Home » Posts tagged 'PPI'

Tag Archives: PPI

Construction Inflation & PPI 2025 updated 10-17-25

11-13-25 See new post Construction Inflation 2025 Update Nov. for all new index tables and plots update dates vary from July, Aug to Q3.

10-17-25 Residential Index reduced and minor reduction in Nonres Bldgs Index, see notes in Construction Analytics Building Cost Indices and Reference Indices. The tables and plots included data only thru July.

9-3-25 Updated PPI tables and plots to JULY data issued 8-15-25.

5-15-25 all ppi DATA UPDATED TO APR

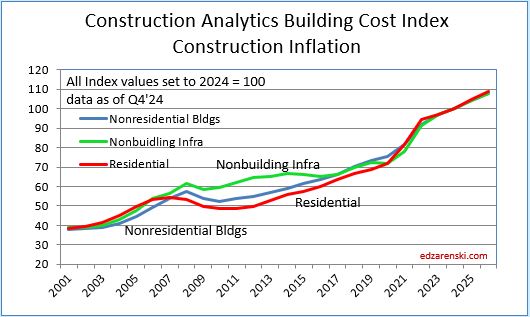

2-21-25 All new data updated to Q4. A major change with this new data / plots, is the change in the base date from 2019 to 2024. These index tables / data cannot be mixed with prior issues. Now using base 2024 = 100 in all data / plots included here. Percents yr/yr or mo/mo don’t change, the indexes change.

To properly adjust the cost of construction over time you must use an Actual Final Cost Inflation Index, otherwise called a selling price index. General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of escalation in construction projects.

Spending Must Be Adjusted by Inflation

Usually, construction budgets are prepared from known “current” costs. If a budget is being developed for a project whose midpoint of construction costs is two years in the future, you must carry in your budget an appropriate inflation factor to represent the expected cost of the building at that time. Why the midpoint? Because half the project cost occurs prior to that point and half occurs later than that. Actually, the midpoint of spending is 50-60% into the schedule, but the calculation to the midpoint of schedule is close. So, the average inflation for the project includes early contracts that have less inflation than average and also later contracts that would have more than the average inflation. Construction inflation should always be calculated from current cost to midpoint of construction, or in the case of using historical data and converting an older actual cost to a future budget, from midpoint to midpoint.

Any time a construction project is delayed or put on hold to start at some future date, construction cost inflation must be calculated and added to the previous budget to account for the unanticipated cost increase due to the delay. Of utmost importance is using appropriate cost indices and forecasting future cost growth to account for the difference in original budget and revised budget.

Besides the estimator’s need to accurately reflect future expected cost, inflation is an important aspect of the company business plan. Typically discussed in tandem with spending, inflation has an impact on tracking and forecasting company growth. All spending includes inflation, but inflation adds nothing except $ signs to the overall growth. For example, in a year when company revenues (spending) increase by 10%, if inflation is 6%, then total business growth is only 4%. To accurately calculate growth, and the need for labor to support that growth, spending must be adjusted by the amount of inflation.

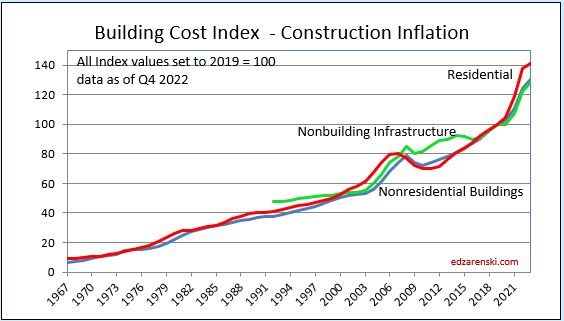

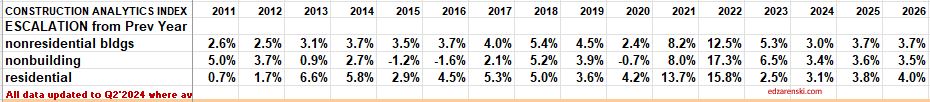

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 3.9%. But those averages include the unusually high inflation years of 2021 and 2022. Without those two years, since 2011, average inflation for Nonres Bldgs is 3.8%, Residential is 3.8% and Non-bldg is 2.4%.

2025 Inflation Forecast, Nonres Bldgs +4.0%, Residential +4.7% and Non-bldg +4.0%.

5-15-25 2025 Inflation Forecast, Nonres Bldgs +4.4%, Residential +5.0% and Non-bldg +4.3%.

Types of Construction Inflation Indices

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of inflation on construction projects.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. The CPI index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI tracks material cost inputs at the producer level, not prices or bids at the as-built level.

Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are examples of commonly used indices that DO NOT represent whole building costs yet are widely referenced by construction firms and estimators everywhere to adjust project costs. Neither includes contractor margins.

It should be noted, there are far fewer available resources for residential inflation than for nonresidential inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce bids. When activity is high, there is a greater opportunity to bid on more work and bids can be higher. The level of activity has a direct impact on inflation.

To properly adjust the total cost of construction over time you must use actual final cost indices, otherwise known as selling price indices.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

Construction Analytics Building Cost Index, Turner Building Cost Index, Rider Levett Bucknall Cost Index and Mortenson Cost Index are all examples of whole building cost indices that measure final selling price (for nonresidential buildings only).

Residential inflation indices are primarily single-family homes but would also be relevant for low-rise two to three story building types. Hi-rise residential work is more closely related to nonresidential building cost indices.

Producer Price Index (PPI) Final Demand Indices are an example of construction cost indices that represent whole building costs. Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, material, equipment, overhead and profit. Labor includes change in wages and productivity.

PPI Final Demand Indices should not be referenced monthly. These are quarterly indices. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices. For more than two years, in most quarters, about 80% to 90% of the change in the index for the quarter was posted in the update month. In some quarters, growth is flipped from negative to positive. And still in other quarters the correction month doubles or halves the rate of growth. There is no way to determine how much occurred in the update month or a previous month, but the update # along with the two previous months will get too the correct end-of-qtr index.

January is an update month. PPI Final Demand for Jan index basically includes the correction for Nov and Dec. Therefore, the index should NOT be compared mo/mo. There is only one of three months that the index is known for certain to be accurate, the update month. Compare qtr/qtr, but make sure to use the defined months, the correct update month with two previous months. For ex., (Jan+Dec+Nov) / (Oct+Sep+Aug). Those are the defined quarters. (I don’t make the rules).

Refer to National Inflation Indices for comparison to several national selling price indices or various Input indices. National reference indices are useful for comparison. Few firms project index values out past the current year, therefore all future projections in these tables are by Construction Analytics.

Construction Inflation History

Post Great Recession, 2011-2020, average inflation rates:

Nonresidential buildings inflation 10-year average (2011-2020) is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. In 2021 it jumped to 8%, the highest since 2006-2007. In 2022 it hit 12.8%, the highest since 1980-81.

Residential 8-year average inflation for 2013-2020 is 5.0%. In 2020 it was 4.5%. In 2021 it jumped to 14% and then in 2022 reached 15.8%. the highest on record.

30-year average inflation rate for residential and nonresidential buildings is 4.1%. But when excluding deflation in recession years 2008-2010, for nonresidential buildings the long-term average is 4.7% and for residential is 4.9%.

For Non-bldg Infrastructure the 30-year average is 3.6%. When excluding deflation in the recession years 2008-2010, Non-bldg long-term average inflation is 3.9%.

All of these long term averages went up in recent years because instead of including 1991-1994, at 2%/yr, we are now including 2021-2024, at 7%/yr to 8%/yr. All long term and short term inflation rates went up.

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- In times of high construction spending growth, nonresidential construction annual inflation averages about 8%. Residential has gone as high as 10%.

- Nonresidential buildings inflation (prior to 2021-2022) averaged 3.7% since the recession bottom in 2011. Six-year 2014-2019 average is 4.4%.

- Residential buildings inflation (prior to 2021-2022) reached a post-recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It has averaged 5.3% for 8 years 2013-2020.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors’ and suppliers’ margins.

- When construction volume increases rapidly, margins increase rapidly.

- Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume went down 33% and jobs were down 30%.

Historically, when spending decreases or remains level for the year, inflation rarely (only 10% of the time) climbs above 3%. Avg inflation for all down/flat years is less than 1%. That did hold true in 2020 for both Nonres Bldgs and Non-bldg Infra. It also held true in 2023 for Residential. It did not hold true in 2021 or 2022. In 2021, spending was down for nonresidential buildings and flat for non-building. Inflation for both was over 8%.

Differences in Tracking Period

Be careful when referencing YTD growth. YTD can be the growth so far this year, that is, growth compared to December of the prior year, or it can be YTD currentyr/YTD lastyr. Neither represents the growth from the avg of the previous year, which becomes the historical value. Both are useful during the year to judge trends. The average growth for the year accounts for all the peaks and valleys within each year and and is the value carried forward into the index tables and charts.

Also, use caution when referencing Dec/Dec growth. An example of the difference between Dec/Dec tracking or year over year, and annual average tracking, is Steel Mill Products which was down 28.7% Dec22/Dec21, but the annual average for 2022 is still up 9.0% from the average 2021. In fact, the three years 20-21-22 show Dec/Dec combined inflation is +71%, but the annual averages for those same three years shows total inflation growth of 87%. Annual averages should be used to report inflation.

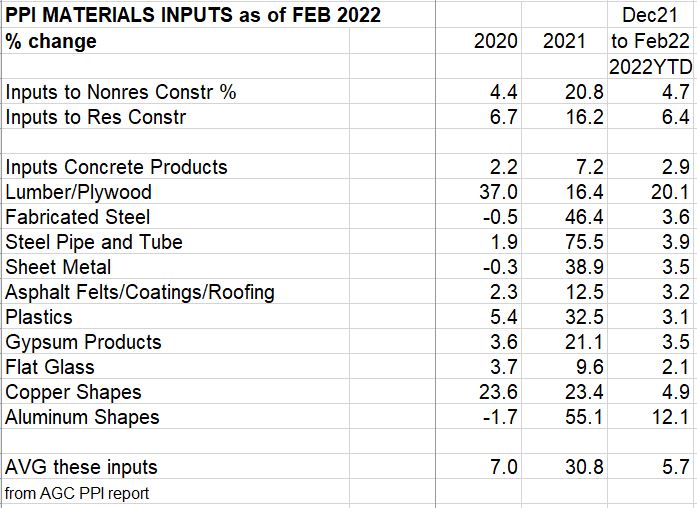

PPI Excludes Imports and Tariffs

When assessing or tracking the pricing effect of tariffs on construction materials, keep in mind that the Producer Price Index (PPI) does not include imports (imports are not produced in the US), so therefore, does not include tariffs. See items 4 and 24 in the FAQ provided by the Bureau of Labor Statistics. Construction PPI changes reflect pricing decisions domestic producers make on domestic products in reaction to tariffs on imported products. Tariffs have big impact on domestic prices.

BLS explanation of method and definitions

The price change we see in the PPI for construction materials reflects the domestic material prices of ALL other domestically produced materials used in the industry. While tariffs may affect only 10% of products used in the industry, the PPI shows us the domestic producers reaction applied to the other 90%.

For example: The 2018 steel tariffs of +25% applied only on imported steel, affected only 30% (the imported share) of steel used in US. However the PPI shows us that the cost of ALL DOMESTIC steel mill products (of all types) produced in the US increased avg 18% in 2018, after the steel tariffs were imposed. Prices of domestic steel receded somewhat, but the point is that tariffs caused a price increase also in domestic steel. The increase in PPI is domestic producers pricing response in reaction to tariffs. Tariffs impacted pricing decisions on all domestically produced products, not just the imported products. Consumers pay the price.

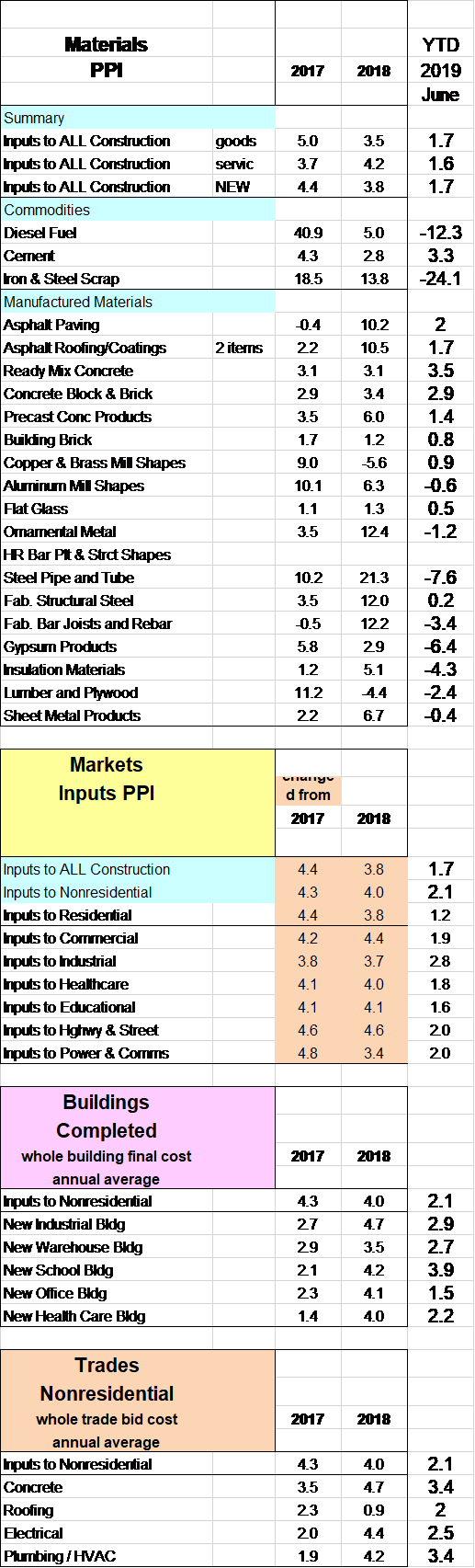

PPI Construction Materials Inputs Indices

See this post for August PPI update Construction Briefs Sept 2025

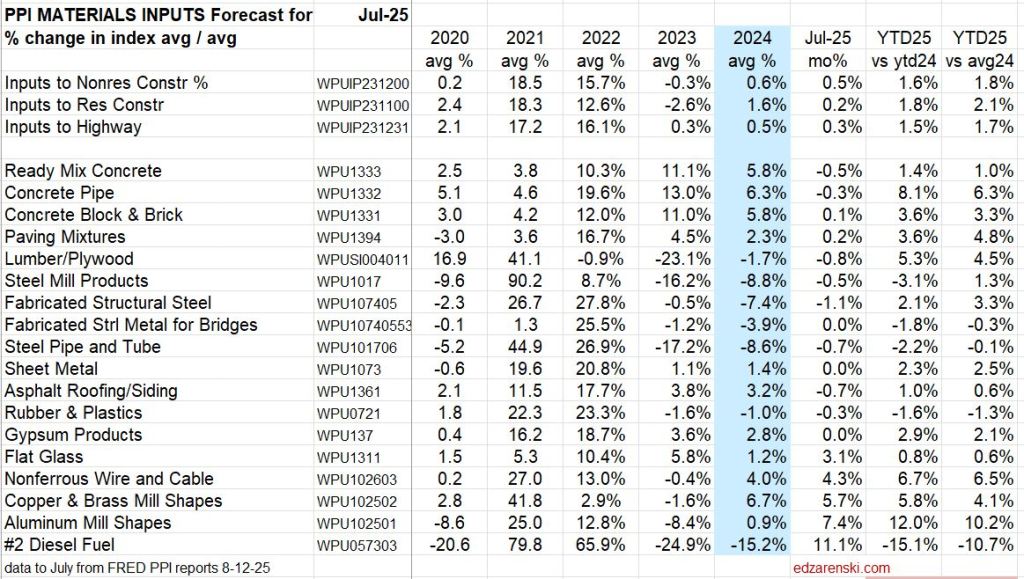

ALL PPI DATA TABLES UPDATED TO JUL 8-15-25

ALL PPI DATA UPDATED TO APR 5-15-25 PPI data INPUTS for the month of Apr: Paving Mixtures -9.5%, Steel Mill Products +5.8%, Steel Pipe & Tube +6.3%, Nonferrous Wire +3.7% YTD25/avg24: Concrete Pipe +8.5%, Paving Mixtures -8.5%, Lumber/Plywd +4.9%, Steel Mill Products +3.7%, Nonferrous Wire +3.5%, Diesel -10.8%. PPI data FINAL DEMAND Apr closes out Q1. Q1’25/Q4’24: Avg Nonres Bldgs +0.6%, School +0.4%, Healthcare +2.2% YTD25/avg24: Avg Nonres Bldgs +1.35%, School +1.4%, Office +1.6%, Healthcare +2.91%.

Inputs Table updated 2-15-25 Jan’25 Inputs are up, +0.8% to Nonres, +1.2% to Residential and 1.2% to Highway, the largest increases since Jan’24. The largest Input item increases in January are Paving Mixtures (up 14.6%), Diesel Fuel (up 3.6%), Concrete Brick, Block & Pipe (up 2.2%), Copper & Brass Shapes (up 1.9%) and Flat Glass (up 1%). Steel Pipe & Tube is down 1.3%. Both Lumber/Plywood and Fabricated Structural Steel are down 0.5% or less.

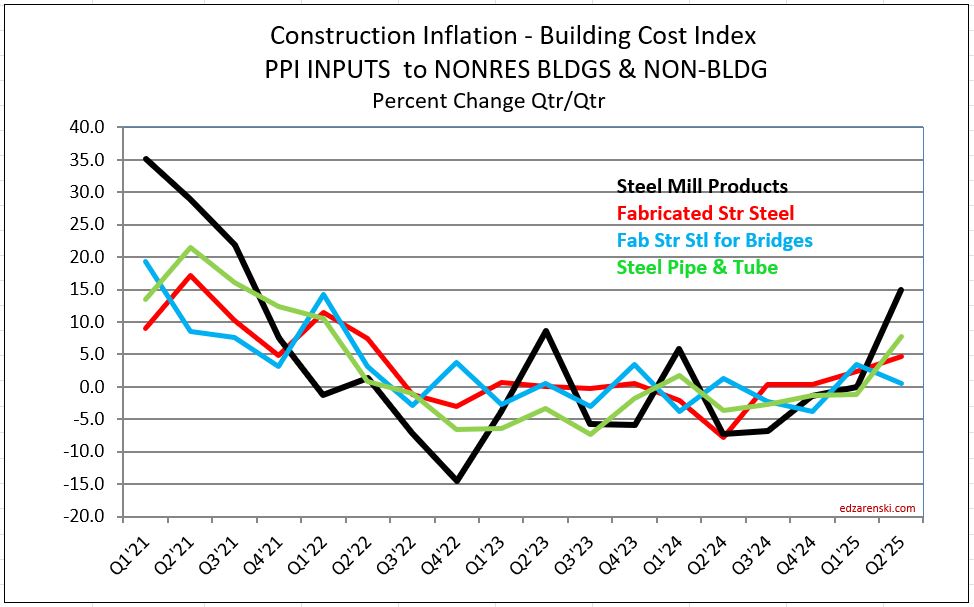

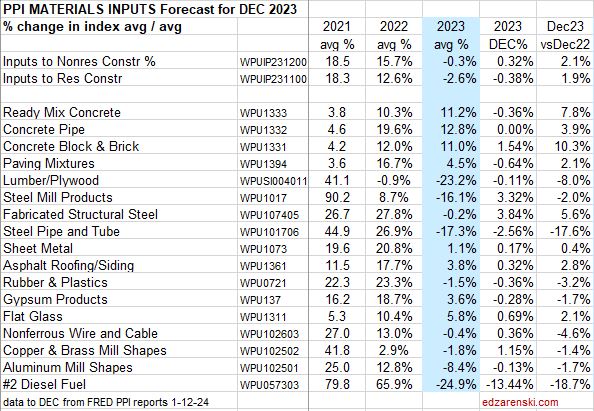

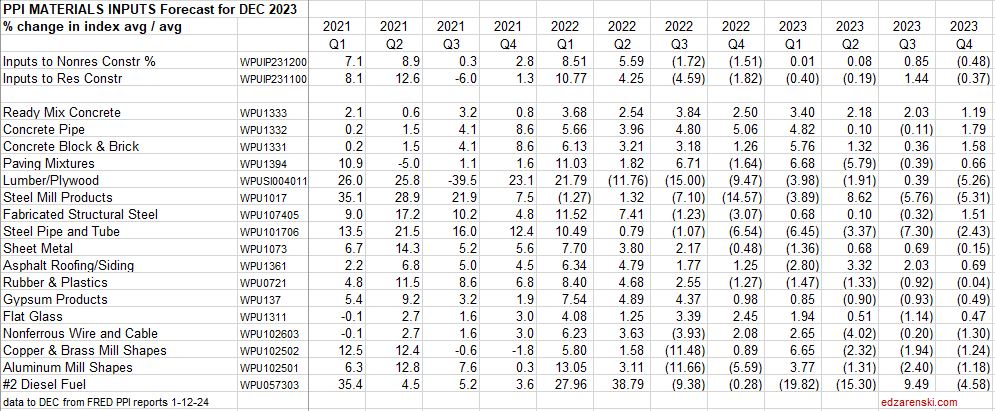

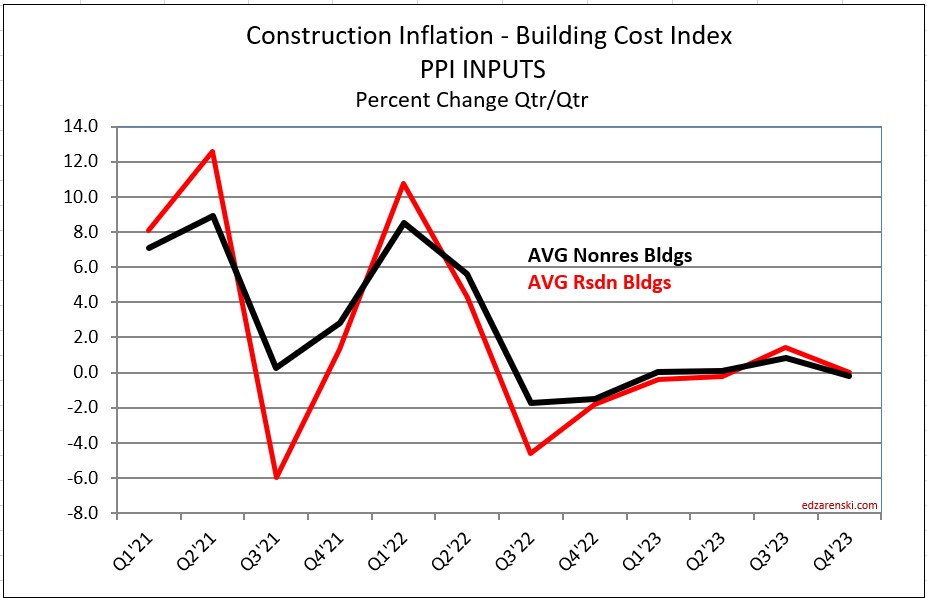

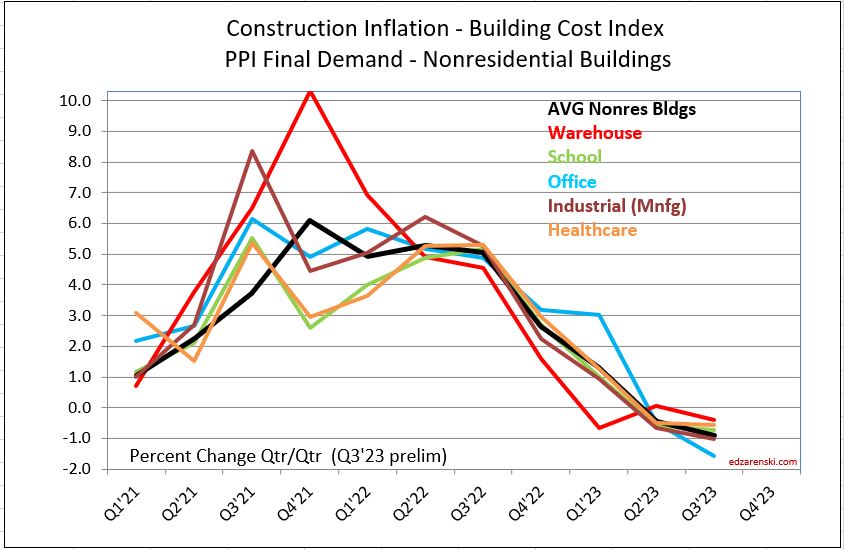

In the quarterly percent change table you can see the drop in Q3’22 and more in Q4’22, a sharp change in the rate of inflation. This shows up as expected in lower average of Inputs to Res and NonRes for 2023.

2-15-25 PPI Materials Inputs for 2024 to Residential are up 1.7%, to Nonres Bldgs are up 0.6% and to Highway are up 0.5%.

In all three of these Inputs PLOTS, the materials plots above and this Summary plot, so far Q1’25 is only Jan. It will wiggle around for 2 more months.

A General construction cost index or Input price index doesn’t track whole building final cost and does not capture the full cost of inflation in construction. Final cost indices represent total actual cost to the owner and are often higher than General indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. PPI Final Demand indices include all costs and do represent actual final cost to the Owner.

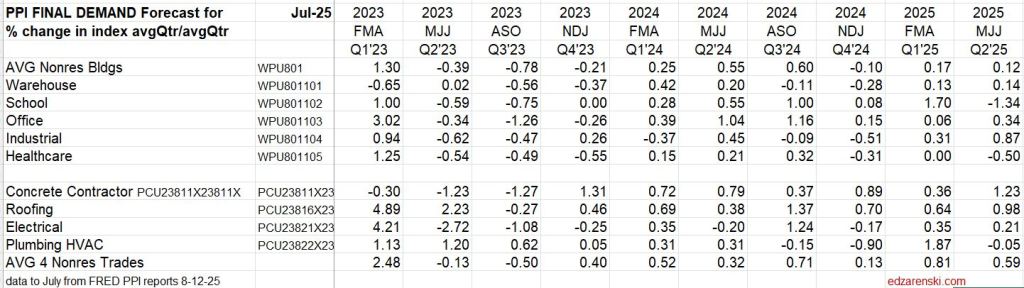

PPI Construction Final Demand Indices

PPI Final Demand indices should not be referenced monthly. These are quarterly indices. PPI Final Demand Indices are for Nonresidential Bldgs only. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices for the current month and the previous two months. For more than two years, in most quarters, about 80% to 90% of the change in the index for the quarter was posted in the update month. In some quarters, growth is flipped from negative to positive in the update month. And still in other quarters the correction month doubles or halves the rate of growth. January data (released in Feb) is an update month. The PPI Final Demand for Jan. is basically the correction for Nov.+Dec.+Jan. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Nov+Dec+Jan)/(Aug+Sep+Oct).

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), the correction month for 5 of the last 8 quarters flipped the sign of the modeled months. In 2 of the remain 3 months the correction months more than doubled the rate of change for the previous 2 months. There is no other proof needed to convince you to take care when using this index. Get it right.

2-15-25 The PPI Final Demand table below is updated to JAN 2025 data.

PPI data FINAL DEMAND Apr closes out Q1.

Q1’25/Q4’24: Avg Nonres Bldgs +0.6%, School +0.4%, Healthcare +2.2%.

YTD25/avg24: Avg Nonres Bldgs +1.35%, School +1.4%, Office +1.6%, Healthcare +2.91%

Jan is the correction month for Q4, so the Jan 2025 value closes out the 4th qtr 2024. Most bldg types and contractors are up in the 2nd half 2024 from the 1st half, but cost growth has been nearly flat. If extended, the trend leading into 2025 is for slow inflation growth. However the Roofing trades are increasing at a slightly faster rate than all others.

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), it is not uncommon that the contractor survey correction month flips the sign of the modeled months for the quarter.

In 2023, for each quarter, we see two months posted positive, then a large negative value for the correction month. The negative correction is large enough in all cases to turn the entire quarter negative. Here’s an example: for the period May-Jun-Jul, Jul is the correction month. PPI values were +0.09%, +0.02%, -1.23%. The average for each of the 3mo is -0.37%, (the sum of the 3 months divided equally. The May and Jun values that were originally posted based on modeling flipped from + to – after the contractor survey value is applied to the QTR. That highlights why PPI Final Demand indices should not be referenced monthly.

However, these declines are from such a high mark at the end of 2022 (we began 2023 up 11%), that the rate as we began 2024 is still up 6% to 7% from the average in 2022.

9-5-25 Q2 Final Demand Index closed out with this July data. Both Table and Plot are updated.

SEE ALSO PPI Data Sept’24

Construction Analytics Building Cost Indices and Reference Indices

2-21-25 Current and predicted Inflation updated to Q4’24

- 2022 Rsdn Inflation 15.8%, Nonres Bldgs 12.8%, Nonbldg Infra 17.3%

- 2023 Rsdn Inflation 2.5%, Nonres Bldgs 5.6%, Nonbldg Infra 6.3%

- 2024 Rsdn Inflation 3.0%, Nonres Bldgs 3.2%, Nonbldg Infra 3.4%

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

2-21-2025 Inflation Forecast, Nonres Bldgs +4.0%, Residential +4.7% and Non-bldg +4.0%. (This is a pre-tariff forecast.)

5-15-2025 Inflation Forecast, Nonres Bldgs +4.4%, Residential +5.0% and Non-bldg +4.3%. (This is a preliminary tariff forecast.)

9-3-2025 Inflation Forecast, Nonres Bldgs +4.4%, Residential +4.7% and Non-bldg +4.0%. (This is a preliminary tariff forecast.)

10-17-2025 Inflation Forecast, Nonres Bldgs +4.2%, Residential +3.8% and Non-bldg +4.0%. (This is a preliminary tariff forecast.) These October revisions are NOT yet carried into the tables and plots. Only Residential changed considerably, however, it is the most dependent on government data, which is currently not available. The biggest change is in the Census Bureau Lasperyes Index, a constant quality residential new build index, which now includes August data and both June and July were revised down slightly.

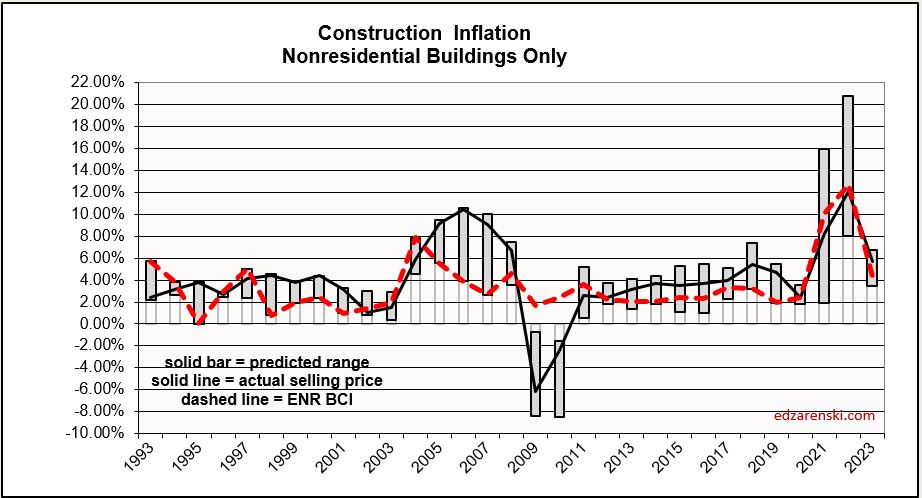

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

Most of the tables and plots here are cumulative indexes. Construction Inflation annual percents for the three major sectors, Residential, Nonresidential Bldgs and Non-building Infrastructure, are recorded in this short table, Escalation form Prev Year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years.

Final cost indices represent total actual cost to the owner and are generally higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost. The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

9-3-25 Although the PPI data was all updated, as of yet it does not have a big effect on inflation. Some slight increase is built into my inflation to account for PPI increasing in the 2nd half. The inflation tables do not yet need an update. Inflation tables will be updated soon.

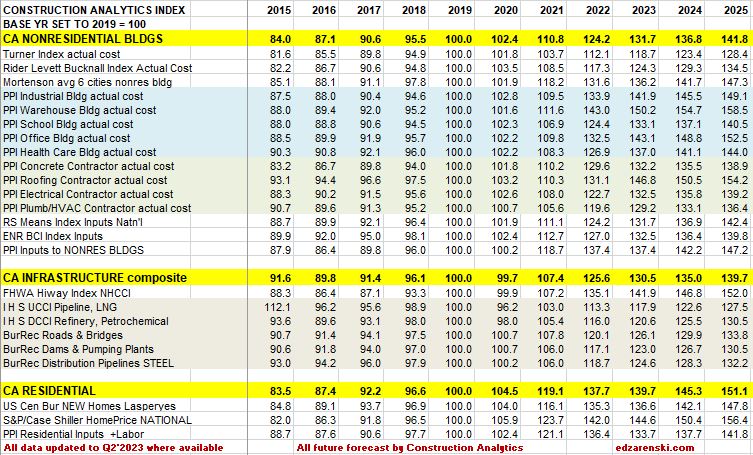

2-21-25 All index tables and plots updated to Q4’24. NOTE: all prior index tables were set to base year 2019=100. All these updated tables are set to base year 2024=100.

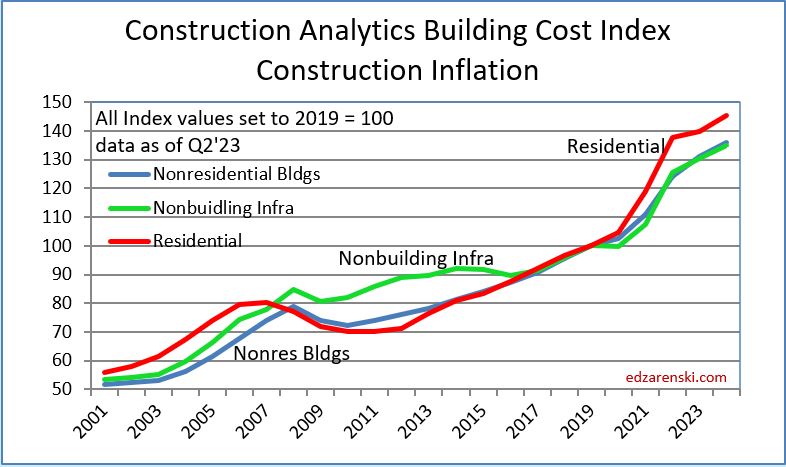

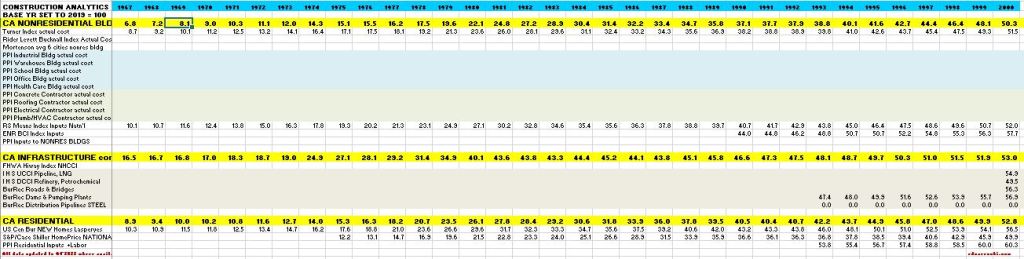

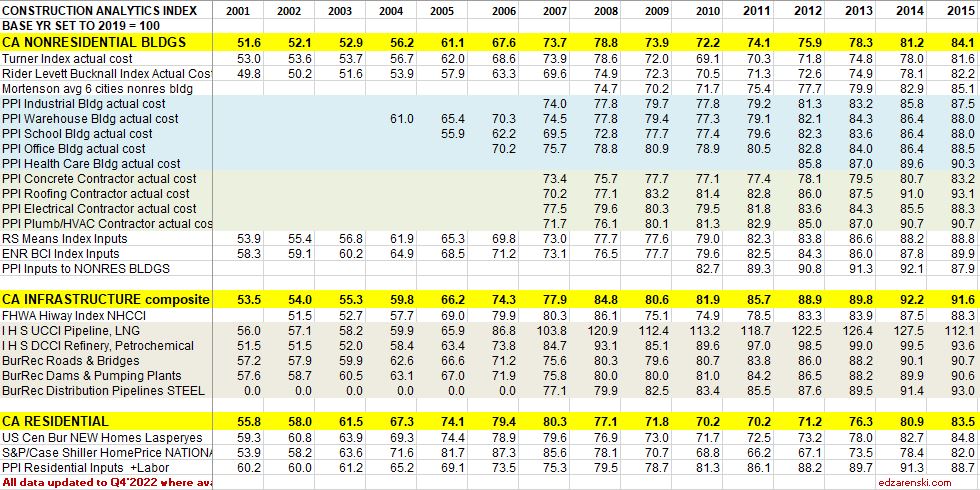

All of the Index Tables and the plot below, Construction Analytics Building Cost Index, show the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. An index already compounds annual percent to prevent the error of adding annual percents. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from, TO/FROM. Costs should be moved from/to midpoint of construction, the centroid of project cost. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

The three yellow highlighted lines in the index tables are plotted here. The three major sectors, Residential, Nonresidential Buildings and Non-building Infrastructure,

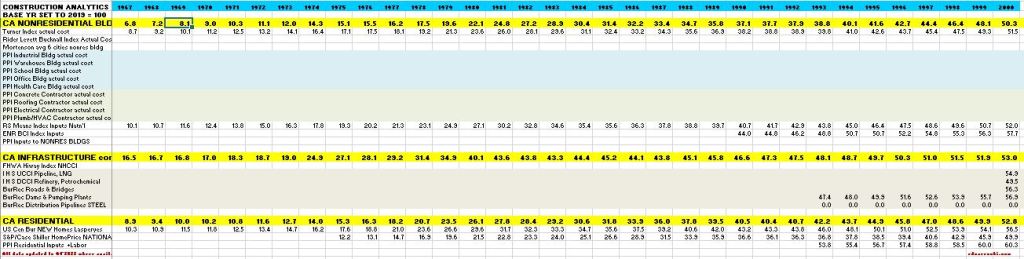

This table and plot is an extension of the tables and plots above. Data is as of Q4 2023, but the table covers from 1967 to 2000. Data is pretty sparse.

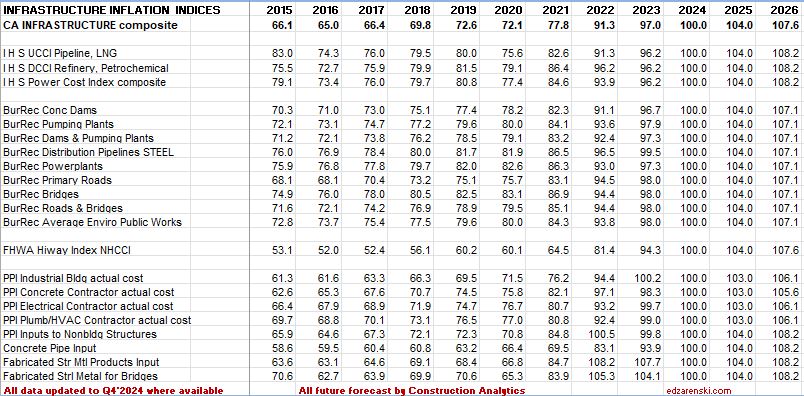

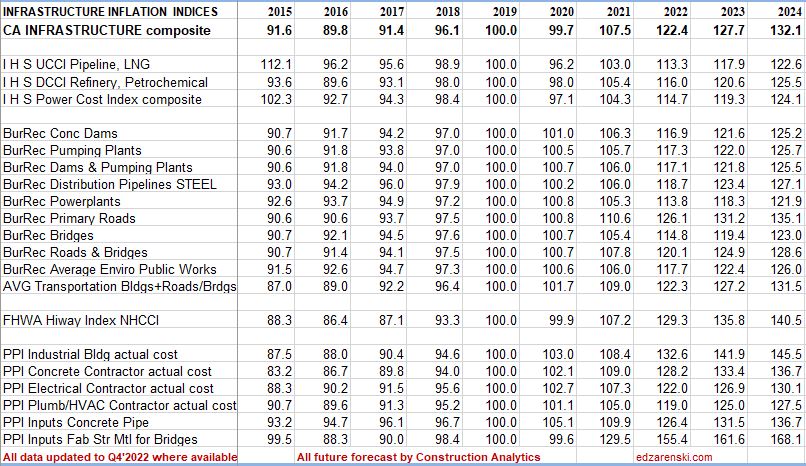

Non-building Infrastructure Indices

In the Index tables above, dividing the current year by the previous year will give the current year’s inflation rate. All indices are the average rate for the year.

Also, in the tables above, all reference indices data is gathered from the original source, then all are normalized to a common base, 2019 = 100. This allows us to see how different indices compare.

Comparison of Indices

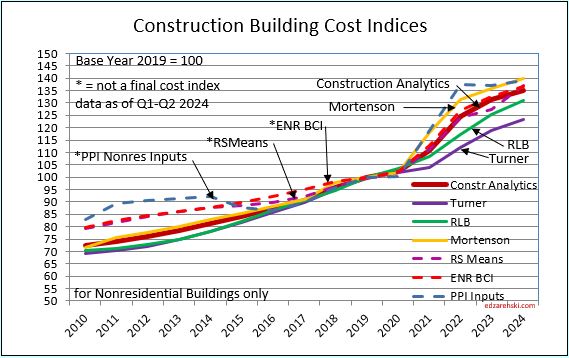

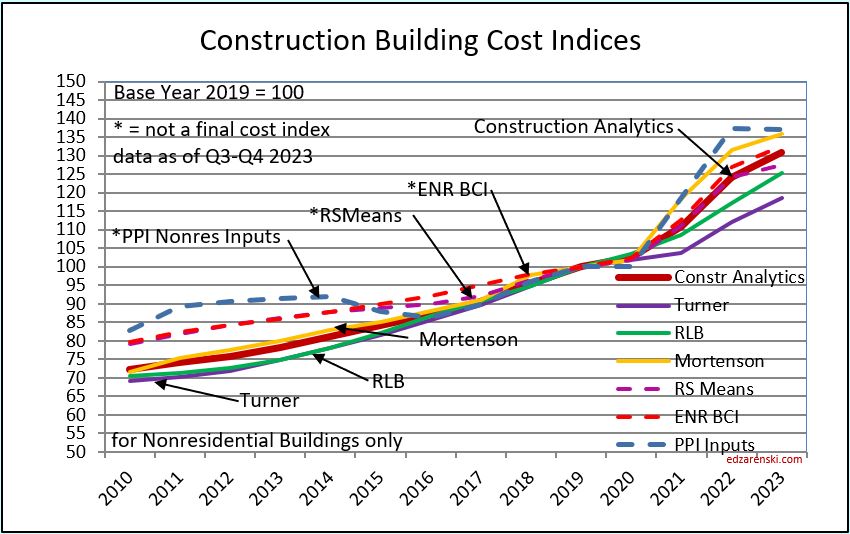

This plot compares four final cost indices and three inputs cost indices. Prior to 2020 there is a lot of symmetry in the final cost group. Everything changed after that.

Previous year Construction Inflation 2024 – last updated JUL 2024 – BASE 2019=100

SEE ALSO Tariffs Create Unknown Costs to Construction

Links to Data Sources Construction Inflation >>> Links

Outlook 2025 CONSTR OUTLOOK 2025 Feb 2025

Links to Explanations of PPI Index PPI Explanation provided by AGC

PPI Data Sept’24

Once again, the Producer Price Index for construction materials is pretty tame with the release of the September data. For Q3, inputs to all types of construction post less than 1% growth for the quarter. This is now 6 or 7 quarters in which Inputs and Final Demand has been near 1% or lower.

Inputs year-to-date vs the 2023 average are up 1.9% for residential and up less than 1% for Nonresidential and Highway.

Individually, a few material inputs had notable moves in September: Lumber/Plywood up 1.1%, Steel Mill Products down 1.2%, Steel Pipe and Tube down 1.3%, Copper and Brass Shapes down 1.1% and Diesel down 14%.

Year-to-date, various concrete items are up 5% to 6%, Steel items are down 6% to 7%, Copper and Brass Shapes are up 6% and Diesel is down 13%.

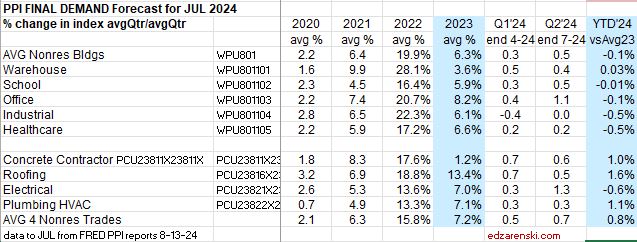

Final Demand indices for 2024 are barely moving. Although Office and School are both up over 1% for Q3, no building type is up even a half percent when compared to the average of 2023. Roofing Trades are up 1.7% YTD. The average YTD for the four trades is up less than 1%. Over the last six months The only Final Demand indices to move more than 2% (for the full 6mo) were Office Bldgs and Electrical Trades.

SEE ALSO Construction Inflation 2024 – updated 7-12

Construction Inflation Tame in July PPI

With the PPI release on Aug 13, for July data, we see both Inputs and Final Demand year-to-date (YTD) tempered considerably. Inputs since December are up only 1% to 2%. Final Demand is up less than 1% YTD.

PPI Inputs averaged for Nonres Bldgs, Residential and Highway, have all been at +1% or lower since Q3 2022. Inputs do not track final cost. No labor or Margins. Inputs can be at very different stages of manufacture and can include a variety of products. For instance Fabricated Structural Steel has been ordered from the mill and includes detailing and fabrication, ready to deliver to the jobsite, whereas Steel Mill Products has not yet been fabricated to any end-user details and in fact includes all types of steel, which would include sheet steel used for manufacture of automobiles and appliances.

Construction Inflation per PPI Final Demand has been at -1% to +1% since Q2 2023. A number of independent firms report Nonres Bldgs inflation at 3% to 4%. I’m tracking at 3.1%.

Turner Index is up 1.9% for the first two quarters of 2024. That is up 3.5% from the average of 2023. RLB is up 2.4% since December and that is up 4.6% from the average of 2023. The U.S. Census New Homes index is up less than 1% since December but that is up 2.8% from the average index in 2023. These are all final cost indices.

Construction Inflation 2024

SEE Construction Inflation 2025 – 2-21-25

This post was last updated Jul 2024. All Index Tables and plots here are BASE 2019 = 100. The more recent Inflation 2025 post is revised to BASE 2024 = 100.

To properly adjust the cost of construction over time you must use an Actual Final Cost Inflation Index, otherwise called a selling price index. General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of escalation in construction projects.

Spending Must Be Adjusted by Inflation

Usually, construction budgets are prepared from known “current” costs. If a budget is being developed for a project whose midpoint of construction costs is two years in the future, you must carry in your budget an appropriate inflation factor to represent the expected cost of the building at that time. Why the midpoint? Because half the project cost occurs prior to that point and half occurs later than that. Actually, the midpoint of spending is 50-60% into the schedule, but the calculation to the midpoint of schedule is close. So, the average inflation for the project includes early contracts that have less inflation than average and also later contracts that would have more than the average inflation. Construction inflation should always be calculated from current cost to midpoint of construction, or in the case of using historical data and converting an older actual cost to a future budget, from midpoint to midpoint.

Any time a construction project is delayed or put on hold to start at some future date, construction cost inflation must be calculated and added to the previous budget to account for the unanticipated cost increase due to the delay. Of utmost importance is using appropriate cost indices and forecasting future cost growth to account for the difference in original budget and revised budget.

Besides the estimator’s need to accurately reflect future expected cost, inflation is an important aspect of the company business plan. Typically discussed in tandem with spending, inflation has an impact on tracking and forecasting company growth. All spending includes inflation, but inflation adds nothing except $ signs to the overall growth. For example, in a year when company revenues (spending) increase by 10%, if inflation is 6%, then total growth is only 4%. To accurately calculate growth, and the need for labor to support that growth, spending must be adjusted by the amount of inflation.

Types of Construction Inflation Indices

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of inflation on construction projects.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. The CPI index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI tracks material cost inputs at the producer level, not prices or bids at the as-built level.

Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are examples of commonly used indices that DO NOT represent whole building costs yet are widely referenced by construction firms and estimators everywhere to adjust project costs. Neither includes contractor margins.

It should be noted, there are far fewer available resources for residential inflation than for nonresidential inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce bids. When activity is high, there is a greater opportunity to bid on more work and bids can be higher. The level of activity has a direct impact on inflation.

To properly adjust the total cost of construction over time you must use actual final cost indices, otherwise known as selling price indices.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

Construction Analytics Building Cost Index, Turner Building Cost Index, Rider Levett Bucknall Cost Index and Mortenson Cost Index are all examples of whole building cost indices that measure final selling price (for nonresidential buildings only).

Residential inflation indices are primarily single-family homes but would also be relevant for low-rise two to three story building types. Hi-rise residential work is more closely related to nonresidential building cost indices.

Producer Price Index (PPI) Final Demand Indices are an example of construction cost indices that represent whole building costs. Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, material, equipment, overhead and profit. Labor includes change in wages and productivity.

PPI Final Demand Indices should not be referenced monthly. These are quarterly indices. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices. For the past six quarterly updates, about 80% to 90% of the change in the index for the quarter was posted in the update month. There is no way to determine how much occurred in the update month or a previous month, but the update # along with the two previous months will get too the correct end-of-qtr index.

January is an update month. PPI Final Demand for Jan index basically includes the correction for Nov and Dec. Therefore, the index should NOT be compared mo/mo. There is only one of three months that the index is known for certain to be accurate, the update month. Compare qtr/qtr, but make sure to use the defined months, the correct update month with two previous months. For ex., (Jan+Dec+Nov) / (Oct+Sep+Aug). Those are the defined quarters. (I don’t make the rules).

Refer to National Inflation Indices for comparison to several national selling price indices or various Input indices. National reference indices are useful for comparison. Few firms project index values out past the current year, therefore all future projections in these tables are by Construction Analytics.

Construction Inflation History

Post Great Recession, 2011-2020, average inflation rates:

Nonresidential buildings inflation 10-year average (2011-2020) is 3.7%. In 2020 it dropped to 2.5%, but for the six years 2014-2019 it averaged 4.4%. In 2021 it jumped to 8%, the highest since 2006-2007. In 2022 it hit 12%, the highest since 1980-81.

Residential 8-year average inflation for 2013-2020 is 5.0%. In 2020 it was 4.5%. In 2021 it jumped to 14% and then in 2022 reached 15.7%. the highest on record.

30-year average inflation rate (excluding 2021 and 2022) for residential and nonresidential buildings is 3.7%. Excluding deflation in recession years 2008-2010, then for nonresidential buildings it is 4.2% and for residential it’s 4.6%.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- In times of rapid construction spending growth, nonresidential construction annual inflation averages about 8%. Residential has gone as high as 10%.

- Nonresidential buildings inflation (prior to 2021-2022) averaged 3.7% since the recession bottom in 2011. Six-year 2014-2019 average is 4.4%.

- Residential buildings inflation (prior to 2021-2022) reached a post-recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It has averaged 5.3% for 8 years 2013-2020.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors’ and suppliers’ margins.

- When construction volume increases rapidly, margins increase rapidly.

- Deflation is not likely. Only twice in 50 years have we experienced construction cost deflation, the recession years of 2009 and 2010. That was at a time when business volume went down 33% and jobs were down 30%.

Historically, when spending decreases or remains level for the year, inflation rarely (only 10% of the time) climbs above 3%. Avg inflation for all down/flat years is less than 1%. That did hold true in 2020 for both Nonres Bldgs and Non-bldg Infra. It also held true in 2023 for Residential. It did not hold true in 2021 or 2022. In 2021, spending was down for nonresidential buildings and flat for non-building. Inflation for both was over 8%.

Differences in Tracking Period

Be careful when referencing YTD growth. YTD can be the growth so far this year, that is, growth compared to December of the prior year, or it can be YTDcurrentyr/YTDlastyr. Neither represents the growth from the avg of the previous year, which becomes the historical value. Both are useful during the year to judge trends. The average growth for the year accounts for all the peaks and valleys within each year and and is the value carried forward into the index tables and charts.

Also, use caution when referencing Dec/Dec growth. An example of the difference between Dec/Dec tracking or year over year, and annual average tracking, is Steel Mill Products which was down 28.7% Dec22/Dec21, but the annual average for 2022 is still up 9.0% from the average 2021. In fact, the three years 20-21-22 show Dec/Dec combined inflation is +71%, but the annual averages for those same three years shows total inflation growth of 87%. Annual averages should be used to report inflation.

PPI Construction Materials Inputs Indices

Inputs Table updated 7-12-24 Biggest move in May and June data, Fabricated Str Steel down 7.5% year-to-date; Concrete up 3.9% YTD; Paving Mixtures up 5%.

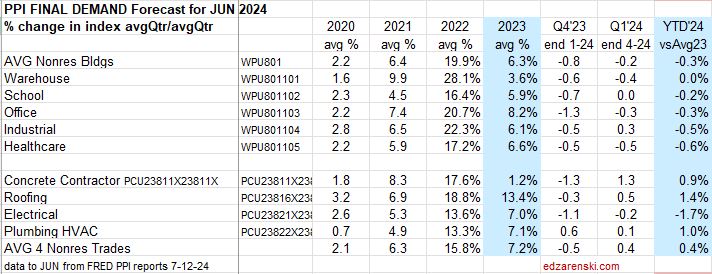

A few construction Inputs are up 5%, Concrete Products and Copper. Steel Products are down ytd 5% to 7%. Otherwise the PPI for Construction Inputs is up year-to-date only 1% to 2%. Final Demand is down ytd <1%.

In the quarterly percent change table you can see the drop in Q3’22 and more in Q4’22, a sharp change in the rate of inflation. This shows up as expected in lower average of Inputs to Res and NonRes for 2023.

7-12-24 PPI Materials Inputs to Residential and Nonres Bldgs and Highway are UP only 1%-2% since December 2023. PPI Final Demand shows several qtrs down, but in 2024, Inputs is up slightly and Final Demand is down slightly. So, inflation inputs are not being passed on in Final Demand. Recent inflation relief could be decrease in margins.

A General construction cost index or Input price index doesn’t track whole building final cost and does not capture the full cost of inflation in construction. Final cost indices represent total actual cost to the owner and are often higher than General indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. PPI Final Demand indices include all costs and do represent actual final cost to the Owner.

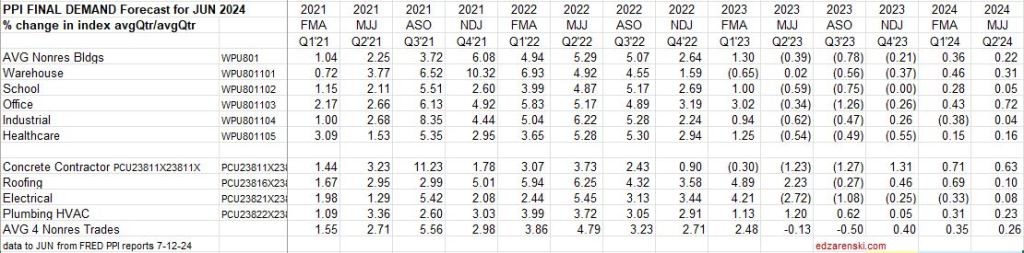

PPI Construction Final Demand Indices

PPI Final Demand indices should not be referenced monthly. These are quarterly indices. PPI Final Demand Indices are for Nonresidential Bldgs only. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct the PPI Final Demand indices for the current month and the previous two months. For the past six quarterly updates, about 80% to 90% of the change in the index was posted in the update month. January data (released in Feb) is an update month. The PPI Final Demand for Jan. is basically the correction for Nov.+Dec.+Jan. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Nov+Dec+Jan)/(Aug+Sep+Oct).

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), the correction month for the last 3 full periods flipped the sign of the 6 modeled months and turned every month for the last 9 months negative. There is no other proof needed to convince you to take care when using this index. Get it right.

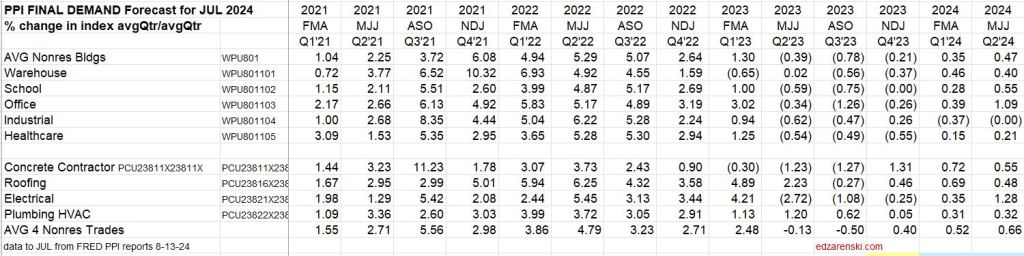

7-12-24 The PPI Final Demand table below is updated to JUN, 2024 data.

July is the correction month for Q2, so we do not yet know results for Q2 Final Demand. Most bldg types are down from Nov-Dec’22-Jan’23 to Nov-Dec’23-Jan’24, so, if extended, the trend leading into 2024 is for slightly lower inflation. However Roofing and Plumbing trades are increasing.

The Construction PPI Final Demand for Nonres Bldgs posted declines for the last three, and in some cases four, quarters, Q1 thru Q4 2023. When the adjustment is distributed back into the months being corrected, Apr into Feb and Mar, Jul into May and Jun, and Oct into Aug and Sep, it shows all bldgs, except Offc, have at least nine months of a declining rate of inflation cost, and actually for the last 6 months negative inflation or deflation. Office has been negative for 2 quarters, warehouse has been declining for 12 months and negative for 9 months.

Due to the nature of the PPI Final Demand Index, (2 monthly readings from model then every 3rd month correction by contractor survey), the correction month for the last 3 periods has flipped the sign of the 6 modeled months and turned every month for the last 9 months negative.

In 2023, for each quarter, we see two months posted positive, then a large negative value for the correction month. The negative correction is large enough in all cases to turn the entire quarter negative. Here’s an example: for the period May-Jun-Jul, Jul is the correction month. PPI values were +0.09%, +0.02%, -1.23%. The average for each of the 3mo is -0.37%, (the sum of the 3 months divided equally. The May and Jun values that were originally posted based on modeling flipped from + to – after the contractor survey value is applied to the QTR. That highlights why PPI Final Demand indices should not be referenced monthly.

However, these declines are from such a high mark at the end of 2022 (we began 2023 up 11%), that the rate as we began 2024 is still up 6% to 7% from the average in 2022.

7-12-24 The PPI Final Demand table of qtr/qtr is updated to Jun, 2024 data

7-12-24 The PPI Final Demand plot is updated to JUN, 2024 data, but July data is needed to close Q2, so Q2 is not reported in this plot.

SEE ALSO Construction Inflation Tame in July PPI

SEE ALSO PPI Data Sept’24

Construction Analytics Building Cost Indices and Reference Indices

Current and predicted Inflation updated to Q4’23 1-13-24

- 2022 Rsdn Inflation 15.7%, Nonres Bldgs 12.1%, Nonbldg Infra 17.0%

- 2023 Rsdn Inflation 2.5%, Nonres Bldgs 5.4%, Nonbldg Infra 4.9%

- 2024 Rsdn Inflation 3.4%, Nonres Bldgs 4.5%, Nonbldg Infra 3.8%

The following Construction Inflation plot (for Nonresidential Buildings only) shows three elements: 1) a solid grey bar reflecting the max and min of the 10 indices I track in my weighted average inflation index, 2) a solid black line indicating the weighted average of those 10 indices, and 3) a dotted red line showing the Engineering News Record Building Cost Index (ENR BCI). Notice the ENR BCI is almost always the lowest, or one of the lowest, indices. ENR BCI, along with R S Means Index, unlike final cost indices, do not include margins or productivity changes and in the case of ENR BCI has very limited materials and labor inputs.

Most of the tables and plots here are cumulative indexes. Construction Inflation annual percents for the three major sectors, Residential, Nonresidential Bldgs and Non-building Infrastructure, are recorded in this short table, Escalation form Prev Year. Useful to compare to last year, but you would need to mathematically do the compounding to move over several years.

Final cost indices represent total actual cost to the owner and are generally higher than general indices. Producer Price Index (PPI) INPUTS to construction reflect costs at various stages of material production, generally do not represent final cost of materials to the jobsite and do not include labor, productivity or margins. Even with that, a PPI Inputs index +20% for a material could be only a +5% final cost. PPI Final Demand indices include all costs and do represent actual final cost. The solid black line (above) represents the Construction Analytics Building Cost Index for Nonresidential Bldgs and is a final cost index.

All of the Index Tables and the plot below, Construction Analytics Building Cost Index, show the cumulative inflation index, or the cumulative compounded effect of inflation for any two points in time.

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. An index already compounds annual percent to prevent the error of adding annual percents. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from, TO/FROM. Costs should be moved from/to midpoint of construction, the centroid of project cost. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

The three yellow highlighted lines in the index tables are plotted here. The three major sectors, Residential, Nonresidential Buildings and Non-building Infrastructure,

This table and plot is an extension of the tables and plots above. Data is as of Q4 2023, but the table covers from 1967 to 2000. Data is pretty sparse.

Non-building Infrastructure Indices

In the Index tables above, dividing the current year by the previous year will give the current year’s inflation rate. All indices are the average rate for the year.

Also, in the tables above, all reference indices data is gathered from the original source, then all are normalized to a common base, 2019 = 100. This allows us to see how different indices compare.

Comparison of Indices

This plot compares four final cost indices and three inputs cost indices. Prior to 2020 there is a lot of symmetry in the final cost group. Everything changed after that.

Previous year Construction Inflation 2023 – last updated 12-15-23

Links to Data Sources Construction Inflation >>> Links

Links to Explanations of PPI Index PPI Explanation provided by AGC

Construction Inflation 2023

Construction Inflation

1-16-24 SEE Construction Inflation 2024

1-12-24 PPI Inputs table updated to Dec data, updated quarterly inputs, updated 2023 Firms Inflation plot

12-13-23 PPI ( Inputs Only) updated to Nov data

11-15-23 PPI Inputs and Final Demand updated to OCT data

10-13-23 PPI Inputs updated to SEP data

10-4-23 PPI Inputs and Final Demand tables updated to AUG data

8-11-23 PPI Inputs and Final Demand tables updated to July data

8-19-23 Inflation Table 2015-2025 updated to Q2 2023

Usually construction budgets are prepared from known “current” costs. If a budget is being developed for a project whose midpoint of construction costs is two years in the future, you must carry in your budget an appropriate inflation factor to represent the expected cost of the building at that time. Why the midpoint? Because half the project cost occurs prior to that point and half occurs later than that. The balance point for spending is 50-60% into the schedule. Construction inflation should always be calculated from current cost to midpoint of construction, or in the case of converting an older actual cost to a future budget, from midpoint to midpoint.

Any time a construction project is delayed or put on hold to start at some future date, construction cost inflation must be calculated and added to the previous budget to account for the unanticipated cost increase due to the delay. Of utmost importance is using appropriate cost indices and forecasting future cost growth to account for the difference in original budget and revised budget.

The level of construction activity has a direct influence on labor and material demand and margins and therefore on construction inflation.

- Long-term construction cost inflation is normally about double consumer price index (CPI).

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors/supplier margins.

- When construction volume increases or decreases rapidly, margins change rapidly.

When construction is very actively growing, total construction costs typically increase more rapidly than the net cost of labor and materials. In active markets, overhead and profit margins increase in response to increased demand. These costs are captured only in Selling Price, or final cost indices.

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of inflation on construction projects.

Consumer Price Index (CPI), tracks changes in the prices paid by consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. This index in not related at all to construction and should not be used to adjust construction pricing.

Producer Price Index (PPI) for Construction Inputs is an example of a commonly referenced construction cost index that does not represent whole building costs. The PPI tracks material cost inputs at the producer level, not prices or bids at the as-built level.

Engineering News Record Building Cost Index (ENRBCI) and RSMeans Cost Index are examples of commonly used indices that DO NOT represent whole building costs yet are widely used to adjust project costs. Neither includes contractor margins.

It should be noted, there are far fewer available resources for residential inflation than for nonresidential inflation.

One of the best predictors of construction inflation is the level of activity in an area. When the activity level is low, contractors are all competing for a smaller amount of work and therefore they may reduce bids. When activity is high, there is a greater opportunity to bid on more work and bids can be higher. The level of activity has a direct impact on inflation.

To properly adjust the cost of construction over time you must use actual final cost indices, otherwise known as selling price indices.

Selling Price is whole building actual final cost. Selling price indices track the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor margins or overhead and profit.

Refer to National Inflation Indices for comparison to several national selling price indices or various Input indices. National reference indices are useful for comparison. Few firms project index values out past the current year, therefore all future projections in these tables are by Construction Analytics.

1-18-23 Construction Analytics PPI Tables and Building Cost Index

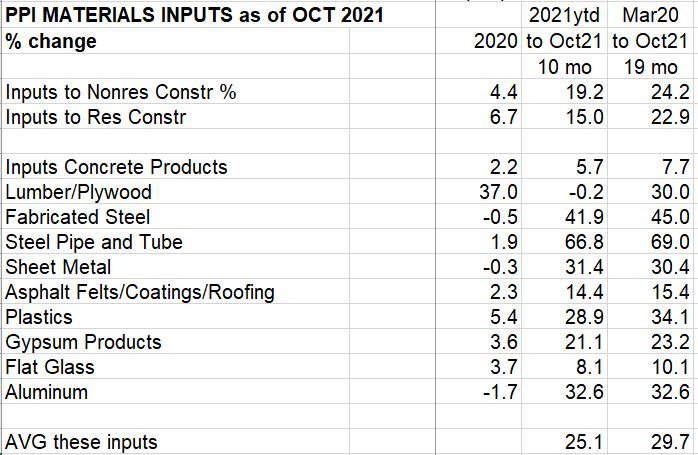

Construction Inputs to Nonresidential Buildings dropped for five of of last six months, now down 5.2% since June, but still up 7.2% since last December. However, the average index for 2022, when compared to the average for 2021, is up 15.7%.

The average growth for the year accounts for all the peaks and valleys within each year and is the value carried forward into the index tables and charts. A glaring example of the difference between Dec/Dec tracking, or year over year, and annual average tracking, is Steel Mill Products which is down 28.7% Dec22/Dec21, but the annual average for 2022 is still up 9.0% from the average 2021. In fact, the last three years show Dec/Dec combined inflation is +71%, but the annual averages for the last three years show total inflation growth of 87%. Annual averages should be used to report inflation.

Residential inputs are down seven of the last eight months, down 7.1% since April, but still up 7.1% since last December. The average for 2022, when compared to the average for 2021, is up 12.7%.

Several major cost components have been on decline the last few months: Lumber/Plywood, Steel Mill Products, Fabricated Steel, Steel Pipe and Tube, Aluminum and Diesel Fuel. Of the 15 items tracked here, 10 declined in the last quarter. Concrete is the only product that has not posted any monthly decline in 2022. Costs are still high, but are moving in the right direction after 1st quarter 2022 costs that averaged +7% (28%annual) to +8%. Historically, most cost increases are posted in the 1st quarter and the least in the 4th quarter.

If inputs costs remain where they are right now as we start the year, input costs for 2023 will finish the year at -2% Nonres and -4% Residential. If we were to post small but steady cost increases of 0.25%/mo for the rest of the year, we would end with both Res and Nonres input costs up 4% for the year.

4-14-23 PPI Inputs slowed considerably since last year.

PPI Inputs to Construction March 2023—Nonres down 0.1% in Mar, down 6 of last 12mo, -1%over 12mo. Rsdn down 0.3% in Mar, down 9 of last 12mo, -7.5% over 12mo.

Qtrly change last 5 qtrs Nonres 9.7, 3.0, -3.2, -2.5, 1.6 Rsdn 15.2, -1.4, -5.0, -2.3, 1.0

Historically, the 1st or 2nd qtr would post the highest gains for the year. Here’s 1st and 2nd qtr for 2021, 2022, 2023

Nonres 7.1% & 8.9, 9.7 & 3.0, 1.6 & … Rsdn 8.1 & 12.6, 15.2 & -1.4, 1.0 & …

Last 12 months down -1.0% for Nonres and -7.5% for Rsdn. 1st qtr 2023 1.6 and 1.0, instead of (2022) 9.7 and 15.2% and (2021) 7.1 and 8.1%

Still early, but 12mo, 6mo and 3mo PPI signs are pointing down or at least low increases for construction inputs in 2023

Be careful when referencing the 2023YTD. YTD is the growth so far this year. That is growth AFTER December. That does not represent the growth from the avg 2022. As an example, using Inputs to Nonres, the average growth in 2022 was 15.7%. That could be expressed as a starting Jan index of 100, a Jul 1 index of 115.7 and an ending Dec index of 131.4. The average of all 12 months in 2022 = 115.7, the average being at midyear. Well by averages the midyear index would be 115.7. The 2023YTD index is 2.6% since December (131.4) not 2.6% added to 115.7. This really highlights why it is much better to track the index than to report the percentage.

The last column, YTD vs 2022avg, gives an indication of 2023 avg if current YTD costs remain constant for the remainder of the year.

PPI INPUT TABLES and Inputs plot UPDATED 1-12-24

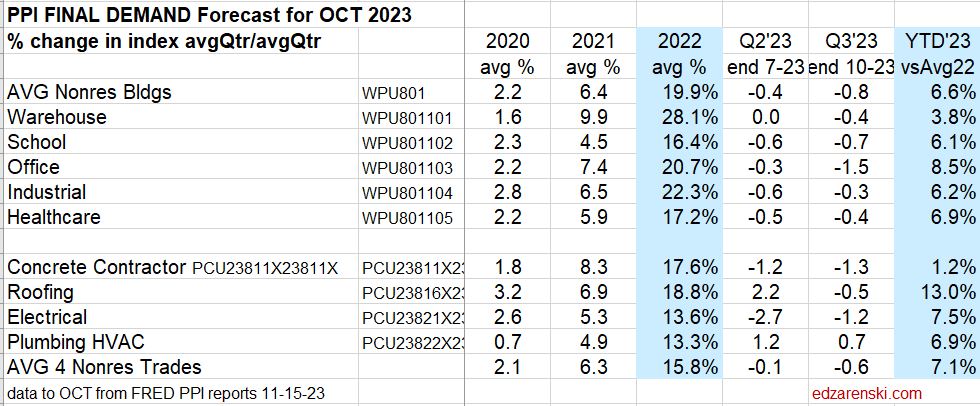

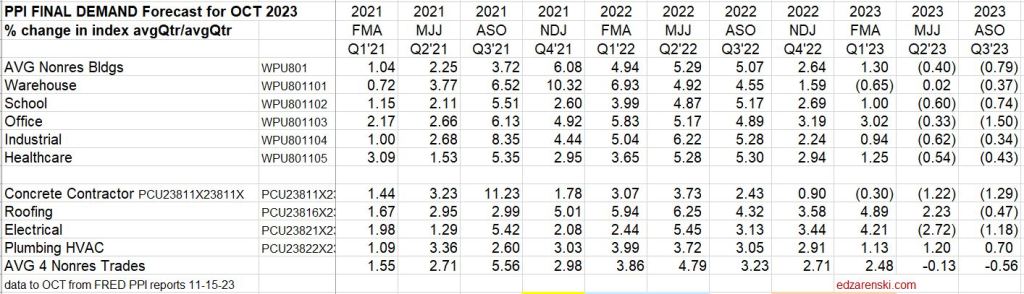

Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, material, equipment, overhead and profit. Labor includes change in wages and productivity. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct these Final Demand indices. For the past six quarterly updates, about 80% to 90% of the change in the index was posted in the update month. Therefore, Final Demand indices should not be referenced monthly. These are quarterly indices. January is an update month. PPI Final Demand for Jan index is basically the correction for Nov and Dec. The index should NOT be compared mo/mo. Compare qtr/qtr, but make sure to use the correct update month with two other months, (Jan +Dec+Nov)/(Oct+Sep+Aug) The table shows the slowing progression from a 20% annual rate of gain for all of 2022 (avg nonres bldgs), to 2% the last two qtrs to only 0.1% the last qtr. Slowing is good. The last column, YTD vs 2022avg, gives an indication of 2023 avg if current YTD costs remain constant for the remainder of the year.

PPI FINAL DEMAND TABLE UPDATED 11-15-23

The Construction PPI Final Demand for Nonres Bldgs posted declines for the two most recent adjustment months, Apr and Jul. If distributed back to the months being corrected, Apr into Feb and Mar, Jul into May and Jun, it shows all bldgs, except Offc, have at least 6 months of declining cost. Office has been declining for only 3 months but Warehouse has been declining for 8 months.

The final demand PPI index for 2022 nonresidential buildings is substantially higher than Construction Analytics nonresidential buildings cost index reported in the index tables. These PPI values are but one of the references used to develop construction analytics building cost index.

Current and predicted Inflation rates 1-18-23:

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 7.4%, Non-bldg Infra Avg 7.9%

- 2022 Rsdn Inflation 16.1%,Nonres Bldgs 12.9%, Non-bldg Infra Avg 13.8%

- 2023 Rsdn Inflation 1.9%, Nonres Bldgs 4.0%, Non-bldg Infra Avg 4.3%

Current and predicted Inflation updated to Q4’22 3-3-23

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.4%, Nonbldg Infra -0.3%

- 2021 Rsdn Inflation 14.0%, Nonres Bldgs 8.0%, Nonbldg Infra 7.9%

- 2022 Rsdn Inflation 15.8%, Nonres Bldgs 12.2%, Nonbldg Infra 13.8%

- 2023 Rsdn Inflation 2.2%, Nonres Bldgs 4.8%, Nonbldg Infra 4.7%

Current and predicted Inflation updated to Q2’23 8-17-23

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 8.2%, Nonbldg Infra 7.8%

- 2022 Rsdn Inflation 15.7%, Nonres Bldgs 12.1%, Nonbldg Infra 16.9%

- 2023 Rsdn Inflation 1.2%, Nonres Bldgs 5.4%, Nonbldg Infra 3.9%

- 2024 Rsdn Inflation 4.0%, Nonres Bldgs 3.8%, Nonbldg Infra 3.5%

Current and predicted Inflation updated to Q3’23 10-2-23

- 2023 Rsdn Inflation 1.4%, Nonres Bldgs 6.0%, Nonbldg Infra 3.9%

- 2024 Rsdn Inflation 4.0%, Nonres Bldgs 3.8%, Nonbldg Infra 3.5%

Most of the tables and plots here are cumulative indexes. Construction Inflation annual percent for Nonres Bldgs is plotted on this bar chart. The gray bar represents range of predicted inflation from 8 to 10 sources. The dark line is Construction Analytics (final cost) BCI. The red dash is ENR BCI (input index). The range in 2021 and 2022 was widest ever. The range for 2023 is small.

Construction Analytics Building Cost Index and other industry references

Tables and Plots 2001-2015 updated to Q4’22 2-6-23:

the following table 2015-2024 was updated to Q2 2023 on 10-2-23

In the table above, dividing the current year by the previous year will give the current year inflation rate. All indices are the average rate for the year.

Also in the tables above, all reference indices data is gathered, then all are normalized to a common base, 2019 = 100. This allows to see how different indices compare.

How to use an index: Indexes are used to adjust costs over time for the effects of inflation. An index already compounds annual percent to prevent the error of adding annual percents. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from, TO/FROM. Costs should be moved from/to midpoint of construction, the centroid of project cost. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

Tables and Plots updated to Q4’22 2-6-23:

This Plot updated to Q3’23 11-15-23:

Plots below updated to Q4’23 1-12-24:

4-21-23 This table and plot is an extension of the tables and plots above. Data is as of Q4 2022, but the table covers from 1967 to 2000. Data is pretty sparse.

Previous year Construction Inflation 2022 – updated 12-10-22

Previous year PPI Tables 2022 Producer Price Index to NOV’22

Links to Data Sources Construction Inflation >>> Links

PPI Tables 2022 Producer Price Index to NOV’22

PPI tables show input costs and final costs monthly to nonresidential buildings and residential. Here I use that information to track year-to-date (ytd). SEE the latest information at the bottom of this post.

January Inputs PPI is up 2.6% in nonresidential and 3.3% for residential. Most of the inputs reported here are up less than 2% YTD, but Lumber/Plywood is up 15%. Final costs of contractors is up 1% to 5% and final cost of buildings is up 3% to 6%. SEE also Construction Inflation 2022

3-23-22 update Input Costs through February 2022 to nonresidential buildings up 4.5% year-to-date, residential up 6.4%. Inputs to residential went up 3.0% in Feb. In a typical year of 4% inflation, costs would increase only 0.25% to 0.50% per month. Residential is up 6%+ after the first two months! Most of the inputs reported here are up less than 2% for February, except Lumber/Plywood up 4.1% and Aluminum up 6.2%. Year-to-date, for two months, Lumber/Plywood is up 20% and aluminum is up 12.1%. Watch copper, up 4.9% ytd, for potential world situation interfering with supply. Final costs of contractors and final cost of buildings changed very little in February. Range is mostly up 2% to 4% ytd, but up to 6% year-to-date. 4-12-22 edited, corrections.

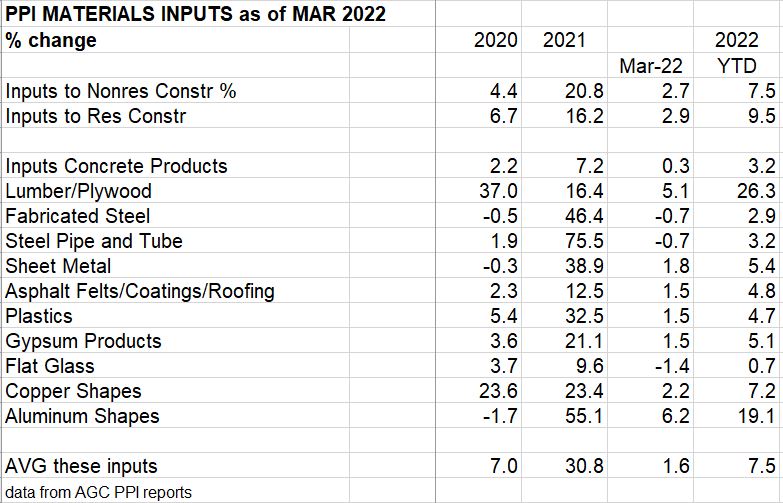

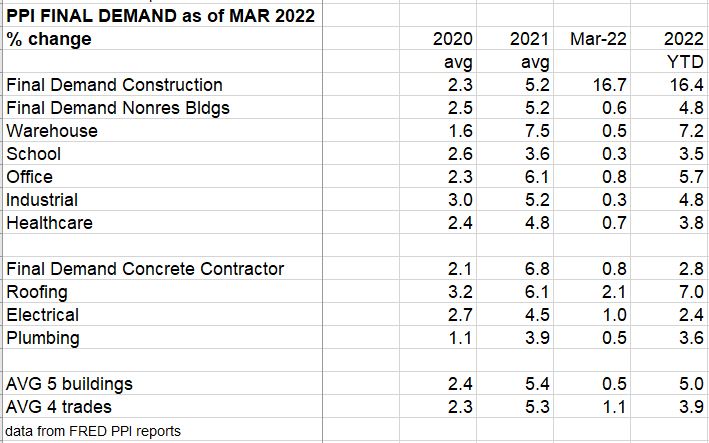

4-13-22 update > Input Costs through March 2022 to nonresidential buildings up 7.5% year-to-date, to residential up 9.5% ytd. In a typical year of 4%-5% inflation, costs would increase only 0.25% to 0.50% per month. Residential is now up 9% after the first 3 months of 2022! Keep in mind when reading these year-to-date (YTD) results, these are cumulative for 1st quarter 2022. That’s not a guess at year end results.

The only inputs reported here up more than 2% for March are Lumber/Plywood, up 5.1%, and Aluminum, up 6.2%. Year-to-date, for 3 months, Lumber/Plywood is up 26% and aluminum is up 19.1%. Watch copper, up 7.2% ytd, for potential world situation interfering with supply. Final costs of contractors and final cost of buildings changed very little in February or March. The final cost average of 5 building types is up 5.2% ytd in the first 3 months of 2022.

The PPI inputs through the 1st quarter is putting pressure on the nonres bldgs index for 2022 to move higher than forecast.

5-8-22 Correction to 2020 and 2021 Totals

I had taken the 2020 and 2021 totals from the AGC PPI reports. However, all analysis by Construction Analytics reports inflation as the annual average. AGC reports the annual growth as the December value, so compares Dec to previous Dec. That does not represent annual growth. For example, some costs in 2021 maintained a level 3% annual growth rate for 9 months then rapidly increased to 9% in the final 3 months. AGC reports the annual growth at 9%, whereas the annual average is 4%. Inflation rate reporting must be consistent, you cannot mix Dec/Dec and annual average. Therefore, all PPI data has been edited using the original source data from Bureau of Labor Statistics.

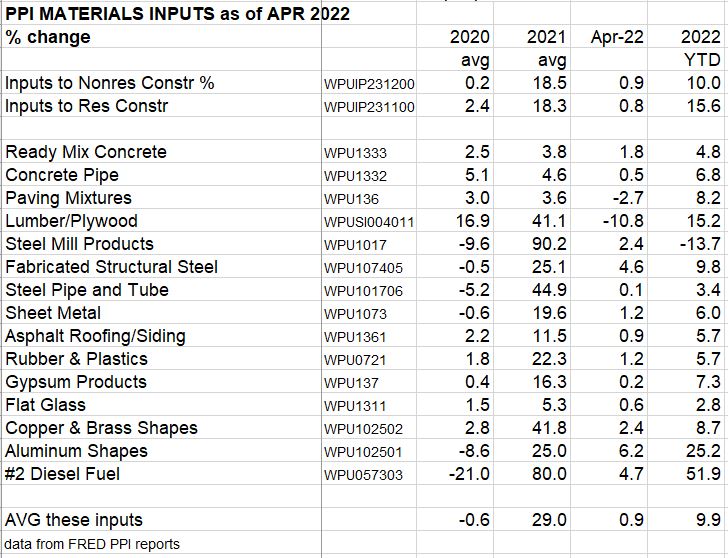

5-12-22 Construction PPI for April Construction Inputs post slowest monthly gains so far this year.

Nonresidential Inputs up 0.9% in Apr, up 10.0% YTD. Residential Inputs up 0.8% in Apr, up 15.6% YTD

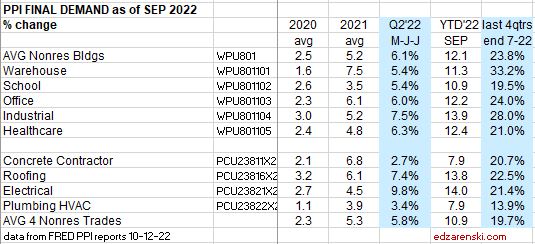

Final Demand (Selling Price) Nonres Bldgs post strong gains in 1st 4 months, up 4.1% in April, up 9.0% ytd. Warehouses up 12% ytd.

6-14-22 Construction PPI for MAY Construction Inputs to residential post, for second consecutive month, slowest monthly gains so far this year.

May PPI data for construction > Big gainers from 2021 have slowed in 2022, Lumber, Steel, Sheet Metal, Rubber/Plastics, Copper. New gainers in 2022 are Ready Mix Conc, Conc Pipe, Paving Mixtures, Gypsum. We could see the same levels of inflation as last year, just from different products.

Final Demand pricing is updated every 3-4 months. Just had a major revision in April, some items increased by 50-75%. May increases look low, but the next revision month could change that, as did April. Better to look at this indicator quarterly, after the revision month.

7-14-22 Construction PPI for JUNE Construction Inputs to residential down for thrid consecutive month.

June PPI data for construction > Biggest gain in June is Deisel Fuel, up 14.1%, up 93.8% year-to-date. Biggest decline is Lumber/Plywood, down 14.7% in June, now down 1.9% ytd.

Final Demand (Selling Price) of nonresidential buildings and trades continues to climb, buildings on average up 0.5% in June, up 9.5% ytd, trades up 1.0% for June, up 8.1% ytd.

In this June report, there are many instances where FRED has revised number in previous 2022 months, mostly in the prior two months, but in some cases back to January. So, the year-to-date change from May to June will not match the May ytd previously reported x the June change.

8-12-22 Construction PPI for JULY Construction Inputs to residential down for third consecutive month.

July PPI data for construction > Biggest gainers in July – Ready Mix Concrete posts largest monthly gain of the year, up 2.7%. Now up 9% in 7 months, also up 9.3% compared to same 7 mo 2021. Biggest decliner – Diesel Fuel, down 16% for the month. Now up 62% for first 7mo of 2022, but up 77% compared to same 7mo in 2021.

Final Demand (Selling Price) of nonresidential buildings and trades continues to climb, buildings on average up 6.2% for 2nd quarter (M,J,J), up 12% ytd. Trades up 5.7% for Q2, up 12.5% ytd.

Material Inputs PPI represents change in cost of producing those materials. Average material cost is about 50% of final bldg cost. But with several margins tacked on before install, PPI $ represents less than half of final bldg cost, perhaps 40%.

Final Demand PPI, or Selling Price, represents contractors bid price to client. Includes labor, mtrl, equip, overhead and profit. Labor includes change in wages and productivity. Every three months (Jan, Apr, Jul, Oct) BLS performs an update survey to correct these Final Demand indices. For the past three quarterly updates about 80% to 90% of the change in the index was posted in the update month. Therefore, they should not be referenced monthly. These are quarterly indices.

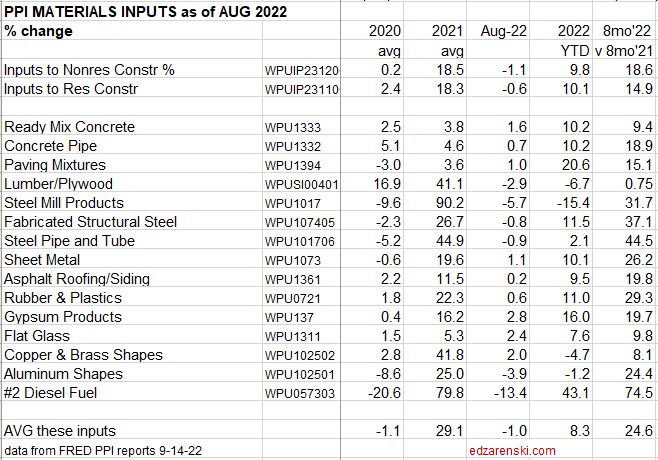

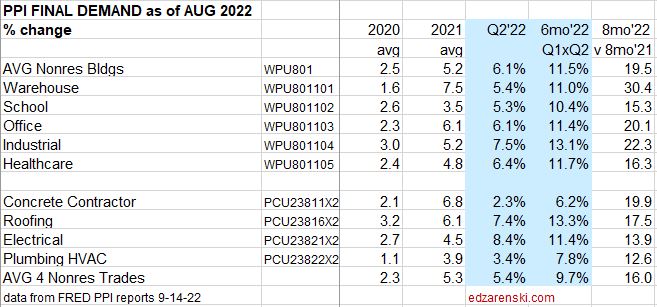

9-14-22 Construction PPI for AUGUST

Construction Inputs to nonresidential buildings dropped for the second consecutive month after posting only a 0.4% increase in June, now down -2.4% for the past three months, but still up 9.8% year-to-date. Residential inputs are down for the fourth consecutive month, down -4.4% since April, up 10.1% ytd. Costs are still high, but are moving in the right direction after 1st quarter costs that averaged +10% to +15%. Historically, most cost increases are posted in the 1st quarter and the least in the 4th quarter.

Average of all inputs for nonresidential buildings is up 18.6% for eight months 2022 compared to the same months 2021. Avg inputs for residential compared to 2021 is up 14.9%

- Ready Mix Concrete, up 7 of 8 months, ytd is up10.2%

- Lumber/Plywood, down 4 of the last 5 months a total 28%, ytd down -6.7%

- Fab Str Steel, down -2.1% the last two months, up 11.5% ytd

- Diesel Fuel, down -28% in last 2mo, up 43% ytd

PPI $ represents less than half of final bldg cost, perhaps 40%.

It will take two more months before we see the effect these changes have on Final Demand PPI, which is updated every three months. Next update is to October data released mid-Nov. Every three months (Jan, Apr, Jul, Oct data) BLS performs an update survey to correct these Final Demand indices. For the past three quarterly updates about 80% to 90% of the change in the index was posted in the update month. Therefore, they should not be referenced monthly. These are acting like quarterly indices.

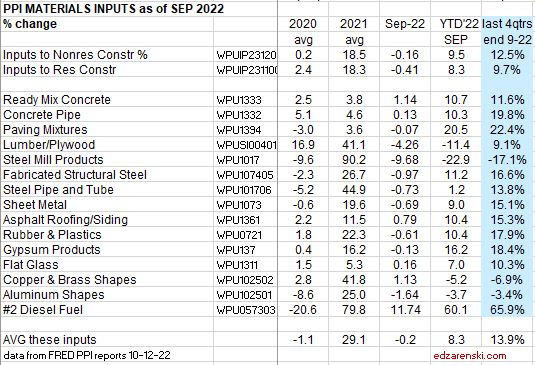

10-14-22 Construction PPI for SEPTEMBER

Construction Inputs to nonresidential buildings dropped for the third consecutive month after posting only a 0.4% increase in June, now down -3.1% for the past three months, but still up 9.5% year-to-date. Residential inputs are down for the fourth consecutive month, down -6.0% since April, up 8.3% ytd. Several major cost components have been on decline the last few months: Lumber/Plywood, Steel Mill Products, Fabricated Steel, Steel Pipe and Tube, Aluminum and Diesel Fuel. Costs are still high, but are moving in the right direction after 1st quarter costs that averaged +7% (28%annual) to +8%. Historically, most cost increases are posted in the 1st quarter and the least in the 4th quarter.

Costs for the last four quarters for all inputs for nonresidential buildings are up 12.5%. Avg inputs for residential for the last four quarters are up 9.7%. The average cost for the last 4 quarters (last 12 months) for the 15 input products I track is up 13.9%.

- Ready Mix Concrete, up 10.7% year-to-date (YTD), up11.6% last 12 months.

- Lumber/Plywood, up 30% in Q1 but down 11.4% ytd, up 9.1% last 12 months

- Fab Str Steel, up 11.2% ytd, up 16.6% last 12 months

- Diesel Fuel, down -17% in 2 of last 3mo, up 60% ytd, up 66% last 12 months

PPI $ represents less than half of final bldg cost, perhaps 40%.

Final Demand PPI is updated every three months. Next update is to October data released mid-Nov when we will see the third quarter, Aug-Sep-Oct, for 2022. Every three months, (Jan, Apr, Jul, Oct data), BLS performs an update survey to correct these Final Demand indices. For the past six quarterly updates about 80% to 90% of the change in the index for the previous quarter was posted in the update month. Therefore, they should not be referenced monthly. Two months are extremely low to the average and the third month is extremely high. Also, the January index is an update month, so most of the index reported that month refers to Nov and Dec, so should not be counted in 2022. Therefore, I chose to report the quarters as reported and updated by BLS. The quarters are FMA, MJJ, ASO, NDJ.

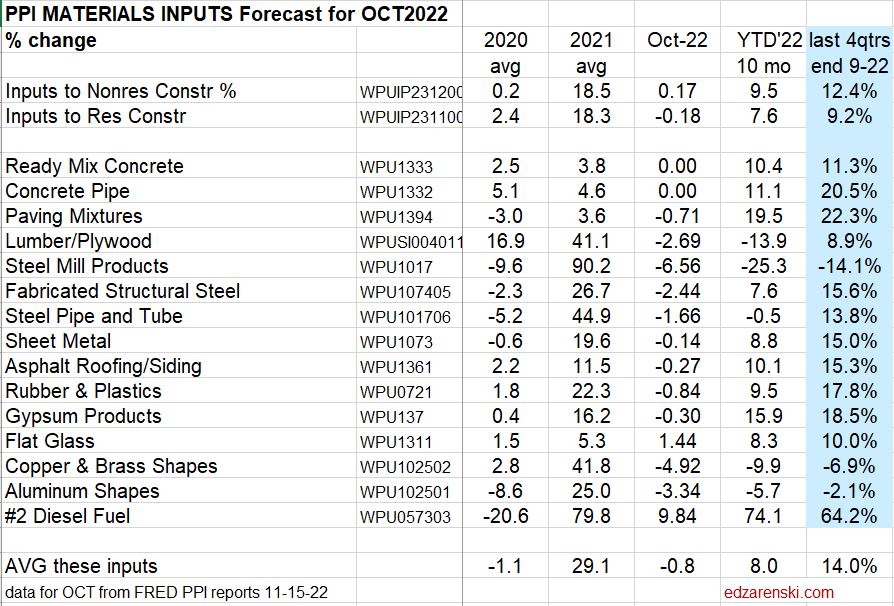

11-15-22 Construction PPI for OCTOBER 2022

Since June, PPI Input costs have been in decline. However Final Demand costs lag and have not posted any declines in at least the last 6 quarters.

Construction PPI Data for Oct’22 > Inputs to Nonres Bldgs UP 9.5%ytd, 12.4% last4qtr. Inputs to Rsdn UP 7.6%ytd, 9.2% last4qtr

FRED corrects Final Demand values quarterly, Jan,Apr,Jul,Oct. Oct value corrects entries for Aug&Sep. Most recent qtr lowest in last4qtrs.

Final Demand PPI is updated every three months. October Final Demand data released mid-Nov represents the correction value for the third quarter, Aug-Sep-Oct. Every three months, (Jan, Apr, Jul, Oct data), BLS performs an update survey to correct these Final Demand indices. For the past six quarterly updates about 80% to 90% of the change in the index for the previous quarter was posted in the update month. Therefore, they should not be referenced monthly. Two months are extremely low to the average and the third month is extremely high. Also, the January index is an update month, so most of the index reported that month refers to Nov and Dec, so should not be counted in 2022. Therefore, I chose to report the quarters as reported and updated by BLS. The quarters are FMA, MJJ, ASO, NDJ.

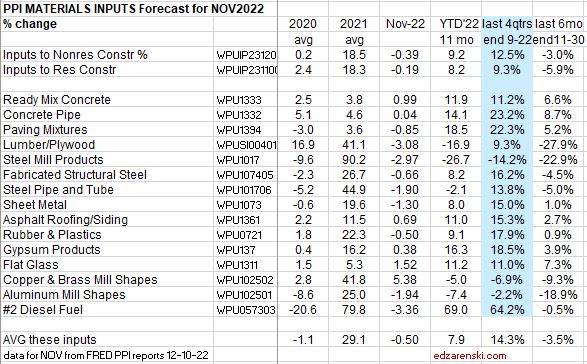

12-10-22 Construction PPI for NOVEMBER 2022

Since June, PPI Input costs have been in decline. However Final Demand costs lag and have not posted any declines in at least the last 6 quarters. PPI Input$ represent only about 30% to 40% of Final Demand cost.

Construction PPI Data for Nov’22 > Inputs to Nonres Bldgs UP 9.2% ytd, 12.5% last4qtr. Inputs to Rsdn UP 8.2% ytd, 9.3% last4qtr.

For the last 6 months Inputs to nonresidential construction are down -3.0% and to residential are down 5.9%.

FRED corrects Final Demand values quarterly, Jan, Apr, Jul, Oct. Oct value corrects entries for Aug & Sep. Most recent qtr lowest in last4qtrs. We will not get another reliable indicator to Final Demand cost until January when FRED will issue the corrections to Nov and Dec.

Final Demand PPI is updated every three months. October Final Demand data released mid-Nov represents the correction value for the third quarter, Aug-Sep-Oct. Every three months, (Jan, Apr, Jul, Oct data), BLS performs an update survey to correct these Final Demand indices. For the past six quarterly updates about 80% to 90% of the change in the index for the previous quarter was posted in the update month. Therefore, they should not be referenced monthly. Two months are extremely low to the average and the third month is extremely high. Also, the January index is an update month, so most of the index reported that month refers to Nov and Dec, so should not be counted in 2022. Therefore, I chose to report the quarters as reported and updated by BLS. The quarters are FMA, MJJ, ASO, NDJ.

PPI TRENDS

A few years back I looked at PPI historical data. This is what I found.

- 60% of the time, the highest increase of the year in the PPI is in the first quarter.

- 75% of the time, two-thirds of the annual increase occurred in the first six months.

- In 25 years, the highest increase for the year has never been in Q4.

- 60% of the time, the lowest increase of the year in the PPI is in Q4.

- 50% of the time, Q4 is negative, yet in 25 years the PPI was negative only four times.

Since the onset of the pandemic, Feb 2020, residential construction inflation is up 33%, nonresidential up 20%. If you are a residential contractor, take 33% off the top of your revenue growth from Feb20 to Nov22. What remains is your business volume growth. Is your business growing?

Current and predicted Inflation rates updated 12-10-22:

- 2020 Rsdn Inflation 4.5%, Nonres Bldgs 2.6%, Non-bldg Infra Avg -0.3%

- 2021 Rsdn Inflation 13.9%, Nonres Bldgs 7.4%, Non-bldg Infra Avg 7.8%

- 2022 Rsdn Inflation 15.4%, Nonres Bldgs 12.2%, Non-bldg Infra Avg 13.6%

- 2023 Rsdn Inflation 6.0%, Nonres Bldgs 4.8%, Non-bldg Infra Avg 4.3%

October Record Increase to Construction Inflation 11-10-21

What’s the Construction Inflation rate?

From Sept to Oct construction materials input price changes were normal, but Final Demand prices for October increased in one month by what could be considered an entire year’s increase. We’ve been watching the price pass thru catch up slowly, until now.

This is the single largest monthly increase in Final Demand pricing since final demand records began in 2006. Prior to this, based on changes in recent months, I expected future cost increases to add on slowly. So I wasn’t expecting the huge jump all at once. This may be some increases that were occurring over a few months that finally got captured in the index.

In October, the Final demand cost for Buildings and Trades averaged +12% year-to-date. In July, August and September it was between 5% and 6%. A change like this in one month has never occurred before. In fact, this one-month change is greater than any annual change on record. So, it resets the baseline for all forecasts.

For Oct, Nonresidential Buildings 2021 inflation is estimated at 6.8% and Residential at 15%. The forecast for 2022 is estimated at 4.5% for nonresidential buildings inflation and 7% for residential. See inflation and PPI data on my blog for more.

It must be noted that huge jump in nonresidential buildings inflation may not yet be picked up in many of the industry indices that we reference. Construction Analytics BCI is now updated to include the 11-10-21 PPI final demand inflation. Some sources update only quarterly, some semi-annually. After this event, I would expect to see a change in most other sources, which may update sometime over the next quarter.

One important thing, when inflation turns out to be higher than you thought, that means productivity is lower than you thought.

See Inflation – PPI data Jun to OCT Updated 11-10-21

Also see 2021 Construction Inflation – updated 11-10-21

Inflation – PPI data Jun to OCT Updated 11-10-21

7-15-21 Final demand pricing is still well below materials price increases. However, it’s hard to visualize how more of the cost does not get passed on to consumer. I’m expecting future reports will show final cost inflation increasing.

11-10-21 Got That ^ right.

10-14-21 My current forecast for inflation in 2021 is now 4.5% for nonresidential buildings and 13% for residential. Residential inflation seems to have slowed but nonresidential is headed towards 5%.

11-10-21 Final Demand Bldgs and Trades prices for October gained a year’s worth of increase (6.5%) in one month for Oct. This is the largest monthly increase on record back to the start of these series, 2006.

11-16-21 My current forecast for inflation in 2021 is now 6.5% for nonresidential buildings and 14% for residential. I expected to see some increase, just not this much. The PPI reports give the first clues to pass thru costs.

See the most recent inflation comments 2021 Construction Inflation updated 10-15-21

Most years, inflation climbs at a steady rate. 2021 could end up being a year in which inflation is drastically different in one or two quarters vs the entire year.

8-13-21 As expected, many Final Demand prices surged in July by 1.5% to 2%.

10-14-21 Final Demand Trades prices up again since July. Some Buildings increased. Wood products have come way down, but almost every other material product has gone up, metals way up.

11-10-21 From Sept to Oct materials price changes were normal, but Final Demand prices jumped what could be considered an entire year’s worth of increase in just one month. We’ve been watching the price pass thru increase slowly, until now. This is the single largest monthly increase in Final Demand pricing that I can remember.

Producer Price Index Year-to-date June & July 2020

7-14-20 updated 8-28-20

Producer Price Index selected items year-to-date through June 2020. All values compare most recent June pricing to December 2019. Pricing represents 6-month change, not annualized change.

- -2.5% Inputs to new nonresidential construction

- -0.9% Inputs to new residential construction

- +1.0% Final demand construction

- -0.4% New Warehouse Bldg

- +1.2% New School Bldg

- +0.7% New Office Bldg

- +1.4% New Industrial Bldg

- +1.4% New Healthcare Bldg

- New work on nonresidential buildings

- +0.7% Concrete contractors

- +1.8% Roofing contractors

- +1.4% Electrical contractors

- +1.2% Plumbing contractors

- Selected Material Inputs

- -42.0% #2 Diesel fuel

- +2.7% Ready Mix Concrete

- +1.3% Precast concrete products

- +1.3% Flat Glass

- +0.1% Gypsum products

- +6.1% Lumber and Plywood

- -5.7% Steel pipe and tube

- -11.5% Aluminum mill shapes

- +2.2% Fabricated structural metal

- +10.3% Fabricated structural metal bar joists and reinforcing bars

- +11.9% Fabricated structural metal for non-industrial buildings

- -3.7% Fabricated structural metal for bridges

- -2.2% Fabricated steel plate

- +1.6% Iron and steel scrap

AGC does not publish year-to-date values. The data in this post is the combined effect of comparing June to March and March to December.

Here’s the link to AGC PPI reports for all months

8-28-20 There were some pretty dramatic changes in July in the Producer Price Index selected items year-to-date. Edited here, all values compare most recent JULY pricing to December 2019. Pricing represents 7-month change, not annualized change.

- -1.0% Inputs to new nonresidential construction ytd through JULY

- +1.0% Inputs to new residential construction ytd through JULY

- +1.6% Final demand construction ytd through JULY

- +1.0% New Warehouse Bldg

- +1.8% New School Bldg

- +1.7% New Office Bldg

- +2.2% New Industrial Bldg

- +2.2% New Healthcare Bldg

- New work on nonresidential buildings ytd through JULY

- +0.5% Concrete contractors

- +2.2% Roofing contractors

- +1.7% Electrical contractors

- +0.7% Plumbing contractors

- Selected Material Inputs ytd through JULY

- -24.0% #2 Diesel fuel

- +2.8% Ready Mix Concrete

- +1.3% Precast concrete products

- +1.2% Flat Glass

- +0.3% Gypsum products

- +13.8% Lumber and Plywood

- -5.5% Steel pipe and tube

- -10.0% Aluminum mill shapes