Home » Articles posted by edzarenski (Page 3)

Author Archives: edzarenski

Los Angeles Fires – Reconstruction

This is a preliminary estimate of what it might take to rebuild buildings and infrastructure lost to the incredible firestorms we are witnessing in Los Angeles. We don’t yet know precisely the vast extent of damages, but there has been some early projections of 10,000 buildings lost and $150 billion in damages. So, there is a lot of estimation here, but also some necessary information on which to base this estimate of reconstruction.

Census tracks employment by metro areas. Although all cities and towns are not listed, the total employment is captured within these sometimes broad areas. To understand how many construction jobs currently exist in the LA metro area, I’ve included all Census defined metros around LA. The Los Angeles metro area, to approximately a 50 mile radius, which includes Los Angeles, Long Beach, Glendale, Anaheim, Santa Ana, Irvine, Santa Barbara, Oxnard, San Bernardino and Riverside, currently has approximately 400,000 construction jobs. https://www.bls.gov/regions/west/california.htm#tab-1

In the most recent years, 2021, 22, 23 and 24, this entire pool of jobs had annual growth of 1%/yr., or only about 4,000 jobs per year. From 2011 thru 2019 the jobs growth rate averaged 6%/yr, or about 15,000 to 20,000 jobs per year. Once in 20 years (2015) jobs increase 10%, which at that time was about 25,000 jobs and that occurred in a year when volume posted the largest increase ever. Jobs have not increased more than 4%/yr since 2017.

Nationally, jobs growth (excluding the losses in 2020) has averaged 3.5%/yr since 2011. Growth has not exceeded 5%/yr since 1999.

We need to predict jobs growth at a reasonable rate of growth. With recent LA metro construction jobs growth at 1%/yr., not more than 4% growth in the last 8 yrs., and national average growth of 3.5% over the last 15 years, but currently with excessive demand influencing growth, I will use a future growth rate of 5%/yr. Currently that works out to adding 20,000 jobs per year.

The Harvard Joint Center for Housing Studies recently posted that In Texas, California, New Jersey, and the District of Columbia, immigrants make up more than half of construction trade workers. This analysis will make no effort to discuss the potential impact of immigrants in the workforce, but we must recognize the makeup of who is filling these jobs. Keep in mind after this analysis reaches some conclusions that this aspect may weigh heavily on the outcome.

We do not know the average value of the buildings destroyed, nor do we know how many are residential buildings and how many are civic or retail buildings, but we have a preliminary estimate of 10,000 buildings lost and $150 billion in damages. As of yet we don’t know how much of that $150 billion is buildings. We do know some is autos and some is public utilities, but we don’t know how much. Expecting we will know some of this information at a future date, at best, all we can do is predict for a portion of that lost that will be easily used to expand our estimate at a later date.

Rather than work with a quantity of buildings, which creates some difficulty because buildings have different total value, we can work with the dollar value of the damage estimates, because we have some historical information of how much in dollar value can be put-in-place by some number of jobs.

Let’s work with an increment of $10 billion dollars of damaged buildings and determine how much labor might be available to rebuild those losses and how long it would take. Recognize that $10 billion is very likely low when compared to the total estimated value of damage, but it gives us an easily workable increment to adjust our estimate in the future when we know more about the true extent.

Historical construction data shows it takes 4000 to 5000 jobs for 1 year to put-in-place $1 billion worth of construction. Therefore we would need 40,000 to 50,000 jobs 1 year to replace $10 billion in reconstruction. This is a combination of residential and nonresidential buildings and infrastructure.

You can see why I went with calculating labor to replace a dollar value. Home values in those areas can range from $1mil to $5mil+. Value per unit dwelling is variable. But I know it takes at least 4,000jobs/$1bil to put-in-place construction work.

The area damaged is certainly less than the total metropolitan areas used to develop our labor pool estimate of 400,000 jobs. We must recognize that the largest part of that pool remains occupied on planned workload in backlog in the remaining areas not affected by the fires. But, to fill the reconstruction need, let’s assume that 10% of the existing workforce of 400,000 plus expected annual growth of 20,000 is available to work on replacing buildings lost. So, we take 42,000 jobs away from normal construction over the surrounding metro area. That’s a big hit to the remaining metro areas. Seldom, if ever, that labor in your area falls 10%. That also means those surrounding areas, since they may see a reduction in jobs, may also see a reduction in work put-in-place.

Some of these jobs may be filled by workers traveling into the area from afar to take advantage of the expected workload. That would mean a lower demand on reconstruction jobs supported from the existing 400,000 workforce. But those workers came from somewhere, just not this metro area.

If I can’t get the labor (minimum 40,000 jobs) to replace $10 bil/year, it’s not the cost that changes, the timeline moves out. It’s not likely there would be more labor available, but there could be less.

So we have 42,000 jobs available to support a reconstruction effort. The growth rate of 2,000 jobs/yr. can be assumed to fill the gap over a few years in the range of 40k to 50k jobs per year needed. This sits well with the above estimate that it would require 40k to 50k jobs 1 year to replace $10 billion of damaged buildings.

As you can see, the labor pool may support $10 billion of reconstruction in one year. If the estimates of building damage turns out to be $100 billion, the labor pool available for reconstruction, based on this estimate, would require 10 years to accommodate that extent of workload.

This does not include demolition and removal of damage. Nor does it address logistics or demand and supply. Expect increased demand and potentially longer than normal waits for all residential building products; lumber, doors, windows, roofing, siding, drywall, flooring, HVAC, plumbing, electrical and appliances, primarily or exclusively in the affected areas. This estimate does not address inflation, which, even if normal, is a lot over 10 years. So, damage estimates today will take more than today’s value to reconstruct. Furthermore, it is not intended to address insurance issues which may have an impact on how much damaged property does or does not get rebuilt.

1-11-25

This link points to a recorded interview (36min) conducted by @EconstratPB (a mutual follower on X(twitter) and BlueSky) and hosted on his Substack, where we discuss in a little more detail how the above estimate was prepared and some of the issues that will pose difficulties to accomplish this rebuilding effort. www.pinebrookcap.com/p/after-the-…

1-24-25

This link points to a Wall Street Journal brief article referencing their discussion with me regarding this article. https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-01-21-2025/card/how-many-workers-will-it-take-to-rebuild-burned-out-los-angeles–ubf4wXyri8Xcflb24AO8

6-12-25 This original article was written Jan. 11, 2025. In light of recent events in June in Los Angeles , I expect the conclusions reached in this reconstruction analysis will be extended further out in time as there will not be as many workers available to complete the work needed.

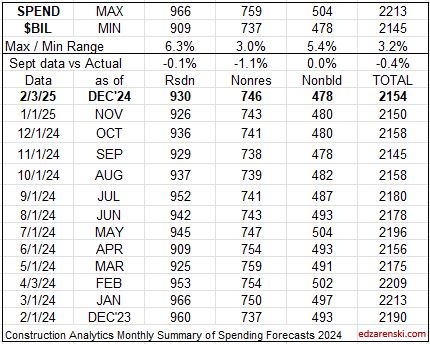

Construction Briefs – As We Begin 2025

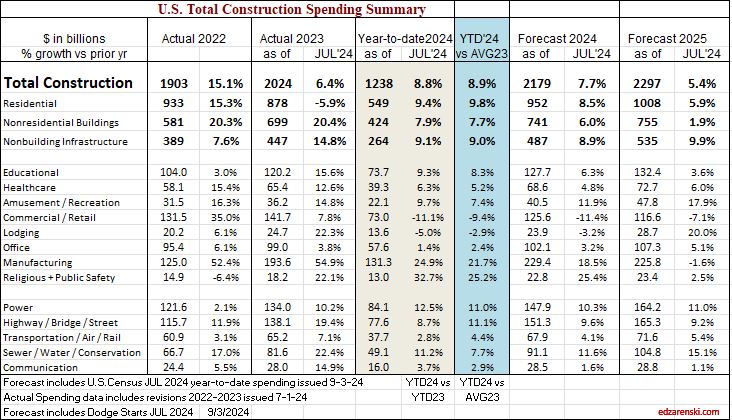

We are close enough, now in mid-January, to see where the numbers will end up for 2024. Construction spending as of Nov is up 6.5% year-to-date vs same 11 months in 2023. We are up 6.0% ytd vs the average of 2023. My forecast predicts we end 2024 up 6.2%, but growth is only 3.4% in 2025.

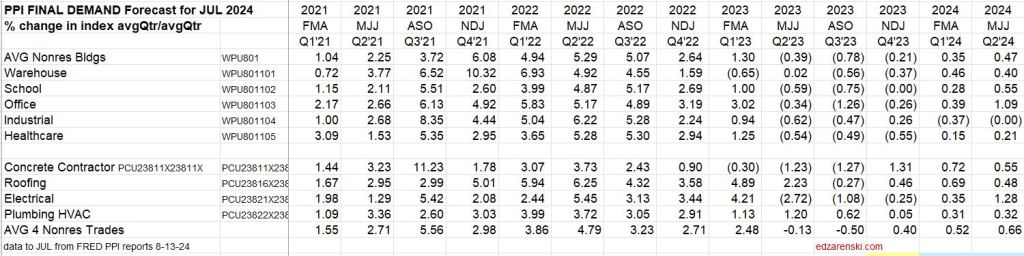

In February of 2024, with the Dec 2023 data in hand, my forecast for 2024 spending was $2,190 billion, only 1.8% higher than my current (Nov’24 data) forecast of $2,150 billion. Most of that early higher estimate was due to what I carried for my residential forecast, which I have since lowered by 3.6% from the initial forecast at the beginning of 2024. You can see in this monthly summary table that the Nonresidential Bldgs and Non-building forecasts have varied very little and the Total forecast has not varied up or down by more than 0.4% over the last 4 months.

edit 2-3-25 updated table to include Dec data. See the line comparing actual to the SEP data forecast.

Single family construction spending reached a post-2006 high in Q4’21 thru Apr’22 ($480bil). From Apr’22 to the lowpoint in May ’23 ($360bil) spending dropped 25%. By year-end 2023 it had recovered almost 3/4ths of that drop. It fell again in mid-2024 to $410bil, but has since recovered to the year-end’23 level ($450bil). That drop is reflected in the difference between the current forecast and the earlier forecast.

NAHB – Cost of Constructing a Home 2024 excellent summary www.nahb.org/-/media/AB4E…

Construction spending in 2024 will hit near $2.15trillion, another new high, up 54% since 2019.

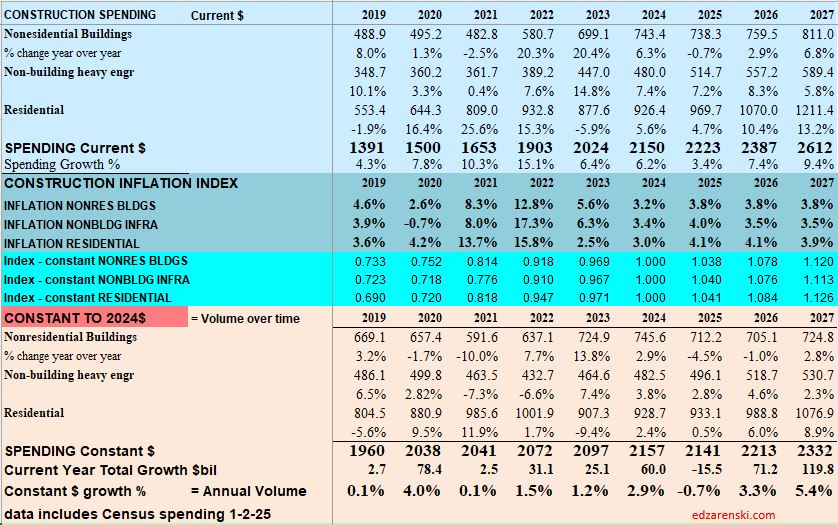

Caution: the following table, showing Constant$ analysis, now shows Constant$ with base year at 2024. Since Q1-2020 I have used the base year at 2019. This update changes the Constant$ amount, but not the Constant$ percent growth. Slight changes in prior years inflation resulted in some minor changes in Constant$ growth.

The last time construction spending declined was 2011. But construction spending includes inflation, which adds nothing to the volume of work put-in-place. Construction volume, (spending minus inflation) will finish the year up only 10% since 2019.

My construction spending forecast for 2025 Nonres Bldgs is down 0.7%. But it’s driven by projects ending in Manufacturing (and Warehouse). In the last 3 yrs, there were $230bil Mnfg starts, most in 2022, $130bil above normal, now some are ending. Without Mnfg, nonres bldgs 2025 spending would be up 4.5%. So while outward appearance may be that nonres spending is declining, in large part it is due to mega spending on Manufacturing buildings (and Warehouse) tapering down upon completion, creating very large annual declines, but normal. See The Manufacturing Spending Taper

Last year at this time, many of the Nonres Bldgs and Non-bldg line items showed Nov-Dec spending was already several points higher than the 2023 average. This was an indication leading into 2024 that those markets were on track to start the year already up. This year,most markets show a decline from the 1st half of the year into the 2nd half. Two notable declines are Warehouse and Office w/o Data Centers. Both start 2025 down 5%+ from the average in 2024.

I didn’t realize how much impact there was with the inclusion of (increasing) Data Centers in the (decreasing) Office construction spending values. I’ve now separated Data Centers from Office and Warehouse from Commercial/Retail. Office spending was pretty strong near it’s highs until 2h’22. Early in ’24 it had fallen to 8%-12% below ’22. Office spending is now 15%-18% below 2022. On the other hand, Data Center spending as of Nov is up 30% from the same months in 2023, and is up more than 60% above the average of 2023 and 120% above 2022. It will continue to increase into 2025.

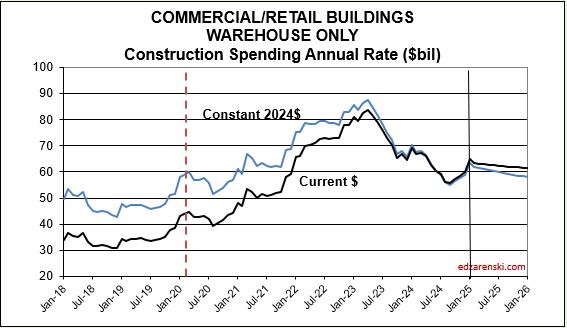

In 2014-2015, Data Centers was less than 5% of total Office+DC construction spending. Today it is approaching 30%. Next year it will approach 40%. In 2015, Warehouse was 25% of total Commercial spending. By 2022 it had climbed to 54%. In 2025, it will fall back to 45%. Warehouse spending is now decreasing after climbing 100%+ since 2019.

Dodge reports as of Nov construction starts for 2024 up 5% YTD. Residential starts up 7%. Nonresidential Buildings starts up 4%. Non-building starts up 5%.

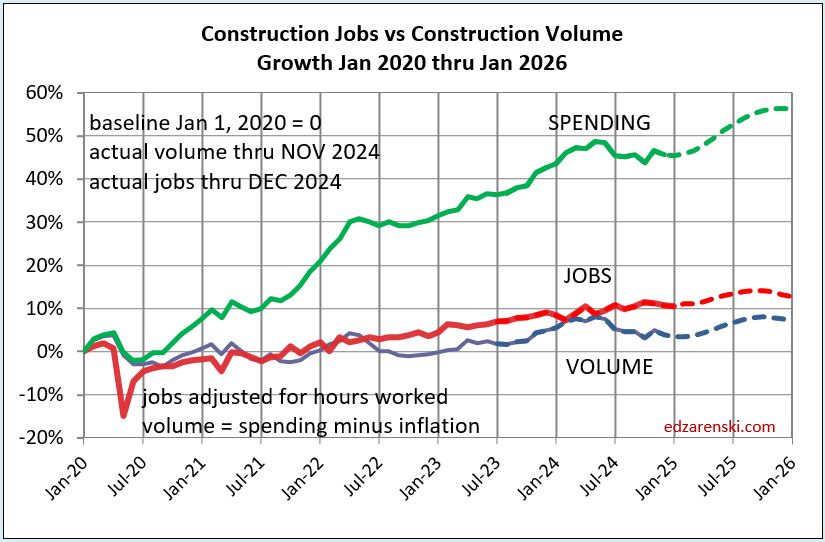

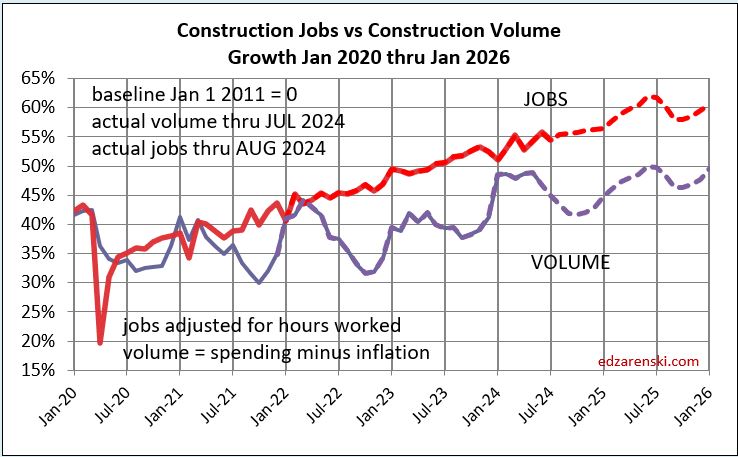

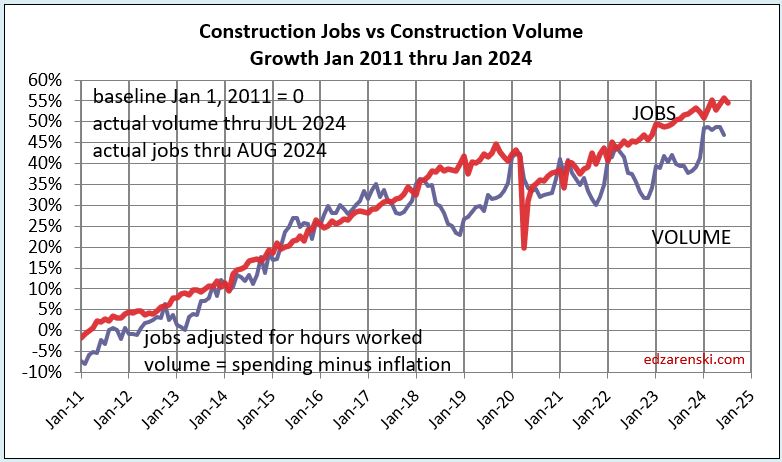

Construction Jobs do not get compared to construction spending. Spending includes inflation, which adds nothing to business volume. Compare jobs growth to Volume growth.

Construction Jobs counts here are the average for the year. That accounts for months during the year, other than Dec/Dec, with higher (or lower) percentage of yr/yr growth. For instance, total jobs Dec24 vs Dec23 increased only by 196k jobs or 2.4%. If you based annual growth on Dec/Dec, it would indicate 2024 increased by 2.4%. However, during the year, jobs growth in Mar-Apr-May were all greater than +3% compared to same month prior year. In fact, every other month during the year had a higher yr/yr growth rate than Dec/Dec. Yearly average of all 12 months shows total jobs annual average up 226K or 2.8%.

Dec/Dec shows a snapshot in time of one month compared to same month last year, without taking into account what might have happened in any of the other 11 months. YR24avg/YR23avg shows the change in the number of jobs over the whole year and accounts for all activity in the year.

Jobs 2024 AVG thru DEC. Rsdn+61k +1.9%. Nonres Bldgs+134k+3.7%. Nonbldg +29k+2.6%

Construction Volume AVG thru NOV Residential +2.9% Nonres Bldgs +3.3% Nonbldg +4.3%.

From 2012-2019, we added a yearly average 245,000 jobs/yr. In 2024 we added 226,000 jobs, but from 2021-2024, we added an average of 247,000 jobs/yr. We add the most jobs in Feb and Mar. We add the least jobs in Apr and Jun. We add more jobs, by far, in the 1st qtr. than any other qtr.

Don’t be surprised if 2025 construction jobs growth slows a bit. Jobs are slightly ahead of volume growth. Since 2019, both Jobs and Volume increased 10%. But that includes 2020, when volume increased 4% but jobs fell by 250k, or 3%. Over the period of 4 years 2021 thru 2024, Jobs increased 13%. Volume of work increased only 6%.

The unemployment rate in construction goes UP in the 1st qtr every year, by 2% to 3% (data since 2011). Now, your 1st thought may be, if unemployment is increasing, that is probably because jobs are falling. Well, construction has ADDED jobs in the 1st qtr. every year since 2011 (excluding 2020), by an avg of nearly 30% of all jobs added annually. More recently, since 2020, we’ve added almost 40% of total annual jobs in Q1. Construction unemployment is not going up in winter months because we lose jobs in winter. So how can the unemployment rate still go up? There’s only one number left in the equation. It goes up because the entire workforce increases by greater than the number of jobs added.

For an example of how this employment timing information can be useful see Employing Correlation – Using construction industry employment data as a proxy for flatbed demand

Harvard Joint Center for Housing Studies posted that In Texas, California, New Jersey, and the District of Columbia, immigrants make up more than half of construction trade workers.

Nov PPI for Construction Mtrls little changed from Oct Inputs YTD to Nonres +0.6%, to Rsdn +1.7%, to Hiway +0.6% Concrete products up 6%, Steel products down 7%-8%, Lumber/Plywood down 2%, Copper up 6%, Diesel down 14%. Final Demand YTD (all in) Nonres Bldgs all up 0.5% or less. Trades up 1%-2%.

We can’t always tell what affect changes in the cost of construction materials will have on the final outcome of annual construction inflation. PPI materials index does not account for productivity or margins and varies on stage of input. A good example of stage of input is PPI for Steel Mill Products. That does not include delivery from mill to fabricator, detailing, fabrication, shop painting, delivery to jobsite, shakeout, lifting, installation and finally overhead and profit, in all about 75% of the cost of structural steel installed.

Construction Analytics Nonres Building Cost Index is a weighted average of eight final cost indices.

NAHB estimates that $184 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2023 and that $13 billon of those goods were imported. eyeonhousing.org/2024/12/impo…

Steel Statistics Cost Increase Effect on Construction? written 2016 US is world’s largest steel importer at 30MMT/yr. 50% from our top suppliers, Canada, Brazil, South Korea and Mexico. China supplies less than 2%. The U.S. annually imports about $2bil from Mexico.

One quarter of all annual Brussel Sprouts consumption occurs around the Christmas holiday.

Construction – More Thoughts Dec’24

The PPI data for November released 12-12. Nov PPI for Construction Materials shows very little change from Oct. Inputs YTD to Nonres are +0.6%, to Rsdn +1.7%, to Hiway +0.6%. Concrete products +6%, Steel products -7% to -8%, Lumber/Plywood -2%, Copper +6%, Diesel -14%. Material Inputs will contribute less than 1% to 2024 Inflation (1.7% for Rsdn) as shown in the Final Demand (Nonres) prices. Final Demand YTD (all in cost) to Nonres Bldgs shows all building types up +0.5% or less. Warehouses, and Industrial Bldgs show -0.1% to -0.25%. Concrete, Roofing and HVAC/Plumbing Trades are up +1% to +2%. Electrical trades are down slightly.

The economists watching residential permits and starts number of units are indicating current poor performance and are predicting a gloomy outlook for 2025. So far, the Dodge Construction Network, which tracks dollars starts, has residential starts up 7% year-to-date 2024, when compared to same 10 months 2023. Dodge is forecasting starts up next year. When I spread those starts out over time, the cashflow (spending) is stacking up pretty well at 7%/yr. There could be some downward changes to 2025 forecast due to immigration issues and tariffs.

I’ve been wondering, Should the duct tape be given as much value as the banana? Without the duct tape this whole banana art thing just doesn’t hold up.

Construction – Brief Thoughts Dec’24

Construction spending in 2024 will hit near $2.15 trillion, another new high, up 50%+ since 2019. (The last time constr spending declined was 2011. Construction volume, (spending minus inflation) will finish the year up only 10% since 2019.

Construction Spending for OCT is up 0.4% mo/mo. Aug & Sep rvsd up ~1%/mo, mostly Rsdn. Spending now essentially flat for last 4mo. YTD’24 vs YTD’23 now +7.2%, falling slightly as expected for last few mo, because spending was rapidly increasing in late months of 2023 and is flat in 2024.

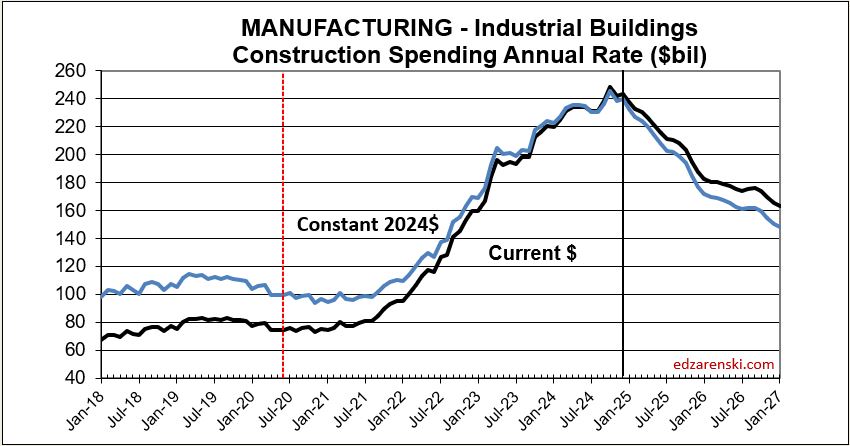

Real Manufacturing Construction Starts over last 3yrs is just over $600bil, whereas normal starts without any influx of government investment would be about $300bil for the same 3yrs. Most of those starts were posted from Q3’22 thru Q4’23. By far the highest period of growth in new starts was the 2nd half 2022. About $100bil of that spending growth over the 3 years is inflation, leaving the remainder of about $200bil in excess (but welcome) spending growth attributed to government investment in new manufacturing facilities. Now some of these projects are ending or soon to end. My latest construction spending forecast for 2025 Nonresidential Bldgs is down 0.5%. But this decline is driven by projects ending in Manufacturing. Without Manufacturing, Nonresidential Buildings 2025 spending would be up 4%.

The same effect on spending by the tapering off of Manufacturing Bldgs ending will happen in Infrastructure spending due to the current increases in Highway/Bridge, only ending a few years later.

Construction jobs increased to 8.313 mil in NOV. Since SEP, last two months barely increased, only +12k jobs. But perhaps more important, hours worked, since SEP, decreased 0.75%, equiv of 60k jobs. However, ytd’24 vs ytd’23, jobs are up 2.9%, total hrs worked is up only 2.7%

The unemployment rate in construction goes UP in the 1st qtr every year, by 2% to 3% (data here since 2011). Now, your 1st thought is that if unemployment is increasing, that is probably because jobs are falling. Well, construction has ADDED jobs in the 1st qtr. every year since 2011, by an avg of 24% of all jobs added annually, and more recently by over 30% of total annual jobs. Construction unemployment is not going up in winter months because we lose jobs in winter. It goes up because the entire workforce increases by greater than the number of jobs added.

To properly inflation adjust the cost of construction, use a Final Cost Inflation Index. General construction cost and Input price indices that don’t track whole bldg final cost do not capture the full cost of escalation in construction.

Will vacant office space to residential conversions be the construction spending that ignites the 2025 fire? Residential is forecast now to spring ahead 8% in 1H’25, then hold steady thru 2H. If conversions jump, that percent goes up and we could see a shortage of residential labor. (not addressing deportations).

There are 870K construction jobs in TX. 500K are immigrants and 300K are undocumented.

Sweet potatoes should be steamed only just soft enough to slice (long way preferred) about 1/2″ thick, then griddle fried in butter and maple syrup until there is some blackening (important). This was my dad’s recipe. No other recipes are allowed.

The Manufacturing Spending Taper

11-21-24 My construction spending forecast for 2025 Nonresidential Bldgs is down 1.5%. But this decline is driven by projects ending in Manufacturing. In the last 3 yrs, there were $230bil Mnfg new starts, most in 2022, about $130bil above normal for 3yrs. Now some are ending. Without Mnfg, Nonres Bldgs 2025 spending would be up 4.5%. (This original article written 11-21-24)

(edit 4-15-25 only to update forecast. Mnfg data has not changed) Construction spending for 2025 Nonres Bldgs is forecast up 2.9%. Manufacturing is expected to fall 9%, from $233bil in 2024 to $212bil in 2025. Mnfg is forecast to drop to $174bil in 2026. Without Mnfg data, Nonres Bldgs 2025 spending would be forecast up 8.2% in 2025. Tariffs and/or recession would (will) lower this forecast.

Now, let me clarify. The spending I reference is Census PIP current$ spending. It doesn’t matter if we look at current$ or constant$ (inflation adjusted), by the end of 2025 spending on Mnfg bldgs will be down 25%. The new starts above are those reported by a firm that tracks construction starts. But, only about 40% of actual starts are captured in that number. Real Mnfg starts over last 3yrs is just over $600bil, whereas normal starts without any influx of government investment would be about $300bil/3yrs. Most of those starts were posted from Q3’22 thru 2023. By far the highest period of new starts was the 2nd half 2022. About $100bil of that spending growth over the 3 years is inflation, leaving the remainder of about $200bil in excess (but welcome) spending growth attributed to government investment.

Mnfg projects can have a longer spending curve (on average) than most nonres bldgs, so obviously end dates are pushed out further. The average spending for all nonres bldgs is spread out over a spending curve of approximately 20:50:30, where 20% of all the starts in the year gets spent in the year started, 50% in the 2nd year and 30% over the 3rd and 4th yr. The spending curve for Mnfg is more like 17:40:30:13. We will see declining spending from this pool that will impact total nonres bldgs spending at least for the next 2-3 years.

So while the outward appearance in the data may be that nonres spending in total is declining, in large part it may be due to mega-spending on mnfg bldgs tapering down upon completion, creating large, but normal, annual declines. This may have the effect of offsetting gains in other nonres bldgs markets. That influx of spending is unlikely to be repeated. So, as we see mnfg spending begin to taper off, we should not expect additional support from new mnfg starts. We should expect mnfg starts to return to a more normal growth rate.

edited 2-4-25 added next paragraph and following Mnfg spending plot

Whenever we get an unusually large increase in new construction starts and spending, the tapering off of those projects leads to a decline on the tail end of the timeline. Peak spending was near the midpoint of projects, so after that it’s all declining. Mnfg new starts peaked in 2022-2023. Here’s what the manufacturing spending taper may look like.

edited 4-11-25 added Warehouse Plot and text

This is exactly what happened in Warehouse spending. Warehouse contract starts began to rise in 2020, but rose rapidly in 2021 and 2022. Therefore, the rate of spending began to rise in late 2020, then rose substantially from late 2021 well into 2022, when project spending would have been expected to peak. New starts began to fall back in 2023 and more-so in 2024. Peak spending was reached in Q1 2023 and spending has fallen in 18 of the last 24 months. The current rate of spending is now back to the level of 2021.

This same scenario will occur in Highway/Bridge. Normal starts have consistently been about $100bil/yr, with slow growth. But for the last 3 years, actual starts were closer to $500bil for the 3 years. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for 4 years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. But once the taper begins it will have the same effect on Nonbldg Infrastructure spending that we will see from Mnfg in Nonres Bldgs.

If you know in advance what to expect, there should be no surprises when it occurs.

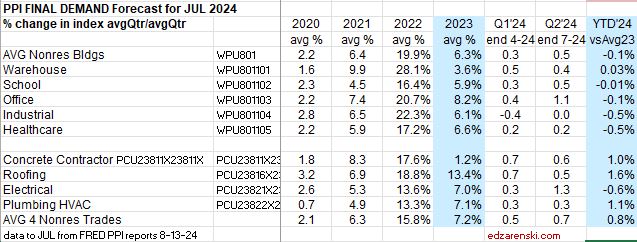

PPI Data Sept’24

Once again, the Producer Price Index for construction materials is pretty tame with the release of the September data. For Q3, inputs to all types of construction post less than 1% growth for the quarter. This is now 6 or 7 quarters in which Inputs and Final Demand has been near 1% or lower.

Inputs year-to-date vs the 2023 average are up 1.9% for residential and up less than 1% for Nonresidential and Highway.

Individually, a few material inputs had notable moves in September: Lumber/Plywood up 1.1%, Steel Mill Products down 1.2%, Steel Pipe and Tube down 1.3%, Copper and Brass Shapes down 1.1% and Diesel down 14%.

Year-to-date, various concrete items are up 5% to 6%, Steel items are down 6% to 7%, Copper and Brass Shapes are up 6% and Diesel is down 13%.

Final Demand indices for 2024 are barely moving. Although Office and School are both up over 1% for Q3, no building type is up even a half percent when compared to the average of 2023. Roofing Trades are up 1.7% YTD. The average YTD for the four trades is up less than 1%. Over the last six months The only Final Demand indices to move more than 2% (for the full 6mo) were Office Bldgs and Electrical Trades.

SEE ALSO Construction Inflation 2024 – updated 7-12

Hurricanes & Residential Construction

Over the next few years there could be many billion$ of construction spending to “repair” hurricane damaged homes. That spending will NOT be reported in Census construction spending reports. According to Census definition, renovations to “repair” natural disaster damage are not recorded in construction spending.

Construction spending to “replace” homes entirely lost to hurricane damage (wiped completely off the foundation) IS reported in Census spending, but it is reported as renovations/repair, not new SF or MF construction. These are not “new” homes and do not add to the new home count. The work is to replace an existing home.

There will be billions$ of residential construction and the associated labor that will fall outside posted Census data. Some of that spending and labor will be diverted from the growth in residential construction tracked by the Census Rsdn$. So, it is conceivable that Census tracked residential spending could slip slightly from current projections, and yet the work is being done, only unaccounted for.

(All of this is true also for nonresidential).

Expect increased demand and potentially longer waits for all residential building products; lumber, doors, windows, roofing, siding, drywall, flooring, HVAC, plumbing, electrical and appliances, primarily or exclusively in the affected regions.

If your business is in a region that is currently outside the affected region and slow for residential construction, consider that anybody with a hammer and a pick-up truck may be traveling to the affected regions to work. That could mean that many slow regions may lose some available labor, as the labor will move to the affected area.

For every $1billion of work needed to replace damaged buildings it requires 4000-5000 construction workers for one year. That could also be stated as 1000 jobs for 4 to 5 years. Very early damage projections due to Helene and Milton range from $50-$175 billion, but not all of that is construction. If even $10 billion of work is construction to repair/replace damaged buildings, that would require 10,000 jobs for a period of 4 to 5 years (or 20,000 jobs for 2 to 2 1/2 years).

Construction Data JULY Briefs 9-5-24

Construction spending 2024 through July is still on track to finish the year up 7.7%. Residential is forecast up 8.5%, Nonresidential Buildings up 6.0% and Non-building up 8.9%.

We still have 3 or 4 more months of slightly declining construction spending, driven mostly by residential, but also by Manufacturing. This is not a long term trend. Sit tight. Oct or Nov, trend tuns back up. You can see the dip in this Current $ spending plot.

Construction spending total for 2024 expected up 7.7%. With inflation at a 4yr low (3%-4%), the amount of spending that is real volume growth is up this year, highest since 2016. It just edge out 2020.

I’m forecasting residential construction spending total for 2024 at $952b ,+8.5%. But three other indicators I calculate to compare to my forecast are telling me it could come in between $960b and $970b. I’m leaning towards higher, but I’d like to see Aug data, and Sept data.

And then there’s this. Census SAAR avg YTD (the average of the reported rsdn monthly SAAR for the 1st 7 months) is $939b. My YTD SAAR avg is $964b. Some down months will lower that slightly by year-end. .

Statistically, YTD spending through July for Rsdn and Nonres Bldgs is 57% of the total annual $ spent. This is indicating year-end total $ for residential will be $963b and $744b for Nonres Bldgs.

JOBS REPORT

Jobs are up by 34,000, 0.4%, in August, up by 80,000 in the last 4 mo., for a total up 1%/4mo. Year-to-date construction jobs are up 160,000 or 2%. Of those, 100,000 were for Nonresidential Buildings. Typical growth is 3.5%/year or about 250,000 to 300,000 jobs/year.

In this last month volume fell 1%. In the last 3 months, business volume fell 2.5%. Volume is falling and jobs are still increasing. There will be a slow patch for the next few months where volume will still fall another 1% to 2%. But jobs did not fall recently, and I don’t expect jobs to fall in the next few months.

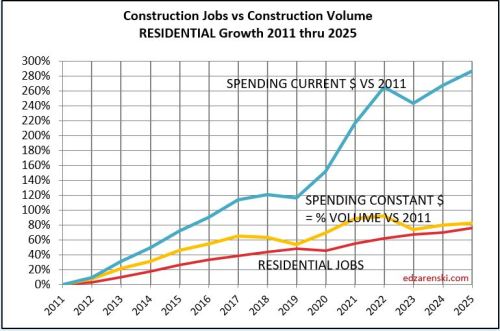

The plot above from Jan2020 to Jan2026 is just enlarged view from this plot below, which shows how consistent jobs growth has been over the last 14 years. After the 2020 dip, the slope of jobs growth is about the same as Jan2011-Jan2020.

These next three plots break out the major sectors.

Can We Increase Residential Construction by 3 Million Units in 4 Years?

Here’s a look at the residential construction industry. Except for the first mention of Current $, All $ in this analysis are inflation adjusted Constant 2019$, so all years can be compared on equal terms. All numbers are rounded slightly.

Currently in 2024 $, residential construction spending is $940 billion/year, 43% of all construction. Only 60% of that ($560 billion) is spending on new housing units. The other 40% is Reno.

Currently for 2024, residential construction supports 3,350,000 jobs. Only 60% of the jobs (2,000,000) are for new units.

30 years ago residential construction spending was $550 billion/year and there were 2,200,000 jobs. On average over 30 years (including all up or down years) we’ve added $14 billion/year in spending and 38,000 jobs per year.

The 30 year (1995-2024) average growth in residential spending, counting only 21 up years, (eliminating all 9 down years) is +$36 billion/year. There were 2 years that we added +$70 billion/year in spending (one of those in 2021) and including those, there were only 7 years over +$50 billion/year.

The 30 year (1995-2024) average growth in residential jobs, counting only 21 up years, (eliminating down years) is +125,000 jobs/year. In 1999, we added 270,000 residential jobs. Since 2011, the most we’ve added in a year is 170,000 jobs in 2021. That’s for ALL residential construction.

In 30 years, we’ve never added more than $70 billion/year in residential construction spending nor more than 270,000 residential jobs in a year. Since 2011, the most residential spending increased was $70 billion in a year and the most residential jobs increased was 170,000 jobs in a year, both in 2021.

Only 60% of all residential spending and jobs is associated with building new housing units. The other 40% is renovations, not associated with new construction. That must be considered when reviewing all the historical data noted above. So the following is just to look at the data without renovation.

Reduce the data by 40% to eliminate spending and jobs associated with renovation and look at just the data associated with building new housing units: In 30 years, we’ve never added more than $40 billion/year (2004,2021) in residential construction spending on new units nor more than 160,000 residential jobs in a year (1999,2005). This is for New Units construction only.

Since 2011, the most spending increased for new units was $40 billion in a year (in Constant 2019$) and the most jobs increased was 100,000 residential jobs, both in 2021.

The last time residential jobs for new units increased by 100,000 or more in a year was 2005. Best growth ever was 2004-2005-2006, when we averaged +120,000 jobs/yr for 3 years, just for new units. In fact, the only times residential jobs for new units increased by more than 100,000 were 1999, 2004, 2005 and then finally again in 2021. But 2004-2006 was a time when the construction unemployment rate averaged 7.5%-8.5%. In 2021, construction unemployment averaged 6%. Now the unemployment rate is averaging 4.5%.

(It would be wise to use post-2011 data for the jobs analysis. The construction industry, especially residential and nonres bldgs, experienced a labor base reset in the period 2006-2010, a period from which we have never fully recovered. Notice in this plot that residential was nearly level at 4000 for 10 years, then from 2005-2009, it shot up to over 5000. It’s remained near 5000 since 2010.).

If we were to match the maximum growth rates since 2011 (and in the case of spending, since 1994) we would increase new residential units construction spending by $40bil/$390bil = 10% and we would increase new residential jobs by 100,000/2,000,000 = 5%. Spending maxed at 10%, but jobs max growth at 5%.

The number of new housing units built in a year varies, but for this post I’ll use 1,500,000. Currently it’s a bit less than that. Increasing new units by 5% to 10% per year on a base of 1.5 million units/year would net a growth between 75,000 to 150,000 added units per year. Let’s use 100,000 new units in the first year. That would be 6.7% growth, already more than the 5% jobs. We would continue the growth, so we increase that by another 100,000 in the 2nd year, and again in the 3rd and 4th years. Leave no doubt, growth of 100,000 units/yr would mean adding jobs to match or exceed the best single-year growth rate in the residential new units construction industry since 2005, and keep matching that growth rate for four consecutive years.

CORRECTION: 8-21-24 The Corrections (now fixed) above raise the upper limit of potential growth based on spending from 7% to 10%, or 150,000 units/yr, but only if we take the result to be dependant on the upper limit % spending growth. I had divided by current $ when I should divide by constant $. Spending can vary a lot more than jobs. While some years of jobs growth reach 6%-7%, average residential jobs growth is just over 4%. Jobs never grow at 10%/year.

This plot shows the steady growth in residential jobs, 75% over 15 years. Compounded that’s about 4%/yr. So, it seems much more likely the limiting factor here is jobs, not spending.

In this analysis, the number of units was chosen at 100,000/yr., an increase of 6.7%/yr., well below potential spending growth but already more than jobs growth. The jobs increase in 2021 was 5%/yr. In 2004-2005, jobs growth was 8%/yr. So, this 6.7% is near the high end of potential jobs growth. This implies an add of 130,000 jobs.

So we would increase new units by 100,000 + 200,000 + 300,000 + 400,000 or 1,000,000 total new affordable residential units over the next 4 years.

By this rough analysis, to increase new residential units by 3 million over current production over the next 4 years would require that we increase residential construction and jobs by 3x greater than the best performance achieved in the construction industry in the last 30 years, and keep it up for the next 4 consecutive years. That’s more jobs than the entire construction industry gains in one year and the new units subset of construction is only 25% of all construction.

Although there has been times past when jobs increased by 120,000/year, that was a time when unemployment was much higher and there were more workers available to readily go back into the workforce. It’s not impossible that jobs can grow faster, and therefore also the number of new units, but it is unlikely.

If a substantial portion of the current 1,500,000 unit production (500,000 units a year for the next 4 years) were shifted over to affordable units, the picture changes considerably. But I wouldn’t expect that current demand to just go away and shift to lower cost units. So, this leaves current demand as is and adds jobs.

A Proposal: If some amount of the funds to be invested in this program is directed towards trades training programs, within two years, and every year after, we could potentially be turning out some of the extra 260,000 additional workers we would need every year to achieve 3 million new housing units. This approach would create both good jobs and new affordable homes. Incentivize the training program somehow. Paid internship. Perhaps with a guarantee in return to work for 2-3yrs. If we don’t invest in training workers for this effort, we cannot build more than the labor we have. Here’s a thread on my training proposal. https://x.com/EdZarenski/status/1828778915055468816

Construction Inflation Tame in July PPI

With the PPI release on Aug 13, for July data, we see both Inputs and Final Demand year-to-date (YTD) tempered considerably. Inputs since December are up only 1% to 2%. Final Demand is up less than 1% YTD.

PPI Inputs averaged for Nonres Bldgs, Residential and Highway, have all been at +1% or lower since Q3 2022. Inputs do not track final cost. No labor or Margins. Inputs can be at very different stages of manufacture and can include a variety of products. For instance Fabricated Structural Steel has been ordered from the mill and includes detailing and fabrication, ready to deliver to the jobsite, whereas Steel Mill Products has not yet been fabricated to any end-user details and in fact includes all types of steel, which would include sheet steel used for manufacture of automobiles and appliances.

Construction Inflation per PPI Final Demand has been at -1% to +1% since Q2 2023. A number of independent firms report Nonres Bldgs inflation at 3% to 4%. I’m tracking at 3.1%.

Turner Index is up 1.9% for the first two quarters of 2024. That is up 3.5% from the average of 2023. RLB is up 2.4% since December and that is up 4.6% from the average of 2023. The U.S. Census New Homes index is up less than 1% since December but that is up 2.8% from the average index in 2023. These are all final cost indices.