Home » Forecast (Page 15)

Category Archives: Forecast

IF Another Recession, What Would Happen to Construction?

8-15-19 See WHAT IF? Construction Recession 2020

1-27-16

The wheels of construction turn slowly.

There is plenty of talk these days of whether or not we may slip into another recession. On any given day you can read several articles pointing to why or why not we are headed into another recession. I’m not trying to take a position here. I would like to get a rough idea what would happen to this current construction recovery if we do slip into recession.

A starting baseline for this discussion is my forecast for 2016; total spending up 10%. nonresidential buildings up 14% after a 17% increase in 2015, residential up 12% following 13% in 2015 and non-building infrastructure up 1% for a total less than 2% in 2015-2016. So, you can see I’m not predicting a recession.

If you think of a recession as having an immediate affect on total construction, like a quick drop in materials prices or cost of buildings, think again. Construction is sort of like an aircraft carrier, it takes a long time to turn around.

The best indicator of future construction activity is the projected cash flow generated by all the construction starts that have been recorded. Construction starts represent the beginning of spending on new projects. Projects can take many months to reach completion. Some portion of the total project spending occurs in every month over the full duration of the project from start to completion.

We start 2016 with a backlog of projects that will generate about 70% of all the cash flow in 2016. It’s likely that most if not all of the projects already started would move on to completion. But new starts will be cut back.

To get an idea how another recession might affect construction spending, I kept all backlog as is but I reduced future new construction starts for the next two years (2016 and 2017) by 30% for residential and nonresidential buildings, and 15% for infrastructure projects. This mimics the declines we experienced from 2006 to 2009. I then allowed for a 5% increase across all sectors in 2018.

The result is a 5% drop in construction spending in 2016, still higher than 2014, but then a 10-15% drop in 2017 setting us back to near the same level as 2013.

These spending declines would cause a temporary loss of about 400,000 to 500,000 jobs.

Nonresidential buildings could still eke out a slight gain in 2016 but would drop 20% in 2017. Residential construction would drop about 5% in 2016 and then drop another 10-15% in 2017. Nonresidential infrastructure work would decline 10% in 2016, but then rebound to no change in 2017.

After two years of declines, in 2018 nonresidential buildings would climb back to near even with 2017, residential would grow 5% and infrastructure would remain flat. Total 2018 spending would climb only 2% over 2017 and would still only reach spending in 2013.

So, a 30% decline in activity for two consecutive years starting today would set us back four to five years, but the major affect would not be felt until 2017. If that were to happen, obviously spending would be revised, but also I would have much different predictions for inflation and jobs.

There’s a reason we see the dips and rises on the chart in both 2016 and 2017. It reflects the decline in the rate of new starts plus the remainder of old backlog finishing at varying end-dates. Also, given a constant amount of seasonally adjusted new starts, there is a difference in the actual amount of starts in winter months vs summer months. This plays out over time as dips and rises in spending. Spending activity will not be smooth in a recession.

What Did He Say? Fact Checker – Track Record

MY TRACK RECORD

Indoor Masters National Track Championships

masters age group 45-50

Mile – 4:41.7 – 4th place

3000m – 9:25.3 – 3rd place

Oh, wait. That’s not what you are here to read. You want my track record on construction economic forecasts. How good are my forecasts? Do they prove to be accurate? How do they compare to the rest of the industry forecasts? OK. Let’s have a look.

- Bullets show what I forecast.

This is what actually occurred. Actual is in red if I got it wrong.

From Jan 2013

- The ABI, McGraw Hill Dodge new starts and the Dodge Momentum Index (DMI) are all indicating a dip in nonresidential spending potentially from February through May 2013.

- Architecture Billings Index (ABI) went UP from May 2012 to January 2013 with only December down slightly (see figure B). This is a very good leading indicator for new construction work starting in Q3-Q4 2013.

- I expect a dip in nonresidential buildings work between January and May 2013, at which point all indicators point to sustained growth through year end.

From February 2013 through June 2013 actual spending on nonresidential buildings dropped by 2%. Then from June through November spending increased by 6%.

From Jan 2013

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. However, contractors almost always are playing catch-up. In the most recent three-month period, contractors’ costs began to climb faster than whole building costs went up, due to both increasing material costs and declining productivity.

- Once growth in nonresidential picks up and both residential and nonresidential are active, we will begin to see apparent labor shortages and productivity losses.

For 2013 and 2014 construction spending increased 7% and 10%. During that 2 year period, total labor and materials inputs increased only 2% to 3%, but construction inflation measured 4.5%. Margins increases drove up the total inflation cost. Available (nonworking) workforce declined to about 400,000, near the lowest on record. Productivity declined by 2%.

From Jan 2013

- Construction Spending for 2013 will be pushed higher by huge growth in residential construction, a rate of spending growth that increased by 30% from Q1 to Q4 2012

Residential spending in 2013 grew at a rate of 1.5% per month, largest one year growth since 2004.

From Jan 2013

- The National Association of Home Builders consensus estimate for new residential units is growth of 23% in 2013 and 33% in 2014. 2012 grew by 28%.

- The NAHB projections are for an increase of 150,000 units in 2013 and 230,000 in 2014, 20% and 27% growth the next two years. There’s a possibility we could achieve that. But, especially in 2014, that would exceed the fastest growth rates, both volume and total jobs, achieved in the last 30 years.

- Mark Zandi, economist for Moody’s, in the same article is quoted as saying his more optimistic forecast has residential construction growing to 1.1mil in 2013 and 1.7mil new housing starts in 2014, growth of 46% and then 54%. I say NO WAY

- A more reasonable projection is new housing starts may reach 850K to 900K in 2013 and 1.0 to 1.05 million in 2014, new homes growth rates of 15% to 20% and total residential spending growth of 12% to 15%. That still has the workforce expanding rapidly, but at least at a not unheard of rate.

Housing starts reached 925,000 in 2013 and 1,003,000 in 2014, well below the 30 year historical annual growth.

From Jan 2013

- Future escalation, in order to capture increasing margins, will be higher than normal labor/material cost growth. Lagging regions will take longer to experience high escalation.

- I’m advising a range of 4% to 6% for 2013, 5% to 7% for 2014 and 6% to 8% for 2015.

- Expect residential escalation near the upper end of the range.

Actual total construction cost inflation 2013 = 4.3%, 2014 = 4.7% 2015 = 2.9%. All inflation values were held to lower totals due to infrastructure work which did not have more than 2% inflation during that period and actually experienced deflation in 2015. Residential buildings inflation for 2013-14-15 was 8.9%, 7.1% and 4.1%.

Posted April 2014

- Construction Spending “residential buildings” expect $379 billion in 2014

- Construction Spending “nonresidential buildings” expect $325 billion in 2014

- Construction Spending “totals” expect $960 billion in 2014

Posted August 2014

- Construction Spending “residential buildings” expect $365 billion in 2014

- Construction Spending “nonresidential buildings” expect $314 billion in 2014

- Construction Spending “totals” expect $961 billion in 2014

2014 Residential spending = $354 billion

2014 Nonresidential spending = $320 billion

2014 Total Construction spending = $960 billion

These values prior to U.S. Census major correction to data.

Posted August 2014

- If you are pricing future construction jobs the way you always have, with 2-3 pct escalation, you are already in trouble!

- If you’re an owner with plans to construct a building in the future and you are inflating cost by only 2-3 pct, you’ve missed the boat.

Total construction inflation for 2013-14-15 was 4.3%, 4.7% and 2.9%. All years were reduced by a lack of inflation in infrastructure work. Inflation for nonresidential buildings was 3.5%, 4.2% and 4.8%. Residential buildings inflation was 8.9%, 7.1% and 4.1%.

Posted September 2014

- Real Construction Volume in 2014 (construction spending minus inflation) will grow less than 2 percent

Real construction volume in 2014 increased 4.9%. Commercial nonresidential construction started it’s current boom.

Posted Dec 2014

- Construction Spending “residential buildings” expect $405 billion in 2015

- Construction Spending “nonresidential buildings” expect $364 billion in 2015

- Construction Spending “totals” expect $1,040 billion in 2015

Posted Jan 2015

- Cash flow of new starts for nonresidential buildings indicates a 15% increase in the monthly rate of spending over the next 10 months.

- Both ABI and Starts cash flows indicate a mild slowdown in nonresidential buildings construction spending at the end of 2014 before a strong upturn in spending in 2015. Expect another drop in spending late in 2015

For the period Nov 2014 through Feb 2015, spending on nonresidential buildings stalled flat for 4 months. The monthly rate of spending increased 14% over the 10 months from Oct 2014 to September 2015. Since Sept 2015 spending has been flat.

Posted March 2015

- Even if new starts turn flat for rest of 2015, starts already recorded are indicating Nonresidential buildings construction spending for 2015 will reach 15%+ growth. My closest competitor is forecasting 12.5% growth. The average of all other industry forecasts is 8% growth.

Spending for nonresidential buildings actually hit +17% growth over 2014.

Posted July 2015

- Construction Spending “residential buildings” expect $388 billion in 2015

- Construction Spending “nonresidential buildings” expect $397 billion in 2015

- Construction Spending “totals” expect $1,067 billion in 2015

2015 Residential spending = $390 billion

2015 Nonresidential spending = $387 billion

2015 Total Construction spending = $1068 billion

These values prior to U.S. Census major correction to data.

Posted July 2015

- Nonresidential Buildings spending growth 2015 vs 2014.

- My forecast (Average all others) [closest competitor]

- Educational 7.1% (3.8%) [5.6%]

- Healthcare 6.0% (3.9%) [4.0%]

- Commercial/Retail 5.5% (11.8%) [8.4%]

- Lodging 24.0% (13.7%) [17.1%]

- Office 21.1% (13.5%) [19.2%]

- Manufacturing 49.6% (15.9%) [24.6%]

Educational 6.7%

Healthcare 4.6%

Commercial/Retail 8.4%

Lodging 30.8%

Office 21.9%

Manufacturing 47.3%

So there you have it. Several years of forecasts and how they turned out. You can get an idea of my track record. You be the judge. 🙂

Construction Forecast 1st Look – What To Expect in 2016?

Construction spending may reach historic growth in 2016.

There are currently six estimates available forecasting 2016 total construction spending ranging from 6% to 10% growth, with an average of 8.7%. My forecast is 9.7%.

Total construction spending, forecast to grow 9.7% in 2016, could reach a total 30% for the three years 2014-15-16. The only comparable periods in the last 20 years are 29% in 2003-04-05 and 27% in 2013-14-15.

The current nonresidential buildings construction boom could become an historic expansion. Nonresidential buildings spending is forecast to grow 13.7% in 2016. Added to 8.8% in 2014 and 17.1% in 2015, the three-year total growth could reach 40% for 2014-15-16. The only comparable growth periods in the last 20 years are 40% in 2006-07-08 and 32% in 1995-96-97.

For perspective, residential spending increased 46% in 2013-14-15, similar to only one comparable period in the last 20 years, 48% in 2003-04-05.

Non-building infrastructure projects, in two of the last three years have barely shown any gains entirely due to declines in power plant projects. This will repeat in 2016.

This is still the 1st or 2nd most active 3 year period of growth in construction in more than 20 years, and it’s already been ongoing since 2013-2014. With the forecast for 2016, spending growth could reach a new three-year high.

From the middle of Q1 2016 to the end of Q3 2016, total spending will post six to eight months at an annual growth rate of 20%, but due to the dips at the beginning and the end of the year, total 2016 construction spending will finish at 9.7% growth. Construction spending momentum is not yet losing steam. We may be seeing the effects of a few years of erratic growth patterns and a shift from more rapidly changing commercial and residential work to slower growth institutional work.

Residential spending will slow several percent early in 2016 before resuming upward momentum to finish the year with 12% growth, slightly less than growth in 2014 and 2015. Periods of low new start volumes need to work their way thru the system and this produces growth patterns with periodic dips. The upward momentum will carry into 2017.

Nonresidential buildings spending will slow moderately in the next few months before we see a 15% growth rate through the middle of the year, only to see another slowdown late in 2016. Major contributions are increasing from institutional work in educational and healthcare markets. Office, commercial retail, lodging and manufacturing will decline considerably from 2015 but still provide support to growth.

Infrastructure projects spending will decline over the next six months due to the ending of massive projects that started 24 to 42 months ago. There will be large advances in spending midyear before we experience another slowdown later in 2016. Following a 0.5% increase in 2015, spending will increase only 1.2% in 2016, held down by a 10% drop in power projects, the second largest component of infrastructure work.

Construction added 1.0 million jobs in the five years 2011-2015. 800,000 jobs were added in the last three years. To support forecast spending, jobs need to grow by 500,000 to 600,000 in 2016-2017. Growth in nonresidential buildings and residential construction in 2014 and 2015 led to significant labor demand which has resulted in labor shortages in some building professions. Demand in 2016-2017 will drive up labor cost and may slow project delivery.

Spending growth, up 35% in the four-year period 2012-2015, exceeded the growth during 2003-2006 (33%) and 1996-1999 (32%) which were the two fastest growth periods on record with the highest rates of inflation and productivity loss. Construction spending growth for the period 2013-2016 is going to outpace all previous periods.

Construction inflation is quite likely to advance more rapidly than some owners have planned. Long term construction cost inflation is normally about double consumer price inflation. Construction inflation in rapid growth years is much higher than average long-term inflation. Since 1993, long-term annual construction inflation for buildings has been 3.5%, even when including the recessionary period 2007-2011. During rapid growth periods, inflation averages more than 8%.

For the last three years the nonresidential buildings cost index has averaged just over +4% and the residential buildings cost index just over +6%, however, the infrastructure projects index declined. The FWHA highway index, the IHS power plant index and the PPI industrial structures and other nonresidential structures indices have all been flat or declining for the last three years. This provides a good example for why a composite all-construction cost index should not be used to adjust costs of buildings. Infrastructure project indices often do not follow the same pattern as cost of buildings.

Anticipate construction inflation of buildings during the next two years closer to the high end rapid growth rate rather than the long term average.

2016 Construction Outlook Articles

Articles Detailing 2016 Construction Outlook

Links will open in a new tab

These links point to articles here on this blog that summarize end-of-year data for 2015 and point to articles with projections for 2016.

Most Recently Published

Summary of 2017 Construction Outlook 2-21-17

How Much Does A Steel Cost Increase Affect Construction? 9-18-16

2015 Results

Construction Spending 2015-2016 – How Do The Forecasts Compare? 12-9-15

Construction Spending 2015 and 2016 11-9-15

Construction Spending Market Performance of Nonresidential Bldgs 2015-2016 10-15-15

New Starts and 2016 Starting Backlog

Construction Backlog 2017 3-20-17

New Construction Starts Leading Into 2017 1-24-17

Behind The Headlines – Construction Backlog 1-16-17

Starts Point to Robust 2017 Spending 10-20-16

New Construction Starts Much Better Than Might Appear 9-23-16

Spending Forecast

Forecast 2017 Construction Spending 1-7-17

2016 Construction Spending year end 1-3-17

Are We at New Peak Construction Spending? 1-4-17

Construction Spending Gets Revised UP 10-6-17

Construction Spending 2016 – Midyear Summary

1st Quarter 2016 Construction Spending and Forecast

Construction Forecast 1st Look – What To Expect in 2016? 1-14-16

Erratic Pattern Ahead for 2016 Construction Spending. Why?

Nonresidential Buildings

Construction Spending 2016 – Midyear Nonresidential Markets

Updated 1-23-16 Forecasts of 2016 Nonres Buildings Construction Spending % Growth

Construction Spending Market Performance of Nonresidential Bldgs 2015-2016 10-15-15

Residential

Construction Spending vs Dodge Starts vs New Housing Unit Starts 4-27-16

Residential Work Flow From Housing Starts 4-25-16

Housing Starts > Look a Little Deeper 11-18-15

Claryifying Housing Starts Numbers 11-6-15

Residential Construction – Not All Data Tells The Same Story 10-25-15

Infrastructure Outlook

Infrastructure – Ramping Up to Add $1 trillion 1-30-17

Infrastructure Outlook 2017 1-12-17

Calls for Infrastructure Problematic 1-12-17

Saturday Morning Thinking Out Loud #1 – Infrastructure 10-29-16

Public Construction

Infrastructure & Public Construction Spending 3-5-17

Public Construction Spending 2016-2017 10-21-16

Jobs

Construction Spending vs Jobs 2-9-17

Behind The Headlines – Construction Jobs 2-16-17

Construction Jobs Show 3rd Qtr Growth 10-7-16

How Many Construction Jobs Needed to Support 2016-2017 Spending Forecast? 1-12-16

Inflation

How Much Does A Steel Cost Increase Affect Construction? 9-18-16

Construction Inflation Cost Index 1-31-16

Updated 1-23-16 Forecasts of 2016 Nonres Buildings Construction Spending % Growth

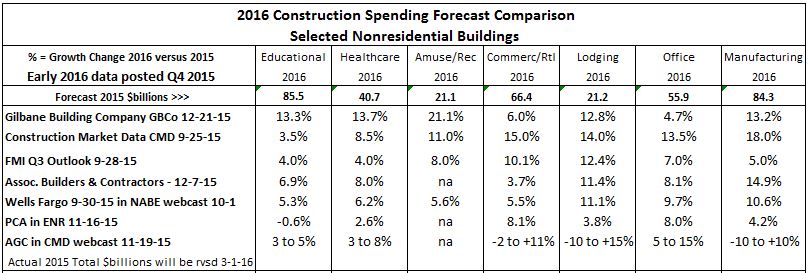

Updated 1-23-16 – CMD, FMI and I have updated 2016 construction spending forecast in the last month and the latest is included in this table.

Original post 12-21-15

Below are early Q3-Q4 2015 forecasts for growth in 2016 nonresidential buildings construction spending markets.

Seven firms posted forecasts for spending growth. My 12-21-15 forecasts include new starts through November in my projection.

Most of the starts that will generate spending next year are already in place. For the 2016 forecast, new starts booked through December 2015 will contribute 75% to nonresidential buildings spending. We expect new starts growth in nearly every market. However, the pattern of spending will not be a constant upward slope.

Don’t expect 2016 forecast to change much with the last month of data. Commercial/Retail, Office and Manufacturing have been declining in recent months and are expected to continue to drop. Institutional work is on the increase.

As in the 2015 spending growth forecast, I’m well outside the range of predictions for several building types, particularly Educational, Healthcare, Amusement and Office. However I’m OK with my contrary positions since I had the same regarding 2015 spending and now as we near year end I may potentially have had the closest forecast for 5 or 6 of the 7 markets.

Look back at this chart a year from now to see how we did.

Construction Spending 2015-2016 – How Do The Forecasts Compare?

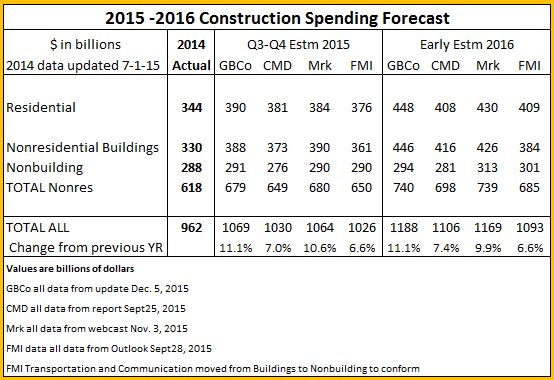

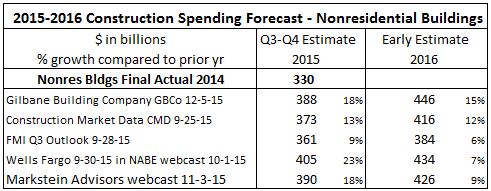

Throughout the year a number of firms provide forecasts of construction spending. Spending projections give us an indication of the level of activity to expect. Here’s a summary of the most recent forecasts.

Actual spending put-in-place for October year-to-date (YTD) became available December 1st and new construction starts for October became available November 23rd. My GBCo 12-5-15 forecast includes both of those data updates. Not all these firms have yet incorporated the October data into their analysis and some will update in the near future. Most all of these values will be updated in January. Also, the AIA semi-annual Consensus report, forecasts of nonresidential buildings only, will come out in January. Again I’ll point out, my numbers have not changed much since July when I predicted $1067 for total, $388 for residential and $397 for nonres bldgs spending in 2015. Click on this link to an older post that shows the midyear predictions for three firms.

Once spending data through September is available it allows an analysis of a select data set that gives a prediction of the year end result within +/- 1%. I use this analysis to check my forecast. It indicates 2015 should finish with total spending between $1.067 trillion and $1.087 trillion and nonresidential buildings spending between $386 billion and $395 billion. The actual spending total has not fallen outside the statistical range since 2001, as far back as I’ve been tracking the data. I’m confident that total spending for the year will fall within this predicted range. My 2015 forecast of $1.067 trillion total and $397 billion for nonresidential buildings falls within those ranges.

Spending in any given month is the sum total contributed by all the projects that started and are currently underway. That includes spending from projects that started recently with foundations just coming out of the ground and also projects that started 18-36 months ago that are near completion. Spending patterns are affected mostly by the pattern of starts recorded over the period 12-36 months ago. New starts will generate the next 2 to 3 years of spending. Only if the starts pattern is even in growth will spending be even in growth. That will not be the case in 2016.

What we do know is that most starts that will generate spending next year are already in place. For the 2016 forecast, new starts booked through December 2015 will contribute 75% to nonresidential buildings spending, 55% to residential spending and 80% to spending on nonbuilding infrastructure. The pattern of spending will not be a constant upward slope.

This table compares all 2015 values to the final of $330 billion in 2014. For 2016 each firm is compared to their own 2015 value. Once an actual value is determined for 2015 (which won’t be until March 1, 2016) I cannot be certain if some other firms forecast dollars change or percent floats. In the Gilbane forecast, 2016 percent would float. This will also affect the 2016 values in the first table in this blog post.

Construction Inflation

LINK to most recent articles on inflation 2019

11-17-2015

( Also See 1-31-2016 comments and chart on inflation )

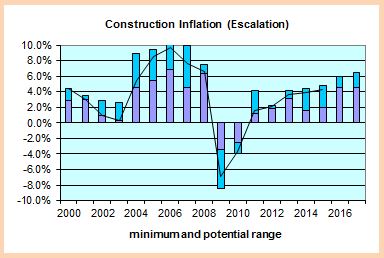

Over the last 24 months work volume has increased and short-term construction inflation has increased to more than double consumer inflation. It appears construction inflation is already advancing faster than and well ahead of consumer inflation, which supports that consumer inflation is not an indication of movements or magnitude of construction inflation.

It is always important to carry the proper value for cost inflation. Whether adjusting the cost of a recently built project to predict what it might cost to build a similar project in the near future or answering a client question “What will it cost if I delay my project start by one year?”, whether you carry the proper value for inflation (which can differ every year) can make or break your estimate.

- Long term construction cost inflation is normally about double consumer price inflation (CPI).

- Since 1993 but taking out 2 years of recession (-8%), the 20-year average inflation is 4.2%.

- Average long term (30 years) construction cost inflation is 3.5% even with any/all recession years included.

- In times of rapid construction spending growth, construction inflation averages about 8%.

- Although inflation is affected by labor and material costs, a large part of the change in inflation is due to change in contractors/suppliers margins.

- When construction volume increases rapidly, margins increase rapidly.

- Construction inflation can be very different from one major sector to the other and can vary from one market to another. It can even vary considerably from one material to another.

In the 5 years of rapid growth in spending for nonresidential buildings from 2004 through 2008, nonresidential buildings cost inflation totaled 39%, or averaged ~8% per year.

In the 6 years of spending during the residential construction boom from 2000 through 2005, residential building cost inflation totaled 47%, or averaged ~8% per year.

Neither the producer price index (PPI) for construction inputs nor the CPI are good indicators of total construction cost inflation.

Some construction cost indices include only the cost changes for a market basket of labor and materials and do not include any change for margins. Those indices are not a complete analysis of construction cost inflation.

Construction cost inflation must include all changes related to labor wages, productivity, materials cost, materials availability, equipment and finally contractors margins. Margins are affected by the volume growth of new work and demand for new buildings. So be sure to verify what is included in any cost index you reference for real construction cost inflation.

For the last three years residential construction inflation has averaged 5.7% and nonresidential buildings inflation has averaged 4.2%. Nonresidential buildings cost inflation has increased for five consecutive years. Both are likely to increase next year since anticipated volume in both sectors will grow next year.

In my construction spending data set, which goes back to 1993, there were six years with greater than 9% spending growth. By far the largest spending growth years were 2004 and 2005, 11.2% and 11.5%. We are about to repeat that historic level of spending growth. I am predicting 2015 will finish with growth of 11.6% and 2016 will experience 11% growth.

(8-12-16) 2015 finished at 10.6% because 2014 was revised up. Construction spending for 2016 will probably finish closer to 8%.

I expect historic levels of growth in spending will be accompanied by inflation relative to historic high growth periods. Don’t expect long term average inflation in high growth periods. Don’t be caught short in your construction cost budgets!

Graphic updated 1-8-16

The chart shows the low and high range of various independent nonresidential buildings construction actual cost indices. In 2015, the range of estimates was from 2% to 5%. The actual inflation came in at 4%. The plotted line is my result of where inflation actually ended up. A chart for residential construction would show much different values.

( Also See 1-31-2016 comments and chart on inflation )

Nonresidential Buildings Construction Spending 2015 – How Do Industry Predictions Compare?

Throughout the year a number of firms provide predictions of various construction data. Some firms provide estimates for all segments of construction. More firms provide estimates only for spending on nonresidential buildings. This is a summary of various firms estimates published in the 2nd quarter and also for those who’ve updated their estimate recently.

The current available spending data through August allows an analysis of a select data set that gives a prediction of the year end result within +/- 1.5%. My current data predicts 2015 will finish with nonresidential spending at $393 billion, with a potential range between $387 billion and $400 billion. We will have even better data on November 2nd when the US Census publishes construction spending for the month of September. Once the September data is incorporated into the monthly totals, an analysis of a select data set provides a prediction of the year-end totals that has not varied more than +/- 1% from the end-of-year actual since 2002, as far back as the market data is available.