Home » Jobs (Page 6)

Category Archives: Jobs

Construction Jobs – Behind The Headlines

10/13/16

Headline comparisons we read are often what happened this month versus last month or year-to-date versus last year. For comparisons to construction spending and jobs it is perhaps beneficial to look at recent and longer term trends. Here I will discuss construction jobs growth versus spending growth and highlight some of the pitfalls when comparing these values for productivity.

The most talked about reason for slower jobs growth is the lack of experienced workers available to hire. In fact, recent surveys indicate about 70% of construction firms report difficulty finding experienced workers to fill vacant positions. That certainly cannot be overlooked as one reason for slower jobs growth, but that is not the only reason?

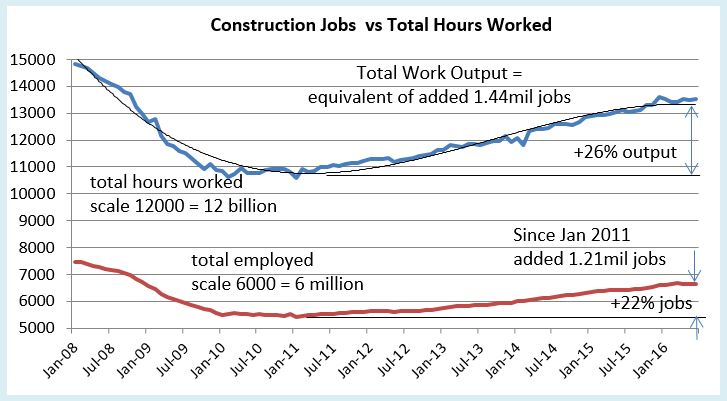

Even with all this talk of difficulty finding experienced construction workers, there has been very good jobs growth. For the 5 ½ year period from the bottom in January 2011 to the present (August 2016) we added 1,240,000 construction jobs.

- Jobs increased by 23% in 5 ½ years with peak growth in 2014 and 2015.

- For the two years 2014+2015 we added 650,000 jobs, the largest number of new jobs in two years since 2004+2005.

In 2014-2015, jobs expanded by 11%, the highest number of jobs in a two-year span since 2004-2005 and the fastest two-year percent growth since 1998-1999. Peak growth was 6.1% in 2014 with slower growth in 2015. I expect even slower growth in 2016.

- For the 6-month period including Oct’15 thru Mar’16 construction gained 214,000 jobs, the fastest rate of consecutive months jobs growth in 10 years. Then, after 3 months of losses, July shows a modest gain.

Jobs growth from October 2015 through March 2016 was exceptional, 214,000 construction jobs added in 6 months, topping off the fastest 2 years of jobs growth in 10 years. That is the highest 6-month average growth rate in 10 years. That certainly doesn’t make it seem like there is a labor shortage. However, it is important to note, the jobs opening rate (JOLTS) is the highest it’s been in many years and that is a signal of difficulty in filling open positions.

I would expect growth like that to be followed by a slowdown in hiring as firms try to reach a jobs/workload balance, after such a robust period of jobs growth. It appears we may have experienced that slowdown. Jobs have been down four of the last six months and up most recently.

- Q2’16 jobs declined all 3 months. Keep in mind, this immediately follows the fastest rate of jobs growth in 10 years. But it also tracks directly to three monthly declines in spending. (I predicted this jobs slowdown in my data 9 months ago. I predicted the 1st half 2016 spending decline more than a year ago).

It is not so unusual to see jobs growth slowed in the 2nd quarter. It follows directly with the Q2 trend in spending and it follows what might be considered a saturation period in jobs growth. The last two years of jobs growth was the best two-year period in 10 years. It might also be indicating that after a robust 6 month hiring period there are far fewer skilled workers still available for hire. The unemployed available for hire is the lowest in 16 years.

Construction spending hit bottom at the same time as jobs, the 1st quarter 2011. For the same 5 ½ year period, Jan 2011 to Aug 2016, construction spending increased 52%, far more than jobs growth. For 2014+2015, spending increased close to 11% per year, the fastest spending growth in more than 10 years.

- For the same 6-months, Oct’15 thru Mar’16, Q4’15 spending was flat but by the end of Q1’16 spending had increased more than 4% in 6 months, to an annual rate of +8%.

- 2nd quarter 2016 spending came in 2% below 1st quarter.

- Total 1st half spending finished 7.2% above the 1st half 2015.

Although spending slowed in the 2nd quarter this year, in part it’s because the 1st quarter was so strong. They combined for a strong 1st half up 7.2% over last year.

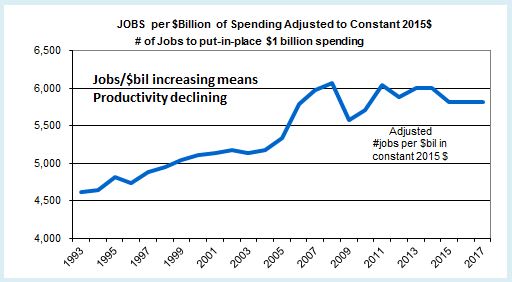

Why is it that jobs don’t increase at the same rate as construction spending? Because much of that spending growth is just inflation, not true volume growth. Volume is construction spending minus inflation. To get volume we need to convert all dollars from current $ in the year spent into constant $ by factoring out inflation.

- Jobs growth should not be compared to spending growth.

- Spending increased 52% from Jan/Feb 2011 to Jul/Aug 2016.

- After adjusting for inflation from Q1 2011 to Q3 2016, we find that construction volume increased by 28% in 5 ½ years.

So, it looks like volume (+28%) still increased much more than jobs (+23%) in the same period and this would indicate increasing productivity. But this still is not the whole picture. Jobs need to be adjusted.

- Jobs needs to take into consideration the hours worked.

Before the dramatic decline in jobs from 2007 through 2010, hours worked ranged between 37hrs/wk and 38hrs/wk. But by 2015, and into 2016, hours worked has been consistently over 39hrs/wk. So not only did the workforce grow by 1.24 million jobs (+23%), but also the entire 7.0 million work force is working about 4% more hours/week. This must be considered to get net jobs, or work output.

- After adjusting for hours worked from Q1 2011 to Q3 2016, we find that net jobs growth increased by 28% in 5 ½ years.

- Since Q1 2011 the constant $ value of construction spending increased by 28%.

- Since Q1 2011 Jobs/hours worked output also increased by 28%.

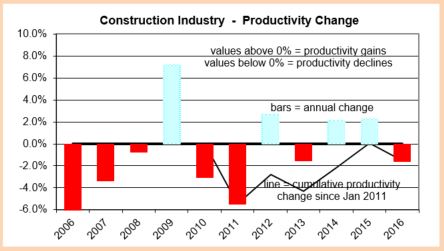

Since Jan 2011, volume increased 28% and workforce output increased 28%, for a net productivity balance, but in 2011 we had a significant productivity loss and a smaller loss in 2013. The huge 2011 productivity loss is probably in part explained by the resumption of hiring after historic job cuts, particularly in 2009 when the work force was cut 16% but, while spending declined by 16%, work volume declined only 11%, which may have overshot the balance mark. That helps account for the huge productivity gain in 2009, but also leads to the losses in 2010 and 2011.

From Jan 2014 to Dec 2015 volume increased by 15% and workforce output increased by only 10.5%. Total hours worked compared to total constant value of spending shows productivity increased for those two years. Historically, we should not expect to see productivity growth continue for a third year and as of August it is down year-to-date.

I expected to see a turn-around in jobs growth in the 2nd half of 2016, and so far, for the 3-month period July-Sept we’ve added 34,000 jobs. That’s starting out perhaps a little slower than I thought. For much of 2014 and 2015 volume growth was exceeding jobs growth, but for 10 months from August 2015 through May 2016, volume growth mostly stalled and jobs growth, which just had 6 months of record high growth, exceeded volume growth by 3%. Only in the last few months has volume growth begun to outpace jobs growth again. But I suspect it is this slow down in real volume growth that has led to slow jobs growth. This leads me to think if spending plays out as expected into year end 2016, then construction jobs may begin to grow faster in late 2016. However, availability could have a significant impact on this needed growth.

Availability already seems to be having an effect on wages. Construction wages are up 2.6% year/year, but are up 1.2% in the last quarter, so the rate of wage growth has recently accelerated. The most recent JOLTS report shows we’ve been near and now above 200,000 job openings for months. With this latest jobs report, that could indicate labor cost will continue to rise rapidly.

As wages accelerate, also important is work scheduling capacity which is affected by the number of workers on hand to get the job done. Inability to secure sufficient workforce could impact project duration and cost and adds to risk, all inflationary. That could potentially impose a limit on spending growth. It will definitely have an upward effect on construction inflation this year.

For all of 2016 and 2017, I predict construction spending will increase about 15%, BUT after inflation construction volume will increase only about 6% to 7%, most of that in 2017. For all of 2016 and 2017, I predict jobs will grow by 350,000 to 450,000, only about 5% to 6%.

Reference Source Information:

U.S. Census released August Construction Spending 10-3-16

BLS released the September jobs Report 10-7-16

Reference Posts:

Construction Jobs Show 3rd Qtr Growth

Construction Jobs – Is July a Turning Point?

Construction Jobs Show 3rd Qtr Growth

Allow me to start this post with a reference

from my blog post 8-6-16 Construction Jobs – Is July a Turning Point?

- For the 6 month period including Oct’15 thru Mar’16 construction gained 214,000 jobs, the fastest rate of growth in 10 years. Then, after 3 months of losses, July shows a modest gain.

- During that same period Q4’15 spending was flat but by the end of Q1’16 spending had increased more than 4% in 6 months, or at an annual rate of 8% to 9%.

- Even though some upward revision is expected for June spending, total Q2’16 spending will still be down 2% to 3% from Q1.

- Q2’16 jobs declined all 3 months, keeping in mind this immediately follows the fastest rate of growth in 10 years. But it also tracks directly to three monthly declines in spending.

Comment Update 10-7-16

U. S. Census released August Construction Spending 10-3-16

BLS released the September jobs Report 10-7-16

June spending did get revised up by 1.85% and 2nd qtr spending came in 2.05% less than 1st qtr. However total 1st half spending finished 7.2% above the 1st half 2015. August spending looks low at 1st print but we can expect that to be revised up by 1% to 2%. Historically, the 1st release of construction spending gets revised up 90% of the time. So it looks like spending bounced off of the April-May low point.

The 2nd quarter jobs slowdown coincided with the 2nd quarter spending dip.

From my blog post 8-6-16 Construction Jobs – Is July a Turning Point?

It is not so unusual to see jobs growth slowed in these last few months. It follows directly with the Q2 trend in spending and it follows what might be considered a saturation period in jobs growth. The last two years growth was the best two-year period in 10 years. It might also be indicating that after a robust 6 month hiring period there are far fewer skilled workers still available for hire. The unemployed available for hire is the lowest in 16 years.

We got modest growth in July that I hope to see continue for the 2nd half 2016. I expect spending to experience strong growth in the 2nd half and jobs growth should follow closely, perhaps adding 125,000 to 150,000 more jobs. However, although I do expect both spending and jobs growth, jobs could be somewhat restrained by lack of available skilled workers.

Comment 10-7-16

Construction Jobs growth from October 2015 through March 2016 was exceptional, 214,000 construction jobs added in 6 months, topping off the fastest 2 years of jobs growth in 10 years. Growth like that can only be followed by a slowdown in hiring until companies reach a jobs/workload balance, and it appears we may have experienced that slowdown. Jobs have been down four of the last six months. I expected to see a turn-around in the 2nd half, and so far, for the 3 month period July-Sept we’ve added 34,000 jobs. That’s starting out perhaps a little slower than I thought. For much of 2014 and 2015 volume growth was exceeding jobs growth, but for 10 months from August 2015 through May 2015, volume growth stalled and jobs growth exceeded volume growth by 3%. Only in the last few months has volume growth begun to outpace jobs growth again. I predicted at least 125,000 new jobs in the 2nd half, so we would need to add 90,000 to 100,000 more before year-end. But, there could be skilled labor constraints and the Aug and Sept numbers are still subject to revision. And we still have 3 months to go.

June Jobs Report Construction

June Jobs Report (May 15-Jun 18) released July 8

There have been no job gains in construction for the last 3 months. In fact we’ve lost 22,000 jobs since March and have only 46,000 new jobs year-to-date. I have to admit after the Apr and May losses, I expected a sizable jobs gain in June. However, for quite a while I’ve predicted spending would decline in Q1 and since a peak in Mar it’s been going down for 2 months. Lower spending would correlate to lower jobs.

Construction jobs are up 3.9% over the same period 2015, so a temporary slowdown should not have much effect. We have just gone through the best 3 years of construction jobs growth since 2004-2006. Perhaps we may experience a leveling out between spending and jobs. At any rate, I see construction spending increasing. There’s still a lot of spending growth in current backlog from starts, so I expect further increases in jobs.

The available unemployed pool dropped to the lowest in 16 years. That could also have some correlation with slow or no jobs growth, as it may mean the people to hire are not available.

Availability already seems to be having an effect on wages. Construction wages are up 2.6% year/year, but are up 1.2% in the last quarter, so the rate of wage growth has recently accelerated. The most recent JOLTS report shows we’ve been near 200,000 job openings for months. That with this latest jobs report could indicate labor cost will continue to rise rapidly.

As wages accelerate, also important is work scheduling capacity which is affected by the number of workers on hand to get the job done. Inability to secure sufficient workforce could impact project duration and cost and adds to risk, all inflationary. That could potentially impose a limit on spending growth. It will definitely have an upward effect on construction inflation this year.

Construction worker output Q2 2016 (# workers x hours worked) is up 3.7% over the same quarter last year, but up only 0.6% from Q1 2016.

Spending minus inflation (volume) has been growing faster than workforce output for the last few years. Since Jan 2011, volume has increased 20% and workforce output increased 26%, a net productivity loss, but since Jan 2014 volume increased by 16% and workforce output increased by only 12.5%. Total hours worked compared to total spending shows productivity has been increasing for the last two years. It would be unusual to see productivity growth continue for another year. This leads me to think if spending plays out as expected then construction jobs will grow by about 200,000 in 2016. Availability could have a significant impact on this needed growth.

Construction Expectations 2016

4-6-16

What should we expect in 2016 for construction spending, jobs and cost?

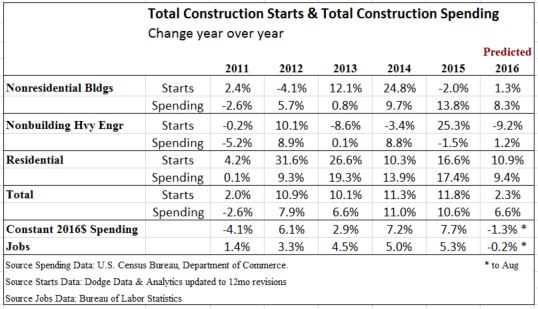

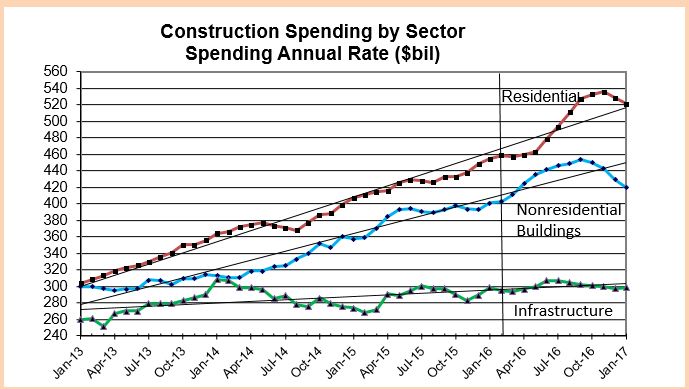

Nonresidential buildings starts (as reported by Dodge Data & Analytics) were well above average from March 2014 through May 2015 but since then have been below average. It takes about 24 to 30 months for nonresidential building starts to reach completion. The effect of below average starts will kick in at the end of this year after strong spending growth.

Non-building infrastructure starts jumped 50% above average from November 2014 to peak in February 2015, then settled back to average in July of 2015. Those very strong starts in early 2015 will be spread out over 4 to 6 years so will not cause spending to spike. They will help support a slow steady increase in spending over the next two years.

Residential starts averaged near 20%/yr growth for 3 years but dropped below average for the entire 2nd half of 2015. That late 2015 dip in starts may not slow residential spending too much until the end of 2016. Overall, the data shows another repeat year of growth similar to the last three years.

2015 Construction spending finished the year up 10.6% over 2014. After 3 years of growth averaging 9%/year, 2016 total construction spending could climb 11% above 2015, the largest percent gain in over 10 years. Any construction spending slowdown is temporary, baked in from old uneven starts causing uneven cashflow, soon to be ending. By the 2nd quarter 2017 all sectors return to positive growth for strong spending in 2017.

Nonresidential buildings construction spending went from zero growth in 2013 to 9% in 2014 and took off to hit 17% growth in 2015. Nonres bldgs spending could reach 12% growth in 2016 and 7% in 2017.

Infrastructure spending will increase a little in 2016 but we won’t see a sizable increase of 8% until 2017.

Residential spending averaged over 15%/year for the last 3 years and could go over 15% growth in 2016, combining for the best four years of spending growth since 2002-2005.

Don’t be mislead by news that construction spending is close to reaching the previous highs. That may be true of spending, but spending is not the measure of expansion in the construction industry. The measure of expansion is volume, spending minus inflation.

Construction spending is up nearly 40% off the 2011 lows and within 5% of the 2006 highs. But after adjusting for inflation, volume is up only 22% from the 2011 lows and is still 17% below 2005 peak volume. We still have a long way to go. While spending is predicted to reach over 11% growth in 2016 and may do the same in 2017, volume will increase only 5% to 6% each year. The rest is due to inflation.

March 2016 construction jobs increase 37,000 from February and although up and down, have averaged 37,000 jobs per month for the last 6 months. That is the highest 6 month average growth rate in 10 years. That certainly doesn’t make it seem like there is a labor shortage. However, it is important to note, the jobs opening rate (JOLTS) is the highest it’s been in many years and that is a signal of difficulty in filling open positions.

To support the expected 2016 volume growth we need an average 25,000 new jobs per month in 2016, 300,000 new jobs, reaching a three-year gain of nearly 1 million jobs for the period 2014-2016, the highest three-year total jobs growth since 1997-1999. The labor force hasn’t expanded this fast in over 16 years. That can have some undesirable consequences. Rapid jobs growth may result in accelerating wages and lost productivity, compounding the cost to labor.

4-6-16

If we get a construction jobs slowdown in the next few months, it’s not all due to labor shortages and not being able to find people. Construction volume has been growing faster than jobs for more than a year. It means productivity in 2015 is up after several down years. But, while we’ve recorded consecutive years of productivity declines many times, we have not had two consecutive years of productivity gains in the last 22 years. So historically we should expect a decline, not gains this year.

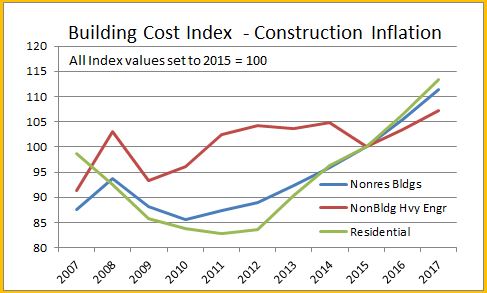

Material input costs to construction are down over the last year, but that accounts for only a portion of the final cost of constructed buildings. The cost of new residential construction is up 5% to 6% in the last year. Several nonresidential building cost indexes are indicating construction inflation between 4% and 5%. The Turner non-residential bldg cost index for 2015 is 4.6%. The 1st qtr 2016 is up 1.15% from the 4th quarter 2015. The Rider Levitt Bucknall nonresidential building 2015 cost index is 4.8% and the Beck Cost Report has 5.0% for 2015. I recommend an average 5.5% cost inflation in 2016 for residential and nonresidential buildings. Non-building infrastructure costs are unique to each individual infrastructure market, so average building cost indices should not be used for infrastructure.

Construction Volume Growing Faster Than Jobs, and That’s a Good Thing.

2-24-16

The most talked about reason for slower jobs growth is the lack of experienced workers available to hire. In fact, recent surveys indicate about 80% of construction firms report difficulty finding experienced workers to fill vacant positions. That certainly cannot be overlooked as one reason for slower jobs growth, but is that the only reason?

Even with all this talk of difficulty finding experienced construction workers, there is a lot of hiring going on. For the 5 year period 2011-2015 we added 1,100,000 construction jobs with the peak growth rate in 2014 at 6.1%. Jobs increased by 20% in 5 years.

For the two years 2014 + 2015 we added 650,000 jobs, the largest number of jobs in two years since 2004 + 2005. In that two years, jobs expanded by 11%, the fastest percent growth since 1998-1999, the fastest pace in 17 years. But peak growth was in 2014 with slower growth in 2015. I expect even slower growth in 2016.

Construction spending hit bottom at the same time as jobs, the 1st quarter 2011. For the same 5 year period 2011-2015 construction spending increased far more than jobs growth. Why is it that jobs don’t increase at the same rate a construction spending? Because much of that spending growth is just inflation. When describing a shortfall of construction workers, jobs growth should not be compared to spending growth. After adjusting for inflation from Q1 2011 to Q4 2015, we find that construction volume increased by 22% in 5 years.

Now it looks like over 5 years jobs seem to be growing nearly the same as construction volume. It even looks like productivity increased, but that’s still not the whole picture.

Real work output growth is total jobs adjusted by the hours worked each year. From 2011 to 2015 construction hours worked increased by 3.6% from near the lowest on record to the highest ever recorded. The reason this has such a huge effect is hours worked gets applied on all 6.5 million jobs, not just the new jobs added. So, a workforce that grew by 20% worked 3.6% longer hours showing that net total work output actually increased 24.3%.

This data shows that over the last 5 years new volume increased by 22% while work output to produce that volume increased by 24%. Data clearly indicates we have added more work output than the volume of work we have produced. This indicates a drop in productivity over the last 5 years.

It is not uncommon at all that productivity declines during rapid growth. This pattern of growth appears prominently in the last two expansions between 1996 and 2006. Firms may be increasing staff based on revenue without strict attention to real volume growth, only to then slow jobs growth and allow volume production to catch up.

By measuring to previous productivity levels, we could say the construction workforce is currently overstaffed. Of course, spending (and net volume after inflation) is expanding rapidly and with it so must the workforce. But, if there is any hope that eventually productivity will return to previous levels, then we must hope for a minimum increase of 2%+ in volume with no matching additional increase in new jobs or hours worked.

Over the next two years I predict construction spending will increase close to 20%, BUT construction volume will increase only 10%, most of that in 2017. In a previous post, “How Many Construction Jobs Will Be Needed” I predicted jobs will grow by 500,000 to 600,000, only about 8%.

Filling positions with workers less qualified than those who were lost accounts for some of the decline in productivity. Working longer hours also leads to productivity loss. To regain lost productivity, new workers need to gain experience AND overall hours need to be reduced and that workload replaced with new jobs. That’s certainly not likely to happen all in one year, but it may account for some of the reason why volume is currently growing faster than jobs, and that’s a good thing. I expect that will continue at least for the next two years.

How Many Construction Jobs Will Be Needed to Support 2016-2017 Spending Forecast?

1-12-16

This is a pretty straight forward analysis. If productivity is to remain the same, then jobs need to grow by the same percentage as volume. If volume grows faster, then productivity increases. If jobs grow faster, then productivity declines. Let’s have a look at the numbers to find out what’s been going on and where we might be headed. Spending forecasts will give the basis for predicting jobs growth.

A few weeks back I commented on a study published by Bureau of Labor Statistics on how many construction jobs would be created by 2024. BLS Says +790,000 Construction Jobs by 2024. Let’s Look Behind The Headlines. Now that I’ve completed updating spending and jobs data and developed a forecast for 2016-2017, I will show what has taken place over the last 4 years and what to expect for the next two years.

Here’s what we know.

Volume is not the same as construction spending. Spending is the number nearly everyone follows. Volume is spending minus inflation. I use composite inflation factors based on tracking numerous construction selling price indices.

In 2015 nonresidential buildings spending grew by 17%, but after inflation, volume grew by only 12%. Overall construction spending in 2015 grew by 11%. Total all construction volume grew by 8%. Annual construction inflation varies for residential, nonresidential buildings and nonresidential infrastructure.

For the four years 2012 through 2015 construction spending grew by 35% but after inflation volume grew by 21%.

Work output grows by number of new jobs added and by any increase in total hours worked. For the four years 2012 through 2015 construction jobs increased from 5.5 million to 6.4 million, or 16%. In addition hours worked by the entire 6 million workforce increased by 2%. So effectively, total workforce output increased by 18%.

The last four years volume grew 21% and the effective number of jobs grew 18%. There was an increase in productivity over this four year period of 3%. An increase in productivity occurred because we put-in-place more volume than the (effective) number of jobs added.

Now we can ask the question, “How many construction jobs will be added in the next two years if we achieve the spending forecast?”

Let’s use what we know and apply it to the forecast.

I’m forecasting 10% spending growth in 2016 and 12% in 2017. I anticipate higher inflation than we have experienced in the last few years. After inflation, volume should grow 4% and 6%. So, total volume growth for the next two years is forecast 10%.

With rapid growth, I would expect productivity to decline slightly, but the last 4 years of growth showed a slight productivity gain, so let’s go with that. That means we will lower our estimate of jobs needed because some of the increased volume over the next 2 years will be supported with increased productivity.

Total volume growth for the next two years is forecast at 10%. If we follow the same pattern as the last 4 years, we may see an increase in productivity of 2%. So we need only an 8% increase in workforce output to put-in-place the forecast volume. The average number of jobs for 2015 is 6.4 million. An 8% increase in 2 years on the 6.4 million means we need to add 512,000 jobs in 2016-2017.

If we do not see gains or losses in productivity we need to add 10% to jobs, the same percentage jobs as we have volume growth. That would be 640,000 new jobs in 2016-2017.

As a result, based on this analysis expect a need of about 500,000 to 600,000 new construction jobs in the next two years.

For comparison, in 2014-2015, 601,000 new jobs were added. Then, spending grew 20% but volume after inflation was 12%. Jobs grew by 10%.

Jobs have increased more than 600,000 in two adjacent years only a few times. Any two years within 1996-1998 were over 600,000, also 83-84 and 93-94. The highest ever was 1998-99 when we added 770,000 new jobs, and that two year period had the same total jobs as 2014-2015. The only other recent high periods are 2004-05 added 700,000 and 2014-15 added 601,000.

Also, it’s easy to see now, had this been based on total spending increases for the two years rather than volume, the need would be 20+% or 1.0 to 1.2 million jobs, not just the 8% or 10% jobs growth used here. The last time jobs grew by more than 10-12% in two years was 1977-1978 at 18% and the highest growth ever was 770,000 jobs added in 1998-99, the only time over 700,000. So, as expected, 20+% growth and a million jobs in two years has never been reached.

BLS predicted construction will add 790,000 jobs over 10 years, the period from 2015 through 2024. In 2015 we’ve already gained 260,000 jobs so that would leave 530,000 new jobs expected over the remaining 9 years.

The spending forecast and past job growth patterns indicate that we will add far more jobs and much faster than is predicted by BLS.

Of course, another recession would alter this, but this is not based on another recession.

BLS Says +790,000 Construction Jobs by 2024. Let’s Look Behind The Headlines.

In a report released December 8, 2015 the Bureau of Labor Statistics (BLS) predicts jobs growth for industries. Construction is pegged as a leader with expected 790,000 new jobs from 2014 to 2024. Robert Deitz at NAHB provides a good summary of the BLS report.

Let me provide a few historical averages and break this down so we can see how it stacks up.

The prediction period is from 2014 through 2024, so all of 2014 is already in the BLS baseline. The average number of construction jobs in 2014 was 6,138,000 and BLS uses that baseline. BLS says 2024 will average 6,928,000 construction jobs, growth of 790,000 jobs over 10 years, from which we can infer 12.9% growth in 10 years or a 1.22% compounded growth rate.

In 2015 we’ve already gained 215,000 ytd through November. The average jobs for 2015 is currently 6,390,000, so that leaves 540,000 expected over the remaining 9 years. That would imply a growth rate of 8.5% in 9 years or an average compounded growth rate of only 0.9% per year.

Now here is where it gets interesting.

Spending growth is predicted by several firms between 5% and 10% per year for the next 4 years. My own forecast has 2016 growth at 11%. Average of forecasts for the period 2016-2019 are currently 8%, 7.5%, 6% and 7%.We need to take out inflation to get real volume growth, so we will assume 4% inflation per year for the next 4 years. Long term construction inflation is 3.5% per year, but in rapid growth years it has reached 6%-8% per year. For the period 2013-2015 construction inflation averaged 4%. Adjusting for inflation at 4% results in volume growth for 2016-2019 at 4%, 3.5%, 2% and 3%. This is much faster growth than the BLS average, so we will remain more conservative in this analysis.

Historical volume growth over the last 22 years is grossly distorted by the recession. Volume declined in 8 of those 22 years. In the three worst three years of the recession, 2008, 2009 and 2010, volume declined by 28%. When we take out those three years the typical growth period averages are more apparent. The historical average volume growth in construction with recession data removed and after adjusting for inflation is 2% per year for 19 years.

Jobs growth over the last 20 years averaged 1.6% per year, even when we include the catastrophic losses during the recession years of 2007 through 2010. The BLS is predicting 1.22% growth for 10 years, lower than the average with a recession. Without the four worst recession years of job losses the average growth jumps to 3.7% per year, almost triple the BLS predicted growth. Minus the recession years, there has never been a prolonged period where jobs growth has averaged growth less than 2% per year, so we shouldn’t expect such low growth.

BLS assumes productivity will increase 1% per year. This would lower the number of jobs needed. Construction productivity has never done this before. My records show over the last 20 years there has not even been two consecutive years of construction productivity increases. Long term productivity in the construction industry has declined by 1% per year. Data would indicate jobs growth must be greater than volume growth to make up for productivity losses.

We have differences based on my analysis of historical growth and productivity. Forecasts show expectations of rapid growth in the next few years. These differences would produce dramatically different estimates of jobs growth in coming years. How much different? Let’s see.

Let’s be conservative with assumptions. Based on:

- No productivity increases or losses. Therefore jobs will grow at the same rate as volume.

- Volume growth of 1.5% per year will be less than forecast and less than the historical non-recession average. This allows for some years to decline.

- There will be no recession, but there will be down years.

- Starting from 2015 baseline of 6,390,000 jobs

Jobs need to grow at 1.5% per year compounded for 9 years. That’s 14.3% in 9 years from the 2015 baseline of 6,390,000. Growing 14% in nine years adds 895,000 jobs by 2024. We’ve already gained 215,000 jobs in 2015. For the period of the BLS analysis, my conservative prediction is a total gain of 1,110,000 jobs over 10 years, 320,000 more than the BLS prediction.

Jobs reached a peak in 2006-2007 at 7,700,000. At conservative growth rates we will not reach the previous peak by 2024. However, if construction volume and jobs growth follow a little more closely to historical 20 year patterns, we will add 1,300,000 jobs from 2014 to 2024, but still be short of the previous peak. This scenario adds 500,000 to the BLS prediction.

If volume growth does reach forecast levels and if jobs growth does include some losses in productivity then my estimate for jobs is double BLS and we could reach the previous peak in jobs several years earlier.