Home » Forecast (Page 8)

Category Archives: Forecast

WHAT IF? Construction Recession 2020

8-15-19

Talk these days isn’t whether or not we may slip into another recession, but when. Analysts are watching for signals. On any given day you can read articles pointing to why we are or why we are not headed into another recession. But, I wrote an article similar to this 3 years ago, so that opinion has been around awhile. I’m not taking a position here. I would just like to get a rough idea of implications, so I tested some data.

What would happen to this current construction recovery if we slip into recession?

If you think of a recession as having an immediate affect on total construction, like a quick drop in materials prices or cost of buildings, think again. Construction is sort of like an aircraft carrier, it takes a long time to turn around.

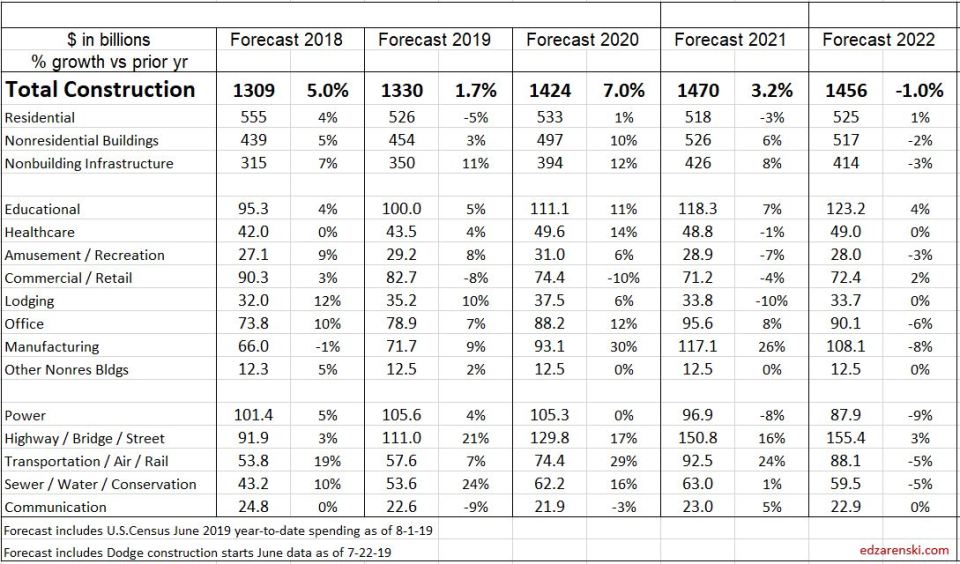

My starting baseline is my current construction spending and backlog forecast for 2019-2020 which includes YTD Spending and Starts through June. All spending and starts are current$, unadjusted for inflation. There is considerable strength in Nonresidential Buildings and Non-building Infrastructure starts and spending. There is weakness in residential.

NORMAL FORECAST current to Jul 2019 with no modifications

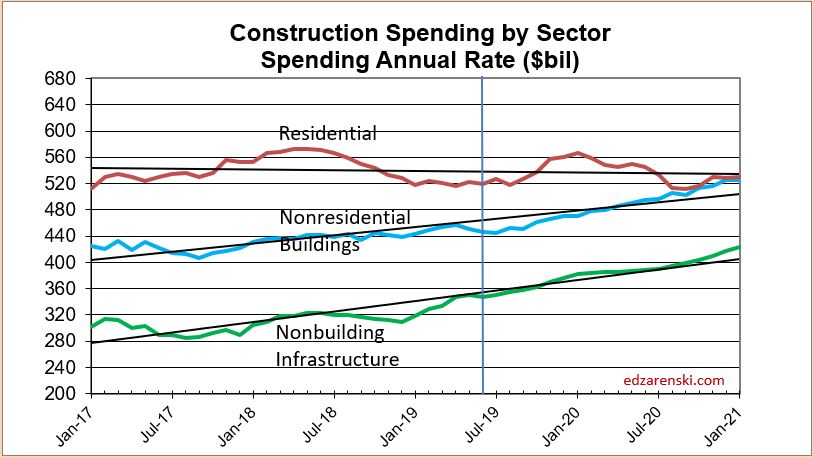

NORMAL FORECAST spending plots for the next 18 months.

Recession What If? Starting Point

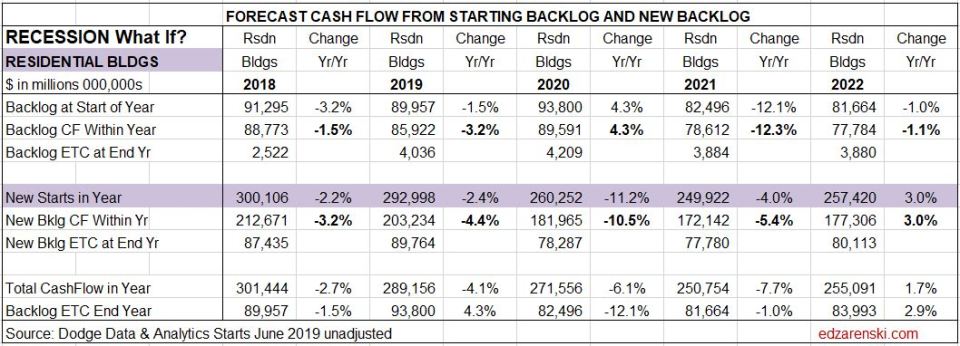

The best indicator of future construction activity is the projected cash flow generated by all the construction starts that have been recorded. Construction starts mark the beginning of spending on new projects. Projects can take many months to reach completion, and the cash flow varies over the project time.

For the 2020 forecast, we can look at new starts and backlog.

Construction Starts YTD total as of June is down 8% from 2018. That’s expected to improve by year end.

Residential construction starts peaked in 2018. Starts have been sideways or in light decline since mid-2018. Year-to-date June 2019 starts are down 9% from 2018. Avg SAAR for 1st 6mo 2019 is $315bil, same 6mo last year was $340bil. Starting backlog is down 5% from 2017 to 2019. Spending is forecast down 5% in 2019 and up only 1% in 2020.

Nonresidential Buildings starting backlog increased 10%/year for the 4 years 2017-2020. Prior to this recession scenario analysis, nonresidential buildings spending was forecast up 10% in 2020 and 6% in 2021.

Infrastructure starting backlog has increased 15%/year for the 3 years 2018-2020. Prior to this recession scenario analysis, non-building infrastructure spending was forecast up 12% in 2020 and 8% in 2021.

For nonresidential buildings, 80% of all spending in any given year is already in backlog from starts prior to that year. For non-building infrastructure it’s 85%. Starting Jan. 1, 2020, 80% to 85% of all nonresidential spending in 2020 is already on record in backlog. For residential, only 30% of spending in 2020 is in backlog at the start of the year. Due to shorter duration, spending is more dependent on new starts within the year.

Backlog starting 2020 for the following six markets is at the highest starting backlog ever for each of the six markets. Also, these six markets account for 1/3rd of all construction spending. Much of the spending from these starts occurs in 2020.

These markets posted the best construction starts 12-month totals ever (in noted period).

- Manufacturing from Jun18>May19, up 36% in two years

- Office May18>Apr19, up 8%/yr for the last 4 years

- Educational Jun18>May19, monthly rate for 12 of the last 16 months increased by 20%.

- Public Works May18>Apr19, increased 30% in the last 24 months.

These very long duration markets posted best new starts ever.

- Highway Dec 17>Nov18, up 25% compared to prior 12 months, which was the 2nd best 12mo ever, with peak spending from those starts expected in 2020.

- Transportation (2yrs) Jan17>Dec18, up 25% from the prior 2 years, but with the peak 12 months up 35% from the prior 2 years, with peak spending 2020.

Growth in new starts and backlog for the last three years (2017-2018-2019):

- Manufacturing starts up 44%, backlog up 62%

- Office starts up 30%, backlog up 62%

- Highway starts up 45%, backlog up 70%;

- Transportation starts up 64%, backlog up 138%;

- Public Works new starts up 45%, backlog up 72%.

In the last two years, Commercial/Retail market starts are down 18% and 2020 starting backlog will be down 11%. The only other declines in 2020 starting backlog are Amusement/Recreation (-1%) and Power (-5%).

So, we are starting 2020 with the highest backlog on record after several years of elevated starts. However residential work is already down slightly while non-building infrastructure work is super-elevated. It is this elevated backlog that will mute the impact of a recessionary downturn.

What If? we reduce new starts

If a recession were to occur, it would substantially reduce future construction starts. Most, if not all, projects already started would move on to completion, but new starts will be cut back. However, the last “construction” recession started in 2006-2007 with declines in residential work. New starts in nonresidential buildings kept increasing into 2008. The “nonresidential” spending recession did not start until 2009, three years after the beginning of the residential decline.

To get an idea how another recession might affect construction spending, I kept all backlog growth predicted through 2019, but I reduced future new construction starts, for two years, starting Jan 2020. I’ve started the reductions for all sectors at Jan. 1, 2020 because residential starts and spending have already been in decline for more than a year.

- Residential starts reduced by 15% in 2020 and by 5% more in 2021

- Nonresidential buildings reduced by 20% in 2020 and by 10% more in 2021

- Infrastructure projects reduced by 10% in 2020 and by 5% more in 2021

This is only about 20% of the residential declines we experienced from 2006 to 2009, but I’m not anticipating another residential massacre. Residential has already been in decline for 12 months. The nonresidential buildings decline now is only half of 2008-2010. I reduced infrastructure by the least since there was only moderate decline in infrastructure work in 2009-2010, yet still I’ve reduced infrastructure twice as much as 2009-1010. I allowed for a 3% increase in new starts in 2022 across buildings sectors and a 2% increase in infrastructure.

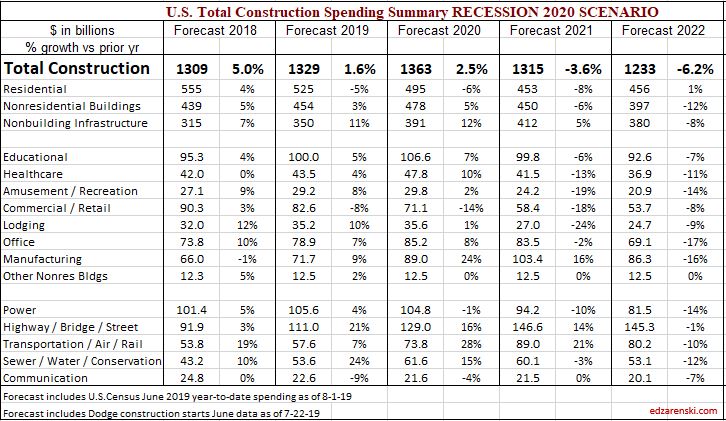

The Recession Scenario Results

The recession 2020 scenario keeps 2019 forecast intact and reduces new starts by 15%-20% in 2020 and 5%-10% in 2021, so imparts a two year downturn. It’s effects, begun Jan.1, 2020 could be translated over time, if say the same scenario started but 12 months later. Negative reaction in the market is quickest to happen for residential, delayed a year for nonres buildings and takes longest (2 years) for infrastructure, for reasons of longest duration type work and highest prior rate of backlog growth.

The recession affects are muted by the fortunate starting point of record high backlog. Residential construction spending will experience two to three declining quarters each of the next three years. But beyond Jun 2022, residential stabilizes and resumes growth. Residential is the only sector to post quarterly spending declines in 2020. Nonresidential buildings posts the 1st quarterly decline in Q1 2021 and has at least seven consecutive quarters of declines before flattening out in Q4 2022. Non-building Infrastructure experiences the 1st two consecutive quarters of decline starting Q4 2021 and reaches a low in Q4 2022. Due to the unevenness of growth, Total Construction spending increases through Q1 2020, posts two declining quarters in 2020 and three consecutive quarters of declines in each of 2021 and 2022.

RECESSION FORECAST spending plots for the next 30 months.

Here’s a reminder of the amount of reductions in new starts. I kept all backlog growth predicted through 2019, but I reduced future new construction starts, starting Jan 2020. I’ve started the reductions for all sectors at Jan. 1, 2020 because residential starts and spending have already been in decline for more than a year.

- Residential starts reduced by 15% in 2020 and by 5% more in 2021

- Nonresidential buildings reduced by 20% in 2020 and by 10% more in 2021

- Infrastructure projects reduced by 10% in 2020 and by 5% more in 2021

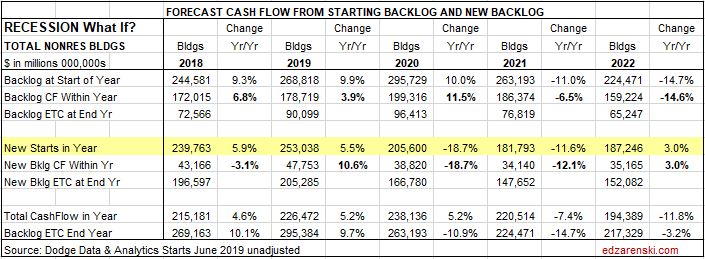

We still see an 11% increase in backlog in 2020, because we did not reduce 2019 starts, but spending from reduced new starts in 2020 drops 2020 cash flow within the year to slow growth of 2%. Reference the baseline spending chart to see prior to reducing starts 2020 spending was forecast to increase 7%. Backlog drops 7% in 2021 and then 11% in 2022. This model predicts a 4% decline in construction spending in 2021 (baseline was +3%) and a 5% drop in 2022 (baseline was -1%), setting us back to the level 2016-2017.

Starting Backlog is down 4.4% for 2023, but even modest new starts growth of 3% helps partially offset the decline in spending. Spending never drops below the level posted in 2015-2016.

The last recession started with residential in 2005 and ended with nonresidential in 2011. Total decline during that period set total spending back 12 years, although the setback was 15 years for residential, 7 years for nonresidential buildings and only 4 years for infrastructure. This mild recession causes a setback to 2015-2016 levels, back 6 years, and less for infrastructure.

RECESSION FORECAST current to Jul 2019 with reduced starts 2020-2021

Residential construction would drop about 6% in 2020 and then drop another 8% in 2021. Residential is far more dependent on new starts within the year for spending than on backlog. That’s why residential spending drops quicker than all other work.

Nonresidential buildings gain 5% in 2020 but then drop 6% in 2021 and 12% in 2022. The strength of backlog going into 2020 pushes most of the declines out to 2021 and 2022.

Non-building Infrastructure has so much work in backlog that this sector still posts spending gains in 2020 and 2021. It drops 8% in 2022. The strength of backlog going into 2020 pushes much of the declines out 2022.

The baseline forecast would have produced spending increases of 9% from 2020-2022. The recession scenario indicates a 7% decline. That magnitude of turn around would impact the jobs situation. We would probably not see any reduction in workforce in 2020 but the spending declines in 2021 and 2022 could lead to a temporary loss of about 200,000 jobs in 2021 and 300,000 jobs in 2022.

Educational 2019 spending is supported by a steady stream of strong starts that began in late 2017 and extended into summer 2018. Jun-Jul-Aug 2018 starts posted the best 3mo total starts ever and peak spending from those starts occurs from April 2019 to Jan 2020. Most spending in 2020 comes from projects that start in the 1st half of 2019. So far in 2019 starts are up 15% ytd over 2018.

Commercial Both store and warehouse starts dropped in 2018. Commercial starts are seeing strong gains from distribution centers (warehouses, which are in commercial spending). Since 2015 the 10% decline in retail stores is being hidden by the 50% increase in warehouses, which are at an all-time high. Stores are down 10% from the peak in 2016. Warehouses are down 5% in 2018 but increased 500% from 2010 to 2017.

Manufacturing Backlog is still very strong, but a drop in peak spending from the schedule of cash flows will lead to a period of moderate spending declines. After that, manufacturing spending increases steadily through the end of 2020. Current expectations are that manufacturing will finish the year up 8%. 2020 will be an extremely strong growth year, spending potentially increasing 20%+. Reductions in starts won’t show up as negative spending until 2022.

Office spending is expected to finish 2019 up 7% or less. New starts in 2018 were up 11% to a new high, but much of the peak spending, from over-sized long-duration projects, will benefit 2020 when I expect to see spending growth of 8%-11%.

Transportation starts have two main parts, Terminals and Rail. Some analysts include transportation in nonresidential buildings. That does not consider the following: airports include not only land-side terminals but also air-side runway work; rail includes platforms and all railway right of way work, which includes massive civil engineering structures. About half of all transportation spending is rail work. Construction Analytics follows U S Census construction spending reports which include all terminals and rail in Transportation.

Terminals and rail starts reached record highs in 2017 and record backlog in 2019. 2019 starting backlog is four times what it was in 2015.

However, much of that backlog is very long duration project spending that will occur in future years. Some of the project starts in 2016 and 2017 have an eight-year duration. From Oct’16 through Oct’18 there were sixteen $billion+ new project starts and seven $500million+ new starts. Some projects started in this period have peak spending occurring in 2020 and 2021.

Highway/Street/Bridge starts hit an all-time high in 2018. Current 2019 progress shows new starts leveling off. Starting backlog increased 70% in the last 3 years leading into 2020. A lot of this is long duration backlog that will provide for large increases in spending in from 2019 to 2021.

Environmental Public Works (Sewage, Water supply and Conservation) new starts all declined from 2014 through 2017. Then all showed 14% gains in 2018 and the forecast is +15% in new starts in 2019.

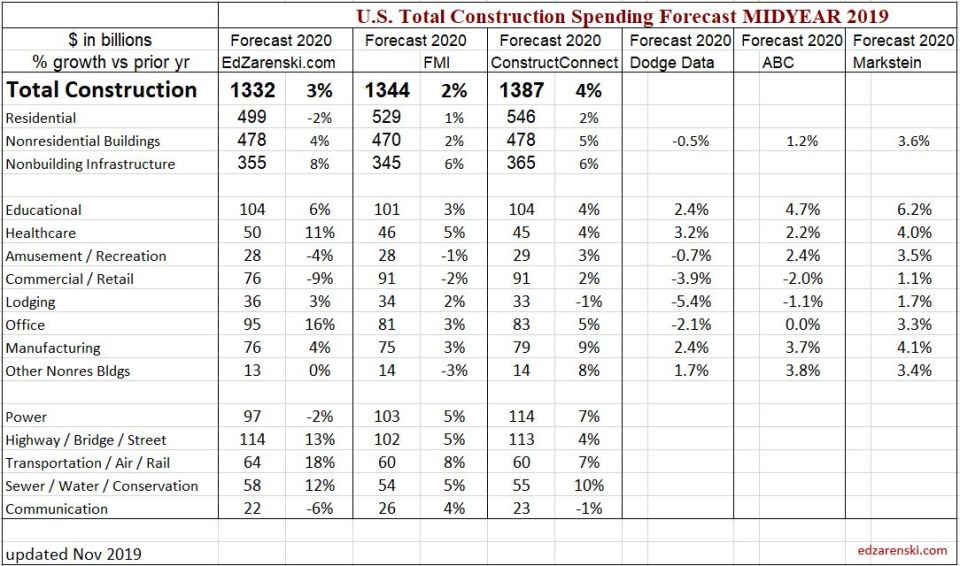

Midyear 2019 Construction Spending Forecasts Compared

8-1-19 edited Nov 2019

Construction Analytics compares midyear construction spending forecast to other industry resources

(note 10-3-19: major revisions to starts data cash flow substantially reduces forecast spending in both 2019 and 2020. These revisions won’t be posted until November. Largest downward revisions 2019, Residential -15, Highway -10. Largest downward revisions 2020 Residential -23, Manufacturing -10, Power -12, Highway -12)

The following comparison data is compiled from data published in several other reports, by FMI 2nd Qtr 2019 Construction Outlook, ConstructConnect Summer 2019 PIP Construction Forecast and AIA July 2019 Midyear Consensus Forecast. Data is all midyear forecast for 2019 and look ahead to 2020.

There are some significant differences in the forecasts, especially in the Non-building Infrastructure forecasts, but also in the Nonresidential buildings 2020 Forecast. I am substantially higher than my peers. Only time will tell who has the closest forecast.

All EdZarenski.com (Construction Analytics) forecasts are based on predicted cash flow from modeling Dodge Data construction starts and include ytd data through June. All other reports were published prior to Aug 1st so would not include the June spending.

How can we assess if forecasts are on track to finish as predicted? Well, for the 2019 forecast, as of August 1, we have actual spending and starts data through June.

Spending year-to-date (ytd) gives some clues:

- Amusement/Rec is up ytd 8.8%

- Commercial is down ytd 8.6%

- Lodging is up ytd 8.2%

- Highway Bridge is up ytd 14.6%

- Sewer/Water/Conserv is up ytd 16.2%

- Communication is down ytd 7.4%

For the remainder of 2019 and 2020 forecast, we can look at new starts and backlog.

Construction Starts YTD total as of June is down 8% from 2018. That’s expected to improve by year end.

Residential construction starts peaked in 2018. Starts have been sideways or in light decline since mid-2018. Year-to-date June 2019 starts are down 9% from 2018. Avg SAAR for 1st 6mo 2019 is $315bil, same 6mo last year was $340bil. Starting backlog is down 5% from 2017 to 2019. Spending is forecast down 6% in 2019, down 2% in 2020 and near 0% in 2021.

Nonresidential Buildings starting backlog increased 10%/year for the 4 years 2017-2020. Nonresidential buildings spending is forecast up 0.5% in 2019, up 4% in 2020 and up less than 1% in 2021.

Infrastructure starting backlog has increased 15%/year for the 3 years 2018-2020. Non-building infrastructure spending is forecast up 7% in 2019, up 8% in 2020 and 8% in 2021.

Table updated to Nov where data available

For the 2020 forecast, we can take a look at new starts and backlog.

These markets recently posted the best construction starts 12 month totals ever over the noted period. Much of the spending from these starts occurs in 2020.

- Manufacturing from Jun18>May19, up 36% in two years

- Office May18>Apr19, up 8%/yr for the last 4 years

- Educational Jun18>May19, monthly rate for 12 of last 16 months increased by 20%.

- Public Works May18>Apr19, increased 30% in the last 24 months.

Manufacturing new starts jumped substantially in 2018 and so far in 2019 have remained higher. Growth in Manufacturing starts jumped 36% in two years. Office starts have increased on average 8%/yr for the last 4 years. Educational starts monthly rate for 12 of the last 16 months increased by 20%. Public Works starts combined (sewer, water supply, conservation) began to increase in 2017, then took off in 2018-2019 increasing 30% in the last 24 months.

These very long duration markets posted best new starts ever.

- Highway Dec 17>Nov18, up 25% compared to prior 12 months, which was the 2nd best 12mo ever, with peak spending from those starts expected in 2020.

- Transportation (2yrs) Jan17>Dec18, up 25% from the prior 2 years, but with the peak 12 months up 35% from the prior 2 years, with peak spending 2020.

Backlog starting 2020 for these six markets is up an average of 25%, at the highest starting backlog ever for each of the six markets. Also, these six markets account for 1/3rd of all construction spending.

Growth in new starts and backlog for the last three years (2017-2018-2019):

- Manufacturing starts up 44%, backlog up 62%

- Office starts up 30%, backlog up 62%

- Highway starts up 45%, backlog up 70%;

- Transportation starts up 64%, backlog up 138%;

- Public Works new starts up 45%, backlog up 72%.

In the last two years, Commercial/Retail market starts are down 18% and 2020 starting backlog will be down 11%. The only other declines in 2020 starting backlog are Amusement/Recreation (-1%) and Power (-5%).

So, we are starting 2020 with the highest backlog on record after several years of elevated starts. However residential work is already down slightly while non-building infrastructure work is super-elevated.

Table updated to Nov where data available

The baseline forecast produces spending increases of only 3% in 2021-2022, so is not aggressive in predicting future starts. Here’s some drivers of starts:

Educational 2019 spending is supported by a steady stream of strong starts that began in late 2017 and extended into summer 2018. Jun-Jul-Aug 2018 starts posted the best 3mo total starts ever and peak spending from those starts occurs from April 2019 to Jan 2020. Most spending in 2020 comes from projects that start in the 1st half of 2019. So far in 2019 starts are up 15% ytd over 2018.

Commercial Both store and warehouse starts dropped in 2018. Commercial starts are seeing strong gains from distribution centers (warehouses, which are in commercial spending). Since 2015 the 10% decline in retail stores is being hidden by the 50% increase in warehouses, which are at an all-time high. Stores are down 10% from the peak in 2016. Warehouses are down 5% in 2018 but increased 500% from 2010 to 2017.

Manufacturing Backlog is still very strong, but a drop in peak spending from the schedule of cash flows will lead to a period of moderate spending declines. After that, manufacturing spending increases steadily through the end of 2020. Current expectations are that manufacturing will finish the year up 8%. 2020 will be an extremely strong growth year, spending potentially increasing 20%+.

(note 11-8-19: major revisions to Manufacturing starts data substantially reduces forecast spending in 2020 and 2021. Dodge Data, in their October Outlook 2020 report, reduced forecast for Manufacturing new starts from their June Midyear report by -$10bil (30%) for 2019 and by -$7bil (25%) for 2020. This reduces 2020 spending growth to only 4%.

Office spending is expected to finish 2019 up 7% or less. New starts in 2018 were up 11% to a new high, but much of the peak spending, from over-sized long-duration projects, will benefit 2020 when I expect to see spending growth of 8%-11%.

Transportation starts have two main parts, Terminals and Rail. Some analysts include transportation in nonresidential buildings. That does not consider the following: airports include not only land-side terminals but also air-side runway work; rail includes platforms and all railway right of way work, which includes massive civil engineering structures. About half of all transportation spending is rail work. Construction Analytics follows U S Census construction spending reports which include all terminals and rail in Transportation.

Terminals and rail starts reached record highs in 2017 and record backlog in 2019. 2019 starting backlog is four times what it was in 2015.

However, much of that backlog is very long duration project spending that will occur in future years. Some of the project starts in 2016 and 2017 have an eight-year duration. From Oct’16 through Oct’18 there were sixteen $billion+ new project starts and seven $500million+ new starts. Some projects started in this period have peak spending occurring in 2020 and 2021.

Highway/Street/Bridge starts hit an all-time high in 2018. Current 2019 progress shows new starts leveling off. Starting backlog increased 70% in the last 3 years leading into 2020. A lot of this is long duration backlog that will provide for large increases in spending in from 2019 to 2021.

Environmental Public Works (Sewage, Water supply and Conservation) new starts all declined from 2014 through 2017. Then all showed 14% gains in 2018 and the forecast is +15% in new starts in 2019.

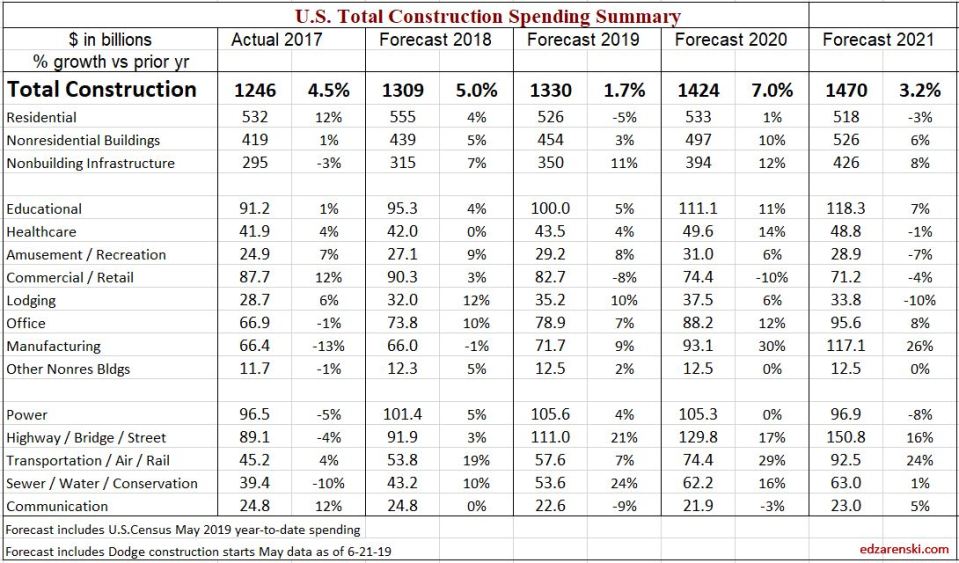

May 2019 Construction Spending Report -Changes Since Dec Forecast for 2019

7-1-19

May construction spending was posted by U.S. Census today at an annual rate of $1.294 trillion. Construction spending has averaged $1.296 trillion for the 1st five months of 2019. Year-to-date (ytd) spending is down 0.2% from the 1st five months of 2018.

Residential spending is down 8% ytd from 2019. Two thirds of that decline is in renovations which is down 15%. Single family (SF) is down 8% but multifamily (MF) is up 9%. SF is 51% of all residential spending, MF is 15%, Reno is 34%.

Nonresidential buildings spending is up 3% ytd. Best performers ytd in nonres bldgs are Manufacturing +11%; Office +9%; Amusement/Recreation +9% and Lodging +8%; (Public Safety is up +10% ytd, but represents less than 1% of nonres bldgs, so has little impact). Commercial is down -8%.

Non-building infrastructure is up 7% ytd. Best performers ytd in nonbldg infra are Highway +18%; Environmental Public Works (combined) +16%; Transportation +9%. Communication is down -7%.

Construction Analytics 2019 forecast for total construction spending for 2019 is now $1.330 trillion compared to $1.341 trillion forecast in December. The changes in the forecast by sector since December are: residential spending was forecast to reach $564 billion but is now projected to hit only $526 billion. Nonresidential buildings spending is now forecast to reach $454 billion, up $10 billion since December supported by increases in Educational and Manufacturing. Non-building Infrastructure spending is forecast to finish at $350 billion up $16 billion since the initial forecast. Most of the infrastructure increase is in Highway.

Current forecast shows all three sectors improving by year end. Forecast spending for 2019 shows residential finishing down 5%, nonres bldgs up 4% and nonbldg infrastructure up 13%.

Inflation is expected between 4% and 5% in 2019. Volume is spending minus inflation. After adjusting for inflation, residential volume is expected to finish 2019 down 9%, nonres bldgs down 1% but nonbldg infrastructure up 8%.

This is the third year in which construction volume will post no significant gain. Spending in 2017 was up 4.5% and in 2018 up 5%, but after inflation, volume was up only 0.1% in 2017 and 0.2% in 2018. Overall, total 2019 spending will finish up 1.7%, but volume after inflation will be down 2.7%.

While volume is now in the third year of no gains, jobs have increased, so far since Jan 2017 by 8%. This does not support the ongoing discussions of a labor shortage. In fact, jobs growth is exceeding construction volume.

Biggest upward revisions to my forecast since December: Educational from -4% to +5%, +$7bil; Manufacturing from -2% to +9%, +$7bil; Highway from +1% to +21%, +$18bil; Environmental Public Works from +7% to +24%, +$7bil.

Biggest downward revisions to my forecast since December: Residential from +0.5% to -5%, -$38bil; Commercial from -1% to -8%, -$8bil; Transportation from +14% to +7%, -$5bil.

See also Notes on April 2019 Construction Spending Report which includes greater explanation of major market activity.

Bullet Points for May

Construction is cyclical in periods, not so much month over month. The 1st 5 months 2019 averaged slightly higher than the last 6 months of 2018.

Residential construction is the biggest drag on total spending right now. The current 3mo average spending is the lowest in 27 months. That will improve some over the next 12 months, but then, if the forecast for new construction starts does not improve, will head even lower for 2020.

All sectors will improve in the 2nd half of 2019 vs 1st half. Residential +3%, Nonresidential buildings +3%, Non-building Infrastructure +9%. These improvements are only enough to bring total 2019 spending to +2.3% over 2018.

Nonresidential new construction starts through 2018 are at all-time highs and are expected to set new highs again in 2019.

Although ytd spending is down 0.2% from the 1st five months of 2018, by year end ytd will climb to 2.3%. The 2nd half of 2018 was in decline while the 2nd half of 2019 is on the rise.

Non-building Infrastructure spending is the strongest it has been in many years. Indications are for a steady increase in spending completely through 2020. Highway, Transportation and Public Works are all contributing to increases.

Growth in new starts and backlog last three years: Highway starts up 33%, backlog up 42%; Transportation (since 2015) starts up 60%, backlog up 100%; Public Works new starts up 38%, backlog up 33%. Backlog growth for these three markets all expected to increase ~25% for start of 2020.

Growth in annual spending in data going back to 2001: Highway spending for 2019-2021 best 3 yrs ever; Transportation 2018-2021 best 4 yrs ever; Public Works 2019-2020 best 2 yrs ever.

For nonresidential buildings, almost 80% of all spending in any given year is already in backlog from starts prior to that year. For non-building infrastructure it’s 85%. So come Jan. 1 2020, 80% to 85% of all nonresidential spending in 2020 is already on record in backlog. For residential it’s only 30% due to shorter duration and the dependence on more starts within the year.

Inflation has been increasing 4% to 5% per year since 2012. Construction spending needs to increase greater than inflation to add volume within the year. Total construction volume has not increased in over two years and will drop 2% in 2019.

Jobs are increasing while volume is decreasing. That’s like a factory putting on more workers to make fewer widgets.

I wouldn’t be surprised to see, within the next few jobs reports, a slowdown in total construction jobs growth but a pick up in heavy engineering jobs. If the last 5 months are an indicator, the decline may have already begun. We’ve just posted the lowest 5 months jobs growth (52k jobs) in the last 7 years.

For more on Jobs see Construction Jobs and JOLTS

My forecast output is dependent on all monthly cash flows from scheduled new construction starts. I rely on Dodge Data & Analytics for starts data.

This forecast does not predict a recession, however does reduce growth in new starts over the next three years. If a recession were to occur, it would substantially reduce future starts. However, the last “construction” recession started in 2006-2007 with declines in residential work. New starts in nonresidential buildings kept increasing into 2008. The “nonresidential” spending recession did not start until 2009, three years after the beginning of the residential decline.

Construction Analytics Voted Best Construction Blog 2019

Ed Zarenski’s Construction Analytics blog

won the 2019 Best Construction Blog competition.

“Sometimes patience and quality count more for success than razzle dazzle and pushy marketing. These observations seem appropriate for the 2019 Best Construction Blog winner, Ed Zarenski’s Construction Analytics.”

“His blog’s uniqueness and success results from its detailed analysis and data about the construction economics topic, including forecasts and projections — with a Google search leadership relating to construction inflation.”

“Zarenski’s blog, effectively, provides a solid overview of the construction industry’s economic picture. That knowledge is useful for contractors, suppliers and professionals seeking to benchmark performance and plan their business’s future based on industry-focused but larger economic trends.”

Construction Analytics wins 2019 Best Construction Blog competition

Notes on April 2019 Construction Spending Report

6-3-19

Construction Spending for April came in at $1.299 trillion. Current spending has been stable for the last three months but at a level 1% to 2% lower than this time last year. That should change to positive growth as the year goes on because the 2nd half of 2018 was declining while the 2nd half of 2019 should increase.

Residential spending YTD is down 8%

Nonresidential Buildings spending ytd increased 3.5%

Non-building Infrastructure spending ytd is up 6%

Spending-Inflation-Jobs

In 2017 construction spending increased 4.5%, but inflation was 4.4%. Real construction volume increased only 0.1%. In 2017, construction jobs increased 3.4%.

In 2018 with 4.8% inflation and only 5% spending growth, real construction volume increased only 0.2%. In 2018, jobs increased 4%.

Considering 4.5% construction inflation for 2019 with spending predicted up only 2%, real volume will be down 2.5% from last year. Jobs thru April are up 1.2%.

Revenue growth looks like 5%/year but it’s all or nearly all inflation. We’ve grown top heavy jobs by 10% in less than three years.

Now well into the third year of jobs growth exceeding growth in work volume, unsupported jobs growth will eventually lead to downward correction in construction jobs. Maybe in 2019.

6-7-19 BLS released Construction Jobs for May, up 4,000. But March and April were both revised down by a total of 13,000. Only 26,000 jobs have been added in the last 4 months. That’s the slowest jobs growth for any four months since 2012. In 2018 jobs increased by an average 26,000/month.

From Jan 2017 to April 2019, jobs growth exceeded construction volume by 10%. The last four months is the slowest 4mo in seven years.

Is this the beginning of a jobs slowdown? Are greater job losses on horizon? The last two years look remarkably similar to 2005-2007 when jobs were still increasing rapidly but already residential construction was well into a downturn.

Residential construction spending saar for April 2019 = $506bil. April 2018 was $570bil. Down 9%. Monthly spending is down 10 of last 12 months. Current $ spending is indicating a 3% drop for 2019. After inflation, that would indicate an 8% drop in real 2019 residential volume.

Residential spending for Q1 2019 is 11% below Q2 2018. The decline is about half in single family and half in renovations. Multi-family spending is up 8% ytd (but accounts for only 12%-13% of all residential spending). Total spending for the first four months of 2019 is the lowest residential spending saar for any 4mo in more than two years.

I’ve posted reasons why I expect upward revisions to residential spending, but I question if revisions can offset the current decline from 2018. With a deficit near 10%, it now looks like residential construction spending will NOT post any gains in 2019 and could finish the 2nd consecutive year of zero growth or real volume decline.

In real volume, after adjusting for inflation, residential construction through April is down 13% year over year. We haven’t posted a volume decline like that since 2009. Perhaps revisions will recover half that decline, but not all. Contrary to the decline in real volume, in the last year residential construction jobs are UP 3.5%.

Educational spending will finish 2019 much stronger than current spending but the yearly totals will only make slight gains over 2018. There was an uneven distribution of spending curve peaks contributing less in the 2nd half of 2018 that is now behind us. 2019 spending is supported by a steady stream of strong starts that began in late 2017 and extended into summer 2018. Jun-Jul-Aug 2018 starts posted the best 3mo total starts ever and peak spending from those starts occurs from April 2019 to Jan 2020. I’m predicting 3% growth in 2019 and 9% in 2020. Some of the expected stronger spending in 2020 could move into 2019. Current spending is up 6.6% ytd over 2018. Most spending in 2020 comes from projects that start in the 1st half of 2019. So far in 2019 starts are up 15% ytd over 2018.

Commercial spending is currently down 4.5% ytd. It will move slightly lower before it improves, finishing the year down 2%. Both store and warehouse starts dropped in 2018. 2020 may not get more than a 2% gain in spending. Commercial starts are seeing strong gains from distribution centers (warehouses, which are in commercial spending). Since 2015 the 10% decline in retail stores is being hidden by the 50% increase in warehouses, which are at an all-time high. Stores are down 10% from the peak in 2016. Warehouses are down 5% in 2018 but increased 500% from 2010 to 2017.

Manufacturing spending, up 10% year-to-date, currently appears stronger than it is expected to finish the year. Backlog is still very strong, but a drop in peak spending from the schedule of cash flows will lead to a period of moderate spending declines from March through September. After that, manufacturing spending increases steadily through the end of 2020. Initial forecast was for 2% growth in 2019. Current expectations are that manufacturing will finish the year up 6%. 2020 will be an extremely strong growth year, spending potentially increasing 20%+.

Office spending, currently up 9% ytd, similar to manufacturing, could post several months of moderate declines from June to November, but then rebound with a steady stream of increases through 2020. In fact, my forecast shows office spending will remain flat or post a slight declines in 6 out of the next 7 months and finishes the year near the same monthly rate of spending as we are at now. Office spending is expected to finish 2019 up 6% or less. Initial forecast was up 6% for 2019. New starts in 2018 were up 11% to a new high, but much of the peak spending, from over-sized long-duration projects, will benefit 2020 when I expect to see spending growth of 7%.

Healthcare starts dropped back a bit in 2018, finishing 9% down. This slowed spending to remain flat for 2018 and 2019. Spending ytd is up only 1% from 2018. Backlog increased 11% for 2017 and 8% for 2018, but with the slowdown in new starts in 2018, 2019 backlog will be down slightly. New starts need to increase in 2019 to see growth in 2020 starting backlog.

Healthcare construction spending for 2018 is forecast to finish at $42 billion, an increase of only 0.2% over 2017. Considering the recent range between 3.5%-5% inflation, healthcare real volume has declined every year since 2012 with exception of 2017 which gained only 0.3%. It will decline again in 2019 with a forecast 0.6% gain in spending, but with a 4.5% rate of inflation. Dependent on how starts materialize in 2019, 2020 could realize the 1st big spending and real volume increase in 8 years.

Transportation starts have two main parts, Terminals and Rail. Some analysts include transportation in nonresidential buildings. That does not consider the following: airports include not only land-side terminals but also air-side runway work; rail includes platforms and all railway right of way work, which includes massive civil engineering structures. About half of all transportation spending is rail work. Construction Analytics follows U S Census construction spending reports which include all terminals and rail in Transportation.

Terminals and rail starts reached record highs in 2017 and record backlog in 2019. 2019 starting backlog is four times what it was in 2015.

However, much of that backlog is very long duration project spending that will occur in future years. Some of the project starts in 2016 and 2017 have an eight-year duration. From Oct’16 through Oct’18 there were sixteen $billion+ new project starts and seven $500million+ new starts. Some projects started in this period have peak spending occurring in 2020 and 2021.

Transportation spending is up 8% ytd but could post several slow months in mid-2019. Spending in 2018 is forecast to finish up more than 19%. Spending for 2019 is expected to finish up only 4% but then increase at least into mid-2021. 2020 and 2021 could see increases in spending of 15% to 20%/year.

Highway/Street/Bridge starts hit an all-time high in 2018. Current 2019 progress shows new starts leveling off. Starting backlog increased 50% in the last 4 years leading into 2019. A lot of this is long duration backlog that will provide for large increases in spending in from 2019 to 2021.

Highway construction spending ytd is up 17%. Spending is forecast to increase 16% in 2019 and 10% in 2020. 2021 may see an increase of 10% in spending.

Environmental Public Works (Sewage, Water supply and Conservation) new starts all declined from 2014 through 2017. Then all showed gains in 2018 and the forecast is more gains in 2019. All these projects are public spending and saw no real gains in spending from 2010 through 2017. Spending ytd 2019 is up 16% to 20% for this group. I’m predicting 2019 spending will finish up 22% and 2020 spending is now forecast to increase 17%.

Brief Notes on Mar2019 Construction Spending Report

5-1-19

Census released March spending today and from my point of view the numbers are showing a surprise downward shift. Nonresidential Buildings and Non-building Infrastructure both showed upward movement as expected but Residential spending posted the eight decline in nine months.

Construction Spending for March posted at $1.282 trillion, 1.5% below (my) expectations. Nonresidential increased BUT Residential is down 2% from Feb. Jan was revised down 4.6% and Feb revised down 5.6%.

Residential spending is now 8% below March 2018. The decline is about half in single family and half in renovations. Multi-family spending is up 11% year/year.

The only monthly gain in residential spending since July 2018 is in Dec, but in the nine months Jul to Mar spending is down 10%. Q1 2019 spending has dropped back to a level of Q1 2017. This is pushing my 2019 residential spending forecast into a decline, 1st decline since 2010.

I’ve posted reasons why I expect upward revisions to residential spending, but I question if revisions can turn around the current 10% decline from last July. It now looks like residential construction spending will NOT post any gains in 2019. That’s more serious than it first appears, since spending needs to increase at least 4% to 5% just to counter inflation. In other words, if residential spending in 2019 posts a 2% decline, real residential volume after inflation would decline by 6% or 7%.

In real volume, after adjusting for inflation, residential construction spending, as of March, is down 12.5% year over year. That hasn’t happened since 2009. Perhaps revisions will recover half that decline, but not all. Contrary to the decline in real volume, in the last year residential construction jobs are UP 3.5%.

Manufacturing currently appears stronger than it is expected to finish the year. Up 6% year-to-date and up 10% from last March, we could see those gains fall off over the next 6 months. Backlog is still very strong, but the schedule of cash flows from old jobs will lead to several months of moderate declines. Initial forecast was for 2% growth in 2019. Current expectations are that manufacturing will finish the year up between 2% to 4%. 2020 will be an extremely strong growth year.

Office spending, similar to manufacturing, could post several months of moderate declines. In fact, my forecast shows office spending declines in 6 out of the next 7 months and finishes the year at the same monthly rate of spending as we are at now. Office is up 8.4% ytd but I expect the year to finish up 4% or less. Initial forecast was up 6% for 2019. New starts in 2018 were up 11% but most of that spending will benefit 2020 when I expect to see growth of 6%.

Commercial spending is currently down 4.8% ytd and 7% lower than last March. It will move slightly lower before it improves, finishing the year down only 1% to 2%. 2020 may not get more than a 1% gain.

Educational spending will finish 2019 much stronger than current spending but the year will only make slight gains over 2018. Current spending is up 5.5% ytd over 2018 but that will taper off. However, the strong activity in the 2nd half of 2019 will lead to substantial growth in 2020.

More notes will be added in the coming days as I review all other markets in the spending report.

Inflation and Forecasting Presentation Advancing Precon & Estm Conf 5-22-19

This is a PDF of slides (including notes) from my

Construction Inflation & Forecasting Presentation

at Hanson Wade

Advancing Preconstruction & Estimating Conference

Dallas, TX 5-22-19

Advancing Pre-construction & Estimating conference 2019

Full EdZ Presentation Inflation-Forecasting w notes HW-APE 5-22-19 PDF

Who Reads Construction Analytics?

Construction Analytics provides in-depth and unique analysis and future forecasting of construction data valuable to a wide variety of users. Construction Analytics data has been referenced by construction firms, university graduate studies, real estate firms, online educators, investment firms, school district planning boards, public agencies for developing infrastructure budgets and news agencies around the country.

Construction Analytics has consulted for and provided special reports and presentations to Construction firms, real estate developers, national construction organizations and industry conferences.

National agencies, universities, construction firms and conference planners have reached out to Construction Analytics for presentations to large and small groups. A sampling of some construction economic presentations: American Institute of Architects; Associated General Contractors; Project Management Institute; McGraw Hill Construction; Georgia Tech Civil Engineering; Worcester Polytechnic Institute Civil Engineering; Hanson-Wade Advancing Building Estimation Conference.

Construction Analytics has appeared in interviews by Bloomberg TV and ConstructechTV and has been widely quoted in Bloomberg News, Washington Post Business, WaPo Fact Checker, Financial Times, CNBC, Marketwatch Economy, Newsweek, Los Angeles Times, Ontario Construction News, strategy+business, Yahoo!Finance, STEEL Market Update, BuildingConnected, Constructiondive, BuildZoom and a host of other blogs and news sources.

Contact:

Construction Analytics

Ed Zarenski

edzarenski@gmail.com

Construction Forecasting – Volume

Feb 26, 2019

Since the bottom of the construction recession year 2011, through 2018 construction spending has increased 67%. During that time construction volume has increased only 32%. All the rest was inflation.

Construction spending is not the only factor for business growth planning. The adjustment for Inflation is the most important factor.

If your company revenues are increasing at a rate of 7% per year at a time when construction inflation is 5%, your business volume is increasing only 2% per year. If you do not factor inflation into your growth projections, you are not forecasting growth properly. Spending is revenue. Volume is spending minus inflation.

Look at the data to the left of the vertical line through 2006. Notice in the bottom plot in the years 2004 and 2005 there is very high spending but very low volume. In 2006 spending was up 4% but real volume declined 3%. For those three years inflation totaled nearly 30%. On the top plot you can see the cumulative effect of several years of high inflation. From 2000 to 2006 spending increased 45% but volume barely moved at all. During this period jobs increased by about 15% and even that outpaced volume. Businesses watched as spending increased 45% in seven years. They increased staff by 15%, but real volume was flat. Heading into the recession construction dollars on the books had been increasing for years but volume was stagnant and companies were top-heavy with jobs.

Addressing the current period 2011 through 2018, if you base business growth on your annual revenue growth, or spending, rather than using inflation adjusted dollars, your forecast for business growth over this eight year time period would be more than double actual volume growth.

Notice the blue bars for annual spending growth in 2017 and 2018 at approximately 4% and 5% respectively. But look at the black lines superimposed on those bars that reflect real volume growth after inflation. There has been only 1% real volume growth in the last two years. Yet jobs increased 8% in two years. Most of the growth in spending is inflation dollars, not real volume growth. Inflation does not support jobs growth.

For 2017-2018 residential spending increased 17% but volume was up only 7%. Nonresidential buildings spending up 6.5% but volume was down 2.5%. Non-building infrastructure spending was up 4% but volume was down by 3%. Inflation across these sectors totaled 7% to 10% for these two years.

Construction jobs, now over 7,400,000 have been over 7,300,000 since summer 2018. The last time jobs were over 7,300,000 was mid-2005 through early 2008, at which point the recession abruptly caused the loss of over 700,000 jobs within 10 months and more than 2 million jobs over the next three years. Jobs are now only 5% lower than the previous high of 7,700,000 in 2006-2007. But construction volume is still 15% below peak constant $ volume reached in early 2006. So the current situation of jobs growth rate exceeding volume growth is worse than it was leading into the last recession.

For 2019 I expect residential and nonresidential buildings to experience a slight decline in volume. I do not yet see a recession as volume picks up again in 2020, but nonresidential construction jobs in particularly have been increasing faster than volume for several years. Part of that is explained by some nonresidential workers are used to build residential space (hi-rise structure). When the next downturn hits, the potential need to cut nonresidential construction jobs may be quite painful.

How to Use Construction Starts Data

New Construction Starts data is published monthly by Dodge Data and Analytics. Starts data captures a share of the total market or a portion of all construction, on average about 50% to 60% of all construction. Changes in sample size can introduce potential errors in forecast when using starts to predict construction spending.

In any survey, if sample size remains constant, let’s say at 50% of actual output, but survey response increases 5%/year, then that reflects output should increase at 5%/year. However, if survey response increases at 5%/year but sample size is increasing at 3%/year (50%, 53%, 56%, 59%, etc.) then actual output should increase at only 2%/year.

For a survey sample to be used to compare to itself from year to year to predict growth in spending, sample size must remain constant from year to year. If it is not constant, the apparent growth in starts does not all reflect real growth in spending.

It is impossible within a single year to verify if the current market share captured is constant with previous year sample size. The sample period of data is a year of new starts. To find out if the sample size is consistent, the sample must be compared to actual spending from starts from that period. Starts from any given year get spent over a period of the next 2 to 4 years. It takes several years to see the pattern of starts sample size versus actual spending.

An average spending pattern for nonresidential buildings starts, OR A TYPICAL CASH FLOW CURVE, for any given year is: 20% of the revenue gets spent in the year started, 50% in the next year and 30% in the 3rd and 4th year. Multi-billion $ highway projects, manufacturing facilities, power projects and transportation terminals would have much longer duration cash flow curves. In other words, if you desire to predict construction spending in 2019, you need to know what starts were at a minimum in 2017 and 2018, and in many cases back to 2016 or even 2015.

2018 construction starts do not provide enough information to predict 2019 spending.

If starts survey sample size varies from year to year, it’s possible some of the spending growth anticipated from new starts may not represent growth in real volume of future work but could simply represent a change in sample size. Potential significant variations in sample size are seen in the data and may cause errors in the forecast.

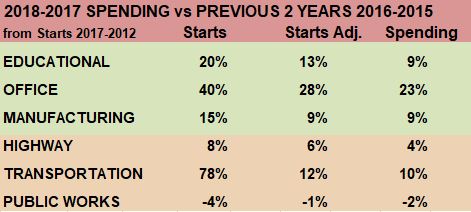

Here are some examples. In the following table the line item “starts vs actual cash flow $” uses cash flow curves unique to each type of construction. For instance, in Office and Educational the spending curve is close to the average 20%/50%/30% as described above. That means 2015 starts is compared to a cash flow curve that spreads spending of 2015 starts over the next three years by 20%/50%/30%.

In the Educational data we see it is unusual that Starts and Backlog continued to grow for five years but that same rate of growth was not reflected in actual spending. From 2013 to 2018 new starts increased more than 60% but spending for the period of those starts (97% gets spent between 2014-2020) increased only 30%. That would seem to indicate a very large volume of work is growing in backlog, and spending, at some point, should boom and remain high for an extended period. But the cash flow model is not in agreement.

A possible explanation is the sample survey of new starts has been increasing, so not all the starts growth for five years represents growth in new work. Some of the increase in starts is simply growth in sample size.

As evidence, Educational starts for the period 2012-2015 averaged just less than 50% sample size of actual total spending. In 2016-2018 the average sample size vs spending was over 60%.

Office Spending increased by 20%/year from 2013 to 2016, but in 2017 it turned to a 1% decline. That was unusual and unexpected since 2016 starts and 2017 backlog had both reached 10-year highs. Highly probable is that the sample size of starts increased dramatically in 2016 and the increase in starts was not all growth in real volume but was partially just a change in sample size, therefore the 2017 spending forecast may have been significantly overstated.

For the period 2011-2015 sample size increased from 45% to near 50% of actual total spending. In 2016, sample size jumped 25%! For 2016-2018 the average sample size vs spending was near 60%.

Transportation Terminals and Rail starts reached record high in 2017, both up 120% after a 35% increase in 2016. Starting Backlog increased 22% in 2017 then jumped 95% in 2018. Spending in 2018 is forecast to finish up more than 20%. However, Transportation sample size of new starts may have increased far more than any other market. Does it all represent a real increase in future spending or is this a good example of a change in sample size?

For the period 2011-2015 sample size increased from 25% to 30% of actual total spending. In 2016, sample size jumped to 40% of actual. In 2017 sample size jumped to 70%!

A large portion of the 2017 increase in starts is expected to be a change in sample size. Starts more than doubled from 2015 to 2017. If all that represented an increase in volume, spending would have doubled from 2016 to 2019. We already have actual spending in hand of more than half of 2017 starts and there is no possible outcome that shows the 125% increase in new starts in 2017 will produce an equivalent increase in spending. Most of the actual spending occurs in 2018 and 2019. For those two years, spending will be up 35%.

Office in 2016 posted a 31% increase in starts, mostly due to Hudson Yards and Vanderbilt Tower in NYC. This appears to have increased the annual share of market captured in the starts for 2016. Overall spending in the following years did not increase. Transportation starts in 2017 posted a 121% increase, but almost all of that can be attributed to an increase in market share captured due to $16 billion in starts for LaGuardia, Orlando and LAX airport work. In a year when several multi-billion $ projects start, the starts data share of market increases. This signifies a change in survey size, not an equally sizable increase in future construction spending.

These examples show that starts share of market captured from year to year are not all consistent and therefore starts compared to previous year should not be used to predict spending directly but that starts sample size must be analyzed before using the data to forecast future spending. Construction Analytics models adjusted starts using unique cash flow curves to predict construction spending for the Economic Forecast published here.