Home » Behind the Headlines (Page 13)

Category Archives: Behind the Headlines

Is Infrastructure Construction Spending Near All-Time Lows?

10-10-17

Is Infrastructure construction spending near all-time lows? This question is raised because I saw comments to this affect recently posted on a major national construction professional organization twitter feed.

First, this raises several other questions:

- Exactly what construction markets are being referenced as infrastructure?

- Does this reference include public work only, or both public and private?

- Are educational and health care being included as infrastructure?

- Does this reference constant inflation adjusted spending?

The construction markets typically referred to as infrastructure, in order of largest to least volume, include; Power, Highway, Transportation, Sewage/Waste Water, Communications, Water Supply and Conservation. Sometimes also considered are Educational (3rd after Highway), Healthcare (after Transportation) and Public Safety (2nd smallest).

If only public work is included, everything changes. Most (90%+) of Power spending is private, so it represents less than 3% of public work. The largest contributors in this case are: Highway (32% of public work), Educational (25%), Transportation (11%), Sewage (8%) and Water Supply (4%). No other market is greater than 3% of public work.

And finally, is the reference to current dollars as originally spent within each year, or to constant inflation adjusted dollars, adjusting all historical expenditures to constant 2017 dollars? Any comparison to determine if real growth has occurred should be in constant dollars, in this case all adjusted to 2017.

Typical infrastructure, not including educational, healthcare or public safety, but including all public and private sector work produces this result:

However, the most likely reference is to typical public infrastructure, not including educational, healthcare or public safety. This scenario includes only the public sector work of typical infrastructure and eliminates private spending. This eliminates 90%+ of all power work, 30% of transportation and 100% of communications, in total, more than $100 billion in current dollars. This is the result:

In both instances, the lows, whether using current or constant dollars, occurred between 1993 and 2004. The highs are recent, all occurring from 2007 to 2016. 2017 spending dropped somewhat from 2016, but this is still prone to revision, which is always up.

To answer the question, Is Infrastructure construction spending near all-time lows? NO! Infrastructure construction spending is not at or even near all-time lows. Public sector infrastructure is lower than All infrastructure, but All infrastructure is not even near recent lows. It is near all-time highs!

Infrastructure construction spending in June-August dropped to the lowest since November 2014. However, this was not unexpected. Cash flow models of infrastructure starts from the last several years show monthly spending dips and peaks. Current dips in spending are being caused by uneven project closeouts from several years ago. The actual current backlog is at an all-time high and spending will follow the expected cash flow.

Infrastructure starting backlog hit a new all-time high in 2017 and will again in 2018. Public Infrastructure new starts reached all-time highs in 2013 and 2015 and are on track to go higher in 2017. 80% of infrastructure spending within the year comes from backlog at the start of the year and that backlog may be comprised of jobs one, two, three and even four years old.

Infrastructure spending in 2017, although down slightly from the all-time high reached in 2015 and nearly equaled in 2016, will reach a new high in 2018.

(This analysis does not include any spending projections from an infrastructure investment bill).

Highway spending is currently benefiting from projects that started in 2015 but that have unusually high value and long duration. They contribute spending well into 2018 beyond the duration that typical projects have ended.

Transportation Terminal starts in the first three months of 2017 were more than three times higher than any three-month period in the previous five years. However, 2017 spending is still affected by uneven starts from two to three years ago, holding down gains in the 2nd half. Transportation will show only a 1% gain in 2017 but produces double digit gains in 2018.

Infrastructure construction spending is near all-time HIGHS and has been for the last several years. That is not meant to indicate there is no need for infrastructure investment. I think the need is well established, particularly for public infrastructure. However, I’ve been writing about infrastructure for more than a year, pointing out the level of activity in this sector and the difficulty that will arise when we try to increase work volumes. The approach to adding new work and the discussions surrounding this approach should reference accurate data, and that should include an accurate representation of current workload and future ability to absorb more work.

For much more in-depth related to infrastructure construction see this post Infrastructure Spending & Jobs

So, About Those Posts “construction spending declines…”

You know those articles you’ve been seeing, “Worst year for construction spending since 2010″, well there’s some truth to that, BUT

2017 is the 6th year of the expansion. It has slowed, but… Here comes the BUT!

10-4-17 – Construction numbers are at all-time highs! Slowing or not, activity is very strong. Looking behind the headlines, here’s what we see;

Residential construction spending is slowing the most, from +11% in 2017 to only +2% in 2018 after six years averaging 13%/yr. Nonresidential buildings spending this year just kept up with the rate of inflation (4%), none-the-less, it’s at record highs. It doubles that rate of growth to 8% in 2018. Non-building infrastructure, down 2% in 2017, next year expect growth of 10%+, coming from long duration jobs.

The real performance numbers in Infrastructure are completely hidden. Spending was near flat for three years. But during that time, contrary to every other sector which experienced inflation of 15%, Non-building Infrastructure experienced deflation of 7%. (Gee, didn’t I read somewhere that activity within a sector is a primary driver of inflation?) Anyway, flat spending means volume really increased by 7% during that time. Spending by itself never tells the whole story!

There were some expected dips in spending recently, Manufacturing, Power, Highway, and there will be more in early 2018. BUT, there are also expected boosts in spending, Office, Commercial/Retail. Some of these already have matched up with the forecast, and there are more to come in 2018, Power, Transportation.

All Nonresidential Backlog is at record highs.

Buildings and Infrastructure will both hit new all-time highs for starting backlog in 2017 and again in 2018. For four years, from 2010 to 2013, all nonresidential backlog remained fairly constant. Since then, backlog for infrastructure is up 30% and for buildings it’s up 60%. (75% to 80% of nonresidential spending within the year comes from backlog at the start of the year. For residential, 70% of spending comes from new starts within the year.) Buildings will hit spending records in both 2017 and 2018. Infrastructure spending will hit a new high in 2018.

Ignoring for the moment that comparing any month to the same month last year can be grossly misleading as to the direction the markets are headed (for reasons explained in other recent posts on this blog), 2017 total spending growth is the lowest % yr/yr growth since 2011 (not 2010). Does that make it “worst”?

Spending will gain +5.6% in 2017, the least gain in six years. Last year was +6.5%, 2013 was +6.6%. The average for the last six years is +8%. So 2017 is the worst. Pretty damn good worst!

Why Many Get Construction Spending Wrong

9-2-17

Construction spending for July was released yesterday, posted at $1.211 trillion, down 0.6% from an upwardly revised June. This is the sixth time in seven months of 2017 in which the initial release for monthly spending is down from the previous month. This is actually a very normal occurrence.

The 1st release of monthly spending vs the previous month has been down 15 times in the last 21 months. This may be what leads some analysts and pundits to write that construction spending is heading to recession. Nothing could be further from the truth!

For the last 21 months, in which 15 first reports showed a decline vs the previous month, 18 of the monthly values were revised up. After revisions, only five months remain down vs the previous month. Seven months are still pending further revisions, almost always up.

Construction spending is highly prone to revisions. After the 1st release it is revised each of the next two months and once again the following year. Spending has been revised UP 48 of the last 52 months, 92% of the time. The average upward revision for the last five years is +3.2%/month. In the last 52 months the upward revision averaged 3.7%.

Construction spending revisions after first release of data:

- Total Construction UP 48 of last 52 months, avg 3.7%/mo

- Total Construction UP 16 of last 18 months, avg 2.6%/mo

- Residential revised UP 29 of last 30 months, avg 7.0%/mo

- Residential UP 17 of 18 avg 3.8%/mo

- Commercial UP 17 of 18 avg 6.0%

- Educational UP 14 of 18 avg 2.2%

- Power UP 18 of 18 avg 12.0%

- Commercial/Retail May +3.9%, June +2.6%

- Lodging May +3.8%, June +1.1%

- Educational May +2.8%, June +3.6%

- Transportation May +3.6%, June +2.3%

January through May values have already been adjusted twice in these reports. June has one more revision next month and July gets revised twice. It’s quite likely both June and July values go up. All 2017 months still get one more revision next year when the May data is released (July 1). The post-annual total revision for the last 15 mo averages +2%, close to the long term average. First release values are ALWAYS being compared to previous values that have already been revised, 92% of the time UP. So first release values almost always understate performance. Since July 1st 2017, all 2016 monthly values have been revised three times so monthly releases this year starting with May have the most understated initial % comparison year-over-year because an un-adjusted release is being compared to a 3x-adjusted value.

When judging performance of monthly spending, it is reasonable to predict spending will get revised UP from the first release. Therefore, the most immediate monthly analysis you read, if based on initial release, 92% of the time is under-stating the performance of construction spending.

Construction spending forecasting not only must rely on performance year-to-date, but also on predictive analysis of how much revision there may be to current values. As an estimate, if monthly spending is initially posted as 2% down, 18/mo.averages indicate it will end up at least +2.6% higher after revisions, so would be a positive 0.6% growth month.

A few closing points:

Construction Spending 1st release for July is $1.211 trillion. Expect this to be revised up. YTD Jan-Jun revisions are UP 1.8%. Historical revisions last 5 years predict the final July value will be up 3% from the 1st release.

Construction Spending AVG 2017 Jan-Jul YTD ($1.226tr) has reached an all-time high. We’ve now posted three consecutive quarters of spending all averaging above $1.220 trillion. Spending is on track to total $1.250 trillion for 2017, up 5.5% over 2016.

Construction Spending avg YTD = $1.226tr, is up YTD 4.7% with revisions through May. Without revisions, the 1st releases would have averaged only $1.208tr, up only 3%.

Commercial Retail, Office and Residential lead 2017 construction spending gains, all over 10%. Office spending is at a record high.

After 5 months of stalled construction jobs growth, August added 28,000 jobs and put 2017 growth back on track towards 250,000 jobs. YTD is up 135,000. March thru July added only 19,000 construction jobs. Jan+Feb added 88,000, ending a six-month period, Sep16-Feb17, that added 167,000 jobs.

Harvey related jobs will be muted by jobs lost, I suspect for at least two months. There will be a period of slack records that will take some time to see the real effects of Harvey.

Further reading on this topic

June Construction Spending – What’s Up, or Down?

June Construction Spending – What’s Up, or Down?

8-2-17

Here’s some headlines this month on the June Construction Spending release: Plummets in June; Largest one month drop in 15 years; Clearly Decelerating; US Construction Spending Just Collapsed; and my personal favorite, Construction Spending Plummets to Economic Crisis Levels.

Frankly, I have much more trust in my data than to suggest we are at crisis levels.

In the latest Census construction spending report, June spending dropped 1.3% from May, but May was revised down -0.7%. The consensus of economists predicted spending would be up +0.5% (from the original May value), so the data posted is actually 2.5% below consensus estimates.

I expected May to get revised up 0.6% and the initial June release would be flat vs the revised May value. So the actual came in 2.6% below my expectation.

June construction spending was posted at $1.205 trillion, down 1.3% from May and down 2.7% from March. With the revised data, the May Year-to-date (YTD) vs 2016 was only +5.5% (not +6.1% as initially reported) and for June it’s now +4.8%.

My opinion is this preliminary June value appears suspect. This is sort of like driving a well maintained car that gets 30 mpg and all of a sudden the gauges indicate 20 mpg for the latest tankful of gas. Although the road may be a little bumpy, there does not seem to be any serious mechanical problems, so we have to ask, why did gas mileage drop so much?

The April decline and the Apr-May-June decline are the single largest monthly and 3-month total non-recessionary declines on record. We would need to look at recession data to find similar declines. Spending drops like this just don’t normally occur, especially when cash flow patterns from starts predict 4% growth during the 3-month period. That’s a 6.7% miss over 3 months.

The largest declines in the June Seasonally Adjusted Annual Rate (SAAR) construction spending were Highway and Educational, together 60% of the total monthly decline. (There are other markets with greater mo/mo% declines, however most of those markets have a very small share of the total spending so don’t amount to much). Almost all of the largest declines are public work. In fact, the initial June release shows every public market declined. However, all ten other public markets together don’t equal half of the declines generated by these two major markets. Furthermore, for the past 3 months Highway spending shows a decline of 12.5%, and Educational spending is down 7.6% in 4 months. A review of data back to 2005 shows neither of these markets have ever had any periods where they’ve experienced declines of this magnitude. These would be record declines if they stick. Market trend data simply is not indicating to expect record declines at this time. So I consider these data suspect.

Construction spending initial release is always preliminary data. The June value, released August 1st, will be revised in each of the next two reports and then once again next year when all 2017 data is reviewed. The average revision to June spending data over the last 4 years (similar growth years to current expectations) is +4.8%.

There are three more opportunities for revision to the June data and two more to the May data. We will have a much better idea what really happened on October 1st, but we won’t know the final outcome until the final 2017 revision on July 1, 2018.

So, what data seems to indicate a trend contrary to current declines? The last 12 months of Dodge Data new starts for nonresidential buildings are the highest since 2008 and they peaked from August to October. Residential starts, at their highest since 2006, peaked from December’16 to March’17. Backlog is at an all-time high. There is no indication here that spending will plummet.

Also, one month of Educational or Highway new starts each generate about $250 to $300 million per month in spending, for the next 24 to 36 months. Normally, with some variation, we have the current month of new starts coming into backlog and one month of old starts ending. Since starts have been normal or high recently, the spending declines posted in June would imply that we’ve lost two to three months of backlog from current spending. Again, there are no indications that we have an extreme imbalance or a canceling of backlog.

Most of the nonresidential spending occurring right now is from projects that started between mid 2015 and the end of 2016. Nonresidential buildings projects that started in 2015 or earlier still make up one third of the spending in the 1st half of 2017. Non-building infrastructure projects that started in 2015 and earlier contributed 50% of spending in the 1st half of 2017. Residential projects have shorter duration so most spending is from more recent jobs, but we hit a 10 year peak in new residential starts just a few months ago. All sectors have fluctuations in spending and have down months but the index of long term cash flows out to completion shows normal backlog and spending growth across every sector.

I’m inclined to expect substantial upward revisions to June construction spending in the next two releases. No other data supports a big June drop.

Keep in mind, current construction spending is always being compared to previous months revised spending and growth is almost always being understated. Monthly spending has been revised UP 45 times in the last 48 months. All previous months and all 2016 data have been revised several times. The average revision to ALL spending data over the last 4 years is +3.9%/month. Since January 2016, the average revision is +3.0%/month. The average revision to June spending data over the last 4 years is +4.8%.

June data is un-adjusted preliminary data. Many of the news articles declaring construction spending was a miss are based on this preliminary data which very often gets revised away in following months. For example, The 1st 6 months of 2016 have already been revised up, three times each, by a total of 2.5%. All the months YTD in 2017 still have pending revisions. June 2017 vs June 2016 shows a percent growth of only +1.6%, but June 2016 has already been revised up by 4.7% and June 2017 has not yet been revised at all. June 2017 has a 90% chance of being revised up.

I predict after all the revision are in we will see that June spending did not drop to a low of $1.205 trillion, but that it was closer to $1.250 trillion.

Construction Spending May 2017 – Behind The Headlines

7-6-17 Construction Spending May 2017 – Behind The Headlines

See Also Construction Spending Summary 7-11-17

Headline – Construction Spending for May came in flat compared to April, up 4.5% vs May 2016.

In this latest May report, April spending was revised up by 1% and May 2016 was revised up by 3%. The average revision since Jan 2016 is 3%/month. May 2017 will be revised in each of the next two reports and again with the May report issued in July 2018.

Current unadjusted construction spending is always being compared to previous months revised spending and growth is almost always being understated. Spending has been revised UP 45 times in the last 4 years.

In 2016, the 1st report indicated monthly spending declined 8 times from the previous month. After revisions, spending declined only twice from the previous month. Most MSM articles declaring construction spending was a miss are revised away in following months.

Nonresidential Construction Spending Remains Stagnant in May.

I’ve said this before many times, spending predictions are best tracked based on cash flows from all projects that have started. This is not simply tracking total backlog, nor is it tracking new construction starts. New starts (new backlog) represent only 20% to 25% of total spending within the year. Most spending comes from projects that started in previous years.

Big monthly changes in spending come from unusual fluctuations in starts. Very large projects ending (spending ending), compared to new projects starting, would cause a monthly drop in spending. The reverse would cause an increase. If a record volume month of construction projects that started two or three years ago are now reaching completion, and new starts today are experiencing normal growth not at record levels, then spending will most likely decline temporarily. Most monthly construction spending predictions are predetermined months ago.

Also, Nonresidential construction is comprised of two very different sectors, nonresidential buildings and non-building infrastructure. Infrastructure is quite erratic while buildings spending has been climbing at a steady strong rate for several years. Buildings spending is up 2% from Q2’16 and up 6% YOY. In the 2nd half 2017 YOY spending is expected to reach 8%.

Most infrastructure projects that started in 2015 and 2016 are still ongoing so do not effect much change in current monthly spending. It is projects from late 2014/early 2015 that are finishing that are resulting in the largest share of current spending drops. Worthy of note is that non-building infrastructure spending just experienced two years of record highs, so even though spending is down slightly we will still see 2017 finish near record highs.

Construction Companies Continue to Face Labor Shortage Challenges

Construction Spending for the last 24 months increased +13%, but after inflation actual volume during that period increased only +5.5%. Construction jobs output, (jobs x hours worked) for that same period increased +7.6%. Overall, jobs output is exceeding the growth in volume put-in-place. Most of this is being driven by imbalances in Nonresidential Buildings, for which jobs output grew by 7% in two years but volume growth measured only 2% after inflation.

Why is it that jobs output is growing faster than construction volume? Could it be that shortages are localized, not as widespread as thought? Or perhaps it’s that contractors can’t get skilled workers, so they are hiring more workers with less skill? Maybe contractors anticipate growth, so they are hiring more now to prepare for the future? Whatever the case, jobs are growing faster than construction volume and that is not what should be expected in a labor shortage.

Are contractor’s responses to survey questions about filling job positions based on an anticipated need to staff up to meet revenue growth? If so, that is a major miscalculation to determine staffing needs. This is not as far-fetched as you might think. I’ve talked with numerous contractors in the past who were doing this. As I tried to explain in several previous articles, growth in revenue (or construction spending) doesn’t address how much of the growth is due to inflation. Right now, in fact for the last 24 months, the largest portion of spending growth is inflation, not real volume growth.

If you are hiring to match your revenue growth, you are part of the reason jobs are growing faster than volume. INFLATION!

See also Construction Jobs Growing Faster Than Volume

Is there a Residential Construction Spending slowdown? If so, how significant?

YTD Residential Construction spending for the 1st 5 months 2017 is up 12.2% from 1st 5 months 2016. YTD has been above 12% since January.

Average spending for the last three months is up 4.0% from the average in Q4 2016. That’s a ~10% annual rate of growth. Starts cash flows are indicting flat spending for the next few months but then accelerated spending from late Q3 into the end of the year. Current projected spending for 2017 is $523 billion, +10.5% higher than 2016.

May vs April residential construction spending shows a 0.5% decline. However, April has been revised up once and May has not yet been revised. All months are revised twice after the first release of data. The average revision (to residential data) for the last 16 months is up 4%, the average revision for the last 28 months is up 7%. All revisions for the last 28 months were up. After revisions, there were only two monthly declines in the last 28 months, and both of those were slight.

If new starts collapse to show no gains for the remainder of the year, then based on starts already in backlog and reduced starts for the remainder of the year, spending would be reduced to $513 billion. That’s still 8.5% higher than 2016. Of course, this would be an extremely unlikely scenario. The last time residential construction starts declined for three or more consecutive months was 2010, and the last time there were no gains for six or more months was 2008.

Construction Spending Almost Always Revised UP.

revised 6-5-17

April construction spending 1st release was issued on 6-1-17 by U. S. Census. The initial release shows April DOWN 1.4% from March, a value many news sources have reported as “construction spending is slowing”, “one of the largest drops in six years”, “an unexpected slump”, “spending continued to demonstrate substantial weakness.” I’ve written about this numerous times but it’s worth repeating again. Construction spending almost always gets revised UP in the following month after 1st release. Average revision so far in 2017 is +1.8% and for the last 18 months +1.3%. Monthly construction spending has now been revised UP every one of the last 43 consecutive months.

5-1-17

Headlines of construction spending declines are almost always premature.

Construction spending is almost always a miss when first posted, until it gets revised up in the following monthly report to show is it almost never a miss.

The 1st release of March construction spending came out May 1. This initial release indicates a decline of 0.2% from February. Keep in mind, all 12 monthly reports in 2016 were subsequently revised up. Nine times in the previous 14 months, the 1st report of spending was down vs the prior month. After revisions, only three months were down compared to the prior month.

In the last 48 months, the 1st report of spending was down vs the prior month 20 times. 47 times the initial value was revised UP. After revisions, only nine months were down compared to the prior month.

Monthly construction spending has been revised UP every one of the last 42 consecutive months.

The 1st release of spending is almost always being compared to a previous month and a previous year that have been revised up. Upward revisions to monthly construction spending in 2016 have been as high as 3.4% and for the year average 1.1%/mo. So, a 0.2% mo/mo decline s probably not a decline at all after revision, and there will be a revision, most likely UP.

After spending is first published it is revised in each of the two following months. Then all the values for the entire year are revised with the May data release the following year.

Some specific markets construction spending revised after 1st release (2016 data). These markets represent almost 50% of nonresidential data.

- Office revised UP 8 of 12 months (average of all 12 +1.1%)

- Commercial UP 9 of 12 avg 1.8%

- Educational UP 10 of 12 avg 1.8%

- Power UP 12 of 12 avg 3.6%

Don’t Like YOY Construction Spending?

4-4-17

Don’t like the year-over-year (yoy) Construction Spending percent change? Just wait until next month. It’s going to be worse!

The latest year over year construction spending through February is up 3.0% compared to Feb 2016.

March data yoy comparison is going to come in at or under 2%. But construction spending is increasing!

It just so happens March 2016 was an outstanding month. That lowers the yoy percent change, but March 2016 is the anomaly.

Yoy doesn’t indicate if this year is doing poorly or if that month last year was a great month.

Yoy doesn’t indicate what direction current spending is taking.

Yoy compares an unadjusted 2017 value to an upwardly adjusted 2016 value.

For the last 40 consecutive months the construction spending value has been revise UP. But not until after major news media gets to report that yoy construction spending did not meet expectations.

For the last 18 months the average adjustment to construction spending after the 1st release of data +2%.

The yoy and mo/mo percentage change in the 1st release was understated every time.

For Q1 2017, yoy values are expected to range between 1.5% and 3.5%. 2017 is expected to finish the year up 6% over 2016.

Infrastructure Spending & Jobs

3-22-17

This is a summary of the main points on Infrastructure from several recent articles. Those articles detail current market conditions, growth already in backlog and future growth potential. The articles (linked here) are:

- Calls for Infrastructure Problematic

- Infrastructure & Public Construction Spending

- Infrastructure – Ramping Up to Add $1 trillion

- Infrastructure Outlook 2017 – Construction Spending

Non-building Infrastructure spending in 2016 will finish at $290 billion, down 1% from 2015. Negative drivers were Transportation, Sewage/Waste Disposal, Communications and Water Supply. However, Power and Highway/Bridge, 57% of all infrastructure, were both up. Spending based on projected cash flow from Dodge Data Starts predicted this drop.

- In 2017, Non-building Infrastructure, following two slightly down years, will increase by 4.4% to $304 billion, due to growth in the highway and transportation markets.

- Headlines point to a 6% decline in new infrastructure starts in 2017

- Starting backlog for 2017 increased 6% over 2016.

- The cash flow in 2017 from starting backlog will be up 10%.

Infrastructure currently has the highest amount of work in backlog in history. Starting backlog accounts for 80% of all spending within the year. Even with an anticipated decline in new starts in 2017, starting backlog for 2018 will still be at another new high. Spending from starting backlog is predicted to reach record levels in both 2017 and 2018.

- Total Construction spending for 2017 is more than $1.200 trillion.

- Infrastructure, public and private, is $300 billion, only 25% of total construction spending.

- Public is only 60% of all infrastructure, $180 billion, so 15% of total construction.

- Public Nonresidential Institutional Buildings referred to as infrastructure (Educ, HlthCr, Safety) adds another $95 billion, 8% of total construction.

The two largest markets contributing to public spending are highway/bridge (32%) and educational (25%), together accounting for 57% of all public spending. The next largest market, transportation, is only about 10% of public spending.

- Total Construction spending average constant $ growth post-recession is $50 billion/year. It exceeded $75 billion/year only once.

- Infrastructure, only 25% of total construction spending, increased by more than $25 billion in a single year only once. The average annual growth for the past 20 years (excluding recession yrs) is less than $10 billion/year.

- Public Infrastructure annual growth averages only $6 billion/year, has never exceeded $16 billion in a single year.

- Public Institutional Buildings annual growth averages only $6 billion/year, has never reached $20 billion.

Current backlog already accounts for 80% of all spending. Current spending growth from backlog (Public infrastructure + Institutional) is predicted to add $20 billion/year in work over the next two years. This will absorb some current jobs and create 100,000 to 150,000 new heavy engineering and nonresidential jobs.

For every $10 billion a year in added infrastructure spending, that also means adding about 40,000 new construction jobs per year.

Any infrastructure plan added, for the most part, needs to be considered as added on top of the current spending plan, $20bil/yr next two yrs, already at all time highs.

- Average growth in total construction jobs is about 270,000 jobs per year. The largest growth was 400,000 in 1999.

- Average post-recession growth in public infrastructure + institutional jobs is about 35,000 jobs per year. The best growth was 50,000 jobs/year.

Current data predicts public institutional and infrastructure spending and jobs growth, already above the long term average, is expected to increase slowly in 2018 but then by $20 billion/year for the next two years.

Adding $20 billion/year more in spending for an infrastructure expansion plan would push total public work to double record levels. It’s doable, but would be difficult to achieve and is probably not sustainable at that rate.

One limiting factor will be jobs growth. Also, the supply chain may not have the capacity to increase so rapidly, especially to think the industry could continue to expand at a historical rate of growth for years to come. In years past, expansion like this has led to rampant inflation within the industry.

Adding $100 billion in a single year to public infrastructure and institutional work is unrealistic. That is greater than the maximum level of growth for the entire construction industry. The portion of the industry we are dealing with here is less than 25% of the entire industry.

Adding $100 billion, a one third increase in annual spending for this sector, would require the distribution network surrounding the industry to expand equally as fast. It would need 300,000 to 400,000 new jobs filled in a year, in a sector that has at maximum grown 50,000 jobs in a year. That’s unrealistic.

The public infrastructure subset of the construction industry appears too small to accommodate an increase of $10 billion/year and 40,000 new jobs/year over current growth. When the potential projects pool is expanded to include public institutional buildings, that total pool may then accommodate an increase of $10 to $15 billion/year over normal growth.

Excessively rapid growth will only take volume and jobs away from normal growth, generally leads to rapid inflation and has a devastating effect when a massive program ends and all those jobs disappear.

Behind The Headlines – Construction Starts

3-21-17

Dodge released the Feb 2017 construction starts today. For the Jan and Feb reports, I think the most relevant piece of information in this report is that Jan and Feb 2016 values were revised up, in total by 15%. That alone has added 2% to total 2016 starts.

In the Dodge October Construction Outlook report, construction starts total for 2016 were predicted at $676 billion, and 2017 at +5%, or $713 billion. Revisions so far have increased 2016 actual to $692 billion. 2016 is on track to go above $700 billion, and at +5%, 2017 could reach $735 billion.

New 2017 starts are being compared to upwardly revised 2016 values. That understates 2017 performance. Dodge Data provides revised starts a month later and 12 months later. In every monthly release, the previous month is revised AND the last year’s year-to-date is revised. Dodge does incorporate other (minor) revisions at a later date, but the “12 month” revision to the previous year-to-date values captures the largest part of all revisions.

This February report includes revisions to the total 2016 YTD, Jan+Feb 2016. The 2017 values won’t get that equivalent “12 month” revision until next year. Therefore, Current year YTD values (not-yet-revised) are being compared to the previous year YTD revised values which has the affect of making current YTD growth appear lower than it should.

In the last 10 years the YTD revisions have always been up. Usually, most of the revisions occur to nonresidential buildings, about 5% to 6% per year, with only a 3% to 4% revision to infrastructure and only 2% to residential.

So far in 2017, year-to-date 2016 values for Jan+Feb have been revise up by 15%. That’s a 2% revision to the 2016 annual total. Already in just the first two months, on an annual basis, nonresidential buildings have been revised up 2%, non-building infrastructure up 4% and residential up 1.3%.

While the 2017 YTD value this month is noted as down 4% compared to last year, keep in mind last year’s value was just revised up by 15%. So, much of the reason 2017 is down is because 2016 values have had revisions applied and 2017 have not. To me, this latest report looks up.

Behind The Headlines – Construction Starts is not Spending

3-17-17

A major construction industry news source has a series of articles referencing Dodge Data New Construction Starts, listing the starts data, but then incorrectly refers to the data as construction spending and looks at the yr/yr trend in values to predict % change that construction spending will rise or fall. This is incorrect use of starts data and misrepresents how to use Dodge Data New Starts. The starts data, as it is being used, isn’t a valid indicator to get a spending projection in the next year.

New Starts for the year is the total value of project revenues that came under contract in that year. The values reported by Dodge are a sampling survey of about 50% to 60% of the industry. The percent change in values is very useful. The total dollar volume is not comparable to actual spending.

The entire value of a project is considered in backlog when the contract is signed. That’s a new start. Projects booked on or before December 2016 that still have work remaining to be completed are in backlog at the start of 2017. Simply referencing total new starts or backlog does not give an indication of spending within the next calendar year, particularly for infrastructure and residential. Projects, from start to completion, can have significantly different duration. Whereas a residential project may have a duration of 6 to 12 months, an office building could have a duration of 18 to 24 months and a billion dollar infrastructure project could have a duration of 3 to 4 years. So new starts within any given year could contribute spending spread out over several years.

Backlog at the start of 2017 could include revenues from projects that started last month or as long as several years ago. For a project that has a duration of several years, the amount in starting backlog at the beginning of 2017 is not the total amount recorded when that project started, but is the amount remaining to complete the project or the estimate to complete (ETC). And all of that ETC may not be spent in the year following when it started, dependent on the duration remaining to completion.

The only way to know how much of total starts or total backlog that will get spent in the current year and following years is to prepare an estimated cash flow from start to finish for all the projects that have started over the past few years. The sum of the amounts from all projects in each month gives total cash flow in that month, or monthly spending in that year. Spending in any given month could have input from projects over the last 36 months. That’s what shows the expected change in spending.

Construction Starts provide the values entering backlog each month. Except for residential, new project starts within the year contribute a much smaller percentage to total spending in the first year than all the backlog ETC on the books at the start of the year. New residential projects contribute the most to spending within the year started because generally residential projects have the shortest duration. Residential projects started in the first quarter may reach completion before the year is over. New infrastructure projects generally have the longest duration and may contribute some share of project value to backlog spread over the next several years.

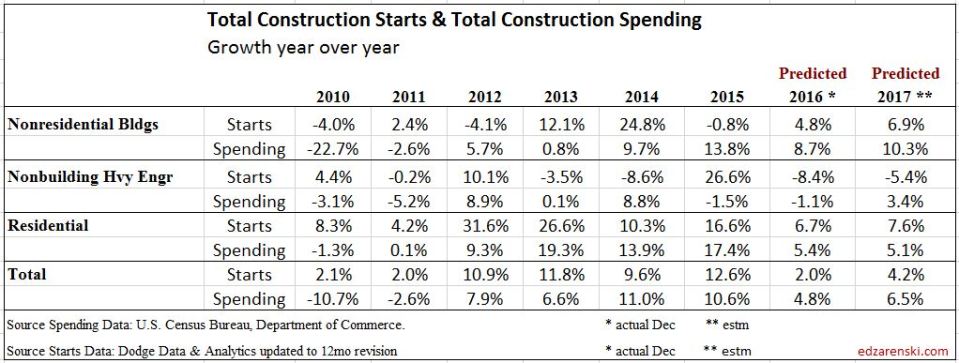

The following table clearly shows there is not a correlation between starts in any year with spending in the following year. The practice of using construction starts directly to predict spending in the following year can be very misleading in an industry that relies on data for predictive analysis to plan for the future. Not only does it not predict the volume of spending in the following year, it does not even consistently predict the direction spending will take, up or down, in the following year. It’s a false indicator and it’s not a good use of data.

Dodge Data New Construction Starts is powerful data if used properly.