Home » Posts tagged 'Volume'

Tag Archives: Volume

Construction Data Briefs AUG Data 10-6-2023

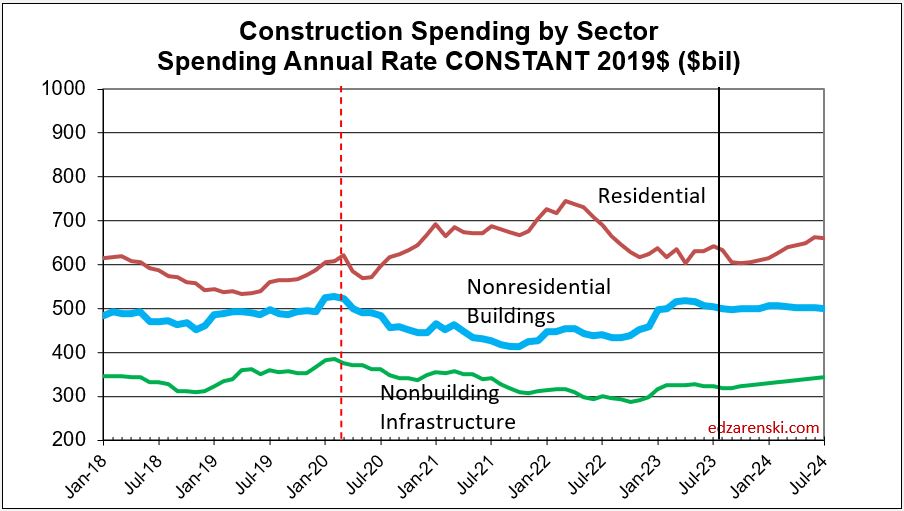

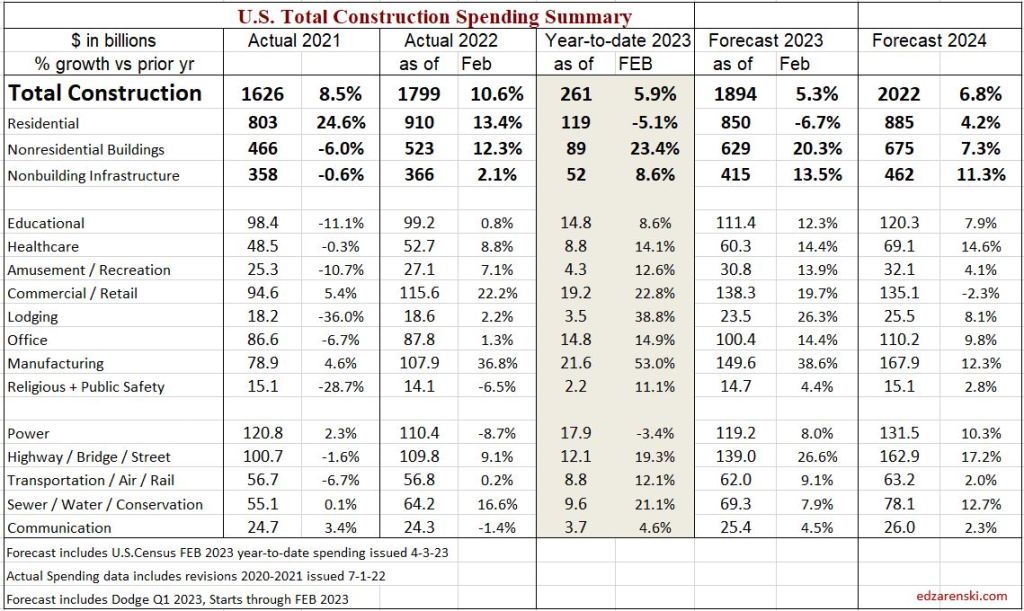

Total Construction Spending in 2023 is forecast at $1,950 billion, an increase of 5.5% over 2022.

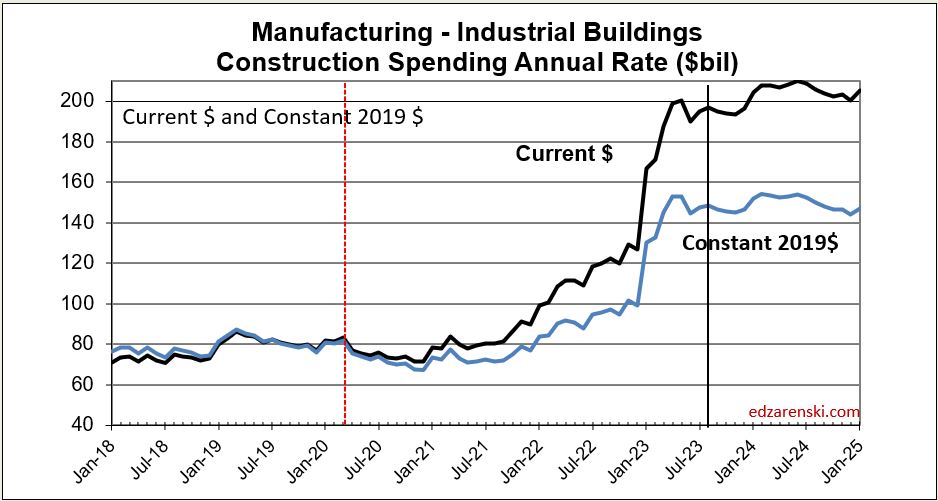

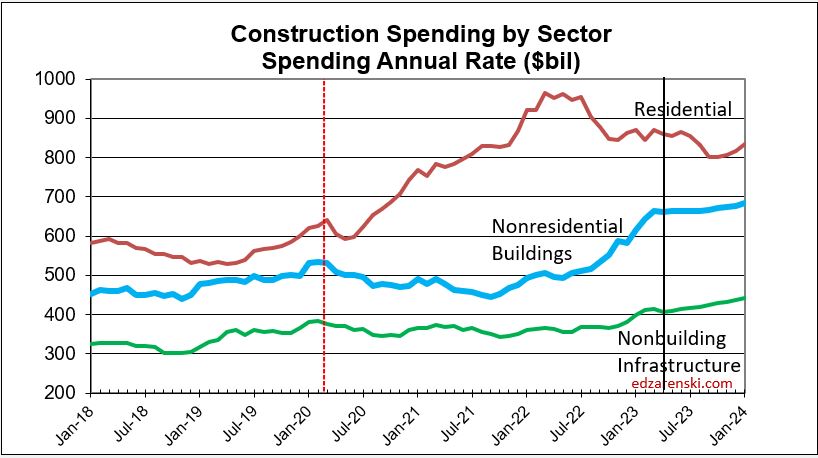

Nonresidential Buildings spending is leading Construction spending growth. With eight months in the year-to-date (ytd) for 2023, total all construction spending ytd is up 4.2%. Nonresidential buildings spending is up 22% ytd compared to Jan-Aug 2022, the fastest rate of nonres bldgs growth in over 30 years. Only 2006 & 2007 come close at 13% & 19% growth years. Commercial/Retail spending peaked in January 2023 and has dropped every month since. It will drop from a ytd of 8.5% down to a yearly total of 5%. Manufacturing is up 74% ytd and will hold on to finish the year up 66%.

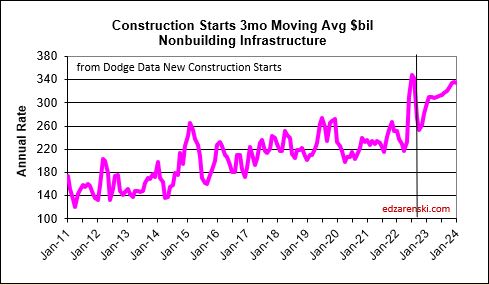

Nonbuilding spending ytd is up 12%. The largest advances are in Highway, up 16% ytd, and Public Utilities. Sewage/Waste Water is up 24% ytd, Water Supply is up 15% ytd and Conservation/Rivers/Dams is up 26% ytd .

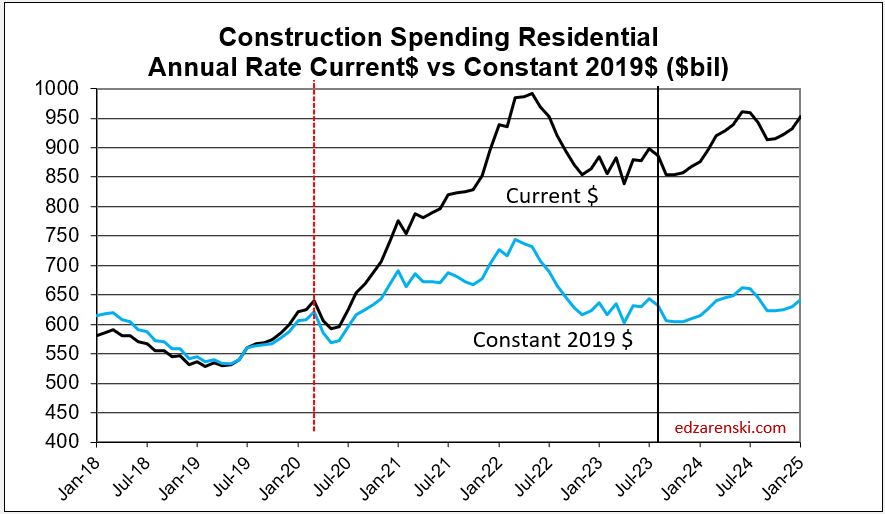

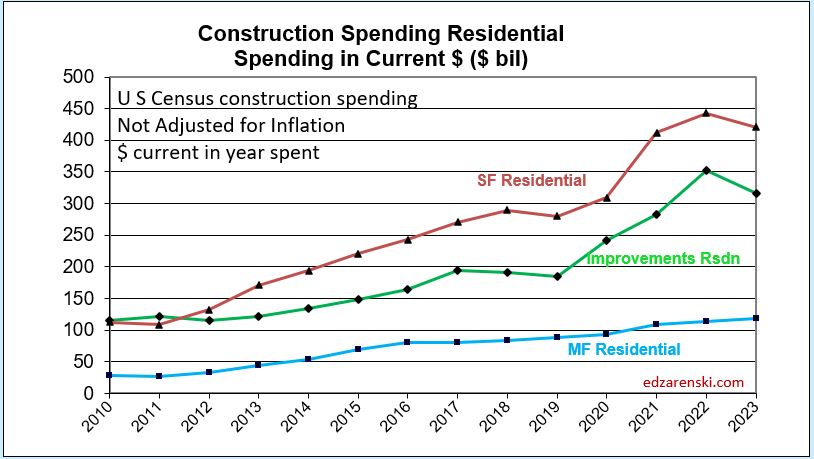

Residential Spending ytd compared to Jan-Aug 2022 is still down -8.7%. Residential spending peaked in Mar 2022 and had a recent bottom in Apr 2023. Since April, the annual rate of residential spending is up 5.6%, almost entirely due to an 8% increase in the largest segment, single family spending, 45% of all residential spending. Multifamily spending is is up 6%, but it’s only 15% of residential spending.

Spending Forecast

Total Construction Spending in 2023 is forecast at $1,950 billion, an increase of 5.5% over 2022.

Nonresidential Buildings spending is forecast at $662 billion, an increase of 20.6% over 2022.

Non-building Infrastructure spending is forecast at $421 billion, an increase of 12.9% over 2022.

Residential Buildings spending is forecast at $867 billion, a decline of -6.5% less than 2022.

This forecast does not include a recession.

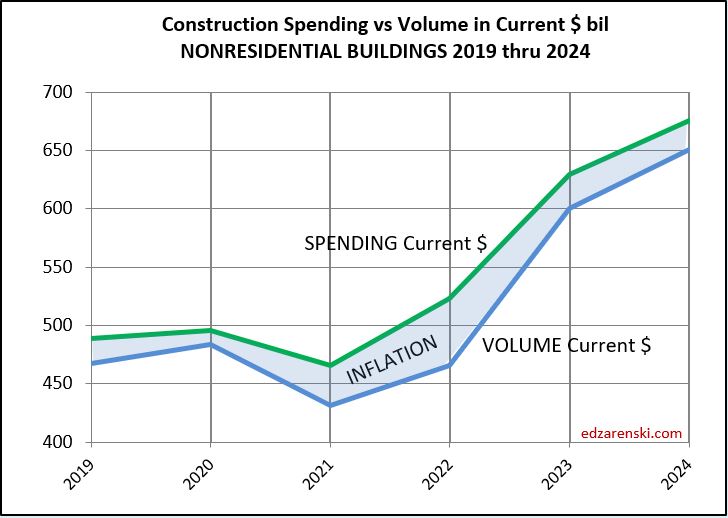

Spending by Sector Current $ and Inflation Adjusted Constant $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Non-building Infrastructure leading spending growth. Both are expected to post spending growth greater than the inflation index, so there will be real volume growth. In 2020+2021, residential volume grew 10%/yr. For 2023, residential volume drops 10%. Nonresidential Bldgs will post a 13% increase in volume in 2023 and flatten out at that level through 2024. Non-building volume increases 6% to 7%/yr for the next few years.

New Construction Starts

The rate of construction spending in 2023 will be influenced predominantly by a 50% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged near $500 billion/year. From Mar-Aug 2023 starts averaged $400 billion/year. Many of those projects will have peak spending in 2023 or 2024.

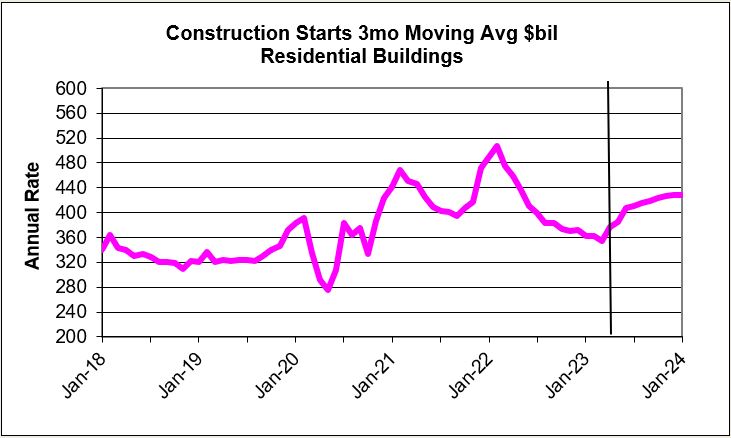

Residential construction (Dodge) starts posted the five highest months ever, all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Q1 2023, residential starts dropped another 12% below 2nd half 2022. Finally in July and August, starts regained some strength coming in 33% higher than the lows in Q1. Residential starts are still down 17% year-to-date vs 2022.

Nonresidential Buildings, in 2022 posted the largest ever one-year increase in construction starts, up 50%. Nonres Bldgs starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history. Starts fell 20% in the 1st half 2023 but still posted the 2nd highest 6mo average ever. Nonres Bldgs starts are down 17% ytd.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%.

Non-building starts for the 6 month period Mar-Aug 2023 posted the best 6 months on record, up 30% from the average of 2022. The 2nd half 2022 was up 50% over 1st half 2022. The 6 months Mar-Aug 2023 is up 18% from 2nd half 2022. For 2023, Highway/Bridge and Power have the strongest gains. Total Non-building Starts for 2023 are forecast up 25%. Non-bldg starts are up 22% ytd.

Current $ Spending, Inflation and Constant $ Volume

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. Spending is current to the year stated. The values in the constant table are indexed to a constant value year, 2019. This shows business volume year to year, can be a lot different than spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

SEE Construction Inflation 2023

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. Therefore, Revenue does not measure volume growth. In 2022, Nonresidential buildings inflation was 12%, so business volume was 12% less than spending, or 12% less than revenue. Residential volume was 15% less then spending.

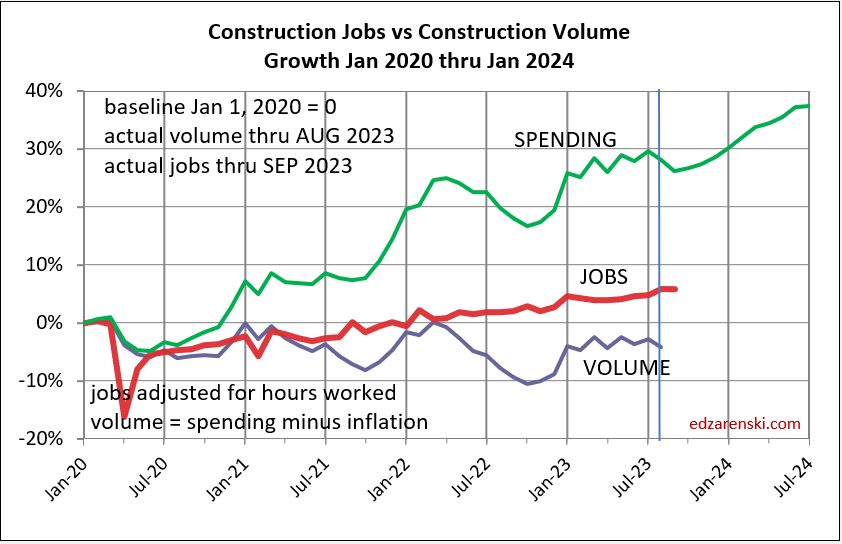

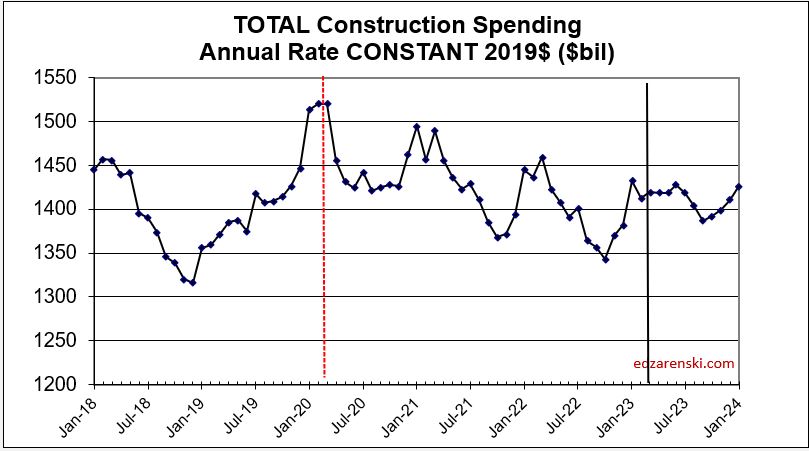

Through August 2023, Overall Construction Spending is up 28% in the 42 months since the onset of the pandemic, but, during that same period inflation increased 33%. After adjusting for 33% inflation, constant $ volume is down 5%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

Does Volume of Work Support Jobs Growth?

or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a second deeper low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019, but it is improving because volume is increasing rapidly and jobs are increasing slowly.

Nonresidential Buildings spending in 2023 is forecast at $660 billion, an increase of 20.6%, or an increase of $113 billion in 2023. Non-building Infrastructure spending is forecast up 13% ($50bil) in 2023 and 10% ($40bil) in 2024.

Generally, it takes 5000 jobs to put-in-place $1 billion in one year. It could easily vary from 4000 to 6000. So an add of $100 billion+ in 2023 would need 500,000 new jobs. Adding $200 billion over two years would need 1,000,000 new jobs.

Construction Jobs vs Construction Volume

These plots updated to jobs report 10-6-23

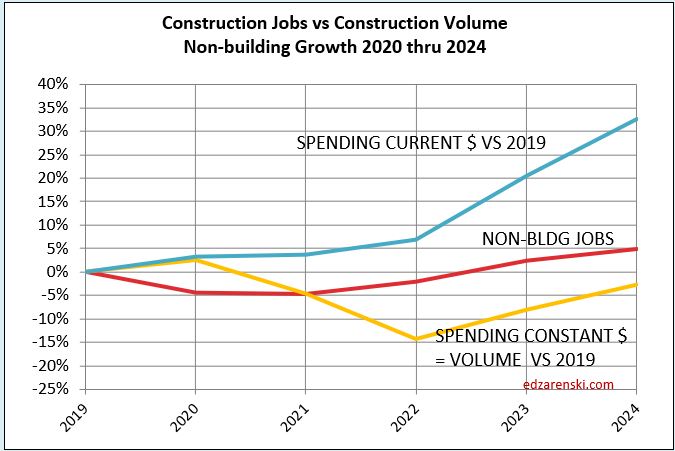

Since Q1 2020, pre-pandemic high, spending increased 28%, but inflation was 33%, so real volume of work is down 5%. In that time jobs increased 5%. Jobs are way ahead of volume, but volume is backfilling in the void, especially in nonres bldgs.

This plot with baseline Jan 1, 2011 shows that jobs increase pretty consistently at about 3% to 4% per year. Except for the spike down in 2020, rate of growth (slope of the jobs line) is consistent for 13 years.

If we were to grow the labor force to meet the newly identified workload added from new starts, we would need to double the prior maximum rate of construction jobs growth. Normal construction jobs growth is about 250,000 jobs per year and maximum prior growth is about 400,000. The workload discussed above would require 500,000 new jobs/yr., back to back. That’s an expansion of the industry by 15%, in an industry that normally grows 3%/yr. This industry can’t grow that fast. (Which means we may all need to account for over-capacity growth as a potential reduction in future forecast. You can’t increase spending that fast if you can’t also expand the labor force and the suppliers to the industry that fast).

My first thoughts were, Jobs may not be able to increase fast enough to put-in-place the forecast spending. This impediment needs to be accounted for and could reduce overall construction spending forecast over the next two years. The most likely markets where a reduction might occur are Manufacturing, Highway and Public Utilities.

However this is what happened the past year. In the last 12 months, Aug’22 to Aug’23, Nonres Bldgs jobs are up 3.8%. Nonres Bldgs spending is up 21%, by far driven by Manufacturing, but after ~6% inflation, volume of nonres bldgs workload is up 15%. So, we have a 3.8% increase in jobs to accomodate a 15% increase in volume.

The last year has shown a huge increase in the volume of nonres bldgs work, without an equal increase in jobs. This shows the excess nonres bldgs jobs for the past three years is now absorbing new workload, (a 3.8% increase in jobs to accomodate a 15% increase in volume), without collapsing the labor force or canceling the volume. However, the ability to absorb work into the existing workforce cannot continue.

Non-building, over the next two years, could experience the same kind of growth spurt as Nonres Bldgs., a forecast increase in volume the next two years without an equal increase in jobs. Volume which was lower than jobs since 2021, is now increasing faster than jobs. Non-bldg volume is forecast up 6% to 8%/year the next 3 years. Jobs increase at an avg. 3.5%/year.

Residential volume has exceeded residential jobs all the way back to 2011. The recent decline in volume brings the two even, if the jobs hold the pace.

SEE more discussion on Volume and Jobs

here 2023 Construction Volume Growth

here 2023 Midyear Jobs Outlook

and here Infrastructure Construction Expansion – Not So Fast

See also Midyear Construction Forecast Update 8-12-23

Construction Data Briefs JUN 2023

Nonresidential Buildings spending is leading Construction spending growth. For the first four months of 2023, total construction spending year-to-date (ytd) is up 6.1%. Nonresidential buildings spending is up 30% ytd compared to the same four months 2022, the fastest rate of nonres bldgs growth in over 20 years. Nonbuilding spending ytd is up 11%. Residential spending peaked in March 2022. Since then the annual rate of residential spending has dropped 11%.

SPENDING FORECAST

Total Construction Spending in 2023 is now forecast to reach $1,915 billion, an increase of 6.4% over 2022.

Nonresidential Buildings spending in 2023 is now forecast at $660 billion, an increase of 26.2% over 2022.

Construction Spending through April is up 6.1% ytd. Spending is forecast to finish 2023 up 6.4%.

Total construction spending for 2023 is on track to increase +6.4%. Residential -8.1%, Nonres Bldgs +26.2%, Nonbldg +14.4%.

SPENDING BY SECTOR CURRENT $ AND INFLATION ADJUSTED CONSTANT $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Nonbuilding Infrastructure leading spending growth. Both are expected to grow greater than the inflation index.

See also Construction Spending Outlook – Feb 2023

STARTS

The rate of construction spending in 2023 will be influenced predominantly by a 40% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged over $500 billion/year. Many of those projects will have peak spending in 2023. Some will occur in 2024.

Residential construction (Dodge) starts posted the five highest months ever all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Jan and Feb 2023, starts dropped another 20% below 2nd half 2022. Starts are now down 25% in 12 months.

Nonresidential Bldgs starts in 2022 posted the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021. Nonres Bldgs new starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%. Office is up 33% (datacenters), Healthcare up 23%, Comm/Rtl up 30% (warehouses). Warehouse stats have slowed and will hold Comm/Rtl down the next two years. Nonresidential buildings starts in 2023 decline in most markets, but 2023 will still be the 2nd highest year for total Nonres Bldgs starts.

Non-building starts increased more than 100% in July 2022. The 2nd half 2022 was up 50% over 1st half 2022. For 2022, Highway is up 25%, Transportation up 45%, Power up 30% and Public Works up 15%. Starts for 2023 are forecast up 15%. For 2023, every market is forecast up double digits.

Current $ Spending, Inflation and Volume

SEE Construction Inflation 2023

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). Inflation adds nothing to volume growth. The following table shows spending, inflation and volume (spending without inflation) for each year. All $ are current to the year stated. The values in this table are not indexed to a constant value year. This simply shows business volume in any given year is not as high as spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. In 2022, Nonresidential buildings inflation was 11.9%, so business volume was 11.9% less than spending, or less than revenue. Residential volume was 15.5% less then spending.

SPENDING TOTAL CURRENT $

VOLUME CURRENT $ = SPENDING MINUS INFLATION

CONSTANT $ = VOLUME OVER TIME

Overall Construction Spending is up 25% in the 38 months since the onset of the pandemic, but, during that same period inflation increased 31%. After adjusting for 31% inflation, constant $ volume is down 4%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

NONRESIDENTIAL SPENDING (CURRENT $) AND VOLUME (CONSTANT $)

Nonresidential Buildings spending in 2023 is forecast at $660 billion, an increase of 26.2%, or $137 billion.

In 2022 we realized the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021.

The AIA Consensus Construction Forecast, December 2022 predicts only a 5.8% increase in spending for nonresidential buildings in 2023. My beginning of year forecast for comparison was 15.8%. My current forecast is +26.2%. The current year-to-date spending through April is up 30%.

We began the year with record new starts indicating an increasing spending rate. The monthly rate of spending is up 12 of the last 14 months, has increased for 6 consecutive months and is up 20% in the last 6 months. The rate of spending is predicted to increase 10 out of 12 months in 2023, a total increase of 11% over the year. Barring any unforeseen negative occurrence, the trajectory in the rate of spending is increasing.

Year-to-date nonresidential buildings spending for Apr is up 30%. This is driven by Manufacturing, up 84% ytd, but also supported by Lodging up 40% ytd and Commercial/Retail up 23% ytd. Every nonresidential building market except Public Safety (up only 8%) is up greater than 10% ytd.

Nonresidential buildings spending fell 17% from March 2020 to Sept 2021, then increased 48% from Sept 2021 to Apr 2023. Currently, as of Apr 2023, spending is 24% higher than the pre-pandemic peak in Feb 2020. But nonresidential buildings inflation over that same 36 months increased 27%. Business volume in constant $ actually fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in business volume has increased 31%, but that still leaves volume nearly 2% lower than the pre-pandemic high.

Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year for two years. Non-building Infrastructure will post the 1st year of sizable gains since 2019, forecast at $418bil, up 13.5% in 2023. In 2022, Highway and Public Utilities posted strong gains of 9.1% and 16.6%, but those gains were offset by a 8.7% decline in Power. For 2023, Highway and Transportation recorded the strongest starts in five years. All markets post spending gains in 2023, with Highway up 26%, Transportation up 6% and Public Utilities up 18%.

Non-building Infrastructure spending is up 6% since Feb 2020. After adjusting for 27% inflation, constant business volume is down 16%.

RESIDENTIAL SPENDING SF-MF-RENO CURRENT $ AND CONSTANT $

Residential starts are forecast down or flat in 2022 and 2023. Spending grew 44% in the last 2yrs, but inflation was 30% of that 44%. With no growth in starts forecast for 22-23, spending will struggle to keep up with inflation. Residential spending is forecast to fall 8% in 2023. Most of the decline is single family. Single family is down 24% over 12 consecutive down months. Multifamily is up 24% over the same 12 months. But, it’s not an even swap. There’s 3x more spending in SF than in MF. Renovations gained 25% in 2022 but spending varies +/- 10% throughout the year. Midyear there is potential for 6 consecutive down months that could send residential spending down another 7% before year end.

DOES VOLUME OF WORK SUPPORT JOBS GROWTH? or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019.

Nonresidential Buildings spending in 2023 is forecast at $660 billion, an increase of 26.2%, or an increase of $137 billion in 2023. Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year each year.

Normally, it takes 5000 jobs to put-in-place $1 billion in one year. So an add of $100 billion in 2024 would need 500,000 new jobs. 2023 would need 750,000 new jobs.

If we were to grow the labor force to meet the newly identified workload added from new starts, we would need to double the prior maximum rate of construction jobs growth. Normal growth is about 250,000 jobs per year and maximum prior growth is about 400,000. The workload discussed above would require 750,000 + 500,000 new jobs back to back. That’s an expansion of the industry by 15%, in an industry that normally grows 3%/yr. This industry can’t grow that fast. (Which means I need to account for over-capacity growth as a potential reduction in future forecast. You can’t increase spending that fast if you can’t expand the industry that fast).

My first thoughts were, Jobs may not be able to increase fast enough to put-in-place the forecast spending. This impediment needs to be accounted for and could reduce overall construction spending forecast over the next two years. The most likely markets where a reduction would occur are Manufacturing, Highway, Commercial/Retail and Office.

However this is what happened the past year. In the last 12 months, Mar’22 to Mar’23, nonres bldgs jobs are up 3.5%. Nonres Bldgs spending is up 21%, but after ~7% inflation, volume of nonres bldgs workload is up 14%. So, we have a 3.5% increase in jobs to accomodate a 14% increase in volume.

The last year has shown a huge increase in the volume of nonres bldgs work, without an equal increase in jobs. This shows the excess nonres bldgs jobs for the past three years is now absorbing new workload, (a 3.5% increase in jobs to accomodate a 14% increase in volume), without a cry of jobs shortages.

SEE more discussion on Volume and Jobs

here 2023 Construction Volume Growth

and here Infrastructure Construction Expansion – Not So Fast

Construction Data Briefs APR 2023

Construction is booming. Nonresidential buildings is leading growth. For the first two months of the year, total construction spending year-to-date (ytd) is up 5.9%, but nonresidential buildings spending is up 23% ytd, the fastest rate of nonres bldgs growth in over 20 years. Nonresidential buildings annual rate of spending has increased 19% in the last six months. Nonbuilding spending ytd is up 8%. Nonbuilding annual rate of spending increased 10% in the last four months. Residential spending peaked in March 2022. Since then the annual rate of residential spending has dropped 11%.

Total Construction Spending in 2023 is now forecast to reach $1,894 billion, an increase of 5.3% over 2022.

Nonresidential Buildings spending in 2023 is now forecast at $629 billion, an increase of 20.3% over 2022.

STARTS

The rate of construction spending in 2023 will be influenced predominantly by a 40% increase in new nonresidential building starts in 2022. In recent years, new nonres bldgs starts averaged $300 billion/year. In the 2nd half of 2022, starts averaged over $500 billion/year. Many of those projects will have peak spending in 2023. Some will occur in 2024.

Residential construction (Dodge) starts posted the five highest months ever all in the 1st 6 months of 2022. In the second half of 2022, residential starts fell 15%. In Jan and Feb 2023, starts dropped another 20% below 2nd half 2022. Starts are now down 25% in 12 months.

Nonresidential Bldgs starts in 2022 posted the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021. Nonres Bldgs new starts in the 2nd half 2022, averaged 67% higher than any other 6mo period in history.

Growth in Manufacturing construction starts for 2022 far surpasses growth in any other market, up over 150%. Office is up 36% (datacenters), Healthcare up 17%, Comm/Rtl up 23% (warehouses).

Non-building starts increased more than 100% in July 2022. The 2nd half 2022 was up 50% over 1st half 2022. Starts for 2023 are forecast up 15%. For 2022, Highway up 25%, Transportation up 45%, Power up 30% and Public Works up 15%.

SPENDING FORECAST

Construction Spending through February 2023 is up 5.9% ytd. Spending is forecast to finish 2023 up 5.3%.

While residential falls back nearly 7% in 2023, Nonresidential buildings is leading with a forecast of 20% spending growth.

Total construction spending for 2023 is on track to increase +5.3%. Residential -6.7%, Nonres Bldgs +20.3%, Nonbldg +13.5%.

SPENDING BY SECTOR CURRENT $ AND INFLATION ADJUSTED CONSTANT $

In 2023, it’s Nonresidential Buildings leading growth. In 2024, it will be Nonbuilding Infrastructure leading spending growth. Both are expected to grow greater than the inflation index.

See also Construction Spending Outlook – Feb 2023

Current $ Spending, Inflation and Volume SEE Construction Inflation 2023

Inflation adjusted volume is spending minus inflation, or to be more accurate, spending divided by (1+inflation). The following table shows spending, inflation and volume (spending without inflation) for each year. All $ are current to the year stated. This table shows that inflation adds nothing to volume growth. All values in this table are current to the year stated. The values in this table are not indexed to a constant value year. This is an attempt to show that business volume in any given year is not as high as spending would indicate. When inflation is positive, volume is always less than spending by the amount attributed to inflation.

Spending during the year is the value of business volume plus the inflation on that volume. When inflation is 12%, volume plus 12% = total spending. Revenue is generally measured by spending put-in-place during the year. In 2022, Nonresidential buildings business volume was 12.2% less than spending, or less than revenue. Residential volume was 15.7% less then spending.

SPENDING TOTAL CURRENT $ AND INFLATION ADJUSTED CONSTANT $

Overall Construction Spending is up 22% in the 36 months since the onset of the pandemic, but, during that same period inflation increased 31%. After adjusting for 31% inflation, constant $ volume is down 7%. So, while the plot on the left shows three years of increases in spending, the actual change in business volume is still down and has not yet returned to the pre-pandemic peak in Feb-Mar 2020.

NONRESIDENTIAL SPENDING (CURRENT $) AND VOLUME (CONSTANT $)

Nonresidential Buildings spending in 2023 is forecast at $629 billion, an increase of 20.3%, or $100 billion and add another $50 billion in 2024.

In 2022 we realized the largest ever one-year increase in new nonresidential buildings construction starts, up 40%. Starts were also up 15% in 2021.

The AIA Consensus Construction Forecast, December 2022 predicts only a 5.8% increase in spending for nonresidential buildings in 2023. My beginning of year forecast for comparison was 15.8%. My current forecast is +20.3%.

We began the year with record new starts indicating an increasing spending rate. The monthly rate of spending is up 12 of the last 14 months, has increased for 6 consecutive months and is up 20% in the last 6 months. The rate of spending is predicted to increase 10 out of 12 months in 2023, a total increase of 11% over the year. Barring any unforeseen negative occurrence, the trajectory in the rate of spending is increasing.

Year-to-date nonresidential buildings spending for Jan+Feb is up 23%. This is driven by Manufacturing, up 53% ytd, but also supported by Lodging up 38% ytd and Commercial/Retail up 23% ytd. Every nonresidential building market except Educational (up only 8%) is up greater than 10% ytd.

Nonresidential buildings spending fell 17% from March 2020 to Sept 2021, then increased 36% from Sept 2021 to Feb 2023. Currently, as of Feb 2023, spending is 14% higher than the pre-pandemic peak in Feb 2020. But nonresidential buildings inflation over that same 36 months increased 26%. Business volume in constant $ actually fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in business volume has increased 18%, but that still leaves volume nearly 10% lower than the pre-pandemic high.

Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year for two years. Non-building Infrastructure will post the 1st year of sizable gains since 2019, forecast at $415bil, up 13.5% in 2023. In 2022, Highway and Public Utilities posted strong gains of 9.1% and 16.6%, but those gains were offset by a 8.7% decline in Power. For 2023, Highway and Transportation recorded the strongest starts in five years. All markets post spending gains in 2023, with Highway up 26%, Transportation up 9% and Public Utilities up 8%.

Non-building Infrastructure spending is up 4% in 36 months since Feb 2020. After adjusting for 26% inflation, constant business volume is down 17%.

RESIDENTIAL SPENDING SF-MF-RENO CURRENT $ AND CONSTANT $

Residential starts are forecast down or flat in 2022 and 2023. Spending grew 44% in the last 2yrs, but inflation was 30% of that 44%. With no growth in starts forecast for 22-23, spending will struggle to keep up with inflation. Residential spending is forecast to fall 7% in 2023. Most of the decline is single family. Single family is down a total of 23% over 10 consecutive months. Multifamily is up 22% over 13 consecutive months. Renovations gained 25% in 2022 but spending varies +/- 10% throughout the year. Midyear there is potential for 6 consecutive down months in residential spending.

DOES VOLUME OF WORK SUPPORT JOBS GROWTH? or, Can jobs growth support volume of work?

Jobs should track volume, not spending growth. Volume = spending minus inflation. Volume is down, although now increasing, while jobs are up. Nonres Bldgs volume, in constant $, fell 25% from Feb 2020 to Sept 2021, and hit a secondary low in mid-2022. Since then, the actual change in nonres bldgs volume has increased 18%. Yet nonres bldgs jobs increased only 3.5%. That still leaves volume nearly 10% lower than the pre-pandemic high. If the same production levels ($ put-in-place per worker) as 2019 were to be regained, theoretically, nonresidential volume would need to increase 10% with no increase in nonresidential jobs. For now, productivity is well below that of 2019.

Nonresidential Buildings spending in 2023 is forecast at $629 billion, an increase of 20.3%, or $100 billion and another $50 billion in 2024. Non-building Infrastructure spending for 2023-24 is forecast up 25%, up $50 billion/year each year.

This growth amounts to an increase of $150 billion in 2023 and $100 billion in 2024. It takes 5000 jobs to put-in-place $1 billion. So $100 billion in 2024 would need 500,000 new jobs. 2023 would need 750,000 new jobs.

If we were to grow the labor force to meet the newly identified workload added from new starts, we would need to double the prior maximum rate of construction jobs growth. Normal growth is about 250,000 jobs per year and maximum prior growth is about 400,000. The workload discussed above would require 750,000 + 500,000 new jobs back to back. That’s an expansion of the industry by 15%, in an industry that normally grows 3%/yr. This industry can’t grow that fast. (Which means I need to account for over-capacity growth as a potential reduction in future forecast. You can’t increase spending that fast if you can’t expand the industry that fast).

4-16-23 update- Everything forecast above is predicated on the normal cash flow of forecast new starts. As of yet, this forecast has not been reduced to reflect the inability of the industry to expand jobs fast enough to absorb the volume of spending generated from forecast starts. Whether new starts get canceled or delayed, spending needs to be reduced annually for at least the next two years simply because jobs cannot increase fast enough to put-in-place the forecast spending. This impediment needs to be accounted for and could reduce overall construction spending forecast by approximately $40-$60 billion in 2023 and $25-$40 billion in 2024. The most likely markets where a reduction would occur are Manufacturing, Highway, Commercial/Retail and Office.