Construction Jobs report for Mar 2022 shows total jobs up 19,000 from Feb

Rsdn jobs +7,600, Nonres Bldgs +6,300, Civil +5,000

Although construction jobs increased by 19,000 in March, total hours worked dropped by 1.8% from Feb, so total workforce output is down.

It’s real hard to compare construction jobs growth by sector. If you work for a concrete firm or structural steel firm, with firm doing primarily nonresidential work, but you are out there putting in concrete or steel for a high-rise multifamily buildings, your job is still classified as nonresidential.

Jobs are up 82,000 year-to-date, 1.1% from Dec, but that’s also up 3.5% from ytd 2021. With the latest quarter at +1.1%, jobs are increasing at a rate of 4%/year. But inflation adjusted spending, building activity, is expected up only 2.5% in 2022, after dropping -2% in 2021. Jobs increased 2.5% in 2021.

2022 spending started the year at the highpoint. I expect a slow decline in monthly spending in all sectors of 2% over the 2nd half. That provides no support for jobs growth.

Construction jobs have nearly returned to pre-pandemic levels. The problem with construction jobs having returned to pre-pandemic levels is the level of inflation adjusted construction volume of activity that is needed to support those jobs is still 5% below Feb 2020 and 13% below the 2006 peak. So since Feb 2020, jobs are back to that level, but volume is not so productivity has dropped by 5%.

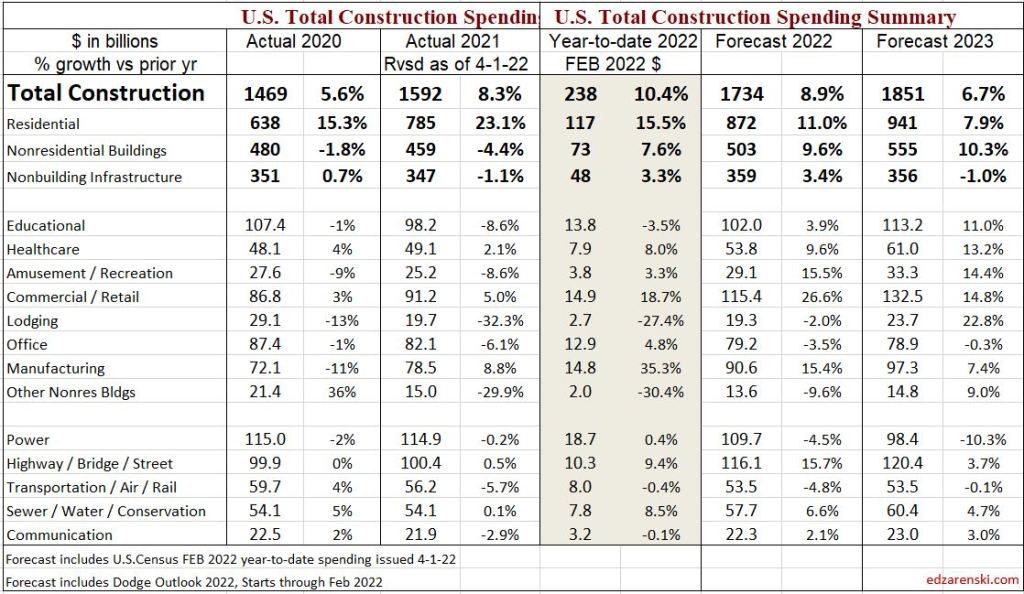

Construction Spending is up +10.4% year-to-date (in 2 months!) mostly driven by +15.5% ytd Residential.

A plot of residential construction spending inflation adjusted. Taking out inflation shows volume of building activity. Perhaps the trend in residential is strong enough to keep going.

Total spending is up +4% in 3mo since Nov 2021 (and 10% ytd-2mo), but I don’t expect this rate of growth to hold. However, this and any other changed data inputs revises my 2022 spending forecast.

Examples of big changes since initial forecast:

Manufacturing spending has increased so much in Jan-Feb, (up 35% ytd) that even if the next 10 months finish flat year/year, Mnfg will still finish up 5% for 2022.

Residential new starts for the latest 3 mo, Dec-Jan-Feb, avg is as high as any quarter last year. Nearly all of this spending occurs in 2022.

Construction buildings cost inflation over the last 4 years is up 25%. Labor cost, wages up 15% & productivity down 7%, is up 22%. But labor is 35% of total building cost so 22% x 35% = labor is 8% of that total 25% building cost inflation. Fully 1/3 of construction inflation over last 4 years went into workers pockets.

Ed, I recently sold a home in the city and moved to a family farm. I planned to use the proceeds from my home sale and build a large barn/loft structure, and do some remodeling on the extremely small farmhouse. I feel now is the worst time for this project, and am hanging on with what I have. Builders around here will barely look at my drawings, as they are so busy, workers are hard to find out here and materials are so unpredictable. Do you see any possibility of a break in this for the individual looking to build/remodel? My hopes were that a recession might actually help me get my project done, but I’m wondering if I am naive. If you were hoping to build privately now, how would you proceed?

LikeLike

I do not see a recession in construction. The demand on contractors may continue at least in 2023. However, I would expect material input price increases to slow down.

LikeLike