Home » Articles posted by edzarenski (Page 2)

Author Archives: edzarenski

Immigrants in the Construction Workforce

The construction industry in the US heavily relies on immigrant workers, notably undocumented individuals. Total immigrants comprise about 20% of the workforce. That amounts to about 1.6 million immigrant workers and about 1.3 million (15%) are undocumented.

The perils of Undocumented Construction Workers in the United States https://limos.engin.umich.edu/deitabase/2024/05/28/undocumented-construction-workers-us/

Largest occupations for undocumented workers in construction https://www.americanprogress.org/wp-content/uploads/sites/2/2021/02/EW-Construction-factsheet.pdf

20% of the US construction workforce is made up of immigrants. Data provided in the American Progress article above indicates about 1.3 million are undocumented. The US construction workforce increases at an avg rate of about 3%/year. If we were to lose those undocumented workers, it would take about 4-5 years to replace them, if ever. Could set back construction almost a decade. In fact, instead of 3% growth per year advancing growth, for 4-5 years it would be 3%/year jobs growth just backfilling the hole left behind before resuming growth. We would be behind forever. After 10 years, we would still be down 15%.

In construction, every trade is dependant on the trade before them to complete their part of the building progress according to schedule. If even one trade disappears from the schedule, the building progress can screech to a halt. For example, just try to put up all the drywall in a new house before the electrician and the plumber finish all their rough-in work and the inspector signs off. Lose either one of those trades and progress stops.

I live in New England. In the past 10-12 years 30 houses were built in the development right behind my property. Every single one of them had immigrants crews at some point on the project. My observation as I would walk my dog every day and watch progress is they work hard, and sing while they work.

A recent comment by this current administration (hellbent on deporting immigrants) went something like this: ‘forget deporting criminals. Just round up roofers and short order cooks so we reach our goal.’ That could really hurt construction, not only primarily in some/all of the southwest states, some with 40% immigrants working in construction, but in all states. It would kill housing, and right now LA needs all the housing workers it can get.

Unemployment and productivity includes only jobs counted in the official U.S. Census Bureau of Labor Statistics (BLS) jobs report. There is a large, unaccounted for shadow workforce in construction. By some accounts, 40% or more of the construction workforce in California and Texas are immigrant workers. Immigrants may comprise between 14% and 22% of the total construction workforce. It is not clear how many within that total may or may not be included in the U.S. Census BLS jobs report. However, the totals are significant enough that they would alter some of the results commonly reported.

But this we know, (in residential construction, where most of these workers are likely working), it takes 4,000 jobs a year to put-in-place $1 billion of construction. So for every 4000 jobs lost, we lose the ability to put-in-place $1billion of new residential construction. If even 30% (400,000) of undocumented immigrants in construction are lost to deportation, that could amount to a loss of the ability to put-in-place $100 billion in construction in one year, or a trillion$ (without accounting for inflation) over 10 years.

I’ve been writing about immigrant construction labor for about a decade. Want to get more facts? See these (dated) articles.

Construction Briefs June 2025

Construction Spending Explained

- New Starts + Existing Backlog generate Spending

- Spending = Revenue

- Revenue includes inflation which adds nothing to volume

- Revenue – Inflation = Business Volume

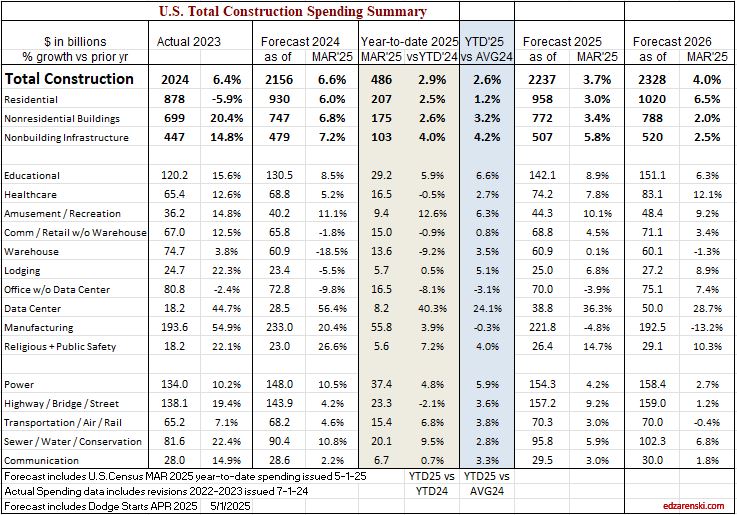

Construction spending fell slightly in April, down 0.4% from March. Spending has fallen slightly each of the last 3 months, but total spending is still at/near an all-time high with the seasonal rate at $2,200 billion. The forecast predicts spending will increase to 3% growth by year end.

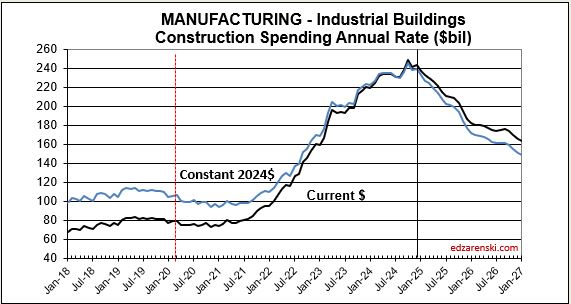

Construction Forecast Update – Data Centers shows the largest % growth for 2025, forecast +33%. Manufacturing is still the largest $ contributor ($223bil/yr) to nonresidential bldgs total spending ($772bil/yr), but has fallen 6% in the last 5 months.

Peak manufacturing construction spending was posted from Sep thru Dec 2024. The avg of 1st 4mo of 2025 is down 4% from that peak. By Q4’25, avg spending will be down 10% from peak.

BTW, this is totally normal. We are beginning the tail end of an above normal huge influx of new manufacturing projects that started over the last 3 years, and the spending curve is beginning the downhill slope. Spending will continue to fall for the next 3yrs.

Data Center construction spending has not yet hit peak. Data Centers are continuing on a phenomenal streak of +45% growth in 2023 and +56% in 2024 and now 33% in 2025. The avg of 1st 4mo of 2025 is up 39% from same 4mo 2024. Spending will finish the year almost 20% higher than today. 2025 forecast +33% over 2024. Currently projecting peak spending end of 2027, or later.

Headwinds could slow new starts growth. Many economists predict current trade impacts will slow overall economic growth. That in turn could slow capital expenditures, which, in this case, is new construction starts.

Any capex pause could reduce all Data Center numbers. However, starts are up 400% since 2020 and could finish 2025 up 500%. Would take a lot of canceling or delaying to collapse these numbers. (This is going to first appear in construction starts, “firms pausing or delaying capex.” It’s already started with Data Center).

What’s propping up construction spending growth? Here’s the top growth markets.

- Market——1yr/%/$ growth ——3yr growth

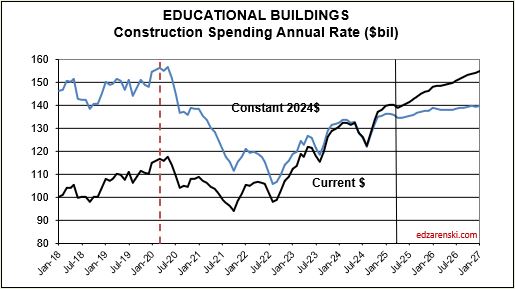

- Educational 1yr/+8%/+$10bil +3yr/+30%/+$30bil

- Data Centers +56%/+$10bil +286%/+$18bil

- Public Utilities +11%/+$9bil +58%/+$38bil

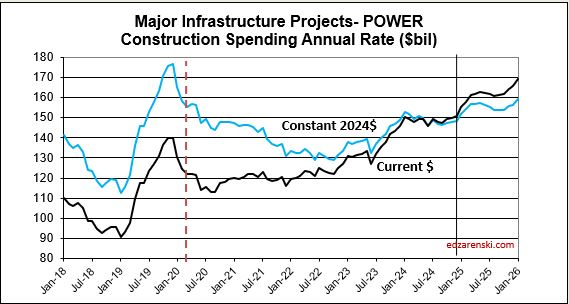

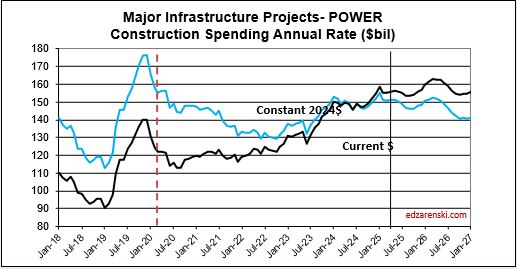

- Power +10%/+$14bil +24%/+$29bil

- Highway +4%/+$6bil +40%/+$40bil

Data Centers far and away takes the prize for highest % growth, but Data Centers is only 1.7% of all construction spending. Power is 7%, Highway is 6.6%, Educ is 6.3%, Pub Util is 4.4%

Manufacturing is notably absent from the above list, because after 3 outstanding years, Mnfg is no longer contributing growth. Mnfg spending is beginning to taper off. Mnfg is 9.3% of construction spending. The only market over the last year, or 2 or 3 years, with more $ spending than Manufacturing is Residential.

Mnfg 1yr/+20%/+$39bil 3yr/+284%/+$150bil

Mnfg 2025 forecast -10%/-$24bil

What’s holding spending growth back?

6-17-25 When May construction starts are reported later this month, I’m expecting an overall decline and a lower forecast. There are already reports of pauses in manufacturing facilities and data centers. Hiway and Public Utilities are probably immune from cuts but Power may see some reductions. Education and Healthcare are questions. Residential construction expected down slightly. Housing permits continued a downhill trend in April for the fourth month in a row. KB and Lennar report market pricing is down slightly. # of homes on the market is increasing.

This next plot shows the number of workers required to put-in-place $1 billion of construction in 1 year. Except for Nonbldg Infra, which has remained relatively flat over time, it requires more jobs to put-in-place $1bil today than it did 10 years or 20 years ago. Total construction workforce (8,300,000) divided by # of billions$ put-in-place (2,200 billions$/yr) is the simplest way to show the decline in construction productivity. Results here broken out for major sectors.

Construction Jobs Total hours worked peaked in March, now down 0.4%. For May, jobs increased by 4,000 (<0.1%), but unemployment dropped from 5.6% to 3.5% (175,000). That would mean that 171,000 workers dropped out of the workforce.

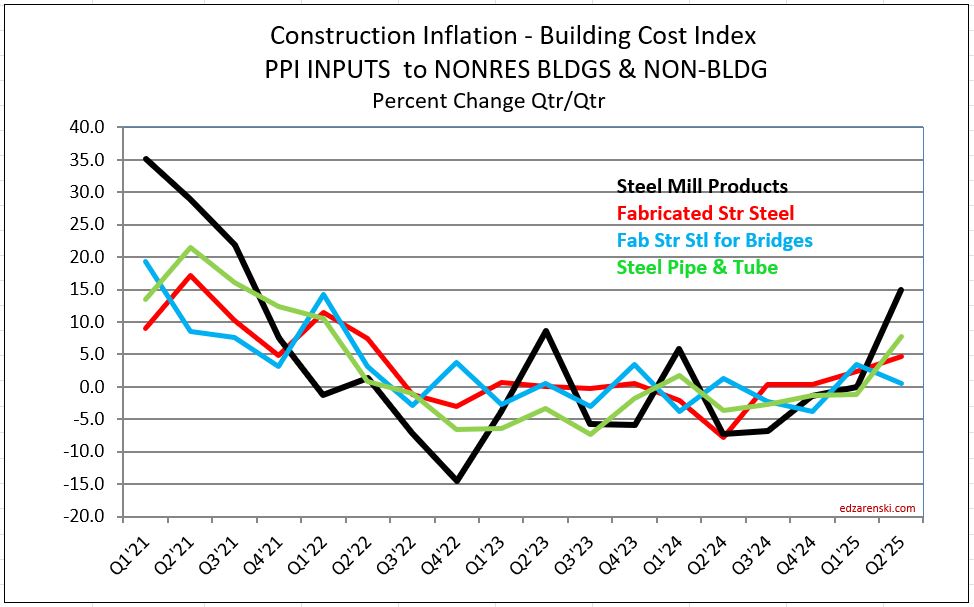

Steel Tariffs 50%

50% of nonres bldgs are structural steel. Str Stl is 10% of total bldg final cost. Nonres bldgs construction spending = $770bil/yr., $385bil on SS nonres bldgs., $38.5bil on str stl

Struct Steel material is only 25% of steel total contract cost, so 38.5 x 25% = only $9.6 bil is mtrl used in SS nonres bldgs. So at 50% tariff = $4.8bil added cost to nonres bldgs total spending. (This assumes ALL steel increases in cost).

Above is structural steel only. When including all other steel used in a building, (rebar, studs, frames, etc), steel is 15% of total bldg cost. So added cost would be $7.7bil.

And that is just nonres bldgs. MF Rsdn uses a little steel, but Nonbldg markets, Power, Highway, Transport, Pub Util adds about another $5bil.

So, steel tariffs, IF ALL STEEL WERE TO INCREASE, adds inflation to total Nonres Bldgs and Nonbldg. Half of all Nonres Bldgs use structural steel, so inflation to SS bldgs is 4.8/385, or 1.25% on structural steel bldgs. If looking at the macro view, inflation over the nonres bldg sector, then the $4.8bil increase would be divided by the total nonres spending, or 4.8/770 = 0.625%. All other bldg steel, applied to all nonres bldgs, added another 2.9/770 = 0.4%

Nonbldg Infrastructure markets, if it is a SS building, add the same 1.25% + 0.4%. But Public Works and especially Bridge construction can add significantly more. If domestic producers also raise pricing to follow suit with tariffs, as expected, this is what happens to total Nonres inflation.

US imports 30% of steel it uses. 40% of all steel is used in construction. If 30% is balanced across all types of steel, then 30% of constr steel is imported. (It would take some concentrated effort to determine % imports for each of the individual steel uses.) IF ONLY IMPORTED STEEL WERE TO INCREASE and no domestic manufacturers raise prices, 30% of building steel increases in cost. That is not likely at all. But if so, tariffs would add only 0.4% to nonres bldgs and about 0.1% for all other steel.

Construction Forecast Update May 2025

The total construction spending forecast, now at $2,237bil, +3.7% vs. 2024, has been lowered a bit since the Outlook in Feb. ($2,272bil, +5.5%). Most of the reduction is in Residential, from $997bil, +7.2% down to $958bil, +3.0%. Nonres Bldgs was reduced by $11bil and Nonbldg increased by $7bil. Compared to the average for the year 2024, current total spending YTD is up 2.6%, but is expected to pick a little up throughout the year across all sectors.

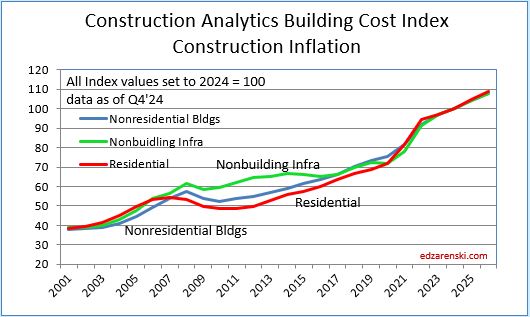

Constant $ growth is forecast down 0.7% in 2025 and down more after that. Inflation Index shows annual percent and index to base 2024 = 100. All years, current spending / index = reported as constant 2024$, as if all constant years are the same 2024$.

Residential Single Family spending has been in a range +/- 2.5% for the last 7 months. With only a few months lower than that, this range extends back 18 months. Take out 3%/yr inflation and you can see that SF volume has been flat to down. Multi-family spending, for the last 12 months, is down 15% off recent highs in Q1’24. Reno/repair spending extended recent highs across 5 months in mid 2024, before falling off 10% in Q4, and now, in Q1’25 it has gained back most of that drop. Any spending gains in the near future would be driven by multi-family.

Manufacturing is still the largest $ contributor ($222bil/yr) to nonresidential bldgs total spending ($772bil/yr), but has fallen 6% in the last 5 months. The trend is down in most months for 2025 and down in 2026. This decline is entirely expected and you can read about it in my article, The Manufacturing Taper.

Data Centers shows the largest % spending growth for 2025, forecast +39%, continuing on a phenomenal streak of +45% in 2023 and +56% in 2024. Data Center starts increased 300% over the previous 3 yrs. and still increase in 2025 and 2026, but at a slower rate of growth. Manufacturing spending peaked in Oct’24. Data Center spending continues to increase for the next few years. Both of these forecasts take into account some cancelations or delays announced recently (see May Briefs), however do not account for any major stoppages due to recent trade impacts.

The largest $ increases in spending are Power, forecast to increase +$16bil, and Highway +$13bil. Educational spending is forecast to post the largest nonres bldgs $ growth in 2025 (+$12bil, +9%). Data Centers increase $10bil.

This same scenario that looks to occur in Manufacturing will occur also in Highway/Bridge. Normal starts were about $100bil/yr, with slow growth. But for the last 3 years, actual starts totaled closer to $500bil for the 3 years or $167bil/yr. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for 4 years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. But once the taper begins it will have the same effect on Nonbldg Infrastructure spending that we will see from Mnfg in Nonres Bldgs.

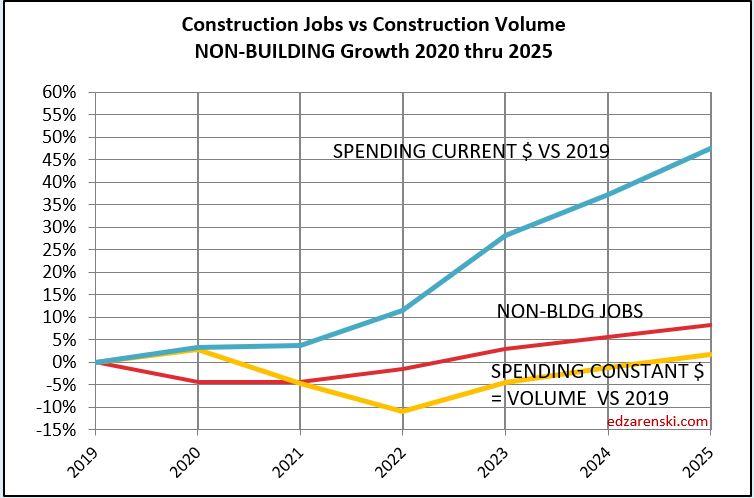

Typical jobs growth is 2.5% to 3.5% per year, even though spending can sometimes far outpace that. But jobs growth doesn’t track spending, it tracks volume growth. Volume is spending minus inflation. For example, for the 4 years 2021 thru 2024, spending increased 44%. But inflation increased 33%. Volume growth was only 11%. Jobs increased 12.5%. For 2025, Inflation will outpace spending growth by 1%, but jobs are still expected to increase by 1.5%. Rarely do jobs decrease. That could change.

There are 870K construction jobs in TX. 500K are immigrants and 300K are undocumented.

New starts are forecast up in 2025, but I would caution there are a lot of headwinds that could slow new starts growth. Many economists predict the current trade impacts will slow overall economic growth. That in turn could slow capital expenditures, which, in this case, is new construction starts. So far year-to-date, spending is outpacing new starts growth. That means backlog is decreasing, mostly in nonresidential buildings. We haven’t seen a decrease in Nonres Bldgs backlog since pre-2011. Residential backlog is down slightly. Nonbuilding is increasing.

See Also Construction Briefs May 2025

and Construction Briefs Apr 2025

5-15-25 all ppi DATA UPDATED TO APR See Construction Inflation 2025

I’ve increased the inflation outlook since Feb to a range of 4.5% to 5%. Inflation may be the most uncertain of all factors affecting construction this year. We have yet to see any significant impact from tariffs, and there is sure to be impacts to many construction inputs. We may not know the total impact for several more months. But I would expect, if anything, inflation will go up from here, not down.

The bees are swarming the flowers outside. At least some lifeform is content and at peace with this world.

Construction Briefs May 2025

For the 9th consecutive year, I will be speaking at Advancing Preconstruction. I will be opening the program May 22 to the plenary session with a summary of the current and expected economic conditions affecting everyone involved in construction, all geared towards one word, RISK.

Construction Spending Q1’25 vs Q4’24 notable Q/Q increases: Education, Healthcare, Amusement/Recreation and Communication are all up 2% to 3%. Highway is up+4.9%, Data Centers +5.4%, Warehouse +7.5% and Lodging +8.3%.

Construction Spending for March is down 0.5% from Feb, but that’s because Feb was revised UP by 0.5%. Jan also revised up 0.66%. YTD Total vs Jan-Mar 2024 is up 2.8% YTD. Data Centers vs Jan-Mar 2024 is up 40%.

Construction Spending Q1’25 vs Q4’24 is UP in every category except Residential, Commercial/Retail w/o Warehouse and Manufacturing (Mnfg was expected). Residential and Comm/Rtl are down only a slight 0.2% and 0.4%. Manufacturing is down 4.7% Q1vQ4. This is the beginning of the Manufacturing spending taper as early projects come to an end. I described that taper here. The Manufacturing Spending Taper

Not seeing any major indications in spending due to tariffs yet. Still early in the data (thru Mar) for that.

Construction Jobs increased 11,000 in April. However, hours worked dropped by 0.6%. Total workforce hours worked declined by an equivalent of 50,000 jobs. Jobs are now at 8,316,000, an all-time high. Jobs are up 27k year-to-date, the slowest growth for the 1st 4 months since 2012 (excld 2020). Although hours worked fell in April, total workforce hours worked increased 2.1% over same 4mo 2024. Average yr/yr growth for Jan-Apr hours worked is 3.7% for the last 10 yrs (ex 2020).

J P Morgan expects imports from China to fall 75%-80% in the 2nd half of the year. Total all imports from all sources are expected down 20%. Some products are going to become unavailable.

The U.S. imports about 30 million metric tons, about 30% of total steel used, of all types of steel annually. The U.S. imports about 6 million metric tons of steel pipe annually. Approx 2/3rds of steel pipe used annually in the U.S. is imported. If the U.S. loses its imports of steel pipe, we can’t support as many building projects. Pipe here refers to pipe and tube. That includes things like gas and oil pipelines, water pipe, steel conduit and structural square/rectangular tube sections (Trump’s Wall).

What’s frustrating this week is all the latest construction spending and jobs data just came out, and everyone wants to know, What’s the impact on the forecast?, and none of the data reflects tariff impacts or potential slowdowns. Spending is thru Mar31 and jobs are thru Apr12. Some of the inflation data is 1 to 2 quarters behind.

I am expecting, when I prepare the Midyear Forecast, that spending projections will go down, perhaps 1% to 3%, and inflation projections will go up. Currently, I’m carrying inflation between 4%-5%. Owner’s may slow or even cancel capital expenditures and material prices are broadly expected to increase.

When PPI data is released May12, that will be thru April. But remember, PPI data is domestic products only. So any inflation in the PPI data is domestic suppliers adjusting pricing to reflect pricing similar to expected increases to match imports. We might begin to see our first clues of tariff impacts/demand when the next construction starts data gets released around the end of May. How much in previous starts have been canceled/delayed? We already know of some chip plants and data centers canceled/delayed.

Construction – What to Watch: Cost to build going up; Cost to finance is up; Product availability in question; Product delivery schedule delays; Margins pressured; Small/Midsize firms squeezed; Labor let go/disappearing; Projects in planning, delayed; Project ROI not met; Projects planned, canceled.

I recommended (going back 6 yrs ago, but still relevant today) that every construction cost estimator is going to need to identify in every estimate/budget presented to an owner for every upcoming project, all items subject to price revision due to tariff. If you don’t you stand to lose your already meager profits.

I can’t even begin to know what to tell construction cost estimators to carry in budgets for increased cost due to tariffs and supply issues. Best I could suggest at this time is to carry an agreed allowance (IMO, better than contingencies), which can be visited at a later date and adjusted to actual cost. Contingencies are for unknown, unexpected, unidentified issues. Allowances are described in the basis of estimate for identified cost issues, but at unknown cost amounts. All allowances in any estimate/budget should be identified at conception with intent to revisit at later date to adjust to actual cost. (The most common allowance you may be familiar with is a rock allowance). Identify allowances up front and reach agreement on budgeted cost with all parties. This will make your contract administration go a lot smoother than trying to negotiate how much of the contingency you can use for a cost increase that was foreseen. The only unforeseen here is actual cost.

ABI – DMI – CBI Leading Construction Indicators

With exception of residential, which has short durations and for which backlog is always only about 30%-35% of previous yr revenues, for all other work, never (since 2010) was backlog shown to be less than the previous yr spending. https://edzarenski.com/2021/05/01/abi-dmi-cbi-leading-indicators/

Construction Backlog, all work under contract yet to be put-in-place, usually extends out 2 to 3 years. Backlog changes only IF new starts are greater than spending in the month, backlog goes UP. If new starts are less than spending, backlog goes DOWN. Subtract canceled projects from starts causes backlog to go down, but delays are are just moved out in time, so are still in backlog.

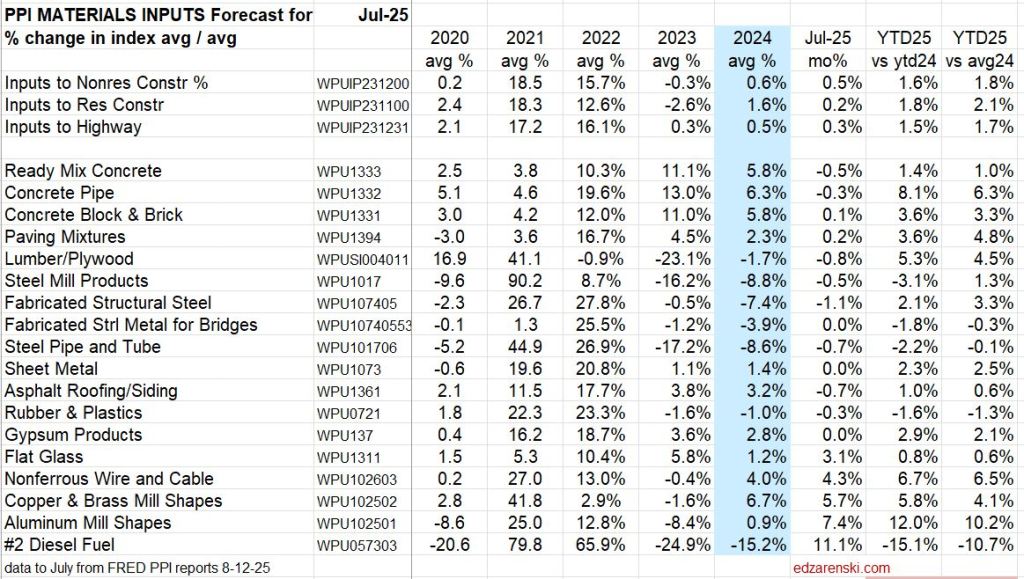

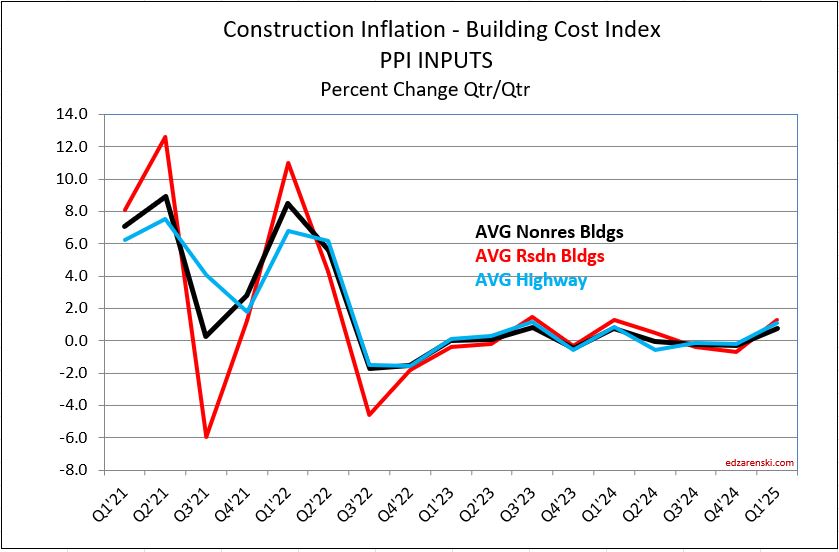

PPI INPUTS Q1 vs avg 2024: to Nonres Bldgs +0.9%, to Residential +1.15%, to Highway +1.0%. All these being near 1% for Q1, if growth is constant, would be near 4% for the year. Big IF! Paving mixtures +11% in Q1, Lumber Plywood +4.5%, Fab Str Steel +0.03%, Fab Str Stl Bridges -1.1%, #2 Diesel Fuel -9.6%, Steel Pipe and Tube -3.85%, Nonferrous Wire and Cable +1.8%, Copper and Brass Mill Shapes +4.7%, Aluminum Mill Shapes +7.5%.

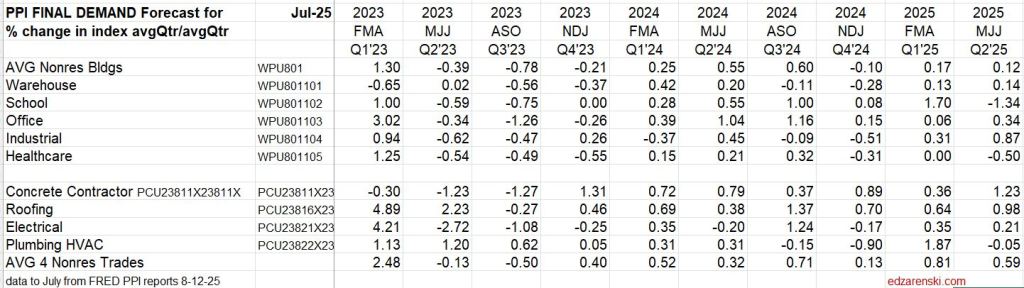

PPI Final Demand 1st 3mo vs avg 2024: Avg Nonres Bldgs +1.3%, Educational +1.6%, Healthcare +2.7%, Roofing Contractor + 2.8%, Avg 4 trades +1.7%. Your monthly reminder, although this index is posted monthly, it is corrected quarterly. April data is the correction month for Q1.

New home construction costs have risen about 3% in the last year, from lumber down 4% to concrete up 6%, per JBREC. The US Census Constant Value Rsdn Index is up 3.5% for the 1st 3 months 2025.

The Biden admin supported the construction $200 billion in new manufacturing facilities that began in 2022 and is now tapering down. It will take a lot of jobs to fill those facilities. But will jobs grow in the current economic environment?

Just about anything that can be considered a leading indicator is pointing down. Layoffs, container ship projected offloads are down and falling, China cut shipping to US, supply chains disrupted, immigrant fears affecting labor. Expect costs up, workload down, labor tight.

I’ve been asked, Why don’t you use AI to develop economic analysis? Artificial Intelligence sometimes gets analysis really wrong. There is some percentage (40%?, 60%?) of end results that AI creates that is literally just made up. If you were to use AI to develop forecasts and analysis of construction data, without having a thorough knowledge of the data and an ability to recognize when it’s meaningful, or garbage, then how would you know when AI is right or wrong. Understand your data well enough to know when your analysis makes sense. For my part, I’d rather spend my time understanding the data and the analysis then to spend it verifying if AI is producing realistic and meaningful output.

Summer is just around the corner. The Hummingbirds returned last week.

Building Connections Podcast Apr’25

Here’s a link to the podcast, Building Connections, of my interview with Rob Ryan, CEO of Twining, Inc. We discuss how I got to where I am today, why I provide a free blog on construction economics, who uses my data and what to expect from tariffs.

Construction Briefs Apr 2025

Tariff actions are not yet reflected in Feb PPI Inputs or PPI Final Demand index. Still early. Also remember, PPI does not include imports or tariffs on imports. When we do see movement in the PPI, it reflects domestic pricing decisions following on tariffs.

Lutnick: “Foreign goods may become a little more expensive, but domestic goods do not.” FALSE see next par.

PPI Excludes Imports/Tariffs. The 2018 steel tariffs of +25% applied on imported steel. However the 2018 PPI data shows that the cost of ALL DOMESTIC steel mill products (of all types) produced in the US increased 18% in 2018, after the steel tariffs were imposed.

If tariffs, for example, affect only 10% or 20% of products used in the industry, then the PPI shows us the domestic producers reaction to tariffs, which gets applied to the other 80% to 90% of product. For instance all steel is not imported, so not all steel will experience a tariff. The point here is that tariffs impact pricing decisions on all domestically produced products, not just the imported products. Consumers pay the price.

Impacts on Construction Inflation and Spending (guesstimates).

2021 inflation was 8%-14%. 2022 it was 12%-17%. Could 2025 repeat 2022? Yes. Will it? ??? I guess it hits 6%-10%.

I’m guessing some projects contributing to 2025 spending will be canceled/postponed. So maybe spending drops 5% from here, to zero growth. Construction spending annual growth is normally in the range 4% to 10%. 2025 and 2026 were both forecast at 5% to 7%. No doubt some projects will be canceled or mothballed. So the next 3 yrs spending gets reduced, and cost gets increased.

I’m beginning to think one of the first issues we have to deal with is supply shortages. All types of imported products are not going to be available, and there aren’t enough domestic products to replace them. This will add delays and cost to building projects.

Yeears ago, when I was a construction cost estimator, a major client would run numbers on a proposed new building project. If it couldn’t balance a ROI in 7 yrs, project would not move forward. As cost to build increases, it becomes harder to hit ROI. This supports that some projects may be canceled or postponed.

- Construction – What to Watch

- Cost to build going up

- Cost to finance is up

- Product availability in question

- Product delivery schedule delays

- Margins pressured

- Small/Midsize firms squeezed

- Labor let go/disappearing

- Projects in planning, delayed

- Project ROI not met

- Projects planned, canceled

Virginia has the largest concentration of Data Centers in the U.S. Virginia is projecting energy shortages due to the extreme demand DCs put on power grids. If you don’t build out the energy grid, the data centers put too great a demand on the current grid. “There are six states in the United States where data centres already consume over 10% of the electricity supply, with Virginia leading at 25%.” https://www.iea.org/reports/energy-and-ai/understanding-the-energy-ai-nexus

In the Q1 pre-tariff outlook, Data Center spending (SAAR), began the year 16% above the avg of 2024, is steadily climbing at 1.5% to 2%/mo., and sometimes more, is now up 22% vs avg 2024. By midyear the rate of spending will be up 28%. Data Center spending increased 45% in 2023 and 56% in 2024. Forecast for 2025 +37%. Obviously, this could get reduced if/when some projects get canceled.

The New Albany (Ohio) project, projected worth $1bil, is one of the two announced DC projects that have been halted https://www.nbc4i.com/news/local-news/licking-county/microsoft-pulls-out-of-licking-county-projects/

What if: A 10%/yr reduction in forecast new Data Center starts in 2025 and 2026 would result in reduced Data Center construction spending by -3% in 2025, -7% in 2026, -7% in 2027 and -3% in 2028.

What if: A 10%/yr reduction in forecast new Data Center starts in 2025 and 2026, combined with a 10% cancelation of 2024 starts, would result in reduced Data Center construction spending by -8% in 2025, -10% in 2026, -8% in 2027 and -3% in 2028. A 10% drop in Data Center spending is $4bil/yr.

It is not clear if the two halted projects mentioned in the article above were already committed construction starts or future proposed starts.

The Fed Chair just said what every credible economist, every economics textbook, and every empirical study shows: Tariffs reduce output and raise prices. – Justin Wolfers, Econ professor at Michigan, Senior fellow, Brookings and PIIE.

Let’s not forget what initiated growth in new manufacturing facilities. New manufacturing building contract starts over the last 3yrs is just over $600bil. Normal starts without government investment would be about $300bil over 3yrs. About $100bil of spending growth over the 3 years is inflation, leaving the remainder of about $200bil in spending growth attributed to government investment. All that began, and most of it got spent, under the previous administration. https://www.forbes.com/sites/courtneyfingar/2024/12/12/manufacturing-jobs-boom-arrives-too-late-for-biden-to-benefit/

Whenever we get an unusually large increase in new construction starts and spending, the tapering off of those projects leads to a decline on the tail end. Mnfg new starts peaked in 2022-2023. We are entering the period of the manufacturing construction spending taper. Mnfg spending has fallen slightly in 4 of the last 5 months. The forecast for 2025 is down -10%.

Microsoft has announced a pullback in spending on new Data Centers. Reduced demand negates need for new facilities, kills expansion plans, lowers new construction forecast, decreases jobs growth in construction. Mothball if partially built factory, not only expensive for owner, but also negative impact to contractor’s forecast revenues.

Whenever there’s a devastating natural disaster, causing destruction to homes, property and infrastructure, the supply of contractors, laborers and materials stays the same while demand skyrockets from victims trying to rebuild. Contractors generally pick more profitable projects over less lucrative ones.

In the Construction Analytics Outlook Feb 2025 report I said, “Don’t be surprised if 2025 construction jobs growth slows a bit. Jobs are slightly ahead of volume growth, particularly in the Non-building Infrastructure sector.”

Construction gained 19k (+0.2%) jobs in Feb, BUT total hours worked declined 0.3%. Total jobs have increased but Hrs worked has gone down the last 5 months. We’ve posted minor jobs gains in both Jan and Feb, and yet unemployment has gone up from 5.2% in Dec to 7.2% in Feb.

The March jobs report shows only minor gains in the # of jobs. We’ve added only 24,000 new jobs in the 1st quarter, the slowest 1st qtr jobs growth in 13 years (except for 2020, Covid). But hours worked in March increased by 1.5%. That acts on the entire 8.3 million workforce and is equivalent to adding 128,000 more jobs.

The jobs numbers reported April 4th cover the period from Feb15-Mar15. There are not yet any impacts from tariffs reflected in the jobs numbers.

We may see the term “force majeure” come up a lot in the near future. And if construction contracts don’t have a force majeure clause, there may be a lot of contractors in trouble.

My guess is if the people of Greenland take a vote to Join the United States, it would be 99-1 No. Of course, they would say “No, thank you.” As they so eloquently put it, “We’re not assholes.”

Tariffs Create Unknown Costs to Construction

Assessing the impact of tariffs on the cost of construction accurately has now become a nearly impossible task. Tariffs can be on PARTS used in the manufacture of goods. Who (architect?, engineer?) will identify which parts included in which products used in the building are subject to tariff? Is only 10% of the whole product subject to tariff?

For example, look at something simple like light fixtures. The shell, the ballast, the reflector, the shade, the lamps or the wiring could be made in China. Who’s job will it be to identify where parts are made? How much is the cost of the part in question? Who now estimates the share of tariff increase on those parts to determine tariff impact on cost of manufacturing the entire light fixture?

Expand that issue to a pump assembly with valves and pressure gauges. Who identifies which parts in the pump assembly come from what country? How does an estimator determine the cost of manufacturing the pumps, valves and gauges and determine what fraction of total cost has a tariff?

This will inevitably lead to inflation, but it will be hidden inflation, hard to determine if a manufacturer’s price increase for a product is substantiated. This is not like the tariff on mill steel, a 25% tariff on mill steel which represents 25% of final structural steel bid, which represents 10% of the building cost.

At the conceptual or schematic design phase of construction, all the products are not even identified. And the project start date might be a year or two years out. It can’t possibly be determined with certainty what factor should be carried to cover cost increases due to tariffs.

Inflation factors and contingency factors will need to increase to cover known unknown costs. This increases the share of the budget that is unidentified, always a contentious issue with owners. Then instead, identify the known tariffs, but the unknown value of end-cost, and carry as an allowance. Frankly with the margins general contractors or construction managers get for services on a large construction project, these unknown factors, if understated in cost factors or left unaddressed, could wipe out the total fee or profit for the job.

This is not a good position to be in, but I don’t yet see how it would be any different.

PS Here we are in Feb. 2025. I wrote this six years ago. https://edzarenski.com/2019/08/01/next-level-of-tariffs-will-be-unknowns/

Construction Inflation & PPI 2025 updated 10-17-25

11-13-25 See new post Construction Inflation 2025 Update Nov. for all new index tables and plots update dates vary from July, Aug to Q3.

10-17-25 Residential Index reduced and minor reduction in Nonres Bldgs Index, see notes in Construction Analytics Building Cost Indices and Reference Indices. The tables and plots included data only thru July.

9-3-25 Updated PPI tables and plots to JULY data issued 8-15-25.

5-15-25 all ppi DATA UPDATED TO APR

2-21-25 All new data updated to Q4. A major change with this new data / plots, is the change in the base date from 2019 to 2024. These index tables / data cannot be mixed with prior issues. Now using base 2024 = 100 in all data / plots included here. Percents yr/yr or mo/mo don’t change, the indexes change.

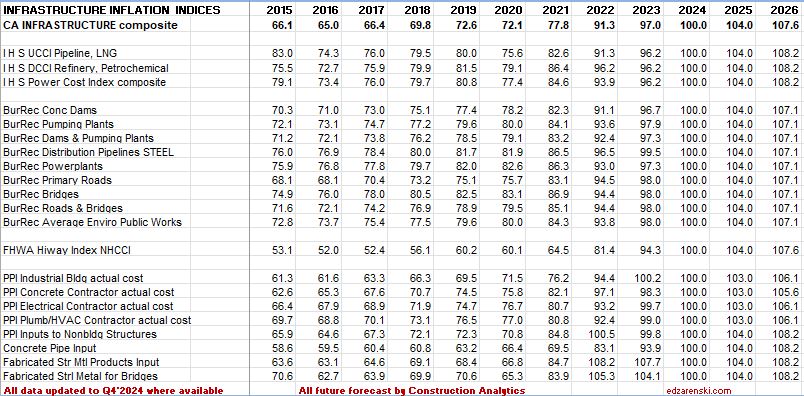

To properly adjust the cost of construction over time you must use an Actual Final Cost Inflation Index, otherwise called a selling price index. General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of escalation in construction projects.

Spending Must Be Adjusted by Inflation

Usually, construction budgets are prepared from known “current” costs. If a budget is being developed for a project whose midpoint of construction costs is two years in the future, you must carry in your budget an appropriate inflation factor to represent the expected cost of the building at that time. Why the midpoint? Because half the project cost occurs prior to that point and half occurs later than that. Actually, the midpoint of spending is 50-60% into the schedule, but the calculation to the midpoint of schedule is close. So, the average inflation for the project includes early contracts that have less inflation than average and also later contracts that would have more than the average inflation. Construction inflation should always be calculated from current cost to midpoint of construction, or in the case of using historical data and converting an older actual cost to a future budget, from midpoint to midpoint.

Any time a construction project is delayed or put on hold to start at some future date, construction cost inflation must be calculated and added to the previous budget to account for the unanticipated cost increase due to the delay. Of utmost importance is using appropriate cost indices and forecasting future cost growth to account for the difference in original budget and revised budget.

Besides the estimator’s need to accurately reflect future expected cost, inflation is an important aspect of the company business plan. Typically discussed in tandem with spending, inflation has an impact on tracking and forecasting company growth. All spending includes inflation, but inflation adds nothing except $ signs to the overall growth. For example, in a year when company revenues (spending) increase by 10%, if inflation is 6%, then total business growth is only 4%. To accurately calculate growth, and the need for labor to support that growth, spending must be adjusted by the amount of inflation.

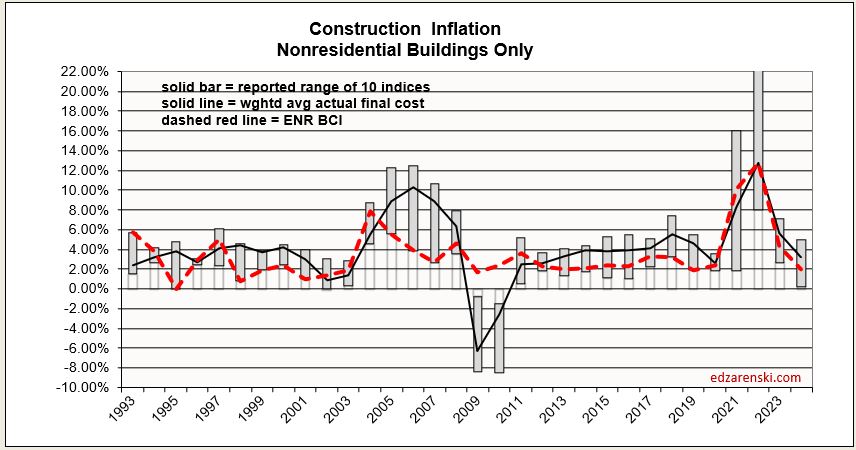

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 3.9%. But those averages include the unusually high inflation years of 2021 and 2022. Without those two years, since 2011, average inflation for Nonres Bldgs is 3.8%, Residential is 3.8% and Non-bldg is 2.4%.

2025 Inflation Forecast, Nonres Bldgs +4.0%, Residential +4.7% and Non-bldg +4.0%.

5-15-25 2025 Inflation Forecast, Nonres Bldgs +4.4%, Residential +5.0% and Non-bldg +4.3%.

Types of Construction Inflation Indices

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of inflation on construction projects.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. The CPI index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI tracks material cost inputs at the producer level, not prices or bids at the as-built level.

Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are examples of commonly used indices that DO NOT represent whole building costs yet are widely referenced by construction firms and estimators everywhere to adjust project costs. Neither includes contractor margins.

It should be noted, there are far fewer available resources for residential inflation than for nonresidential inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce bids. When activity is high, there is a greater opportunity to bid on more work and bids can be higher. The level of activity has a direct impact on inflation.

To properly adjust the total cost of construction over time you must use actual final cost indices, otherwise known as selling price indices.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

Construction Analytics Building Cost Index, Turner Building Cost Index, Rider Levett Bucknall Cost Index and Mortenson Cost Index are all examples of whole building cost indices that measure final selling price (for nonresidential buildings only).

Residential inflation indices are primarily single-family homes but would also be relevant for low-rise two to three story building types. Hi-rise residential work is more closely related to nonresidential building cost indices.

Producer Price Index (PPI) Final Demand Indices are an example of construction cost indices that represent whole building costs. Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, material, equipment, overhead and profit. Labor includes change in wages and productivity.

PPI Final Demand Indices should not be referenced monthly. These are quarterly indices. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices. For more than two years, in most quarters, about 80% to 90% of the change in the index for the quarter was posted in the update month. In some quarters, growth is flipped from negative to positive. And still in other quarters the correction month doubles or halves the rate of growth. There is no way to determine how much occurred in the update month or a previous month, but the update # along with the two previous months will get too the correct end-of-qtr index.

January is an update month. PPI Final Demand for Jan index basically includes the correction for Nov and Dec. Therefore, the index should NOT be compared mo/mo. There is only one of three months that the index is known for certain to be accurate, the update month. Compare qtr/qtr, but make sure to use the defined months, the correct update month with two previous months. For ex., (Jan+Dec+Nov) / (Oct+Sep+Aug). Those are the defined quarters. (I don’t make the rules).

Refer to National Inflation Indices for comparison to several national selling price indices or various Input indices. National reference indices are useful for comparison. Few firms project index values out past the current year, therefore all future projections in these tables are by Construction Analytics.

Construction Inflation History

Post Great Recession, 2011-2020, average inflation rates:

Nonresidential buildings inflation 10-year average (2011-2020) is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. In 2021 it jumped to 8%, the highest since 2006-2007. In 2022 it hit 12.8%, the highest since 1980-81.

Residential 8-year average inflation for 2013-2020 is 5.0%. In 2020 it was 4.5%. In 2021 it jumped to 14% and then in 2022 reached 15.8%. the highest on record.

30-year average inflation rate for residential and nonresidential buildings is 4.1%. But when excluding deflation in recession years 2008-2010, for nonresidential buildings the long-term average is 4.7% and for residential is 4.9%.

For Non-bldg Infrastructure the 30-year average is 3.6%. When excluding deflation in the recession years 2008-2010, Non-bldg long-term average inflation is 3.9%.

All of these long term averages went up in recent years because instead of including 1991-1994, at 2%/yr, we are now including 2021-2024, at 7%/yr to 8%/yr. All long term and short term inflation rates went up.

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- In times of high construction spending growth, nonresidential construction annual inflation averages about 8%. Residential has gone as high as 10%.

- Nonresidential buildings inflation (prior to 2021-2022) averaged 3.7% since the recession bottom in 2011. Six-year 2014-2019 average is 4.4%.

- Residential buildings inflation (prior to 2021-2022) reached a post-recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It has averaged 5.3% for 8 years 2013-2020.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors’ and suppliers’ margins.

- When construction volume increases rapidly, margins increase rapidly.

- Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume went down 33% and jobs were down 30%.

Historically, when spending decreases or remains level for the year, inflation rarely (only 10% of the time) climbs above 3%. Avg inflation for all down/flat years is less than 1%. That did hold true in 2020 for both Nonres Bldgs and Non-bldg Infra. It also held true in 2023 for Residential. It did not hold true in 2021 or 2022. In 2021, spending was down for nonresidential buildings and flat for non-building. Inflation for both was over 8%.

Differences in Tracking Period

Be careful when referencing YTD growth. YTD can be the growth so far this year, that is, growth compared to December of the prior year, or it can be YTD currentyr/YTD lastyr. Neither represents the growth from the avg of the previous year, which becomes the historical value. Both are useful during the year to judge trends. The average growth for the year accounts for all the peaks and valleys within each year and and is the value carried forward into the index tables and charts.

Also, use caution when referencing Dec/Dec growth. An example of the difference between Dec/Dec tracking or year over year, and annual average tracking, is Steel Mill Products which was down 28.7% Dec22/Dec21, but the annual average for 2022 is still up 9.0% from the average 2021. In fact, the three years 20-21-22 show Dec/Dec combined inflation is +71%, but the annual averages for those same three years shows total inflation growth of 87%. Annual averages should be used to report inflation.

PPI Excludes Imports and Tariffs

When assessing or tracking the pricing effect of tariffs on construction materials, keep in mind that the Producer Price Index (PPI) does not include imports (imports are not produced in the US), so therefore, does not include tariffs. See items 4 and 24 in the FAQ provided by the Bureau of Labor Statistics. Construction PPI changes reflect pricing decisions domestic producers make on domestic products in reaction to tariffs on imported products. Tariffs have big impact on domestic prices.

BLS explanation of method and definitions

The price change we see in the PPI for construction materials reflects the domestic material prices of ALL other domestically produced materials used in the industry. While tariffs may affect only 10% of products used in the industry, the PPI shows us the domestic producers reaction applied to the other 90%.

For example: The 2018 steel tariffs of +25% applied only on imported steel, affected only 30% (the imported share) of steel used in US. However the PPI shows us that the cost of ALL DOMESTIC steel mill products (of all types) produced in the US increased avg 18% in 2018, after the steel tariffs were imposed. Prices of domestic steel receded somewhat, but the point is that tariffs caused a price increase also in domestic steel. The increase in PPI is domestic producers pricing response in reaction to tariffs. Tariffs impacted pricing decisions on all domestically produced products, not just the imported products. Consumers pay the price.

PPI Construction Materials Inputs Indices

See this post for August PPI update Construction Briefs Sept 2025

ALL PPI DATA TABLES UPDATED TO JUL 8-15-25

ALL PPI DATA UPDATED TO APR 5-15-25 PPI data INPUTS for the month of Apr: Paving Mixtures -9.5%, Steel Mill Products +5.8%, Steel Pipe & Tube +6.3%, Nonferrous Wire +3.7% YTD25/avg24: Concrete Pipe +8.5%, Paving Mixtures -8.5%, Lumber/Plywd +4.9%, Steel Mill Products +3.7%, Nonferrous Wire +3.5%, Diesel -10.8%. PPI data FINAL DEMAND Apr closes out Q1. Q1’25/Q4’24: Avg Nonres Bldgs +0.6%, School +0.4%, Healthcare +2.2% YTD25/avg24: Avg Nonres Bldgs +1.35%, School +1.4%, Office +1.6%, Healthcare +2.91%.

Inputs Table updated 2-15-25 Jan’25 Inputs are up, +0.8% to Nonres, +1.2% to Residential and 1.2% to Highway, the largest increases since Jan’24. The largest Input item increases in January are Paving Mixtures (up 14.6%), Diesel Fuel (up 3.6%), Concrete Brick, Block & Pipe (up 2.2%), Copper & Brass Shapes (up 1.9%) and Flat Glass (up 1%). Steel Pipe & Tube is down 1.3%. Both Lumber/Plywood and Fabricated Structural Steel are down 0.5% or less.

In the quarterly percent change table you can see the drop in Q3’22 and more in Q4’22, a sharp change in the rate of inflation. This shows up as expected in lower average of Inputs to Res and NonRes for 2023.

2-15-25 PPI Materials Inputs for 2024 to Residential are up 1.7%, to Nonres Bldgs are up 0.6% and to Highway are up 0.5%.

In all three of these Inputs PLOTS, the materials plots above and this Summary plot, so far Q1’25 is only Jan. It will wiggle around for 2 more months.

A General construction cost index or Input price index doesn’t track whole building final cost and does not capture the full cost of inflation in construction. Final cost indices represent total actual cost to the owner and are often higher than General indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. PPI Final Demand indices include all costs and do represent actual final cost to the Owner.

PPI Construction Final Demand Indices

PPI Final Demand indices should not be referenced monthly. These are quarterly indices. PPI Final Demand Indices are for Nonresidential Bldgs only. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices for the current month and the previous two months. For more than two years, in most quarters, about 80% to 90% of the change in the index for the quarter was posted in the update month. In some quarters, growth is flipped from negative to positive in the update month. And still in other quarters the correction month doubles or halves the rate of growth. January data (released in Feb) is an update month. The PPI Final Demand for Jan. is basically the correction for Nov.+Dec.+Jan. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Nov+Dec+Jan)/(Aug+Sep+Oct).

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), the correction month for 5 of the last 8 quarters flipped the sign of the modeled months. In 2 of the remain 3 months the correction months more than doubled the rate of change for the previous 2 months. There is no other proof needed to convince you to take care when using this index. Get it right.

2-15-25 The PPI Final Demand table below is updated to JAN 2025 data.

PPI data FINAL DEMAND Apr closes out Q1.

Q1’25/Q4’24: Avg Nonres Bldgs +0.6%, School +0.4%, Healthcare +2.2%.

YTD25/avg24: Avg Nonres Bldgs +1.35%, School +1.4%, Office +1.6%, Healthcare +2.91%

Jan is the correction month for Q4, so the Jan 2025 value closes out the 4th qtr 2024. Most bldg types and contractors are up in the 2nd half 2024 from the 1st half, but cost growth has been nearly flat. If extended, the trend leading into 2025 is for slow inflation growth. However the Roofing trades are increasing at a slightly faster rate than all others.

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), it is not uncommon that the contractor survey correction month flips the sign of the modeled months for the quarter.

In 2023, for each quarter, we see two months posted positive, then a large negative value for the correction month. The negative correction is large enough in all cases to turn the entire quarter negative. Here’s an example: for the period May-Jun-Jul, Jul is the correction month. PPI values were +0.09%, +0.02%, -1.23%. The average for each of the 3mo is -0.37%, (the sum of the 3 months divided equally. The May and Jun values that were originally posted based on modeling flipped from + to – after the contractor survey value is applied to the QTR. That highlights why PPI Final Demand indices should not be referenced monthly.

However, these declines are from such a high mark at the end of 2022 (we began 2023 up 11%), that the rate as we began 2024 is still up 6% to 7% from the average in 2022.

9-5-25 Q2 Final Demand Index closed out with this July data. Both Table and Plot are updated.

SEE ALSO PPI Data Sept’24

Construction Analytics Building Cost Indices and Reference Indices

2-21-25 Current and predicted Inflation updated to Q4’24

- 2022 Rsdn Inflation 15.8%, Nonres Bldgs 12.8%, Nonbldg Infra 17.3%

- 2023 Rsdn Inflation 2.5%, Nonres Bldgs 5.6%, Nonbldg Infra 6.3%

- 2024 Rsdn Inflation 3.0%, Nonres Bldgs 3.2%, Nonbldg Infra 3.4%

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

2-21-2025 Inflation Forecast, Nonres Bldgs +4.0%, Residential +4.7% and Non-bldg +4.0%. (This is a pre-tariff forecast.)

5-15-2025 Inflation Forecast, Nonres Bldgs +4.4%, Residential +5.0% and Non-bldg +4.3%. (This is a preliminary tariff forecast.)

9-3-2025 Inflation Forecast, Nonres Bldgs +4.4%, Residential +4.7% and Non-bldg +4.0%. (This is a preliminary tariff forecast.)

10-17-2025 Inflation Forecast, Nonres Bldgs +4.2%, Residential +3.8% and Non-bldg +4.0%. (This is a preliminary tariff forecast.) These October revisions are NOT yet carried into the tables and plots. Only Residential changed considerably, however, it is the most dependent on government data, which is currently not available. The biggest change is in the Census Bureau Lasperyes Index, a constant quality residential new build index, which now includes August data and both June and July were revised down slightly.

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

Most of the tables and plots here are cumulative indexes. Construction Inflation annual percents for the three major sectors, Residential, Nonresidential Bldgs and Non-building Infrastructure, are recorded in this short table, Escalation form Prev Year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years.

Final cost indices represent total actual cost to the owner and are generally higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost. The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

9-3-25 Although the PPI data was all updated, as of yet it does not have a big effect on inflation. Some slight increase is built into my inflation to account for PPI increasing in the 2nd half. The inflation tables do not yet need an update. Inflation tables will be updated soon.

2-21-25 All index tables and plots updated to Q4’24. NOTE: all prior index tables were set to base year 2019=100. All these updated tables are set to base year 2024=100.

All of the Index Tables and the plot below, Construction Analytics Building Cost Index, show the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. An index already compounds annual percent to prevent the error of adding annual percents. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from, TO/FROM. Costs should be moved from/to midpoint of construction, the centroid of project cost. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

The three yellow highlighted lines in the index tables are plotted here. The three major sectors, Residential, Nonresidential Buildings and Non-building Infrastructure,

This table and plot is an extension of the tables and plots above. Data is as of Q4 2023, but the table covers from 1967 to 2000. Data is pretty sparse.

Non-building Infrastructure Indices

In the Index tables above, dividing the current year by the previous year will give the current year’s inflation rate. All indices are the average rate for the year.

Also, in the tables above, all reference indices data is gathered from the original source, then all are normalized to a common base, 2019 = 100. This allows us to see how different indices compare.

Comparison of Indices

This plot compares four final cost indices and three inputs cost indices. Prior to 2020 there is a lot of symmetry in the final cost group. Everything changed after that.

Previous year Construction Inflation 2024 – last updated JUL 2024 – BASE 2019=100

SEE ALSO Tariffs Create Unknown Costs to Construction

Links to Data Sources Construction Inflation >>> Links

Outlook 2025 CONSTR OUTLOOK 2025 Feb 2025

Links to Explanations of PPI Index PPI Explanation provided by AGC

Compare 10 Construction Spending Forecasts for Nonres Bldgs Feb 2025

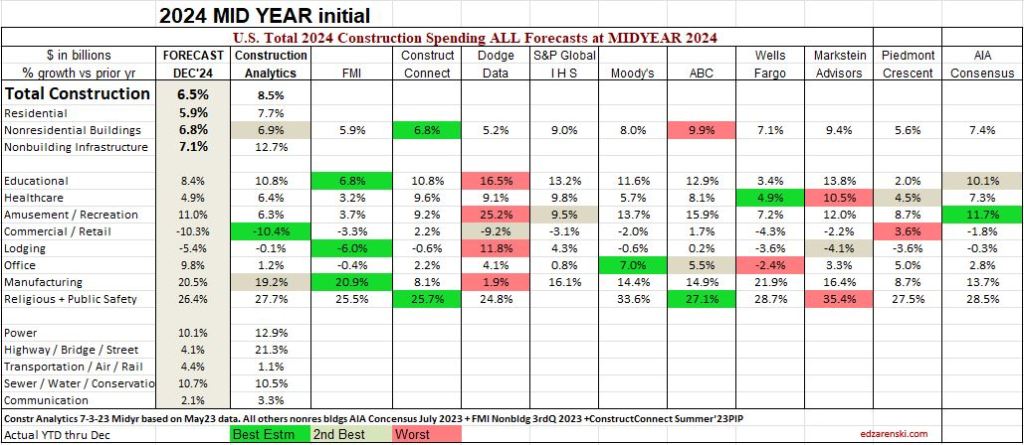

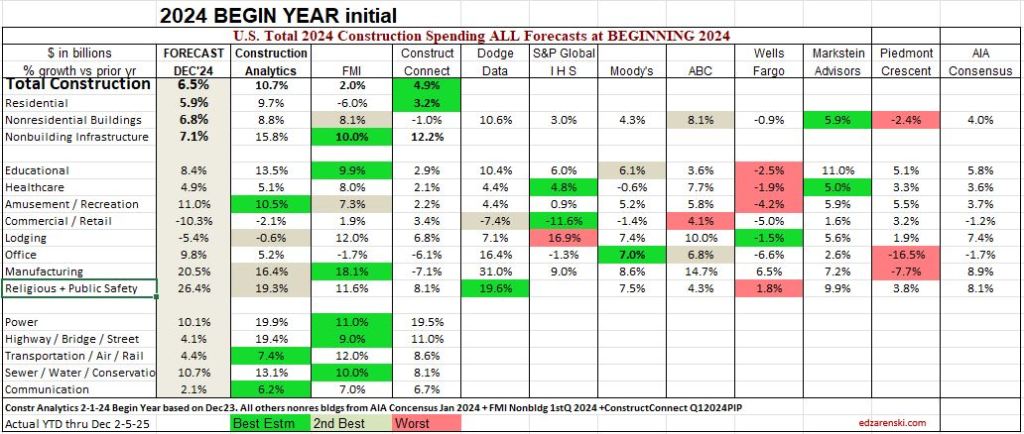

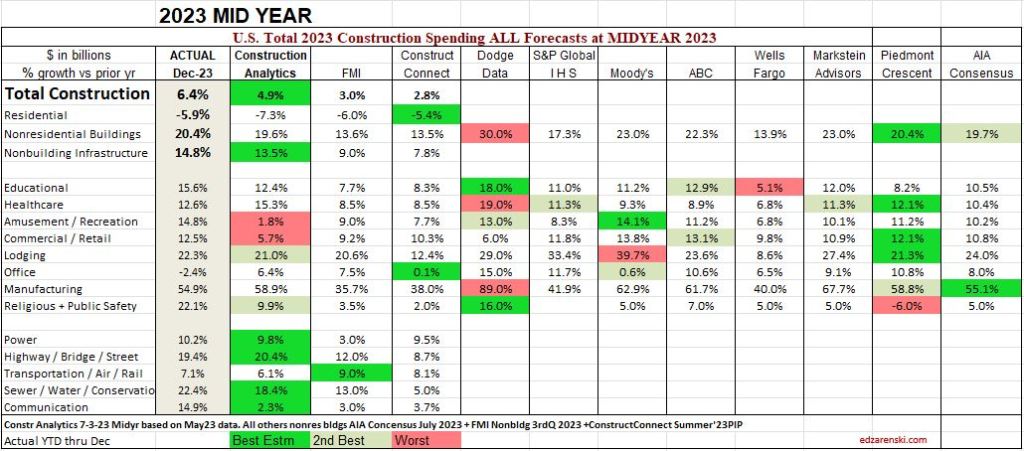

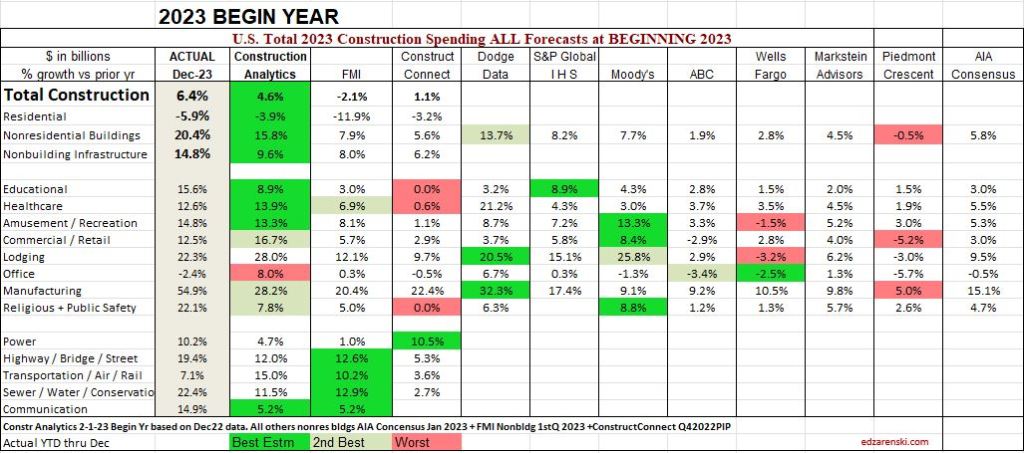

Construction Analytics updates the Construction Spending Forecast every month, usually publishing at least a Brief, every other month. The AIA Consensus solicits forecasts from 9 firms that prepare construction spending forecasts and publishes a Consensus Forecast every January and every June-July. The AIA Consensus reports only on nonresidential buildings.

This table captures the percents growth issued by the 9 firms reporting in the AIA Consensus and the Consensus average. Included is Construction Analytics full forecast. Also included, FMI and Construct Connect also provide full forecasts. Capturing this history provides a ready template to compare “How’d we do?” at the end of the year. It’s not often that we get to look back at forecasts to see how they performed when compared to the actual results. But I’m sure you’ve been asked, “Did you ever go back and look to see how you’ve done?”

You can see in this most recent 2025 table that some of the forecasts vary widely. For instance, in the most recent forecast for 2025: Data Centers forecasts range from +17% to +42%; Manufacturing from -11% to +18%; Educational -2% to +10%; Healthcare -1% to +21%; Warehouse -9% to +12%; Lodging -7% to +22%. Very few (if any) forecasts are in agreement. That’s why it’s valuable to capture the data and compare it to actuals once all the data is in at the end of the year. The first total for every year is issued in Feb., but the final annual actual value is subject to Census revisions until July of the following year,

These are the current Jan forecasts for 2025 nonresidential Buildings spending

Here are some past results, looking back in chronological order. Each table summarizes the percent growth forecast issued by each forecaster. Then, the forecasts are compared to the actual value. Individual market forecasts are marked as best, 2nd best and worst forecast. Color makes it easy to see the performance at a glance. This is a simple table collecting all the forecasting data for one period into one table for ease of comparison. Nothing is changed after the forecasts are issued, except for the actual data at year-end to which it is compared, which gets revised three times through July of the following year after the annual results are posted. You will see that I’ve done better in some forecasts than others. I scored a lot of the 2nd best estimates. Other old posts on this blog show the year I absolutely bombed, 2021, I think. My column was a sea of red. You might think that the updated Midyear forecast is always an improvement from the Beginning of year forecast, but that is not always the case, as you will see. The numbers don’t lie. We post our forecasts and wish for the best. Sometimes we get the best.

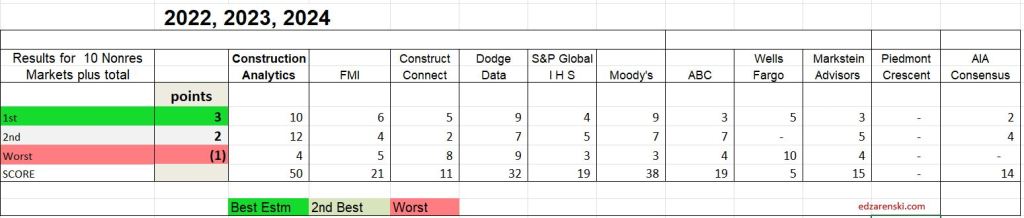

The inquisitiveness in me wants to know how this shakes out, so I put a score to the results. Here’s three years of completed data with two forecasts each year, but I took out (low scoring 8pts) Piedmont, as they were not involved to provide a forecast for 2022. So, How’d we do? These six tables, two each from 2022, 2023 and 2024, are scored here. There are 8 Nonres Bldgs markets plus the Nonres Bldgs total included in the count, so there are 9 line items. I gave 3 pts for best, 2pt for 2nd and -1 for worst.

See any favorites of yours in the list of forecasters? Well, this is a small subset of their forecasting performance over recent years. What’s their score?

I summed the same sets of data back to 2020 to find if this trend, that Construction Analytics is scoring highest, is consistent. Again, I took out (low scoring 8pts) Piedmont, as they did not provide a forecast in 20, 21 or 22. The trend is similar. ABC picked up the most points (29), Markstein Advisors picked up 26, but Construction Analytics still picked up 22 points and retained the top spot.

The maximum any company can score in one forecast is 27 by scoring best on all 8 line items plus the total. The highest single forecast score in five years by any company is 17, that was by Construction analytics in the 2023 Beginning of Year forecast. Out of 11 firms across 9 forecasts in 5 years (no 2020 Beginning forecast and only 4 for Piedmont), or 94 forecasts, only 7 times has any firm scored higher than 10 out of a max 27. That might even make you think forecasting is difficult.

Sometimes, no forecast gets even close to the actual number. As an example, in the 2022 Beginning of year forecast, the average difference from forecasts to actual growth for Manufacturing was off by 40%+. The closest forecast was only within 23%. Why is that? Well, I base my forecast of construction starts. I’m sure others do too. New starts reported for a 3yr period 2020 thru 2022 averaged $50bil/year. But construction spending for the same period grew from $75bil/yr. to $125bil in 2022 and then shot up to $190bil in 2023. The starts report did not give a clear indication of what was leading into spending.

Some of the things I watch for when preparing my forecast are; What is the current rate of spending (Dec’24), compared to the year (2024) average, as we begin the new year (2025)? and What is the recent rate of growth? Does my forecast fit within the current trend? For example, as we begin 2025, the current rate of spending in Q4 2024 on Data Centers is already up 16% from the average of 2024, and it is climbing at a rate from 1%/mo to a few percent per month. That means that unless we experience some unexpected event that would cause spending to decline, we will easily increase from 16% growth to far greater by the end of 2025, or for that matter even by the end of Q1. So, the low is already established at 16% as we begin the year. All growth is an increase from there. New starts have averaged growth of 50%/yr for the last three years, so growth is established. There are a few low forecasts of 17%, 18% and 19% spending growth for the year. That would mean remaining spending growth for all of 2025 would be 1% to 3%, but that’s not realistic with new starts at 50% growth. Forecasts in the range of 20% +/- will be surpassed in the first few months of 2025. The AIA consensus 2025 forecast for Data Centers is +21.9%. I suspect that will be surpassed before Q1 is over.

There are some older posts on this blog that capture this info from earlier years. Not sure at this point what the title of the post would be to search for them. If you are so inclined, try searching for AIA or for the word Compare or Consensus. SEE Link Below. I had awful results one year.

So, I may not have prepared the best total forecast every year from 2020 thru 2024, but overall, I posted the most overall 1st or 2nd best line by line forecasts. In fact, for the Nonres Bldgs Totals (the sum of the 8 markets), out of the 9 forecasts from 2020 thru 2024, I had only 2 of the best Totals forecasts. Markstein Advisors is the only other firm that had 2 of the best totals forecasts.

I will close by saying, the data for the past 3 years or even 5 years shows that I’m providing you with the longest trend best forecast of Nonresidential Bldgs cost growth, and I’m happy to do so.

Construction Analytics Outlook Feb 2025

2-22-25 — A PDF of this entire Outlook article has been attached at the bottom of this post. 32pages, watchout. The Outlook has quite a bit more than in the post here.

Construction Spending

for 2024 vs 2023, as of Dec 2024 data, is up 6.5%. All sectors gained between 6% and 7% over 2023. Growth is forecast at 5.5% in 2025. While Residential and Non-building Infrastructure will both gain 7%, Nonresidential Buildings will only see growth of 2% in 2025.

In February of 2025, with the Dec 2024 data in hand, my forecast for 2025 spending is $2,272 billion, 5.5% higher than my current 2024 forecast of $2,154 billion. There is strength in most markets, but Manufacturing is starting a downward slope in spending after three years of blockbuster performance.

This is the first report of a full 12 months of data from 2024. This number gets revised in Mar and Apr and again in July, when any/all months for the last two years get revised.

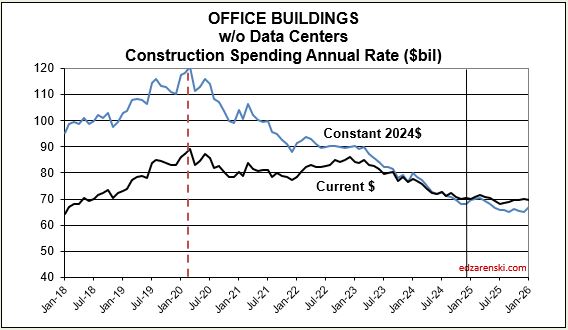

Last year at this time, leading into 2024, many of the Nonres Bldgs and Non-bldg line items showed Nov-Dec spending was already several points higher than the 2023 average. This year, many markets show very small gains or a decline in the rate of spending from the 1st half of the 2024 into the 2nd half. Some notable declines are Warehouse (-2.7%), Office w/o Data Centers (-3.6%) and Highway/Bridge (-2.9%). All begin 2025 down from the average in 2024.

However, Data Center spending is already up 16% in Oct-Nov-Dec vs the average of 2024, so begins 2025 on a high note, up 16% from 2024. Data Center spending increased 45% in 2023 and 56% in 2024. With spending increasing at an average 3%+ per month in 2024, and starting out at that pace in 2025, it’s easy to predict Data Center spending may reach 40% growth for 2025.

As we begin 2025, the current rate of spending (SAAR) for Nonresidential Buildings in Q4’24 is $761bil, only 2% higher than the average for 2024 ($746bil). If spending stays at the current level and no additional growth occurs, Nonresidential Bldgs spending will finish 2024 up 2%. Spending would need to have more monthly declines than increases to finish the year up less than 2%. The current forecast shows the monthly SAAR rates for Manufacturing, Warehouse and Office w/o DC are driving the downward pressure on overall spending.

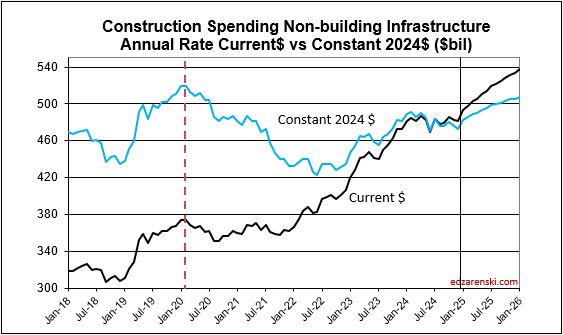

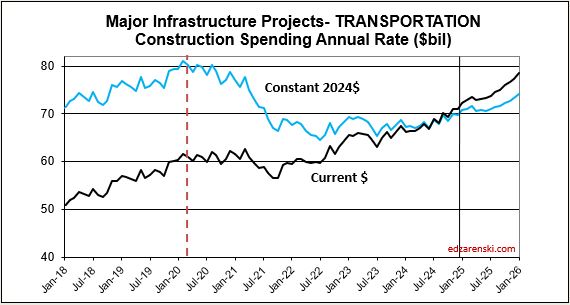

Non-building Infrastructure current rate of spending is only 1% higher than the average for 2024, however the forecast is indicating steady growth of 1.5%/mo for all of 2025. Highway, Transportation and Public Utilities are all contributing to that growth in the spending rate.

Residential current rate of spending is a bit less than 2% above the 2024 average. Growth of 1%/mo will occur in the 1st half 2025, then reverse to a slight decline in the 2nd half.

My construction spending forecast for 2025 Nonres Bldgs is only an annual gain of 2%. Low growth is driven by projects ending in Manufacturing and Warehouse. In the last 3 yrs, there were $230bil Mnfg starts, most in 2022, $130bil above normal, now some are ending. Without Manufacturing, Nonres Bldgs 2025 spending would be up 6%. So while outward appearance may be that Nonres spending is declining, in large part it is due to mega spending on Manufacturing buildings (and Warehouse) tapering down upon completion, creating very large annual declines, but normal. See The Manufacturing Spending Taper

Whenever we get an unusually large increase in new construction starts and spending, the tapering off of those projects leads to a decline in spending in the 2nd half of the scheduled construction. Mnfg new starts peaked in late 2022 – early 2023, so some of these projects would now be in construction for anywhere from 24 to 30 months, well past the midpoint or peak spending. Here’s what the manufacturing spending taper may look like.

In three years, 2020-2022 Manufacturing new starts increased by over 200%. Now, even projects that started in late 2022 are more than 24 months into construction. Peak spending occurs at the midpoint of a project, so peak spending may already be behind us. The current rate of spending in constant$, with exception of Oct. which jumped 2%, remained near flat for the last 8 months. Mnfg new starts peaked in late 2022 – early 2023, so some of these projects would now be in construction for anywhere from 24 to 30 months, well past the midpoint or peak spending. It appears the slowdown in the 2nd half 2024 may be an indication that spending peaked. Although 2025 spending begins 4% higher than 2024 average, my model indicates the rate of spending drops 10% by midyear and by year-end is down 25% from current spending. I’m forecasting 2025 spending average falls 8.5% below 2024.

See The Manufacturing Spending Taper

This same scenario will occur in Highway/Bridge. Normal Highway starts have consistently been about $100bil/yr, with slow growth. But actual starts were closer to $500bil total for the last three years. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for four years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. Once the taper begins it will have the same effect on Non-bldg Infrastructure spending that we will see from Manufacturing in Nonres Bldgs.

Residential spending is 45% SF, 15% MF and 40% Reno. So, only 60% of the total is spending on new housing units. The other 40% is Renovations. Single family construction spending reached a post-2006 high in Q4’21 thru Apr’22. From Apr’22 to the low-point in May ’23 spending dropped 25%. By year-end 2023 it had recovered most of that drop. It fell again in mid-2024, but has since recovered again to the year-end’23 level. Single Family spending is up 7% in 2024 over 2023. Multi-family in Q4’24 is down 10% from Q4’23. Renovations is up 15% from Q4’23 to Q4’24.

The Non-Building Infrastructure spending forecast for 2025 will be most affected by the fact that Power starts for the last 3 years range from 9% to 11%, Highway new starts range from 8% to 11% and Public Works new starts range from 13% to 17%. Starts have been greater than spending each of the last three years. Backlog increased 10% each in 2023 and 2024 and 9% in 2025. Power spending will increase $13bil (8.5%) in 2025, supported by 22% growth in starts the last 2 years. Public Utilities (Sewage and Waste, Water Supply and Conservation-Rivers-Dams) will increase $12bil (13%), with 30% growth in starts the last 2 years.

The Nonresidential Buildings spending forecast for 2025 is most affected by declines in Manufacturing and Warehouse, and increases in Educational and Data Centers. Starts in 2021 and 2022 increased at an average 14%/yr. But new starts in 2023 were only 5.5%, and in 2024 were only 2.6%. Starts in 2023, and especially 2024, have the most impact on 2025 spending. Backlog is increasing, but the rate of backlog growth has slowed from 15% in 2022 to 5% in 2024 and 2% in 2025. Although Data Center spending is expected to increase 42%, that is $12bil. Educational spending will also increase $12bil, even though that is only 9%.

Educational SAAR rate of spending begins 2025 4.5% higher than the average for 2024. Starts are up 18% over the last 2 years. Spending finished 2024 3% higher than it started. The rate of spending is increasing at 0.50% to 0.75%/month for 2025. My forecast is for 9% spending growth in 2025.

Healthcare SAAR rate of spending begins 2025 0.5% lower than the average for 2024. Starts are up 22% over the last 2 years. The rate of spending, increasing since June, is flat in Q1’25, then increases at an average of 1.5%/month for Q2 and Q3 before slowing. My forecast is for 6% spending growth in 2025.

Amusement /Recreation SAAR rate of spending begins 2025 3.0% higher than the average for 2024. Starts are up 18% over the last 2 years. The rate of spending, up 9% from Q1’24 to Q4’24, increases at an average 1.25%/month for 2025. My forecast is for 13% spending growth in 2025.

Lodging SAAR rate of spending begins 2025 3% lower than the average for 2024. Starts are up 14% in 2024 and 20% over the last 2 years. The rate of spending, lower in the 2nd half 2024, increases at an average of 1.25%/month for 2025. My forecast is for 9.5% spending growth in 2025.

Office Bldgs w/o Data Centers SAAR rate of spending begins 2025 3.6% lower than the average for 2024. Starts are down 15% over the last 2 years. Spending in the 2nd half of 2024 is down 5% from the 1st half, in fact from Q1’24 to Q4’24, the rate of spending fell 10%. The rate of spending increases 0.5%/mo in Q1’25, but then falls at 0.50% to 0.75%/month for Q2 thru Q4. My forecast is for a 4% spending decline in 2025.

Data Centers SAAR rate of spending begins 2025 16% higher than the average for 2024. Starts are up 120% over the last 2 years. From beginning to end of 2024 spending increased 20%. The rate of spending increases at near 2%/month for 2025. My forecast is for 42% spending growth in 2025.

Commercial / Retail Bldgs w/o Warehouse SAAR rate of spending begins 2025 only 1.5% higher than the average for 2024. Starts are down 0.5% over the last 2 years. In 2024, the rate of spending fell 3% over the year. The rate of spending begins 2025 with a slight drop then is flat for the rest of the year. My forecast is for 1% drop in spending in 2025.

Warehouse Bldgs SAAR rate of spending begins 2025 2.7% lower than the average for 2024. Starts are down 17% over the last 2 years. Spending in the 2nd half of 2024 is already down 13% from the 1st half 2024. The rate of spending in 2025 drops at 0.25%/month. My forecast is for 4% spending decline in 2025.

Highway SAAR rate of spending begins 2025 2.9% lower than the average for 2024. Spending fell 7% over the course of 2024, but still finished the year up 4%. Starts are up 18% over the last 2 years. Monthly spending is up and down, but averages 0.8%/mo for the year. My forecast is for 3% spending growth in 2025.

Power SAAR rate of spending begins 2025 2.0% higher than the average for 2024. Starts are up 22% over the last 2 years. 2024 spending finished level with where it started and begins 2025 up 2% over avg. 2024. The rate of spending starts strong at 2%/mo in Q1, then falls back to 0.3%/mo for the remainder of 2025. My forecast is for 8.5% spending growth in 2025.

Public Utilities SAAR rate of spending begins 2025 1.7% higher than the average for 2024. Starts are up 29% over the last 2 years. From Q1’24 to Q4’24, spending increased 9%. The rate of spending slows from 1.5%/mo at the beginning of 2025 to 1%/mo by year-end. Sewage/Waste and Water Supply provide the greatest $ growth. My forecast is for 13% spending growth in 2025.

Transportation SAAR rate of spending begins 2025 4.0% higher than the average for 2024. Starts are up 9% over the last 2 years. Spending finished 2024 6% higher than it started. The 2025 rate of spending starts strong just above 1%/mo, but averages only 0.75%/mo for the whole year. My forecast is for 8.7% spending growth in 2025.

STARTING BACKLOG

Starting backlog is the estimate to complete (in this analysis taken at Jan 1) for all projects currently under contract. The last time starting backlog decreased was 2011. If new construction starts in the year are greater than construction spending in the year, then for the following year starting backlog increases. It’s when new starts don’t replenish the amount of spending in the year that backlog declines.

80% of all nonresidential spending in any given year is from backlog and could be supported by projects that started last year or 3 to 4 years ago. Residential spending is far more dependent on new starts than backlog. Only about 30% of residential spending every year comes from backlog and 70% from new starts.

The table below, Forecast Starting Backlog, is model generated by Construction Analytics. Adjusted starts are spread over time to generate cash flow. Spending each year is subtracted from starting backlog and new starts are added to get starting backlog in the following year.

Construction Backlog leading into 2025 in total is up 53% from Jan 2020. Even though several markets are down for the year, every sector (Res, Nonres, Nonbldg) is at all-time high. Since 2020, construction starts have been greater than construction spending, therefore backlog is increasing, but the spread is decreasing. From 2015 through 2019, new construction starts were steady at 4% greater than spending. In 2020, 2021 and 2022, starts exceeded spending by 8%. In 2023 it fell to 6% and in 2024 it was 5%. For 2025, starts are expected to exceed spending by only 3%, indicating the rate of backlog growth is slowing.

Reaching new highs in Backlog could mean not enough labor to support advancing growth so quickly. Future workload from new starts is piling up faster than the current workforce can complete. And the labor force has limitations to how fast it can grow. Nonresidential Bldgs and Non-building posted higher than average starts growth vs spending.

Residential new starts average only 2% greater than spending. Residential new starts in 2023 were lower than spending, so, in 2024, for the first time in 10 years, residential backlog decreased. Even then, residential backlog beginning 2025 is up 61% since 2020. However, these backlog numbers are not inflation adjusted. 45%, or about ¾’s of the 61% residential backlog growth over 5 years is inflation. Real residential backlog growth since 2020 is 16%.

Nonresidential Bldgs starting backlog for 2025 received a boost from all the starts in 2021, 2022 and 2023. Backlog is up 55% from 2020. After 36% inflation, real backlog growth over 5 years is 19%.

Non-building Infrastructure starting backlog was also boosted by strong starts in 2021- 2024. For 2025, backlog is up 49% from Jan 2020. After 38% inflation, real backlog growth over 5 years is 11%.