Please refer to Construction Inflation & PPI 2025 updated 10-17-25 for extended discussion of inflation, how and when to apply, historical indices, PPI Data and Tables. Also see Construction Briefs Sept 2025 for August PPI data. No PPI data has been updated since Aug data issued in Sept.

We are still missing a lot of information. It was expected that much of the tariff costs would show up in Q3, or even Q4, so these costs are more likely to go up than down. But we can’t see those changes in cost. However, there are no shortage of reports of cost pressures. It’s much more than just tariffs.

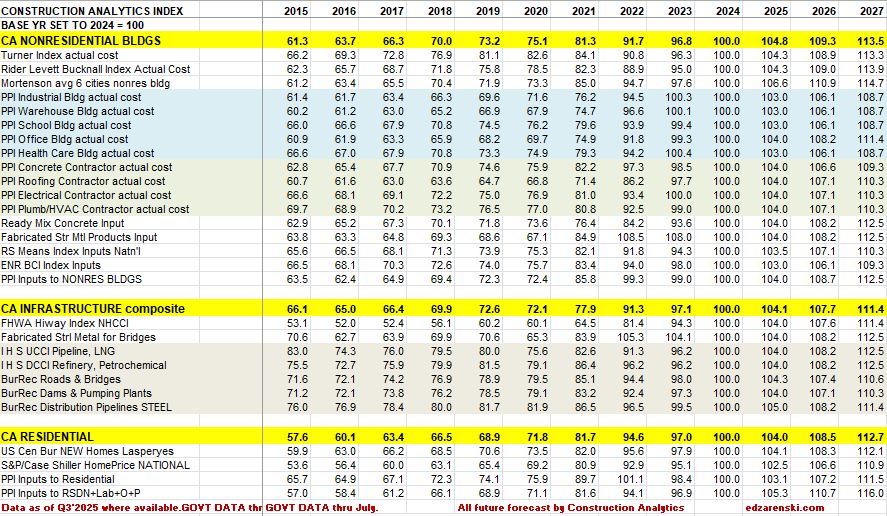

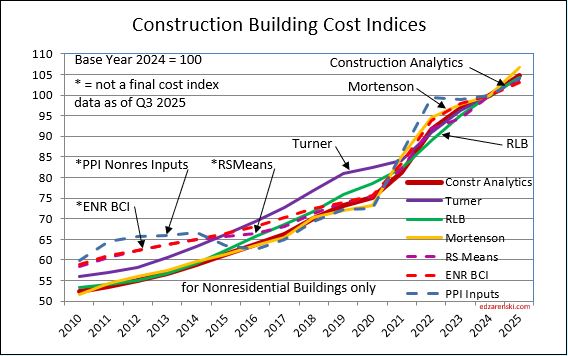

Turner Nonres Bldgs Index is up 3.5% ytd for Q3, up 1.1%-1.2% each quarter.

Rider Levitt Bucknall Nonres Bldg Index for Q3 is up 3.3%, up 1.0%-1.1% each quarter.

Mortenson Nonres Bldgs Index is up 6.3% for 9 months.

Census New Single Family Home Index is up 3.9% YTD for 8 months thru Aug.

RS Means Nonres Bldgs Index is up 3.4% for 9 months, w/o margins.

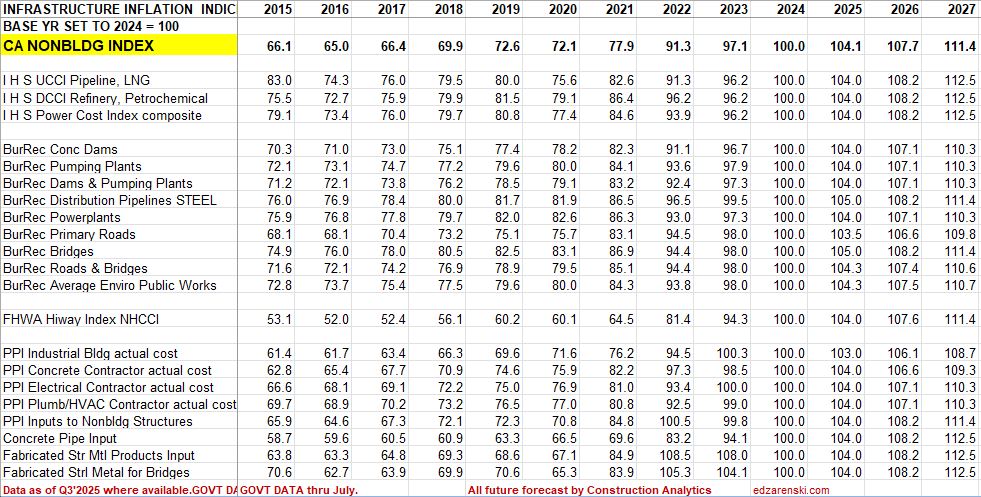

The Producer Price Index for construction materials shows these items up greater than 4% ytd as of Aug: Concrete pipe, Paving Mixtures, Lumber/Plywood, all copper and aluminum wire and shapes.

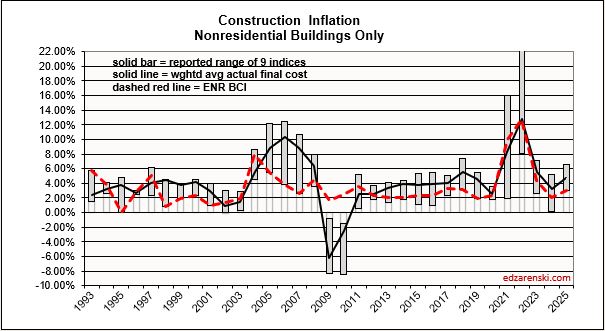

30-year average inflation rate for residential and nonresidential buildings is 4.1%. But when excluding deflation in recession years 2008-2010, for nonresidential buildings the long-term average is 4.7% and for residential it’s 4.9%.

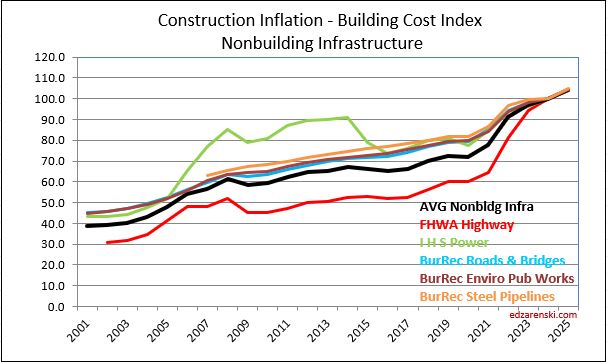

For Non-bldg Infrastructure the 30-year average is 3.6%. When excluding deflation in the recession years 2008-2010, Non-bldg long-term average inflation is 3.9%.

All of these long term averages went up in recent years because, instead of including 1991-1994 at 2%/yr, we are now including 2021-2024 at 7%-8%/yr. All long term and short term inflation rates went up.

Since 2011, Nonres Bldgs inflation is 4.8%, Residential is 5.4% and Non-bldg is 4.3%.

The forecast values carried in the following tables reflect trades and firms currently posted Q3 inflation trackers, using an assumption that rates tend to follow the current pattern and with no reasoning to assume a Q3/Q4 price decline.