Home » Forecast (Page 13)

Category Archives: Forecast

Infrastructure Outlook 2017 – Construction Spending

1-12-17

2-1-17 Upated to include Decmber data

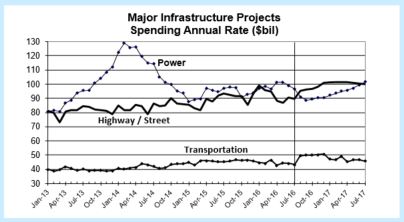

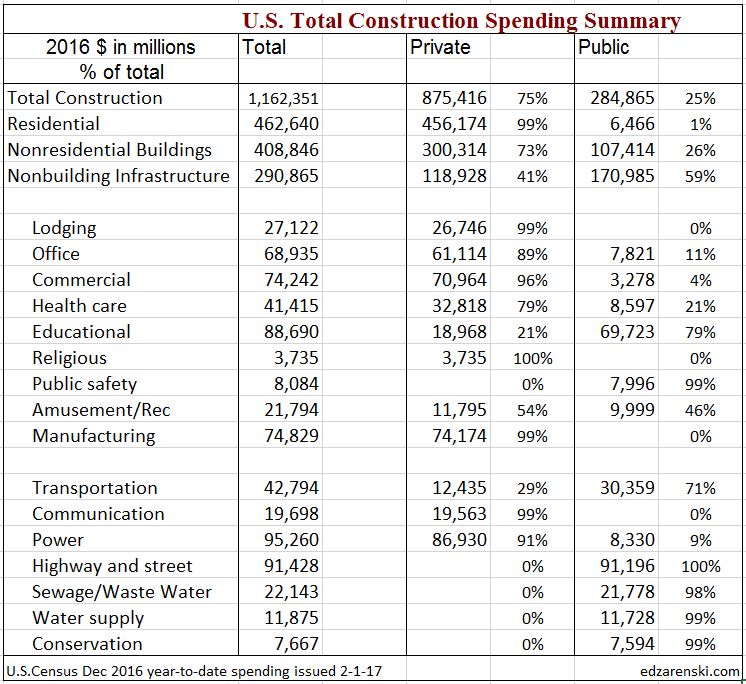

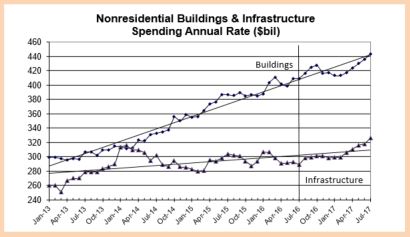

Non-building Infrastructure spending in 2016 will finish at $291 billion, down less than 1% from 2015. Spending based on projected cash flow from Dodge Data Starts predicted this drop. The negative drivers were Transportation, Sewage/Waste Disposal, Communications and Water Supply. Power, the largest infrastructure market at 34% of total sector spending, will finish up 3.3%. Highway/Street, 31% of total sector, will finish up 2%.

In 2017, Non-building Infrastructure, following two down years, will increase by 4.4% to $304 billion, due to growth in the highway and transportation markets. In the most recent quarter spending began to recover from 2016 lows posted in August and September. 2017 will be a record year for Infrastructure spending supported by spending generated from the Fixing America’s Surface Transportation Act and potentially the Water Resources Development Act.

Annual percent growth in new starts (backlog), by itself, is not necessarily a good indicator of spending in the following year. The duration of backlog must be known to forecast spending.

At the beginning of 2016, work in backlog had increased 9% over 2015, but because a large percentage was very long duration work, the amount of cash flow (work put-in-place) in 2016 from that backlog decreased from 2015.

At the beginning of 2017, work in backlog increased only 6% over 2016. What is significant though is that the amount of cash flow in 2017 from that backlog will be up 10%. That is being caused by long duration work-to-complete backlog from 2014 and 2015, which is dominated by spending in the power market. In the 1st five months of 2015, a years worth of Power work started and it’s not yet completed. It’s still contributing to infrastructure spending in 2017.

Although new starts in 2016 will finish down 6% from 2015, starts in 2015 were so strong that 2016 will still be a high volume of new starts. 2015 was up 25% from 2014. So, even though headlines will point to a 6% decline in new infrastructure starts in both 2016 and 2017, due to the distribution of spending from backlog, 2017 spending will post the largest growth in 3 years. 2017 will be a record year for spending on infrastructure, up more than 4% from 2016.

Infrastructure construction starts and spending is dominated by movements in Power and Highway markets. Power/Electric/Gas and Highway/Bridge/Street, about equally, comprise 65% of all infrastructure spending. Transportation/Air/Rail accounts for 15%. Sewage/Waste 8%, Communication 6%, Water 4% and Conservation 3%.

Power is 90% private, 10% public. Highway is 100% public. Transportation is 30% private, 70% public. Sewage, Water and Conservation are 100% public. Communication is 100% private.

Power project starts dropped 25% in 2016 but from the highest annual total of starts on record in 2015. In addition, power had very strong starts in late 2014. All of those very strong starts in late 2014 and all of 2015 are still ongoing in backlog and will contribute to strong spending in 2017. Almost half of all the spending in 2017 is generated from projects that started in 2014 and 2015. Power spending in 2017 will increase 2% over 2016 for a 6th consecutive year of near $100 billion in spending.

Highway/Street, the second largest public market, reached all-time highs in spending from the 3rd quarter 2015 through the 1st quarter 2016. After a 6 month slow down, spending in November again reached a new all-time high. Highway spending in 2017 will grow 5% over 2016.

Transportation hit all-time highs in spending all during the 2nd half of 2015. Spending declined by 6% in 2016 but is still the second highest year on record. It will again equal those 2015 highs throughout all of 2017. Transportation spending in 2017 will grow 6% over 2016.

Projected impact of proposed infrastructure stimulus:

- None of the starts or spending detailed above includes any projections of potential work from future stimulus.

- Infrastructure spending, about 25% of total construction spending, increased more than $25 billion in a single year only once. The average annual growth for the past 20 years is less than $10 billion/year. Although infrastructure growth is always erratic with no growth some years, the average growth for the last six years (post-recession) has averaged $10 billion/year. Some of those years included prior stimulus growth.

- The annual growth in PUBLIC Infrastructure has never exceeding $20 billion in a single year and averages only $7 billion.

- The average growth in infrastructure jobs (excluding all recessionary years because those years would make the result approach zero) is about 25,000 jobs per year.

- Based on infrastructure proportion of all construction, and on both all construction and infrastructure historical maximum rates of spending and jobs growth, it may be unrealistic to anticipate more than $10 billion/year growth in the infrastructure sector. ie., (from current total add $10bil yr1, $20bil yr2, $30bil yr3, etc.) See Infrastructure – Ramping Up to Add $1 trillion for more detailed explanation.

-

Also See Infrastructure & Public Construction Spending

Forecast 2017 Construction Spending

1-7-17

This is my initial forecast for 2017. Census final revisions to Oct., Nov. and Dec. 2016 spending will not be posted until February, March and April. I will then update the 2017 forecast to reflect better input. Then, with the June 1, 2017 release of spending, Census will post revisions to all 2016 spending. The 2016 record will then be updated.

2-1-17 Updated to include Dec 2016 data

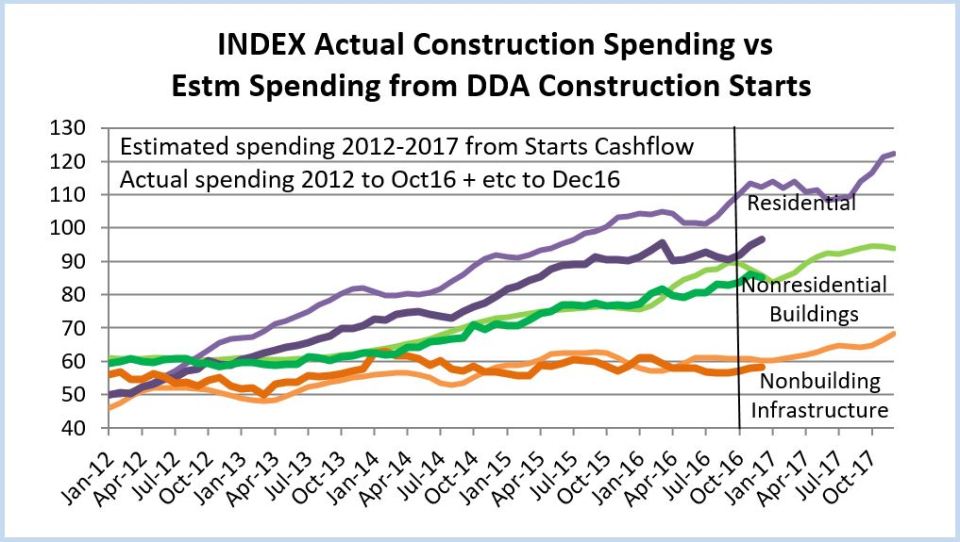

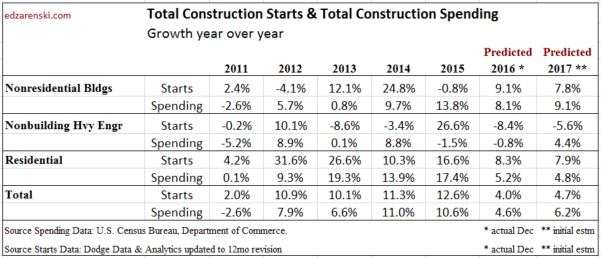

Total construction spending in 2017 will reach $1,236 billion supported by a 4th consecutive year of strong growth in nonresidential buildings. The monthly rate of spending will range from near $1.2 trillion in January to $1.3 trillion at year-end.

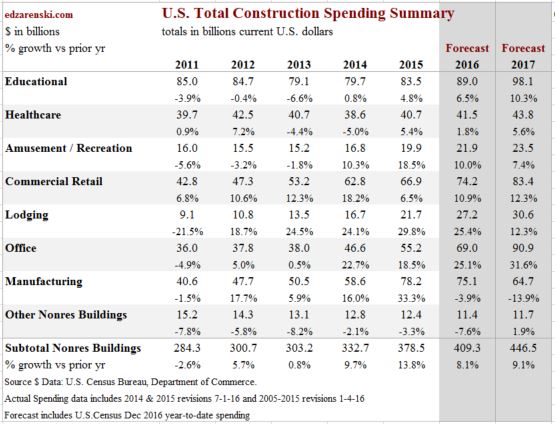

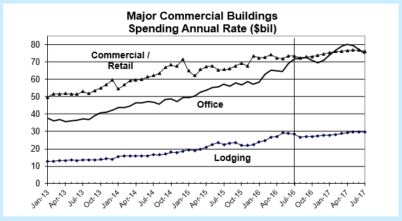

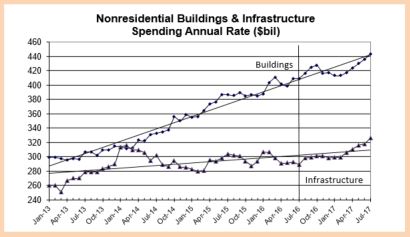

Nonresidential Buildings spending in 2017 will increase to $447 billion, 9.1% over 2016. The most recent 3-month average seasonally adjusted annual rate (SAAR) is $420 billion, only 5.5% below the peak of $444 billion in 2008. By midyear 2017 the SAAR will reach a new all-time high and it will finish the year near a SAAR of $460 billion. Office spending will lead 2017 with 30%+ growth. Commercial, Lodging and Educational markets are all expected to post strong gains over 10%.

For details on Nonresidential Buildings, See Behind The Headlines – Nonres Bldgs Construction Spending and Nonresidential Bldgs 2017 Forecasts Comparisons

Non-building Infrastructure, following two down years, will increase by 4.4% to $304 billion, due to growth in the highway and transportation markets. In the most recent quarter spending began to recover from 2016 lows posted in August and September. 2017 will be a record year for Infrastructure spending supported by spending generated from the Fixing America’s Surface Transportation Act and potentially the Water Resources Development Act.

For Non-building Infrastructure details see Infrastructure Outlook 2017

Residential will increase only moderately to $485 billion, adding 4.8% over 2016. That follows on three years of substantial growth averaging 17%/year. More than any other sector residential work is more dependent on new starts within the current year to generate spending, approximately two thirds of all spending within the year.

Office building new starts through August were up only 6% year-to-date but starts in September reached the highest in years. The 2016 starts finished at +37% providing the highest amount of work in backlog going back at least 8 years. Lodging starts in 2016 finished up nearly 40%, Healthcare up 20% and Amusement/Recreation up 35%.

Power project starts dropped 30% in 2016 but from the highest amount of starts on record in 2015. In addition, power had very strong starts in late 2014. All of those very strong starts in late 2014 and all of 2015 are still ongoing in backlog and will contribute to positive spending in 2017. Almost half of all the spending in 2017 is generated from projects that started in 2014 and 2015.

See Also 2016 Construction Spending 1-3-17

Nonresidential Bldgs Construction Spending 2017

1-4-17

This is a first pass at 2017 spending. It will be update in February when December starts and spending become available.

2-1-17 updated to include December data

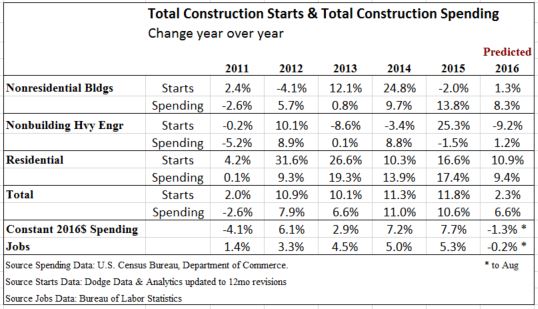

Nonresidential Buildings spending for 2016 totaled $409 billion, UP 8.1% from 2015. Spending posted increases of 9.7% in 2014 and 13.8% in 2015.

Nonresidential Buildings spending in 2017 will increase to $447 billion, 9.1% over 2016. The most recent 3-month average seasonally adjusted annual rate (SAAR) is $420 billion, only 5.5% below the peak in 2008. By midyear 2017 the SAAR will reach a new all-time high. Office, Commercial, Lodging and Educational markets are all expected to post strong results over 10% growth in 2017.

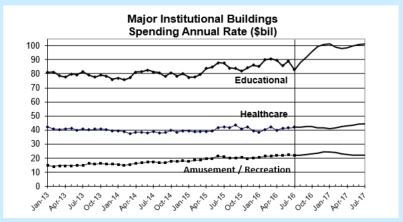

Office building new starts through August were up only 6% year-to-date but starts in September as tracked by Dodge Data & Analytics reached the highest in years. 2016 starts finished at +37% providing the highest amount of work in backlog going back at least 8 years. Lodging starts in 2016 finished up nearly 40%, Healthcare up 20% and Amusement/Recreation up 35%.

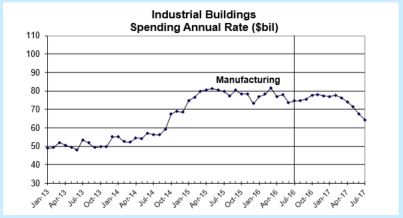

Manufacturing – spending will finish down this year, $75 billion vs $78 billion in 2015, but both years are more than 30% higher than the next closest years, 2014 and 2009. Rather than labeling 2016 a down year, 2015-2016 should be described as an extended period of extremely strong spending. 2017 spending will drop the most since pre-recession to $65 billion but will still remain well above 2014. In 2005-2006, manufacturing was less than 10% of total spending in the nonresidential buildings sector. In 2015 it reached 21%. Today it is 18%. Manufacturing in some reports is referred to as Industrial.

Office – spending dropped more than 40% from $65 billion/year in 2007-2008 to $37 billion from 2010 to 2013. Since then it has increased every year by an average of more than 20%/year and is expected to continue that level of growth in 2017. New starts for office projects increased more than 30% in 2016. Office construction 2017 starting backlog (projects under contract as of Jan 1, 2017) is the highest in at least 8 years, more than double at the start of 2014 when the current growth cycle of office construction spending began. More importantly, the ratio of spending from starting backlog is also increasing for 2017. This is setting up a very strong spending growth pattern for the next 2 years. Office construction reached a new all-time high in September 2016. Spending will be in the range of +20% to +30% year over year growth for 2017 with total coming in at $91 billion. Office was more than 16% of total sector spending in 2006 through 2008 before dropping to 13% in the recession. Now at over 17%, it has been growing steadily for the last few years. In 2017 it will be 19% of total sector spending. Offices includes data centers.

Commercial/Retail – this market dropped from $90 billion in 2007 to $40 billion in 2010. It has been growing steadily since reaching bottom in early 2011, but has only recovered to an annual total rate of $78 billion. New starts in 2016 increased moderately. For 2017 spending remains in a tight range between $82 and $84 billion, with total 2017 growth coming in at just over +12%.

Lodging – this market recorded the largest drop of any, falling 75% from $36 billion in 2008 to $9 billion in 2011. However it recorded the strongest rebound of any market climbing 19% to 30% per year for the last 5 years. New starts in 2016 increased almost 40% setting up increased spending from starting backlog in 2017. In 2017, lodging will grow by 12% with a spending total of just over $30 billion. Lodging is still 2 years away from reaching previous highs. Lodging dropped to only 3% of total sector spending in 2011 but has rebounded to 7% in 2016.

Educational – previous highs of over $100 billion in both 2007 and 2008 are perhaps two years away. However, the rate of growth has been increasing slowly since 2014 from 1% to 4.8% to 6.5% annually. New starts have increased every year since 2012. Expect 2017 educational spending to increase by more than 10% to $98 billion. At peak, educational represented 30% of all nonresidential buildings spending. Now it’s only 22%.

Healthcare – this market has been very slow to recover, experiencing declines as recently as 2013 and 2014, hitting an 8 year low in 2014, when all other nonresidential building markets had already returned to growth. 2015 was a moderate growth year, up 5%, but 2016 increased less than 2%. Starts are indicating 5.6% growth to $44 billion for Healthcare spending in 2017. Healthcare has dropped from 14% to only 10% of all nonresidential buildings spending.

Amusement/Recreation – this market hit an 8 year low in 2013 but we’ve had 3 years of excellent growth of 10%/yr or more. 2017 is expected to increase 7.4% over 2016 to a total of $23 billion. This market is only 5%of nonresidential buildings spending.

Religious and Public Safety represent less than 3% of total nonresidential building spending. The religious bldg market has been declining since 2002 and is down 55%. Public Safety peaked in 2009 and has declined every year since, now down 40%.

2016 Construction Spending 1-3-17

1-3-17

U. S. Census posted November construction spending 0.9% higher than October and 4.1% higher than November 2015. Year-to-date spending through November is 4.4% higher than 2015.

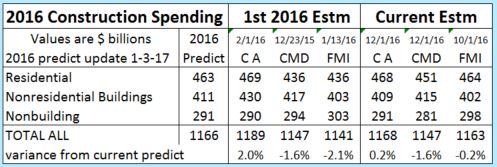

With only one month to go, 2016 is predicted to finish at $1,166 billion, up 4.8% from 2015. December spending is projected to come in at an annual rate near $1,200 billion. At this point, in order for total 2016 spending to drop below $1,160 billion, December would need to fall 6% below November, a magnitude of change that simply does not occur from month to month.

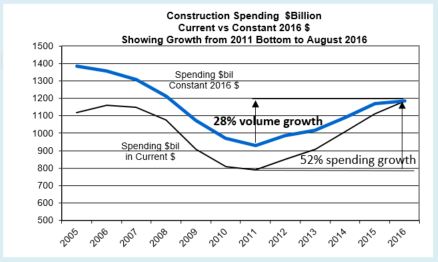

Current monthly spending is at a 10 year high and on a current dollar basis (before adjusting for inflation) is exceeded in all historical spending by only 5 months at the peak spending in early 2006. By the 2nd quarter of 2017 spending will reach all-time highs on a current dollar basis. On a constant dollar basis adjusted for inflation we are still several years below peak spending.

For inflation adjusted spending see “Are We at New Peak Construction Spending”

Revised spending for September is 1.25% higher than original posted on 11-1-16 and for October is -0.1% lower than original posted 12-1-16. However, October data is still pending revision again on 2-1-17 and is expected to increase. In the last 3 years every month has been revised up from the original amount posted. 2016 monthly revisions year-to-date average +1.3%.

The table included here shows the predicted total 2016 spending compared to 1st 2016 estimates and current 2016 estimates provided from my data = CA (Construction Analytics) and from CMD (ConstructConnect) and FMI.

Construction Spending Sept 2016

11-1-16

September data for construction put-in-place was released today. Year-to-date (YTD) spending is up 4.4% over last year. With September first data release at $1,150 bil SAAR, this seems to establish that we’ve clearly passed a forecast dip in spending that bottomed in April and May. We’ve now had 4 months of spending up from the previous quarter and all up from the same respective months in 2015.

One thing that stands out in the data; so far every month in 2016 construction spending has been revised upwards after the first data release, by an average of +1.2%. Checking back to Jan 2014, all but once spending was revised up after the first number released.

For the 1st eight months of 2016, six of eight times the first comparison of spending showed a decline this month vs previous month. After revisions, the final values show only one month/month comparison was down.

June data which appeared quite low at first has now been revised up by +1.8% (+$21bil saar), with most of the June revision in nonresidential buildings. Most of the July revision was to residential spending. The last three months of construction spending on average have been revised up by +1.5% each.

So, even though the first print shows September down -0.4% from August, historical data would indicate we could expect September to get revised up, perhaps by 1%+ which would result in September finishing higher than June, July or August. Of course, there is always the chance it might get very little increase, and August could still get revised.

Residential spending is up 5.7% ytd and is on track to finish 2016 at $470bil, +6.6% over 2015. Last year, peak spending was in September, then residential spending dropped slightly in Q4 2015. This year I expect 2016 spending to peak in Q4, so we should see ytd performance get better as we approach year end. Cash flow from new starts indicate growth of 9% in 2017 spending.

Total Nonresidential spending is up 3.6% ytd, on track to finish 2016 at $700 bil, up 4.2% over 2015. Almost all the 2016 growth is in nonresidential buildings, not infrastructure.

For the 3rd quarter 2016, compared to the same quarter in 2015, nonresidential spending is up only 1%, but the spending patterns are not apparent unless we separate nonresidential buildings from non-building infrastructure.

For the 3rd quarter 2016, compared to a year ago, nonresidential buildings spending is up 7% and non-building infrastructure is down 6%.

Nonresidential Buildings spending is up 8% ytd through September, led by Office, Lodging and Commercial Retail markets. We should finish 2016 up 8% with a total at $410 billion vs. $379 billion in 2015. Total sector growth for the last three years is 35%. I’m predicting 2017 spending for Nonresidential Buildings will increase 8%, led by Educational and Office spending.

The market share percent of total nonresidential buildings for each market is:

educ=22%, mnfg=19%, comm=18%, offc=17%, hlthcr=10%, lodg=7% and amus/rec=5%.

Office construction spending 2016 growth will be 20%+, now greater than 20%/yr for three consecutive years. At 17% market share, by far it is the largest contributor to nonresidential buildings spending growth in 2016, contributing +3.7% growth.

Lodging is expected to finish 2016 up 26% and has averaged greater than 25%/yr growth for four years. But lodging has only 7% market share, so contributes only +1.8% growth to nonresidential buildings.

Commercial Retail is up 9% with 18% market share and so contributes +1.6% to overall nonresidential buildings growth. For the three-year period 2012 to 2014, commercial averaged 14% growth.

Educational spending, up 5% at 22% of the market, contributes +1.1% to overall nonresidential buildings growth in 2016. Educational spending should finish 2016 up 6%.

Manufacturing buildings present a unique situation in 2016. Manufacturing is down -2.4% ytd. At 19% market share, that reduces total nonresidential buildings growth by -0.5%. On the surface, manufacturing is lowering total nonresidential buildings growth. Although manufacturing spending is down, it’s still very high, so it’s impact should not be viewed as negative to the overall sector. Spending increased 50%+ in 2014 & 2015. Spending in 2016 will still be the 2nd highest year on record, down only slightly from 2015 but still more than 30% higher than 2014 and more than 50% higher than 2013.

Educational spending is 80% public and 20% private. In public markets educational is only up 4% ytd, but in private markets it’s up 10%. Private spending is driving total educational to $89 billion for 2016, up 6% from 2015. 2016 will be the best year since 2008. 2017 may reach 7% to 8% growth.

60% of all public work is infrastructure. Education accounts for 25% of public work. Educational is by far the largest building type in public work. All the remaining building types contribute only 2% to 4% each.

We are currently at what I expect could be the 2016 nonres bldgs spending peak, with very little gains across Jul-Aug-Sep-Oct. Nonres bldgs spending may flatten or drop for several months before resuming the climb. This drop may be in large part due to uneven starts from the end of 2014 and beginning of 2015, a period when starts were abnormally high, that are now finishing and dropping out of the monthly spending values. Usual normal growth patterns do not fill the void left when abnormally high volume of projects finish.

Nonbuilding Infrastructure spending is down 1% ytd. Cash flows from starts predicted this drop. The biggest negative drivers are Transportation, Sewage/Waste Disposal and Water Supply, each contributing more than 0.5% to the total decline. Power, the largest infrastructure market at 33% of total, is up 4% ytd so adds +1.33% to growth, tempering some of the declines. Spending in 2016 will reach $292 billion, down less than 1% from 2015. Growth resumes in Q1 2017.Although new starts in 2016 will finish down 10%, starts in 2015 were so high that 2016 will still be a good volume of new starts. Cash flows from all existing starts are predicting 2017 will be a record year for spending on infrastructure, up more than 6% from 2016.

My forecast for total spending in 2016 is $1,170 billion, up 5% from 2015. I expect 8% growth in 2017.

U S Census September Construction Spending Released 11-1-16

See also this post from October Starts Point to Robust 2017 Spending

Construction Inflation >>> LINKS

- 10-24-16 Originally posted

- 2-11-22 added INFRASTRUCTURE index table Q4 2021

This post is preserved for the multitude of LINKS back to sources of cost indices and for the explanation of the difference between Input indices and Output or Final Cost Indices. For all latest indices plots and table see the latest yearly Inflation post.

2-20-25 SEE Construction Inflation 2025

2-1-23 SEE Construction Inflation 2023

2-11-22 SEE Construction Inflation 2022

11-10-21 See 2021 Construction Inflation

See the article Construction Inflation 2020

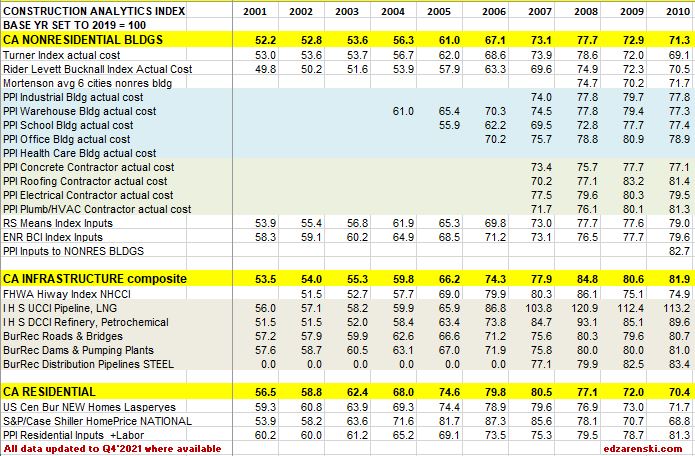

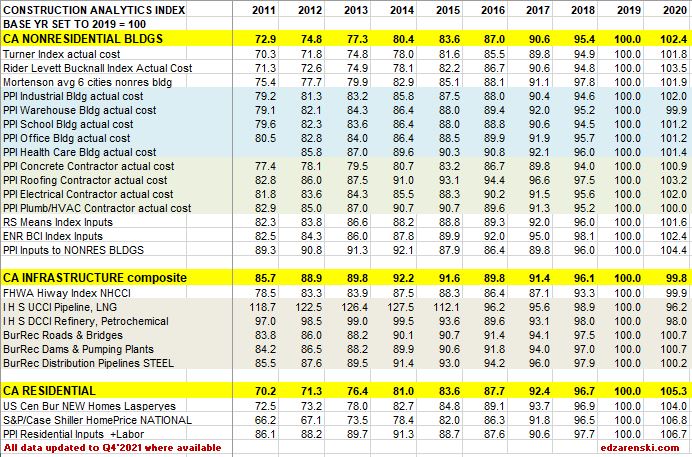

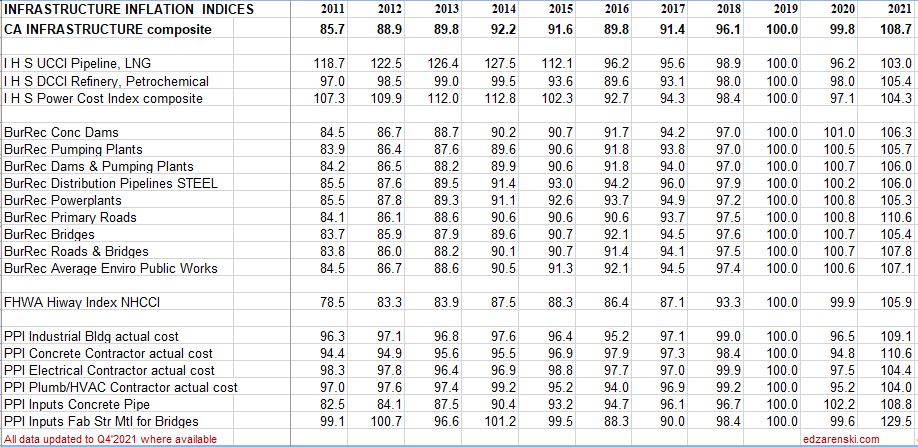

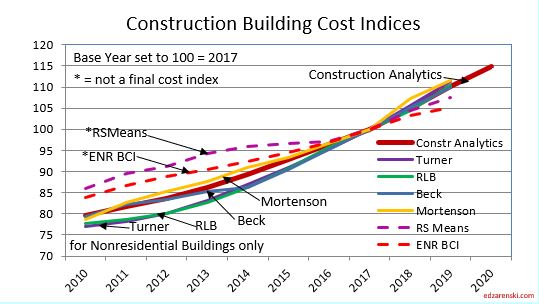

Construction Cost Indices come in many types: Final cost by specific building type; Final cost composite of buildings but still all within one major building sector; Final cost but across several major building sectors (ex., residential and nonresidential buildings); Input prices to subcontractors; Producer prices and Select market basket indices.

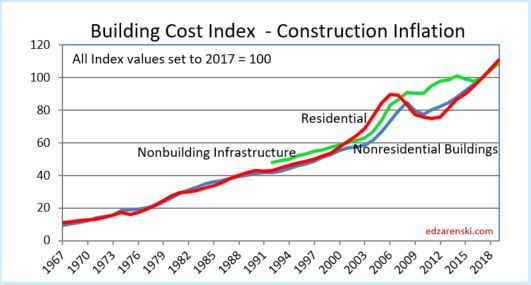

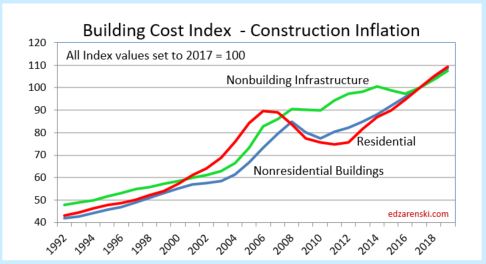

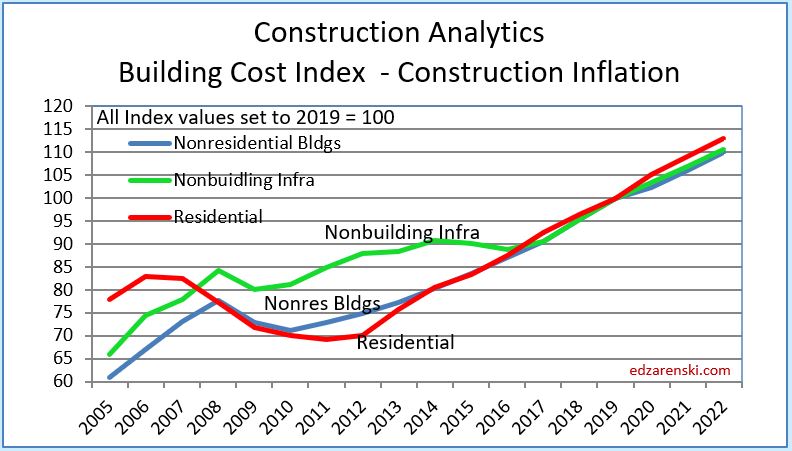

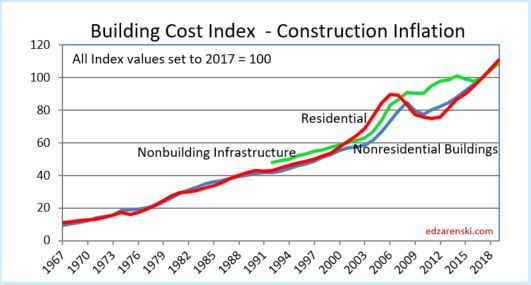

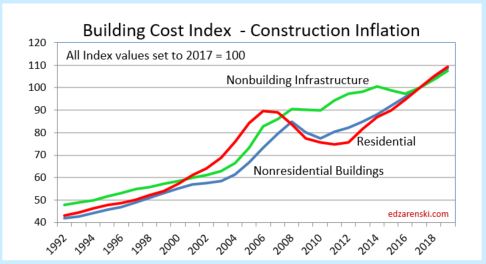

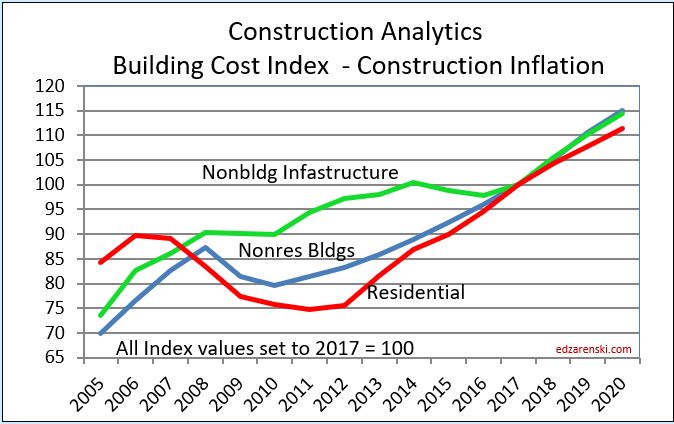

Residential, Nonresidential Buildings and Non-building Infrastructure Indices developed by Construction Analytics, (in highlighted BOLD CAPS in the tables below), are sector specific selling price (final cost) composite indices. These three indices represent whole building final cost and are plotted in Building Cost Index – Construction Inflation, see below, and also plotted in the attached Midyear report link. They represent average or weighted average of what is considered the most representative cost indicators in each major building sector. For Non-building Infrastructure, however, in most instances it is better to use a specific index to the type of work.

The following plots of Construction Analytics Building Cost Index are all the same data. Different time spans are presented for ease of use.

See the article Construction Inflation 2022

All actual index values have been recorded from the source and then converted to current year 2017 = 100. That puts all the indices on the same baseline and measures everything to a recent point in time, Midyear 2017.

All forward forecast values wherever not available are estimated and added by me.

Not all indices cover all years. For instance the PPI nonresidential buildings indices only go back to years 2004-2007, the years in which they were created. In most cases data is updated to include June 2019.

- June 2017 data had significant changes in both PPI data and I H S data.

- December 2017 data had dramatic changes in FHWA HiWay data.

SEE BELOW FOR TABLES

When construction is very actively growing, total construction costs typically increase more rapidly than the net cost of labor and materials. In active markets overhead and profit margins increase in response to increased demand. When construction activity is declining, construction cost increases slow or may even turn to negative, due to reductions in overhead and profit margins, even though labor and material costs may still be increasing.

Selling Price, by definition whole building actual final cost, tracks the final cost of construction, which includes, in addition to costs of labor and materials and sales/use taxes, general contractor and sub-contractor overhead and profit. Selling price indices should be used to adjust project costs over time.

quoted from that article,

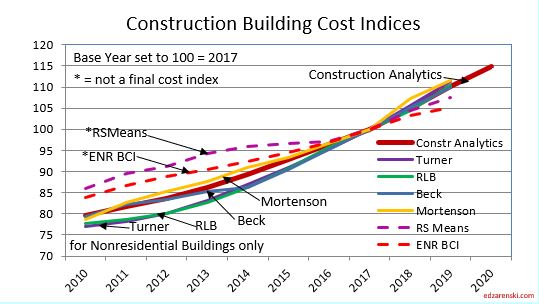

R S Means Index and ENR Building Cost Index (BCI) are examples of input indices. They do not measure the output price of the final cost of buildings. They measure the input prices paid by subcontractors for a fixed market basket of labor and materials used in constructing the building. ENR does not differentiate residential from nonresidential, however the index includes a quantity of steel so leans much more towards nonresidential buildings. RS Means is specifically nonresidential buildings only. These indices do not represent final cost so won’t be as accurate as selling price indices. RSMeans Cost Index Page RS Means subscription service provides historical cost indices for about 200 US and 10 Canadian cities. RSMeans 1960-2018 CANADA Keep in mind, neither of these indices include markup for competitive conditions. FYI, the RS Means Building Construction Cost Manual is an excellent resource to compare cost of construction between any two of hundreds of cities using location indices.

Notice in this plot how index growth is much less for ENR and RSMeans than for all other selling price final cost indices.

8-10-19 note: this 2010-2020 plot has been revised to include 2018-2020 update.

Turner Actual Cost Index nonresidential buildings only, final cost of building

Rider Levett Bucknall Actual Cost Index published in the Quarterly Cost Reports found in RLB Publications for nonresidential buildings only, represents final cost of building, selling price. Report includes cost index for 12 US cities and cost $/SF for various building types in those cities. Boston, Chicago, Denver, Honolulu, Las Vegas, Los Angeles, New York, Phoenix, Portland, San Francisco, Seattle, Washington,DC. Also includes cost index for Calgary and Toronto. RLB also publishes cost information for select cities/countries around the world, accessed through RLB Publications.

Mortenson Cost Index is the estimated cost of a representative nonresidential building priced in seven major cities and average. Chicago, Milwaukee, Seattle, Phoenix, Denver, Portland and Minneapolis/St. Paul.

Beck Biannual Cost Report in 2017 and earlier cost reports developed indices for six major U.S. cities and Mexico, plus average. In the most recent Summer 2021 report, while Beck provides valuable information on cost ranges for 30 different types of projects, the former inflation index is absent. Beck has not published city index values since 2017. Read the report for the trend in building costs. See discussion for Atlanta, Austin, Charlotte, Dallas/Fort Worth, Denver, Tampa and Mexico

Bureau of Labor Statistics Producer Price Index only specific PPI building indices reflect final cost of building. PPI cost of materials is price at producer level. The PPIs that constitute Table 9 measure changes in net selling prices for materials and supplies typically sold to the construction sector. Specific Building PPI Indices are Final Demand or Selling Price indices.

PPI Materials and Supply Inputs to Construction Industries

PPI Nonresidential Building Construction Sector — Contractors

PPI Nonresidential Building Types

PPI Materials Inputs and Final Cost Graphic Plots and Tables in this blog updated 2-10-19

PPI BONS Other Nonresidential Structures includes water and sewer lines and structures; oil and gas pipelines; power and communication lines and structures; highway, street, and bridge construction; and airport runway, dam, dock, tunnel, and flood control construction.

RS MEANS Key material cost updates quarterly

National Highway Construction Cost Index (NHCCI) final cost index, specific to highway and road work only.

The Bureau of Reclamation Construction Cost Trends comprehensive indexes for about 30 different types of infrastructure work including dams, pipelines, transmission lines, tunnels, roads and bridges. 1984 to present.

IHS Power Plant Cost Indices specific infrastructure only, final cost indices

- IHS UCCI tracks construction of onshore, offshore, pipeline and LNG projects

- IHS DCCI tracks construction of refining and petrochemical construction projects

- IHS PCCI tracks construction of coal, gas, wind and nuclear power generation plants

S&P/Case-Shiller National Home Price Index history final cost as-sold index but includes sale of both new and existing homes, so is an indicator of price movement but should not be used solely to adjust cost of new residential construction

US Census Constant Quality (Laspeyres) Price Index SF Houses Under Construction final cost index, this index adjusts to hold the build component quality and size of a new home constant from year to year to give a more accurate comparison of real residential construction cost inflation

TBDconsultants San Francisco Bay Area total bid index (final cost).

Other Indices not included here:

CoreLogic Home Price Index HPI for single-family detached or attached homes monthly 1976-2019. This is a new home and existing home sales price index.

Consumer Price Index (CPI) issued by U.S. Gov. Bureau of Labor Statistics. Monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. This index in not related at all to construction and should not be used to adjust construction pricing.

Jones Lang LaSalle Construction Outlook Report National Construction Cost Index is the Engineering News Record Building Cost Index (ENRBCI), a previously discussed inputs index. The report provides some useful commentary.

Sierra West Construction Cost Index is identified as a selling price index with input from 16-20 U.S. cities, however it states, “The Sierra West CCCI plays a major role in planning future construction projects throughout California.” This index may be a composite of several sectors. The link provided points to the description of the index, but not the index itself. No online source of the index could be found, but it is published in Engineering News Record magazine in the quarterly cost report update.

Leland Saylor Cost Index Clear definition of this index could not be found, however detailed input appears to represent buildings and does reference subcontractor pricing. But it could not be determined if this is a selling price index. A review of website info indicates almost all the work is performed in California, so this index may be regional to that area. Updated Index Page

DGS California Construction Cost Index CCCI The California Department of General Services CCCI is developed directly from ENR BCI. The index is the average of the ENR BCI for Los Angeles and San Francisco, so serves neither region accurately. Based on a narrow market basket of goods and limited labor used in construction of nonresidential buildings, and based in part on national average pricing, it is an incomplete inputs index, not a final cost index.

Vermeulens Construction Cost Index can be found here. It is described as a bid price index, which is a selling price index, for Institutional/Commercial/Industrial projects. That would be a nonresidential buildings sector index. No data table is available, but a plot of the VCCI is available on the website. Some interpolation would be required to capture precise annual values from the plot. The site provides good information.

CALTRANS Highway Cost Index Trade bids for various components of work and materials, published by California Dept of Transportation including earthwork, paving and structural concrete. Includes Highway Index back to 1972, quarterly from 2012.

Colorado DOT Construction Cost Index 2002-2019 Trade bids for various components of work published by Colorado Dept of Transportation including earthwork, paving and structural concrete.

Washington State DOT Construction Cost Index CCI for individual components or materials of highway/bridge projects 1990-2016

Minnesota DOT Highway Construction Cost Index for individual components of highway/bridge projects 1987-2016

Iowa DOT Highway Cost Index for individual components of highway/bridge projects 1986-2019

New Hampshire DOT Highway Cost Index 2009-2019 materials price graphs and comparison to Federal Highway Index.

New York Building Congress New York City Construction Costs compared to other US and International cities

U S Army Civil Works Construction Cost Index CWCCIS individual indices for 20 public works type projects from 1980 to 2050. Also includes State indices from 2004-2019

Eurostat Statistics – Construction Cost Indices 2005-2017 for European Countries

Comparative International Cities Costs – This is a comparative cost index comparing the cost to build in 40 world-wide cities If this International Cities Costs is a parity index, which involves correcting for difference in currency, then you must know the parity city in each country, which in the US I think is Chicago.

OECD International Purchasing Power Parity Index

Turner And Townsend International Construction Markets 2016-2017

Turner And Townsend International Construction Markets 2018

Rider Levitt Bucknall Caribbean Report 2018

US Historical Construction Cost Indices 1800s to 1957

Click Here for Link to Construction Cost Inflation – Commentary

2-12-18 – Index update includes revisions to historic Infrastructure data

1-26-21 The tables below, from 2011 to 2020 and from 2015 thru 2023, updates 2020 data and provides 2021-2023 forecast.

NOTE, these tables are based on 2019=100. Nonresidential inflation, after hitting 5% in both 2018 and 2019, and after holding above 4% for the six years 2014-2019, is forecast to increase only 2.5% in 2020, but then 3.8% in 2021 and hold near that level the next few years. Forecast residential inflation for the next three years is level at 3.8%. It was only 3.6% for 2019 but averaged 5.5%/yr since 2013 and returned to 5.1% in 2020.

11-10-21 Follow the link at the bottom to 2021 Inflation

The Tables below 2001 to 2010 and 2011-2020 are updated to Q4 2021 with any revisions to past years posted on source websites.

The Table below 2015 to 2023 is updated to Q4 2021

How to use an index: Indexes are used to adjust costs over time for the affects of inflation. To move cost from some point in time to some other point in time, divide Index for year you want to move to by Index for year you want to move cost from. Example : What is cost inflation for a building with a midpoint in 2022, for a similar nonresidential building whose midpoint of construction was 2016? Divide Index for 2022 by index for 2016 = 110.4/87.0 = 1.27. Cost of building with midpoint in 2016 x 1.27 = cost of same building with midpoint in 2022. Costs should be moved from/to midpoint of construction. Indices posted here are at middle of year and can be interpolated between to get any other point in time.

All forward forecast values, whenever not available, are estimated by Construction Analytics.

2-13-23 Construction Inflation 2023

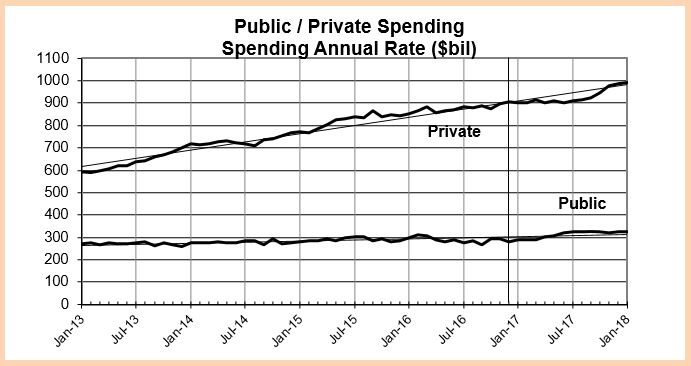

Public Construction Spending 2016-2017

10-21-16

updated 2-16-17 edited to include 2016 year-end total$ public vs private

The two largest components of Public Construction Spending, by far, are Highway/Bridge/Street and Educational Buildings. These two markets have more impact on the magnitude of public spending than any other markets. All of Highway ($90bil) is public spending. About 80% ($70bil out of $88bil) of Educational buildings is public spending. Together they add up to 55% of all public construction spending.

The next three largest public markets in order are: 70% of Transportation ($30/$42bil); all of Sewage/Wastewater ($22bil) and all of Water Supply ($12bil). These three markets account for only about 22% of public spending. Eight remaining markets, none larger than 3.5% of the total public sector, combined make up ~20% of total public spending. Five of those eight, Office, Health care, Public Safety, Amusement and Power, each account for $8 to $10bil and each is 3% to 3.5% of Public work.

Public Construction Spending average for the first six months of 2016 was the highest since 2010 and is up 10% from the Q4’13-Q1’14 low point.

Public spending finished 2016 down 0.8% from 2015, but that is down from a near six-year high, so spending is still strong. It is still -9% below its 2009 peak.

The biggest mover to total public spending this year is educational spending. Public educational spending in 2016 is up 4.7%. Because it represents 25% of all public spending, it has a net impact of moving total public spending up +1.2%, greater impact than any other market.

Public commercial spending is up 24% but has only a 1% market share of public work so moves public spending by only +0.24%. Power is down -20% but at a share of only 3% moves public spending by only -0.6%. Public components of office, public safety, sewage/waste disposal and water supply are all down by a combined -7%. At a combined market share of 18% that nets a -1.26% reduction in total public spending.

Public spending peaked in 2009 when Educational buildings spending was at its highest. Highway spending has been at or near its peak for the last 16 months but that, with current educational spending, which is still more than 20% below its peak, has not been enough to carry public spending to new highs.

Expected spending predicted from new construction starts gives a much better picture for 2017.

Highway/Bridge/Street starts in 2015 finished just shy of a 6-year high (in 2013) but 2016 was down 13% from 2015. On average 2015+2016 starts are still 5% higher than 2014. Highway projects are long duration, so very good starts from the end of 2014 and the beginning of 2015 will still contribute strong spending well into 2017. Highway spending is expected to finish up slightly over 2016.

Educational new starts in 2016 finished the year up 11%, posting a 4th consecutive annual increase and educational spending for 2017 should finish up 10%.

Transportation spending in 2017 should increase 6%.

Overall, total public construction spending in 2017 is predicted to grow by 8% to 9%, the first substantial growth since 2007, reaching new highs in the 2nd half. Educational spending will take the lead in 2017 public work. Historically, public spending increases by less than 10% per year.

Construction Jobs – Behind The Headlines

10/13/16

Headline comparisons we read are often what happened this month versus last month or year-to-date versus last year. For comparisons to construction spending and jobs it is perhaps beneficial to look at recent and longer term trends. Here I will discuss construction jobs growth versus spending growth and highlight some of the pitfalls when comparing these values for productivity.

The most talked about reason for slower jobs growth is the lack of experienced workers available to hire. In fact, recent surveys indicate about 70% of construction firms report difficulty finding experienced workers to fill vacant positions. That certainly cannot be overlooked as one reason for slower jobs growth, but that is not the only reason?

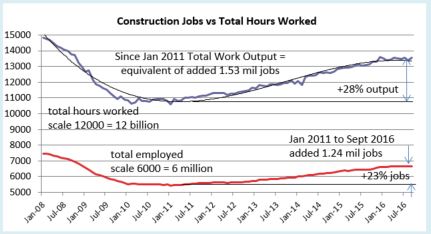

Even with all this talk of difficulty finding experienced construction workers, there has been very good jobs growth. For the 5 ½ year period from the bottom in January 2011 to the present (August 2016) we added 1,240,000 construction jobs.

- Jobs increased by 23% in 5 ½ years with peak growth in 2014 and 2015.

- For the two years 2014+2015 we added 650,000 jobs, the largest number of new jobs in two years since 2004+2005.

In 2014-2015, jobs expanded by 11%, the highest number of jobs in a two-year span since 2004-2005 and the fastest two-year percent growth since 1998-1999. Peak growth was 6.1% in 2014 with slower growth in 2015. I expect even slower growth in 2016.

- For the 6-month period including Oct’15 thru Mar’16 construction gained 214,000 jobs, the fastest rate of consecutive months jobs growth in 10 years. Then, after 3 months of losses, July shows a modest gain.

Jobs growth from October 2015 through March 2016 was exceptional, 214,000 construction jobs added in 6 months, topping off the fastest 2 years of jobs growth in 10 years. That is the highest 6-month average growth rate in 10 years. That certainly doesn’t make it seem like there is a labor shortage. However, it is important to note, the jobs opening rate (JOLTS) is the highest it’s been in many years and that is a signal of difficulty in filling open positions.

I would expect growth like that to be followed by a slowdown in hiring as firms try to reach a jobs/workload balance, after such a robust period of jobs growth. It appears we may have experienced that slowdown. Jobs have been down four of the last six months and up most recently.

- Q2’16 jobs declined all 3 months. Keep in mind, this immediately follows the fastest rate of jobs growth in 10 years. But it also tracks directly to three monthly declines in spending. (I predicted this jobs slowdown in my data 9 months ago. I predicted the 1st half 2016 spending decline more than a year ago).

It is not so unusual to see jobs growth slowed in the 2nd quarter. It follows directly with the Q2 trend in spending and it follows what might be considered a saturation period in jobs growth. The last two years of jobs growth was the best two-year period in 10 years. It might also be indicating that after a robust 6 month hiring period there are far fewer skilled workers still available for hire. The unemployed available for hire is the lowest in 16 years.

Construction spending hit bottom at the same time as jobs, the 1st quarter 2011. For the same 5 ½ year period, Jan 2011 to Aug 2016, construction spending increased 52%, far more than jobs growth. For 2014+2015, spending increased close to 11% per year, the fastest spending growth in more than 10 years.

- For the same 6-months, Oct’15 thru Mar’16, Q4’15 spending was flat but by the end of Q1’16 spending had increased more than 4% in 6 months, to an annual rate of +8%.

- 2nd quarter 2016 spending came in 2% below 1st quarter.

- Total 1st half spending finished 7.2% above the 1st half 2015.

Although spending slowed in the 2nd quarter this year, in part it’s because the 1st quarter was so strong. They combined for a strong 1st half up 7.2% over last year.

Why is it that jobs don’t increase at the same rate as construction spending? Because much of that spending growth is just inflation, not true volume growth. Volume is construction spending minus inflation. To get volume we need to convert all dollars from current $ in the year spent into constant $ by factoring out inflation.

- Jobs growth should not be compared to spending growth.

- Spending increased 52% from Jan/Feb 2011 to Jul/Aug 2016.

- After adjusting for inflation from Q1 2011 to Q3 2016, we find that construction volume increased by 28% in 5 ½ years.

So, it looks like volume (+28%) still increased much more than jobs (+23%) in the same period and this would indicate increasing productivity. But this still is not the whole picture. Jobs need to be adjusted.

- Jobs needs to take into consideration the hours worked.

Before the dramatic decline in jobs from 2007 through 2010, hours worked ranged between 37hrs/wk and 38hrs/wk. But by 2015, and into 2016, hours worked has been consistently over 39hrs/wk. So not only did the workforce grow by 1.24 million jobs (+23%), but also the entire 7.0 million work force is working about 4% more hours/week. This must be considered to get net jobs, or work output.

- After adjusting for hours worked from Q1 2011 to Q3 2016, we find that net jobs growth increased by 28% in 5 ½ years.

- Since Q1 2011 the constant $ value of construction spending increased by 28%.

- Since Q1 2011 Jobs/hours worked output also increased by 28%.

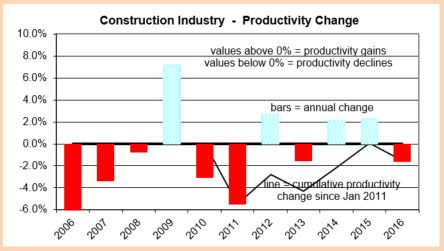

Since Jan 2011, volume increased 28% and workforce output increased 28%, for a net productivity balance, but in 2011 we had a significant productivity loss and a smaller loss in 2013. The huge 2011 productivity loss is probably in part explained by the resumption of hiring after historic job cuts, particularly in 2009 when the work force was cut 16% but, while spending declined by 16%, work volume declined only 11%, which may have overshot the balance mark. That helps account for the huge productivity gain in 2009, but also leads to the losses in 2010 and 2011.

From Jan 2014 to Dec 2015 volume increased by 15% and workforce output increased by only 10.5%. Total hours worked compared to total constant value of spending shows productivity increased for those two years. Historically, we should not expect to see productivity growth continue for a third year and as of August it is down year-to-date.

I expected to see a turn-around in jobs growth in the 2nd half of 2016, and so far, for the 3-month period July-Sept we’ve added 34,000 jobs. That’s starting out perhaps a little slower than I thought. For much of 2014 and 2015 volume growth was exceeding jobs growth, but for 10 months from August 2015 through May 2016, volume growth mostly stalled and jobs growth, which just had 6 months of record high growth, exceeded volume growth by 3%. Only in the last few months has volume growth begun to outpace jobs growth again. But I suspect it is this slow down in real volume growth that has led to slow jobs growth. This leads me to think if spending plays out as expected into year end 2016, then construction jobs may begin to grow faster in late 2016. However, availability could have a significant impact on this needed growth.

Availability already seems to be having an effect on wages. Construction wages are up 2.6% year/year, but are up 1.2% in the last quarter, so the rate of wage growth has recently accelerated. The most recent JOLTS report shows we’ve been near and now above 200,000 job openings for months. With this latest jobs report, that could indicate labor cost will continue to rise rapidly.

As wages accelerate, also important is work scheduling capacity which is affected by the number of workers on hand to get the job done. Inability to secure sufficient workforce could impact project duration and cost and adds to risk, all inflationary. That could potentially impose a limit on spending growth. It will definitely have an upward effect on construction inflation this year.

For all of 2016 and 2017, I predict construction spending will increase about 15%, BUT after inflation construction volume will increase only about 6% to 7%, most of that in 2017. For all of 2016 and 2017, I predict jobs will grow by 350,000 to 450,000, only about 5% to 6%.

Reference Source Information:

U.S. Census released August Construction Spending 10-3-16

BLS released the September jobs Report 10-7-16

Reference Posts:

Construction Jobs Show 3rd Qtr Growth

Construction Jobs – Is July a Turning Point?

Construction Cost Inflation – Commentary 2019

1-28-20 See the new post Construction Inflation 2020

8-10-19 updated plots and commentary

General construction cost indices and Input price indices that don’t track whole building final cost do not capture the full cost of escalation in construction projects. To properly adjust the cost of construction over time you must use actual final cost or selling price indices.

Click Here for Link to a 20year Table of 25 Indices

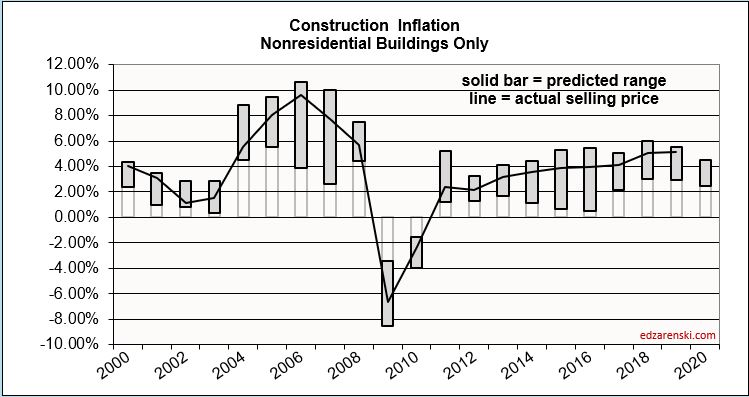

Inflation in construction acts differently than consumer inflation. When there is more work available, inflation increases. When work is scarce, inflation declines. A very large part of the inflation is margins, wholesale, retail and contractor. When nonresidential construction was booming from 2004 through 2008, nonresidential final price inflation averaged almost 8%/year. This was at a time when input costs were averaging between 5% and 6%/year. When residential construction boomed from 2003 to 2005, inflation in that sector was 10%/year. But from 2009 through 2012 we experienced deflation, the worst year being 2009. Residential construction experienced a total of 17% deflation from 2007 through 2011. From 2008 to 2010, nonresidential buildings experienced 10% deflation in two years.

The following plots are all the same data. Different time spans are presented for ease of use.

8-10-19 note: this 2005-2020 plot has been revised to include 2018-2020 update.

Nonresidential Buildings – Since 1993, the 25-year long-term annual construction inflation has averaged 3.5%, even when including the recessionary period 2007-2011. Long-term average inflation, without recessionary declines, is 4% for 20 non-recessionary years since 1993. During rapid growth period of 5 years from 2004-2008, inflation averaged 8% per year. Since 2011, nonresidential buildings inflation has averaged 3.8%, averaging 4.25%/yr. for the last 4 years with a high of 5.1% in 2018.

Residential, from 2007- 2011 experienced 5 consecutive years of deflation, down 20%. In the 4-year boom just prior to that, 2003-2006, inflation averaged 9% per year. Residential inflation snapped back to 8.0% in 2013. It slowed to 4.4% in 2018 but has averaged over 5% for the last three years.

Construction Spending growth posted two separate 4-year periods of 40%+ growth, up 41% in 2012-2015 and up 40% in 2013-2016, exceeding the growth during the closest similar four-year periods 2003-2006 (+37%) and 1996-1999 (+36%), which were the two fastest growth periods on record with the highest rates of inflation and productivity loss. Growth peaked at +11%/year in 2014 and 2015, exceeded only slightly by 2004-2005.

Spending growth slowed to 7.0% in 2016 and only 4.5% in 2017. In 2018, spending dropped to a gain of only 3.3%. It’s expected, after revisions that 2019 spending will finish at a gain of less than 2%.

Producer Price Index (PPI) Material Inputs (excluding labor) costs to new construction increased +4% in 2018 after a downward trend from +5% in 2011 led to decreased cost of -3% in 2015, the only negative cost for inputs in the past 20 years. Input costs to nonresidential structures in 2017+2018 average +4.2%, the highest in seven years. Infrastructure cost are up near 5% and single-family residential inputs are up 4%. But material inputs accounts for only a portion of the final cost of constructed buildings.

Labor input is currently experiencing cost increases. When there is a shortage of labor, contractors may pay a premium to keep their workers. All of that premium may not be picked up in wage reports. Also, some of the labor inflation is due to lost productivity due to less skilled workforce. Unemployment in construction is the lowest on record. There is some sign of jobs growth slowing down in Q2 and Q3 2019, and potentially getting slower.

Nationally tracked indices for residential, nonresidential buildings and non-building infrastructure vary to a large degree. When the need arises, it becomes necessary that contractors reference appropriate sector indices to adjust for whole building costs.

Click Here for Link to a Table of 25 Index Values

ENRBCI and RSMeans input indices are prefect examples of commonly used indices that DO NOT represent whole building costs, yet are widely used to adjust project costs. An estimator can get into trouble adjusting project costs if not using appropriate indices. The two input indices for nonresidential buildings did not decline during the 2008-2010 recession. All other final cost indices dropped 6% to 10%.

From 2010 to 2019, total final price inflation is 110/80 = 1.38 = +38%. Input cost indices total only 106/85 = 1.25 = +25%, missing a big portion of the cost growth over time.

CPI, the Consumer Price Index, tracks changes in the prices paid by urban consumers for a representative basket of goods and services, including food, transportation, medical care, apparel, recreation, housing. This index in not related at all to construction and should never be used to adjust construction pricing. Historically, Construction Inflation is about double the CPI. However for the last 5 years it averages 3x the CPI.

Taking into account the current (Jan 2018 12 mo) CPI of 2% and the most recent 5 years ratio, along with accelerated cost increases in labor and material inputs and the high level of activity in markets, I would consider the following forecasts for 2018 inflation as minimums with potential to see higher rates than forecast.

Residential construction, from 2007- 2011, experienced five consecutive years of deflation, down 20%. In the 4-year boom just prior to that, 2003-2006, inflation averaged +9% per year. Residential construction inflation saw a slowdown to only +3.5% in 2015. However, the average inflation for five years from 2013 to 2017 is 6%. It peaked at 8% in 2013. It climbed back over 5% for 2016 and reached 5.8% in 2017. For 2018, residential final cost inflation indexes are up only 4.5%. Residential construction inflation for 2019 is now about 4% to 4.5%.

A word about Hi-Rise Residential. About 95% of the cost of a hi-rise residential building would remain the same whether the building was for residential or nonresidential use. This type of construction is totally dis-similar to low-rise residential, which in large part is stick-built single family homes. Therefore, a more appropriate index to use for hi-rise residential construction is the nonresidential buildings cost index.

Nonresidential Buildings inflation, during the rapid growth period of five years from 2004-2008, averaged 8% per year. Inflation averaged near 4% per year for the 4 years 2014-2017.

Several Nonresidential Buildings Final Cost Indices averaged over 5% per year for the last 2 years and over 4% per year for the last 5 years. Nonresidential buildings inflation totaled 22% in the last five years. Input indices that do not track whole building cost would indicate inflation for those four years at only 12%, much less than real final cost growth. For a $100 million project escalated over those four years, that’s a difference of $8 million, potentially underestimating cost.

Nonresidential buildings spending slowed from 2017 to 2019 but is now entering a phase in which it may reach the fastest rate of growth in three years, which historically leads to accelerated inflation. Construction inflation for nonresidential buildings for 2018 and 2019 was 5%/yr. For 2020 expect 4.25%, rather than the long term average of 3.5% to 4.0%.

Non-building infrastructure indices are so unique to the type of work that individual specific infrastructure indices must be used to adjust cost of work. The FHWA highway index increased 17% from 2010 to 2014, stayed flat from 2015-2017, then increased 6%+ in 2018. The Highway index for 2019 is up about 6%. The IHS Pipeline and LNG indices increased in 2018 but are still down 20% since 2014. Coal, gas, and wind power generation indices have gone up only 6% in seven years. Refineries and petrochemical facilities have dropped 5% in 4 years but 2018 regained the level of 2013. Input costs to infrastructure are down slightly from the post recession highs, but most have increased in the last year. Input cost to Highways are up 5.0% and to the Power sector are up 3.6% in 2018. Work in Transportation and Pipeline projects has increased dramatically in 2017 and 2018.

Infrastructure power indices registered 2.5% to 3.5% gains in 2017 and again in 2018. Highway indices increased 6.6% in 2018. Anticipate 4% inflation for Power sector and at least 5%-6% inflation for Highway in 2019 with the potential to go higher in rapidly expanding markets, such as pipeline or highway.

This plot for nonresidential buildings only shows bars representing the predicted range of inflation from various sources with the line showing the composite final cost inflation. Note that although 2015 and 2016 have a low end of predicted inflation of less than 1%, the actual inflation is following a pattern of growth above 4%. The low end of the predicted range is almost always established by input costs, while the upper end of the range and the actual cost are established by selling price indices.

8-10-19 note: this 2005-2020 plot has been revised to include 2018-2020 update.

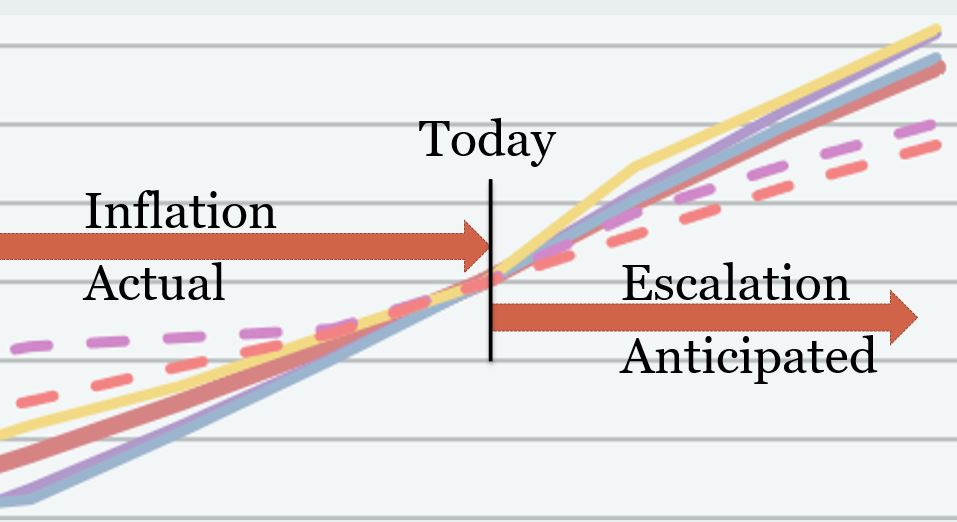

A word about terminology: Inflation vs Escalation. These two words, Inflation and Escalation, both refer to the change in cost over time. However escalation is the term most often used in a construction cost estimate to represent anticipated future change, while more often the record of past cost changes is referred to as inflation. Keep it simple in discussions. No need to argue over the terminology, although this graphic might represent how most owners and estimators reference these two terms.

In every estimate it is always important to carry the proper value for cost inflation. Whether adjusting the cost of a recently built project to predict what it might cost to build a similar project in the near future or adding an escalation factor to the summary of an estimate for a project with a midpoint 2 years out, or answering a client question, “What will it cost if I delay my project start by one year?”, whether you carry the proper value for escalation can make or break your estimate.

- Long term construction cost inflation is normally about double consumer price inflation (CPI).

- Since 1993 but taking out 2 worst years of recession (-8% to -10% total for 2009-2010), the 20-year average inflation is 4.2%.

- Average long term (30 years) construction cost inflation is 3.5% even with any/all recession years included.

- In times of rapid construction spending growth, construction inflation averages about 8%.

- Nonresidential buildings inflation has average 3.7% since the recession bottom in 2011. It averaged 4.6% for the 4 years 2016-2019.

- Residential buildings inflation reached a post recession high of 8.0% in 2013 but dropped to 3.5% in 2015. It averaged 4.6% for the 4 years 2016-2019, but is at the low point of 3.3% in 2019.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors/suppliers margins.

- When construction volume increases rapidly, margins increase rapidly.

- Construction inflation can be very different from one major sector to the other and can vary from one market to another. It can even vary considerably from one material to another.

Click Here for Link to a Table of 25 Index Values

Construction Spending 2016 – Midyear Nonresidential Markets

Construction Spending 2016 – Nonresidential Markets

9-8-16

Refer here to the Construction Spending 2016 Midyear Summary

Nonresidential Buildings

Nonresidential Buildings spending for July totaled a SAAR of $403 billion, down slightly from June but up 1.3% from the May dip. Spending YTD for nonresidential buildings through July is up 8.0% over 2015. The current 3-month average of $403 billion is up slightly from the 1st quarter but is still 9% below the peak in 2008.

How does actual spending YTD compare to my early 2016 forecast?

Nonresidential Bldgs predicted YTD $236.9b, actual YTD $228.1b (-$8.8bil, -3.7%).

Nonresidential Buildings spending for 2016 predicted in Dec 2015 $439.2b. Now with YTD data through July forecast spending for 2016 is $410.9b (-$28.3bil, -6.4%).

Total Nonresidential Buildings construction spending increased 9.7% in 2014 and 13.8% in 2015 and will grow 8.5% in 2016 and 6.3% in 2017.

Nonresidential Buildings Spending History

- 5 years 2004-2008 up 64%

- 3 years 2006-2008 up 45%

- 3 years 2009-2011 down 36%

- 2 years 2014-2015 up 25%

Manufacturing construction spending YTD is down 2.6% from 2015. However, that is because 2015 manufacturing construction spending reached all-time highs after record new starts in 2014, some of which will extend spending into 2017. 2016 is on track to reach the second highest year of spending on record, only slightly below 2015. Although new starts YTD in 2016 are down 75% from 2015, that will have most affect next year. A very large volume of starts in mid-2014 and early 2015 will generate spending extending into the 2nd half of 2016and early 2017. Total manufacturing construction spending for 2016 will finish 2% below 2015. Due to declining new starts in 2015 and 2016, spending in 2017 will drop more than 10%, and yet still be the 3rd highest year on record. Manufacturing construction represents 19% of total nonresidential buildings spending.

Office construction spending YTD is up 22% from 2015. Although new starts are currently down slightly from last year, starts are expected to grow 4% for 2016. Office starts have been strong since 2013. Vacancy rates peaked in 2010 and demand for office space has been increasing. A large component of office construction is data centers. Although we may see a few months of spending declines in late 2016, the large volumes of spending generated by several years of strong starts will keep total spending high. Office construction spending increased 23% in 2014 and 19% in 2015 and it will grow 23% in 2016 and 15% in 2017. Office construction represents 17% of total nonresidential buildings spending.

Commercial construction spending YTD is up 11% from 2015. Commercial new starts have been increasing slowly for the last 4 years. Spending will remain nearly flat for the next several months and is forecast to grow very slowly through mid-2017, then taper off slightly. Commercial construction had its biggest years in 2012-2013-2014 with growth of 11%, 12% and 18%. Total commercial construction spending for 2016 will finish 9% higher than 2015 and 2017 will grow 3% to 4%. Commercial construction represents 18% of total nonresidential buildings spending.

Lodging construction spending YTD is 29% higher than 2015. Lodging construction spending has exceeded the growth rate of all other markets. Starting in 2012 annual spending increased 19%, 25%, 24% and 30%. However, during that time lodging averaged only 5% of total nonresidential buildings spending. It now represents just under 7%. Total lodging construction spending forecast growth for 2016 is 25%. For 2017 expect spending growth of only 8%.

Educational construction spending YTD is up 4.8% from 2015. Educational buildings spending experienced the longest downturn of any market, declining for 5 consecutive years from 2009 through 2013. It has been slow to recover with 2015 showing the first real growth of only 4.8%. 2014 marked the beginning of the turn but registered growth of less than 1%. New starts posted 15% growth in 2014 and then slowed to only 4% growth in 2015. However, a large volume of those starts occurred in late 2014 and then again in early 2015. The timing of these starts generates a lot of spending in late 2016. I expect spending in the 2nd half 2016 to grow 5% over the 1st half. Total educational construction spending for 2016 will finish 8% higher than 2015 and 2017 will grow 9%. Educational construction spending is the largest component of nonresidential buildings representing 22% of total nonresidential buildings spending. Before the 5 years of declines it represented 30% of nonresidential buildings spending.

Healthcare construction spending YTD is up only 2.3% from 2015. Healthcare new starts since 2011 increased only in 2014. Spending may see some moderate declines in late 2016 before resuming slow growth in 2017. Changes and uncertainty in the healthcare climate are having a dampening effect on spending growth. Total healthcare construction spending for 2016 will finish only 2% higher than 2015 and 2017 will grow 3% to 4%. Healthcare construction represents 10% of total nonresidential buildings spending.

Amusement/Recreation construction spending YTD is up 10.1% from 2015. New starts were very strong in 2013 and 2014 and generated strong spending increases of 10% and 18% in 2014 and 2015. However, starts in 2015 declined slightly and 2016 starts to date have been flat. Spending through 2016 will remain strong but we will experience moderate declines in the 1st half of 2017. Total Amusement/Recreation construction spending for 2016 will finish 12% higher than 2015 but 2017 will grow only 2%. Amusement/Recreation construction represents 5% of total nonresidential buildings spending.

Non-building Infrastructure

Non-building Infrastructure spending for July fell to a SAAR of $289 billion, down slightly over for the last four months. YTD spending through July is up only 1.3% over 2015. Spending began to slow in April and May and is now at the 2016 low. The current 3-month average is down 4% from the 1st quarter. However, spending on non-building infrastructure reached an all-time high in the first half of 2014 and has remained near those highs through 2015 into the 1st quarter of 2016.

How does actual spending YTD compare to my early 2016 forecast?

Non-building Infrastr predicted YTD $156.2b, actual YTD $160.5b (+$4.3bil, +2.8%).

Non-building Infrastrusture spending for 2016 predicted in Dec 2015 $293.2b. As of July data forecast spending for 2016 is $297.3b (+$4.1bil, +1.4%).

Total Non-building Infrastructure construction spending increased 8.8% in 2014 but decreased 1.5% in 2015. It will grow only 1.2% in 2016 but then 9.6% in 2017.

Non-building Infrastructure Spending History

- 7 years 1995-2001 up 56%

- 4 years 2005-2008 up 60%

- 3 years 2009-2011 down 8%

- 3 years 2012-2014 up 19%

Power construction spending YTD is up 6.0% from 2015. Power new starts are erratic. Also some power projects are very long duration from start to finish. In 2012 starts totaled over $50 bil., in 2013 only $30 bil. and in 2014 less than $25 bil. In 2015 starts reached an all-time high of $56 bil. The power construction spending pattern for 2012-2015 was +30%, -4%, +18%, -16%. Many of the starts in 2012 supported 18% spending growth in 2014, yet not much of the record year of starts in 2015 supported spending in 2015. Although new starts in 2016 are forecast to drop by 30%, that’s still over $40 bil. and more than in 2013 or 2014. Part of the reason for a drop in spending in 2016 is the tailing off of projects that started in previous years combined with the fact that 2013 and 2014 were “lean” years. Cash flow of starts determines spending and it follows the erratic flow of starts. A very high volume of starts in early 2015 will generate spending extending out through 2019. I’m forecasting total power construction spending for 2016 will finish only 1.2% higher than 2015 and 2017 will increase 7%. Power construction represents 32% of total non-building infrastructure spending.

Highway/Bridge/Street construction spending YTD is up only 2.5% from 2015. Some highway and street projects are long duration from start to finish. Although new starts in 2015 increased by 11%, that was significantly unbalanced with two very high months of new starts in the 1st quarter and below average starts for almost the entire 2nd half of 2015 and the 1st half of 2016. The very high months have starts with much longer duration so do not add significantly to monthly spending, they spread the spending over a longer period of time. Spending has declined in 8 out of the last 12 months. I’m expecting declines in 6 out of the next 12 months. Yet the plus months will still carry both 2016 and 2017 to spending growth. I’m forecasting total highway/bridge/street construction spending for 2016 will finish 4.5% higher than 2015 and 2017 will increase 8%. Highway/Bridge/Street construction represents 32% of total non-building infrastructure spending.

Transportation/Air/Rail construction spending YTD is down 2.4% from 2015. YTD spending is 9% lower than what I had predicted in my early 2016 forecast. There is a disconnect between where Dodge reports transportation starts and how U S Census reports transportation spending, so it is difficult to directly relate the two. I’m forecasting total transportation construction spending for 2016 will finish 2.5% higher than 2015 and 2017 will increase 6%. Transportation construction represents 16% of total non-building infrastructure spending.