Home » Posts tagged 'economics'

Tag Archives: economics

Construction Forecast Update May 2025

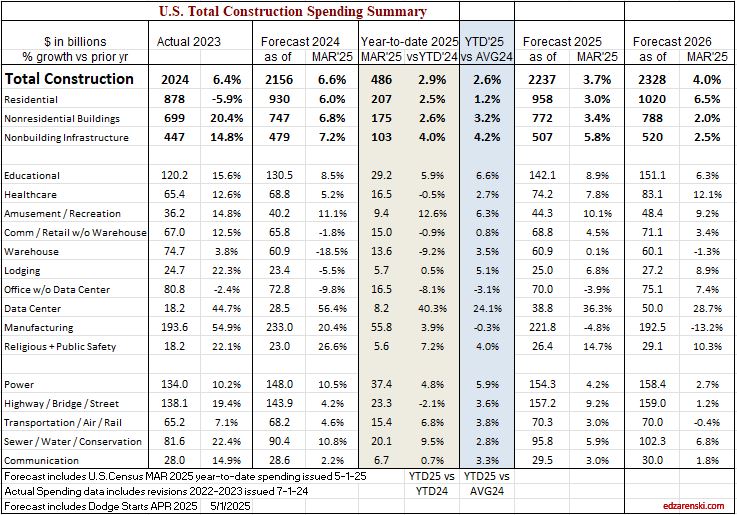

The total construction spending forecast, now at $2,237bil, +3.7% vs. 2024, has been lowered a bit since the Outlook in Feb. ($2,272bil, +5.5%). Most of the reduction is in Residential, from $997bil, +7.2% down to $958bil, +3.0%. Nonres Bldgs was reduced by $11bil and Nonbldg increased by $7bil. Compared to the average for the year 2024, current total spending YTD is up 2.6%, but is expected to pick a little up throughout the year across all sectors.

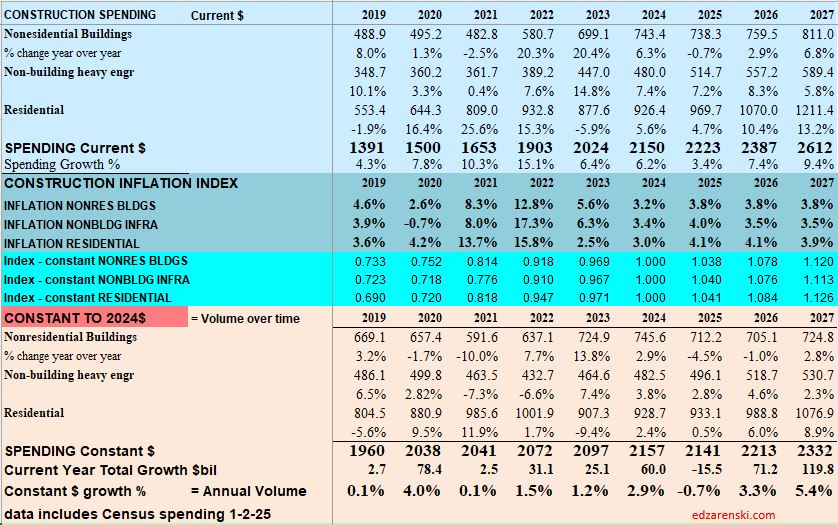

Constant $ growth is forecast down 0.7% in 2025 and down more after that. Inflation Index shows annual percent and index to base 2024 = 100. All years, current spending / index = reported as constant 2024$, as if all constant years are the same 2024$.

Residential Single Family spending has been in a range +/- 2.5% for the last 7 months. With only a few months lower than that, this range extends back 18 months. Take out 3%/yr inflation and you can see that SF volume has been flat to down. Multi-family spending, for the last 12 months, is down 15% off recent highs in Q1’24. Reno/repair spending extended recent highs across 5 months in mid 2024, before falling off 10% in Q4, and now, in Q1’25 it has gained back most of that drop. Any spending gains in the near future would be driven by multi-family.

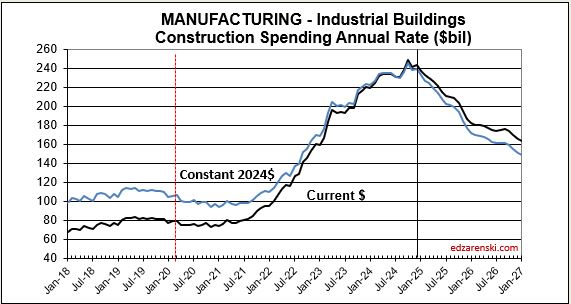

Manufacturing is still the largest $ contributor ($222bil/yr) to nonresidential bldgs total spending ($772bil/yr), but has fallen 6% in the last 5 months. The trend is down in most months for 2025 and down in 2026. This decline is entirely expected and you can read about it in my article, The Manufacturing Taper.

Data Centers shows the largest % spending growth for 2025, forecast +39%, continuing on a phenomenal streak of +45% in 2023 and +56% in 2024. Data Center starts increased 300% over the previous 3 yrs. and still increase in 2025 and 2026, but at a slower rate of growth. Manufacturing spending peaked in Oct’24. Data Center spending continues to increase for the next few years. Both of these forecasts take into account some cancelations or delays announced recently (see May Briefs), however do not account for any major stoppages due to recent trade impacts.

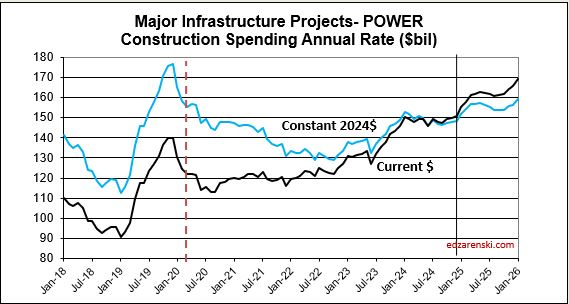

The largest $ increases in spending are Power, forecast to increase +$16bil, and Highway +$13bil. Educational spending is forecast to post the largest nonres bldgs $ growth in 2025 (+$12bil, +9%). Data Centers increase $10bil.

This same scenario that looks to occur in Manufacturing will occur also in Highway/Bridge. Normal starts were about $100bil/yr, with slow growth. But for the last 3 years, actual starts totaled closer to $500bil for the 3 years or $167bil/yr. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for 4 years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. But once the taper begins it will have the same effect on Nonbldg Infrastructure spending that we will see from Mnfg in Nonres Bldgs.

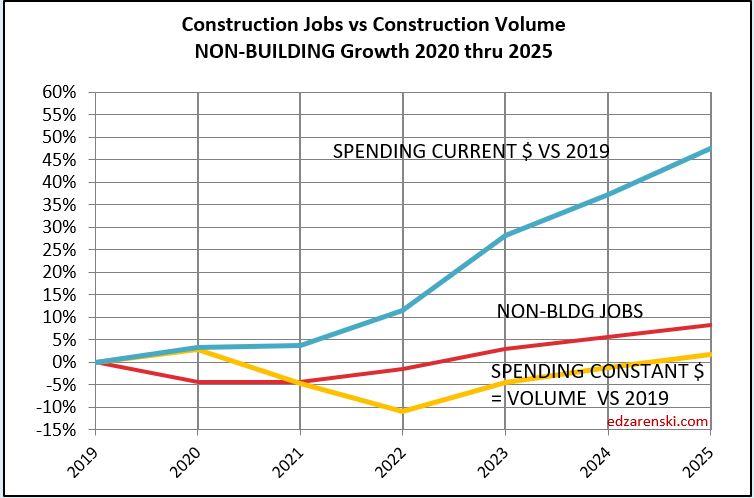

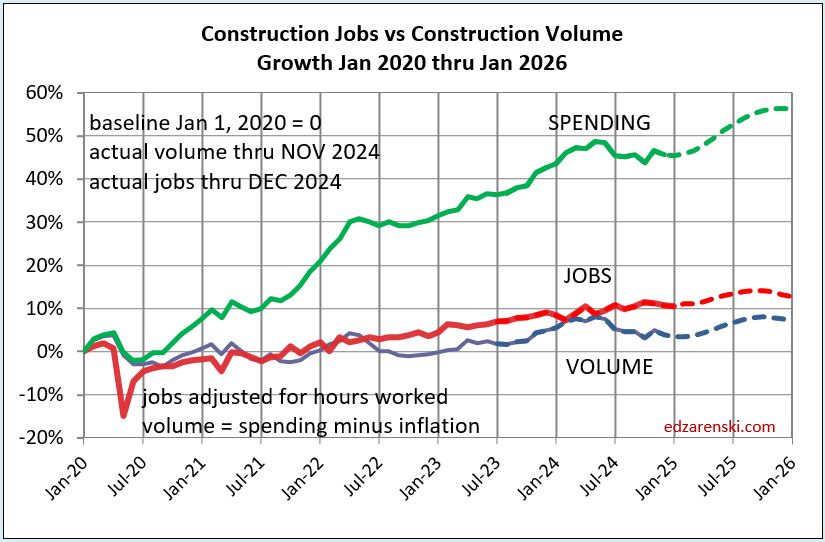

Typical jobs growth is 2.5% to 3.5% per year, even though spending can sometimes far outpace that. But jobs growth doesn’t track spending, it tracks volume growth. Volume is spending minus inflation. For example, for the 4 years 2021 thru 2024, spending increased 44%. But inflation increased 33%. Volume growth was only 11%. Jobs increased 12.5%. For 2025, Inflation will outpace spending growth by 1%, but jobs are still expected to increase by 1.5%. Rarely do jobs decrease. That could change.

There are 870K construction jobs in TX. 500K are immigrants and 300K are undocumented.

New starts are forecast up in 2025, but I would caution there are a lot of headwinds that could slow new starts growth. Many economists predict the current trade impacts will slow overall economic growth. That in turn could slow capital expenditures, which, in this case, is new construction starts. So far year-to-date, spending is outpacing new starts growth. That means backlog is decreasing, mostly in nonresidential buildings. We haven’t seen a decrease in Nonres Bldgs backlog since pre-2011. Residential backlog is down slightly. Nonbuilding is increasing.

See Also Construction Briefs May 2025

and Construction Briefs Apr 2025

5-15-25 all ppi DATA UPDATED TO APR See Construction Inflation 2025

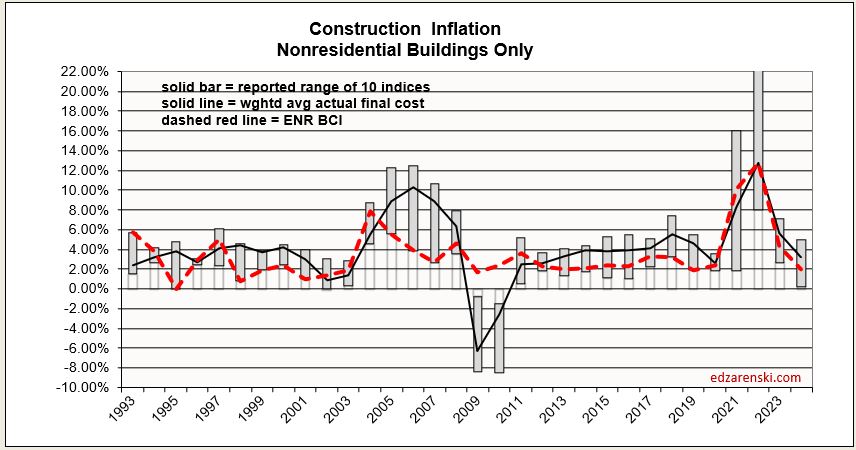

I’ve increased the inflation outlook since Feb to a range of 4.5% to 5%. Inflation may be the most uncertain of all factors affecting construction this year. We have yet to see any significant impact from tariffs, and there is sure to be impacts to many construction inputs. We may not know the total impact for several more months. But I would expect, if anything, inflation will go up from here, not down.

The bees are swarming the flowers outside. At least some lifeform is content and at peace with this world.

Construction Analytics Outlook Feb 2025

2-22-25 — A PDF of this entire Outlook article has been attached at the bottom of this post. 32pages, watchout. The Outlook has quite a bit more than in the post here.

Construction Spending

for 2024 vs 2023, as of Dec 2024 data, is up 6.5%. All sectors gained between 6% and 7% over 2023. Growth is forecast at 5.5% in 2025. While Residential and Non-building Infrastructure will both gain 7%, Nonresidential Buildings will only see growth of 2% in 2025.

In February of 2025, with the Dec 2024 data in hand, my forecast for 2025 spending is $2,272 billion, 5.5% higher than my current 2024 forecast of $2,154 billion. There is strength in most markets, but Manufacturing is starting a downward slope in spending after three years of blockbuster performance.

This is the first report of a full 12 months of data from 2024. This number gets revised in Mar and Apr and again in July, when any/all months for the last two years get revised.

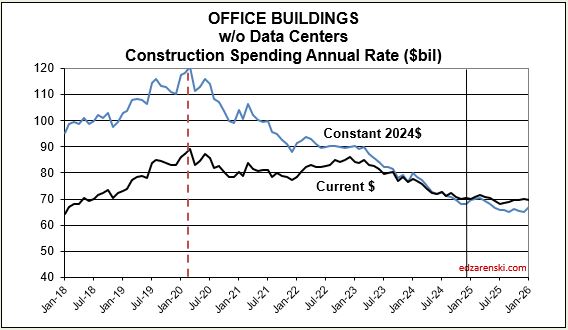

Last year at this time, leading into 2024, many of the Nonres Bldgs and Non-bldg line items showed Nov-Dec spending was already several points higher than the 2023 average. This year, many markets show very small gains or a decline in the rate of spending from the 1st half of the 2024 into the 2nd half. Some notable declines are Warehouse (-2.7%), Office w/o Data Centers (-3.6%) and Highway/Bridge (-2.9%). All begin 2025 down from the average in 2024.

However, Data Center spending is already up 16% in Oct-Nov-Dec vs the average of 2024, so begins 2025 on a high note, up 16% from 2024. Data Center spending increased 45% in 2023 and 56% in 2024. With spending increasing at an average 3%+ per month in 2024, and starting out at that pace in 2025, it’s easy to predict Data Center spending may reach 40% growth for 2025.

As we begin 2025, the current rate of spending (SAAR) for Nonresidential Buildings in Q4’24 is $761bil, only 2% higher than the average for 2024 ($746bil). If spending stays at the current level and no additional growth occurs, Nonresidential Bldgs spending will finish 2024 up 2%. Spending would need to have more monthly declines than increases to finish the year up less than 2%. The current forecast shows the monthly SAAR rates for Manufacturing, Warehouse and Office w/o DC are driving the downward pressure on overall spending.

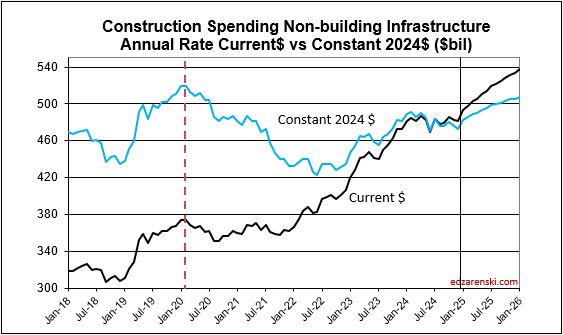

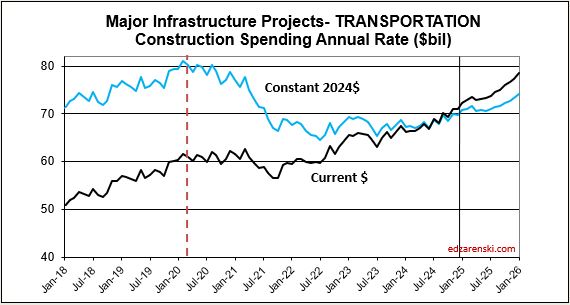

Non-building Infrastructure current rate of spending is only 1% higher than the average for 2024, however the forecast is indicating steady growth of 1.5%/mo for all of 2025. Highway, Transportation and Public Utilities are all contributing to that growth in the spending rate.

Residential current rate of spending is a bit less than 2% above the 2024 average. Growth of 1%/mo will occur in the 1st half 2025, then reverse to a slight decline in the 2nd half.

My construction spending forecast for 2025 Nonres Bldgs is only an annual gain of 2%. Low growth is driven by projects ending in Manufacturing and Warehouse. In the last 3 yrs, there were $230bil Mnfg starts, most in 2022, $130bil above normal, now some are ending. Without Manufacturing, Nonres Bldgs 2025 spending would be up 6%. So while outward appearance may be that Nonres spending is declining, in large part it is due to mega spending on Manufacturing buildings (and Warehouse) tapering down upon completion, creating very large annual declines, but normal. See The Manufacturing Spending Taper

Whenever we get an unusually large increase in new construction starts and spending, the tapering off of those projects leads to a decline in spending in the 2nd half of the scheduled construction. Mnfg new starts peaked in late 2022 – early 2023, so some of these projects would now be in construction for anywhere from 24 to 30 months, well past the midpoint or peak spending. Here’s what the manufacturing spending taper may look like.

In three years, 2020-2022 Manufacturing new starts increased by over 200%. Now, even projects that started in late 2022 are more than 24 months into construction. Peak spending occurs at the midpoint of a project, so peak spending may already be behind us. The current rate of spending in constant$, with exception of Oct. which jumped 2%, remained near flat for the last 8 months. Mnfg new starts peaked in late 2022 – early 2023, so some of these projects would now be in construction for anywhere from 24 to 30 months, well past the midpoint or peak spending. It appears the slowdown in the 2nd half 2024 may be an indication that spending peaked. Although 2025 spending begins 4% higher than 2024 average, my model indicates the rate of spending drops 10% by midyear and by year-end is down 25% from current spending. I’m forecasting 2025 spending average falls 8.5% below 2024.

See The Manufacturing Spending Taper

This same scenario will occur in Highway/Bridge. Normal Highway starts have consistently been about $100bil/yr, with slow growth. But actual starts were closer to $500bil total for the last three years. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for four years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. Once the taper begins it will have the same effect on Non-bldg Infrastructure spending that we will see from Manufacturing in Nonres Bldgs.

Residential spending is 45% SF, 15% MF and 40% Reno. So, only 60% of the total is spending on new housing units. The other 40% is Renovations. Single family construction spending reached a post-2006 high in Q4’21 thru Apr’22. From Apr’22 to the low-point in May ’23 spending dropped 25%. By year-end 2023 it had recovered most of that drop. It fell again in mid-2024, but has since recovered again to the year-end’23 level. Single Family spending is up 7% in 2024 over 2023. Multi-family in Q4’24 is down 10% from Q4’23. Renovations is up 15% from Q4’23 to Q4’24.

The Non-Building Infrastructure spending forecast for 2025 will be most affected by the fact that Power starts for the last 3 years range from 9% to 11%, Highway new starts range from 8% to 11% and Public Works new starts range from 13% to 17%. Starts have been greater than spending each of the last three years. Backlog increased 10% each in 2023 and 2024 and 9% in 2025. Power spending will increase $13bil (8.5%) in 2025, supported by 22% growth in starts the last 2 years. Public Utilities (Sewage and Waste, Water Supply and Conservation-Rivers-Dams) will increase $12bil (13%), with 30% growth in starts the last 2 years.

The Nonresidential Buildings spending forecast for 2025 is most affected by declines in Manufacturing and Warehouse, and increases in Educational and Data Centers. Starts in 2021 and 2022 increased at an average 14%/yr. But new starts in 2023 were only 5.5%, and in 2024 were only 2.6%. Starts in 2023, and especially 2024, have the most impact on 2025 spending. Backlog is increasing, but the rate of backlog growth has slowed from 15% in 2022 to 5% in 2024 and 2% in 2025. Although Data Center spending is expected to increase 42%, that is $12bil. Educational spending will also increase $12bil, even though that is only 9%.

Educational SAAR rate of spending begins 2025 4.5% higher than the average for 2024. Starts are up 18% over the last 2 years. Spending finished 2024 3% higher than it started. The rate of spending is increasing at 0.50% to 0.75%/month for 2025. My forecast is for 9% spending growth in 2025.

Healthcare SAAR rate of spending begins 2025 0.5% lower than the average for 2024. Starts are up 22% over the last 2 years. The rate of spending, increasing since June, is flat in Q1’25, then increases at an average of 1.5%/month for Q2 and Q3 before slowing. My forecast is for 6% spending growth in 2025.

Amusement /Recreation SAAR rate of spending begins 2025 3.0% higher than the average for 2024. Starts are up 18% over the last 2 years. The rate of spending, up 9% from Q1’24 to Q4’24, increases at an average 1.25%/month for 2025. My forecast is for 13% spending growth in 2025.

Lodging SAAR rate of spending begins 2025 3% lower than the average for 2024. Starts are up 14% in 2024 and 20% over the last 2 years. The rate of spending, lower in the 2nd half 2024, increases at an average of 1.25%/month for 2025. My forecast is for 9.5% spending growth in 2025.

Office Bldgs w/o Data Centers SAAR rate of spending begins 2025 3.6% lower than the average for 2024. Starts are down 15% over the last 2 years. Spending in the 2nd half of 2024 is down 5% from the 1st half, in fact from Q1’24 to Q4’24, the rate of spending fell 10%. The rate of spending increases 0.5%/mo in Q1’25, but then falls at 0.50% to 0.75%/month for Q2 thru Q4. My forecast is for a 4% spending decline in 2025.

Data Centers SAAR rate of spending begins 2025 16% higher than the average for 2024. Starts are up 120% over the last 2 years. From beginning to end of 2024 spending increased 20%. The rate of spending increases at near 2%/month for 2025. My forecast is for 42% spending growth in 2025.

Commercial / Retail Bldgs w/o Warehouse SAAR rate of spending begins 2025 only 1.5% higher than the average for 2024. Starts are down 0.5% over the last 2 years. In 2024, the rate of spending fell 3% over the year. The rate of spending begins 2025 with a slight drop then is flat for the rest of the year. My forecast is for 1% drop in spending in 2025.

Warehouse Bldgs SAAR rate of spending begins 2025 2.7% lower than the average for 2024. Starts are down 17% over the last 2 years. Spending in the 2nd half of 2024 is already down 13% from the 1st half 2024. The rate of spending in 2025 drops at 0.25%/month. My forecast is for 4% spending decline in 2025.

Highway SAAR rate of spending begins 2025 2.9% lower than the average for 2024. Spending fell 7% over the course of 2024, but still finished the year up 4%. Starts are up 18% over the last 2 years. Monthly spending is up and down, but averages 0.8%/mo for the year. My forecast is for 3% spending growth in 2025.

Power SAAR rate of spending begins 2025 2.0% higher than the average for 2024. Starts are up 22% over the last 2 years. 2024 spending finished level with where it started and begins 2025 up 2% over avg. 2024. The rate of spending starts strong at 2%/mo in Q1, then falls back to 0.3%/mo for the remainder of 2025. My forecast is for 8.5% spending growth in 2025.

Public Utilities SAAR rate of spending begins 2025 1.7% higher than the average for 2024. Starts are up 29% over the last 2 years. From Q1’24 to Q4’24, spending increased 9%. The rate of spending slows from 1.5%/mo at the beginning of 2025 to 1%/mo by year-end. Sewage/Waste and Water Supply provide the greatest $ growth. My forecast is for 13% spending growth in 2025.

Transportation SAAR rate of spending begins 2025 4.0% higher than the average for 2024. Starts are up 9% over the last 2 years. Spending finished 2024 6% higher than it started. The 2025 rate of spending starts strong just above 1%/mo, but averages only 0.75%/mo for the whole year. My forecast is for 8.7% spending growth in 2025.

STARTING BACKLOG

Starting backlog is the estimate to complete (in this analysis taken at Jan 1) for all projects currently under contract. The last time starting backlog decreased was 2011. If new construction starts in the year are greater than construction spending in the year, then for the following year starting backlog increases. It’s when new starts don’t replenish the amount of spending in the year that backlog declines.

80% of all nonresidential spending in any given year is from backlog and could be supported by projects that started last year or 3 to 4 years ago. Residential spending is far more dependent on new starts than backlog. Only about 30% of residential spending every year comes from backlog and 70% from new starts.

The table below, Forecast Starting Backlog, is model generated by Construction Analytics. Adjusted starts are spread over time to generate cash flow. Spending each year is subtracted from starting backlog and new starts are added to get starting backlog in the following year.

Construction Backlog leading into 2025 in total is up 53% from Jan 2020. Even though several markets are down for the year, every sector (Res, Nonres, Nonbldg) is at all-time high. Since 2020, construction starts have been greater than construction spending, therefore backlog is increasing, but the spread is decreasing. From 2015 through 2019, new construction starts were steady at 4% greater than spending. In 2020, 2021 and 2022, starts exceeded spending by 8%. In 2023 it fell to 6% and in 2024 it was 5%. For 2025, starts are expected to exceed spending by only 3%, indicating the rate of backlog growth is slowing.

Reaching new highs in Backlog could mean not enough labor to support advancing growth so quickly. Future workload from new starts is piling up faster than the current workforce can complete. And the labor force has limitations to how fast it can grow. Nonresidential Bldgs and Non-building posted higher than average starts growth vs spending.

Residential new starts average only 2% greater than spending. Residential new starts in 2023 were lower than spending, so, in 2024, for the first time in 10 years, residential backlog decreased. Even then, residential backlog beginning 2025 is up 61% since 2020. However, these backlog numbers are not inflation adjusted. 45%, or about ¾’s of the 61% residential backlog growth over 5 years is inflation. Real residential backlog growth since 2020 is 16%.

Nonresidential Bldgs starting backlog for 2025 received a boost from all the starts in 2021, 2022 and 2023. Backlog is up 55% from 2020. After 36% inflation, real backlog growth over 5 years is 19%.

Non-building Infrastructure starting backlog was also boosted by strong starts in 2021- 2024. For 2025, backlog is up 49% from Jan 2020. After 38% inflation, real backlog growth over 5 years is 11%.

Manufacturing backlog increased 130% from 2020-2025, from $117bil going into 2020 to $270bil beginning 2025. Prior to tracking Data Centers separately, no other market has ever been close to that growth. But, Manufacturing is 6 times the dollar value of Data Centers. Manufacturing was responsible for 60% of all the Nonres Bldgs spending $ growth in 2023 and 85% in 2024. It was also responsible for 33% of the Nonres Bldgs Backlog growth from 2020 to 2025.

Nonres Bldgs has a total 3.7 million jobs and has never increased by more than 150,000 jobs in one year. Manufacturing is 30% of all Nonres Bldgs spending, so we can assume 30% of Nonres Bldgs jobs. That’s 1.1 million jobs supporting just Manufacturing projects. So Backlog of $270bil, at 5000 jobs per billion per year, would need 1,350,000 jobs for a year. With a 1,100,000 jobs share of the workforce, $270billion in backlog would provide support for 15 months. Of course, new starts add to support throughout the year, but the calculation of how long backlog would support that market segment is valuable.

Likewise, Highway/Bridge has 2025 starting backlog of $240billion and represents 30% of Non-bldg Infrastructure spending, so may occupy 30% of Non-bldg jobs, or 345,000 jobs. But Non-bldg work requires fewer jobs, more like 3,000 jobs/bil/yr, so $240 billion at 3000 jobs/billion/year would need 720,000 jobs for 1 year to complete. Therefore, with a pool of only 345,000 jobs supporting highway work, the backlog of $240billion would provide support for 25 months.

Backlog at the beginning of the year or new starts within the year does not give an indication of what direction spending will take within the year. Backlog is increasing if new starts during the year is greater than spending during the year. An increase in backlog could immediately increase the level of monthly spending activity, or it could maintain a level rate of market activity, but extended over a longer duration. In this case, there is some of both in the forecast. It takes several years for all the starts in a year to be completed. Cash flow shows the spending over time.

NEW CONSTRUCTION STARTS

Total construction starts for 2024 are up 5.3%. Residential starts increased 5.7%.Nonresidential Buildings starts gained 2.6% and Non-building Infrastructure starts are up 8.3%.

Total construction starts for 2025 are forecast to increase 3.8%. Residential starts are forecast to increase 6.1%. Nonresidential Buildings starts are expected to gain 2.5% and Non-building Infrastructure starts will be up only 1.6%.

Residential starts increased 5.7% in 2024. Only about 30% of the spending in 2025 comes from 2024 starts. Most of the spending (70%) in 2025 comes from projects that starts in 2025. This is a result of short duration single-family and renovations projects. Residential starts are expected to increase 6.1% in 2025.

Nonresidential Buildings, starts fell 20% in the 1st half 2023 but still posted the 2nd highest 6-mo average ever. Some of these starts will still be adding to spending into 2025. Nonres Bldgs starts for 2024 gained only 2.6%, due to large declines of 7% to 8% in Manufacturing, Office w/o Data Center and Warehouse, and a moderate 1.2% decline in Commercial / Retail w/o Warehouse. Office w/o Data Center has fallen each of the last 5 years and is down 15% in the last 2 years. Manufacturing starts in 2025 are expected to drop -13%, Office w/o Data Center -4%. Strong growth in new starts in 2025 is expected from Data Centers, Lodging, Healthcare and Public Bldgs (80% of Other Nonres Bldgs). The forecast for Nonres Bldgs new starts in 2025 is +2.5%.

Non-building starts for the 6-mo period Mar-Aug 2023 posted the best 6 months on record, up 30% from the average of 2022. For 2024, Power, Highway/Bridge and Public Works have the strongest gains. These same three markets had the strongest gains in 2023. Power starts are up 22% the last two years. Highway starts are up 19% the last two years. Environmental Public Works are up 29% the last two years and up 50% the last three years. Total Non-building Starts for 2024 are up 8.3%. Non-building starts for 2025 are forecast up only 1.6%.

Data Center starts are up 300% since 2020, up 53% in 2023 and up 44% in 2024, and are expected to increase 27% in 2025. In 2014-2015, Data Centers was less than 5% of total Office+DC construction spending. Today it is approaching 30%. Next year it will approach 40%.

Warehouse starts have dropped 17% in the last two years. Warehouse spending will now slow after climbing 100%+ since 2019. In 2015, Warehouse was 25% of total Commercial spending. By 2022 it had climbed to 54%. In 2025, it will fall back to 45%. But spending will remain near the current level at least for the next three years. Warehouse starts will remain flat in 2025.

Manufacturing starts, the market with the largest $ movement, fell 8.7% in 2024, but still gained 115% from 2019 to 2024. Manufacturing projects can have a moderately long average duration because some of these are multi-billion $ projects and can have schedules that are 4 to 5 years, so some of these projects are still contributing a large volume of spending in 2025. However, as earlier projects begin to taper off, spending will begin to decline.

Manufacturing starts hovered near $80bil/yr from 2014 through 2019. By 2023 new starts had increased to $206bil/yr. Starts fell 9% in 2024 and are predicted to fall by $20bil/yr to $30bil/yr (10% to 15%) over the next three years. Spending is predicted to decline by approx. 10%/yr for the next three years.

Public Works project starts have increased on average 15%/yr for the last four years. Project starts are up 75% in the last four years. Spending is predicted to climb for the next three years.

CURRENT $ SPENDING / INFLATION / CONSTANT $ VOLUME

Volume = spending minus inflation. Spending includes inflation. Inflation adds nothing to volume.

Many construction firms judge their backlog growth by the remaining estimate to complete of all jobs under contract. The problem with that, for example, is that Nonresidential Buildings spending (revenues) increased 14% in 2022, but after adjusting for 12% inflation the actual volume of work was up only 2%. By this method, firms are including in their accounting an increase in inflation dollars passing through their hands. Spending includes inflation, which does not add to the volume of work.

Total volume for 2024 is up 3.1%. Residential +2.7%, Nonres Bldgs +3.3%, Non-bldg +3.5%.

Total volume forecast for 2025 is +1.3%. Residential +2.9%, Nonres Bldgs -1.9%, Non-bldg +3.0%.

Since 2019, spending has increased 55%. Volume has increased only 10%. The difference is inflation.

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. Spending is current to the year stated. The values in the constant table are indexed to a constant value year, now using 2024. This shows business volume year to year, can be a lot different than spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Caution: the following table, showing Constant$ analysis, now shows Constant$ with base year at 2024. Since Q1-2020 I have used the base year at 2019. This update changes the Constant$ amount, but not the Constant$ percent growth. Slight changes in prior years inflation resulted in some minor changes in Constant$ growth.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. Therefore, Revenue does not measure volume growth. In 2022, Nonresidential buildings inflation was 12%, so business volume was 12% less than spending, or 12% less than revenue. Residential volume was 15% less than spending.

Construction spending includes inflation, which adds nothing to the volume of work put-in-place. Construction Volume is a measure of business activity. It eliminates inflation as a variable and shows Constant$ growth. As an example, 2021-22 posted some of the biggest spending increases we’ve seen in 20 years, up over 25% in two years. But, if you look at the bottom row in the table above, we see constant$ growth, or volume, increased only 1.6% in those two years. The inflation rates for those years confirms that almost all of the spending increases were inflation, not added business volume. Construction volume, (spending minus inflation) will finish 2025 up 1.3%, but up only 12% since 2019.

Compare this following Spending by Sector Constant$ plot to the Sector Current$ plot at the beginning of this article.

CONSTRUCTION JOBS

Construction Jobs should not get compared to construction spending. Spending includes inflation, which adds nothing to business volume. Compare Jobs growth to Volume growth. If volume is declining, there is little to no support to increase jobs. And yet, we’ve seen historically that jobs increase at an approximately 3.5%/yr, even when volume does not increase.

Construction Jobs increased 204,000 jobs or 2.5% in 2024. There are currently 8,291,000 construction jobs reported by BLS. The largest annual increase post 2010 is 321,000 jobs (+4.6%) in 2018. The average jobs growth post 2010 is 200,000 jobs per year.

From 2012-2019, we added an annual average 245,000 jobs/yr (+3.9%). From 2021-2024, we added 240,000 jobs/yr (3.1%). In 2024 we added only 204,000 jobs (2.5%). Since 2011, there have been only 3 years in which we added fewer than 200,000 jobs, 2012, 2020, 2021. Also, since 2011, there have been only 3 years in which we added more than 300,000 jobs, 2015, 2018, 2022. Seldom do jobs increase by 400,000 or by 5%/yr. Excluding down years, since 2012, average annual growth is 3.6%/yr.

Here’s an enlarged view of just Jobs/Volume. Removing Spending enhances the vertical scale.

From 2012-2019, we added an annual average 245,000 jobs/yr (+3.9%). From 2021-2024, we added an average of 240,000 jobs/yr (3.1%). In 2024 we added only 204,000 jobs (2.5%). Since 2011, there have been only 3 years in which we added fewer than 200,000 jobs, 2012, 2020, 2021. Also, since 2011, there have been only 3 years in which we added more than 300,000 jobs, 2015, 2018, 2022. Seldom do jobs increase by 400,000 or by 5%/yr. Excluding down years, since 2012, average annual growth is 3.6%/yr.

January jobs report shows we added 4k jobs in Jan, but the unemployment rate went up from an average 4.7% in Q4 2024 (5.2% in Dec), to 6.5% in Jan.

3-7-25 Construction gained 19k (+0.2% mo/mo) jobs in Feb, BUT total hrs worked fell -0.3%. Total jobs have increased but hrs worked has gone down in each of the last 5 months. We’ve posted minor jobs gains in both Jan and Feb, and yet unemployment has gone up from 5.2% in Dec to 7.2% in Feb.

The unemployment rate in construction goes UP in the 1st qtr every year, by at least 2% to 3% (data since 2011). Now, your 1st thought may be, if unemployment is increasing, that is probably because jobs are falling. Well, construction has ADDED jobs in the 1st qtr. every year since 2011 (excluding 2020), by an avg of nearly 30% of all jobs added annually. Construction unemployment is not going up in winter months because we lose jobs in winter. So how can the unemployment rate still go up? The numerator (jobs) is increasing. There’s only one number left in the equation, the denominator (workforce). The result goes up because the entire workforce increases. In this case, the workforce is increasing by greater than the number of jobs added. So, when the unemployment rate increases in Q12025, don’t assume it is because we are losing jobs.

The plot below shows how consistent jobs growth has been over the last 14 years. After the 2020 dip, the slope (annual rate of growth) of jobs growth is about the same as Jan2011-Jan2020. Jobs increase at about 3.5%/yr to 4%/yr., regardless of what volume is doing. In fact, since 2016, the last time volume increased by more than 4%, jobs are up 22%. Volume is up only 11%.

Since Jan 2011, average jobs growth is 3%/yr. Average volume of work growth since 2010 is 2.3%/yr. This plot above shows Jobs and Volume growth closely match from 2011 to 2018. With few exceptions for recession periods, this pattern can be seen throughout the historical data.

What’s remarkable about the growth is this; since 2016, spending has increased 77%, volume after inflation increased only 11% and jobs increased 22%. Volume and jobs should be moving together.

It takes about 5000 (Nonres) jobs to put-in-place $1 billion of volume in one year. It could easily vary from 3000 to 5000, depending on the type of work. So, on average, an add of $100 billion+ of Nonres Bldgs in one year would need 500,000 new jobs. Jobs should track volume, not spending growth. Volume = spending minus inflation. Normal construction jobs growth is about 250,000 jobs per year and maximum prior annual growth is about 400,000.

Non-building, over the next two years, could experience the same kind of growth spurt as Nonres Bldgs., a forecast increase in volume the next two years without an equal increase in jobs. Volume which was lower than jobs since 2021, is now increasing faster than jobs. Non-bldg volume is forecast up 6% to 8%/year the next 3 years. Jobs increase at an avg. 3.5%/year.

Residential volume has exceeded residential jobs all the way back to 2011. The recent decline in volume brings the two even, if the jobs hold the pace.

For as long as I can remember, the construction industry has been complaining of jobs shortages. And yet, as shown in the data mentioned above, jobs have increased greater than volume of work. With an exception for recession years, (2007-2010 and 2020), jobs increase at a rate of 2.5% to 3% per year. The greatest disparity between jobs and volume occurred in late 2022, when jobs growth had already resumed normal pace, but volume of work was still reeling from the effects of new construction starts that were canceled dating back to late 2020 and early 2021. Recent volume growth at a much faster rate than jobs growth is now closing the gap.

For the 4yr period 2021 thru 2024, jobs are up 13%, but volume of work put-in-place is up only 6%.

Don’t be surprised if 2025 construction jobs growth slows a bit. Jobs are slightly ahead of volume growth, particularly in the Non-building Infrastructure sector. Since 2019, both Jobs and Volume increased 10%. But that includes 2020, when volume increased 4% but jobs fell by 250k, or 3%.

When jobs increase without an equal increase in the volume of work, productivity declines. This recent increase in volume and the projected increase in volume in 2024, several points stronger than jobs, will offset some of the disparity which has been negative for a long time.

The Harvard Joint Center for Housing Studies recently posted that In Texas, California, New Jersey, and the District of Columbia, immigrants make up more than half of construction trade workers. This analysis will make no effort to discuss the potential impact of immigrants in the workforce, but we must recognize the makeup of who is filling these jobs. Keep in mind after this analysis reaches some conclusions that this aspect may weigh heavily on the outcome.

INFLATION

To properly inflation adjust the cost of construction, use a Final Cost Inflation Index.

General construction cost indices, that do not address labor, productivity or margins and Input price indices, don’t reflect whole bldg final cost and therefore do not capture the full cost of escalation in construction.

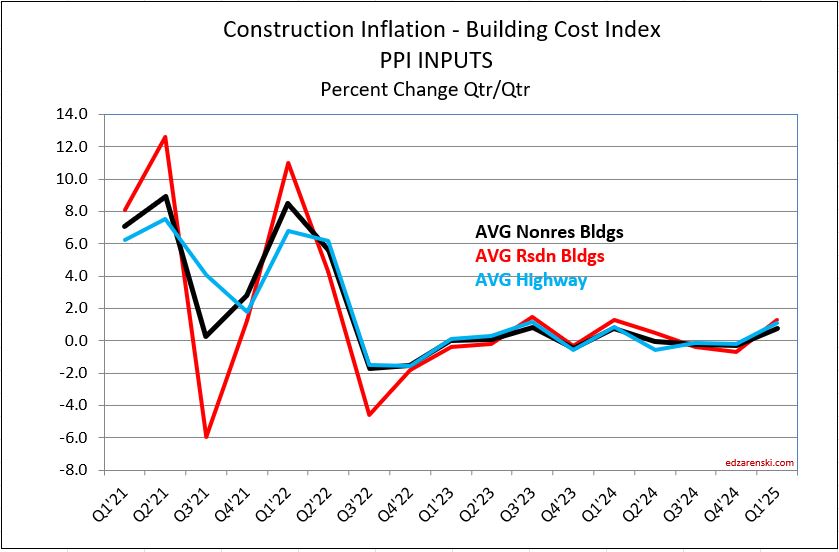

Final cost indices represent total actual cost to the owner and are usually higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, may not represent final cost of materials to the jobsite and do not include labor, productivity or margins. That’s why a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost.

Construction Analytics Building Cost Index is a weighted average of eight final cost indices.

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

This short table shows the inflation rate for each year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years. The plot below shows the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

30-year average inflation rate for residential and nonresidential buildings is 4.1%. But when excluding deflation in recession years 2008-2010, for nonresidential buildings the long-term average is 4.7% and for residential is 4.9%. For Non-bldg Infrastructure the 30-year average is 3.6%. When excluding deflation in recession years 2008-2010, Non-bldg long-term average inflation is 3.9%.

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

Reference Inflation Data Construction Inflation 2024

Construction Analytics Nonres Building Cost Index is a weighted average of eight final cost indices. It is compared below to the PPI Inputs (not final cost) and PPI Final Demand (yes final cost).

Final cost indices represent total actual cost to the owner and are usually higher than general indices.

Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost.

We can’t always tell what affect changes in the cost of construction materials will have on the final outcome of total construction inflation. PPI materials index does not account for productivity or margins and varies on stage of input.

Jan’25 Inputs are up, +0.8% to Nonres, +1.2% to Residential and 1.2% to Highway, the largest increases since Jan’24. The largest Input item increases in January are Paving Mixtures (up 14.6%), Diesel Fuel (up 3.6%), Concrete Brick, Block & Pipe (up 2.2%), Copper & Brass Shapes (up 1.9%) and Flat Glass (up 1%). Steel Pipe & Tube is down 1.3%. Both Lumber/Plywood and Fabricated Structural Steel are down 0.5% or less.

The PPI Final Demand index (for Nonresidential Bldgs only) is one of several that does account for labor and margins, hence it is defined as a final cost index. In this plot, Jan’25 closes out Q4’24. Total growth in 2024 was only 0.4%.

A Check on Measuring Methodology

And finally, here’s one of the markers I use to check my forecast modeling, my forecasting performance tracking index. The light plot line is forecast predicted from my modeling. The dark plot line is actual construction spending. Even after any separation in the indices, the plots should move at the same slope. Almost without fail, the forecast model, estimated spending from cashflow, predicts the changes in direction of actual spending. The nonresidential buildings plots (and the residential plot prior to 2020) are remarkably close, providing an indication the method of analysis employed, cash flow of all construction starts to get spending forecast, is reasonably accurate.

Note the divergence of residential in Jul-Dec 2020. Actual residential spending finished much higher than predicted. Even the cash flow from an all-time high in new residential starts does not predict spending to increase so rapidly. But residential project spending was fully back to prior levels by August 2020, within 3 months from the May 2020 bottom. In 3 months, the actual spending pushed 15% higher than starts predicted. A part of the spending was the resumption of delayed projects, but another big part was renovations, which surged, and reno is 40% of all residential spending.

Construction Inflation 2025 – 2-21-25 PPI data, INDEX TABLES, Inflation History

Construction Briefs – As We Begin 2025 jobs and unemployment, PPI and tracking edz

Construction – Brief Thoughts Dec’24 thoughts on jobs and when spending mega ends

Compare 10 Construction Forecasts Jan 2025 Jan and Midyr Forecasts compared to actual at end of yr

The Next Forecast Challenge written Apr 2023. Nonres volume did climb much faster than Jobs.

This analysis does not take into consideration the inflation impact of a recession or significant new tariffs. Nor does it assume losing any portion of the workforce to deportation. These are all possible. Construction starts may be negatively affected, and if so, then construction spending will also be affected. Some business will be negatively affected. All will lead to higher inflation.

You can print the Summary report by selecting/printing just the first 5 pages.

Los Angeles Fires – Reconstruction

This is a preliminary estimate of what it might take to rebuild buildings and infrastructure lost to the incredible firestorms we are witnessing in Los Angeles. We don’t yet know precisely the vast extent of damages, but there has been some early projections of 10,000 buildings lost and $150 billion in damages. So, there is a lot of estimation here, but also some necessary information on which to base this estimate of reconstruction.

Census tracks employment by metro areas. Although all cities and towns are not listed, the total employment is captured within these sometimes broad areas. To understand how many construction jobs currently exist in the LA metro area, I’ve included all Census defined metros around LA. The Los Angeles metro area, to approximately a 50 mile radius, which includes Los Angeles, Long Beach, Glendale, Anaheim, Santa Ana, Irvine, Santa Barbara, Oxnard, San Bernardino and Riverside, currently has approximately 400,000 construction jobs. https://www.bls.gov/regions/west/california.htm#tab-1

In the most recent years, 2021, 22, 23 and 24, this entire pool of jobs had annual growth of 1%/yr., or only about 4,000 jobs per year. From 2011 thru 2019 the jobs growth rate averaged 6%/yr, or about 15,000 to 20,000 jobs per year. Once in 20 years (2015) jobs increase 10%, which at that time was about 25,000 jobs and that occurred in a year when volume posted the largest increase ever. Jobs have not increased more than 4%/yr since 2017.

Nationally, jobs growth (excluding the losses in 2020) has averaged 3.5%/yr since 2011. Growth has not exceeded 5%/yr since 1999.

We need to predict jobs growth at a reasonable rate of growth. With recent LA metro construction jobs growth at 1%/yr., not more than 4% growth in the last 8 yrs., and national average growth of 3.5% over the last 15 years, but currently with excessive demand influencing growth, I will use a future growth rate of 5%/yr. Currently that works out to adding 20,000 jobs per year.

The Harvard Joint Center for Housing Studies recently posted that In Texas, California, New Jersey, and the District of Columbia, immigrants make up more than half of construction trade workers. This analysis will make no effort to discuss the potential impact of immigrants in the workforce, but we must recognize the makeup of who is filling these jobs. Keep in mind after this analysis reaches some conclusions that this aspect may weigh heavily on the outcome.

We do not know the average value of the buildings destroyed, nor do we know how many are residential buildings and how many are civic or retail buildings, but we have a preliminary estimate of 10,000 buildings lost and $150 billion in damages. As of yet we don’t know how much of that $150 billion is buildings. We do know some is autos and some is public utilities, but we don’t know how much. Expecting we will know some of this information at a future date, at best, all we can do is predict for a portion of that lost that will be easily used to expand our estimate at a later date.

Rather than work with a quantity of buildings, which creates some difficulty because buildings have different total value, we can work with the dollar value of the damage estimates, because we have some historical information of how much in dollar value can be put-in-place by some number of jobs.

Let’s work with an increment of $10 billion dollars of damaged buildings and determine how much labor might be available to rebuild those losses and how long it would take. Recognize that $10 billion is very likely low when compared to the total estimated value of damage, but it gives us an easily workable increment to adjust our estimate in the future when we know more about the true extent.

Historical construction data shows it takes 4000 to 5000 jobs for 1 year to put-in-place $1 billion worth of construction. Therefore we would need 40,000 to 50,000 jobs 1 year to replace $10 billion in reconstruction. This is a combination of residential and nonresidential buildings and infrastructure.

You can see why I went with calculating labor to replace a dollar value. Home values in those areas can range from $1mil to $5mil+. Value per unit dwelling is variable. But I know it takes at least 4,000jobs/$1bil to put-in-place construction work.

The area damaged is certainly less than the total metropolitan areas used to develop our labor pool estimate of 400,000 jobs. We must recognize that the largest part of that pool remains occupied on planned workload in backlog in the remaining areas not affected by the fires. But, to fill the reconstruction need, let’s assume that 10% of the existing workforce of 400,000 plus expected annual growth of 20,000 is available to work on replacing buildings lost. So, we take 42,000 jobs away from normal construction over the surrounding metro area. That’s a big hit to the remaining metro areas. Seldom, if ever, that labor in your area falls 10%. That also means those surrounding areas, since they may see a reduction in jobs, may also see a reduction in work put-in-place.

Some of these jobs may be filled by workers traveling into the area from afar to take advantage of the expected workload. That would mean a lower demand on reconstruction jobs supported from the existing 400,000 workforce. But those workers came from somewhere, just not this metro area.

If I can’t get the labor (minimum 40,000 jobs) to replace $10 bil/year, it’s not the cost that changes, the timeline moves out. It’s not likely there would be more labor available, but there could be less.

So we have 42,000 jobs available to support a reconstruction effort. The growth rate of 2,000 jobs/yr. can be assumed to fill the gap over a few years in the range of 40k to 50k jobs per year needed. This sits well with the above estimate that it would require 40k to 50k jobs 1 year to replace $10 billion of damaged buildings.

As you can see, the labor pool may support $10 billion of reconstruction in one year. If the estimates of building damage turns out to be $100 billion, the labor pool available for reconstruction, based on this estimate, would require 10 years to accommodate that extent of workload.

This does not include demolition and removal of damage. Nor does it address logistics or demand and supply. Expect increased demand and potentially longer than normal waits for all residential building products; lumber, doors, windows, roofing, siding, drywall, flooring, HVAC, plumbing, electrical and appliances, primarily or exclusively in the affected areas. This estimate does not address inflation, which, even if normal, is a lot over 10 years. So, damage estimates today will take more than today’s value to reconstruct. Furthermore, it is not intended to address insurance issues which may have an impact on how much damaged property does or does not get rebuilt.

1-11-25

This link points to a recorded interview (36min) conducted by @EconstratPB (a mutual follower on X(twitter) and BlueSky) and hosted on his Substack, where we discuss in a little more detail how the above estimate was prepared and some of the issues that will pose difficulties to accomplish this rebuilding effort. www.pinebrookcap.com/p/after-the-…

1-24-25

This link points to a Wall Street Journal brief article referencing their discussion with me regarding this article. https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-01-21-2025/card/how-many-workers-will-it-take-to-rebuild-burned-out-los-angeles–ubf4wXyri8Xcflb24AO8

6-12-25 This original article was written Jan. 11, 2025. In light of recent events in June in Los Angeles , I expect the conclusions reached in this reconstruction analysis will be extended further out in time as there will not be as many workers available to complete the work needed.

Construction Briefs – As We Begin 2025

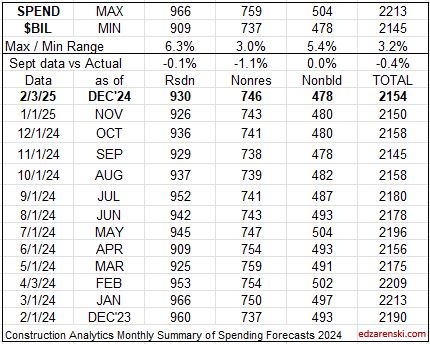

We are close enough, now in mid-January, to see where the numbers will end up for 2024. Construction spending as of Nov is up 6.5% year-to-date vs same 11 months in 2023. We are up 6.0% ytd vs the average of 2023. My forecast predicts we end 2024 up 6.2%, but growth is only 3.4% in 2025.

In February of 2024, with the Dec 2023 data in hand, my forecast for 2024 spending was $2,190 billion, only 1.8% higher than my current (Nov’24 data) forecast of $2,150 billion. Most of that early higher estimate was due to what I carried for my residential forecast, which I have since lowered by 3.6% from the initial forecast at the beginning of 2024. You can see in this monthly summary table that the Nonresidential Bldgs and Non-building forecasts have varied very little and the Total forecast has not varied up or down by more than 0.4% over the last 4 months.

edit 2-3-25 updated table to include Dec data. See the line comparing actual to the SEP data forecast.

Single family construction spending reached a post-2006 high in Q4’21 thru Apr’22 ($480bil). From Apr’22 to the lowpoint in May ’23 ($360bil) spending dropped 25%. By year-end 2023 it had recovered almost 3/4ths of that drop. It fell again in mid-2024 to $410bil, but has since recovered to the year-end’23 level ($450bil). That drop is reflected in the difference between the current forecast and the earlier forecast.

NAHB – Cost of Constructing a Home 2024 excellent summary www.nahb.org/-/media/AB4E…

Construction spending in 2024 will hit near $2.15trillion, another new high, up 54% since 2019.

Caution: the following table, showing Constant$ analysis, now shows Constant$ with base year at 2024. Since Q1-2020 I have used the base year at 2019. This update changes the Constant$ amount, but not the Constant$ percent growth. Slight changes in prior years inflation resulted in some minor changes in Constant$ growth.

The last time construction spending declined was 2011. But construction spending includes inflation, which adds nothing to the volume of work put-in-place. Construction volume, (spending minus inflation) will finish the year up only 10% since 2019.

My construction spending forecast for 2025 Nonres Bldgs is down 0.7%. But it’s driven by projects ending in Manufacturing (and Warehouse). In the last 3 yrs, there were $230bil Mnfg starts, most in 2022, $130bil above normal, now some are ending. Without Mnfg, nonres bldgs 2025 spending would be up 4.5%. So while outward appearance may be that nonres spending is declining, in large part it is due to mega spending on Manufacturing buildings (and Warehouse) tapering down upon completion, creating very large annual declines, but normal. See The Manufacturing Spending Taper

Last year at this time, many of the Nonres Bldgs and Non-bldg line items showed Nov-Dec spending was already several points higher than the 2023 average. This was an indication leading into 2024 that those markets were on track to start the year already up. This year,most markets show a decline from the 1st half of the year into the 2nd half. Two notable declines are Warehouse and Office w/o Data Centers. Both start 2025 down 5%+ from the average in 2024.

I didn’t realize how much impact there was with the inclusion of (increasing) Data Centers in the (decreasing) Office construction spending values. I’ve now separated Data Centers from Office and Warehouse from Commercial/Retail. Office spending was pretty strong near it’s highs until 2h’22. Early in ’24 it had fallen to 8%-12% below ’22. Office spending is now 15%-18% below 2022. On the other hand, Data Center spending as of Nov is up 30% from the same months in 2023, and is up more than 60% above the average of 2023 and 120% above 2022. It will continue to increase into 2025.

In 2014-2015, Data Centers was less than 5% of total Office+DC construction spending. Today it is approaching 30%. Next year it will approach 40%. In 2015, Warehouse was 25% of total Commercial spending. By 2022 it had climbed to 54%. In 2025, it will fall back to 45%. Warehouse spending is now decreasing after climbing 100%+ since 2019.

Dodge reports as of Nov construction starts for 2024 up 5% YTD. Residential starts up 7%. Nonresidential Buildings starts up 4%. Non-building starts up 5%.

Construction Jobs do not get compared to construction spending. Spending includes inflation, which adds nothing to business volume. Compare jobs growth to Volume growth.

Construction Jobs counts here are the average for the year. That accounts for months during the year, other than Dec/Dec, with higher (or lower) percentage of yr/yr growth. For instance, total jobs Dec24 vs Dec23 increased only by 196k jobs or 2.4%. If you based annual growth on Dec/Dec, it would indicate 2024 increased by 2.4%. However, during the year, jobs growth in Mar-Apr-May were all greater than +3% compared to same month prior year. In fact, every other month during the year had a higher yr/yr growth rate than Dec/Dec. Yearly average of all 12 months shows total jobs annual average up 226K or 2.8%.

Dec/Dec shows a snapshot in time of one month compared to same month last year, without taking into account what might have happened in any of the other 11 months. YR24avg/YR23avg shows the change in the number of jobs over the whole year and accounts for all activity in the year.

Jobs 2024 AVG thru DEC. Rsdn+61k +1.9%. Nonres Bldgs+134k+3.7%. Nonbldg +29k+2.6%

Construction Volume AVG thru NOV Residential +2.9% Nonres Bldgs +3.3% Nonbldg +4.3%.

From 2012-2019, we added a yearly average 245,000 jobs/yr. In 2024 we added 226,000 jobs, but from 2021-2024, we added an average of 247,000 jobs/yr. We add the most jobs in Feb and Mar. We add the least jobs in Apr and Jun. We add more jobs, by far, in the 1st qtr. than any other qtr.

Don’t be surprised if 2025 construction jobs growth slows a bit. Jobs are slightly ahead of volume growth. Since 2019, both Jobs and Volume increased 10%. But that includes 2020, when volume increased 4% but jobs fell by 250k, or 3%. Over the period of 4 years 2021 thru 2024, Jobs increased 13%. Volume of work increased only 6%.

The unemployment rate in construction goes UP in the 1st qtr every year, by 2% to 3% (data since 2011). Now, your 1st thought may be, if unemployment is increasing, that is probably because jobs are falling. Well, construction has ADDED jobs in the 1st qtr. every year since 2011 (excluding 2020), by an avg of nearly 30% of all jobs added annually. More recently, since 2020, we’ve added almost 40% of total annual jobs in Q1. Construction unemployment is not going up in winter months because we lose jobs in winter. So how can the unemployment rate still go up? There’s only one number left in the equation. It goes up because the entire workforce increases by greater than the number of jobs added.

For an example of how this employment timing information can be useful see Employing Correlation – Using construction industry employment data as a proxy for flatbed demand

Harvard Joint Center for Housing Studies posted that In Texas, California, New Jersey, and the District of Columbia, immigrants make up more than half of construction trade workers.

Nov PPI for Construction Mtrls little changed from Oct Inputs YTD to Nonres +0.6%, to Rsdn +1.7%, to Hiway +0.6% Concrete products up 6%, Steel products down 7%-8%, Lumber/Plywood down 2%, Copper up 6%, Diesel down 14%. Final Demand YTD (all in) Nonres Bldgs all up 0.5% or less. Trades up 1%-2%.

We can’t always tell what affect changes in the cost of construction materials will have on the final outcome of annual construction inflation. PPI materials index does not account for productivity or margins and varies on stage of input. A good example of stage of input is PPI for Steel Mill Products. That does not include delivery from mill to fabricator, detailing, fabrication, shop painting, delivery to jobsite, shakeout, lifting, installation and finally overhead and profit, in all about 75% of the cost of structural steel installed.

Construction Analytics Nonres Building Cost Index is a weighted average of eight final cost indices.

NAHB estimates that $184 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2023 and that $13 billon of those goods were imported. eyeonhousing.org/2024/12/impo…

Steel Statistics Cost Increase Effect on Construction? written 2016 US is world’s largest steel importer at 30MMT/yr. 50% from our top suppliers, Canada, Brazil, South Korea and Mexico. China supplies less than 2%. The U.S. annually imports about $2bil from Mexico.

One quarter of all annual Brussel Sprouts consumption occurs around the Christmas holiday.