Home » Forecast (Page 14)

Category Archives: Forecast

Construction Spending 2016 – Midyear Summary

Summary 2016 Construction Spending

9-7-16

Total Construction Spending for July reached a seasonally adjusted annual rate (SAAR) of $1.15 trillion, level with June which was revised upwards by $20 billion or nearly +1.8%. Monthly spending always gets revised in subsequent months. This year every month but May, which remained nearly unchanged, has been revised upwards, by an average of +1.4% and as much as 3.4%. Monthly values are subject to revision for two months after the first release and once again in May of the following year.

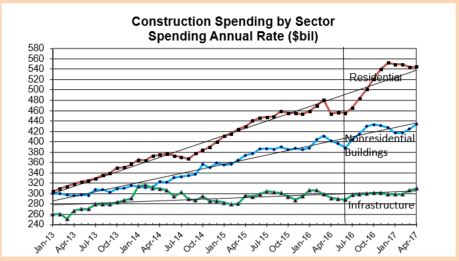

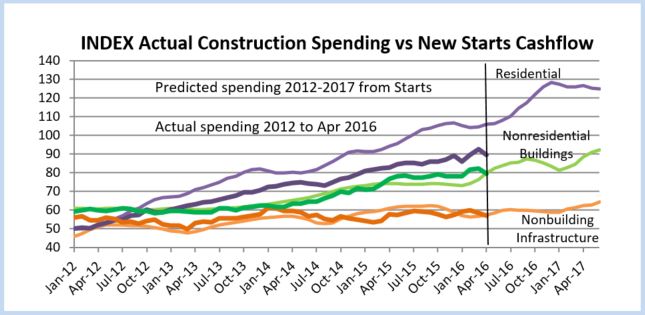

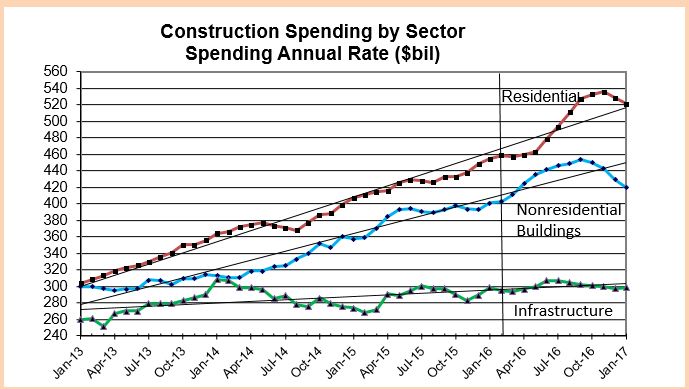

This plot, Construction Spending vs New Starts Cash Flows, shows actual spending (SAAR) by sector through July 2016 and projected trends of spending out to July 2017.

Previously I wrote that we should expect a short duration downturn in spending occurring between January and March. The expected monthly spending cash flows that would be generated from uneven new starts over the last two years indicated that a slowdown in spending would occur during the first quarter 2016. As it turns out, first quarter spending was much stronger than expected, averaging $1.17 trillion SAAR, primarily due to outstanding results in February and March for residential spending. But then April and May experienced significant declines, dropping to an average of only $1.14 trillion SAAR, down almost 3% from Q1. Now with June and July spending both up 1% from the April and May lows, it looks like we may be past that short duration downturn.

Total Construction Spending year-to-date (YTD) through July is up 5.6% over the same seven months 2015. Spending slowed in April and May from a 1st quarter average of $1.17 trillion that reached close to a 10 year high and falls just 4% short of the all-time high. However, it must be noted, that compares unadjusted current dollars, values of all dollars current in the year spent.

When comparing inflation adjusted constant dollars, all dollars adjusted to the same point in time, we can see 2016 spending is still 18% below the 2006 highs.

Total spending YTD through July is slightly ahead of what I predicted back in December, but it’s slightly below what I expected for May, June and July . I expect 2nd half spending to average above $1.2 trillion SAAR, but slightly lower than I originally forecast.

I’ve revised my 2016 spending forecast down slightly to total $1.190 trillion, up 7% from $1.112 trillion in 2015.

How does actual spending YTD compare to my prediction at the beginning of the year?

- Total predicted YTD through July $638.2b, actual YTD $647.7b (+$9.5bil, +1.5%).

- Residential predicted YTD $245.1b, actual YTD $259.2b (+$14.1bil, +5.8%).

- Nonresidential Bldgs predicted YTD $236.9b, actual YTD $228.1b (-$8.8bil, -3.7%).

- Non-building Infrastr predicted YTD $156.2b, actual YTD $160.5b (+$4.3bil, +2.8%).

Where are the revisions?

The single largest reduction in spending is in Nonresidential Buildings Manufacturing. Although there are other variances, that could account for the entire revision downward. Predicted construction starts for Manufacturing was lowered by nearly 35% after the initial start-of-year forecast was made.

Non-building Infrastructure spending increase is being supported by a 20%+ increase in power, which I didn’t expect. New starts for power projects have increased more than 20% since the initial forecast.

Residential construction had unusually large gains in February and March, almost all of that in residential renovations, offset only partially in April through July by declines mostly in new single-family housing.

Here’s my revised 2016 spending forecast based on YTD spending and new construction starts through July, compared to my prediction in December 2015.

- Total predicted Dec 2015 $1,206.2b, July 2016 $1,189.9b (-$16.3bil, -1.4%).

- Residential predicted Dec 2015 $473.8b, July 2016 $481.8b (+$8.0bil, +1.7%).

- Nonresdntl Bldgs predicted Dec 2015 $439.2b, July 2016 $410.9b (-$28.3bil, -6.4%).

- Non-bldg Infrastr predicted Dec 2015 $293.2b, July 2016 $297.3b (+$4.1bil, +1.4%).

Spending and construction starts are often confused by some analysts who refer to starts data as spending. Starts represent total project value recorded in the month the project begins. To determine spending activity, starts values must be spread out over the duration of the projects. Spending is dependent on cash flows each month generated from all previous construction starts. Cash flows expected based on Dodge Data construction starts are indicating a return to growth in spending in the 2nd half 2016. (See chart above Index Actual Construction Spending vs New Starts Cashflows).

Spending Breakout by Sector

Residential construction spending for July totaled a SAAR of $452 billion, remaining near level for the last four months. Residential spending YTD through July is up 6.5% over 2015. Spending slowed in April and May from a very strong 1st quarter average that reached close to a 10 year high. The current 3-month average is just 1% below the 1st quarter and is still at its highest since the 2nd half of 2007 but is 10% below the current dollar all-time high in 2006. I’m still expecting some upward revisions to June or July residential spending.

Residential spending just experienced the strongest three-year stretch of spending growth on record, up 60% in 2013-2014-2015. After taking out inflation, volume growth was only 31%, but that is still the strongest ever for three consecutive years. Spending growth in 2016 will reach only +9%. After adjusting for inflation that represents volume growth of less than +4%, the slowest in 5 years. New starts YTD (as reported by Dodge Data) although down from the 1st quarter, are still near post-recession highs. Starts from late 2015 and early 2016 will still be generating spending into early 2017. 2017 will repeat nearly identical to 2016. What we may be seeing is that it might be difficult to register another year of very high percentage growth in 2016 or 2017 because it is being measured against the 2015 10-year high. Another factor limiting very high growth may be a limited supply of labor to expand the workforce.

Total Nonresidential SAAR spending for July is $701 billion, down slightly from June, but monthly SAAR has varied only +/- 1% for the last six months. YTD spending compared to 2015 is up 5.1%. Nonresidential spending also slowed in April and May but is now up 1.5% from those lows. The current 3-month average is up slightly from the 1st quarter and is just 3% below the pre-recession 2008 current dollar high.

Nonresidential Buildings spending for July totaled a SAAR of $403 billion, down slightly from June but up 1.3% from the May dip. Spending YTD for nonresidential buildings through July is up 8.0% over 2015. The current 3-month average of $403 billion is up slightly from the 1st quarter but is still 9% below the peak in 2008.

Non-building Infrastructure spending for July fell to a SAAR of $289 billion, down only slightly over for the last four months. YTD spending through July is up only 1.3% over 2015. Spending began to slow in April and May and is now at the 2016 low. The current 3-month average is down 4% from the 1st quarter. However, spending on nonbuilding infrastructure reached an all-time high in the first half of 2014 and has remained near those highs through 2015 into the 1st quarter of 2016.

9-7-16

Public spending average for the 1st six months of 2016 is the highest since 2010 and is up 10% from the 2014 low point. YTD public spending is up 0.2% from 2015. All of Highway plus 80% of Educational makes up 55% of all public construction spending. The next largest markets, all of Sewage/Wastewater plus 70% of Transportation accounts for only 19% of public sending. All other markets combined make up less than 20%.

The biggest mover to total public spending this year is educational spending. Public educational spending is up only 4.0% YTD, but because it represents almost 25% of all public spending, it’s has a bigger net impact of +1.0% on moving the trend up than any other single public market. Public commercial spending is up 36.6% YTD but has only a 1% market share of public work. Highway and street is up 2.6% YTD. At 30% of total public that results in a net move of +0.8%. Office, public safety, power, sewage/waste disposal and water supply are all down YTD by a combined -5.3%. At a combined market share of 21% that nets a -1.1% reduction in YTD public spending.

Private spending is dominated by a 52% market share of residential work. At 6.6% growth that nets 3.4% growth in private spending. Several of the nonresidential building markets have high YTD growth (and/or a large market share of private work); lodging +30%, office +27%, Amusement +22%, commercial +10% and power +8%. These five markets combined represent 29% of private spending and combined are up +15% YTD for a net impact of +4.4% to private work.

For a base of reference, here’s a few points in spending history.

Total Construction Spending

- 8 years 1998-2005 up 77%

- 3 years 2003-2005 up 32%

- 3 years 2008-2010 down 30%

- 4 years 2012-2015 up 41%

Residential

- 8 years 1998-2005 up 133%

- 3 years 2003-2005 up 57%

- 3 years 2007-2009 down 60%

- 3 years 2013-2015 up 60%

Nonresidential Buildings

- 5 years 2004-2008 up 64%

- 3 years 2006-2008 up 45%

- 3 years 2009-2011 down 36%

- 2 years 2014-2015 up 25%

Non-building Infrastructure

- 7 years 1995-2001 up 56%

- 4 years 2005-2008 up 60%

- 3 years 2009-2011 down 8%

- 3 years 2012-2014 up 19%

See this post for expanded details on Construction Spending – Nonresidential Markets – Buildings and Infrastructure

See this post for expanded details on Construction Inflation

June 2016 Year-To-Date Construction Spending

update 8-6-16 See this link to July Jobs Report

Construction spending for June reported by U.S. Census totaled $1.134 trillion, the lowest since $1.126 trillion in December 2015. Spending hit the lowest for 2016 after reaching a 9 1/2 year high of $1.176 trillion in March.

Spending for June is down 0.6% month/month from a revised May. May and April were both revised down. Construction spending year-to-date is now only +6.2% vs. the same six months 2015. It was above +8% year-to-date for the last three months.

Construction spending reached a 9 1/2 year high in March. The biggest declines in spending since March are Residential -5%, Healthcare -4%, Educational -6%, Highway & Street -6%, Sewage & Waste Disposal -12% and Manufacturing -8%. The only significant increases since March are Lodging +3.4%, Power +2.5% and Conservation +6%. Power is the only big $ volume sector.

The Census spending numbers for both May and June seem somewhat suspect as they fall well outside the statistical mean for expected percentage of total annual spending within those months. June reported residential spending is 6% below statistical mean for June, larger than any variance in 15 years, therefore it becomes suspect. Granted this is based on only six months of actual spending with six months still to go. However the residential variance is so significant, following that trend would reduce residential spending for the remainder of the year by $30 billion, or more than 10% of the final six months. This is an unlikely scenario, unless it were to signify the beginning of a steep downturn starting in March and continuing for the remainder of 2016. Construction starts dollar volume does not support that scenario. Therefore, I have not adjusted down my predicted spending for the remainder of the year based on the downtrend for April, May and June as-reported actual spending. Although it is an uncomfortable position to take, I expect to see some upward revisions in the coming months.

Spending is dependent on long duration cash flows from all previous construction starts. Construction Starts as reported by Dodge Data & Analytics provide a base to predict spending. Dodge reports starts in dollars. Starts gives a long term trend view of spending.

Previously I said we should expect a short duration downturn in spending occurring from January through March. The monthly unevenness in the dollar volume of new starts over the last two years indicated a slowdown in spending during the first quarter 2016. As it turns out, first quarter spending was much stronger than expected, averaging $1,175 billion which is a 9 1/2 year high. Spending has been declining since the March peak, averaging only $1,140 for Q2, down 3% from Q1, but still near a nine year high.

It will take several more months to see if spending rebounds and to see if that helps identify this April-May-June downturn as the dip I expected in Q1, but just had targeted it off by several months for when the dip would occur.

If May or June get revised up and/or the 2nd half rebounds to confirm the slight dip, spending will come right back to the long term trend.

Total first half spending is only 1% below what I predicted. If a 2nd half spending rebound materializes, we should still finish 2016 near $1.200 trillion in total spending, up 8% from 2015.

This article by Luke Kawa @LJKawa on BloombergMarkets @markets which quotes me also includes comments from Bespoke’s @GeorgePearkes on the disparity between the trend in spending and Census residential # of units under construction. The graphic comparison shows spending vs # units diverging for May-June, units advancing and spending declining. This is another clue this may get revised in future data.

Something Is Odd About the Latest U.S. Construction Data

7-6-17 The most recent release of Census Construction Spending data issued July 3, 2017, revises data back to January 2015. The May and June 2016 data discussed in the Aug. 2, 2016 article linked above were both revised up 3%. This upward revision to the data puts it right in line with growth expected back in August 2016, confirming our questioning the data as suspect at that time.

June Jobs Report Construction

June Jobs Report (May 15-Jun 18) released July 8

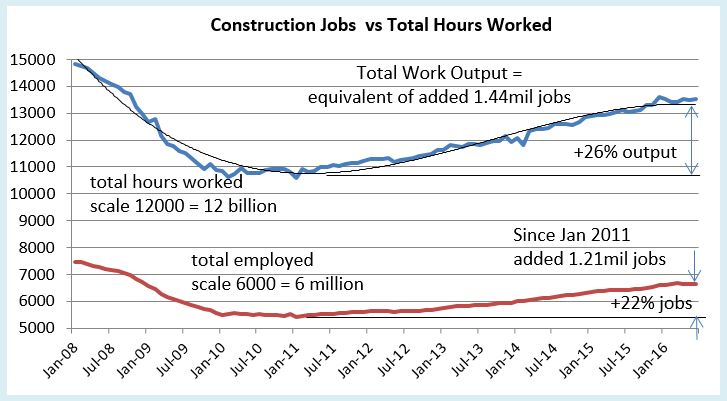

There have been no job gains in construction for the last 3 months. In fact we’ve lost 22,000 jobs since March and have only 46,000 new jobs year-to-date. I have to admit after the Apr and May losses, I expected a sizable jobs gain in June. However, for quite a while I’ve predicted spending would decline in Q1 and since a peak in Mar it’s been going down for 2 months. Lower spending would correlate to lower jobs.

Construction jobs are up 3.9% over the same period 2015, so a temporary slowdown should not have much effect. We have just gone through the best 3 years of construction jobs growth since 2004-2006. Perhaps we may experience a leveling out between spending and jobs. At any rate, I see construction spending increasing. There’s still a lot of spending growth in current backlog from starts, so I expect further increases in jobs.

The available unemployed pool dropped to the lowest in 16 years. That could also have some correlation with slow or no jobs growth, as it may mean the people to hire are not available.

Availability already seems to be having an effect on wages. Construction wages are up 2.6% year/year, but are up 1.2% in the last quarter, so the rate of wage growth has recently accelerated. The most recent JOLTS report shows we’ve been near 200,000 job openings for months. That with this latest jobs report could indicate labor cost will continue to rise rapidly.

As wages accelerate, also important is work scheduling capacity which is affected by the number of workers on hand to get the job done. Inability to secure sufficient workforce could impact project duration and cost and adds to risk, all inflationary. That could potentially impose a limit on spending growth. It will definitely have an upward effect on construction inflation this year.

Construction worker output Q2 2016 (# workers x hours worked) is up 3.7% over the same quarter last year, but up only 0.6% from Q1 2016.

Spending minus inflation (volume) has been growing faster than workforce output for the last few years. Since Jan 2011, volume has increased 20% and workforce output increased 26%, a net productivity loss, but since Jan 2014 volume increased by 16% and workforce output increased by only 12.5%. Total hours worked compared to total spending shows productivity has been increasing for the last two years. It would be unusual to see productivity growth continue for another year. This leads me to think if spending plays out as expected then construction jobs will grow by about 200,000 in 2016. Availability could have a significant impact on this needed growth.

May 2016 Construction Spending YTD vs Predicted

7-7-16

Construction Spending year-to-date (YTD) through May versus the same 5 months 2015 is: Residential +9.8%; Nonresidential Buildings +9.3%; Non-building Infrastructure +3.9%. Total construction spending YTD is up 8.2% from the same period 2015.

How does this compare to my prediction at the beginning of the year?

At $176.6 billion YTD, residential spending is 5.1% higher than predicted (+$8.6bil). Nonresidential buildings spending at $154.9 billion YTD is 2.5% below (-$4bil) expected and non-building infrastructure at $107 billion YTD is 2.4% higher (+$2.5bil) than expected. Total construction spending is 1.8% (+$7.1bil) higher than I expected through May.

Six months ago I predicted a dip in construction spending would occur early in 2016 with different sectors hitting a low point in February or March. Prediction analytics are much better at identifying a trend rather than the exact month it may occur. In this case, both February and March had strong spending increases. It looks like we may see the dips now with declines in both April and May. That makes the June data more important.

Where are the gains and losses?

By a large margin, two thirds of the unexpected gains in Feb-Mar were in residential construction, almost all of that in residential renovations. Likewise, most of the dip in Apr-May is caused by a decline in residential work, but the declines came mostly in new single-family housing spending.

Nonresidential Buildings spending YTD combined for Lodging, Office, Commercial, Educational and Amusement is up 14%. This group just more than 2/3rds of all nonresidential buildings. Manufacturing, another 20% of total nonresidential buildings, is down YTD less than 1%.

Non-building Infrastructure spending is being supported by 7% YTD increases in power, which I didn’t expect, and highway/street. Together they represent 60% of all infrastructure work.

Market Sectors vs Predicted

Year-to-date gains and losses versus my beginning of year predicted include: Manufacturing is -7% (-$2.6bil) lower than predicted; Office +1% higher; Commercial/Retail +3.5% (+$1bil); Lodging +1%; Educational +0.7%; Healthcare -0.5%; Amusement/Recreation -2.1%; Power +18% (+$5.9bil); Highway Street -5.7% (-$1.7bil); Transportation -4.4%; Residential +5% (+$8.6bil).

My prediction still indicates that we are headed for strong growth, total spending up +9% to +10% for 2016. I expect both residential and nonresidential buildings to increase slightly from current trend and non-building infrastructure to slow.

Census Construction Spending with this May 2016 data is revised back to January 2014. Revisions are: 2014 +1.2%; 2015 +1.3%; Jan-Apr2016 +1.7%. This is the first issue of May 2016 data. May data will be revised twice in coming months.

Construction Spending April Data

6-1-2016

Total Construction Spending year-to-date is up 8.7% over Jan-Apr 2015. Spending declined in April 1.8% below March. Every major sector declined from a March value that was revised upward by +1.6% to the highest monthly spending since 2007.

Often the month to month change does not reflect the long term trend. For example, for February and March combined spending was up 3%, a trend if carried out for the full year would indicate annual growth of 18%, a level never achieved. So a decline in April is not too unusual. Including April, three of the last five months were up. The 3 month avg is up 1.8% from the previous 3 months, at its highest since mid 2007 when spending was still near the 2006 peak.

Residential spending for April is down 1.5% by Census SAAR, but that is after a strong March. Year-to-date Jan-Apr compared to 2015 is up 9.1%. The current 3 month average is at its highest since the 2nd half of 2007 and is up 3.5% over the previous 3 months.

Total Nonresidential spending for April is down 2.1% from March by Census SAAR, but that is after a March that came in just 2% below peak pre-recession spending measured in the 1st quarter of 2008. Year-to-date Jan-Apr compared to 2015 is up 8.5%. The current 3 month average is at its highest since the Q1 2009, which was still near the pre-recession peak, and is up 2.8% over the previous 3 months.

Nonresidential Buildings spending year-to-date is up 9.8% over 2015. The current 3 month average is at its highest since Mar-Apr-May 2009 and is up 3.5% over the previous 3 months. Spending on Nonres Bldgs peaked in 2008 and remained near that peak until March 2009. We are on track to regain peak spending by Q3 this year.

- Commercial and Office construction spending are both 5% ahead of year-to-date predicted. If both finish the remaining months of 2016 as predicted, then expect 2016 growth of +9% and +16%.

- Lodging construction spending 5% ahead of year-to-date predicted. If finishes as predicted, expect 2016 +25%.

- Manufacturing construction spending 5% below year-to-date predicted. If finishes as predicted, expect 2016 only +3%.

- Power construction spending 10% above year-to-date predicted. If finishes as predicted, expect 2016 down only -3%.

Nonbuilding Infrastructure spending year-to-date is up 6.5% over 2015. The current 3 month average is up only 1.4% over the previous 3 months. However, spending on nonbuilding infrastructure has been tracking near all-time highs for most of 2014 and 2015. It peaked in early 2014 and again in mid 2015. We may exceed both those peaks in the next 4 months.

Construction Starts lead spending. Starts data is from Dodge Data & Analytics. Early 2015 had elevated levels of new starts in every sector. Although the level of starts has declined since then, the long term trend is still up, so that means the rate of increase in spending may slow, but not decline. I see no indication at this time to expect a decline in long term spending. I previously predicted spending would temporarily slow or drop in early 2016 and I think we have seen that. At this time, I still expect total spending in 2016 to exceed 10% growth. Strong data needed to verify 2016 total spending prediction will be available when we get June spending (August 1 release). At that time we will have a much better indication of what to expect for all of 2016.

Construction Spending vs Dodge Starts vs New Housing Unit Starts

Read my last few blogs and all of this is detailed, but this is worth a look.

Dodge Data Construction Starts cash flowed shows a predicted spending pattern.

Actual spending is shown to compare to the prediction.

For another residential input we have new housing starts. Here I’ve spread activity out from start to completion like a cash flow to get monthly activity. History compares to actual spending and future compares to Dodge New Starts cash flow.

The time flow of activity generated by housing starts is much more important than the monthly starts themselves. It prompts us to look at a much longer term trend of housing starts than just whether they have moved up of down in the last month or quarter.

Modeling for nonresidential buildings and non-building infrastructure appears more accurate than residential. It looks like my prediction of cash flow from Dodge residential starts needs to move 2-4 months to the left.

5-4-16 The cash flow plot for residential has been revised to use a different duration for SF vs MF vs Reno.

Construction Expectations 2016

4-6-16

What should we expect in 2016 for construction spending, jobs and cost?

Nonresidential buildings starts (as reported by Dodge Data & Analytics) were well above average from March 2014 through May 2015 but since then have been below average. It takes about 24 to 30 months for nonresidential building starts to reach completion. The effect of below average starts will kick in at the end of this year after strong spending growth.

Non-building infrastructure starts jumped 50% above average from November 2014 to peak in February 2015, then settled back to average in July of 2015. Those very strong starts in early 2015 will be spread out over 4 to 6 years so will not cause spending to spike. They will help support a slow steady increase in spending over the next two years.

Residential starts averaged near 20%/yr growth for 3 years but dropped below average for the entire 2nd half of 2015. That late 2015 dip in starts may not slow residential spending too much until the end of 2016. Overall, the data shows another repeat year of growth similar to the last three years.

2015 Construction spending finished the year up 10.6% over 2014. After 3 years of growth averaging 9%/year, 2016 total construction spending could climb 11% above 2015, the largest percent gain in over 10 years. Any construction spending slowdown is temporary, baked in from old uneven starts causing uneven cashflow, soon to be ending. By the 2nd quarter 2017 all sectors return to positive growth for strong spending in 2017.

Nonresidential buildings construction spending went from zero growth in 2013 to 9% in 2014 and took off to hit 17% growth in 2015. Nonres bldgs spending could reach 12% growth in 2016 and 7% in 2017.

Infrastructure spending will increase a little in 2016 but we won’t see a sizable increase of 8% until 2017.

Residential spending averaged over 15%/year for the last 3 years and could go over 15% growth in 2016, combining for the best four years of spending growth since 2002-2005.

Don’t be mislead by news that construction spending is close to reaching the previous highs. That may be true of spending, but spending is not the measure of expansion in the construction industry. The measure of expansion is volume, spending minus inflation.

Construction spending is up nearly 40% off the 2011 lows and within 5% of the 2006 highs. But after adjusting for inflation, volume is up only 22% from the 2011 lows and is still 17% below 2005 peak volume. We still have a long way to go. While spending is predicted to reach over 11% growth in 2016 and may do the same in 2017, volume will increase only 5% to 6% each year. The rest is due to inflation.

March 2016 construction jobs increase 37,000 from February and although up and down, have averaged 37,000 jobs per month for the last 6 months. That is the highest 6 month average growth rate in 10 years. That certainly doesn’t make it seem like there is a labor shortage. However, it is important to note, the jobs opening rate (JOLTS) is the highest it’s been in many years and that is a signal of difficulty in filling open positions.

To support the expected 2016 volume growth we need an average 25,000 new jobs per month in 2016, 300,000 new jobs, reaching a three-year gain of nearly 1 million jobs for the period 2014-2016, the highest three-year total jobs growth since 1997-1999. The labor force hasn’t expanded this fast in over 16 years. That can have some undesirable consequences. Rapid jobs growth may result in accelerating wages and lost productivity, compounding the cost to labor.

4-6-16

If we get a construction jobs slowdown in the next few months, it’s not all due to labor shortages and not being able to find people. Construction volume has been growing faster than jobs for more than a year. It means productivity in 2015 is up after several down years. But, while we’ve recorded consecutive years of productivity declines many times, we have not had two consecutive years of productivity gains in the last 22 years. So historically we should expect a decline, not gains this year.

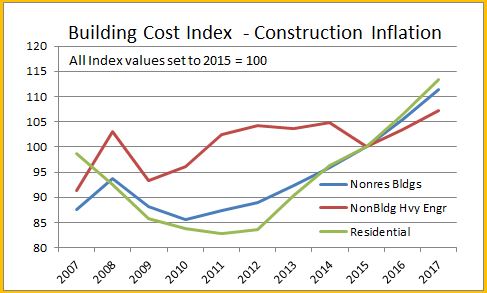

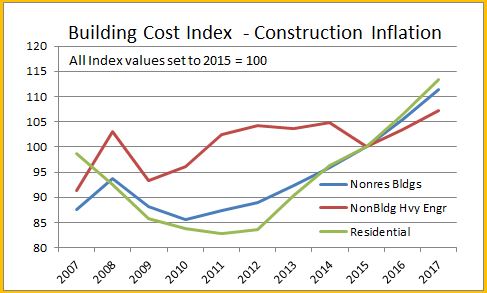

Material input costs to construction are down over the last year, but that accounts for only a portion of the final cost of constructed buildings. The cost of new residential construction is up 5% to 6% in the last year. Several nonresidential building cost indexes are indicating construction inflation between 4% and 5%. The Turner non-residential bldg cost index for 2015 is 4.6%. The 1st qtr 2016 is up 1.15% from the 4th quarter 2015. The Rider Levitt Bucknall nonresidential building 2015 cost index is 4.8% and the Beck Cost Report has 5.0% for 2015. I recommend an average 5.5% cost inflation in 2016 for residential and nonresidential buildings. Non-building infrastructure costs are unique to each individual infrastructure market, so average building cost indices should not be used for infrastructure.

What Drives Construction Spending?

3-23-16

New construction starts drive construction spending. For all the discussion regarding the monthly rise and fall of spending, most of the spending in any given month is already predetermined since two thirds of all construction spending in the next 12 months comes from projects that were started prior to today. This is commonly referred to as backlog.

The pattern of spending does not follow the pattern of new starts which can fluctuate dramatically. It follows the pattern developed by the cashflow from all previous starts. Data for new construction starts is sourced from Dodge Data & Analytics. Cash flow is developed independently. Here’s a much simplified example of cashflow: a new $20 million project start is to be completed in 20 months, therefore we expect this project to generate $1 million of spending every month for the next 20 months.

This plot is an Index, so the ratios of starts and actual spending show the relative volume of each of these three major sectors as compared to each other.

Nonresidential buildings new construction starts were elevated for 16 out of the last 24 months. Starts were strong from February through July of 2015. A slowdown occurred in the second half of 2015 but the last four months have been gaining slowly. It looks like the backlog of elevated starts will keep spending rising at least until the end of 2016 before we see a slight dip in spending.

75% of all nonresidential building spending in 2016 comes from projects that were started between early 2014 and the end of 2015. Each month, new starts generate only 4%-5% of monthly spending. As we start the new year, backlog accounts for 95% of January spending. We know a lot about spending within the next few months, but what we have in backlog for December at the beginning of the year from previous starts accounts for only 50% of December activity. We will add about 4-5% more to December backlog from new starts each month this year.

Five out of six times in the last 18 months that nonbuilding infrastructure new construction starts jumped 25% to 50% above the running average it was due to massive new starts in the power sector. Some of these projects are worth several billions of dollars. While this causes new starts to fluctuate wildly, these projects sometimes take four to five years from beginning to completion, so the cash flow is spread out over a very long period, therefore spending does not experience the same magnitude of monthly change as starts.

80% of all nonbuilding spending in 2016 comes from projects that started from mid-2013 through the end of 2015. New starts each month generate only about 3% of monthly spending.

The average of residential starts for the last three months is higher than any time since 2007 when residential starts were already on the decline by 24% from the previous year. The volume of residential starts predicts that spending should be higher than it is currently. This could mean that some starts have been delayed. Or, it could be because residential starts have the shortest duration, they may be the most difficult to predict spending from starts.

55% of all residential building spending in 2016 comes from projects that started between late 2014 and the end of 2015. New starts each month generate almost 10% of monthly spending.

(6-5-16) RE: a discussion related to a decline in nonresidential permits suggests nonresidential spending will decline. Yes, but at what rate? Permits are directly related to new construction starts. Since every month of new starts has an impact of only 4-5% on nonres spending in every following month for the next 20-25 months, then a 10% drop in permits in a single month would cause only a 0.4% to 0.5% reduction in spending in each of the following 20-25 months. It would take a prolonged trend of declining permits and therefore declining new starts to really see a dramatic decline in spending, and then the greatest effect would be well out into the future.

January 2016 Construction Economics Report

For the latest Construction Economics news follow this link

Construction Economic Outlook

…

…

January 2016 economic report:

BUILDING FOR THE FUTURE

Construction Economics – Market Conditions in Construction.

Construction spending may reach historic growth in 2016. We are currently near the most active 3 year period of growth in construction in more than 20 years, and it’s already been ongoing since 2013-2014.

Construction spending is forecast to increase 9.7% in 2016. Spending could reach a total 30% growth for the three years 2014-15-16. The only comparable periods in the last 20 years are 29% in 2003-04-05 and 27% in 2013-14-15.

Uneven growth rates ranging from rapidly increasing spending to slight dips is more an indication of the effects of uneven new starts patterns than a loss of growth momentum.

SPENDING

Nonresidential buildings spending is forecast to grow 13.7% in 2016 and the three-year total growth could reach 40% for 2014-15-16. The only comparable growth periods in the last 20 years are 40% in 2006-07-08 and 32% in 1995-96-97. Major contributions are increasing from institutional work in educational and healthcare markets. Office, commercial retail, lodging and manufacturing will decline considerably from from the levels in 2015 but still provide support to 2016 growth.

Residential spending increased 46% in 2013-14-15, similar to only one comparable period in the last 20 years, 48% in 2003-04-05. Residential spending will slow several percent early in 2016 before resuming upward momentum to finish the year with 12% growth, slightly less than growth in 2014 and 2015.

Non-building infrastructure projects, in two of the last three years have barely shown any gains, entirely due to declines in power plant projects. This will repeat in 2016. Spending will decline over the next six months due to the ending of massive projects that started 24 to 42 months ago, then resume moderate growth. Following a 0.5% increase in 2015, spending will increase only 1.2% in 2016, held down by a 10% drop in power projects, the second largest component of infrastructure work.

JOBS

Construction added 1.0 million jobs in the five years 2011-2015. 800,000 jobs were added in the last three years. In addition, hours worked increased to an all-time high adding the equivalent of 240,000 more jobs over the last five years.

In the two years 2014-2015, jobs increased the most since 2004-2005. Growth in nonresidential buildings and residential construction in 2014 and 2015 led to significant labor demand and wage growth. To support forecast spending, jobs need to grow by 500,000 to 600,000 in 2016-2017.

From the low-point of the recession in January 2010, the unemployment rate began declining as a result of the unfortunate reason of workers leaving the construction workforce. That decline halted in early 2013, at which point the workforce once again started growing. Since then the unemployment rate has been declining due to the non-working pool being reabsorbed into the the employed workforce.

There are numerous reports of labor shortages in some building professions. Average construction unemployment for Nov-Dec-Jan equaled the lowest on record (for this 3mo period) last seen in 2006, indicating a low available nonworking pool from which to grow jobs. This data supports the argument of labor shortages and potential difficulties ahead in growing employment. However, jobs continue to grow at the fastest rate in 10 years.

INFLATION

Construction inflation for buildings in 2016-2017 is quite likely to advance higher and more rapidly than previously thought. Long term construction cost inflation is normally about double consumer price inflation. Construction inflation in rapid growth years is much higher than average long-term inflation. Since 1993, long-term annual construction inflation for buildings has been 3.5%, even when including the recessionary period 2007-2011. During rapid growth periods, inflation averages more than 8%.

Spending growth, up 35% in the four-year period 2012-2015, exceeded the growth during 2003-2006 (33%) and 1996-1999 (32%) which were the two fastest growth periods on record with the highest rates of inflation and productivity loss. Construction spending growth for the four year period 2013-2016 is going to outpace all previous periods.

Inflation cost for residential buildings, nonresidential buildings and infrastructure projects do not follow the same pattern. For the last three years, the Gilbane Building Cost Index for nonresidential buildings has been increasing and has averaged just over +4%. Residential buildings cost indices averaged just over +6% but have been decreasing. Both are expected to climb in 2016. Caution: composite all-construction cost indices or indices that do not represent final cost should not be used to adjust project costs.

Infrastructure indices are so unique to the type of work that individual specific infrastructure indices should be used to adjust cost of work. The FWHA highway index dropped 4% in 2013-2014 but increased 4% in 2015 and is expected to increase in 2016-2017. The IHS power plant cost index gained 12% from 2011-2014 but then plummeted in 2015 to an eight year low. The Producer Price Index (PPI) industrial structures index and the PPI other nonresidential structures index both have been relatively flat or declining for the last three years.

Anticipate construction inflation for residential and nonresidential buildings during the next two years closer to the high end rapid growth rate of 6% to 8% rather than the long term average of 3.5%.

The full report provides analysis for what occurred in 2015, data that supports 2016 forecasts and historical trends that shape the construction industry.

Author’s note: I provided all opinion in this economic report. Now, as an independent construction economics analyst, I compile economic information and perform data analysis. You can now find all this analysis here in this new blog format. EdZ

Construction Inflation Cost Index

Note: The post you’ve reached here was originally written in Jan 2016. For the latest information follow this link to the newest data on Inflation. 8-15-19

ESCALATION / INFLATION INDICES

Thank You. edz

Jan. 31, 2016

Construction inflation for buildings in 2016-2017 is quite likely to advance stronger and more rapidly than some estimators and owners have planned.

Long term construction cost inflation is normally about double consumer price inflation. Construction inflation in rapid growth years is much higher than average long-term inflation. Since 1993, long-term annual construction inflation for buildings has been 3.5%/yr., even when including the recessionary period 2007-2011. During rapid growth periods, inflation averages more than 8%/yr.

For the period 2013-2014-2015, nonresidential buildings cost indices averaged just over 4%/yr. and residential buildings cost indices average just over 6%/yr. I recommend those rates as a minimum for 2016-2017. Some locations may reach 6% to 8% inflation for nonresidential buildings but new work in other areas will remain soft holding down the overall average inflation. Budgeting should use a rate that considers how active work is in your area.

Infrastructure projects cost indices on average have declined 4% in the last three years. However, infrastructure indices are so unique that individual specific indices should be used to adjust cost of work. The FWHA highway index dropped 4% in 2013-2014 but increased 4% in 2015. The IHS power plant cost index gained 12% from 2011-2014 but then plummeted in 2015 to an eight year low. The PPI industrial structures index and the PPI other nonresidential structures index both have been relatively flat or declining for the last three years.

These infrastructure sector indices provide a good example for why a composite all-construction cost index should not be used to adjust costs of buildings. Both residential and infrastructure project indices often do not follow the same pattern as cost of nonresidential buildings.

Anticipate construction inflation of buildings during the next two years closer to the high end rapid growth rate rather than the long term average.