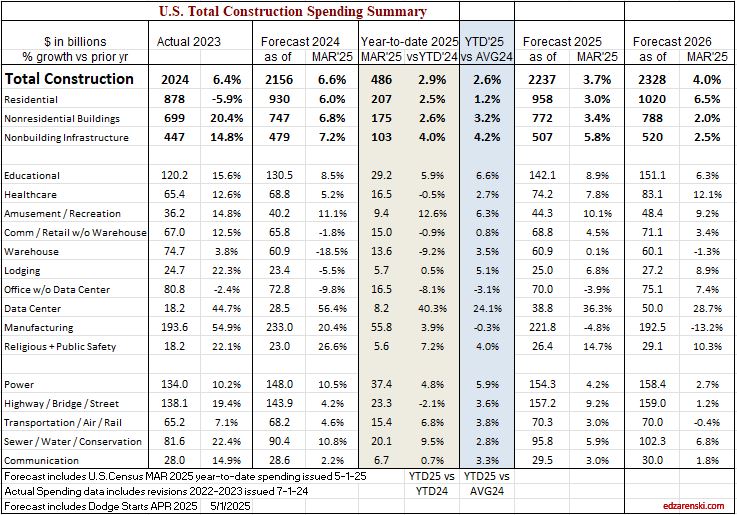

The total construction spending forecast, now at $2,237bil, +3.7% vs. 2024, has been lowered a bit since the Outlook in Feb. ($2,272bil, +5.5%). Most of the reduction is in Residential, from $997bil, +7.2% down to $958bil, +3.0%. Nonres Bldgs was reduced by $11bil and Nonbldg increased by $7bil. Compared to the average for the year 2024, current total spending YTD is up 2.6%, but is expected to pick a little up throughout the year across all sectors.

Constant $ growth is forecast down 0.7% in 2025 and down more after that. Inflation Index shows annual percent and index to base 2024 = 100. All years, current spending / index = reported as constant 2024$, as if all constant years are the same 2024$.

Residential Single Family spending has been in a range +/- 2.5% for the last 7 months. With only a few months lower than that, this range extends back 18 months. Take out 3%/yr inflation and you can see that SF volume has been flat to down. Multi-family spending, for the last 12 months, is down 15% off recent highs in Q1’24. Reno/repair spending extended recent highs across 5 months in mid 2024, before falling off 10% in Q4, and now, in Q1’25 it has gained back most of that drop. Any spending gains in the near future would be driven by multi-family.

Manufacturing is still the largest $ contributor ($222bil/yr) to nonresidential bldgs total spending ($772bil/yr), but has fallen 6% in the last 5 months. The trend is down in most months for 2025 and down in 2026. This decline is entirely expected and you can read about it in my article, The Manufacturing Taper.

Data Centers shows the largest % spending growth for 2025, forecast +39%, continuing on a phenomenal streak of +45% in 2023 and +56% in 2024. Data Center starts increased 300% over the previous 3 yrs. and still increase in 2025 and 2026, but at a slower rate of growth. Manufacturing spending peaked in Oct’24. Data Center spending continues to increase for the next few years. Both of these forecasts take into account some cancelations or delays announced recently (see May Briefs), however do not account for any major stoppages due to recent trade impacts.

The largest $ increases in spending are Power, forecast to increase +$16bil, and Highway +$13bil. Educational spending is forecast to post the largest nonres bldgs $ growth in 2025 (+$12bil, +9%). Data Centers increase $10bil.

This same scenario that looks to occur in Manufacturing will occur also in Highway/Bridge. Normal starts were about $100bil/yr, with slow growth. But for the last 3 years, actual starts totaled closer to $500bil for the 3 years or $167bil/yr. This strong growth in starts is expected to continue at least into 2025, totaling near $650bil for 4 years. Again, consider that part of that is inflation, but the remainder is government investment growth. So a decline from the taper back to normal for Highway/Bridge may not show up at least for the next few years. But once the taper begins it will have the same effect on Nonbldg Infrastructure spending that we will see from Mnfg in Nonres Bldgs.

Typical jobs growth is 2.5% to 3.5% per year, even though spending can sometimes far outpace that. But jobs growth doesn’t track spending, it tracks volume growth. Volume is spending minus inflation. For example, for the 4 years 2021 thru 2024, spending increased 44%. But inflation increased 33%. Volume growth was only 11%. Jobs increased 12.5%. For 2025, Inflation will outpace spending growth by 1%, but jobs are still expected to increase by 1.5%. Rarely do jobs decrease. That could change.

There are 870K construction jobs in TX. 500K are immigrants and 300K are undocumented.

New starts are forecast up in 2025, but I would caution there are a lot of headwinds that could slow new starts growth. Many economists predict the current trade impacts will slow overall economic growth. That in turn could slow capital expenditures, which, in this case, is new construction starts. So far year-to-date, spending is outpacing new starts growth. That means backlog is decreasing, mostly in nonresidential buildings. We haven’t seen a decrease in Nonres Bldgs backlog since pre-2011. Residential backlog is down slightly. Nonbuilding is increasing.

See Also Construction Briefs May 2025

and Construction Briefs Apr 2025

5-15-25 all ppi DATA UPDATED TO APR See Construction Inflation 2025

I’ve increased the inflation outlook since Feb to a range of 4.5% to 5%. Inflation may be the most uncertain of all factors affecting construction this year. We have yet to see any significant impact from tariffs, and there is sure to be impacts to many construction inputs. We may not know the total impact for several more months. But I would expect, if anything, inflation will go up from here, not down.

The bees are swarming the flowers outside. At least some lifeform is content and at peace with this world.