Home » Construction

Category Archives: Construction

Construction Data Briefs APR 2023

Construction is booming. Nonresidential buildings is leading growth. For the first two months of the year, total construction spending year-to-date (ytd) is up 5.9%, but nonresidential buildings spending is up 23% ytd, the fastest rate of nonres bldgs growth in over 20 years. Nonresidential buildings annual rate of spending has increased 19% in the last six months. Nonbuilding spending ytd is up 8%. Nonbuilding annual rate of spending increased 10% in the last four months. Residential spending peaked in March 2022. Since then the annual rate of residential spending has dropped 11%.

Total Construction Spending in 2023 is now forecast to reach $1,894 billion, an increase of 5.3% over 2022.

Nonresidential Buildings spending in 2023 is now forecast at $629 billion, an increase of 20.3% over 2022.

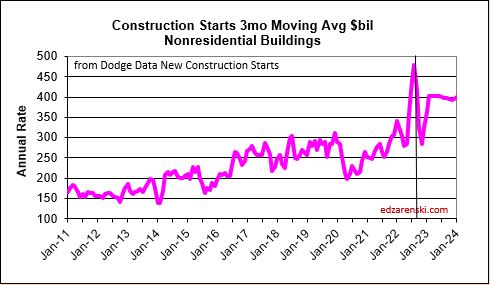

STARTS

The rate of construction spending in 2023 will be influenced predominantly by a 40% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged over $500 billion/year. Many of those projects will have peak spending in 2023. Some will occur in 2024.

Residential construction (Dodge) starts posted the five highest months ever all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Jan and Feb 2023, starts dropped another 20% below 2nd half 2022. Starts are now down 25% in 12 months.

Nonresidential Bldgs starts in 2022 posted the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021. Nonres Bldgs new starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%. Office is up 36% (datacenters), Healthcare up 17%, Comm/Rtl up 23% (warehouses).

Non-building starts increased more than 100% in July 2022. The 2nd half 2022 was up 50% over 1st half 2022. Starts for 2023 are forecast up 15%. For 2022, Highway up 25%, Transportation up 45%, Power up 30% and Public Works up 15%.

SPENDING FORECAST

Construction Spending through February 2023 is up 5.9% ytd. Spending is forecast to finish 2023 up 5.3%.

While residential falls back nearly 7% in 2023, Nonresidential buildings is leading with a forecast of 20% spending growth.

Total construction spending for 2023 is on track to increase +5.3%. Residential -6.7%, Nonres Bldgs +20.3%, Nonbldg +13.5%.

SPENDING BY SECTOR CURRENT $ AND INFLATION ADJUSTED CONSTANT $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Nonbuilding Infrastructure leading spending growth. Both are expected to grow greater than the inflation index.

See also Construction Spending Outlook – Feb 2023

Current $ Spending, Inflation and Volume SEE Construction Inflation 2023

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). The following table shows spending, inflation and volume (spending without inflation) for each year. All $ are current to the year stated. This table shows that inflation adds nothing to volume growth. All values in this table are current to the year stated. The values in this table are not indexed to a constant value year. This is an attempt to show that business volume in any given year is not as high as spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. In 2022, Nonresidential buildings business volume was 12.2% less than spending, or less than revenue. Residential volume was 15.7% less then spending.

SPENDING TOTAL CURRENT $ AND INFLATION ADJUSTED CONSTANT $

Overall Construction Spending is up 22% in the 36 months since the onset of the pandemic, but, during that same period inflation increased 31%. After adjusting for 31% inflation, constant $ volume is down 7%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

NONRESIDENTIAL SPENDING (CURRENT $) AND VOLUME (CONSTANT $)

Nonresidential Buildings spending in 2023 is forecast at $629 billion, an increase of 20.3%, or $100 billion and add another $50 billion in 2024.

In 2022 we realized the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021.

The AIA Consensus Construction Forecast, December 2022 predicts only a 5.8% increase in spending for nonresidential buildings in 2023. My beginning of year forecast for comparison was 15.8%. My current forecast is +20.3%.

We began the year with record new starts indicating an increasing spending rate. The monthly rate of spending is up 12 of the last 14 months, has increased for 6 consecutive months and is up 20% in the last 6 months. The rate of spending is predicted to increase 10 out of 12 months in 2023, a total increase of 11% over the year. Barring any unforeseen negative occurrence, the trajectory in the rate of spending is increasing.

Year-to-date nonresidential buildings spending for Jan+Feb is up 23%. This is driven by Manufacturing, up 53% ytd, but also supported by Lodging up 38% ytd and Commercial/Retail up 23% ytd. Every nonresidential building market except Educational (up only 8%) is up greater than 10% ytd.

Nonresidential buildings spending fell 17% from March 2020 to Sept 2021, then increased 36% from Sept 2021 to Feb 2023. Currently, as of Feb 2023, spending is 14% higher than the pre-pandemic peak in Feb 2020. But nonresidential buildings inflation over that same 36 months increased 26%. Business volume in constant $ actually fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in business volume has increased 18%, but that still leaves volume nearly 10% lower than the pre-pandemic high.

Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year for two years. Non-building Infrastructure will post the 1st year of sizable gains since 2019, forecast at $415bil, up 13.5% in 2023. In 2022, Highway and Public Utilities posted strong gains of 9.1% and 16.6%, but those gains were offset by a 8.7% decline in Power. For 2023, Highway and Transportation recorded the strongest starts in five years. All markets post spending gains in 2023, with Highway up 26%, Transportation up 9% and Public Utilities up 8%.

Non-building Infrastructure spending is up 4% in 36 months since Feb 2020. After adjusting for 26% inflation, constant business volume is down 17%.

RESIDENTIAL SPENDING SF-MF-RENO CURRENT $ AND CONSTANT $

Residential starts are forecast down or flat in 2022 and 2023. Spending grew 44% in the last 2yrs, but inflation was 30% of that 44%. With no growth in starts forecast for 22-23, spending will struggle to keep up with inflation. Residential spending is forecast to fall 7% in 2023. Most of the decline is single family. Single family is down a total of 23% over 10 consecutive months. Multifamily is up 22% over 13 consecutive months. Renovations gained 25% in 2022 but spending varies +/- 10% throughout the year. Midyear there is potential for 6 consecutive down months in residential spending.

DOES VOLUME OF WORK SUPPORT JOBS GROWTH? or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019.

Nonresidential Buildings spending in 2023 is forecast at $629 billion, an increase of 20.3%, or $100 billion and another $50 billion in 2024. Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year each year.

This growth amounts to an increase of $150 billion in 2023 and $100 billion in 2024. It takes 5000 jobs to put-in-place $1 billion. So $100 billion in 2024 would need 500,000 new jobs. 2023 would need 750,000 new jobs.

If we were to grow the labor force to meet the newly identified workload added from new starts, we would need to double the prior maximum rate of construction jobs growth. Normal growth is about 250,000 jobs per year and maximum prior growth is about 400,000. The workload discussed above would require 750,000 + 500,000 new jobs back to back. That’s an expansion of the industry by 15%, in an industry that normally grows 3%/yr. This industry can’t grow that fast. (Which means I need to account for over-capacity growth as a potential reduction in future forecast. You can’t increase spending that fast if you can’t expand the industry that fast).

4-16-23 update- Everything forecast above is predicated on the normal cash flow of forecast new starts. As of yet, this forecast has not been reduced to reflect the inability of the industry to expand jobs fast enough to absorb the volume of spending generated from forecast starts. Whether new starts get canceled or delayed, spending needs to be reduced annually for at least the next two years simply because jobs cannot increase fast enough to put-in-place the forecast spending. This impediment needs to be accounted for and could reduce overall construction spending forecast by approximately $40-$60 billion in 2023 and $25-$40 billion in 2024. The most likely markets where a reduction would occur are Manufacturing, Highway, Commercial/Retail and Office.

SEE more discussion on Volume and Jobs

here 2023 Construction Volume Growth

and here Infrastructure Construction Expansion – Not So Fast

2021 Construction Economic Forecast – Summary

Initial Construction Outlook 2021, 2-5-21, based on data from:

- Actual Jobs data includes BLS Jobs to Jan 16th, issued 2-5-21

- Forecast includes US Census Dec 2020 year-to-date spending as of 2-1-21

- Forecast includes Dodge Outlook 2021 and Dec construction starts 1-19-21

SUMMARY – CONCLUSIONS

Construction Spending drives the headlines. Construction Volume drives jobs demand. Volume is spending minus inflation. Current outlook shows the most recent peak volume was 2017-2018. Total Volume is forecast to decline every year out to 2023, but Residential is rising, Nonresidential is falling.

When spending increases less than the rate of inflation, the real work volume is declining. Nonresidential buildings spending for 2020 is down -2%, but with 3% to 5% inflation, volume is down 5% to 7%. The extent of volume declines would impact the jobs situation.

STARTS – BACKLOG – SPENDING

By far the greatest impact of the pandemic on construction is the massive reduction in new nonresidential construction starts in 2020 that will reduce spending and jobs in that sector for at least the next two years. Residential continues to increase.

- 2020 new starts declined -8%. Res +7%, Nonres Bldgs -24%, Nonbuilding -14%.

- New starts for residential reached an all-time high in 2020. Expect up +5% in 2021.

Nonresidential construction starts in backlog at the beginning of the year provide for 75% to 80% of all spending in 2021. New starts in 2020 were down 24% for buildings and 14% for non-buildings, so backlog is down. It would be difficult to show any scenario that has these sectors up in 2021.

Construction has yet to experience the greatest downward pressure from the pandemic. After hitting a post-pandemic spending high in December, spending and jobs losses won’t hit bottom until 2022. Nonresidential declines outweigh Residential gains.

- Spending forecast for 2021 is up +1.4%, but nonresidential buildings is down -11%.

- Almost all gains in spending are due to large 12%/yr gain in residential.

The largest declines in 2021 spending are Lodging -37%, Amusement/Recreation -26%, Manufacturing -19% and Power -15%.

PROJECT COST ESCALATION – INFLATION

- Inflation for nonresidential buildings near 4% the next few years. Residential 5% to 6%.

VOLUME – JOBS

Construction Jobs annual average for 2020 is down 220,000 jobs. The current spending forecast is indicating that December 2020 was the highpoint for jobs. Residential jobs will be up in 2021, but Nonresidential Buildings jobs are down steep. Net jobs will be down 15 of next 18 months. Forecast 2021 net annual average jobs losses of -200,000. Nonresidential Buildings 2021 jobs losses will outweigh residential gains.

Selected slides from Feb 2021 Construction Outlook Presentation

EdZ Econ Feb 2021 SAMPLE SLIDES PDF

Read More 2021 Construction Economic Forecast

Construction Analytics Voted Best Construction Blog 2019

Ed Zarenski’s Construction Analytics blog

won the 2019 Best Construction Blog competition.

“Sometimes patience and quality count more for success than razzle dazzle and pushy marketing. These observations seem appropriate for the 2019 Best Construction Blog winner, Ed Zarenski’s Construction Analytics.”

“His blog’s uniqueness and success results from its detailed analysis and data about the construction economics topic, including forecasts and projections — with a Google search leadership relating to construction inflation.”

“Zarenski’s blog, effectively, provides a solid overview of the construction industry’s economic picture. That knowledge is useful for contractors, suppliers and professionals seeking to benchmark performance and plan their business’s future based on industry-focused but larger economic trends.”

Construction Analytics wins 2019 Best Construction Blog competition

Who Reads Construction Analytics?

Construction Analytics provides in-depth and unique analysis and future forecasting of construction data valuable to a wide variety of users. Construction Analytics data has been referenced by construction firms, university graduate studies, real estate firms, online educators, investment firms, school district planning boards, public agencies for developing infrastructure budgets and news agencies around the country.

Construction Analytics has consulted for and provided special reports and presentations to Construction firms, real estate developers, national construction organizations and industry conferences.

National agencies, universities, construction firms and conference planners have reached out to Construction Analytics for presentations to large and small groups. A sampling of some construction economic presentations: American Institute of Architects; Associated General Contractors; Project Management Institute; McGraw Hill Construction; Georgia Tech Civil Engineering; Worcester Polytechnic Institute Civil Engineering; Hanson-Wade Advancing Building Estimation Conference.

Construction Analytics has appeared in interviews by Bloomberg TV and ConstructechTV and has been widely quoted in Bloomberg News, Washington Post Business, WaPo Fact Checker, Financial Times, CNBC, Marketwatch Economy, Newsweek, Los Angeles Times, Ontario Construction News, strategy+business, Yahoo!Finance, STEEL Market Update, BuildingConnected, Constructiondive, BuildZoom and a host of other blogs and news sources.

Contact:

Construction Analytics

Ed Zarenski

edzarenski@gmail.com

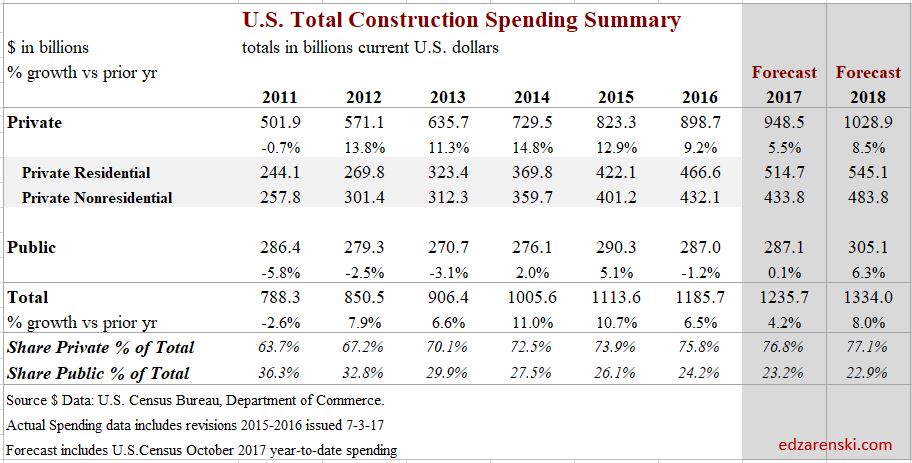

Construction Spending July 2018

9-4-18

U. S. Census posted Construction Spending for July at a seasonally adjusted annual rate (SAAR) of $1,315 billion, up only 0.1% from May.

Year-to-date, July construction spending is up 5.2% from the same period in 2017.

June was revised down slightly, -0.2%, and May was also revised down, -0.6%, but May remains up 1.7% from the 1st May release.

Here’s the link to the Sept. 4 release of July data

Construction Spending for the 1st 7 months of 2018, in Current $, by Census formulas averages $1,306 billion. By my formulas the 1st 7 months average stands at $1,321 billion. Either way, this is an all-time high, well above the pre-recession high spending of $1,205 billion posted in the 1st quarter of 2006. Spending has been above the 2006 high since the 4th quarter 2016, but since 2006, no other 6-month period has averaged above $1,250 billion. Spending is expected to total $1,335 billion for 2018.

Constant $ shows volume reached peak during the 2nd half 2005 and 1st half 2006, with 2005 posting the peak year. 2018 constant $ inflation adjusted spending is still 14% below the 2005-2006 peak.

Total spending year to date through June is $740 billion. Historically, 56% of annual spending occurs in the 1st 7 months. Jan, Feb and Mar are the weakest months of the year, while Jul, Aug and Sep are the strongest spending months. This would indicate a 2018 total annual spending of $1,321 billion, 1% less than my forecast.

Top performing construction spending markets 2018 year-to-date through July are Transportation +15.8%,Water Supply +14.1%, Public Safety +13.1%, Conservation 10.3%, Lodging +10.1%, Sewage and Waste Disposal +9.1%, Residential +7.6% and Office 7.2%.

The only markets down year-to-date are Religious -11.8% and Manufacturing -7.5%. Religious building as a percent of total is so small (1/4 of 1%) it has negligible effect on total annual performance. However, Manufacturing is about 5% of total construction.

Residential, Office, Commercial/Retail, Lodging, Highway and Environmental Public Works (Sewage, Water, Conservation) are all ahead of my expectations for the 1st half of 2018.

Last month, June construction spending showed an unusual $9 billion (SAAR) monthly decline (-9.3%) in Educational spending. At that time I said, “This is several billion greater than the largest decline reported during the recession, so this looks like an anomaly in the data. There has never been a monthly decline like this in the Educational market since I’ve been tracking data, back to 2001. It is double the largest non-recession decline. I expect it will be revised up substantially at some point in the future.” That anomaly in the June data was revised up this month, erasing about half of the decline that was first reported.

Transportation is another market that appeared to be unusually low for June. Last month I said this, “Transportation (terminals and rail) new starts in 2016 increased 34% and then in 2017 increased 120%. Even with long duration cash flow spreading out the spending for big projects, my analysis still predicts Transportation spending up 30% in 2018. Year-to-date through June, Transportation spending is up only 14%. I’ve forecast it should be up 18%. That’s a total shortfall of about $1 billion (SAAR ~$12 billion), or about 7%/month, for 3 months. April, May and June spending are all below expectations.” In the July data, both May and June spending were revised UP by a total of $2 billion. With that revision Transportation spending is up 18% YTD through June, as expected.

Manufacturing spending as of June was reported down 8.7% year-to-date from 2017. Spending through July is now down only 7.5%. I previously reported that I expect the decline to slowly turn positive in the second half of the year to finish up 2%. Spending is currently at an SAAR just above $66 billion and expected to increase to $70 billion by December. In 2017, spending started the year above $70 billion but decreased to $60 billion by year end. Increasing values in the 2nd half 2018 compared to decreasing values in 2017 will continually increase the year-to-date performance in the 2nd half of 2018.

Power, similar to manufacturing, posted the highest spending for 2017 early in the year, then declined. In 2018, the 1st half posted the lowest spending, so the year-to-date is currently low. Increased spending in the 2nd half 2018, compared to the lowest values of the year in 2017, will boost year-to-date spending every month through year end. Although year-to-date spending through July is up only 0.7%, I expect the total for the year will finish up 8%.

Manufacturing and Power highlight one of the biggest shortfalls of judging expected performance based on year-to-date change. It is important to look at the trend line expected in the current year versus the trend line in the previous year. If they diverge, then year-to-date change will not give a clear indication of expected performance in the current year. Manufacturing data as an example follows. Note, SAAR data shows performance trend but NSA$ is needed to get YTD$.

![]()

Public spending increased 5% in 2015, but has been depressed since since 2009. 2017 finished still 7% lower than 2009. For 2018 we should see a gain of $16 billion, +5.7% over 2017 to $308 billion, the highest finish since 2009. Highway and Street is the largest share of public work, but adds very little to 2018 gains. Educational spending makes up about 25% of all public spending gains. Public Works (Sewage/Waste Water, Water Supply and Conservation), only 14% of all public spending, accounts for about 25% of the gains this year. Public Transportation, at only 12% of public spending, accounts for $8 billion in increases in public spending, half of all the gains in public spending this year.

Total spending has increased from an average of $1,254 billion in Q4’17 to $1,292 billion in Q1’18 to $1,321 billion in Q2’18, growth of 3.0% and 2.25% the last two quarters. I’m expecting the rate of monthly spending will be above $1,360 billion by year end. The total spending forecast for 2018 is $1,335 billion.

Residential single family spending is up 8.5% YTD. Multifamily is down 0.9%. Total residential spending is forecast to reach $570 billion in 2018, growth of 7.2% over 2017.

Nonresidential Buildings spending YTD totals $246 billion, up only 1.7% from 2017. It is being held down by Manufacturing which is currently down 7.5% from 2017. 2018 forecast is $445 billion, 6.1% growth over 2017, with best growth in Lodging 13%, Office 11% and Amusement/Recreation 9%.

Non-building Infrastructure will post the best year of growth since 2014 to reach a new all-time high at $308 billion. Transportation, by far, will show the best growth, 25% above 2017.

Cash flow from backlog supports a 2018 spending forecast of $1,335 billion, a spending increase of 7.2% over 2017. The forecast for 2019, based on a modest 3% increase in new starts in 2019 is $1,400 billion, an increase of 5% over 2018. The strongest growth in spending for 2018 and 2019 is forecast to occur in Non-building Infrastructure with Transportation being by far the strongest market.

July Construction Starts Fall but 3moAvg at New High

Construction Spending June 2018

June Construction Starts Reach New Highs

2018 Construction Spending Forecast – Mar 2018

3/15/18

Preliminary data is in for total year 2017 construction spending, 2017 construction starts and 2018 starting backlog. The following forecast is developed using the current data.

2018 Construction Spending Forecast – Mar 2018

A brief note on 2017.

2017 Spending Wrap Up

Total construction spending in 2017 now stands at $1.233 trillion, an increase of 4.0% over 2016.

Residential spending, up 10.5% for the fifth consecutive year above 10% growth, leads all construction spending in 2017 for the seventh consecutive year. Nonresidential Buildings finished the year up 2.3%. Only Non-building Infrastructure did not improve over 2016, down 3.8% for the year. However, Non-building Infrastructure had been at an all-time high for the previous two years.

2017 spending finished below my forecast due to performance in Educational, Office, Power and Highway, four of the five largest markets which together make up half of all nonresidential spending. All came in lower than forecast. However, some of these markets are prone to very large post-annual upward revisions and that has the potential to add to 2017 spending when those revisions are released in July 2018. For instance, in the July 2017 revisions, Power spending for the previous year, 2016, was revised up by 10%.

History shows spending has been revised up 53 times in the last 60 months. I expect to see future revisions smooth out spending in unusually low periods and increase total 2017 spending above this forecast. Both April and July preliminary spending appear statistically too low. The average post-annual total spending revision for the last five years is +2.8%. The post-annual revision to 2016 was only 2.2%. Revisions due for release on July 1, 2018, if even only a +1% revision to 2017, would adjust total 2017 spending up to $1,245 billion. This would slightly alter the 2018 forecast.

2018 Spending Total All Construction

Total All 2018 construction spending is forecast to increase 7.6% to $1.330 trillion.

Nonresidential Buildings spending forecast for 2018, up 9%, will be supported by Manufacturing and Educational. Non-building Infrastructure returns to strong growth of 8%, with potential to hit a new all-time high due to very large projects in Power and Transportation. Residential spending in 2018 slows to growth under 6% after six years all over 10%/year.

Dodge Data 2017 construction starts increased 3% from 2016. However, starts are always revised upward in the following year. I expect revisions will show 2017 starts increased by more than 6% over 2016. Even with that revision, 2017 starts posted the lowest growth since 2011, weighted heavily by the slowdown in residential starts.

Total starting backlog for 2018, currently at an all-time high, has increased on average 10%/year the last three years. 80% of all Nonresidential spending within the year will be generated from projects in starting backlog. Public share of new construction starts are up only 10% in 3 years. But due to long duration job types, 2018 starting backlog is up 30% in the last 3 years.

None of this spending forecast includes any projections for potential work from future infrastructure stimulus.

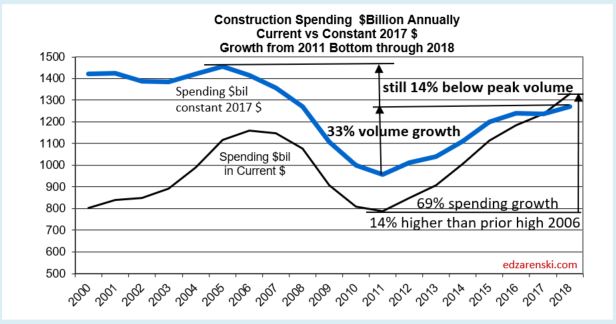

Current$ vs Constant$

Construction spending reached a new current $ high in 2017 at $1,236 billion. The previous high in current $ was $1,161 in 2006. Spending first surpassed that in 2014 and has been increasing since. But that is in current $, which includes inflation.

Comparing current $ spending to previous year spending does not give any indication if business is increasing. The inflation factor is missing. If spending is increasing at 4%/year in a time when inflation is 6%/year, real volume is declining by 2%.

Although 2018 current $ spending will reach $1,330 billion, after adjusting for 4.5% to 5% inflation, 2018 constant $ volume will increase to only $1,270 billion. When comparing inflation adjusted constant dollars, 2018 spending will still be lower than all years from 1998 through 2007. In 2005 constant $ volume reached a peak at $1,450 billion. At current rates of growth, we would not eclipse the previous high before 2022.

While spending in current $ is 7% higher than the previous high spending, volume is still 14% lower than the previous high volume.

For more on Inflation Adjusted spending see Construction Spending is Back

Jobs and Volume

The period 2011-2017 shows both spending and jobs growth at or near record highs.

A spending forecast of 7%+ in 2018, or nearly $100 billion in construction spending, demands a few words on jobs growth. Construction requires about 5000 workers for every added $1 billion in construction volume. Construction jobs have never increased by 500,000 in one year. However, $100 billion in added spending is not the same as $100 billion in volume, and jobs growth is based on volume.

Although spending will increase 7%-8%, construction inflation has been hovering near 4.5% to 5% for the last five years. Real volume growth in 2018 after inflation is expected to be near 3% or $40 billion. That would mean the need, if there are no changes in productivity, is to add only about 200,000 additional workers in 2018, a rate of jobs growth that is well within reach. That is less than the average jobs growth for the last seven years.

Construction added 1,339,000 jobs in the last 5 years, an average of 268,000/year. The only time in history that exceeded jobs growth like that was the period 1993-99 with the highest 5-year growth ever of 1,483,000 jobs. That same 1993-99 period had the previous highest 5-year spending and volume growth going back to 1984-88.

Construction added 185,000 jobs in the last 4 months, Nov17-Feb18. That’s happened, for any 4-month period, only 5 times since 1984. The last time was 2005-06, during the fastest rate of spending increases since 1984.

Total all spending increased 55% since 2010, but there was 30% inflation. Real total volume since 2010 has increased by only 25%. Jobs increased by 30%, 5% in excess of volume growth. But the results are much different for Residential than Nonresidential.

Nonresidential spending increased 43% since 2010, but there was 30% inflation. Real nonresidential volume since 2010 has increased by only 12%. Jobs increased by 27%, 15% in excess of volume growth.

Residential spending increased by 110% since 2010, but after inflation, real residential volume increased by only 57%. Jobs increased by only 37%, 20% short of volume growth.

For more on Jobs see Construction Jobs and Residential Construction Jobs Shortages

Residential Buildings Spending

Total Residential spending in 2017 finished at $523 billion, up 10.6% from 2016. This is the 5th consecutive year that residential spending exceeded 10% annual growth. Average spending growth the last six years is 13%/year.

Residential spending in 2017 was 50% single family, 13% multi-family and 37% improvements. In 2011, improvements was 48% of residential spending.

Census does not include flood damage repairs (house shell remains intact but gut renovate) in improvements but does include full flood damaged structure replacements (structure rebuild permit classified as new) in improvements.

Residential spending is more dependent on new starts within the most recent 12 months than on backlog from previous starts. Total starts for the last 6 months are the highest since 2006, but % growth has slowed considerably. New starts in 2017 posted only 2% growth, but I expect that to be revised up to at least 4%. Similar growth of 6%-7% is expected for 2018. Slower growth is now expected after 5 years (2012-2016) of new starts increasing at an average 20%/year.

Residential 2018 spending growth is forecast to increase only 6% after five years over 10%. Total residential spending in 2018 is forecast at $552 billion.

Residential spending will reach a 12-year high in 2018. Residential spending reached its current $ peak of $630 billion in 2005. Current 2018 pending is still 13% below that peak. In constant $, adjusted for inflation, all years from 1998 through 2007 were higher than 2018. In constant $, 2018 spending is still 27% below the 2005 peak.

Residential buildings construction spending in constant $ reached $523 billion in 2017. Previous spending adjusted to equivalent 2017$ shows that all years from 1996 through 2007 had higher volume than 2017. Volume reached a peak $748 billion in 2005. Only the years 2004-2006 had higher spending in current $. The 2005 current $ peak of $630 billion is still 17% higher than 2017, but 2017 volume is still 30% lower than peak volume.

Nonresidential Buildings Spending

Nonresidential Buildings spending in 2017 finished at $419 billion, up only 2.7% from 2016.

2017 spending finished below my forecast due to performance in Educational and Office. Educational starts increased 6%+/year for the last three years, but spending increased only 4%/year the last two years. Office starts increased nearly 30% in 2016, but spending increased only 3% in 2017. I suspect either big upward revisions to 2017 spending or large increases in backlog will boost 2018 spending in these two markets.

Nonresidential Buildings new starts are up 60% in four years. 2018 starting backlog is the highest ever, up 15% from 2017. Nonresidential Buildings 2018 starting backlog is 50% higher than at the start of 2014, the beginning of the current growth cycle.

Starting backlog has increased for five years at an average 10%/year. Spending from starting backlog, up 10% in 2018, increased for five years at an average 9%/year.

For 2018, Educational spending is projected to increase 14%, the best increase since 2007. Starting backlog increased 10%/year for the last three years. Manufacturing posted several very large project starts in 2017. Spending is projected to increase 12% in 2018.

Nonresidential Buildings spending in 2018 is forecast to reach a new high, $459 billion, an increase of 9.5% over 2017, surpassing the previous 2008 high. Educational and Manufacturing make up 55% of the growth.

For the Full Expanded 2018 Construction Spending Forecast – Nonresidential Bldgs

Nonresidential buildings construction spending in constant $ (inflation adjusted $) reached $419 billion in 2017. In 2018 it will reach $439 billion. Constant $ spending shows all years from 1996 through 2010 had higher volume than the 2018 forecast. Volume reached a peak $536 billion in 2000 and went over $500 billion again in 2008. In constant $ 2018 is still 18% below that 2000 peak.

Non-building Infrastructure Spending

Total non-building infrastructure spending in 2017 dropped to $293 billion, down 3.7% from 2016.

Non-building Infrastructure spending, always the most volatile sector, dropped to yearly lows from June through September, the lowest since November 2014. However, this short dip was predicted. Cash flow models of Infrastructure starts from the last several years predicted that dips in monthly spending would be caused by uneven project closeouts from projects that started several years ago, particularly in Power and Highway markets.

Current backlog is at an all-time high and spending is expected to follow the increased cash flows from the elevated backlog. Environmental Public Works (Sewage/Waste disposal down 14%, Water Supply down 9% and Conservation/Dams & Rivers down 7% in 2017) posted the largest declines in 2017 and accentuated the declines in the infrastructure sector. The sector was expected to increase in the last quarter 2017. All three markets posted increases in the 4th quarter, up 8% over the 1st nine months of 2017.

Non-building Infrastructure 2018 starting backlog is the highest ever, up 10%+ each of the last 3 years. Transportation terminals new starts in 2017 jumped 120%. Rail project starts increased more than 100%. Starting backlog for all transportation work is the highest ever, up 100% in the last two years. Transportation spending is projected to increase 20-25%/year for the next two years.

No future growth is included from infrastructure stimulus and yet 2018 spending is projected to increase by 8%.

Non-building Infrastructure will reach a new high for spending in 2018. Spending reached an all-time high in 2015 and stayed within 0.3% of that high for 2016. A 3.5% decline in 2017 was more of a decline than expected, but there may still be upward revisions to the preliminary total.

Non-building Infrastructure spending in 2018 is forecast to reach $319 billion, an increase of 8.6% over 2017.

My forecast for 2018 is predicting every infrastructure market will post gains, but it is the Power and Transportation markets that account for most of the growth in 2018. Transportation new starts in 2017 grew 120% due to massive new air terminal and rail projects. Spending growth in the Power market is not quite so apparent. Combined Power new starts are down for both 2016 and 2017, but the spending gains are coming from projects that started in 2015, a year in which starts were up over 120%.

Adjusted for inflation, spending in 2018 will be nearly equal to the all-time highs reached in 2015 and 2016.

Non-building Infrastructure construction spending in constant $ reached $294 billion in 2017. Recent highs were posted in 2015 and 2016 at $305 billion and $304 billion and 2018 is expected to reach $319 billion. Previous spending adjusted to equivalent 2017$ shows that 2008 and 2009 were both just slightly higher than $300 billion. Constant $ volume reached a peak $313 billion in 2016. Spending in current $ hit new highs in 2015 and 2016. This is the only sector that has current $ and constant $ at or near all-time highs.

Public Infrastructure and Public Institutional

Only 60% of all Non-building Infrastructure spending, about $170 billion, is publicly funded. That public subset of work averages growth of less than $10 billion/year.

Only about 25% of all Nonresidential Buildings spending, about $100 billion, is publicly funded, mostly Educational.

- Infrastructure = $300 billion, 25% of all construction spending.

- Infrastructure is about 60% public, 40% private. In 2005 it was 70% public.

- Public Infrastructure = $170 billion. Private Infrastructure = $130 billion.

- Power and Communications are privately funded infrastructure.

- Nonresidential Buildings is 25% public (mostly institutional), 75% private.

- Educational, Healthcare and Public Safety are Public Nonres Institutional Bldgs

- Public Commercial construction is not included.

- Public Institutional = $100 billion, mostly Education ($70b).

Public Infrastructure + Public Institutional = $270 billion, 23% of total construction spending.

Public Infrastructure + Institutional average growth is $12 billion/year. It has never exceeded $30 billion in growth in a single year.

See also Publicly Funded Construction

See also Down the Infrastructure Rabbit Hole

Public Spending

Public construction is a subset of Nonresidential Buildings and Non-building Infrastructure and about 1% of Residential.

The two largest markets contributing to public spending are Highway/Bridge (32% of total public spending) and Educational (26%), together accounting for nearly 60% of all public construction spending. At #3, Transportation is only about 10% of public spending. Environmental Public Works combined makes up almost 15% of public spending, but that consists of three markets, Sewage/Waste Water, Water Supply and Conservation. Office, Healthcare, Public Safety and Amusement/Recreation each account for about 3%.

2017 spending was down 1%, but has been at or near the all time high for three years.

Total public spending for 2017 finished flat at $284 billion with most major public markets down for the year. By far, the largest Public spending declines in 2017 are Sewer and Waste Disposal which is 7% of public markets, it was down 16% and Highway/Bridge, down only 3.5%, but Highway is 32% of all public spending.

Public spending hit a low in June 2017. It has been increasing since then, Public Educational, in the second half 2017 up 10% from the low point, now at a post recession high. We can expect to see another six months of growth before spending levels off in mid-2018.

Due to long duration job types, 2018 starting backlog is up 30% in the last 3 years. In 2018, 40% of all spending comes from jobs that started before 2017. Leading 2018 growth are Educational (+15%) and Transportation (+35%), with a combined total forecast 20% growth in public spending.

Current levels of backlog and predicted new starts gives a projection that Public Non-building Infrastructure spending will reach an all-time high in 2018 and again in 2019.

Total Public spending in 2018 is forecast to reach $307 billion, an increase of 8% over 2017, the best growth in 10 years.

Educational and Transportation will contribute equally and together account for almost 60% of the Public spending growth in 2018. Transportation new starts in 2017 grew 120% due to massive new air terminal and rail projects. Educational new starts total for the last three months posted the highest quarter in at least seven years. The 2nd highest quarter was also within the last 12 months, so still contributes fully to 2018 spending. 2018 signifies a turn-round in Public spending which has not posted significant growth since the recession.

Public spending is 10%, $30 billion, below 2009 all-time highs, most of the deficit coming from declines in Educational, Sewage/Waste Water and Water Supply. In 2018, Highway and Transportation are at all-time highs.

Click here for a formatted printable PDF Construction Spending Forecast – Summary Mar 2018

See these posts for additional info

2018 Construction Spending Forecast – Nonresidential Bldgs

Starts Trends Construction 2018 Forecast – Fall 2017 11-8-17

Backlog Construction 2018 Forecast – Fall 2017 11-10-17

For more on Jobs see Construction Jobs / Workload Balance 11-7-17

For effects of inflation see Constant Dollar Construction Growth 11-2-17

Construction Activity Notes 4-25-18

Notes on March 2018 Construction Spending

Construction Economic Reports 2014-2015

Economic Report – Winter 2015-2016 – Executive Summary

Economic Report – Winter 2015-2016 Full

Economic Report – Summer 2015 – Executive Summary

Economic Report – Summer 2015 Full

Fall 2014_Winter 2015 Economic Report_Exec Summary

Fall 2014_Winter 2015 Economic Report Full

US Historical Construction Cost Indices 1800s to 1957

Historical Cost Indices Dating Back to 1800s

See pages 379-386 for indices

See page 387 for start of Housing

Chapter on Housing Historical Data

U S Census Historical Construction Spending Annual totals 1964-2002 USE Table 1

Spending Summary Construction Forecast Fall 2017

3-15-18 see also 2018 Construction Spending Forecast – Mar 2018

12-2-17

Summary

Total construction spending in 2017 will reach $1,236 billion, an increase of 4.2% over 2016. Residential spending is above 10% growth for the 5th consecutive year.

Year-to-date construction spending growth through October is 4.1%.

Residential leads construction spending growth in 2017 for the seventh consecutive year, up 10.6%. My Nonresidential Buildings forecast has been lowered since July but finishes the year up 2.8%. Only Non-building Infrastructure will not improve over 2016, down 3.7% for the year. However, Non-building Infrastructure has been at an all-time high for the previous two years.

This forecast is down slightly since July due to reductions in both nonresidential buildings and non-building infrastructure. Educational, Office, Power and Highway, four of the five largest markets which together make up half of all nonresidential spending, were all lowered. Some of these markets are prone to very large post-annual upward revisions and that has the potential to add to 2017 spending when those revisions are released in July 2018. In the July 2017 revisions, Power spending for 2016 was revised up by 10%.

History shows spending has been revised up 51 times in the last 55 months. I wouldn’t be surprised to see future revisions smooth out spending in unusually low periods (April and July) and increase total 2017 spending above this forecast. I suspect revisions in July 2018 may show 2017 spending as high as $1,250 billion. The average post-annual total spending revision for the last five years is +2.3%. The total revision to 2016 was only 2.2%.

None of the spending detailed in this analysis includes any projections of potential work from future infrastructure stimulus.

Total construction spending in 2018 is currently forecast to reach $1,334 billion, an increase of 8.0% over 2017. For the first time since pre-recession, Non-building Infrastructure will lead all spending with potential to increase by 10% growth over 2017.

Non-building Infrastructure is forecast to lead 2018 spending with an increase of 10.2% due to very large projects in Power and Transportation. Nonresidential Buildings growth is strong for 2018, forecast up 9.3%. Residential spending in 2018 slows to only 5.7% growth after six years averaging 13%/year.

Total spending will reach a new high in 2018 for the third consecutive year. However, in constant $ adjusted for inflation, spending is just back to the level of 2008. The all-time constant $ high was reached in 2005. Adjusted for inflation, 2018 will still be 12% below that level. At current rates of growth, we would not eclipse the previous high before 2022.

Growth of 8% in 2018 or $100 billion in construction spending demands a few words on jobs growth. Construction requires about 5000 workers for every added $1 billion in construction volume. Construction jobs have never increased by 500,000 in one year. However, $100 billion in added spending is not the same as $100 billion in volume, and jobs grow based on volume. Although spending will increase 8%, construction inflation has been hovering near 4.5% to 5% for the last five years. Real volume growth in 2018 after inflation is expected to be just over 3% or $40 billion. That would mean the need, if there are no changes in productivity, is to add about 200,000 additional workers in 2018, a rate of jobs growth that is well within reach since that is below the average jobs growth for the last seven years.

Residential Buildings Spending

Total Residential spending in 2017 will finish at $523 billion, up 10.6% from 2016. Residential spending is above 10% growth for the 5th consecutive year.

Residential spending was expected to dip between May and October due to a low volume of work contributed from starts cash flows. The actual data shows, after reaching a seasonally adjusted annual rate (saar) of $536 billion in March, the high for the year, spending dropped 3% to 4% to as low as $515 billion saar three times and has averaged only $520 billion saar from April through October. New starts in Q1’17 reached an 11-year high, so I expect the rate of spending to increase at year end. Residential work will close out the year with 10.6% growth, the 5th consecutive year over 10%. Average growth the last six years is 13%/year.

Residential spending is 50% single family, 13% multi-family and 37% improvements.

Residential Improvements has posted 18% growth year-to-date. Single Family spending is up 9% while multi-family is up only 4%. That is compared to 2016 when improvements for the year finished up 10%, SF up 4% and MF up 5%. Census does not include flood damage repairs in improvements but does include full flood damaged structure replacements in improvements.

Total residential spending in 2018 slows to a forecast of $553 billion, only 5.7% growth over 2017.

Due to the shorter duration of projects, nearly 70% of residential spending within the year is generated from new starts. Unlike Nonresidential, backlog does not contribute nearly as much to Residential spending within the year. New Residential starts in Q1’17 reached an 11-year high. Residential starts are at a post-recession high.

Residential spending will reach a 12-year high in 2018. Adjusted for inflation, all years from 1996 through 2007 were higher. Inflation adjusted spending is still 30% below the all-time high reached in 2005.

Nonresidential Buildings Spending

Total Nonresidential Buildings spending in 2017 will come in at $420 billion, up only 2.8% from 2016.

Commercial/Retail is expected to finish the year with +13% growth and Lodging +9%. An unexplained surprise was Office, which by early indicators was predicted to show large gains in spending. Two independent sources reported new office starts in 2016 up 25% to 30%. Starting backlog coming into 2017 was near or at an all-time high. Spending was forecast to jumped at least 20% in 2017. Instead, spending posted declines from May to September and is now forecast to finish with only a 4% gain. This market accounts for the single largest miss in my forecast posted in Feb 2017.

The only major nonresidential building in decline this year is Manufacturing. Manufacturing spending was expected to fall in 2017 after peaking in 2015 from massive growth in new starts in 2014. Spending stayed close to that level in 2016. Based on cash flows from starts, spending was expected to decline in 14 of the last 18 months. It declined in 11 of those months. We are at the point of turn-around with only one monthly decline predicted in the next three months and no spending declines expected next year. For 2017, Manufacturing new starts are up 35%.

Nonresidential Buildings starts in the six months from Aug 2016 to Jan 2017 posted the (then) highest amount of new starts since Jan-Jun 2008, also the year Nonresidential Buildings spending peaked. Then new starts in the six months Apr-Sep 2017 just surpassed both those previous peak highs.

Nonresidential Buildings 2018 starting backlog is 50% higher than at the start of 2014, the beginning of the current growth cycle. Starting backlog has increased for five years at an average 10%/year. Spending from starting backlog, up 10% in 2018, increased for five years at an average 9%/year.

Total nonresidential buildings spending in 2018 is forecast to reach $458 billion, an increase of 9.3% over 2017. Office, educational and manufacturing make up 70% of the growth.

Nonresidential Buildings will reach a new high for spending in 2018, surpassing the previous 2008 high. However, adjusted for inflation, spending is 18% below the all-time high reached in 2000.

Non-building Infrastructure Spending

Total non-building infrastructure spending in 2017 drops to $293 billion, down 3.7% from 2016.

Non-building Infrastructure spending, always the most volatile sector, dropped to yearly lows from June through September. Infrastructure construction spending in August dropped to the lowest since November 2014. However, this was predicted. Cash flow models of Infrastructure starts from the last several years show current dips in monthly spending are being caused by uneven project closeouts from projects that started several years ago.

Current backlog is at an all-time high and spending will follow the expected increased cash flows from the elevated backlog. Environmental Public Works (Sewage/Waste disposal down 16%, Water Supply down 9% and Conservation/Dams & Rivers down 7%) posted the largest declines in 2017 and accentuated the declines in the infrastructure sector. The sector is expected to increase slightly in the last quarter 2017. In recent months there are already substantial gains being posted in Conservation and Transportation.

No future growth is included from infrastructure stimulus and yet 2018 is projected to increase by 10%.

Total non-building infrastructure spending in 2018 is forecast to reach $324 billion, an increase of 10.5% over 2017. My forecast for 2018 is predicting every infrastructure market will post gains, but it is the Power and Transportation markets that account for almost all the growth in 2018. Transportation new starts in 2017 grew 120% due to massive new air terminal and rail projects. Spending growth in the Power market is not quite so apparent. Combined Power new starts are down for both 2016 and 2017, but the spending gains are coming from projects that started in 2015, a year in which starts were up over 120%.

Non-building Infrastructure will reach a new high for spending in 2018. This sector had posted a new high in 2015 and nearly equaled that in 2016. Adjusted for inflation, spending in 2018 will be nearly equal to the all-time highs reached in 2015 and 2016.

Public Spending

Total public spending for 2017 remains flat at $287 billion with most major public markets down for the year.

At midyear, I expected Educational and Highway to support a Public spending increase in 2017. Those gains did not materialize. A decline in Highway spending offset small gains in Educational. By far the largest Public spending decline is in Sewer and Waste Disposal, down 16%.

Public spending hit the low for the year in July. It increased for the last three months, most recently by an 11% increase in Public Educational spending in October. We are now near the high for the year and can expect to see another six months of growth before spending levels off in mid-2018.

When you see graphics that present Residential, Nonresidential and Public spending all on the same plot, they are not additive. Only Residential and Nonresidential can be added to reach total spending. Public is a subset of Nonresidential, composed partly of Nonresidential Buildings (~40%) and partly Non-building Infrastructure (~60%), with a slight amount of residential.

The two largest markets contributing to public spending are Highway/Bridge, 32% of total Public spending, and Educational, 25% of Public spending. The third largest market, Transportation, is only about 10% of Public spending. Environmental Public Works combined makes up almost 15% of public spending, but that consists of three markets, Sewage/Waste Water, which accounts for 8%, Water Supply and Conservation. Office, Healthcare, Public Safety and Amusement/Recreation each account for about 3%.

All of Highway/Bridge is Public spending. Only 80% of Educational spending is Public and only 70% of Transportation is Public. Environmental Public Works markets are 99% Public.

Total Public spending in 2018 is forecast to reach $305 billion, an increase of 6.3% over 2017. Public spending in 2018 will reach the highest year over year growth since 2008.

Educational and Transportation will contribute equally and together account for almost 60% of the Public spending growth in 2018. Transportation new starts in 2017 grew 120% due to massive new air terminal and rail projects. Educational new starts total for the last three months posted the highest quarter in at least seven years. The 2nd highest quarter was also within the last 12 months, so still contributes fully to 2018 spending. 2018 signifies a turn-round in Public spending which has not posted significant growth since the recession.

See this companion post for Starts Trends Construction Forecast Fall 2017 11-8-17

After New Starts, dollars are tracked in Backlog, Backlog Construction Forecast Fall 2017 11-10-17

For more on Jobs and Workload see Construction Jobs / Workload Balance 11-7-17

For effects of inflation see Constant Dollar Construction Growth 11-2-17

What Are You Reading 2016

Thank you to all my readers for making this construction economics blog worthwhile. Here’s ten of my most visited articles in 2016.

Construction Cost Inflation – Midyear Report 2016

Construction Inflation Indices

Starts Point to Robust 2017 Spending

Construction Spending 2016 – Midyear Nonresidential Markets

Construction Spending 2016 – Midyear Summary

How Much Does A Steel Cost Increase Affect Construction?