Home » Posts tagged 'productivity'

Tag Archives: productivity

Construction Data Briefs Sept data 11-7-23

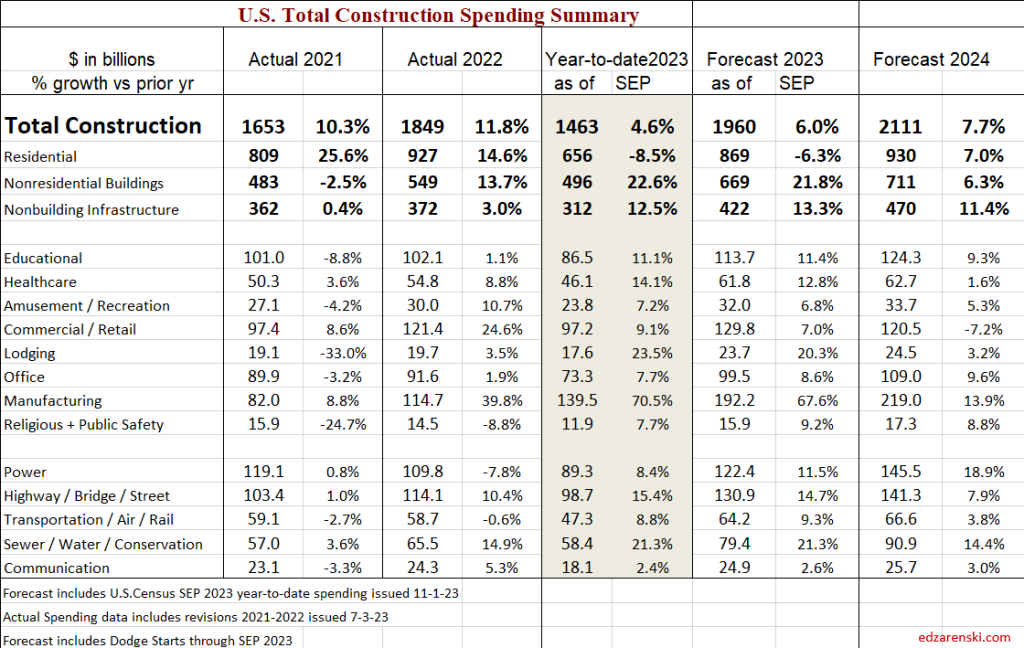

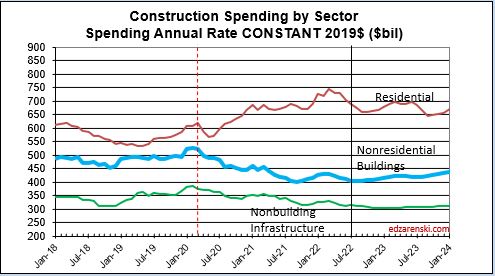

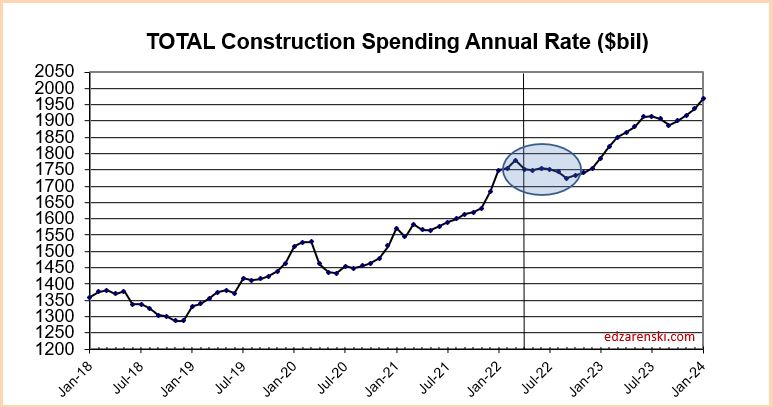

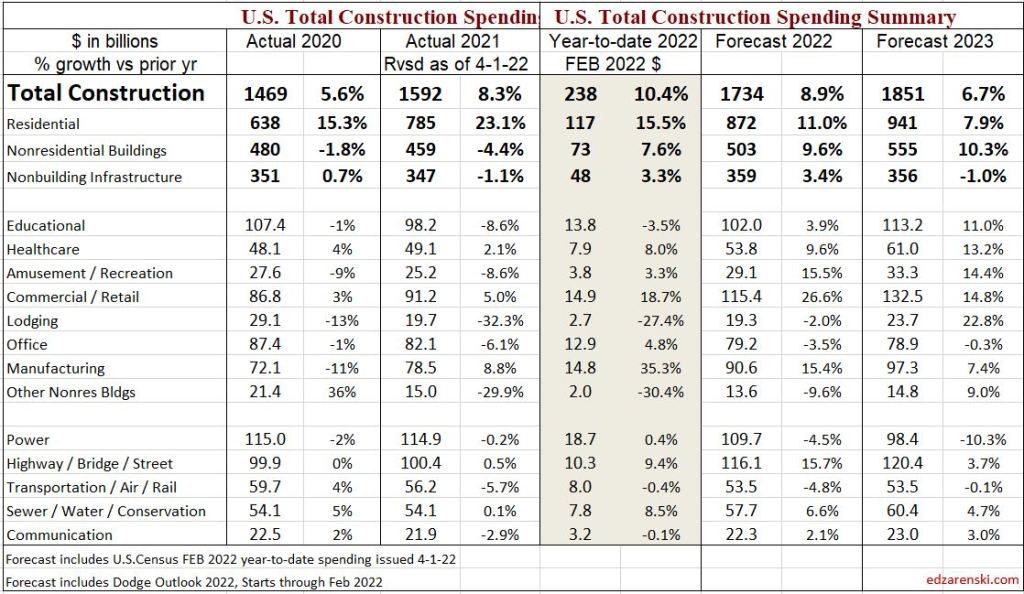

Total Construction Spending in 2023 is forecast at $1,960 billion, an increase of 6.0% over 2022.

Nonresidential Buildings spending is leading Construction spending growth.

With nine months in the year-to-date (ytd) for 2023, total all construction spending ytd is up 4.6%. Nonresidential buildings spending is up 22% ytd compared to Jan-Sep 2022. Manufacturing last month was up 72% ytd. I forecast then it would drop to 66% and this month revised that to 67%. Current ytd dropped this month to 70%.

Construction Spending thru Sept. Residential is down 8% ytd. Could add 7% in 2024. Nonresidential Bldgs is up 22% ytd. Expect +6% in 2024 Non-building Infrastr is up 12% ytd and could add another 11% in 2024

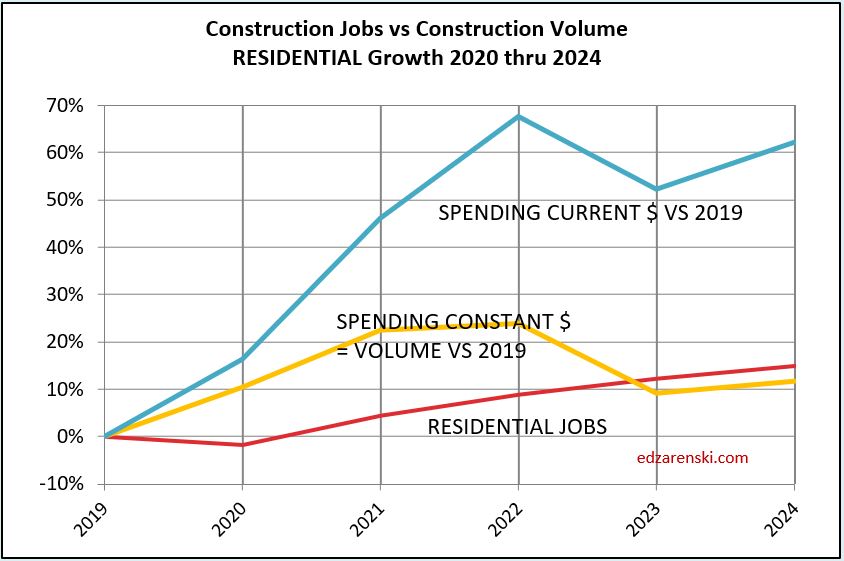

Residential construction spending fell only 8% from Mar’20, the pre-recession high, to May’20, the Covid low. From May’20 to May’22, spending increased 67% to the post-recession high. Since May’22 spending is down 12%.

Manufacturing construction spending, from 2015-2021, averaged $80bil/yr. For 2023-2025, manufacturing constr spending will average $200bil/yr.

Highway spending in 2023 is averaging $130bil and is expected to finish the year at $131bil. That’s up 15% from 2022 and up almost 27% in the last two years. Highway spending is expected to increase 25% over the next two years and may continue upward to a peak spending in 2026.

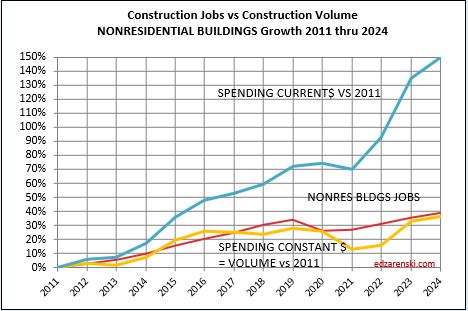

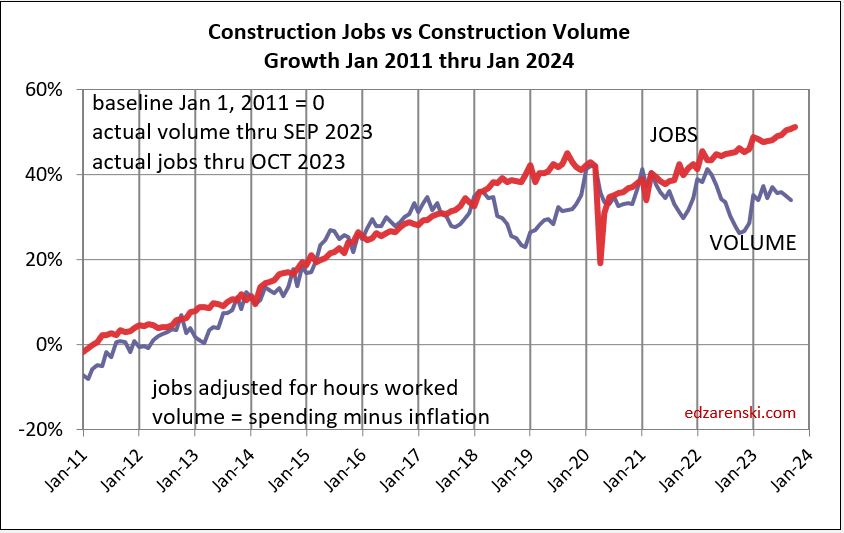

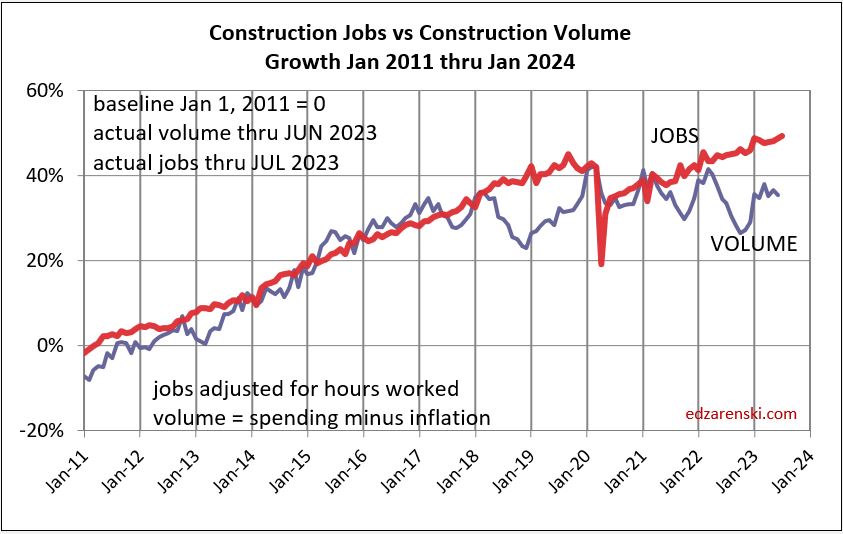

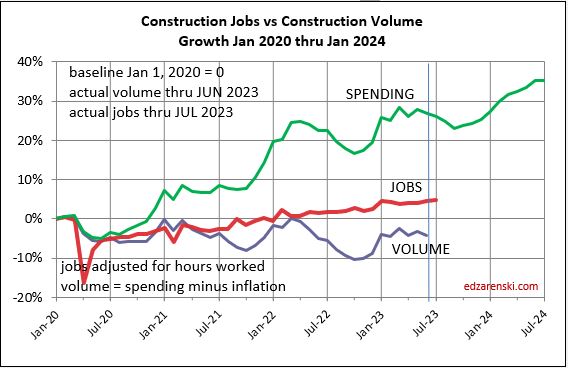

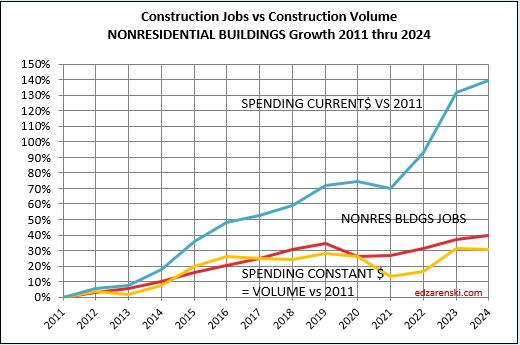

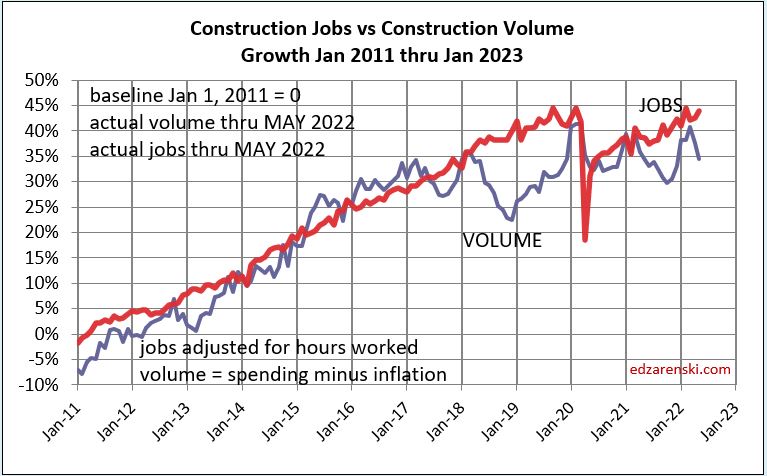

After nearly 8-10 years of fairly well balanced construction volume of work vs jobs, the last 2-4 yrs of volume growth (spending minus inflation) well below jobs, is now coming back into balance. Nonres Bldgs and Non-bldg volume (+11% & +6%) increased to support jobs. Jobs grow steady at 2.8%.

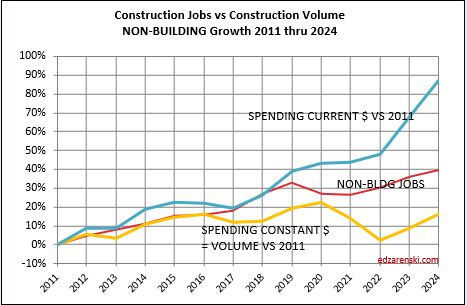

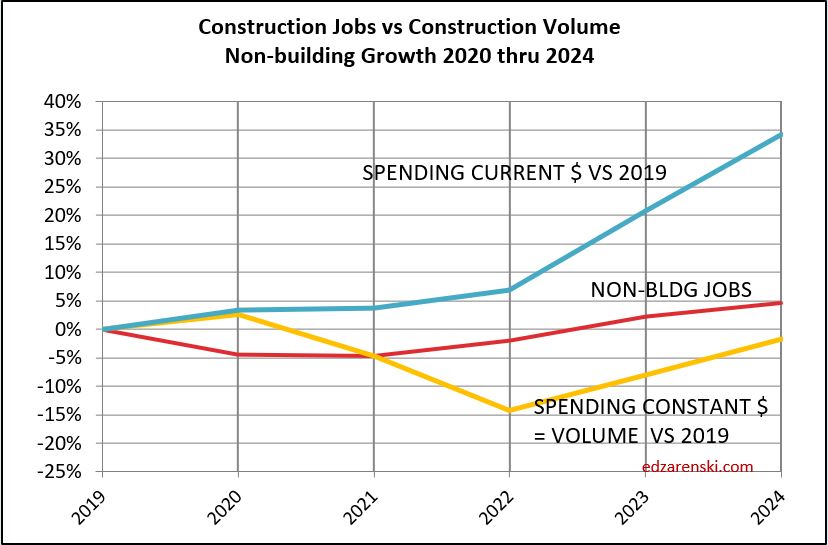

Non-bldg has a ways to go to get to balance. That work volume is on it’s way in the forecast, particularly from Highway and Public Utilities.

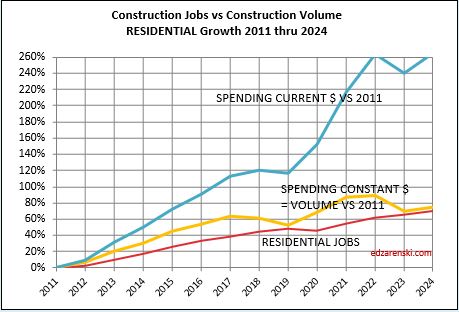

Actual residential jobs is probably higher than shown here as there are several issues with capturing all residential jobs.

Sum of all jobs vs Construction volume from 2011-2018 was balanced. In recent years, 2021-2023, jobs grew faster than volume. Nonres is now playing catch-up, volume is increasing faster than jobs..

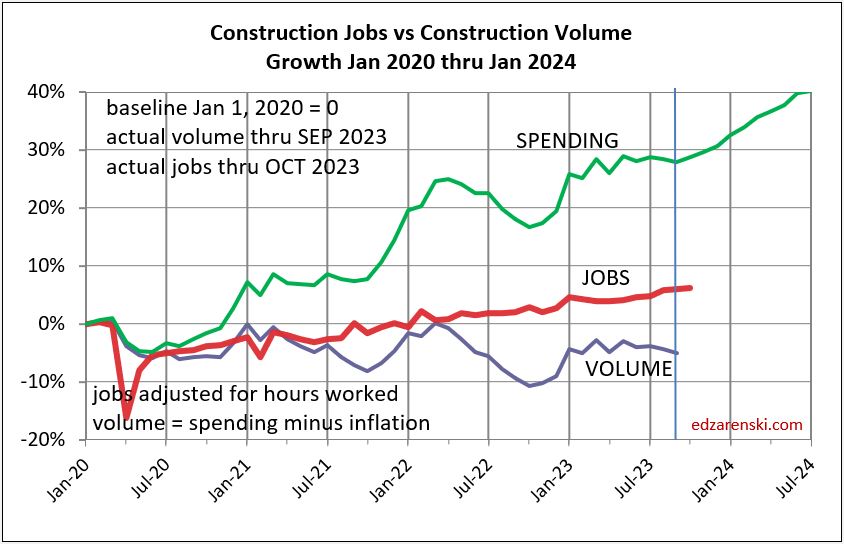

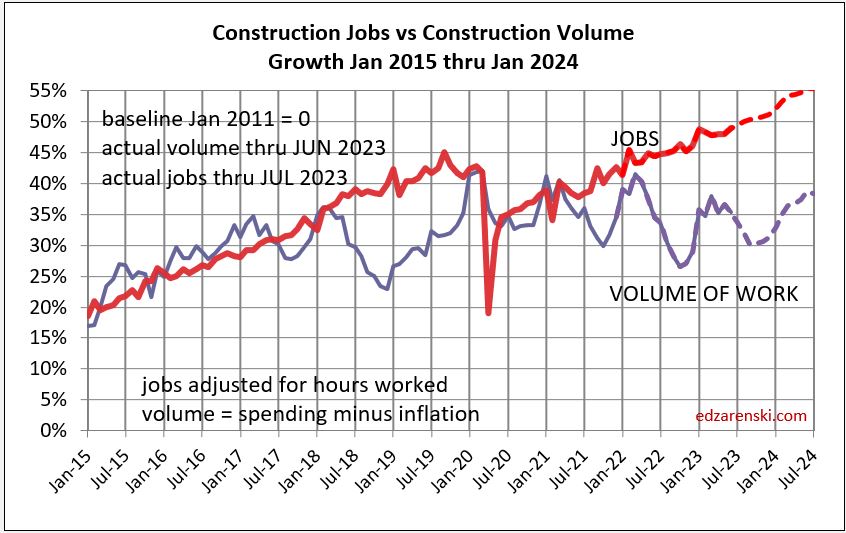

Construction Jobs x hours worked is up 6% since the pre-pandemic high in Q1 2020. Construction volume (spending minus inflation) is down 5.5% since Q1 2020. These two indicators should move in tandem. (See plot above from Jan2011 to Jan2018) When jobs increase faster than the volume of work, productivity is declining.

For 2024 and 2025, volume of work is forecast to increase 3.5% and 4.0%. Most of that gain in 2024 and 2025 is from Non-building Infrastructure forecast growth of 7% and 8%. Jobs increase at a normal rate of 2.5% to 3.0% per year, so this growth in volume will go a long way towards setting jobs vs volume closer to balance.

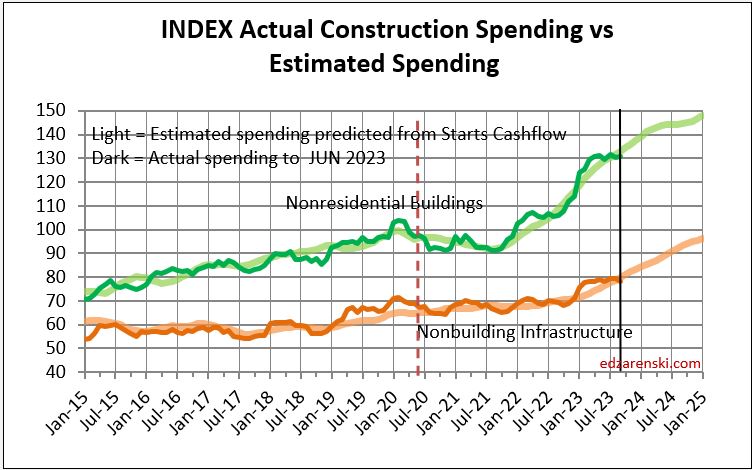

An indicator I track looks at the predicted final spending (for Nonresidential buildings) for the year based on a projection based on the ytd for the statistically strongest months of the year, AMJJAS. These six months each average annual spending variation from average with standard deviation of less than 0.2%. This subset of annual data has produced an annual forecast within less than 2% variance from actual for 22 years. In fact, in 22 years this forecasting check has varied from actual by greater than 1.5% only twice. The average variation for 22 years is 0.7%. Only once in 22 years has the actual annual spending fell outside the range predicted by the statistically strongest months.

Another indicator I track is the forecast vs the actual spending. This plot shows Nonres Bldgs and Non-bldg Infra forecast vs actual. The track of actual spending is bumpier, but tracks right along with the forecast. My plot for residential was on track until the surge in 2020-2021.

Midyear ’23 Jobs Outlook

Construction JOBS continue to creep higher, even when volume is falling. From Apr’22 to Oct’22 jobs increased 1.5% but volume of work dropped 10%. Jobs and volume should track together as seen from 2011 to 2018. Since Oct’22, jobs are up only 2% while volume up 7%. Volume is catching up.

Jobs have been increasing at 3%/year, or approx 200k to 300k jobs per year. In Feb 2020 there were 7.6 million construction jobs. Now there is almost 8.0 million. The average for 2020 dropped 3% or 170k jobs. But we regained jobs at 2.5% growth in 2021, 4.2% in 2022 and so far over 2% in 2023. Now this is interesting, because we did not see an increase in average volume in 2021, 2022 or 2023. In total, jobs are up 4.8% since Feb 2020, while volume of work is down 4.7%.

Construction Jobs have been on an even rate of growth approx. 2.5% to 3% per year, even when volume is falling. Spending has been on a bumpy climb, but keeps climbing. Without inflation real volume of work overall since 2020 has not increased at the same rate as jobs.

Current July Jobs are up 1.5% since Dec.’22, up 3% vs the average for 2022. July will be pretty close to the average for 2023. As construction inflation slowed down (has been slowing since mid-2022), volume gained ground on jobs over the last 9 mo., but jobs since Jan 2020 are still 10% higher than volume.

Here’s a look at total jobs just since 2020

Why do jobs sometimes/often grow faster than volume to support those jobs? Some possibilities:

When inflation is unusually strong, business planners may misjudge growth. Planning jobs growth on inflated revenues that net much lower than expected volume may lead to misjudging jobs growth. Result is jobs growth faster then volume.

When volume is decreasing, firms may be reluctant to (or smart not to) let go jobs. See the period on the above plot from Mar 2022 thru Oct 2022. Vol dropped 10%, Jobs increased 2%. So, the calculation shows a big excess in jobs for that period, because volume growth doesn’t support it. Within the next six months, volume increased 7%, making up half the difference.

Here’s jobs vs vol in each sector.

Notice how Rsdn jobs barely declined in 2020, but Rsdn volume increased 10%. Did that set off cries of jobs shortage in Rsdn? Not so in Nonres.

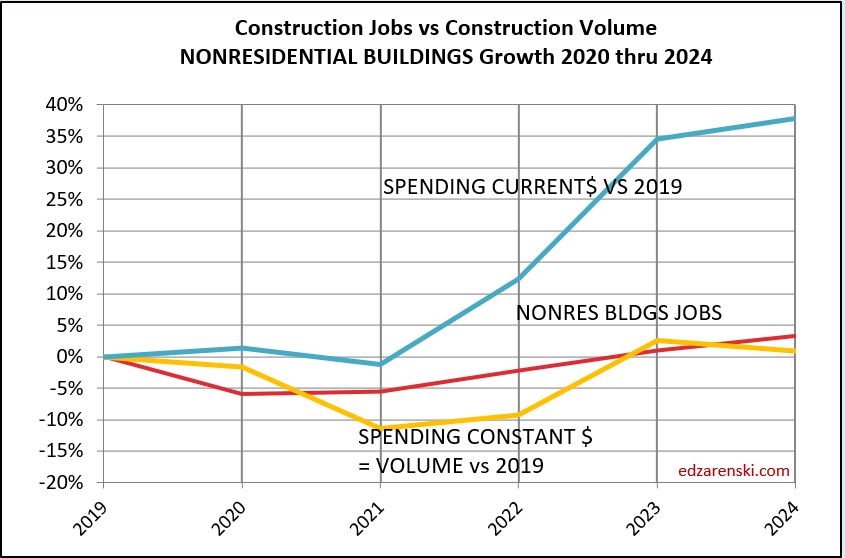

In Nonres Bldgs, volume by 2021 had fallen below growth in construction jobs. The deficit reached its worst in 2022 but in the last 9 months volume growth far faster than jobs growth has evened the balance.

Nonbuilding construction volume fell to a deeper deficit than Nonres Bldgs. But we can see the gap closing as volume increases faster than jobs.

These above three sector plots go back to base 2019, showing how much percent change there has been since 2019. For a longer term look, here below is a plot of Nonresidential Buildings back to 2011. On this plot we can see jobs growth, when compared to 2011, for Nonres Bldgs, is above volume growth since 2017. The low point of volume was in 2021. 2022-2023 has posted the most rapid growth in many years. This closes the gap between Nonres jobs and volume, very helpful to the productivity outlook.

When splitting out jobs by sector we must always remember that some Nonres bldgs jobs actually work on constructing residential buildings (for ex., steel and concrete on a multifamily hirise) but remain counted as nonres jobs. Also, some undocumented workers may not be counted at all in residential jobs. That skews the data plots. But you can see that it would reduce the jobs in Nonres and increase the jobs in residential, improving both plots.

Construction spending data is indicating a slight dip in volume growth over the 2nd half 2023, but then leading into much stronger growth in 2024 in all sectors. Volume by Feb’24 is back to today’s level after falling 5%. I don’t expect jobs to decline with the drop in volume. Maybe slow down. I think at worst jobs hold steady for a few months before resuming 2.5%-3% annual growth later this year.

When jobs continue to increase while volume is dropping, that wrecks productivity. But sometimes volume increases rapidly while jobs grow steady at a 3% rate. Look at the period Oct’22 thru Jan’23. Jobs increased 2%, but volume quickly jumped 6%.

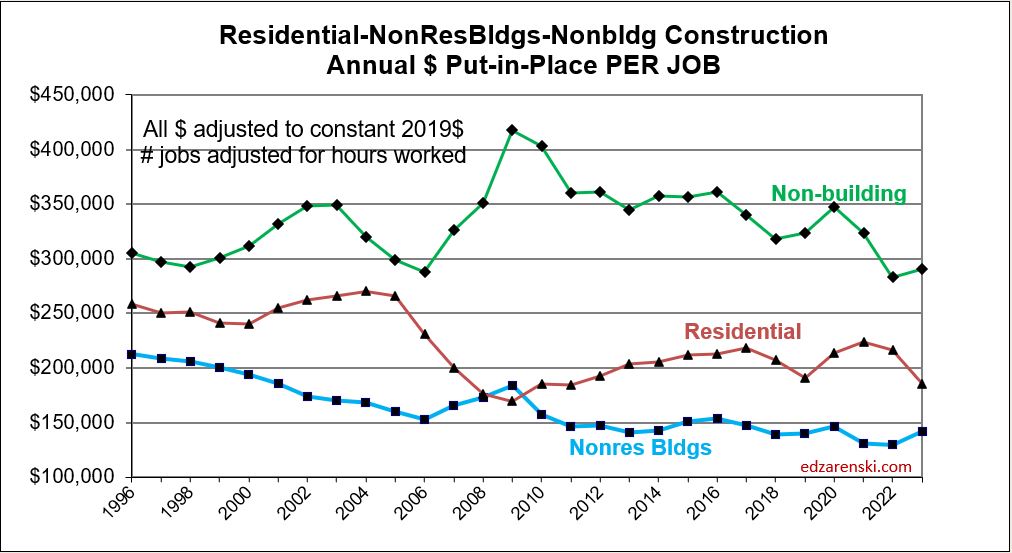

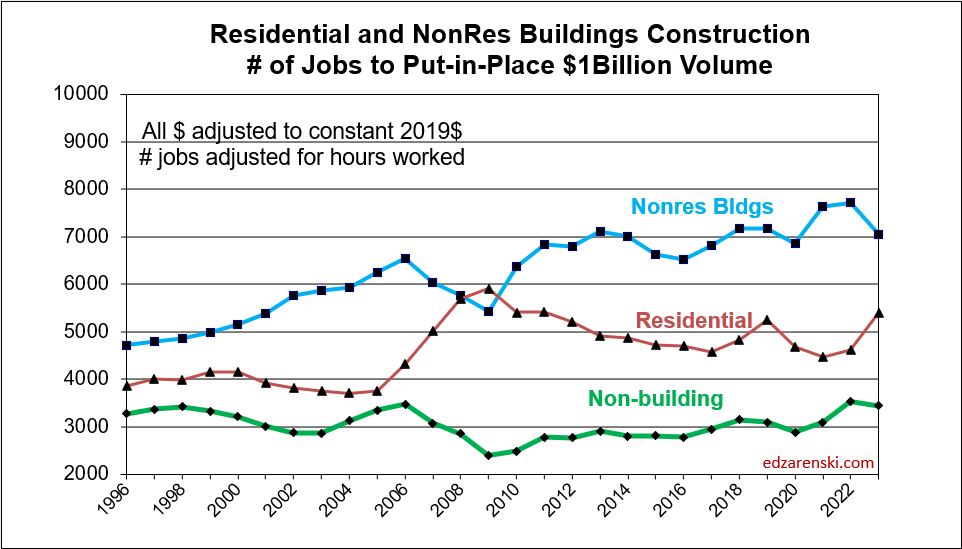

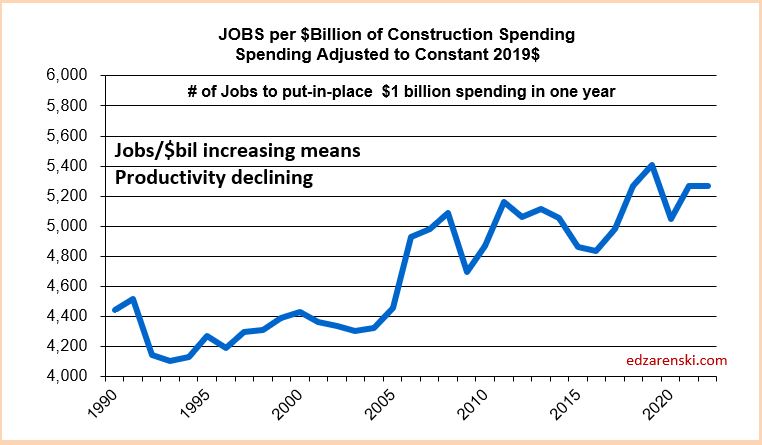

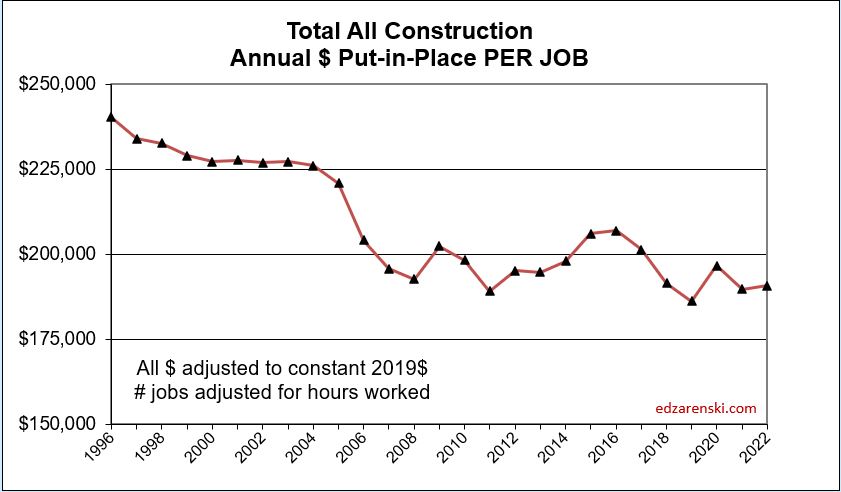

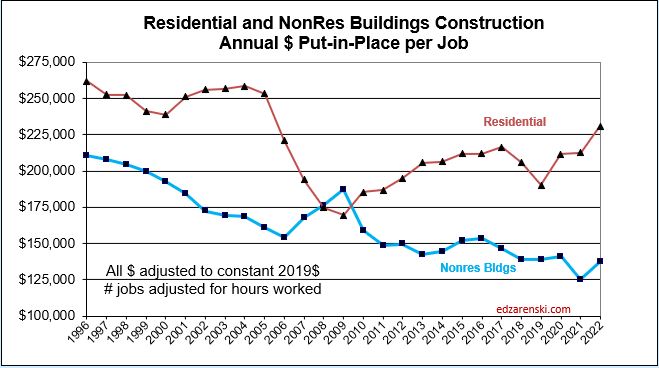

The number of jobs required to put-in-place $1 billion of construction in one year, as plotted below, about 5000 for residential, is the inverse of the plot above, the annual amount of $ put-in-place per job, about $200,000 for residential.

Construction Spending – Volume – Jobs

12-3-22

This plot is not showing good performance. Volume and jobs should be moving directly in tandem. When inflation is very high, spending climbs rapidly. But most of the climb is just due to inflation. To find out what’s really going on we need to look at business volume. Take out the inflation $.

Business volume = Spending minus Inflation. Inflation adds nothing to business volume. Inflation adds only to the amount of revenue that changes hands.

In 2022, residential spending is up 16%. Sounds great, homebuilder’s revenues are up 16%. It’s great until you note that residential inflation for 2022 is 15%. Real residential business volume for 2022 increased only 1%.

Since Jan.2020 spending is up 20%. Revenues are up 20%. It’s pretty hard to not think you need additional staff to support 20% growth in revenues. But inflation is 30%. Take out the inflation dollars and we find that volume is DOWN 10%. Well, during that time, jobs increased 1 to 2%. And yet, business volume is down 10%. That’s a massive 11%-12% loss in productivity. With labor being about 35% of the total cost of a job, that’s added about 4% to total inflation.

I recently read an article that stated (attributed to Assoc. Bldrs. & Contractors) that the construction industry needs to add 1,000,000 jobs over the next two years. Here’s why that won’t happen:

1) The construction industry has never added more than 440,000 jobs in one year. It’s only gone over 400,000 four times in 50 years, the last time 2005, and never two years in a row. The most construction jobs added in a year since 2011 is 360,000 in 2014. The average growth rate from 2011 thru 2019, and now also in 2022, is 230,000 jobs per year. The most jobs added in any two consecutive years is just over 700,000 in 1998-99 and 2005-06. So, the construction industry may not have the capacity to grow 1,000,000 jobs even in two years.

2) Since the Pandemic, nonresidential construction volume is down 20%, but nonresidential jobs are down only 1.5%. Compared to 2019, nonresidential construction has an 18% business volume deficit. In other words, Nonres construction in 2022 now has 18% more jobs per volume of work put-in-place than it did in 2019. Total ALL construction business volume in that period is down 10% while jobs are up 1.5%.

3) Inflation is playing a key roll here. In 2022, construction spending is increasing $160 billion or 10%. But inflation is 13%. Real total construction business volume in 2022 is down 3%. Jobs are up. For 2023, spending is forecast to gain $80 billion, 4.6%, but after inflation volume will be down 1%. 2023 numbers are driven down by residential.

4) In 2023, nonresidential volume increases $35 to $40 billion. Residential volume drops $50 billion. It takes 4000 to 5000 jobs to put-in-place $1 billion of volume in one year. Nonbuilding and nonresidential buildings growth of $40 billion would need 160,000 to 200,000 new jobs. Some small amount of that will come from the drop in residential. But, go back and read #2 again.

Since Jan 2020, the construction industry as a whole has nearly +175,000 (+2%) more workers to put-in-place -$175 billion (-10%) LESS volume. That’s a huge loss to productivity that may take years to recover, if ever.

Construction Briefs Nov’22

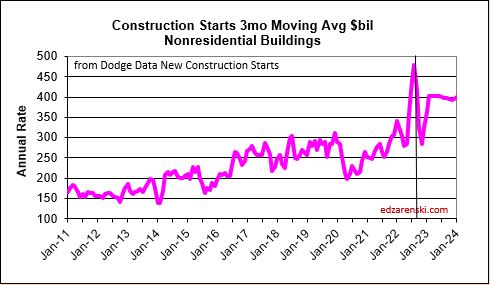

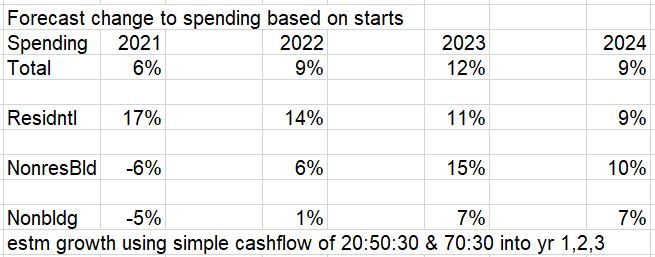

Construction is Booming. Well, OK, construction is setting up to be booming in 2023-2024. New construction starts for Sept are down 19% from August and yet starts are still near the highest levels ever. Sept is 4th highest total starts ever, all four of the highest ever months of new starts are in 2022. July and Aug were the two highest months of new starts ever. Total growth in starts over 2021-2022 > Nonres Bldgs +50%, Nonbldg Infra +40%, Residential (all in ’21) +22%.

STARTS

Construction Spending will not be participating in a 2023 recession. Except, residential might. Residential starts in 2021 were up +21% to a really high new high. But starts are forecast flat in 2022 and 2023. Spending grew 44% in the last 2yrs, but inflation was 30% of that 44%. With zero growth in starts forecast for 22-23, spending struggles to keep up with inflation. Residential will post only an increase of 3% in 2023 spending, but midyear there is potential for 6 consecutive down months.

See also Construction Year-End Spending Forecast Dec’22

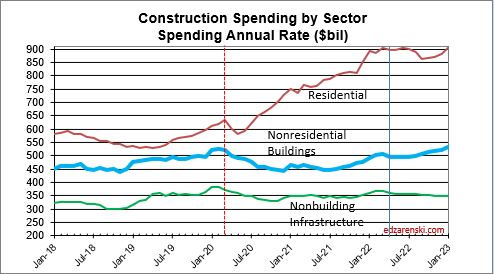

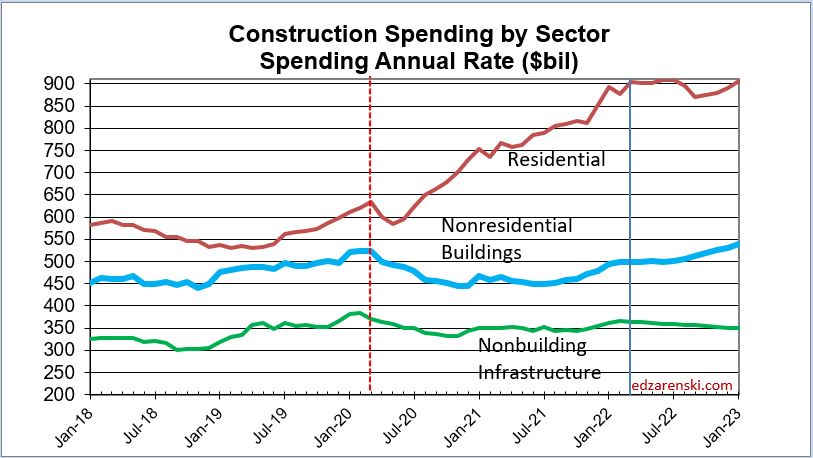

SPENDING BY SECTOR CURRENT $ AND INFLATION ADJUSTED CONSTANT $

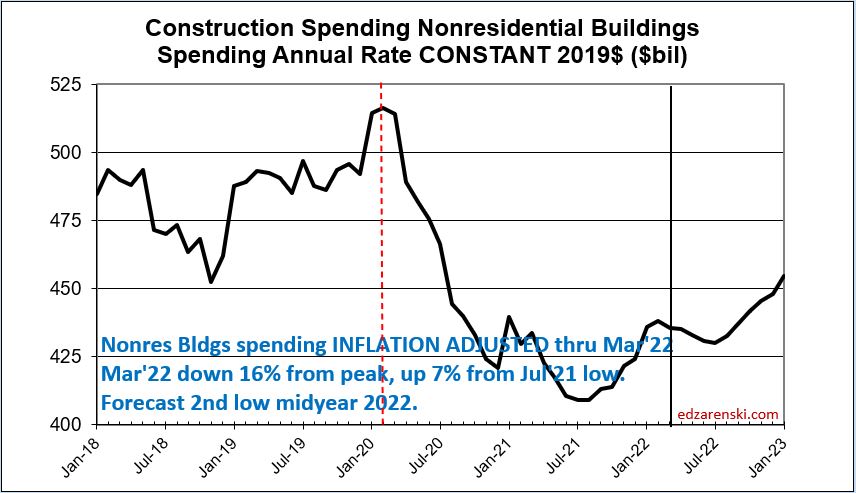

Nonresidential Buildings new starts last 2yrs (2021-2022) are up 50%. Spending next 2yrs (23-24) is forecast up 21%.

Nonbldg starts 2022-23 are forecast up 38%. Spending 2023-24 forecast up 20%.

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Nonbuilding Infrastructure leading spending growth. Both are expected to grow more than the inflation index, so there will be real volume growth to report.

Residential construction (Dodge) starts since Jan 2021 have posted 17 out of 21 months of the highest residential starts ever posted. The 5 highest months ever are all in 2022.

Nonresidential Bldgs starts in Sept dropped 23% from August and yet still that was the 3rd highest month ever. July and August were 2nd and 1st.

Construction starts for Nonresidential Bldgs posted each of the last 4 (consecutive) months thru October higher than any months ever before. The avg of last 4 (consecutive) months is 33% higher than the avg of the best previous 4 mo ever (even non-consecutive). Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150% year-to-date.

Construction Spending Sept total up 0.2% from Aug. Aug & Jul were revised up 1.1% & 1.3%. Total spending YTD thru Sept’22 is up 11.4% from Sept’21. MAJOR movers; Mnfg up 16% since Jun. Jul & Aug were revised up 7.4% & 8.4%. Highway is up 9% since June. Jul & Aug were revised up by 4.0% & 4.4%.

SPENDING FORECAST

Total construction spending for 2022 is on track to increase +11.1%. Residential +16.8%, Nonres Bldgs +9.5%, Nonbldg +0.5%.

Comm/Rtl +18% Mnfg +32% Power -8% Pub Utilities +14%.

Current and predicted Inflation SEE Construction Inflation at Year-End 2022

Inflation adjusted volume is spending minus inflation.

Total volume for 2022 falls 1%. Rsdn +3%, Nonres Bldgs -1%, Nonbldg -9%.

Total volume for 2023 is up 1%. Rsdn -3%, Nonres Bldgs +8%, Nonbldg +2%.

SPENDING TOTAL ALL $ CURRENT $ AND INFLATION ADJUSTED CONSTANT $

Overall Construction Spending is up 15% since the onset of the pandemic, but, after adjusting for 25% inflation, volume is down 10%. Residential jobs are near even on track with volume, but Nonres and Nonbldg have volume deficits of approx 20-25% vs jobs.

- Feb 2020 to Aug 2022

- Resdn spend +42%, vol +6.5%, jobs +7%

- Nonres Bldgs spend -8%, vol -24%, jobs -3%

- NonBldg spend -7.5%, vol -24%, jobs +1%

JOBS VS CONSTRUCTION VOLUME VS SPENDING (VOL = SPENDING MINUS INFLATION

Labor Shortage? Jobs should track volume, not spending growth. Vol = spending minus inflation. Volume is down while jobs are up. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 20% with no increase in nonresidential jobs. I don’t expect that to occur, therefore, productivity will remain well below that of 2019.

LABOR PRODUCTIVITY

Over the next year or two, there could be several billion$ of construction spending to repair hurricane damaged homes in Florida. That spending will NOT be reported in Census spending reports. Renovations to repair natural disaster damage are not recorded in construction spending. Construction spending to replace homes entirely lost to damage IS reported in Census spending, but is reported as renovations/repair, not new SF or MF construction.

RESIDENTIAL SPENDING SF-MF-RENO CURRENT $ AND CONSTANT $

Construction Jobs and Inflation

Construction jobs through August 2022 increased to 1.1% above the pre-pandemic high in Q1’20. Factoring in hours worked, we find that is reduced slightly to show jobs x hours worked for August 2022 is 0.4% lower than the peak in Q1 2020. Most anyone would say jobs have returned to the pre-pandemic high.

Construction spending through July is 14.3% higher than the pre-pandemic high in Q1’20. BUT INFLATION through July is 23% higher than pre-pandemic Q1’20. Therefore real construction volume (spending minus inflation) is currently 7% BELOW the pre-pandemic high in Q1 2020.

Jobs are up, but volume is down.

So, when you read that jobs are back to pre-pandemic levels, maybe that’s not as great as you might think. Sure more people are back to work, but has the volume of work needed to support those jobs increased sufficiently?

Inflation hides a lot of reality. We now produce 7% less volume of work put-in-place with 1.1% more workers putting in 0.4% less hours than before. That’s a huge construction productivity loss, down 6.6% in the last 30 months. Where does that productivity loss show up in the data?

Here’s the plot of actual and forecast CONSTRUCTION SPENDING. Compare this to the next plot.

Here’s the plot of actual and forecast CONSTRUCTION SPENDING ADJUSTED FOR INLATION.

Notice, Residential volume is up 11% since Q1 2020, but nonresidential buildings volume is still down 23% and non-building volume is down 18%.

Let’s say construction labor is 35% of total construction cost. If wages go up by 5%, then total cost goes up by 5%x35% = 1.75%. Well, if productivity declines by 6.6%, labor cost goes UP by 6.6%x35% = 2.3%.

That’s the inflation cost. Here’s a look Behind the Headlines. These two plots show the number of jobs required to put-in-place $1 billion of volume (inflation adjusted spending) or the inverse, the amount of volume put-in-place by one job in one year.

It’s great that jobs are coming back, but don’t overlook the cost that has added to inflation. Don’t expect to see a lot of improvement over the next 12 months. In fact, if jobs continue to grow at the current rate (or any rate for that matter), this time next year the imbalance is worse.

Burning Questions – Recession, Labor, Infrastructure

I gave two conference presentations in the past month. The most pressing questions from the audience were:

Are we headed into a recession? When will recession start?

What can be done about the labor shortage?

How can we support all the infrastructure work that is about to begin?

RECESSION

There is no question the sizable drop in starts in 2020 lead to a downturn in construction spending, mostly felt in 2021, but extending somewhat into 2022. However, this quickly turned around for residential spending and nonres bldgs spending is now past the low point caused by the pandemic initiated slowdown. With new construction starts to date at all-time highs and the forecast for new construction starts in the pipeline, it’s hard to envision how this would lead to a construction recession.

- In 2021, new starts increased 17%. Residential +21%, Nonres Bldgs +15% and Nonbldg +9%.

- In 2022, new starts are forecast up 11%. Residential +10%, Nonres Bldgs +18% and Nonbldg +4%.

- In 2023, new starts are forecast up 10%. Residential +12%, Nonres Bldgs +7% and Nonbldg +11%.

Total of all starts year-to-date in 2022 are up 6% over Jan-May 2021. Nonres bldgs starts are up 17% year-to-date. For the past 6 months, Dec’21 to May’22, residential construction starts posted 5 of the 6 highest months ever. The 6mo total for residential starts is the highest 6mo total ever recorded, up 4% over the previous 6mo record, posted in 2021.

Residential new starts get spent at a ratio of 70:30. Nonresidential Bldgs spending from new starts, on average, gets spent over the next 3 years in the ratio of 20:50:30. That is, 20% of spending from all starts within the year gets spent within the year started, 50% gets spent in the following year and 30% gets spent in the 3rd and sometimes 4th year. So from this we can say, if new starts are up 10% for the year then spending from that source will increase 10% x 20% or 2% the 1st year, 10% x 50%, 5% the 2nd year and 10% x 30%, 3% the 3rd year. If we get 3 consecutive years of growth in new starts there would be no downward pressure on spending for the next 3 to 4 years.

In the 2nd half of 2021, residential starts, although still strong, posted a few lower monthly totals. Although 2022 spending will still finish the year up, these lower monthly starts from late 2021 will work to cause a slight spending dip in the 2nd half of 2022. Nonresidential Bldgs spending is slowly increasing in 2nd half 2022. Nonbldg spending is flat or very slowly decreasing. The net effect is spending will post a decline in 4 of the next 8 months of 2022, but the total declines may not result in 2 consecutive quarters of declines. By the time we head into 2023, all three major construction sectors are in a growth pattern.

So, we will see a few months of spending declines, but the new starts pool of work is growing, not decreasing. The current forecast model is predicting no recession on the horizon.

LABOR SHORTAGE

This next plot shows labor and volume of work (spending minus inflation) to support that labor growing equally, albeit with short-term peaks and troughs, from 2011 to 2018. In fact, this equal growth extends far back with only few years causing exception to this pattern. This plot, and the extension of this plot to older data, shows that normally, labor increases at the same rate as volume. You can see that 2018 posted a significant drop in volume while jobs continued to increase. This departure had nearly corrected itself by Jan 2020.

The most recent construction spending report, issued July 1, revised unadjusted spending data for 2020 and 2021, both years added $30+bil. That brought volume up those years on this plot. The current spread between jobs and volume of work is still 10%.

In May of 2020, jobs were already on the rebound, but the volume of work was not. Work volume did recover some at the end of 2020 but then fell again, as was predicted, into mid-2021. In May of 2020, jobs and the volume of work were near balance. Since May of 2020, spending increased by 22%, but most of that was inflation. Since May 2020, actual work volume increased by only 1.5%. Jobs increased by 9%.

The last time the normal jobs/volume growth pattern was disrupted like this was 2006, the only other time in the last 25 years this occurred.

Volume, not spending, supports jobs. If volume is down, support for more jobs drops. If jobs increase while volume is declining then productivity is declining and the number of jobs required to put-in-place $1 billion of construction volume increases. At the same time, the inverse, the amount of volume put-in-place per job, decreases. This productivity loss drives up construction labor cost inflation and the need for additional labor to complete the job.

edited/added 8-6-22 Where the construction jobs are:

From Feb 2020 to Jul 2022 Nonres Bldgs and Nonbldg jobs are down 3.5% and 1.5%. Volume of work is down 20%.

Residential jobs are up 6.5%. Rsdn volume is up 14%.

It’s not quite that bad in either sector because some workers classified and counted as nonresidential perform work in the residential sector.

Total jobs up 1%. Total volume down 7%. That’s a slip of 8% in productivity. If labor is only 30% of total construction cost, an 8% slip in productivity is a 2.4% increase in inflation. That’s in addition to changes in wages.

INFRASTRUCTURE

The current administration has approved an infrastructure spending bill that earmarks approximately $500 billion for construction spending. It will take several years to start all this work.

The infrastructure spending bill may fund construction for a variety of buildings and non-building types of construction, for example, highway, water and sewer, educational, healthcare, etc. Rather than strictly classified as infrastructure, or as commonly referred to as nonbuilding construction, this bill will fund some forms of buildings and non-building construction in the public construction sector.

The total of all public construction is only 25% of all construction. This subset of construction totals about $360 billion in annual construction spending. It has never increased by more than $37 billion in spending ($35 billion in volume) in a year. Average growth is closer to $10-$15 billion/year. This public sector of construction does not have the capacity to increase by $100 billion/year.

As you can see in the plot above, it takes about 5000 jobs to support $1 billion of volume for 1 year. So, increasing volume by $35 billion in one year would require 35 x 5000 = 175,000 new jobs for that year. Keep in mind, this is to support a subset of construction that is only 25% of all construction.

Jobs rarely (4 out of 50 yrs) increase by more than 400,000 in one year for all construction. Even taking out the 13 years when jobs dropped, the average jobs growth for the past 50 years is only 220,000/year for all construction. That would seem to indicate the average growth for the public sector, at 25% of all construction, averages only 55,000 jobs/year.

Total all construction for the three years 2022-2023-2024 is forecast to increase $140 billion, $117 billion and $116 billion. The remaining 75% of the construction industry still adds a lot of demand for growth and jobs beyond just that of the public sector that gets a boost from the infrastructure bill. But after adjusting for inflation, the growth in volume over this three-year period is only about $120 billion. That would generate a need to create 600,000 new jobs over the next three years. About 25% of those jobs support the infrastructure funded growth.

If the infrastructure spending bill adds $35-$40 billion/year in spending, $30-$35 billion/year in volume, the need would be 150,000 to 175,000 jobs/year to support that 25% of the construction industry. Since it is unlikely the public sector of construction could add that many jobs, it is more likely the amount of construction spending added yearly will be somewhat lower.

Infrastructure has a slower spending curve than the 20:50:30 for nonres bldgs, roughly more like 15:40:30:15. If $100 bil of new contract awards start in 2022 then spending would be $15 bil in 2022, $40 bil in 2023, etc.. At $100 bil of new starts per year, the highest one-year growth would be $40 bil, probably double the pace the sector can grow.

Construction Jobs and Spending Briefs 4-1-22

Construction Jobs report for Mar 2022 shows total jobs up 19,000 from Feb

Rsdn jobs +7,600, Nonres Bldgs +6,300, Civil +5,000

Although construction jobs increased by 19,000 in March, total hours worked dropped by 1.8% from Feb, so total workforce output is down.

It’s real hard to compare construction jobs growth by sector. If you work for a concrete firm or structural steel firm, with firm doing primarily nonresidential work, but you are out there putting in concrete or steel for a high-rise multifamily buildings, your job is still classified as nonresidential.

Jobs are up 82,000 year-to-date, 1.1% from Dec, but that’s also up 3.5% from ytd 2021. With the latest quarter at +1.1%, jobs are increasing at a rate of 4%/year. But inflation adjusted spending, building activity, is expected up only 2.5% in 2022, after dropping -2% in 2021. Jobs increased 2.5% in 2021.

2022 spending started the year at the highpoint. I expect a slow decline in monthly spending in all sectors of 2% over the 2nd half. That provides no support for jobs growth.

Construction jobs have nearly returned to pre-pandemic levels. The problem with construction jobs having returned to pre-pandemic levels is the level of inflation adjusted construction volume of activity that is needed to support those jobs is still 5% below Feb 2020 and 13% below the 2006 peak. So since Feb 2020, jobs are back to that level, but volume is not so productivity has dropped by 5%.

Construction Spending is up +10.4% year-to-date (in 2 months!) mostly driven by +15.5% ytd Residential.

A plot of residential construction spending inflation adjusted. Taking out inflation shows volume of building activity. Perhaps the trend in residential is strong enough to keep going.

Total spending is up +4% in 3mo since Nov 2021 (and 10% ytd-2mo), but I don’t expect this rate of growth to hold. However, this and any other changed data inputs revises my 2022 spending forecast.

Examples of big changes since initial forecast:

Manufacturing spending has increased so much in Jan-Feb, (up 35% ytd) that even if the next 10 months finish flat year/year, Mnfg will still finish up 5% for 2022.

Residential new starts for the latest 3 mo, Dec-Jan-Feb, avg is as high as any quarter last year. Nearly all of this spending occurs in 2022.

Construction buildings cost inflation over the last 4 years is up 25%. Labor cost, wages up 15% & productivity down 7%, is up 22%. But labor is 35% of total building cost so 22% x 35% = labor is 8% of that total 25% building cost inflation. Fully 1/3 of construction inflation over last 4 years went into workers pockets.

Construction Inflation 2022

The most watched indicators of the rate of inflation are the costs of various construction materials and the labor needed to install them. However, the level of construction activity has a direct influence on labor and material demand and margins and therefore on construction inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce margins in bids. When activity is high, there is a greater opportunity to submit bids on more work and bid margins may be higher. The level of activity has a direct impact on inflation.

This analysis is national level data.

this post last updated 12-10-22

SEE 2023 data here Construction Inflation 2023

2-10-22 See the bottom of this post to download a PDF of the complete article.

update 5-3-22 This article AND the attached PDF downloadable document have been updated to include 1st qtr 2022 inflation updates.

update 5-8-22 This article AND the attached PDF downloadable document have been updated to include changes in inflation in PPI factors.

update 8-12-22 See Summary. Revisions to 2022 inflation.

update 9-19-22 SEE INDEX TABLES AND PLOTS updated to Q2 2022. Note these tables and plots are updated here in the blog post only. Original article attached IS NOT updated.

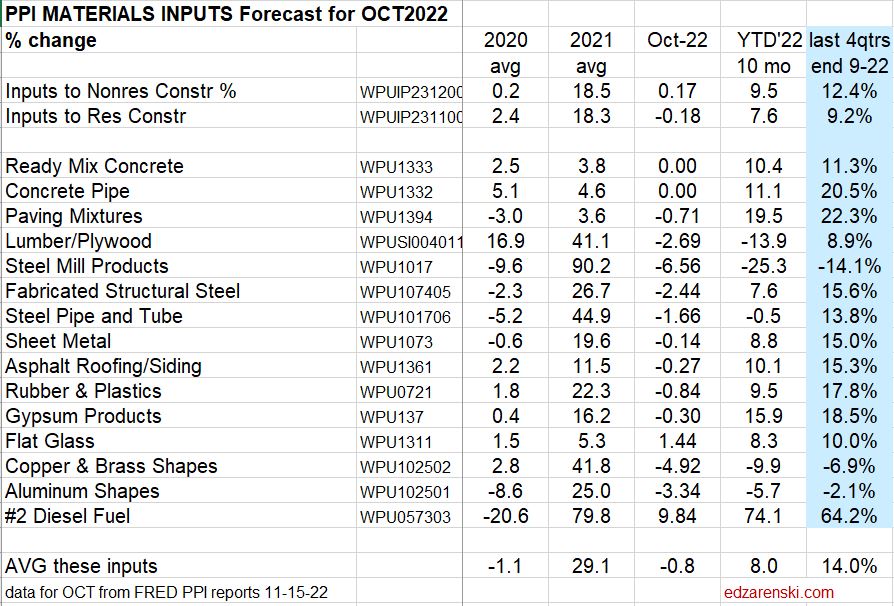

update 11-16-22 PPI INPUTS table and FINAL DEMAD table for October updated 11-16-22.

update 12-1-22 PPI INPUTS table for November updated 12-10-22. Also INDEX TABLES AND PLOTS updated to Q3 or Q4 where available.

End of updates

The construction data leading into 2022 is unlike anything we have ever seen. Construction starts were up in 2021, but backlog leading into 2022 is down. That is not normal. Backlog is rarely down and then usually when starts have been down the previous year. In this case the starts declined in 2020, but that 2020 decline was so broad and so deep, even with an increase in starts in 2021, backlog to start 2022 has not yet recovered (to the start of 2020). Spending for 2021 was up 8%, but after adjusting for inflation, real volume after inflation was down. Last time that happened was 2006 and 2002, the only two other times that happened in the last 35 years.

Summary

A significant impact of the pandemic on construction is the loss of spending due to the massive reduction in nonresidential construction starts in 2020. Those lower starts reduced nonresidential construction spending in 2020, but more-so in 2021, and in some markets will extend lower spending into 2022 and 2023. The most unexpected change was that residential spending continues a strong increase.

- 2020 new starts declined -7%. Res +6%, Nonres Bldgs -18%, Nonbuilding -15%.

- 2021 new starts increased +18%. Res +22%, Nonres Bldgs +18%, Nonbuilding +8%.

- Forecast 2022 starts are up +11%. Res +10%, Nonres Bldgs +18%, Nonbuilding +2%.

Nonresidential construction volume appears now will experience only slight dip mid-2022, the maximum downward pressure from the pandemic is past. Total All Volume, spending minus inflation, is expected to again reach the same bottom in mid-2022 as in 2021. That should impact jobs, but we haven’t seen jobs react to volume losses as would be expected. Jobs growth without volume growth to support those jobs is a productivity decline, increasing inflation.

Spending for 2021 is up 8%, but nonresidential buildings spending is down 4%. Almost all gains in 2021 spending are due to the 23% gain in residential.

Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume dropped 33% and jobs fell 30%. During two years of the pandemic recession, volume reached a low down 8% and jobs dropped a total 14%. But we gained back far more jobs than volume. That means it now takes more jobs to put-in-pace volume of work. That increases inflation.

No one predicted 2021 construction inflation. In Jan 2021, I predicted Inflation for nonresidential buildings near 4% and Residential inflation at 5% to 6%. Looking back, we now see nonresidential buildings inflation is 7%, the highest since 2006-2007 and residential inflation is 13%, the highest since 1977-1979, in part driven by the highest rates of increase in materials on record.

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.2%, Nonres Bldgs 6.7%, Non-bldg Infra Avg 7.5%

- 2022 Rsdn Inflation 11.7%, Nonres Bldgs 6.3%, Non-bldg Infra Avg 5.5%

edit 8-12-22 Much more information from a number of reliable sources is now available regarding recent inflation. Among several inputs, there is a recent BLS update to the Final Demand indices. See latest PPI tables. 2022 Residential Inflation 12.8%, Nonres Bldgs 9.4%, Non-bldg Infra Avg 5.6%.

edit update 9-19-22 inputs revise 2022 construction inflation as shown here. See Tables below:

- 2020 Rsdn Inflation 4.6%, Nonres Bldgs 2.7%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.4%, Nonres Bldgs 6.8%, Non-bldg Infra Avg 7.8%

- 2022 Rsdn Inflation 14.6%, Nonres Bldgs 9.9%, Non-bldg Infra Avg 12.0%

Cost Indices

General construction cost indices and Input price indices that do not track whole building final cost do not capture the full cost of inflation on construction projects.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

When construction activity is increasing, total construction costs typically increase more rapidly than the net cost of labor and materials. In active markets overhead and profit margins increase in response to increased demand. These costs are captured only in Selling Price, or final cost indices.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. This index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI is a materials cost index. Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are other examples of commonly used indices that do not capture whole building cost.

Construction Analytics Building Cost Index, Turner Building Cost Index, Rider Levett Bucknall Cost Index and Mortenson Cost Index are all examples of whole building cost indices that measure final selling price (for nonresidential buildings only).

Residential inflation indices are primarily single-family homes but would also be relevant for low-rise two to three story building types. Hi-rise residential work is more closely related to nonresidential building cost indices.

A nonresidential buildings index would be representative of commercial construction or hi-rise residential construction, since hi-rise residential is quite similar too commercial construction and in fact substantial portions of the building are constructed by firms classified as commercial constructors.

The Construction Analytics Infrastructure composite index is useful only for adjusting the total cost of all non-building infrastructure. Individual types of non-building infrastructure require attention to specific indices related to that type of work.

History

Post Great Recession, 2011-2020, average inflation rates:

Nonresidential buildings inflation 10-year average (2011-2020) is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. In 2021 it jumped to 9%, the highest since 2006.

Residential 8-year average inflation for 2013-2020 is 5.0%. In 2020 it was 5.3%. In 2021 it jumped to 14%, the highest since 1978.

30-year average inflation rate for residential and nonresidential buildings is 3.7%. Excluding deflation in recession years 2008-2010, for nonresidential buildings is 4.2% and for residential is 4.6%.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- In times of rapid construction spending growth, nonresidential construction annual inflation averages about 8%. Residential has gone as high as 10%.

- Nonresidential buildings inflation has average 3.7% since the recession bottom in 2011. Six-year 2014-2019 average is 4.4%.

- Residential buildings inflation reached a post-recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It has averaged 5.3% for 8 years 2013-2020.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors/supplier margins.

- When construction volume increases rapidly, margins increase rapidly.

Historically, when spending decreases or remains level for the year, inflation rarely (only 10% of the time) climbs above 3%. Avg inflation for all down/flat years is less than 1%. In 2021, spending was down for nonresidential buildings and non-building. Inflation for both was over 8%.

Nonresidential buildings inflation, after hitting 5.3% in 2018 and 4.8% in 2019, fell to 2.5% in 2020, lower than the 4.5% average for the previous four years. In 2021 it was 9.0%. Nonresidential buildings spending has not kept up with inflation since 2016. Spending needs to grow at a minimum of inflation, otherwise volume is declining. Since 2016, inflation exceeded spending by almost 20%.

Nonbuilding Infrastructure inflation, from 2013 to 2017 averaged less than 1%, but then jumped to 5% in 2018 and 2019. Inflation fell to -0.2% in 2020, but jumped to 9.1% in 2021.

Residential construction inflation in 2019 was only 3.4%. However, the average inflation for six years from 2013 to 2018 was 5.2%. It peaked at 7% in 2013 but dropped to 3.2% in 2015 and 3.4% in 2019. Residential inflation is 2021 was 14.0%.

Producer Price Index (PPI) Material Inputs (which exclude labor) to new construction averaged less than 1%/yr. from 2012 to 2017. Cost decreased in 2015 and 2016, the only negative costs for inputs in the past 20 years. Input costs averaged over 5% for 2018-2020. Then in 2021 input costs soared to 22%, the highest ever recorded.

2020 Performance

Even though material input costs were up for 2020, nonresidential inflation in 2020 remained low, possibly influenced by a reduction in margins due to the decline in new nonresidential buildings construction starts (-18%), which is a decline in new work to bid on. An 18% drop in new nonresidential buildings starts within one year equals a loss of near $100 billion of spending that would occur over the next 2-4 years. Nonbuilding starts were down 15%, equivalent to a loss of $50 billion in new work that would likely have been spread over 2-5 years. Residential starts in 2020 increased 6%, adding about $35 billion in new spending spread over 2 years.

Nonresidential buildings inflation for 2020 dropped to 2.6%, the first time in 6 years below 4%. Spending fell only 1.8% but after accounting for 2.6% inflation, volume decreased 4.4%. Nonresidential volume dropped every month in 2020 after the February 2020 peak, down 19% by December, but that’s not the bottom. Declines continue into 2021.

Nonbuilding Infrastructure in 2020 posted mild deflation of -0.3% after +5% in 2019, but averaged only 2%/yr. since 2011. 2020 spending increased only 0.7%. After accounting for -0.3% deflation, volume increased 0.4%. Public infrastructure inflation, up only 1.2% in 2020 after reaching over 4% in 2018 and 2019, averaged 2.7%, since 2011.

Residential inflation averaged 4.5% for 2020. Remarkably, spending increased 15% and 2020 volume was up 10%. Residential business volume dropped 9% from the March 2020 peak to the May bottom, but then by December recovered 16% to hit a post Great Recession high, 11% above Dec 2019.

2021 Performance

Most nonresidential construction markets had a weaker spending performance in 2021 than in 2020. Approximately 40%-50% of spending in 2021 is generated from 2020 starts, and 2020 nonresidential starts ranged down 10% to 25%, several markets down 40%.

Nonresidential buildings starts fell 18% in 2020, but gained 18% in 2021. Nonbuilding starts were down 15% in 2020, then added 8% in 2021. Residential starts increased 6% in 2020 and 22% in 2021.

Nonresidential buildings spending fell 4.4% in 2021. Nonbuilding spending was down 1.1%. Residential spending was the star of the year, up 23%, the largest yearly % gain on record.Nonresidential buildings inflation in 2021 jumped to 6.7%, the highest since 2007. Non-building average inflation was 7.5%, the highest since 2008. Residential inflation in 2021 jumped to 13.2%, the highest on record back to 1967.

After adjusting for inflation, total all construction volume in 2021 was down -1.1%. Residential volume for 2021 was up +10% while Nonresidential Bldgs volume was down -10% and non-building volume was down -7%. Jobs average over the year 2021 increased +2.3%. Volume was down -1.1%.

Current Inputs

U.S. Census Single-Family house Construction Index gained only 4% in 2020. The index is up 11.7% for 2021. The index has posted steady growth throughout 2021. Thru February 2022, over the last 4-5 months, the year/year rate of increase in this index has jumped from 12% yoy to 17% yoy. https://www.census.gov/construction/nrs/pdf/price_uc.pdf

Turner Construction Cost Index average annual for 2021 is up only 1.9% from 2020. That is unusually low, well below the range of 5% to 16% and the average of 9% for other nonresidential buildings indices. http://turnerconstruction.com/cost-index

Rider Levitt Bucknall nonresidential buildings index average for 2021 is up 4.8% from 2020. https://www.rlb.com/americas/

Mortenson’s cost index of nonresidential buildings data is posted through Q4 2021. The annual average inflation for 2021 is up 16% over 2020. https://www.mortenson.com/cost-index

RSMeans Nonresidential buildings index for 2021 is up 9.11%.

Engineering News Record (ENR) BCI inputs index for 2021 is up 10.0%. The BCI is up 5.3% year-to-date for the first 4 months of 2022.

Producer Price Index tables published by AGC show input costs to nonresidential buildings up about 18% for 2021. Final costs of contractors and buildings is up 5.3%. PPI Inputs for March show residential inputs up 8.2% and nonresidential buildings inputs up 12.6% ytd for 3 months. Also the average final demand increase cost for residential is up 16% and final demand cost for nonresidential bldgs is up 4.8% in the 1st quarter. https://www.agc.org/learn/construction-data

A caution here. AGC reports inflation for the year as the value reported in December of the year. Many others report the average inflation for all 12 months. These two reporting methods cannot be mixed. Construction Analytics has recently revised PPI data to reflect annual average inflation.

AGC April Construction Inflation Alert “The construction industry is in the midst of a period of exceptionally steep and fast-rising costs for a variety of materials, compounded by major supply-chain disruptions and difficulty finding enough workers—a combination that threatens the financial health of many contractors. No single solution will resolve the situation.”

New construction starts reported by Dodge thru Feb are up 15% over the same period in 2021, with residential at a new high and nonresidential near the previous high. Feb 2022 total was the highest level of new starts on record. High levels of activity often lead to higher levels of inflation.

Wage offerings are increasing (up 6% in 2021), productivity is declining (down 7% in last 4 years) and there are many instances of material shortages or delays in delivery (lumber, windows, roofing, cabinets, mechanical equipment, appliances, etc.). These issues are all present now and all work to increase inflation.

PPI INPUTS table updated 11-16-22

Steel Mill Products prices are up over 100% in 2021, but steel mill products includes all kinds of steel for all uses including automobiles and appliances. Construction uses slightly less than 40% of all steel and that is predominantly fabricated structural steel.

Fabricated Structural Steel prices are up 25% in 2021.

Here’s an example of how a PPI cost change affects the total final cost of the product installed. The mill price of steel is about 25% of the final price of steel installed. The other 75% of the cost is detailing, fabrication, delivery, lifting, labor and equipment for installation and markup. What affect might a steel cost increase have on a building project? It will affect the cost of structural shapes, steel joists, reinforcing steel, metal deck, stairs and rails, metal panels, metal ceilings, wall studs, door frames, canopies, steel duct, steel pipe and conduit, pumps, electrical cabinets and furniture, and I’m sure more. Assuming a typical structural steel building with some metal panel exterior, steel pan stairs, metal deck floors, steel doors and frames and steel studs in walls, then all steel material installed represents about 14% to 16% of total nonresidential building cost. Structural Steel only, installed, is about 9% to 10% of total building cost. The other 6% of total steel cost applies to all buildings. If mill price is up 100%, then subcontractor final cost is up 25%. With all steel representing 16% of total building cost then final cost of building would be up 4%.

Steel Prices Reach Levels Not Seen Since 2008 by The Fabricator

2021 Input costs for Residential and Nonresidential Buildings is the highest on record. Materials prices support high inflation into 2022. But some sources expect gains to moderate from 2021.

PPI FINAL DEMAND updated 11-16-22

For up to data 2022 PPI see Producer Price Index PPI Tables 2022

Inflation

Could a recession bring on deflation?

Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume went down 33% and jobs were down 30%. In 2020, business volume dropped 7% from February to May. By October, volume reached a low for the year, down 8%. Volume of work seemed to be recovering in the first quarter of 2021, up 3% from the October low, but then struggled most of the year. As of December 2021, volume is still down 7% from the February 2020 peak and up only 2% from the 2020 low. Jobs dropped 14%, 1,100,000+ jobs, in two months! But jobs recovered all but 3% by December 2020. As of December 2021, jobs are down 2% from February 2020 peak. We have now gained back 1,000,000 jobs. But we gained back far more jobs than volume. That means it now takes more jobs to put-in-place volume of work. That increases inflation.

Here’s a list of some 2021 indices average annual change and date updated.

- +6.7% Construction Analytics Nonres Bldgs Mar

- +5.4% PPI Average Final Demand 5 Nonres Bldgs Dec

- +5.3% PPI average Final Demand 4 Nonres Trades Dec

- +1.9% Turner Index Nonres Bldgs annual avg 2021 Q4

- +4.8% Rider Levett Bucknall Nonres Bldgs annual avg 2021 Q4

- +16% Mortenson Nonres Bldgs annual avg 2021 Mar

- +11.7% U S Census New SF Home annual avg 2021 Dec

- +7.4% I H S Power Plants and Pipelines Index annual avg 2021 Dec

- +7.1% BurRec Roads and Bridges annual avg 2021 Q4

- +6.0% FHWA Fed Hiway annual avg 2021 Q4

- +9.11% R S Means Nonres Bldgs Inputs annual avg 2021 Q4

- +10.0% ENR Nonres Bldgs Inputs annual avg 2021 Dec

Take note of the top six indices reported here. They all represent nonresidential buildings final cost. The spread is from 2% to 16%, wider than ever seen in any other year. The average of these six is 6.7%.

Future Inflation Forecast

Typically, when work volume decreases, the bidding environment gets more competitive. We can always expect some margin decline when there are fewer nonresidential projects to bid on, which typically results in sharper pencils. However, when materials shortages develop or productivity declines, that causes inflation to increase. We can also expect cost increases due to material prices, labor cost, lost productivity, project time extensions or potential overtime to meet a fixed end-date.

After adjusting for inflation, total volume in 2021 is down 1.1%. Residential volume for 2021 is up +10% while Nonresidential Bldgs volume is down 10% and Non-bldg volume is down 7%.

Total volume for 2022 is forecast up only 1.7%. After adjusting for inflation, Residential volume for 2022 is forecast up only 2%. Nonresidential Bldgs volume is forecast up 4% and Non-bldg volume is forecast down 2%.

Volume declines should lead to lower inflation as firms compete for fewer new projects. However, aside from remarkable cost increases for materials, if jobs growth continues while volume declines, then productivity declines, and that will add to labor cost inflation. Since 2010, Construction Spending is up over 100%, but after adjusting for inflation, Volume is up only 31%. Jobs are up 41%.

Notice in this next plot how index growth for ENR BCI and RSMeans, both input indices, is much less than for all other selling price final cost indices. From 2010 to 2020, Construction Analytics total final cost inflation is 103/71 = 1.45 = +45%. Input cost indices total inflation over the same period is only 103/79 = 1.30 = +30%, missing a big portion of the cost growth over time.

Nonresidential Buildings Selling Price Indices vs Input Indices updated 9-19-22

Several Nonresidential Buildings Final Cost Indices averaged over 5%/yr. in 2018 and 2019 and over 4%/yr. from 2015 to 2019 averaging +25% inflation for 5 years. Input indices that do not track whole building cost averaged only 12% inflation for those five years, much less than final cost growth. As noted previously, most reliable nonresidential selling price indexes have been over 4% since 2014. All dropped to between 2% to 3.5% in 2020.

Current and predicted Inflation rates updated 12-10-22:

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 7.4%, Non-bldg Infra Avg 7.8%

- 2022 Rsdn Inflation 15.4%, Nonres Bldgs 12.2%, Non-bldg Infra Avg 13.6%

- 2023 Rsdn Inflation 6.0%, Nonres Bldgs 4.8%, Non-bldg Infra Avg 4.3%

Construction Analytics Building Cost Index updated 12-10-22

As of April 2022, not all nonresidential sources have updated their Q4 inflation index. A few are still reporting only 2% to 4% inflation for 2021, but several have moved up dramatically, now reflecting between +10% to +14%. One national resource is reporting only 1.9% inflation for 2021! The 2015-2023 table has been updated to include all Q1 2022 data where available. We can still expect some minor change to 2021 and future forecasts.

The tables below, from 2015 thru 2023, updates 2021 data and includes Q1’22 data when available and provide 2022-2023 forecast. The three major sector indices, highlighted, are plotted above. NOTE, in this table and these plots all indices are set to a base of 2019=100. All original data is gathered for all indices, but since all indices have different index dates (start in different years), all data is modified to a common base date, in this case 2019. That allows all indices to be easily compared. These indices are annual average index reported at midyear. All forward forecast values, whenever not available, are estimated by Construction Analytics using long-term avg.

Index Table updated 12-10-22 for older indices see Construction Inflation Index Tables + Links

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from. Example: What is cost inflation for a building with a midpoint in 2021, for a similar nonresidential building whose midpoint of construction was 2016? Divide Index for 2021 by index for 2016 = 111.7/87.0 = 1.284. Cost of building with midpoint in 2016 x 1.28 = cost of same building with midpoint in 2021. Costs should be moved from/to midpoint of construction. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

Non-building infrastructure indices are so unique to the type of work that individual specific infrastructure indices must be used to adjust cost of work. The FHWA highway index increased 17% from 2010 to 2014, stalled from 2015-2017, then increased 15% in 2018-2019. During that time, the average of non-building indices would have given +12% from 2010-2014, +13% for 2015-2017 and +10% for 2018-2019. The IHS Refinery, Petrochemical plants index fell 10% from 2014 to 2016. In that same two-year period the IHS Pipeline, LNG index fell 25%. The CA Infrastructure composite index is useful only for adjusting the grand total cost of all non-building infrastructure.

Infrastructure Table updated 12-10-22

Volume of Work – The Impact of Inflation on Jobs

Volume is spending minus inflation.

Construction Spending drives the headlines. Construction Volume drives jobs demand. Total Volume is forecast flat to down over the next 12 months. Residential dips 4% then recovers to current level, nonresidential buildings volume increases 6% and Non-building infrastructure volume will fall 7%.

To differentiate between Revenue and Volume you must use actual final cost indices, otherwise known as selling price indices, to properly adjust the cost of construction over time.

When spending increases less than the rate of inflation, the real work volume is declining. In 2020, Nonresidential buildings spending was down 2%, but with 2.5% inflation, so volume was down 4.5%. The extent of volume declines impacts the jobs situation. In 2021, Nonresidential Buildings jobs increased by slightly less than 1%, but construction volume was down 10%. Total all construction jobs increased by 2.3%, but construction volume was down 1.1%. Jobs are supported by growth in construction volume, spending minus inflation. If jobs increase faster than volume, that adds to productivity losses and adds to inflation.

Many construction firms judge their business growth by the revenues passing through from all jobs under contract. The problem with that, for example, is that Nonresidential Buildings spending (revenues) are expected to grow 10% in 2022, but after adjusting for inflation the actual volume of work will be up by only 4%. By this method, in part, these firms are including in their accounting an increase in inflation dollars passing through their hands. Spending includes inflation, which does not add to the volume of work and does not support jobs growth.

Total volume for 2022 is forecast up only 1.7%. Residential volume for 2022 is forecast up 2.3%. Nonresidential Bldgs volume is forecast up only 4% and Non-bldg volume is forecast down 2.4%.

Construction Spending Current Dollars

Spending includes inflation which does not add to the volume of work. Before we can look at the effect on jobs, we need to adjust spending for inflation. The plot above “Spending by Sector” is current dollars. The sector plot below is adjusted for inflation and is presented in constant $. Constant $ show volume. Notice future residential remains in a narrow range after adjusting for inflation.

Constant $ = Spending minus inflation = Volume

Residential business volume is no stranger to hefty increases in spending and volume. In three years 2013-2015, spending increased 57% and volume was up 35%. For 2020-2021, spending increased 42% and volume was up 20%. Although residential spending remains near this elevated level for the next year, volume growth slows down in the 2nd half of 2022. Residential spending is forecast up 13% for 2022, but a forecast for 11.7% residential inflation slows volume growth to 2.3% for the year.

In January 2021, I had forecast by 3rd quarter 2021, nonresidential buildings volume would be 25% below the Feb 2020 peak. By 3rd qtr 2021 volume was down 21%. This follows the 20% decline in new starts in 2020. Most of the spending from those lost starts would have taken place in 2021. For 2022, spending is forecast to increase 10%, but inflation is forecast at 6%, resulting in volume growth of 4%.

In 2021, nonresidential buildings volume dropped 10%. Non-building volume dropped 7%. In 2022, nonresidential buildings volume should climb 4% but non-building volume falls 2.4%. In fact, the forecast shows non-building volume still drops another 4% in 2023. Although Power plants posted a massive gain in starts in 2019, declines in pipeline starts offset some of that gain. Transportation, a source of long duration projects, is also contributing to that decline. Although transportation starts were up 16% in 2021, that follows a 33% decline in starts in 2020-2021.

Below is the non-building plot, inflation adjusted. Both the nonresidential buildings and the non-building plots show there has been no substantial increase since Feb 2020 in volume to support jobs growth, and there is little to no help in 2022.

Jobs are supported by growth in construction volume, spending minus inflation. If volume is declining, there is no support to increase jobs. Although total volume for 2022 is forecast up 1.7%, with Residential volume forecast up 2.3%, Nonresidential Bldgs volume up 4% and Non-building volume forecast down 2.4%, we will not see total construction volume return to Feb 2020 level at any time in the next three years. By the end of 2023 volume is still down 3% from Feb 2020.

Construction Jobs Growth

When we see spending increasing at less than the rate of inflation, the real work volume is declining. For example, with construction inflation increasing at 3% annually, a nonresidential building spending decline of -2% would reflect a work volume decline of 5%. The extent of volume declines would affect the jobs situation.

There is a difference comparing growth to same month last year versus comparing annual averages. For Dec’21 vs Dec’20, Residential jobs are up 75k, Nonresidential Bldgs up 61k and Nonbuilding up24k. But annual averages tell a much different story.

AVG 2021 vs AVG 2020, Rsdn+153k (+5.3%), Nonres Bldgs +28k (+0.8%), Non-bldg +9k (+0.9%).

Dec vs Dec simply compares jobs at 2 points in time, without the benefit of what occurred in the other 11 months of the year, so does not tell us what took place over the year. Total labor production for the year must take into account all months. The annual average gives a much clearer indication of jobs growth over the year because it accounts for the peaks and dips of all 12 months during the year.

Jobs average over the year 2021 increased +2.3%. After adjusting for inflation, total volume in 2021 is down -1.1%. Residential volume for 2021 is up 10% while Nonresidential Bldgs volume is down 10% and Non-building volume is down 7%. Those are remarkable nonresidential declines, not seen that deep since 2010.

If jobs are increasing faster than volume of work, productivity is declining. For example, nonresidential buildings volume declined 10%, but nonres bldgs jobs increase 0.8%. That’s a 11% swing in productivity. Since labor is about 30% to 35% of the cost of a project, if productivity declines by 11%, then inflation rises by 11% x 35%, or 3.8%. The most recent year drop in volume, while jobs increased, added 4+% to nonresidential buildings inflation for the year. But some jobs counted as Nonresidential actually work on residential construction, so the individual sector data is skewed and there is insufficient detail to count those jobs. Better to look at all volume vs all jobs.

Jobs and Volume of work growth should move in tandem, as seen in the above plot from 2011 to Jan 2018. With exception of 2006, when jobs increased by 10%, but volume dropped by 5%, a negative impact 15% spread, similar to 2018, these plot lines have been moving in tandem like this, with minor differences, back to 1992. If jobs grow faster than volume, productivity is declining (a negative impact). When these plot lines grow wider apart with jobs above volume, that is a sign of a productivity decline. That loss of productivity for the workforce is a hidden aspect of inflation, not shown in pricing or wages.

Jobs are supported by growth in construction volume, spending minus inflation. Unless volume of work increases or job growth slows, by the end of 2022, volume will be lower than today.

What does that hidden loss of productivity for the workforce look like? How can we tell the magnitude of this impact on inflation when it is hidden, not seen in wages? It shows up in this following plot, the volume of work Put-In-Place per job.

If jobs are increasing faster than volume of work, can we tell if it’s production employees or supervisory employees? BLS reports ALL construction jobs (~7.5million) and Production jobs (~5.5million). The difference between these two data sets is supervisory employees.

Looking at the average number of construction jobs in the last 4 years, the average of 2021 jobs vs the average of 2017 jobs, production jobs increased +5%, but supervisory jobs increased +12%.

In 2011, supervisory jobs was 24% of all construction jobs. Now it is 35%. Growth in supervisory jobs has had a greater negative impact than production jobs on the spread between jobs and volume.

In January 2021, I had forecast We will not see construction volume return to Feb 2020 level at any time in the next three years. Well, unprecedented residential growth outperformed with 10% volume growth in both 2020 and 2021. Nonresidential and non-building volume since Feb 2020 are down 15% to 16%. Total construction volume since Feb 2020 is still down 2.5%. It is expected to fall another 3% in 2022. And the forecast still shows total construction volume from Feb 2020 down 2% by the end of 2023. That is a difficult environment to see jobs growth.

A final word about terminology: Inflation vs Escalation. These two words, Inflation and Escalation, both refer to the change in cost over time. However, escalation is the term often used in a construction cost estimate to represent anticipated future change, while more often the record of past cost changes is referred to as inflation. This graphic might represent how most owners and estimators reference these two terms.

Links to Articles and Data

The U.S. Census Single-Family house Construction Index

NAHB – Prices of goods used in residential construction

The Producer Price Index tables published by AGC

Construction Analytics Construction Inflation Index Tables for indices related to Nonbuilding Infrastructure work and for many more links to sources.

See this post on my blog Construction Economic Outlook 2022

Construction Inflation 2021

This post, originally written in Jan 2021, and updated several times, is viewed over 1,000 times a week.

>>> 2-1-23 SEE Construction Inflation 2023

2-11-22 SEE Construction Inflation 2022

See Feb 2022 note below and updated table at bottom of file.

10-15-21 update – Link to PPI data from Jul to Sep. Table PPI Inputs Sep21. Updated BCI plot.

As of Sept 2021, PPI for materials inputs to construction is up ytd 15% to 18%. For the 18 months since March 2020, the onset of Pandemic, the PPI for materials inputs to construction is up ytd 23%, but the PPI Buildings Cost Index for final cost to owner is up only 5% to 6%. (Part of this can be attributed to periodic PPI forecast updates).

As of 10-15-21, nonres bldgs inflation for 2021 is estimated at 4.6% and residential at 12.9%. Those increases are reflected in the tables and plots below. Both have been trending up.

11-10-21 From Sept to Oct materials price changes were normal, but Final Demand prices jumped what could be considered an entire year’s worth of increase in just one month. We’ve been watching the price pass thru increase slowly, until now. This is the single largest monthly increase in Final Demand pricing since the indices were started in 2006.

As of 11-10-21, nonres bldgs inflation for 2021 is estimated at 6.8% and residential at 15%. The 2022 forecast is estimated at 4.5% for nonres bldgs inflation and 7% for residential.

As of Jan 2022, not all nonresidential sources have updated their Q4 inflation index. A few are still reporting only 4% inflation for 2021, but several have moved up dramatically, now reflecting between +10% to +14%. My estimate for 2021 inflation has been changing, moving up again. Nonres bldgs inflation for 2021 is currently estimated at 8.7% and residential at 15%. Graphs in this post are not yet updated. The 2015-2023 table of indices has been updated 1-20-22.

2-10-22 Here’s a list of 2021 indices average annual change and date updated.

- +8.4% Construction Analytics Nonres Bldgs Dec

- +14.1% PPI Average Final Demand 5 Nonres Bldgs Dec 2021

- +11.4% PPI average Final Demand 4 Nonres Trades Dec

- +1.9% Turner Index Nonres Bldgs annual avg 2021 Q4 2021

- +4.84% Rider Levett Bucknall Nonres Bldgs annual avg 2021 Q4

- +12.6% Mortenson Nonres Bldgs annual avg thru Q3 2021

- +11.7% U S Census New SF Home annual avg 2021 Dec

- +7.4% I H S Power Plants and Pipelines Index annual avg 2021 Dec

- +7.1% BurRec Roads and Bridges annual avg 2021 Q4

- +6.0% FHWA Fed Hiway annual avg 2021 Q4

- +9.11% R S Means Nonres Bldgs Inputs annual avg 2021 Q4 2021

- +10.0% ENR Nonres Bldgs Inputs annual avg 2021 Dec

- +7.2% Ready Mix Concrete Inputs Dec

- +16.4% Lumber/Plywood Inputs Dec

- +46% Fabricated Steel Inputs Dec

- +39% Sheet Metal Inputs Dec

- +21% Gypsum Products Inputs Dec

- +9.6% Flat Glass Inputs Dec

- +23% Copper Products Inputs Dec

- +55% Aluminum Products Inputs Dec

The 2022 forecast is estimated at 4.5% for nonres bldgs inflation and 7% for residential.

Construction Spending Update 10-1-21

Construction Jobs Outlook 10-11-21 read the section on impact of inflation

Inflation – PPI data June-Sept 2021 some materials up 20%-40% but final cost up only 5%-6%

8-15-21 update – These links at top here point to most recent inflation data, to supplement this post. The latest construction spending forecast reflects inflation of 4-6% for nonresidential and 12-13% for residential. The latest tables and BCI plot, as of 8-15-21, are at the very bottom in this file. All 2021 indices have increased since my May 2021 Inflation Report. These tables have the latest.

Also See Construction Inflation Report May 2021 for downloadable report

1-25-21 What impacts should we expect on Construction Inflation in 2021?

In April 2020, and again in June 2020, I recommended adding a minimum 1% to normal long-term construction inflation (nonres longterm inflation = 3.75%), to use 4% to 5% for 2020 nonresidential buildings construction inflation. Some analysts were suggesting we would experience deflation. Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, 2009 and 2010. That was at a time when business volume was down 33% and jobs were down 30%. In 2020, volume dropped 8% from Feb to May and we’ve gained half that back by Dec. Jobs dropped 14%, 1,000,000+ jobs, in two months! Now volume is still down 4% and jobs are down 2% from Feb peak. We’ve gained back 850,000 jobs. But also, we’ve gained back more jobs then volume. That adds to inflation.

Volume drops another 5% in 2021, all nonresidential, and then another 3% in 2022. Jobs could drop overall 8%-10% for all of 2021-2022, 500,000 to 700,000 jobs.

Even though material input costs are up for 2020, nonresidential inflation in 2020 remained low, probably influenced by a reduction in margins due to the decline in new construction starts (-24%), which is a decline in new work to bid on.

Volume = spending minus inflation.

Residential business volume dropped 12% from the January 2020 peak to the May bottom, but has since recovered 22% and now stands at a post Great Recession high, 10% above one year ago. Although residential spending remains near this high level for the next year, volume after inflation begins to drop by midyear. For the year 2020, Residential Building Materials Inputs are up 6.2%. See PPI charts. Sharply higher lumber prices have added more than $17,000 to the price of an average new single-family home since mid-April ($24,000 as of 3-30-21). Residential inflation averaged 5.1% for 2020. (UPDATE 3-30-21 – Single Family home prices increased 11% since March 2020. Lumber cost is now 3x what it was in March 2020. These will both impact cost to build SFH).

10-15-21 – The U.S. Census Single-Family house Construction Index increased 6.7% from Feb 2020 to Feb 2021. Since February 2021 through August it is up another 8.5% for the last 6 months. https://www.census.gov/construction/nrs/pdf/price_uc.pdf

Nonresidential volume has been slowly declining and is now down 8.5% from one year ago. I had forecast by 3rd quarter 2021, nonresidential buildings volume would be down 15% lower than December 2020, or 25% below the Feb 2020 peak. It’s down 5.5% from Dec’20 and down 23% from the Feb’20 peak. This tracks right in line with the 24% decline in new construction starts in 2020. Most of the spending from those lost starts would have taken place in 2021, now showing up as a major decline in spending and work volume. Nonresidential inflation for 2020 dropped to 2.5%, the first time in 7 years below 4%. It’s expected to increase in 2021.

The Producer Price Index tables published by AGC for year-end 2020 https://www.agc.org/sites/default/files/PPI%20Tables%20202012.pdf shows input costs to nonresidential buildings up about 3.5% to 4.5% for 2020, but final costs of contractors and buildings up only 1% to 2%. This could be an indication that, although input costs are up, final costs are depressed due to lower margins, a result of fewer projects to bid on creating a tighter new work available environment which generally leads to a more competitive bidding environment. This could reverse in 2021 as the volume of work to bid on in most markets begins to increase.

As of Sept 2021, PPI for materials inputs to construction is up ytd 15% to 18%. For the 18 months since March 2020, the onset of Pandemic, the PPI for materials inputs to construction is up ytd 23%, but the PPI Buildings Cost Index for final cost to owner is up only 5% to 6%. Construction inflation is very different right now for subcontractors vs general contractor/CM.

11-10-21 From Sept to Oct materials price changes were normal, but Final Demand prices jumped in just one month what could be considered an entire year’s worth of increase. We’ve been watching the price pass thru increase slowly, until now. This is the single largest monthly increase in Final Demand pricing that I can remember. In part, the disparity between these two indices is a data collection issue in how Census gets this information. The Oct increase in the Final Demand index represents several months of growth, all reported at once. Final demand indices are just catching up.

This October 2021 increase is not yet reflected in any other building cost inflation index.

PPI data for Jun – Oct Updated 11-10-21

The Turner Construction 2020 Cost Index for nonresidential buildings averaged 1.8% higher than the avg for all of 2019. The Turner index appears to show the lowest gains in forecasts for 2021, up only 1.4% ytd though Q2. http://turnerconstruction.com/cost-index

The Rider Levitt Bucknall nonresidential buildings average index for 2020 increased 3.5%. Q3 2021 compared to Q3 2020 is up 5.5%. https://www.rlb.com/americas/

R.S.Means quarterly cost index of some materials for the 4th quarter 2020 compared to Q1: Ready-Mix Concrete -1.8%, Brick +10%, Steel Items -1% to -5%, Framing Lumber +32%, Plywood +8%, Roof Membrane +5%, Insulating Glass +12%, Drywall +3%, Metal Studs +23%, Plumbing Pipe and Fixtures +1%, Sheet Metal +20%. https://www.rsmeans.com/landing-pages/2020-rsmeans-cost-index

U.S. manufacturing output posts largest drop since 1946. Think of all the manufactured products that go into construction of a new building: Cement, steel, doors, frames, windows, roofing, siding, wallboard, lighting, heating systems, wire, plumbing fixtures, pipe, valves, cabinets, appliances, etc. We have yet to see if any of these will be in short supply leading to delays in completing new or restarted work.

There have been reports that scrap steel shortages may result in a steel cost increase. Scrap steel prices are up 27% in the last quarter and up 40% for the year 2020. Scrap is the #1 ingredient for new structural steel. The U.S. steel industry experienced the most severe downturn since 2008, as steelmakers cut back production to match a sharp collapse in demand and shed workers. Capacity Utilization dropped from 82% in January 2020 to 56% in April. In mid-August, CapU was up to 61%, still very low. As of January 23, 2021 CapU is up to 76%, well above April’s 56% but still below desired level. Steel manufacturing output is still down compared to pre-covid levels. Until production ramps back up to previous levels there may be shortages or longer lead times for delivery of steel products. In August 2021, CapU is back to 85%.

Steel Prices at mill in the U.S. are up 60% to 100% in the last 6 months. All prices are 50% to 75% higher than Feb 2020. http://steelbenchmarker.com/files/history.pdf . This is mill price of steel which is about 25% of the price of steel installed. What affect might a steel cost increase have on a building project? It will affect the cost of structural shapes, steel joists, reinforcing steel, metal deck, stairs and rails, metal panels, metal ceilings, wall studs, door frames, canopies, steel duct, steel pipe and conduit, pumps, cabinets and furniture, and I’m sure more. Assuming a typical structural steel building with some metal panel exterior, steel pan stairs, metal deck floors, steel doors and frames and steel studs in walls, then all steel material installed represents about 14% to 16% of total building cost. Structural Steel only, installed, is about 9% to 10% of total building cost, but applies to only 60% market share being steel buildings. The other 6% of total steel cost applies to all buildings. https://www.thefabricator.com/thefabricator/blog/metalsmaterials/steel-prices-reach-levels-not-seen-since-2008 At these prices, if fully passed down to the owner, this adds about 1.5%-2% to building cost inflation. With demand in decline for nonresidential buildings, I would expect to see all these steel price increases recede. Also, take note, as of January 2021, none of this steel price movement appears captured in the PPI data or RSMeans data.

Contractors have been saying they have difficulty acquiring the skilled labor they need. This has led to increased labor cost to secure needed skills. I expect the decline in nonresidential work volume in 2021 to result in as much as a decline of 250,000 nonresidential jobs in 2021. This results in labor available to fill other positions.

This SMACNA report quantifies that labor productivity has decreased 18% to meet COVID-19 protocols. https://www.constructiondive.com/news/study-finds-covid-19-protocols-led-to-a-7-loss-on-construction-projects/583143/ Labor is about 35% of project cost. Therefore, just this productivity loss would equate to -18% x 35% = 6.3% inflation. Even if, for all trades, the average lost time due to COVID-19 protocols is only half that, the added inflationary cost to projects is 3% above normal. But that may not remain constant over the entire duration of the project, so the net effect on project cost would be less.

Post Great Recession, 2011-2020, average nonresidential buildings inflation is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. Residential cost inflation for 2020 reached 5.1%. It has averaged over 5% for the last 8 years. The 30-year average inflation rate for nonresidential buildings is 3.75% and for residential it’s over 4%.

This survey of members by AGC https://www.agc.org/sites/default/files/2021_Outlook_National_1221_.pdf just published provides some insight into construction firms outlook for 2021.

Almost every construction market has a weaker spending outlook in 2021 than in 2020, because approximately 50% of spending in 2021 is generated from 2020 starts, and 2020 nonresidential starts are down 10% to 25%, several markets down 40%. Nonbuilding starts are down 15%, but will increase 10% in 2021.