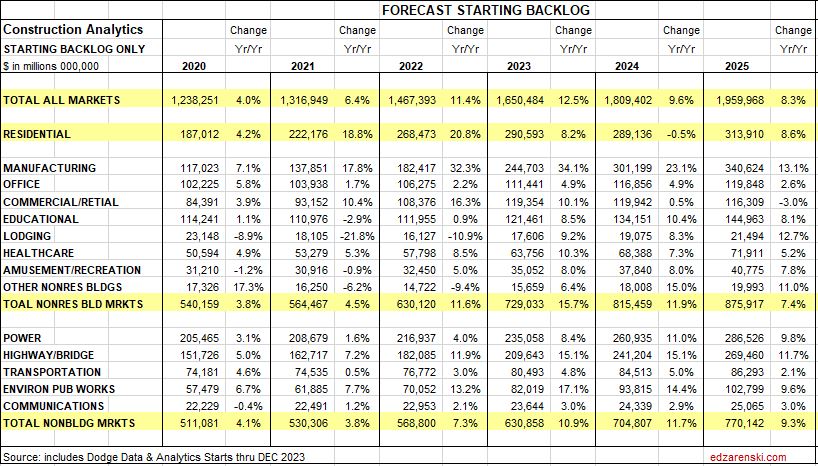

Construction Backlog, the amount of work under contract that is yet to be put-in-place, increased 9% to begin 2024. Nonres Bldgs and Nonbldg both increased over 11%. Although spending is at an all-time high, backlog increases if new starts exceed spending for the year. That could happen if spending decreased, but that is not the case here. It shouldn’t come as a surprise, but manufacturing construction backlog to begin 2024 is up 21%. Highway is up 15%. Environ Pub Works is up 14%.

Don’t try to correlate my Backlog calculation to the Associated Builders and Contractors (ABC) Backlog Indicator. They do not measure the same thing. ABC BI measures current backlog as a percent of previous fiscal year revenues, then multiplies that x12 to get what they refer to as the current remaining backlog months of support. I measure the backlog as the value under contract remaining to be completed at the start of this year compared to the backlog at the start of last year.

Neither of these give any indication of WHEN backlog gets spent. Backlog is never an indication of the amount of work to be completed in the given year. Some backlog gets spent over long duration projects that may go yet for several years.

An avg spending curve for long-duration Non-bldg Infra is 15:30:30:20:5. The greatest spending impact does not show up until year two and three. Example: If 2024 posts $100bil in new starts for Infrastructure, only $15bil of that gets put-in-place in 2024. $30bil would get put-in-place in 2025 and 2026.

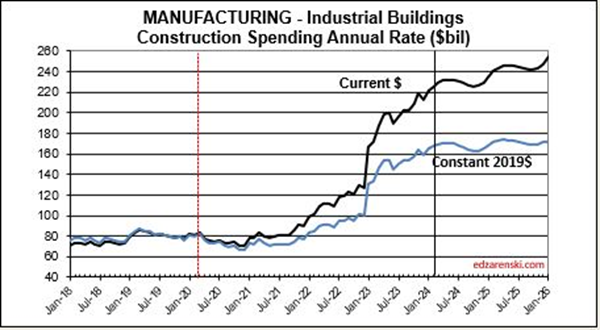

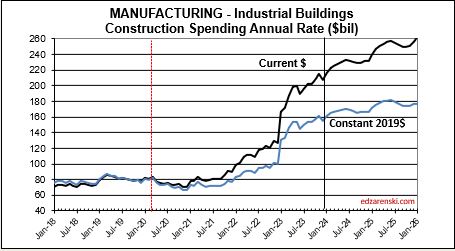

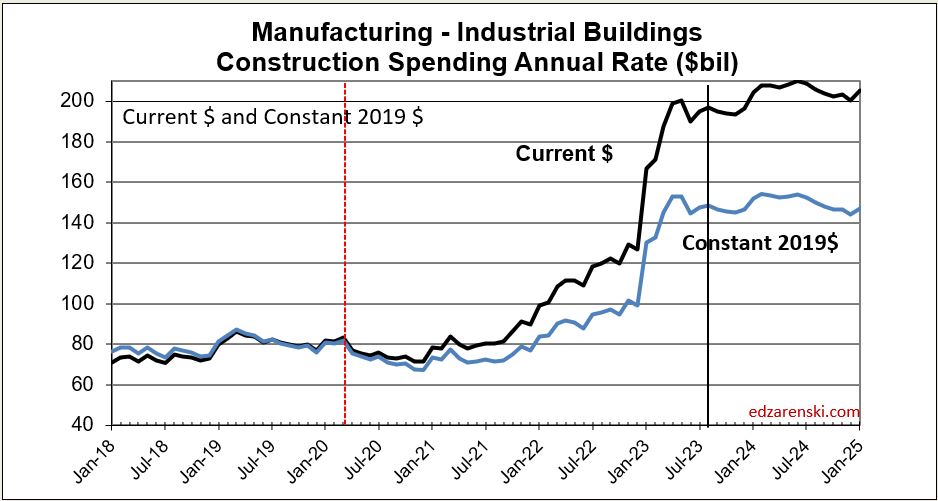

Manufacturing construction spending increased 80% in the last 18 months. After inflation volume increased 70%. Mnfg is 30% of all Nonres Bldgs spending, but generated 60% of the increase in Nonres Bldgs spending over the last 18 months.

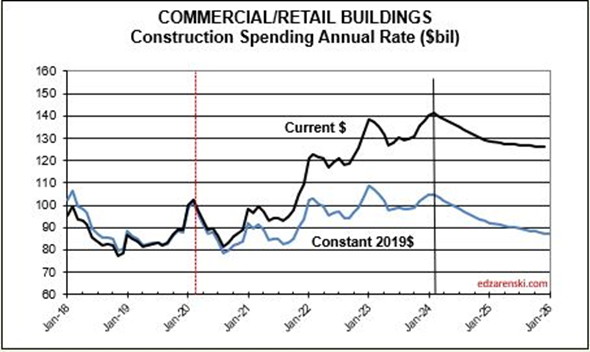

In my forecast, every major sector ticks up each of next 3mo. All markets tick up each of Feb-Mar-Apr, except for Commercial/Retail. Warehouse starts, which comprise 60% of Comm/Rtl, fell 20% in 2023 and are forecast down 10%+ in 2024.

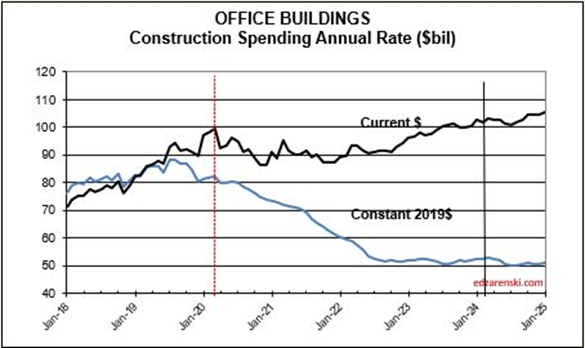

Looking at the Office Bldgs plot, keep in mind, the Office Bldg market includes Data Centers, where spending has increased.

In the past 18 months, Nonresidential Buildings construction spending increased 37%. Nonres Bldgs JOBS increased only 7%. Normally, this would be explained by inflation, but in this case after adjusting for inflation volume still increased 28%. 18 months, +28% volume, +7% jobs.

Jobs and volume of work should be moving together, evenly. The construction industry has been saying jobs shortages, and yet over an 18mo period, the nonresidential bldgs sector added 20% more volume of work than added jobs. Seems to me that would indicate that volume was absorbed by existing jobs.

In 2023 Nonresidential Building construction jobs increased 3.6%. In that same time Nonres Bldgs spending increased 24%. After inflation volume of business increased 17%. I wouldn’t be surprised if construction job openings remain elevated all through 2024.

Since 2016, construction spending has increased 63%, but after inflation, business volume increased only 1%/yr. From 2016 to 2023, jobs increased 2.5%/yr. Volume and jobs should be moving together.

In 2024, construction volume may increase 7%.

Construction Jobs increased every month since last Mar. In fact, there’s been only 2 down months in last 2 yrs. But in both Dec and Jan, avg hrs worked fell more than jobs added, so total hrs worked declined. Overall avg hrs worked for 2023 is up 4%. Volume is increasing.

Construction Analytics Outlook 2024

Construction Analytics Economic Outlook 2024 includes Construction Data – DEC 2023 Data 2-7-24

2-22-24 At the bottom of this article is a downloadable PDF of the complete 2024 Outlook

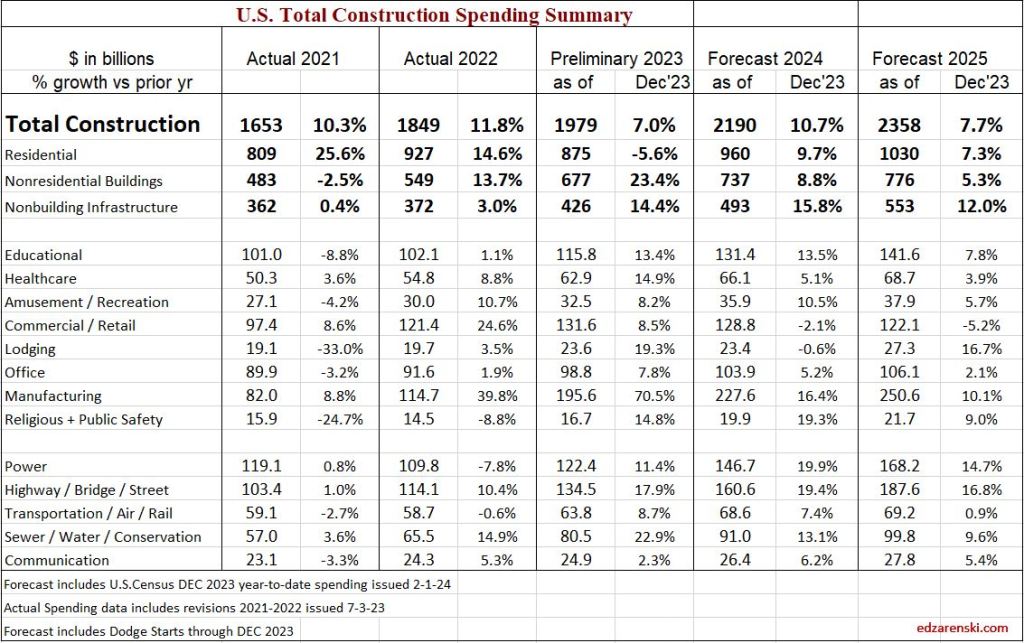

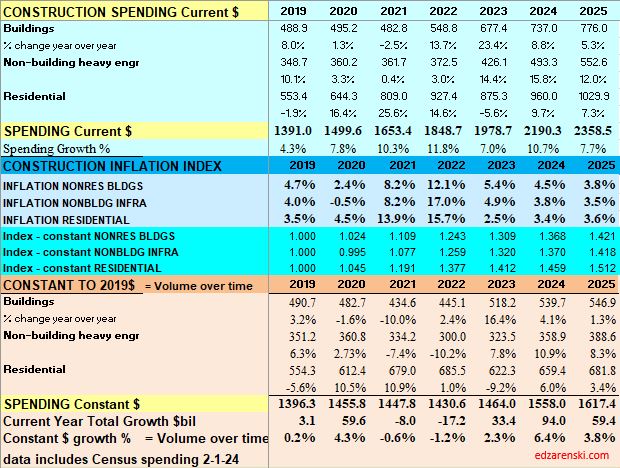

Here is a summary of construction spending through December 2023, Inflation through 4th qtr. or Nov where available, and resulting constant dollar volume. 2023 spending will be revised three times in 2024, Mar1, Apr1 and Jul1, and then again on Jul1 2025. Historically, almost all revisions are up.

Construction spending preliminary total for 2023 is up 7.0%. But nearly 80% of that total is inflation. Except for Nonresidential Bldgs, spending increased 23%, so inflation is only 25% of that. Even deducting inflation still leaves 75% of spending as volume growth Most of that growth is in Manufacturing buildings.

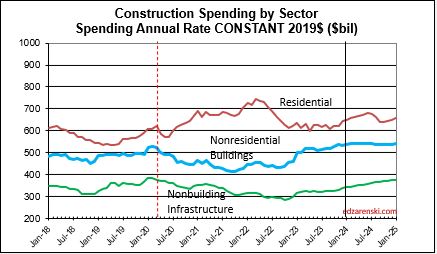

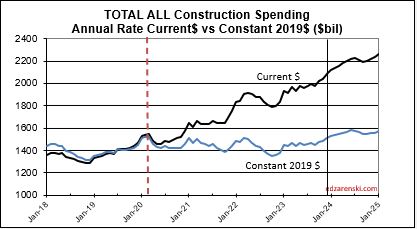

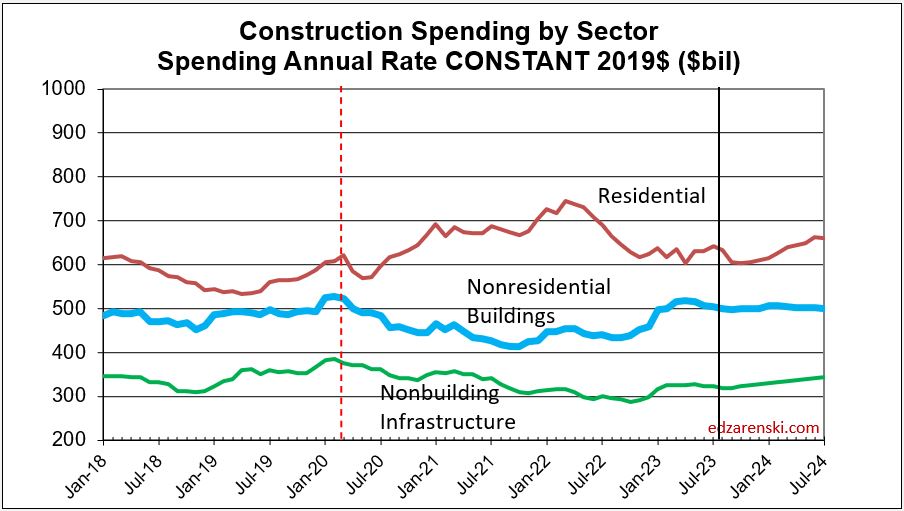

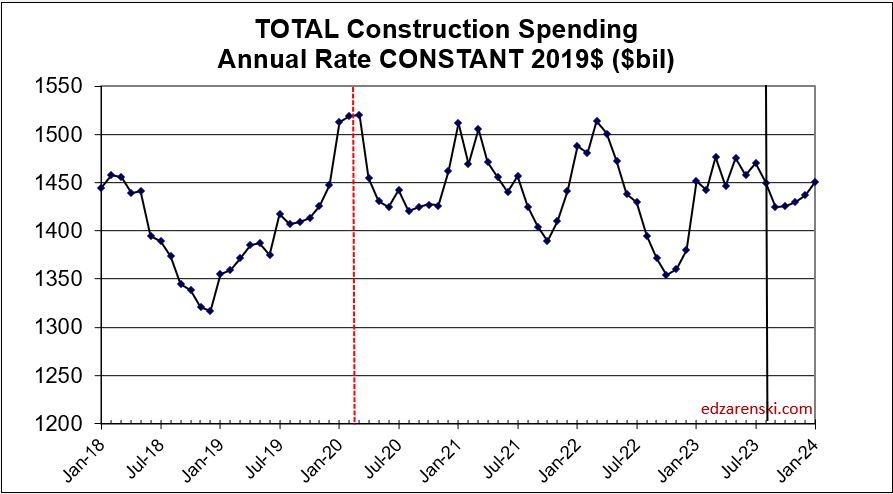

Spending is up a total of 42% since 2019; up 8% in 2020, 10% in 2021, 12% in 2022 and now 7% in 2023. But volume after adjusting for inflation is up only 5% total. You can see the Constant$ line, with one lower dip in 2022, has ranged between Constant$1400bil. to $1500bil. since mid-2019.

Construction spending total forecast for 2024 is up 10.7%. Nonresidential Buildings is forecast up 8.8%, Non-building Infrastructure up 15.8% and Residential up 9.7%. Lower inflation in 2024 means more of that spending is counting towards real volume growth. I’m expecting only 4% to 5% inflation for 2024, so real volume growth could reach 6% for the first time since 2015. From 2012-2016, volume growth averaged 6%/yr. For the last four years, 2020-2023, 42% spending growth vs 37% inflation growth netted only 5% total real volume growth. Since 2017, volume growth averaged less than 1%/yr. Non-building Infrastructure volume could increase 10%+ in 2024.

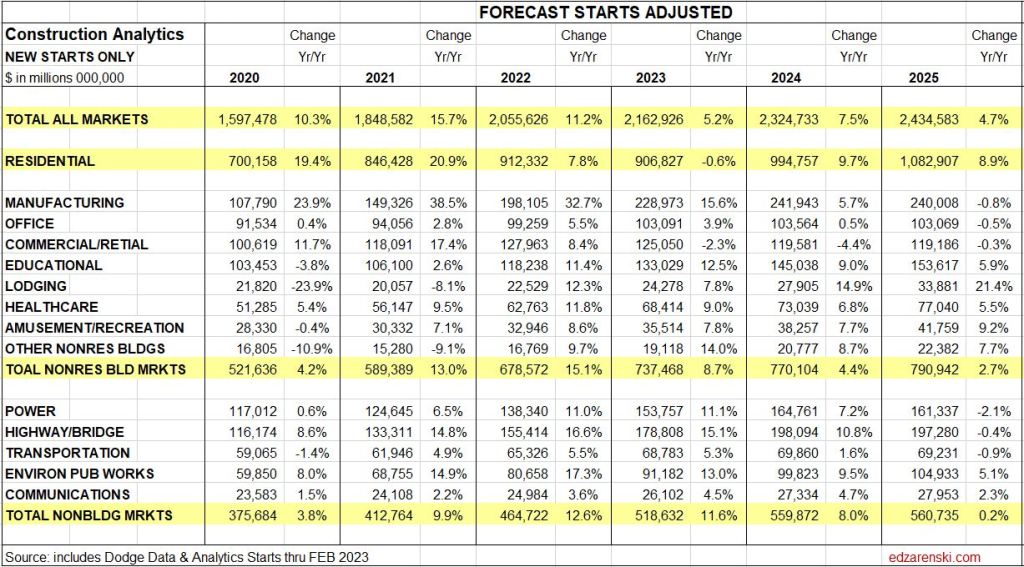

New Construction Starts

Dodge Construction Network (DNC) monthly news article of construction starts by sector provides the data from which the following is summarized.

Total construction starts for 2023 ended down 4%, but Nonresidential Buildings starts finished down 7% and Non-building Infrastructure starts were UP 16%. Residential starts decreased 12% in 2023.

Total construction starts for 2024 are forecast up 7%. Nonresidential Buildings starts are forecast up 5% and Non-building Infrastructure starts up 8%. Residential starts are forecast up 10% in 2024.

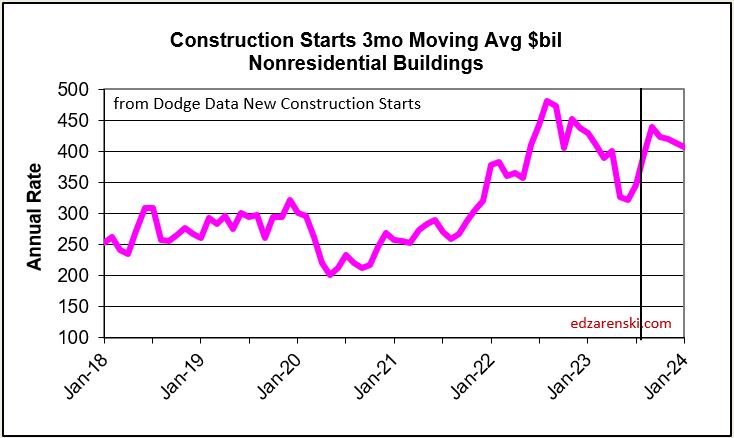

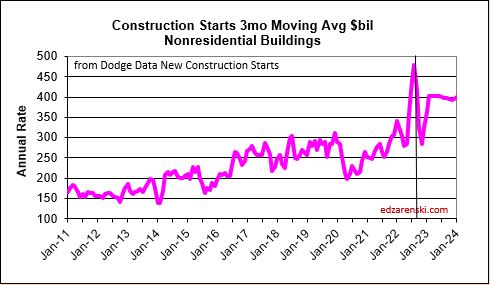

In recent years, Nonres Bldgs new starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged near $500 billion/year. For the 1st half 2023 starts dropped to a rate of $390bil./yr., which is still well above the recent average. Then, for 2nd half 2023, starts came back up to average $430 billion/year, the 2nd highest half year average. A 50% increase in new nonresidential building starts in 2022 has a positive impact on the rate of construction spending in 2023 and 2024. It will continue to add lesser impact into 2025. Projects starting in 2nd half of 2023 could have midpoint of construction, point of peak spending, in 2024 or into 2nd half of 2025, some real long duration starts even later. So, the major spending impact from starts is sometimes one or two years later.

Residential construction (Dodge) starts posted the five highest months ever, all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Q1 2023, residential starts dropped another 12% below 2nd half 2022, the lowest average since Q1-Q2 2020. Finally in July and August, starts regained some strength coming in 33% higher than the lows in Q1. Residential starts finish 2023 down 12% vs 2022. Forecast is up about 10% in 2024.

Nonresidential Buildings, in 2022 posted the largest ever one-year increase in construction starts, up 50%. Some of these starts will be adding to peak spending well into 2025. Nonres Bldgs starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history. Starts fell 20% in the 1st half 2023 but still posted the 2nd highest 6mo average ever. After two years of outstanding growth, Nonres Bldgs starts close 2023 down 7%. Although 2023 is down 7%, that’s still by far the 2nd best year ever. The forecast for 2024 is +5%.

Manufacturing starts, the market with the largest movement, gained 120% from 2020 to 2023. Manufacturing projects can have a moderately long average duration because some of these are multi-billion$ projects and can have schedules that are 4 to 5 years.

Educational, Healthcare, Lodging and Public Buildings all had starts of 20% or more the last two years.

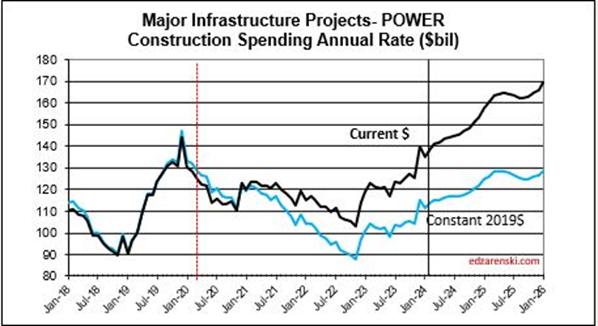

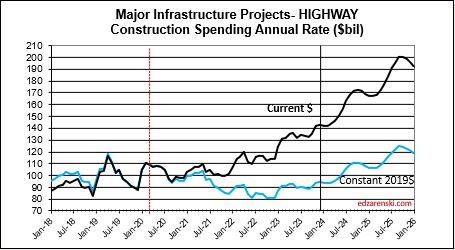

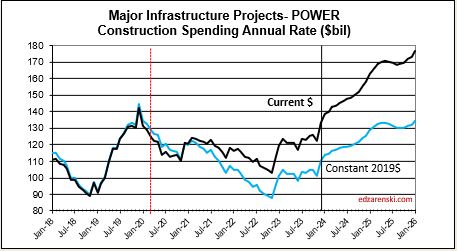

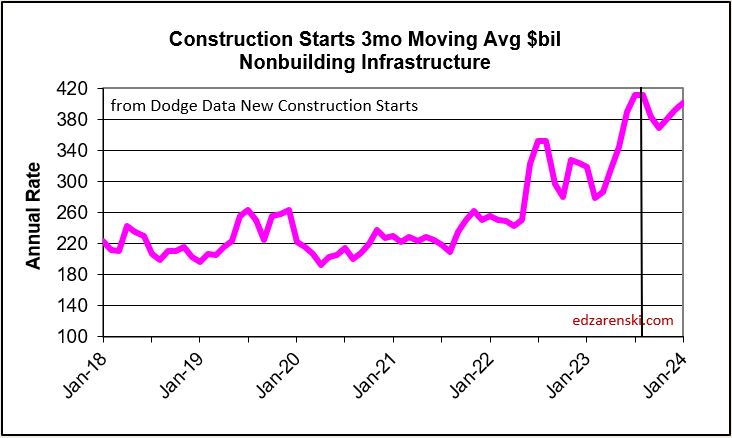

Non-building starts for the 6 month period Mar-Aug 2023 posted the best 6 months on record, up 30% from the average of 2022. The 2nd half 2022 was up 50% over 1st half 2022. For 2023, Highway/Bridge and Power have the strongest gains. Total Non-building Starts for 2023 are up 16% and they were up 25% in 2022. These starts will help elevate spending through 2025. Non-building starts for 2024 are forecast up 8%.

Power starts are up 25% the last two years. Highway starts and Environmental Public Works are both up 33% the last two years and up 50% the last three years.

Starts data captures a share of the total market or only a portion of all construction spending, on average about 60% of all construction. The easiest way to understand this is to compare total annual construction starts to total annual spending. National starts in recent years about $800 billion/year, while spending in this period ranges from $1,300 billion/year to $1,500 billion/year. From this simple comparison we can see starts captures a share of about 60% of the total market. The actual share for each market varies from as low as 35% to as high as 70%. Before using starts data to forecast spending, starts here were first adjusted for market share.

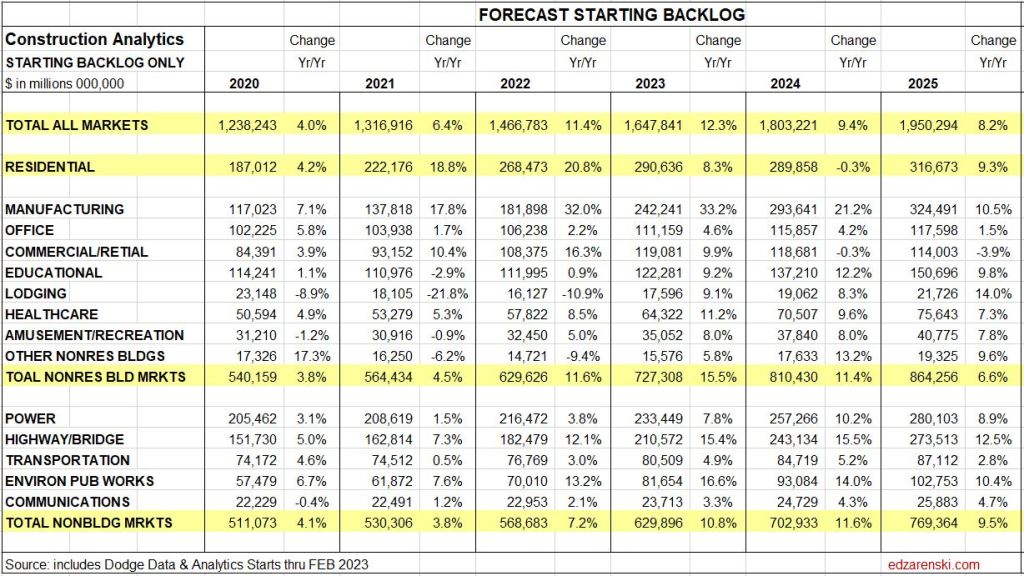

Starting Backlog

Starting backlog is the estimate to complete (in this analysis taken at Jan 1) for all projects currently under contract. The last time starting backlog decreased was 2011. If new construction starts in the year are greater than construction spending in the year, then for the following year starting backlog increases. It’s when new starts don’t replenish the amount of spending in the year that backlog declines.

80% of all nonresidential spending in any given year is from backlog and could be supported by projects that started last year or 2 to 4 years ago. Residential spending is far more dependent on new starts than backlog. Only about 30% of residential spending comes from backlog and 70% from new starts.

The table below, Forecast Starting Backlog, is model generated by Construction Analytics. Adjusted starts are spread over time to generate cash flow. A sum of spending each month/year, subtracted from start of year plus new starts provides Backlog.

Construction Backlog leading into 2024, in every sector, is at all-time high, in total up 46% from Jan 2020. For the years 2022 and 2023, backlog is up 11% and 12%. Reaching new highs in Backlog could mean contractors are comfortable adding some backlog, or it could mean not enough labor, subcontractors or suppliers to support advancing growth so quickly, so growth advances slower and more of the work is retained in backlog for longer, essentially dragging out the timeline, or it could be long term workload, 4yr.-6yr. long projects from new starts, such as Manufacturing, where a very large amount enters backlog and gets spent over 4-6yrs., so, although the monthly drawdowns reduce the amount remaining in backlog, it remains in backlog for a long time.

Residential backlog in 2024 is down 0.5%, but from such a previous high, essentially, starts are riding flat along the top. Starts are up 55% since Jan 2020.

Nonresidential Bldgs starting backlog for 2024 received a boost from all the starts in 2022 and 2023. Backlog is up 12% from 2023 and up 50% from Jan 2020.

Nonbuilding Infrastructure starting backlog is up 12% each of the last two years boosted by strong starts in 2022 and 2023. For 2024, backlog is up 40% from Jan 2020.

Manufacturing backlog increased nearly 300% from 2020-2024, from $117bil going into 2020 to $300bil beginning 2024. No other market has ever been close. Manufacturing was responsible for 60% of all the Nonres Bldgs spending growth in 2023. It was also responsible for 60% of the Backlog growth leading into 2024. Nonres Bldgs has a total 3.6 million jobs and has never increased by more than 150,000 jobs in one year. Manufacturing is 30% of all Nonres Bldgs spending, so assume 30% of Nonres Bldgs jobs. That’s 1.2million jobs supporting just Manufacturing projects. So Backlog of $300bil, at 5000 jobs per billion per year, would need 1,500,000 jobs for a year. With a 1,200,000 jobs share of the workforce, that backlog would provide support for 15 months. Of course, new starts add to support throughout the year, but the calculation of how long backlog would support that market segment is valuable.

Backlog at the beginning of the year or new starts within the year does not give an indication of what direction spending will take within the year. Backlog is increasing if new starts during the year is greater than spending during the year. An increase in backlog could immediately increase the level of monthly spending activity, or it could maintain a level rate of market activity, but spread over a longer duration. In this case, there is some of both in the forecast. It takes several years for all the starts in a year to be completed. Cash flow shows the spending over time.

Current Rate of Spending

The current seasonally adjusted annual rate (SAAR) of spending gives an indication of how spending will perform in the following year. As we begin 2024, the current rate of spending (SAAR) for Nonresidential Buildings in Q4’23 is $709bil., already 4.5% higher than the average for 2023 ($677bil). If spending stays at the current level and no additional growth occurs, Nonresidential Bldgs spending will finish 2024 up 4.5%. Spending would need to have more monthly declines than increases to finish the year up less than 4.5%. The current forecast shows a monthly SAAR rate of growth for Nonresidential Bldgs. averaging about 0.5%/mo in 2024, so we have a minimum, but we can expect 2024 total spending to rise considerably higher than the current rate.

Non-building Infrastructure current rate of spending is now 3.7% higher than the average for 2023, however the forecast is indicating steady growth of 1%/mo for all of 2024.

Residential current rate of spending is 2.4% above the 2023 average and is forecast to average an increase of just under 1%/mo for 2024.

2024 Construction Spending Forecast

Starts lead to spending, but that spending is spread out over time. Starts represent a contract award. Spending takes the amount of that contract award and spreads it out by a cash flow curve over the duration of the job. An average spending curve for the sum of nonresidential buildings is 20:50:30 over three years. Only about 20% of new starts gets spent in the year started. 50% gets spent in the next year and 30% in YR3/4. An average spending curve for Non-building Infrastructure is more like 15:30:30:20:5. The effect of new starts does not show up in spending immediately. For example: If 2024 posts an additional $100 billion in new starts for Infrastructure, only about $15 billion of that would get put-in-place in 2024. The cash flow schedule for that $100 bil of new starts would extend out over 3 to 5 years. Most of that $100 bil would get spent in 2025 and 2026.

Total Construction Spending $2,190 billion +10.7% over 2023.

Nonresidential Buildings $737 billion +8.8% over 2023.

Non-building Infrastructure $493 billion +15.8% over 2023.

Residential Buildings $960 billion +9.7% over 2023.

This forecast does not include a recession.

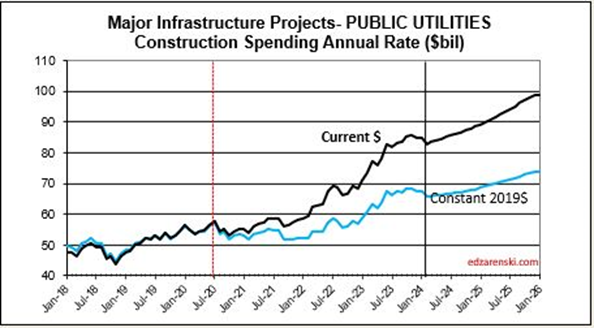

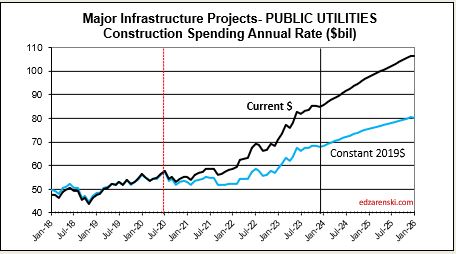

The largest increases to construction spending in 2023 are Manufacturing +$80bil, Highway +$20bil, Public Utilities (Sewage and Waste, Water Supply and Conservation-Rivers-Dams) +$15bil and Educational +$14bil.

Residential regains the top growth spot in 2024 with a forecast spending increase of +$68bil. Manufacturing is forecast to add +$32bil. Highway gains +$26bil, Power +$24bil and Educational gains +$15bil.

One big question is how did the forecast for Manufacturing increase so much since the beginning of 2023. Since January 2023, the starts forecast for 2023 increased by 35%. How much of that 35% is real growth in starts vs an increase in the capture rate of data gathering is yet to be determined, but has an impact of 2023-2024 spending. Also, starts for future years were increased by 50%. Starts (contract awards) drives up the spending forecast, since spending is a function of the future monthly cash flow (spending) of starts.

As we begin the year, Manufacturing SAAR current rate of spending is already 8% higher than the average for 2023. The current rate of spending is increasing at an average of near 2%/month for the next 6 months, then slows or dips slightly for the remainder of the year, indicating total spending for 2024 will finish well above the current rate of 8%. I’m forecasting 16% growth for the year.

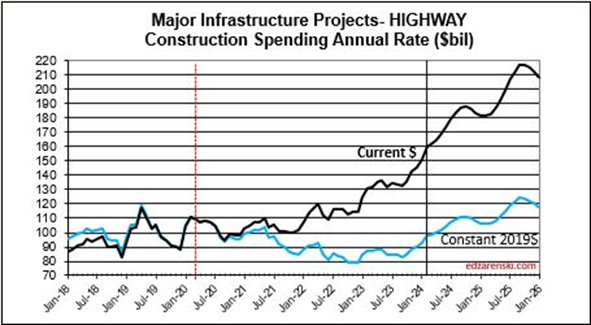

Highway SAAR rate of spending begins the year 6.5% higher than the average for 2023, with the current rate increasing at an average of 1%/month for all of 2024, indicating total spending for 2024 will finish well above the current rate of 6.5%. Starts have increased +15%/yr the last three years. My forecast is for 19% growth in 2024 spending.

Power SAAR rate of spending begins the year 4% higher than the average for 2023, with the current rate increasing at an average over 1%/month for 2024, indicating total spending for 2024 will finish much higher. My forecast is for 20% growth in 2024.

Public Utilities SAAR rate of spending begins the year 6% higher than the average for 2023, with the current rate increasing at an average over 1%/month for 2024. Public Works averaged +15%/yr new starts the last three years. My forecast is for 13% spending growth in 2024.

Residential regains the top spot in 2024 with a forecast spending increase of $68bil. Residential SAAR rate of spending in Q4’23 was up 2.5% over 2023, but December was up 5%. So we begin the year 2.5% to 5% higher than the average for 2023. The rate of spending is forecast to increase 1%/month for 6 months, then fall 0.5%/mo for H2 2024. My forecast is for 10% growth in 2024.

Educational SAAR rate of spending begins 2024 7% higher than the average for 2023, and the current rate is increasing at an average of 0.7%/month for 2024. My forecast is for 13% growth.

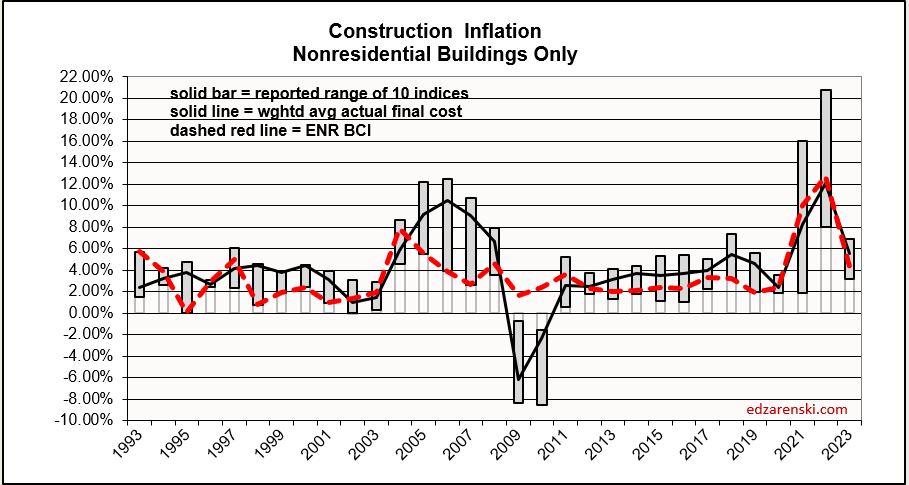

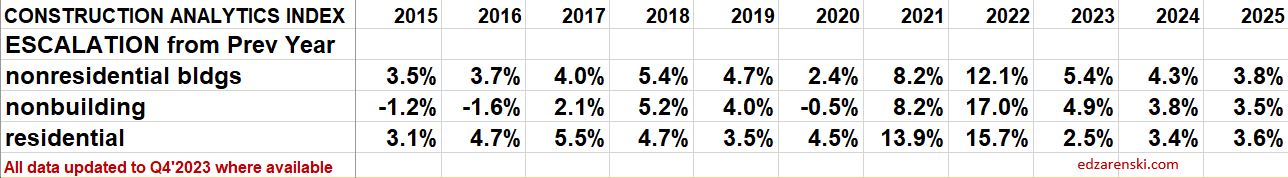

Inflation

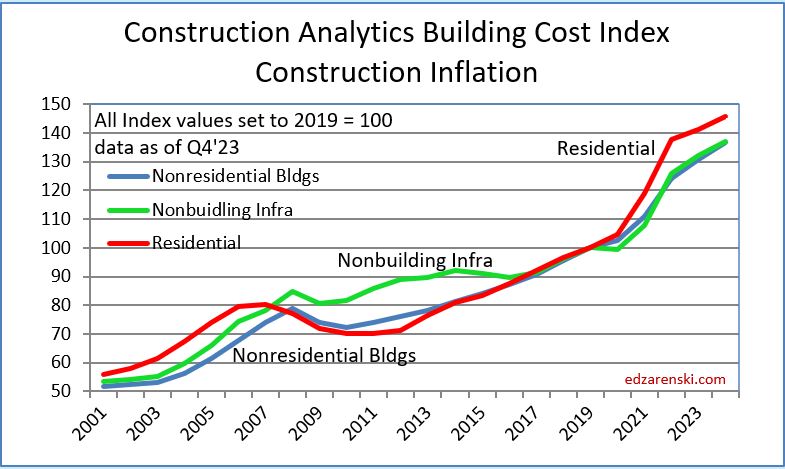

Construction Inflation differs from other common types of inflation, i.e., Consumer Price Index. It must be accounted for in order to make reasonable calculations for business volume and past or future costs.

30-year average inflation rate for residential and nonresidential buildings is 3.7%. Excluding deflation in recession years 2008-2010, for nonresidential buildings is 4.2% and for residential is 4.6%.

Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume dropped 33% and jobs fell 30%. During two years of the pandemic recession, volume reached a low down 8% and jobs dropped a total 14%.But we gained back far more jobs than volume. That means it now takes more jobs to put-in-pace volume of work. That increases inflation.

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

Final cost indices represent total actual cost to the owner and are generally higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost. The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

This short table shows the inflation rate for each year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years. The plot below shows the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

Typically, when work volume decreases, the bidding environment gets more competitive. We can always expect some margin decline when there are fewer nonresidential projects to bid on, which typically results in sharper pencils. However, when labor or materials shortages develop or productivity declines, that causes inflation to increase. We can also expect cost increases due to project time extensions or potential overtime to meet a fixed end-date.

Current$ Spending, Inflation, Constant$ Volume

Volume = spending minus inflation. Spending includes inflation. Inflation adds nothing to the volume.

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. Spending is current to the year stated. The values in the constant table are indexed to a constant value year, 2019. This shows business volume year to year, can be a lot different than spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Lower inflation in 2024 means more of that spending is counting towards real volume growth. Expecting only 4% to 5% inflation for 2024, real volume growth could reach 6% for the first time since 2015. From 2012-2016, volume growth averaged 6%/yr. For the last four years, 2020-2023, 42% spending growth vs 37% inflation growth netted only 5% total real volume growth. Since 2017, volume growth averaged less than 1%/yr. Non-building Infrastructure volume could increase 10%+ in 2024.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. Revenue does not measure volume growth. In 2022, Nonresidential buildings inflation was 12%, so business volume was 12% less than spending, or 12% less than revenue. Residential volume was 15% less then spending.

When referencing Constant $ growth, remember the dollars for all years are reported here as 2019$. If the baseline year is changed to this year (divide all indices by this year’s index), the resulting comparison would be all years reported as 2024$. The dollars would all be greater, but the percent change would be the same. In this table, nominal spending is divided by the inflation INDEX for the year. You can also deduct the percent inflation from any individual year of spending to find inflation adjusted $ for that year alone, however that method would not allow comparing the adjusted dollars to any other year. A baseline year is necessary to compare dollars from any year to any other year.

Reference Inflation Data Construction Inflation 2024

Through December 2023, Total Construction Spending is up 40% for the four years 2020-2023, but, during that same period inflation increased 35%. After adjusting for 35% inflation, constant $ volume is up only 5%. So, while the current $ spending plot shows a four-year total increase of 40% in spending, the actual change in business volume is up only 5% and has just in the last few months returned to the pre-pandemic peak in Feb-Mar 2020.

Jobs are supported by growth in construction volume, spending minus inflation. If volume is declining, there is no support to increase jobs. Although total volume for 2023 is up 2.3%, Residential volume is down 9%, Nonresidential Bldgs volume is up 16% and Non-building volume is up 8%. Inflation was so high in 2021 and 2022 that it ate away most of the spending gains in those years.

Jobs vs Volume

Construction Jobs increased 2.75% in 2023. We added 214,000 jobs (avg’23-avg’22). There are currently 8,056,000 construction jobs. The largest annual increase post 2010 is 321,000 jobs (+4.6%) in 2018. The average jobs growth post 2010 is 200,000 jobs per year.

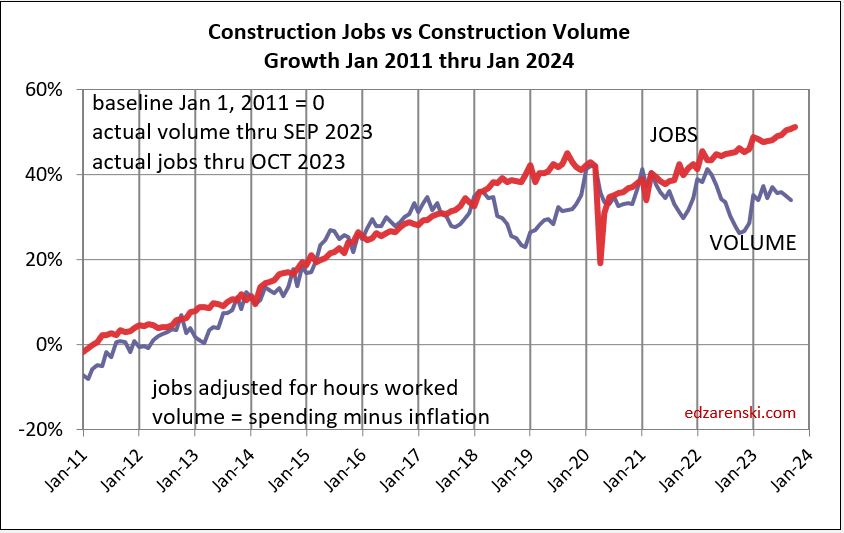

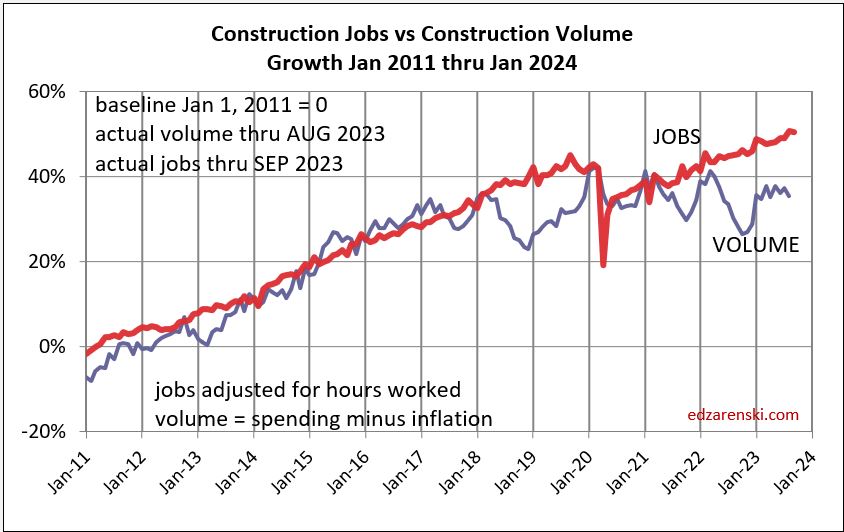

Since 2010, average jobs growth is 3%/yr. Average volume of work growth since 2010 is 2.3%/yr. This plot shows Jobs and Volume growth closely match from 2011 to 2018. With few exceptions for recession periods, this pattern can be seen throughout the historical data.

What’s remarkable about the growth is this, since 2016, spending has increased 63%, volume after inflation increased 6% and jobs increased 19%. In the last 7 years, 2017-2023, jobs increased 2.5%/yr. Volume of work increased only 0.8%/yr. Volume and jobs should be moving together.

It takes about 5000 jobs to put-in-place $1 billion of volume in one year. It could easily vary from 4000 to 6000. So, an add of $100 billion+ in one year would need 500,000 new jobs. Jobs should track volume, not spending growth. Volume = spending minus inflation.

Normal construction jobs growth is about 250,000 jobs per year and maximum prior growth is about 400,000. From the table above, Nonresidential Bldgs and Non-building Infrastructure added $100bil of volume in 2023 and will add $60bil in 2024. The workload discussed above would theoretically require 500,000 new jobs in 2023 and 300,000 more in 2024. That’s an expansion of the industry workforce by 10% in two years, for just half the industry, in an industry that normally grows in total 3%/yr. This industry can’t grow that fast. This may have some impact if over-capacity growth results in a potential reduction or extension in future forecast. You can’t increase spending that fast if you can’t also expand the labor force and the suppliers to the industry that fast.

In the last 12 months, Dec’22 to Dec’23, Nonres Bldgs jobs are up 4%. Nonres Bldgs spending is up 23%, by far driven by Manufacturing, but after ~5.4% inflation, volume of nonres bldgs workload is up 16%. So, we have a 4% increase in jobs versus a 16% increase in volume.

The last year has shown a huge increase in the volume of nonres bldgs work, without an equal increase in jobs. Is this excess nonres bldgs jobs for the past three years now absorbing added workload, (a 4% increase in jobs but a 16% increase in volume), without collapsing the labor force or canceling the volume?

Non-building, over the next two years, could experience the same kind of growth spurt as Nonres Bldgs., a forecast increase in volume the next two years without an equal increase in jobs. Volume which was lower than jobs since 2021, is now increasing faster than jobs. Non-bldg volume is forecast up 6% to

8%/year the next 3 years. Jobs increase at an avg. 3.5%/year.

Residential volume has exceeded residential jobs all the way back to 2011. The recent decline in volume brings the two even, if the jobs hold the pace.

For as long as I can remember, the construction industry has been complaining of jobs shortages. And yet, as shown in the data mentioned above, jobs have increased multiples times greater than volume of work. With an exception for recession years, (2007-2010 and 2020), jobs increase at a rate of 2.5% to 3% per year. The greatest disparity between jobs and volume occurred in late 2022, when jobs growth had already resumed normal pace, but volume of work was still reeling from the effects of new construction starts that were canceled dating back to late 2020-early 2021. Recent volume growth at a much faster rate than jobs growth is now closing the gap.

When jobs increase without an equal increase in the volume of work, productivity declines. This recent increase in volume and the projected increase in volume in 2024, several points stronger than jobs, will offset some of the disparity which has been negative for a long time.

Reference Inflation Data Construction Inflation 2024

Reference Article The Next Forecast Challenge

Reference Article Midyear ’23 Jobs Outlook

Reference Article Reliability of Predicted Forecast

Reference Link to Web Dodge Construction News

Below is a downloadable 24 page PDF of the complete 2024 Outlook

Construction Data Briefs Sept data 11-7-23

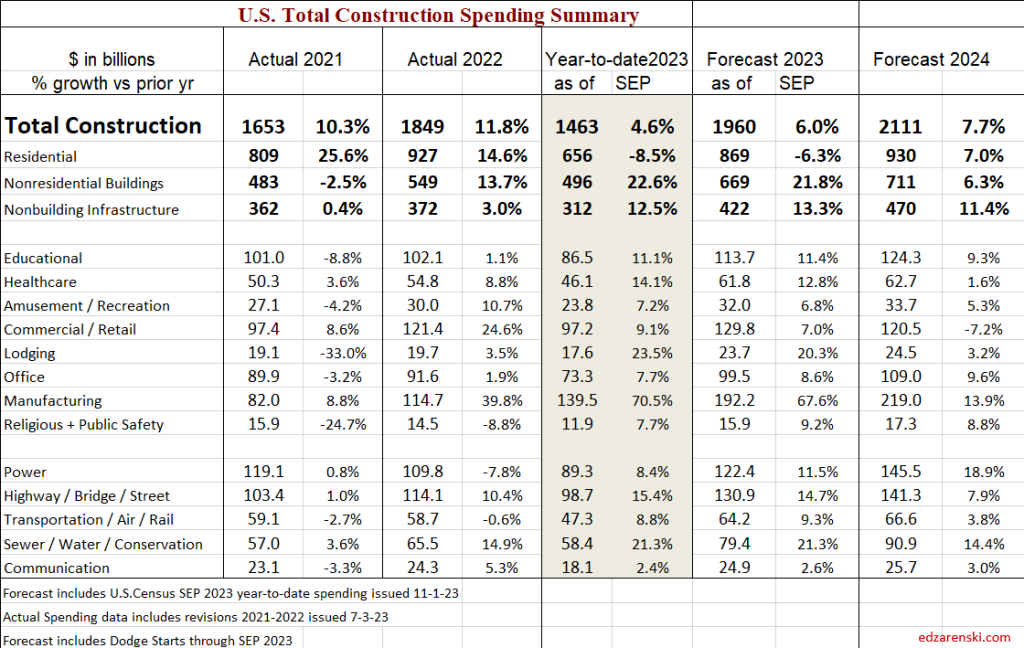

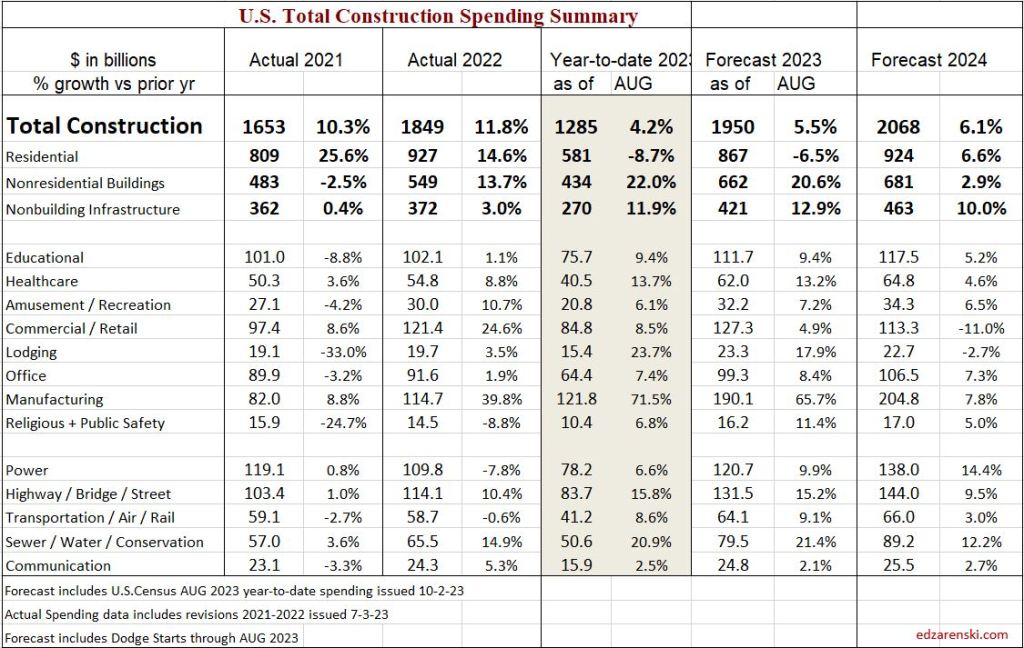

Total Construction Spending in 2023 is forecast at $1,960 billion, an increase of 6.0% over 2022.

Nonresidential Buildings spending is leading Construction spending growth.

With nine months in the year-to-date (ytd) for 2023, total all construction spending ytd is up 4.6%. Nonresidential buildings spending is up 22% ytd compared to Jan-Sep 2022. Manufacturing last month was up 72% ytd. I forecast then it would drop to 66% and this month revised that to 67%. Current ytd dropped this month to 70%.

Construction Spending thru Sept. Residential is down 8% ytd. Could add 7% in 2024. Nonresidential Bldgs is up 22% ytd. Expect +6% in 2024 Non-building Infrastr is up 12% ytd and could add another 11% in 2024

Residential construction spending fell only 8% from Mar’20, the pre-recession high, to May’20, the Covid low. From May’20 to May’22, spending increased 67% to the post-recession high. Since May’22 spending is down 12%.

Manufacturing construction spending, from 2015-2021, averaged $80bil/yr. For 2023-2025, manufacturing constr spending will average $200bil/yr.

Highway spending in 2023 is averaging $130bil and is expected to finish the year at $131bil. That’s up 15% from 2022 and up almost 27% in the last two years. Highway spending is expected to increase 25% over the next two years and may continue upward to a peak spending in 2026.

After nearly 8-10 years of fairly well balanced construction volume of work vs jobs, the last 2-4 yrs of volume growth (spending minus inflation) well below jobs, is now coming back into balance. Nonres Bldgs and Non-bldg volume (+11% & +6%) increased to support jobs. Jobs grow steady at 2.8%.

Non-bldg has a ways to go to get to balance. That work volume is on it’s way in the forecast, particularly from Highway and Public Utilities.

Actual residential jobs is probably higher than shown here as there are several issues with capturing all residential jobs.

Sum of all jobs vs Construction volume from 2011-2018 was balanced. In recent years, 2021-2023, jobs grew faster than volume. Nonres is now playing catch-up, volume is increasing faster than jobs..

Construction Jobs x hours worked is up 6% since the pre-pandemic high in Q1 2020. Construction volume (spending minus inflation) is down 5.5% since Q1 2020. These two indicators should move in tandem. (See plot above from Jan2011 to Jan2018) When jobs increase faster than the volume of work, productivity is declining.

For 2024 and 2025, volume of work is forecast to increase 3.5% and 4.0%. Most of that gain in 2024 and 2025 is from Non-building Infrastructure forecast growth of 7% and 8%. Jobs increase at a normal rate of 2.5% to 3.0% per year, so this growth in volume will go a long way towards setting jobs vs volume closer to balance.

An indicator I track looks at the predicted final spending (for Nonresidential buildings) for the year based on a projection based on the ytd for the statistically strongest months of the year, AMJJAS. These six months each average annual spending variation from average with standard deviation of less than 0.2%. This subset of annual data has produced an annual forecast within less than 2% variance from actual for 22 years. In fact, in 22 years this forecasting check has varied from actual by greater than 1.5% only twice. The average variation for 22 years is 0.7%. Only once in 22 years has the actual annual spending fell outside the range predicted by the statistically strongest months.

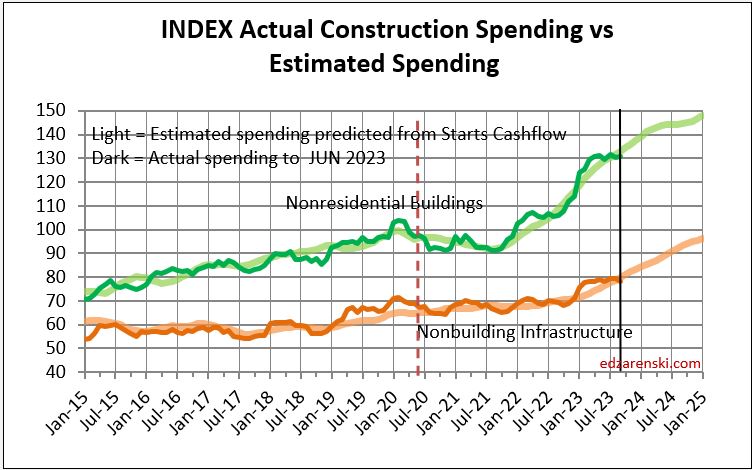

Another indicator I track is the forecast vs the actual spending. This plot shows Nonres Bldgs and Non-bldg Infra forecast vs actual. The track of actual spending is bumpier, but tracks right along with the forecast. My plot for residential was on track until the surge in 2020-2021.

Construction Data Briefs AUG Data 10-6-2023

Total Construction Spending in 2023 is forecast at $1,950 billion, an increase of 5.5% over 2022.

Nonresidential Buildings spending is leading Construction spending growth. With eight months in the year-to-date (ytd) for 2023, total all construction spending ytd is up 4.2%. Nonresidential buildings spending is up 22% ytd compared to Jan-Aug 2022, the fastest rate of nonres bldgs growth in over 30 years. Only 2006 & 2007 come close at 13% & 19% growth years. Commercial/Retail spending peaked in January 2023 and has dropped every month since. It will drop from a ytd of 8.5% down to a yearly total of 5%. Manufacturing is up 74% ytd and will hold on to finish the year up 66%.

Nonbuilding spending ytd is up 12%. The largest advances are in Highway, up 16% ytd, and Public Utilities. Sewage/Waste Water is up 24% ytd, Water Supply is up 15% ytd and Conservation/Rivers/Dams is up 26% ytd .

Residential Spending ytd compared to Jan-Aug 2022 is still down -8.7%. Residential spending peaked in Mar 2022 and had a recent bottom in Apr 2023. Since April, the annual rate of residential spending is up 5.6%, almost entirely due to an 8% increase in the largest segment, single family spending, 45% of all residential spending. Multifamily spending is is up 6%, but it’s only 15% of residential spending.

Spending Forecast

Total Construction Spending in 2023 is forecast at $1,950 billion, an increase of 5.5% over 2022.

Nonresidential Buildings spending is forecast at $662 billion, an increase of 20.6% over 2022.

Non-building Infrastructure spending is forecast at $421 billion, an increase of 12.9% over 2022.

Residential Buildings spending is forecast at $867 billion, a decline of -6.5% less than 2022.

This forecast does not include a recession.

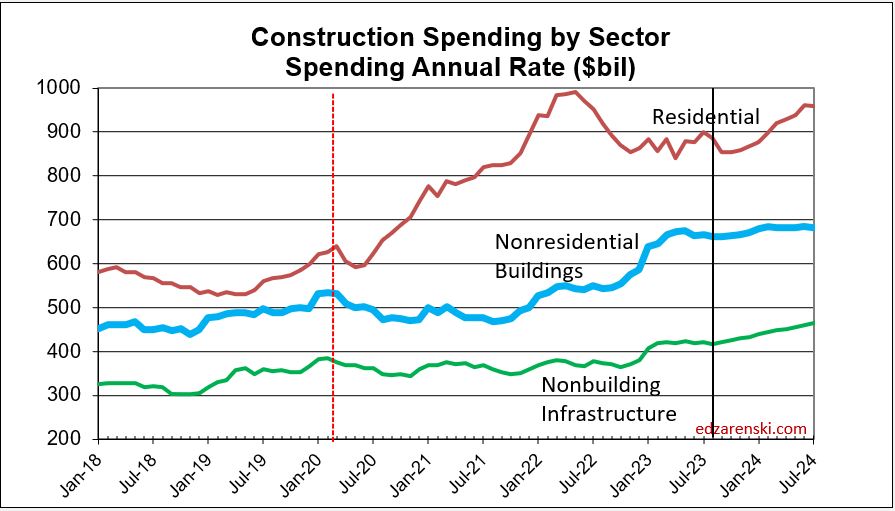

Spending by Sector Current $ and Inflation Adjusted Constant $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Non-building Infrastructure leading spending growth. Both are expected to post spending growth greater than the inflation index, so there will be real volume growth. In 2020+2021, residential volume grew 10%/yr. For 2023, residential volume drops 10%. Nonresidential Bldgs will post a 13% increase in volume in 2023 and flatten out at that level through 2024. Non-building volume increases 6% to 7%/yr for the next few years.

New Construction Starts

The rate of construction spending in 2023 will be influenced predominantly by a 50% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged near $500 billion/year. From Mar-Aug 2023 starts averaged $400 billion/year. Many of those projects will have peak spending in 2023 or 2024.

Residential construction (Dodge) starts posted the five highest months ever, all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Q1 2023, residential starts dropped another 12% below 2nd half 2022. Finally in July and August, starts regained some strength coming in 33% higher than the lows in Q1. Residential starts are still down 17% year-to-date vs 2022.

Nonresidential Buildings, in 2022 posted the largest ever one-year increase in construction starts, up 50%. Nonres Bldgs starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history. Starts fell 20% in the 1st half 2023 but still posted the 2nd highest 6mo average ever. Nonres Bldgs starts are down 17% ytd.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%.

Non-building starts for the 6 month period Mar-Aug 2023 posted the best 6 months on record, up 30% from the average of 2022. The 2nd half 2022 was up 50% over 1st half 2022. The 6 months Mar-Aug 2023 is up 18% from 2nd half 2022. For 2023, Highway/Bridge and Power have the strongest gains. Total Non-building Starts for 2023 are forecast up 25%. Non-bldg starts are up 22% ytd.

Current $ Spending, Inflation and Constant $ Volume

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. Spending is current to the year stated. The values in the constant table are indexed to a constant value year, 2019. This shows business volume year to year, can be a lot different than spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

SEE Construction Inflation 2023

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. Therefore, Revenue does not measure volume growth. In 2022, Nonresidential buildings inflation was 12%, so business volume was 12% less than spending, or 12% less than revenue. Residential volume was 15% less then spending.

Through August 2023, Overall Construction Spending is up 28% in the 42 months since the onset of the pandemic, but, during that same period inflation increased 33%. After adjusting for 33% inflation, constant $ volume is down 5%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

Does Volume of Work Support Jobs Growth?

or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a second deeper low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019, but it is improving because volume is increasing rapidly and jobs are increasing slowly.

Nonresidential Buildings spending in 2023 is forecast at $660 billion, an increase of 20.6%, or an increase of $113 billion in 2023. Non-building Infrastructure spending is forecast up 13% ($50bil) in 2023 and 10% ($40bil) in 2024.

Generally, it takes 5000 jobs to put-in-place $1 billion in one year. It could easily vary from 4000 to 6000. So an add of $100 billion+ in 2023 would need 500,000 new jobs. Adding $200 billion over two years would need 1,000,000 new jobs.

Construction Jobs vs Construction Volume

These plots updated to jobs report 10-6-23

Since Q1 2020, pre-pandemic high, spending increased 28%, but inflation was 33%, so real volume of work is down 5%. In that time jobs increased 5%. Jobs are way ahead of volume, but volume is backfilling in the void, especially in nonres bldgs.

This plot with baseline Jan 1, 2011 shows that jobs increase pretty consistently at about 3% to 4% per year. Except for the spike down in 2020, rate of growth (slope of the jobs line) is consistent for 13 years.

If we were to grow the labor force to meet the newly identified workload added from new starts, we would need to double the prior maximum rate of construction jobs growth. Normal construction jobs growth is about 250,000 jobs per year and maximum prior growth is about 400,000. The workload discussed above would require 500,000 new jobs/yr., back to back. That’s an expansion of the industry by 15%, in an industry that normally grows 3%/yr. This industry can’t grow that fast. (Which means we may all need to account for over-capacity growth as a potential reduction in future forecast. You can’t increase spending that fast if you can’t also expand the labor force and the suppliers to the industry that fast).

My first thoughts were, Jobs may not be able to increase fast enough to put-in-place the forecast spending. This impediment needs to be accounted for and could reduce overall construction spending forecast over the next two years. The most likely markets where a reduction might occur are Manufacturing, Highway and Public Utilities.

However this is what happened the past year. In the last 12 months, Aug’22 to Aug’23, Nonres Bldgs jobs are up 3.8%. Nonres Bldgs spending is up 21%, by far driven by Manufacturing, but after ~6% inflation, volume of nonres bldgs workload is up 15%. So, we have a 3.8% increase in jobs to accomodate a 15% increase in volume.

The last year has shown a huge increase in the volume of nonres bldgs work, without an equal increase in jobs. This shows the excess nonres bldgs jobs for the past three years is now absorbing new workload, (a 3.8% increase in jobs to accomodate a 15% increase in volume), without collapsing the labor force or canceling the volume. However, the ability to absorb work into the existing workforce cannot continue.

Non-building, over the next two years, could experience the same kind of growth spurt as Nonres Bldgs., a forecast increase in volume the next two years without an equal increase in jobs. Volume which was lower than jobs since 2021, is now increasing faster than jobs. Non-bldg volume is forecast up 6% to 8%/year the next 3 years. Jobs increase at an avg. 3.5%/year.

Residential volume has exceeded residential jobs all the way back to 2011. The recent decline in volume brings the two even, if the jobs hold the pace.

SEE more discussion on Volume and Jobs

here 2023 Construction Volume Growth

here 2023 Midyear Jobs Outlook

and here Infrastructure Construction Expansion – Not So Fast

See also Midyear Construction Forecast Update 8-12-23

Who’s Forecast is Closest?

Twice a year, in January and July, The AIA Consensus Forecast is released. The AIA solicits Nonresidential Building construction spending forecast data from a number of firms and publishes the collected data. It can be helpful to compare the forecasts to current actual data. This provides some clues as to which forecasts are in the ballpark and which just don’t seem to be on track with reality.

The following table presents the AIA 2023 Consensus Forecasts published in January. Alongside the AIA Forecasts is my forecast, Construction Analytics 2023 beginning of year nonresidential buildings forecast and the Actual year-to-date spending published by Census. The ytd values are not much different than the current forecast for the year. The values highlighted in green are those that are closest to the current ytd. and expected forecast for the year.

Just one example to highlight forecast performance, more than half of the forecasts submitted to the AIA Consensus for Manufacturing were 10% or less for all of 2023. The current year-to-date spending for manufacturing is up 83%. My current forecast for the year is 67%.

The AIA January Consensus forecast had Nonresidential Buildings up 5.8% for the year. Construction Analytics forecast was 15.8%. The current ytd is 30%.

The Midyear 2023 AIA Consensus will soon be published. I would expect to see some drastic revisions to some of the input forecasts to catch up to actual spending. Construction Analytics will publish a midyear forecast after the July 1 Census data release that includes the revisions 5 years back. FWIW, Construction Analytics midyear forecast, for the last 3 years, has come closest to the actuals for the year in more markets than any firm’s forecast included in the AIA Consensus. As you can see in the table above, it’s looking pretty solid that Construction Analytics beginning of year 2023 forecast also comes closest to forecast for the year. Closest comparison is made to my current 2023 forecast, in table below, so there is room for change. Year-end actual might not hit my forecast, so… Anyway, the percent increase in 2023 forecast shouldn’t change much with July data, so it’s a preview of my midyear forecast.

On July 1st, the Census will release the construction spending data for May. Along with that, they will revise data back 5 years. Usually, the biggest revisions are to last year. The revisions can sometimes be large enough to sizably change the percent growth within a market from year to year.

This following table shows YTD and my current forecast for 2023 and 2024. Discussion of the forecast is in the preceding post. Construction Data Briefs JUN 2023

Construction Data Briefs JUN 2023

Nonresidential Buildings spending is leading Construction spending growth. For the first four months of 2023, total construction spending year-to-date (ytd) is up 6.1%. Nonresidential buildings spending is up 30% ytd compared to the same four months 2022, the fastest rate of nonres bldgs growth in over 20 years. Nonbuilding spending ytd is up 11%. Residential spending peaked in March 2022. Since then the annual rate of residential spending has dropped 11%.

SPENDING FORECAST

Total Construction Spending in 2023 is now forecast to reach $1,915 billion, an increase of 6.4% over 2022.

Nonresidential Buildings spending in 2023 is now forecast at $660 billion, an increase of 26.2% over 2022.

Construction Spending through April is up 6.1% ytd. Spending is forecast to finish 2023 up 6.4%.

Total construction spending for 2023 is on track to increase +6.4%. Residential -8.1%, Nonres Bldgs +26.2%, Nonbldg +14.4%.

SPENDING BY SECTOR CURRENT $ AND INFLATION ADJUSTED CONSTANT $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Nonbuilding Infrastructure leading spending growth. Both are expected to grow greater than the inflation index.

See also Construction Spending Outlook – Feb 2023

STARTS

The rate of construction spending in 2023 will be influenced predominantly by a 40% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged over $500 billion/year. Many of those projects will have peak spending in 2023. Some will occur in 2024.

Residential construction (Dodge) starts posted the five highest months ever all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Jan and Feb 2023, starts dropped another 20% below 2nd half 2022. Starts are now down 25% in 12 months.

Nonresidential Bldgs starts in 2022 posted the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021. Nonres Bldgs new starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%. Office is up 33% (datacenters), Healthcare up 23%, Comm/Rtl up 30% (warehouses). Warehouse stats have slowed and will hold Comm/Rtl down the next two years. Nonresidential buildings starts in 2023 decline in most markets, but 2023 will still be the 2nd highest year for total Nonres Bldgs starts.

Non-building starts increased more than 100% in July 2022. The 2nd half 2022 was up 50% over 1st half 2022. For 2022, Highway is up 25%, Transportation up 45%, Power up 30% and Public Works up 15%. Starts for 2023 are forecast up 15%. For 2023, every market is forecast up double digits.

Current $ Spending, Inflation and Volume

SEE Construction Inflation 2023

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. All $ are current to the year stated. The values in this table are not indexed to a constant value year. This simply shows business volume in any given year is not as high as spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. In 2022, Nonresidential buildings inflation was 11.9%, so business volume was 11.9% less than spending, or less than revenue. Residential volume was 15.5% less then spending.

SPENDING TOTAL CURRENT $

VOLUME CURRENT $ = SPENDING MINUS INFLATION

CONSTANT $ = VOLUME OVER TIME

Overall Construction Spending is up 25% in the 38 months since the onset of the pandemic, but, during that same period inflation increased 31%. After adjusting for 31% inflation, constant $ volume is down 4%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

NONRESIDENTIAL SPENDING (CURRENT $) AND VOLUME (CONSTANT $)

Nonresidential Buildings spending in 2023 is forecast at $660 billion, an increase of 26.2%, or $137 billion.

In 2022 we realized the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021.

The AIA Consensus Construction Forecast, December 2022 predicts only a 5.8% increase in spending for nonresidential buildings in 2023. My beginning of year forecast for comparison was 15.8%. My current forecast is +26.2%. The current year-to-date spending through April is up 30%.

We began the year with record new starts indicating an increasing spending rate. The monthly rate of spending is up 12 of the last 14 months, has increased for 6 consecutive months and is up 20% in the last 6 months. The rate of spending is predicted to increase 10 out of 12 months in 2023, a total increase of 11% over the year. Barring any unforeseen negative occurrence, the trajectory in the rate of spending is increasing.

Year-to-date nonresidential buildings spending for Apr is up 30%. This is driven by Manufacturing, up 84% ytd, but also supported by Lodging up 40% ytd and Commercial/Retail up 23% ytd. Every nonresidential building market except Public Safety (up only 8%) is up greater than 10% ytd.

Nonresidential buildings spending fell 17% from March 2020 to Sept 2021, then increased 48% from Sept 2021 to Apr 2023. Currently, as of Apr 2023, spending is 24% higher than the pre-pandemic peak in Feb 2020. But nonresidential buildings inflation over that same 36 months increased 27%. Business volume in constant $ actually fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in business volume has increased 31%, but that still leaves volume nearly 2% lower than the pre-pandemic high.

Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year for two years. Non-building Infrastructure will post the 1st year of sizable gains since 2019, forecast at $418bil, up 13.5% in 2023. In 2022, Highway and Public Utilities posted strong gains of 9.1% and 16.6%, but those gains were offset by a 8.7% decline in Power. For 2023, Highway and Transportation recorded the strongest starts in five years. All markets post spending gains in 2023, with Highway up 26%, Transportation up 6% and Public Utilities up 18%.

Non-building Infrastructure spending is up 6% since Feb 2020. After adjusting for 27% inflation, constant business volume is down 16%.

RESIDENTIAL SPENDING SF-MF-RENO CURRENT $ AND CONSTANT $

Residential starts are forecast down or flat in 2022 and 2023. Spending grew 44% in the last 2yrs, but inflation was 30% of that 44%. With no growth in starts forecast for 22-23, spending will struggle to keep up with inflation. Residential spending is forecast to fall 8% in 2023. Most of the decline is single family. Single family is down 24% over 12 consecutive down months. Multifamily is up 24% over the same 12 months. But, it’s not an even swap. There’s 3x more spending in SF than in MF. Renovations gained 25% in 2022 but spending varies +/- 10% throughout the year. Midyear there is potential for 6 consecutive down months that could send residential spending down another 7% before year end.

DOES VOLUME OF WORK SUPPORT JOBS GROWTH? or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019.

Nonresidential Buildings spending in 2023 is forecast at $660 billion, an increase of 26.2%, or an increase of $137 billion in 2023. Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year each year.

Normally, it takes 5000 jobs to put-in-place $1 billion in one year. So an add of $100 billion in 2024 would need 500,000 new jobs. 2023 would need 750,000 new jobs.

If we were to grow the labor force to meet the newly identified workload added from new starts, we would need to double the prior maximum rate of construction jobs growth. Normal growth is about 250,000 jobs per year and maximum prior growth is about 400,000. The workload discussed above would require 750,000 + 500,000 new jobs back to back. That’s an expansion of the industry by 15%, in an industry that normally grows 3%/yr. This industry can’t grow that fast. (Which means I need to account for over-capacity growth as a potential reduction in future forecast. You can’t increase spending that fast if you can’t expand the industry that fast).

My first thoughts were, Jobs may not be able to increase fast enough to put-in-place the forecast spending. This impediment needs to be accounted for and could reduce overall construction spending forecast over the next two years. The most likely markets where a reduction would occur are Manufacturing, Highway, Commercial/Retail and Office.

However this is what happened the past year. In the last 12 months, Mar’22 to Mar’23, nonres bldgs jobs are up 3.5%. Nonres Bldgs spending is up 21%, but after ~7% inflation, volume of nonres bldgs workload is up 14%. So, we have a 3.5% increase in jobs to accomodate a 14% increase in volume.

The last year has shown a huge increase in the volume of nonres bldgs work, without an equal increase in jobs. This shows the excess nonres bldgs jobs for the past three years is now absorbing new workload, (a 3.5% increase in jobs to accomodate a 14% increase in volume), without a cry of jobs shortages.

SEE more discussion on Volume and Jobs

here 2023 Construction Volume Growth

and here Infrastructure Construction Expansion – Not So Fast

Sample PP Slides for Economic Forecast Q2 2023

On Thursday morning May 25th, I will be presenting my Q2 2023 Construction Economic Forecast at Hanson Wade’s Advancing Preconstruction conference in Phoenix, AZ. Here is a selection of the slides cut from the full presentation.

The full presentation covers the data used in preparation of the full forecast, and it’s potential impact on the outcome, including Construction Starts, Backlog, Cashflow, Spending, Inflation, Business Volume, Jobs and Risk.

Hanson Wade’s Advancing Preconstruction conference is one of the largest, if not the largest, preconstruction conferences held in the United States. This is my 6th year presenting at AP.

The Next Forecast Challenge

The next big challenge in construction forecasting is to determine, Will Nonres Bldgs spending increase without an equal increase in nonres bldgs jobs? If so, by how much?

At the onset of the Pandemic, nonres bldgs jobs dropped 16%. Jobs have since recovered to down only 1% vs Feb 2020. Spending (bottomed in Sep 2021) fell 17%, but is now up 15% over Feb 2020.

But the key to this comparison is inflation, which, when subtracted from spending gives real volume growth. Inflation adds only to spending, it adds nothing to volume of work.

Nonres Bldgs inflation was 2.4% in 2020, 8.2% in 2021 and 11.9% in 2022. Total Nonres Bldgs inflation from Feb 2020 to Mar 2023 is 26%.

Since the onset of the Pandemic, Nonres Bldgs spending is up 15% but after inflation volume is down 8%. During that time jobs are down 1%. That’s now over three years that jobs exceed volume of work. Let’s look at more recent data.

In the last 12 months, Mar’22 to Mar’23, nonres bldgs jobs are up 3.5%. Nonres Bldgs spending is up 21%, but after ~7% inflation, volume of nonres bldgs workload is up 14%. So, we have a 3.5% increase in jobs to accomodate a 14% increase in volume.

The last year has shown a huge increase in the volume of nonres bldgs work, without an equal increase in jobs. This shows the excess nonres bldgs jobs for the past three years is now absorbing greater workload, (a 3.5% increase in jobs to accomodate a 14% increase in volume), without a cry of jobs shortages.

What’s the real magnitude of this difference in percent growth, a 10.5% increase in volume over jobs. Well that 10.5% increase in volume is $50 billion worth of construction put-in-place. Not delayed, not canceled, put-in-place. With no equal increase in jobs. So the existing jobs put this work in place. $50 billion in one year would normally require 250,000 jobs to put-in-place. Or by using overtime and working the existing workforce longer hours to get it done, the entire nonres bldgs workforce of 3.5 million would need to work 10 hour days 5 days a week to put that much extra work in place. Well, BLS reports hours worked changed by less than 1 hour/week.So, it wasn’t accomplished with added jobs and it wasn’t accomplished with overtime.

Some regular readers here could probably point back to a half dozen articles over the last few years in which I describe nonres bldgs volume levels had dropped but jobs had not. I mentioned before that existing jobs could and probably would absorb some of the growth. That could occur if there were a need to backfill volume to support the existing workforce.

The forecast for Nonresidential Buildings spending in 2023 is +20%. After 6% inflation, volume is forecast +14%. Jobs will not increase by 14%. Jobs have never increased more than 5% and normal is 3.5%. A 14% increase is equivalent to 500,000 jobs, just to support the growth in nonres bldgs. 500,000 jobs is double the normal annual rate of growth for all construction jobs. Nonres Bldgs is is only 33% of all construction

So the questions for the forecaster are these, 1) do we break the mold for construction jobs growth and add half a million jobs, and exceed all known indicators on construction jobs growth?, 2) Will volume vs jobs grow similar to the previous year, volume up 14% and jobs up 3.5%?, or 3) Does nonres bldgs volume growth slow down to a rate of growth more in-line with jobs growth?

I’m heavily leaning to #2, volume will exceed jobs growth. Some of the added work in the near future will be absorbed by the current workforce, but the workforce has already absorbed a great deal in the past year. Also I do think I’m partly leaning towards #3, volume growth will slow to less than currently predicted, although not nearly to the low level of historical jobs growth. I don’t expect jobs growth to exceed historical maximum of 5% annually, 175,000 nonres bldgs jobs. I do expect volume growth will exceed jobs growth, but by much less than in this past year. I do expect to extend the forecast spending out to a further date.

Construction Data Briefs APR 2023

Construction is booming. Nonresidential buildings is leading growth. For the first two months of the year, total construction spending year-to-date (ytd) is up 5.9%, but nonresidential buildings spending is up 23% ytd, the fastest rate of nonres bldgs growth in over 20 years. Nonresidential buildings annual rate of spending has increased 19% in the last six months. Nonbuilding spending ytd is up 8%. Nonbuilding annual rate of spending increased 10% in the last four months. Residential spending peaked in March 2022. Since then the annual rate of residential spending has dropped 11%.

Total Construction Spending in 2023 is now forecast to reach $1,894 billion, an increase of 5.3% over 2022.

Nonresidential Buildings spending in 2023 is now forecast at $629 billion, an increase of 20.3% over 2022.

STARTS

The rate of construction spending in 2023 will be influenced predominantly by a 40% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged over $500 billion/year. Many of those projects will have peak spending in 2023. Some will occur in 2024.

Residential construction (Dodge) starts posted the five highest months ever all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Jan and Feb 2023, starts dropped another 20% below 2nd half 2022. Starts are now down 25% in 12 months.

Nonresidential Bldgs starts in 2022 posted the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021. Nonres Bldgs new starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%. Office is up 36% (datacenters), Healthcare up 17%, Comm/Rtl up 23% (warehouses).

Non-building starts increased more than 100% in July 2022. The 2nd half 2022 was up 50% over 1st half 2022. Starts for 2023 are forecast up 15%. For 2022, Highway up 25%, Transportation up 45%, Power up 30% and Public Works up 15%.

SPENDING FORECAST

Construction Spending through February 2023 is up 5.9% ytd. Spending is forecast to finish 2023 up 5.3%.

While residential falls back nearly 7% in 2023, Nonresidential buildings is leading with a forecast of 20% spending growth.

Total construction spending for 2023 is on track to increase +5.3%. Residential -6.7%, Nonres Bldgs +20.3%, Nonbldg +13.5%.

SPENDING BY SECTOR CURRENT $ AND INFLATION ADJUSTED CONSTANT $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Nonbuilding Infrastructure leading spending growth. Both are expected to grow greater than the inflation index.

See also Construction Spending Outlook – Feb 2023

Current $ Spending, Inflation and Volume SEE Construction Inflation 2023

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). The following table shows spending, inflation and volume (spending without inflation) for each year. All $ are current to the year stated. This table shows that inflation adds nothing to volume growth. All values in this table are current to the year stated. The values in this table are not indexed to a constant value year. This is an attempt to show that business volume in any given year is not as high as spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. In 2022, Nonresidential buildings business volume was 12.2% less than spending, or less than revenue. Residential volume was 15.7% less then spending.

SPENDING TOTAL CURRENT $ AND INFLATION ADJUSTED CONSTANT $

Overall Construction Spending is up 22% in the 36 months since the onset of the pandemic, but, during that same period inflation increased 31%. After adjusting for 31% inflation, constant $ volume is down 7%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

NONRESIDENTIAL SPENDING (CURRENT $) AND VOLUME (CONSTANT $)

Nonresidential Buildings spending in 2023 is forecast at $629 billion, an increase of 20.3%, or $100 billion and add another $50 billion in 2024.

In 2022 we realized the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021.

The AIA Consensus Construction Forecast, December 2022 predicts only a 5.8% increase in spending for nonresidential buildings in 2023. My beginning of year forecast for comparison was 15.8%. My current forecast is +20.3%.

We began the year with record new starts indicating an increasing spending rate. The monthly rate of spending is up 12 of the last 14 months, has increased for 6 consecutive months and is up 20% in the last 6 months. The rate of spending is predicted to increase 10 out of 12 months in 2023, a total increase of 11% over the year. Barring any unforeseen negative occurrence, the trajectory in the rate of spending is increasing.

Year-to-date nonresidential buildings spending for Jan+Feb is up 23%. This is driven by Manufacturing, up 53% ytd, but also supported by Lodging up 38% ytd and Commercial/Retail up 23% ytd. Every nonresidential building market except Educational (up only 8%) is up greater than 10% ytd.

Nonresidential buildings spending fell 17% from March 2020 to Sept 2021, then increased 36% from Sept 2021 to Feb 2023. Currently, as of Feb 2023, spending is 14% higher than the pre-pandemic peak in Feb 2020. But nonresidential buildings inflation over that same 36 months increased 26%. Business volume in constant $ actually fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in business volume has increased 18%, but that still leaves volume nearly 10% lower than the pre-pandemic high.

Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year for two years. Non-building Infrastructure will post the 1st year of sizable gains since 2019, forecast at $415bil, up 13.5% in 2023. In 2022, Highway and Public Utilities posted strong gains of 9.1% and 16.6%, but those gains were offset by a 8.7% decline in Power. For 2023, Highway and Transportation recorded the strongest starts in five years. All markets post spending gains in 2023, with Highway up 26%, Transportation up 9% and Public Utilities up 8%.

Non-building Infrastructure spending is up 4% in 36 months since Feb 2020. After adjusting for 26% inflation, constant business volume is down 17%.

RESIDENTIAL SPENDING SF-MF-RENO CURRENT $ AND CONSTANT $

Residential starts are forecast down or flat in 2022 and 2023. Spending grew 44% in the last 2yrs, but inflation was 30% of that 44%. With no growth in starts forecast for 22-23, spending will struggle to keep up with inflation. Residential spending is forecast to fall 7% in 2023. Most of the decline is single family. Single family is down a total of 23% over 10 consecutive months. Multifamily is up 22% over 13 consecutive months. Renovations gained 25% in 2022 but spending varies +/- 10% throughout the year. Midyear there is potential for 6 consecutive down months in residential spending.

DOES VOLUME OF WORK SUPPORT JOBS GROWTH? or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019.

Nonresidential Buildings spending in 2023 is forecast at $629 billion, an increase of 20.3%, or $100 billion and another $50 billion in 2024. Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year each year.

This growth amounts to an increase of $150 billion in 2023 and $100 billion in 2024. It takes 5000 jobs to put-in-place $1 billion. So $100 billion in 2024 would need 500,000 new jobs. 2023 would need 750,000 new jobs.